Have you ever felt overwhelmed by deceptive practices promising quick fixes to your credit woes? It's becoming increasingly common to encounter scams that prey on vulnerable individuals looking for financial relief. Understanding how to identify and report these scams is crucial for protecting yourself and others from falling victim. Join us as we break down the warning signs and guide you through the process of reporting credit repair scams effectively!

Clear Subject Line

Credit repair scams often target individuals seeking financial relief, exploiting vulnerable situations. Unscrupulous companies promise to remove negative items from credit reports within 30 days, often charging exorbitant fees exceeding $1,000. Many consumers may report these scams to authorities like the Federal Trade Commission (FTC) using online platforms dedicated to consumer protection. Affected individuals frequently share experiences on social media, warning others about deceptive practices and stressing the importance of research before engaging with any credit repair service. Legal actions often arise in 2022 as awareness of these frauds grows, as consumers seek justice and restitution for financial losses.

Contact Information

Credit repair scams often target vulnerable individuals seeking financial stability, particularly those facing significant debt or credit challenges. These fraudulent schemes promise quick fixes and improvements to credit scores, taking advantage of the Fair Credit Reporting Act regulations. For instance, scammers may request a fee, often ranging from $500 to $2,000, in exchange for services that are often ineffective or illegal. Entities may utilize misleading names, claiming affiliations with nonprofits or government programs, while operating from dubious addresses, frequently changing to evade detection. Victims, primarily in metropolitan areas such as Los Angeles and New York City, report emotional distress and worsening financial circumstances after engaging with these deceptive organizations. Seeking legal recourse through agencies like the Consumer Financial Protection Bureau or reporting to the Federal Trade Commission remains crucial for those affected.

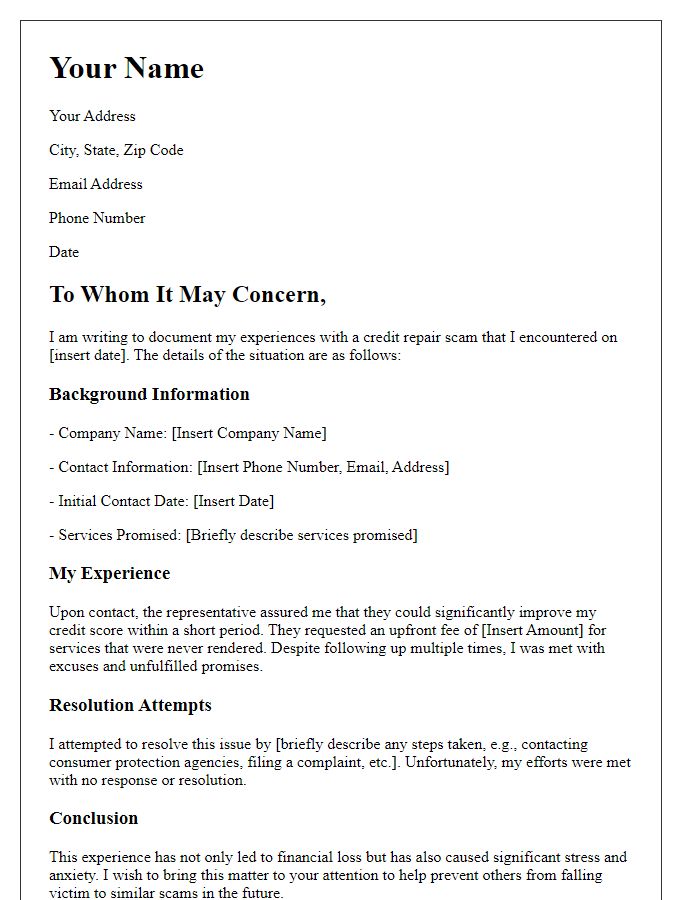

Description of Scam

The credit repair scam involves fraudulent companies promising to remove negative credit history for a fee. Victims often receive calls or emails claiming to have connections with credit bureaus, offering tailored services for quick credit score improvements. These scams can be present across the United States, with notable cases reported in states like California and Florida, where local consumer protection agencies have noted a rise in complaints. Dishonest actors often request upfront payments, typically ranging from $500 to $2,000, before they provide any services. Many individuals end up with more damaged credit scores due to missed payments for services not rendered, alongside potential identity theft from shared personal information. Reporting these incidents to the Federal Trade Commission is vital for consumer protection.

Evidence Documentation

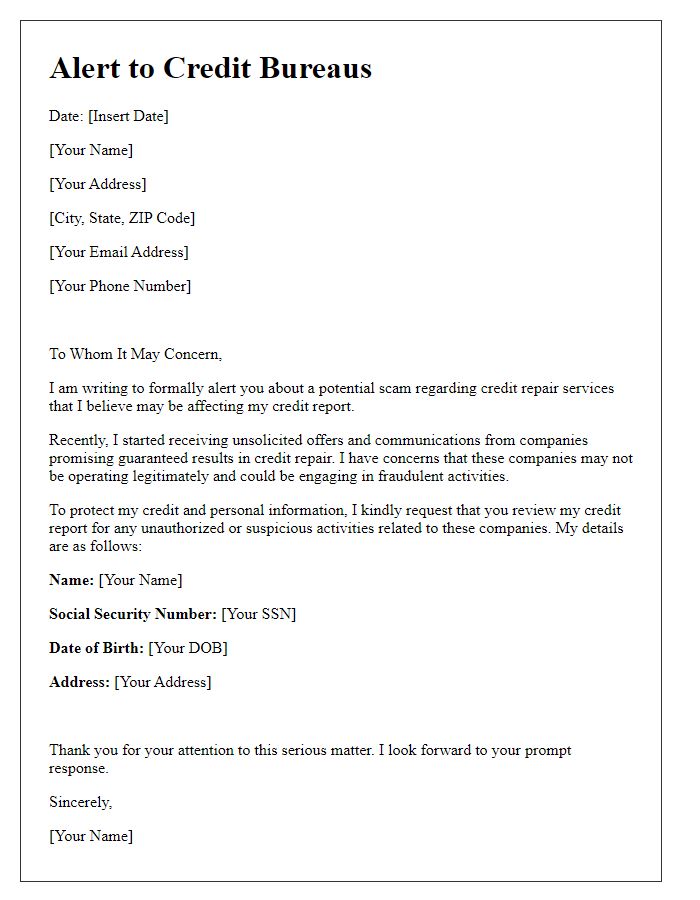

Credit repair scams often target vulnerable individuals seeking financial help. Common tactics include misleading promises of quick credit score improvements and charging hefty fees upfront, without delivering any results. Key indicators of fraud include requests for personal information, like Social Security numbers, and pressure to stop communication with credit bureaus. Victims may notice unauthorized charges from companies like "Bad Credit Solutions" or "Fast Fix Credit," often using generic, non-specific addresses. Collecting evidence is crucial; documentation may include emails, contracts, recorded phone calls, and screenshots of misleading advertisements. Reporting these scams to organizations like the Federal Trade Commission (FTC) and the Consumer Financial Protection Bureau (CFPB) can help mitigate further fraud and protect others from falling victim.

Requested Action Steps

In 2023, a notable increase in credit repair scams has emerged, affecting individuals across the United States. Scammers often promise extraordinary results, such as increasing credit scores by over 100 points within a month or removing negative information from credit reports. Victims in cities like Los Angeles and New York have reported losses averaging $1,500, often after being misled by fraudulent companies. Unscrupulous practices include charging upfront fees without providing any services, which is illegal under the Credit Repair Organizations Act (CROA). Additionally, these scams can involve the fabrication of false identities or accounts, further complicating the victims' credit histories. Reporting these scams to the Federal Trade Commission (FTC) and local consumer protection agencies is crucial for victims aiming to seek justice and recover their finances.

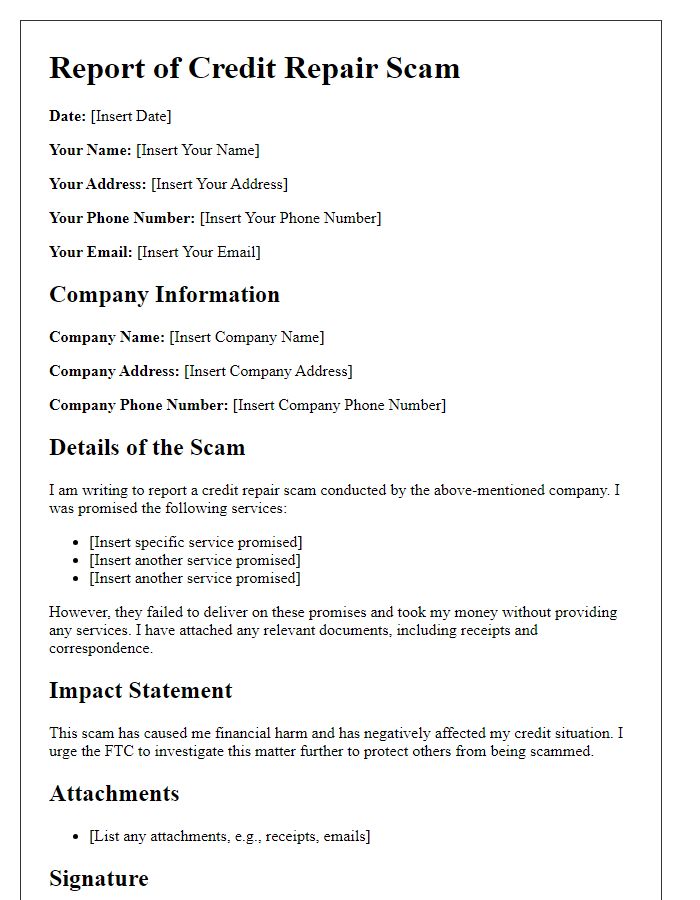

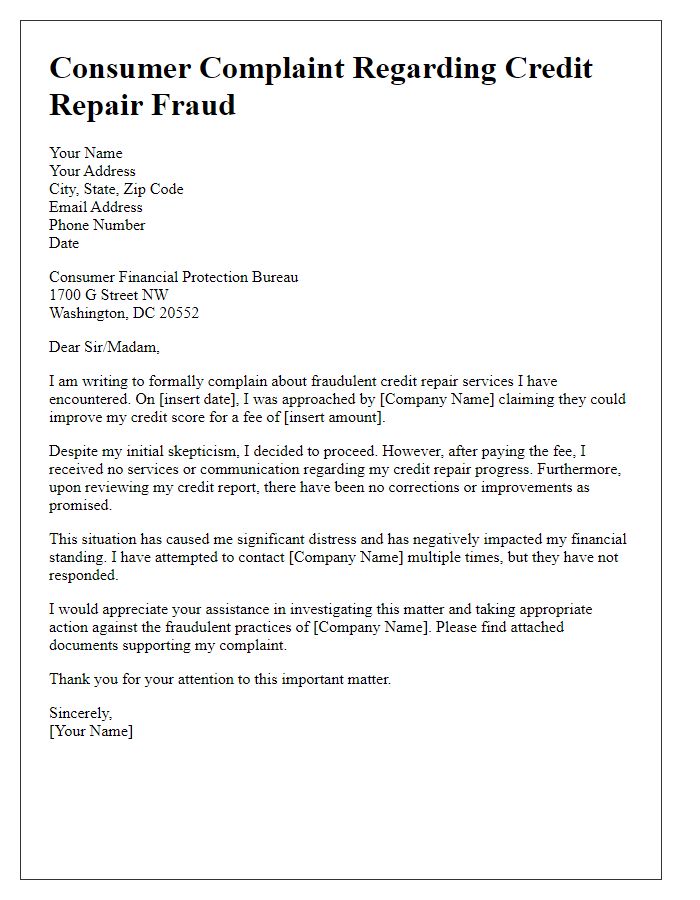

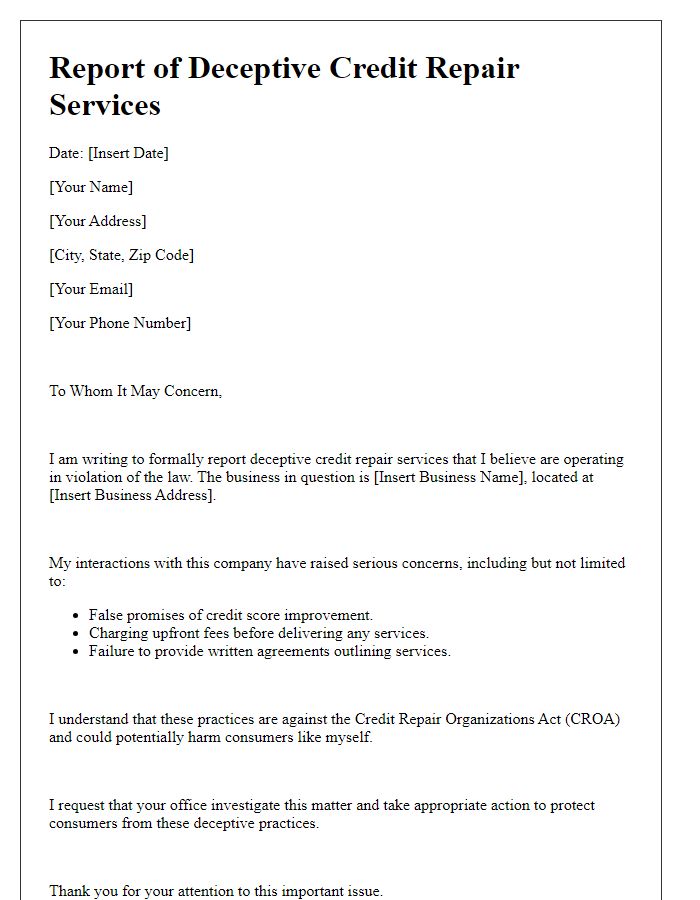

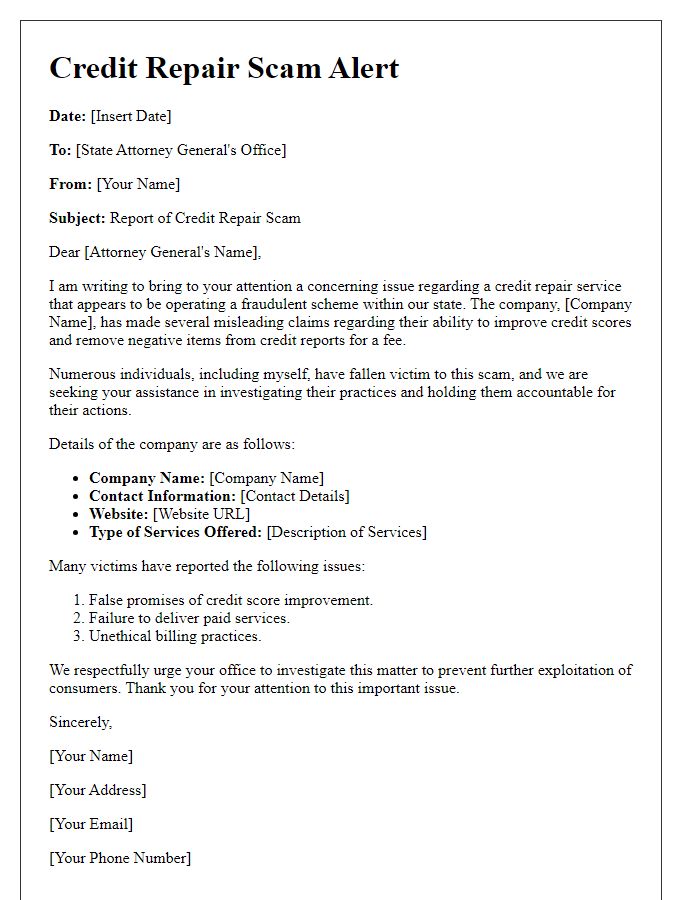

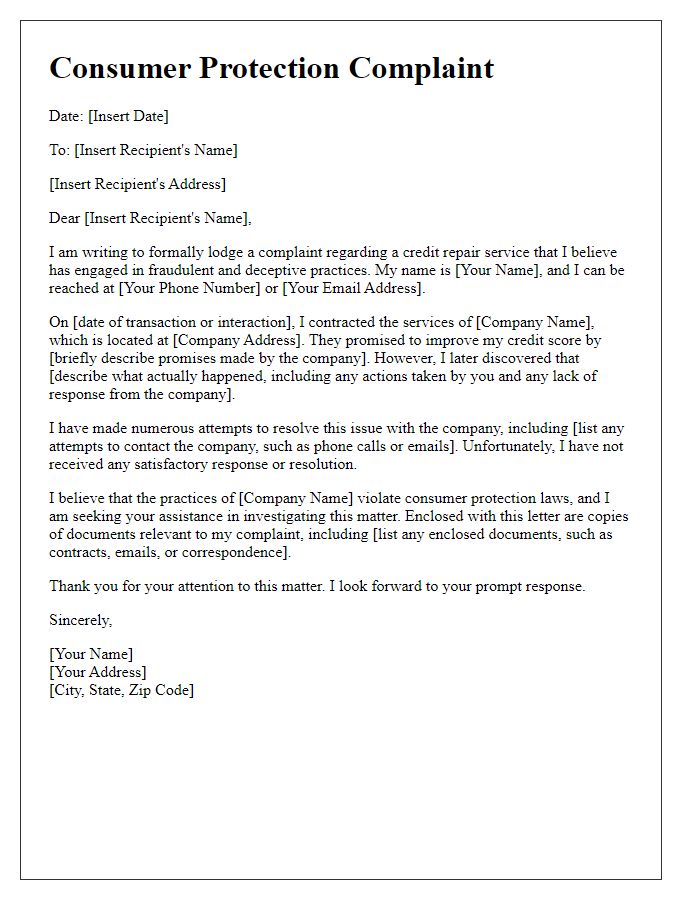

Letter Template For Reporting Credit Repair Scam Samples

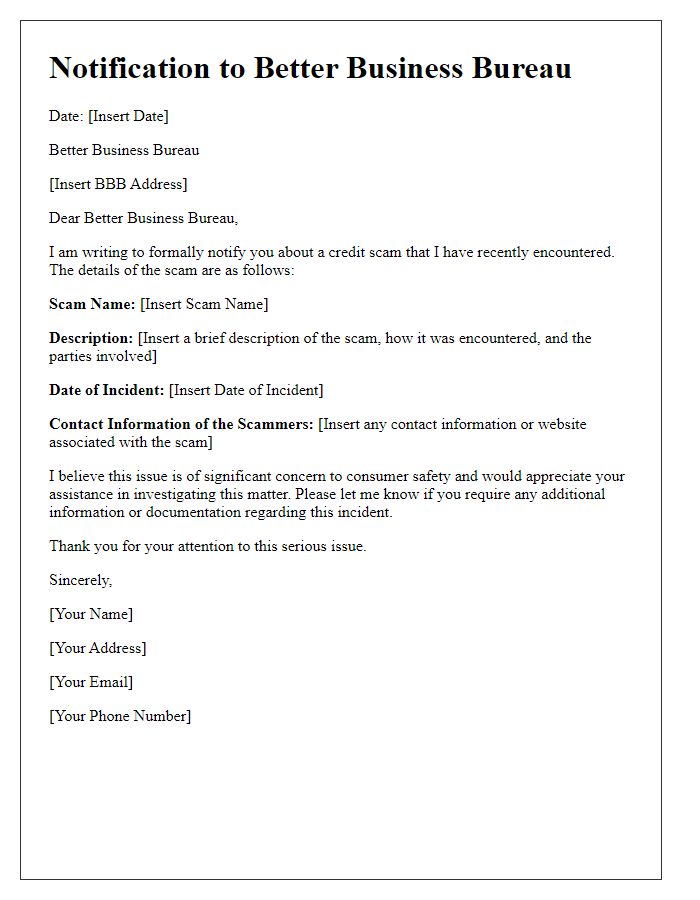

Letter template of notifying the Better Business Bureau about credit scam

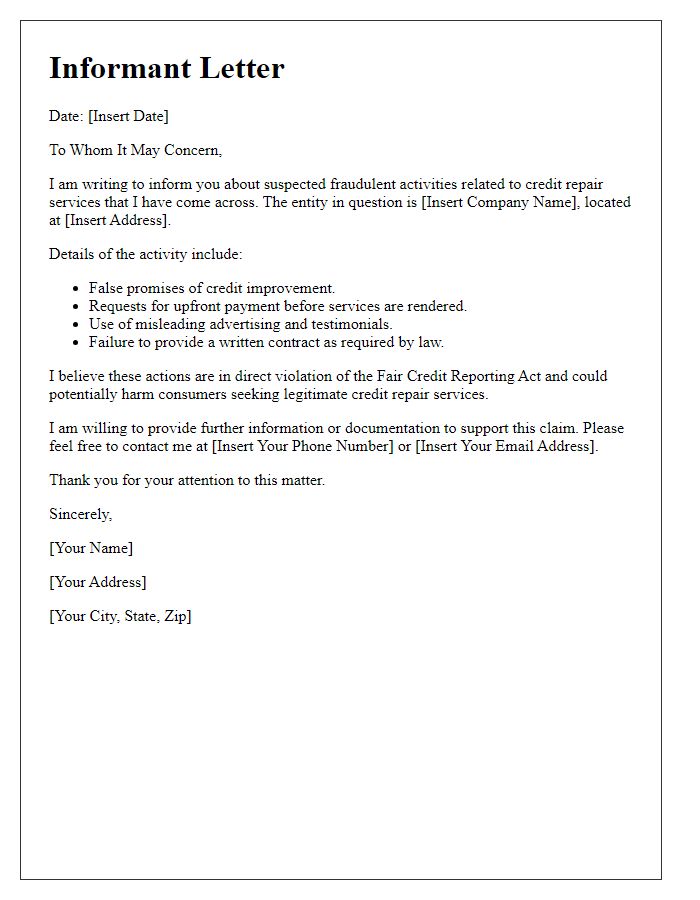

Letter template of informant letter for fraudulent credit repair activities

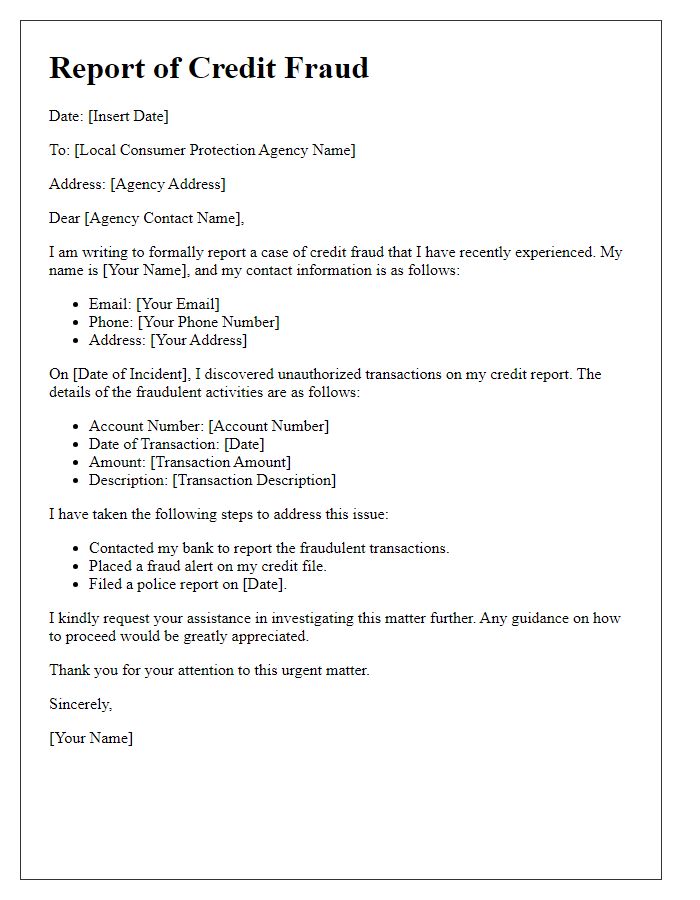

Letter template of report to local consumer protection agency about credit fraud

Comments