Have you ever found yourself puzzled by a soft inquiry on your credit report? Soft inquiries can happen when lenders check your credit for promotional purposes, and while they don't impact your score, they might not be your favorite thing to see. If you're looking to have a soft inquiry removed, the process is easier than you might think. Keep reading to discover a simple template for your request that can help you get those pesky inquiries off your report!

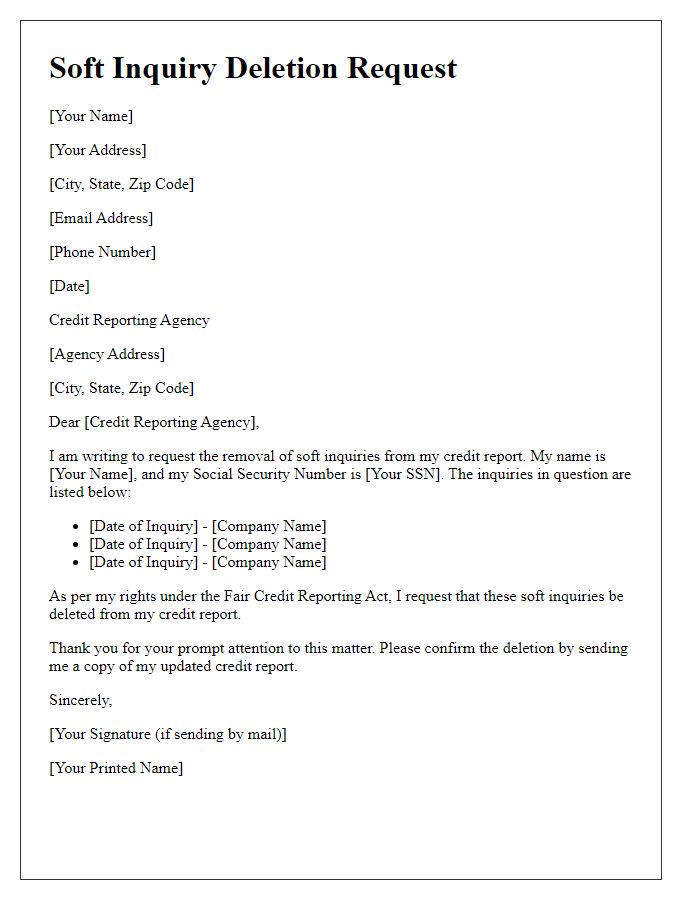

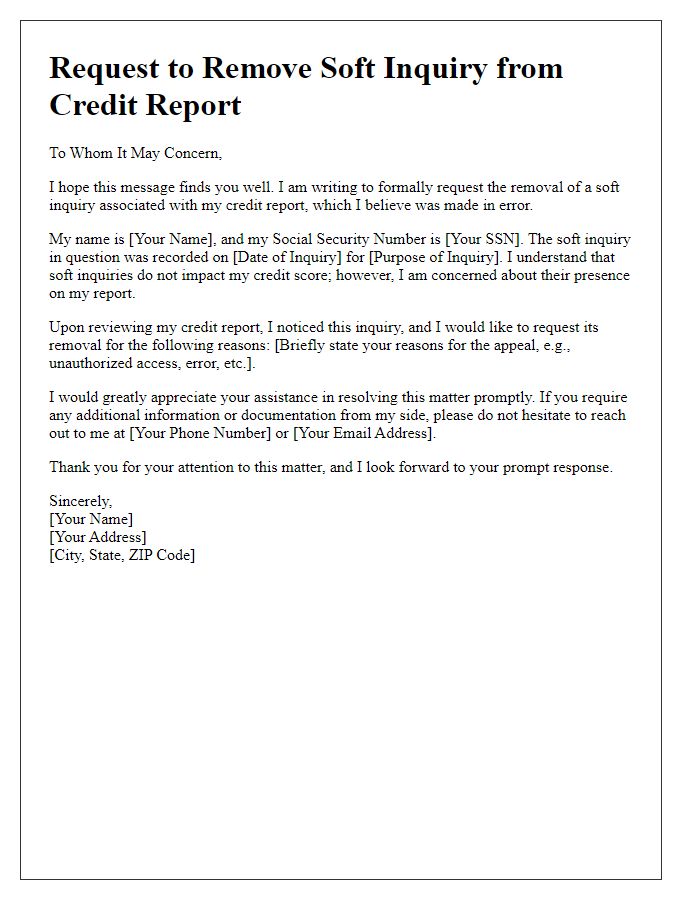

Clear identification details

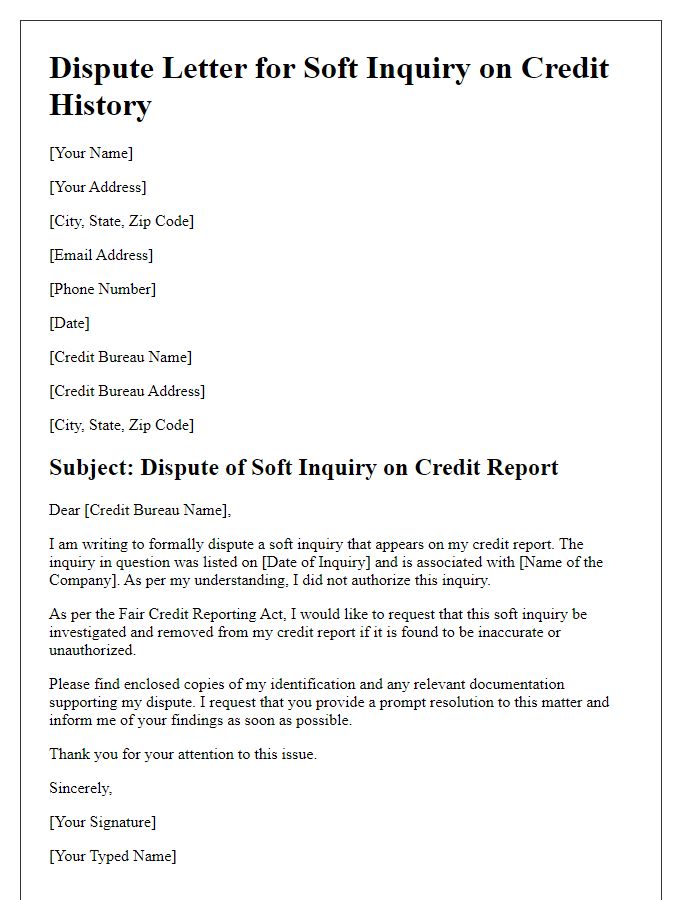

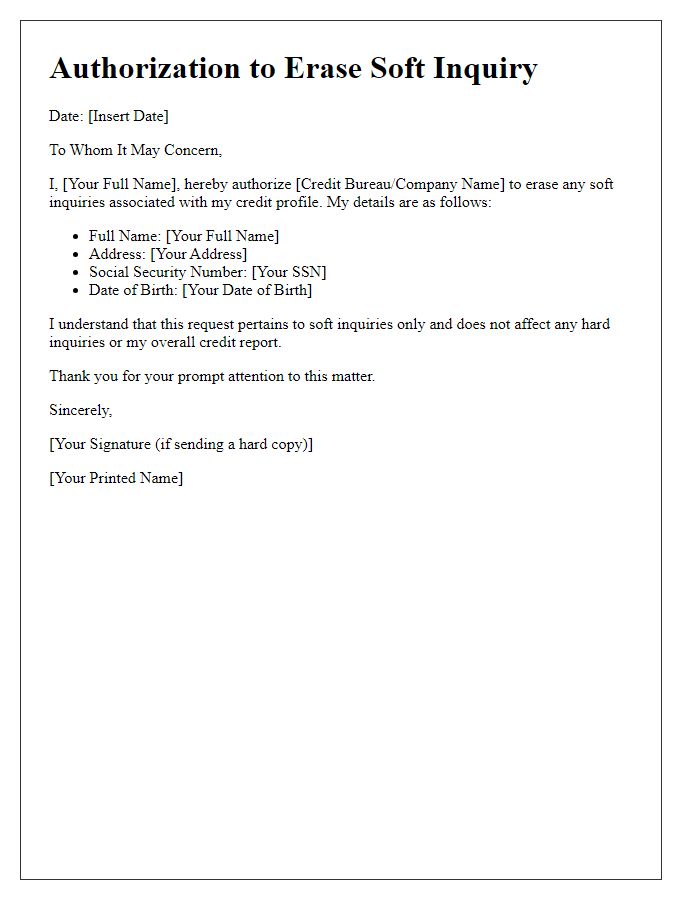

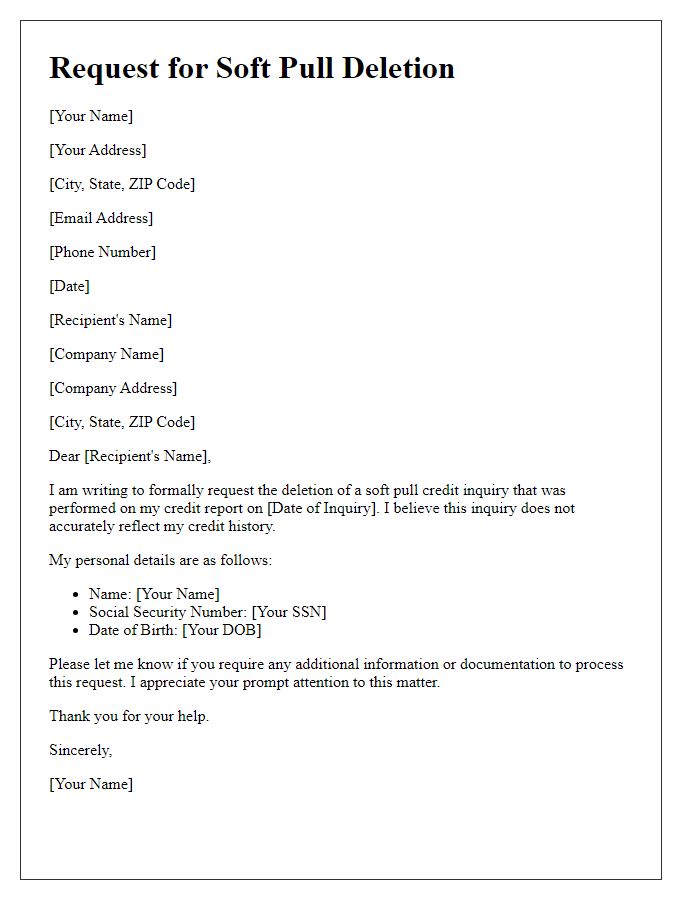

A soft inquiry removal request involves addressing the effects of a soft inquiry on credit scores and the importance of safeguarding personal financial information. Soft inquiries, such as those from pre-approved credit offers or credit checks made by potential employers, do not impact credit scores but can accumulate in credit reports (maintained by Equifax, Experian, and TransUnion). Individuals seeking removal should properly identify themselves, including full name, address, Social Security number, and any account or reference number associated with the inquiry. This ensures credit reporting agencies can accurately locate and process the request. With appropriate identification, processing concerns about privacy and potential future impact on creditworthiness is more effective.

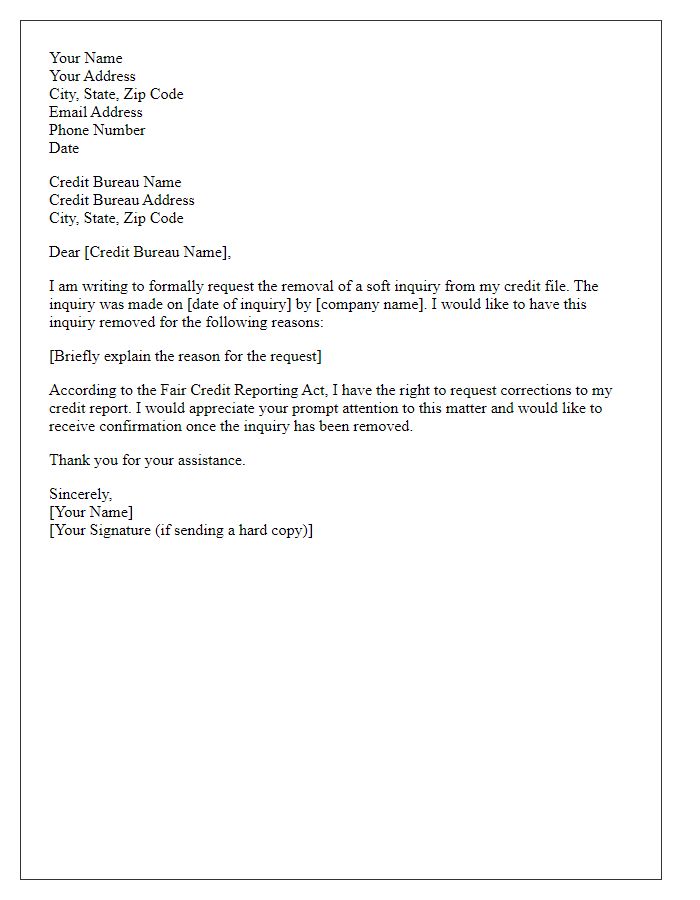

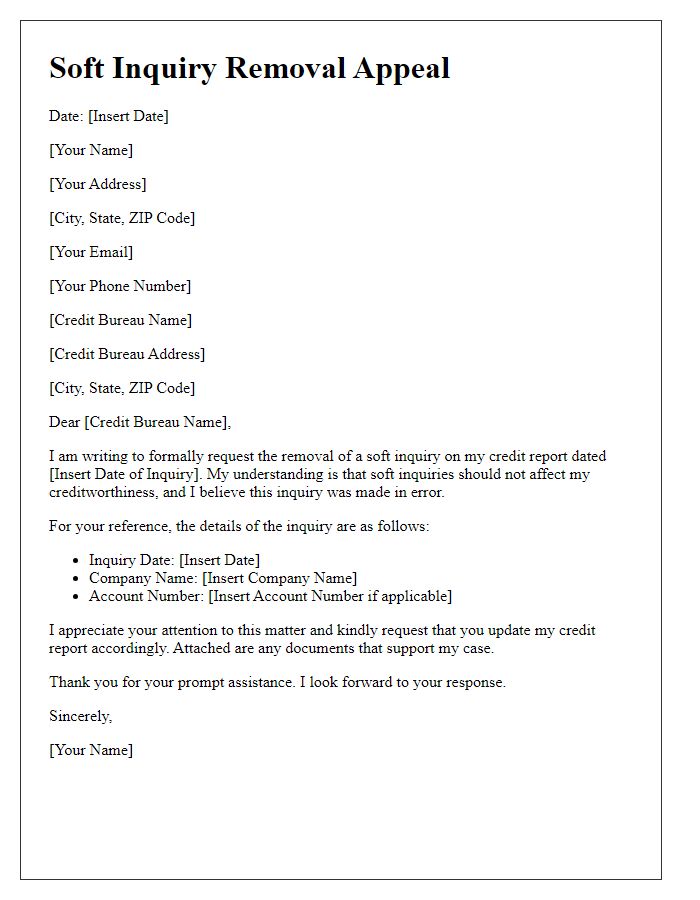

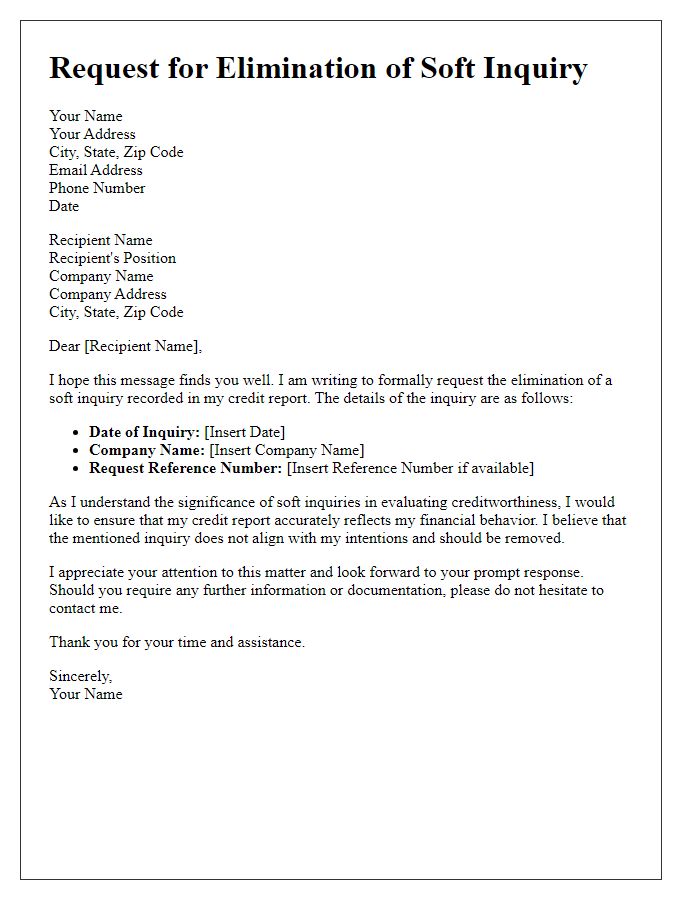

Specific soft inquiry reference

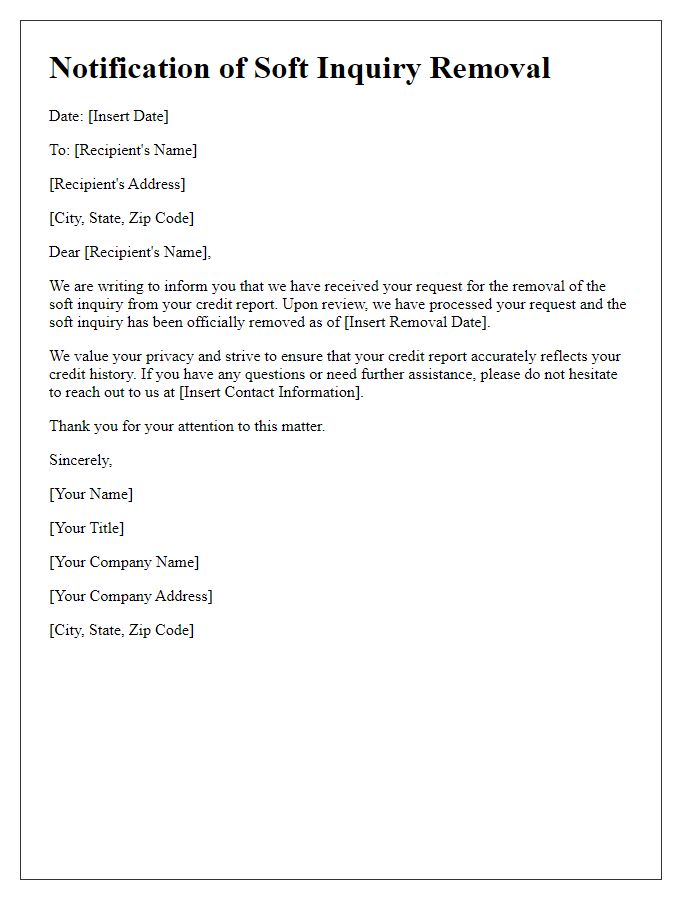

A soft inquiry, which refers to a type of credit check that does not affect a consumer's credit score, can often be tied to various financial activities such as pre-approvals for loans or credit cards. For individuals seeking to have specific soft inquiries removed from their credit report, it is essential to reference the precise inquiry in question, typically noted by the date of the inquiry and the name of the institution. Upon contacting credit reporting agencies like Experian, Equifax, or TransUnion, providing this detailed information will streamline the process for removal. In cases of financial institutions performing soft pulls without explicit consent, individuals may cite violations of consumer protection laws which could bolster their request for removal. This action aids in maintaining the individual's credit profile clean and potentially improving chances for favorable credit offers in the future.

Reason for removal request

Removal of soft inquiries from credit reports may be requested to enhance overall creditworthiness and improve eligibility for loans. Soft inquiries, typically arising from pre-approval checks or personal credit assessments, do not influence credit scores directly. However, an accumulation of multiple soft inquiries may create a negative perception for potential lenders. Addressing concerns related to unsolicited offers or frequent credit checks can promote a cleaner credit profile. This approach aims to foster better opportunities for favorable interest rates and loan approvals in the future, especially in competitive financial markets.

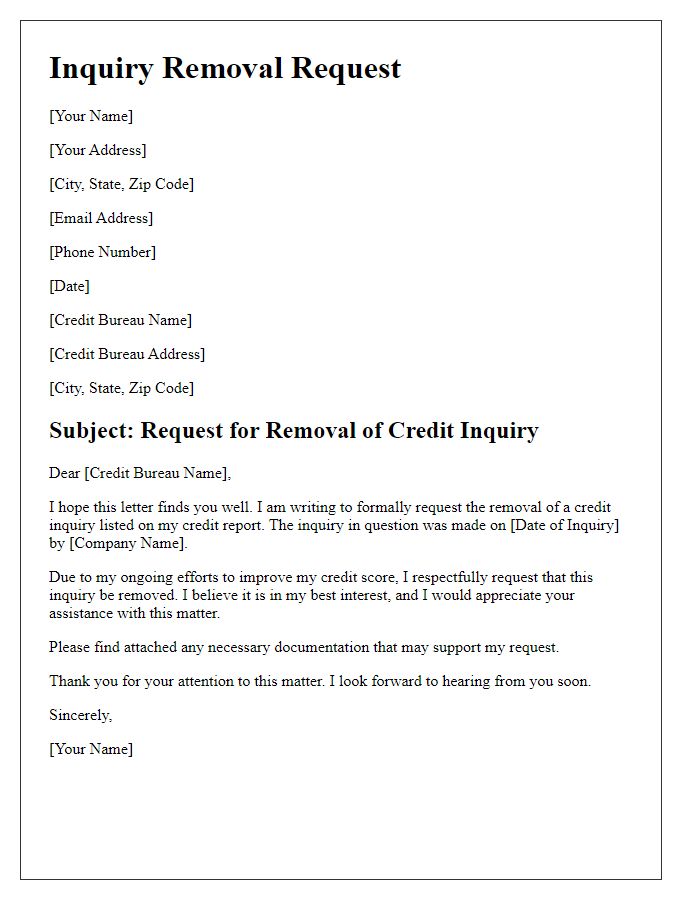

Formal tone and polite language

A soft inquiry, or a soft pull, refers to a type of credit check that does not impact an individual's credit score, often used for background checks or pre-approval processes. It is important for individuals to monitor their credit reports regularly, as too many hard inquiries can negatively affect credit scores. While soft inquiries are generally benign, individuals may prefer to request their removal for clarity or to maintain privacy. Be sure to verify the date and nature of the inquiry and provide relevant personal information (such as full name, address, and Social Security number) when submitting the request to ensure accurate processing.

Accurate contact information

Inaccurate contact information can lead to complications during the soft inquiry removal process, impacting your credit profile negatively. Soft inquiries, which include requests by employers or creditors not affecting credit scores, may linger on your report if not addressed properly. Accurate personal details (such as full name, address, and Social Security number) are crucial for the credit reporting agencies like Experian, Equifax, and TransUnion. This accuracy ensures the efficient processing of your removal request, improving your overall credit standing and potential opportunities for future loans or credit cards.

Comments