Are you looking to simplify your online life by removing closed accounts? It's a common desire to declutter and ensure that your digital presence aligns with your current needs. In this article, we'll guide you through the process of requesting closed account removals, making it easier than ever to take control of your online identity. Keep reading to discover the essential steps and letter template you'll need to get started!

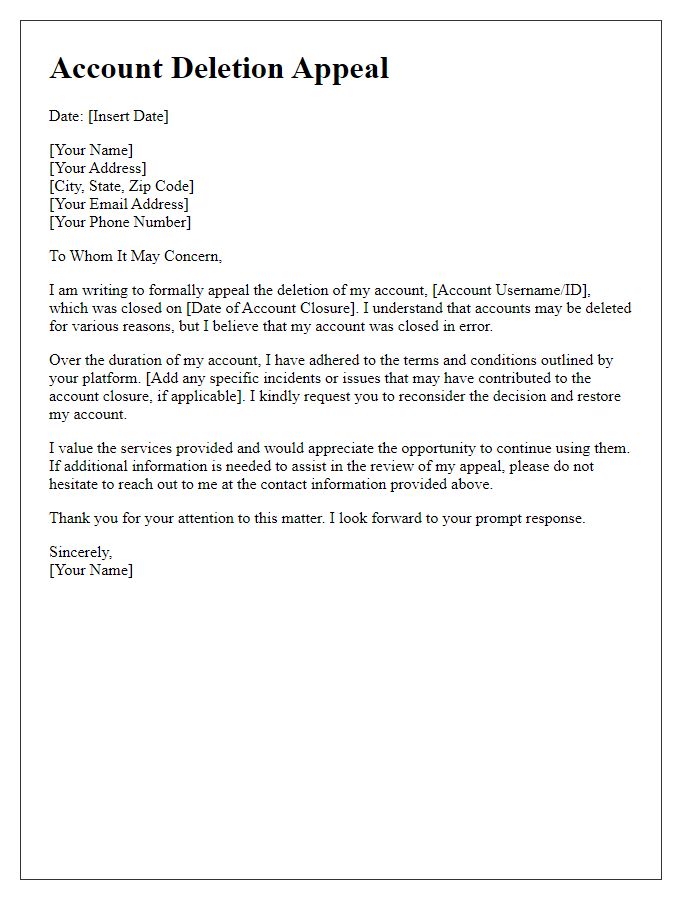

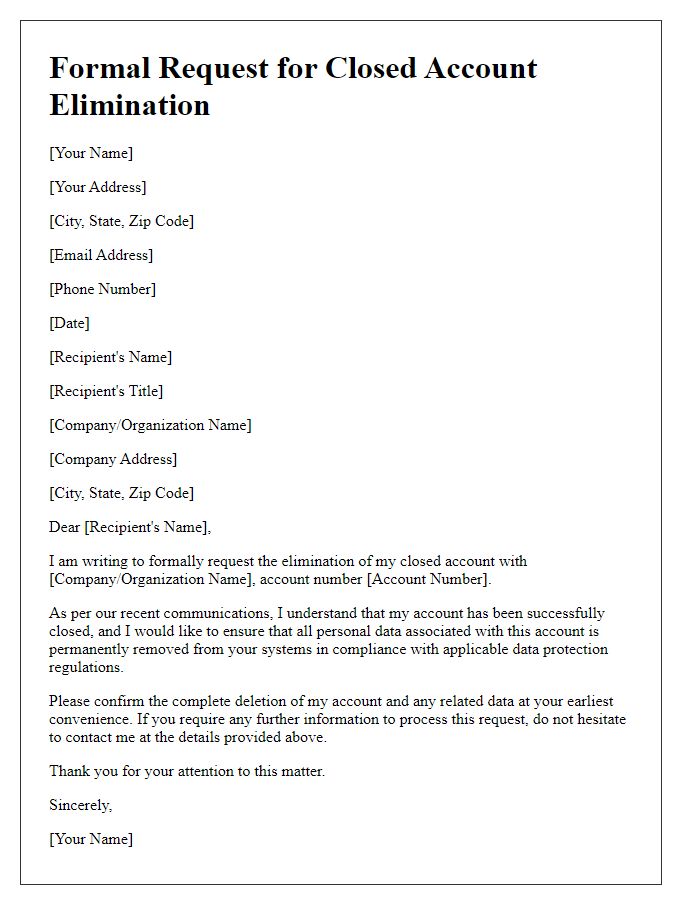

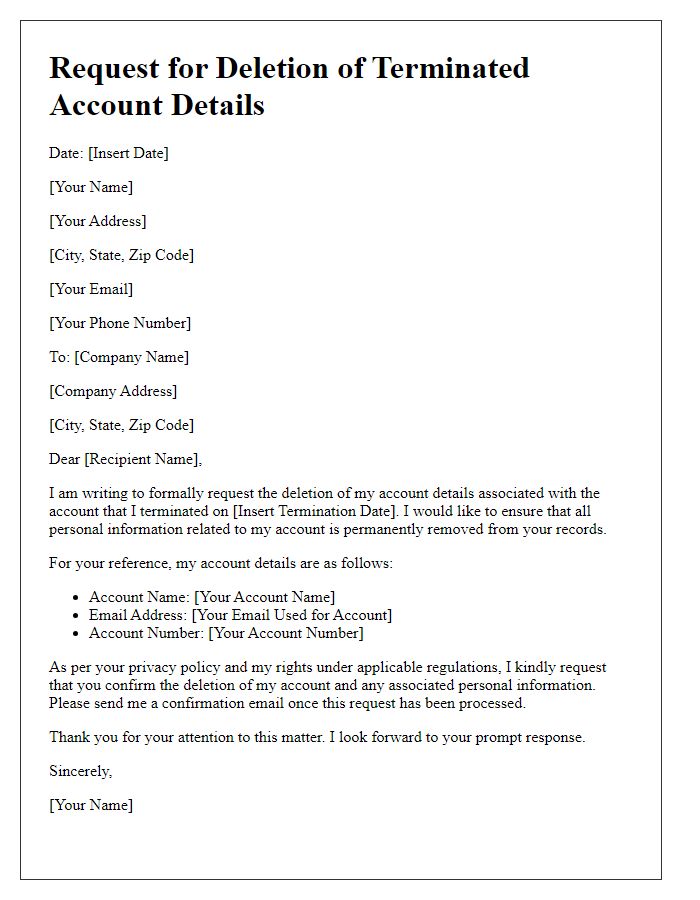

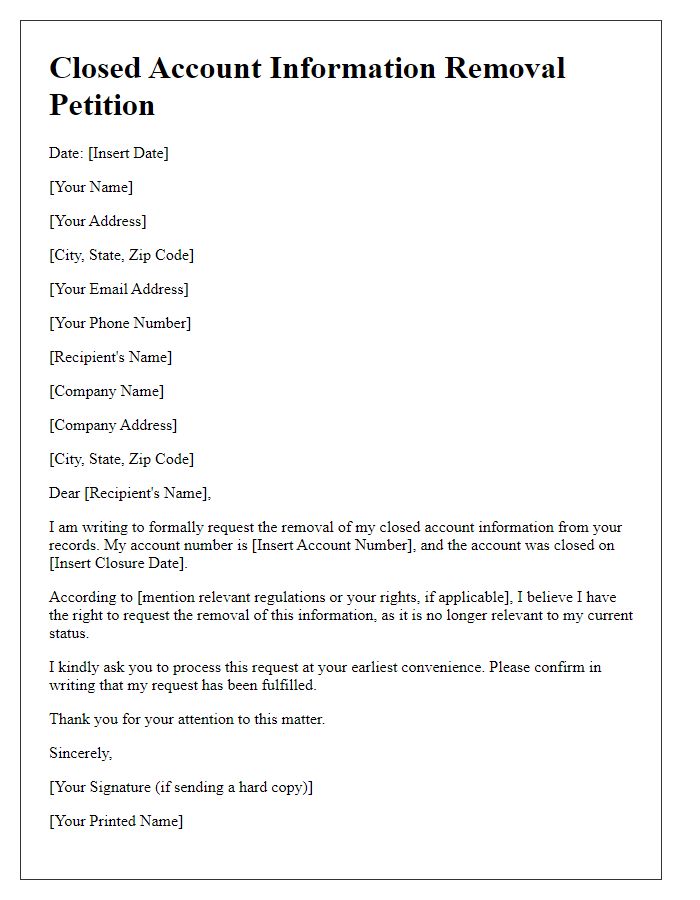

Clear identification of account details

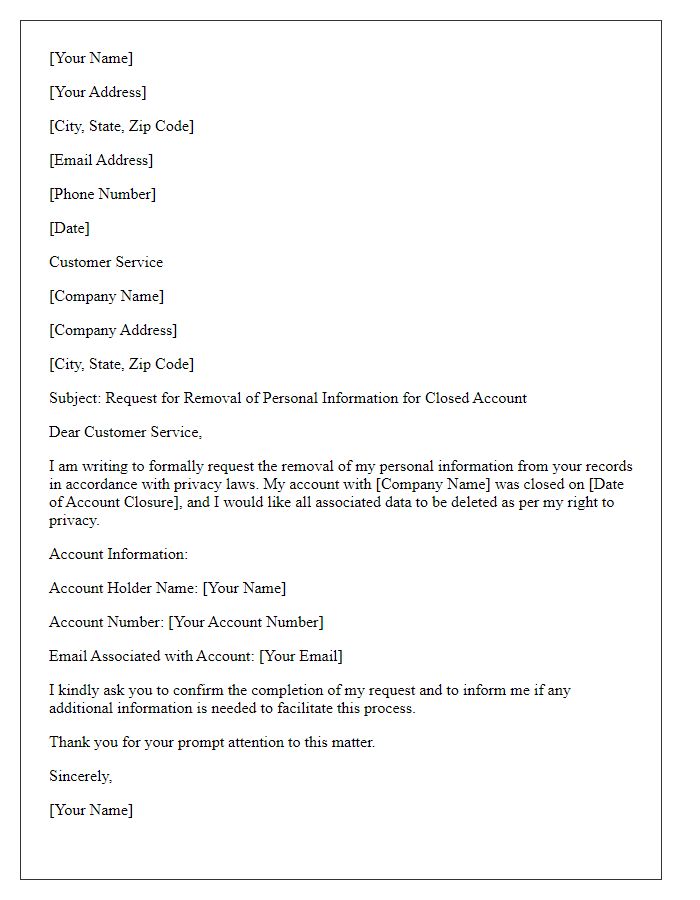

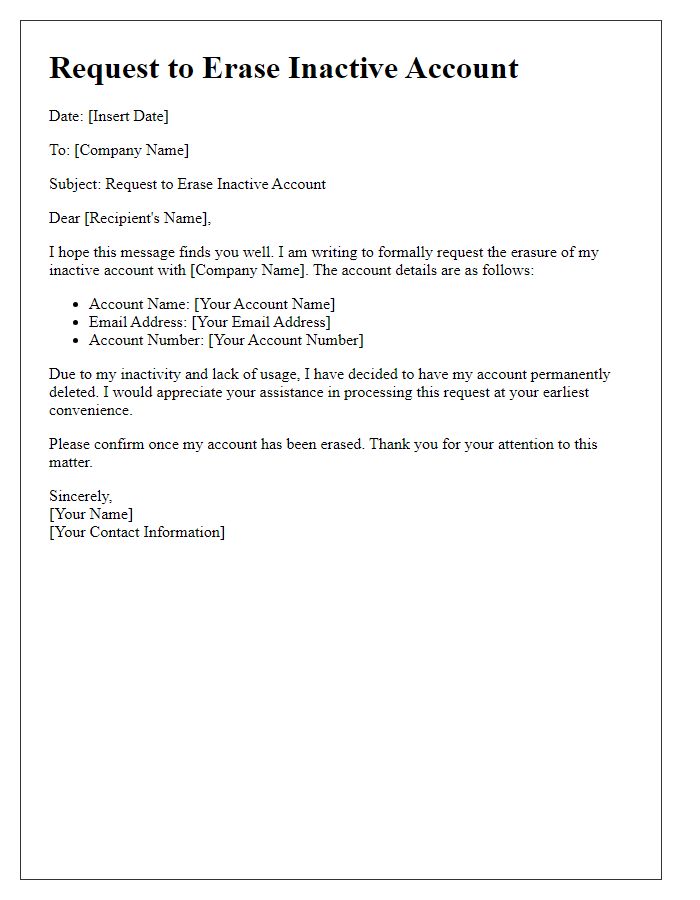

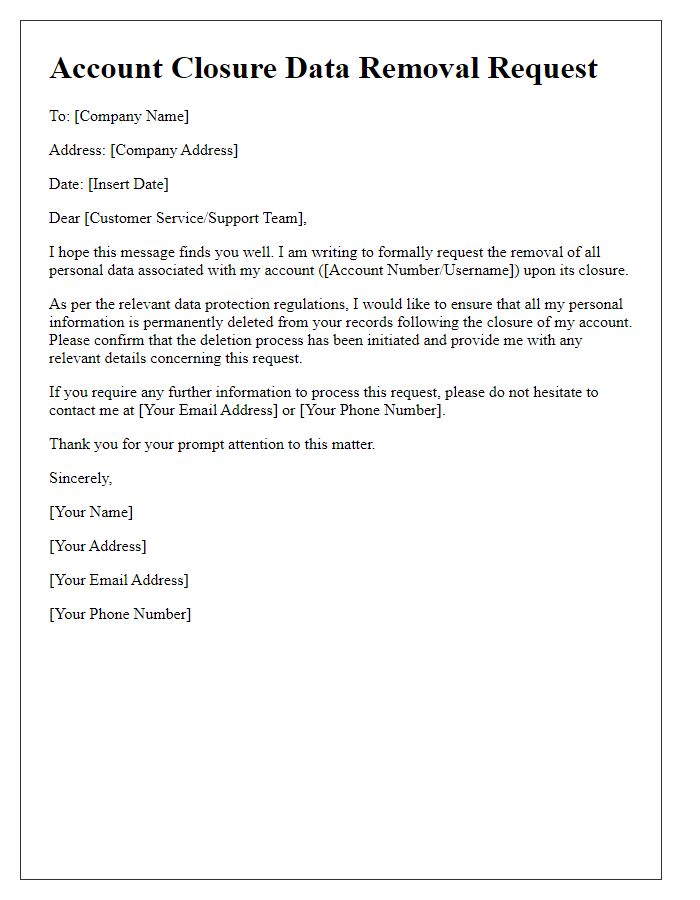

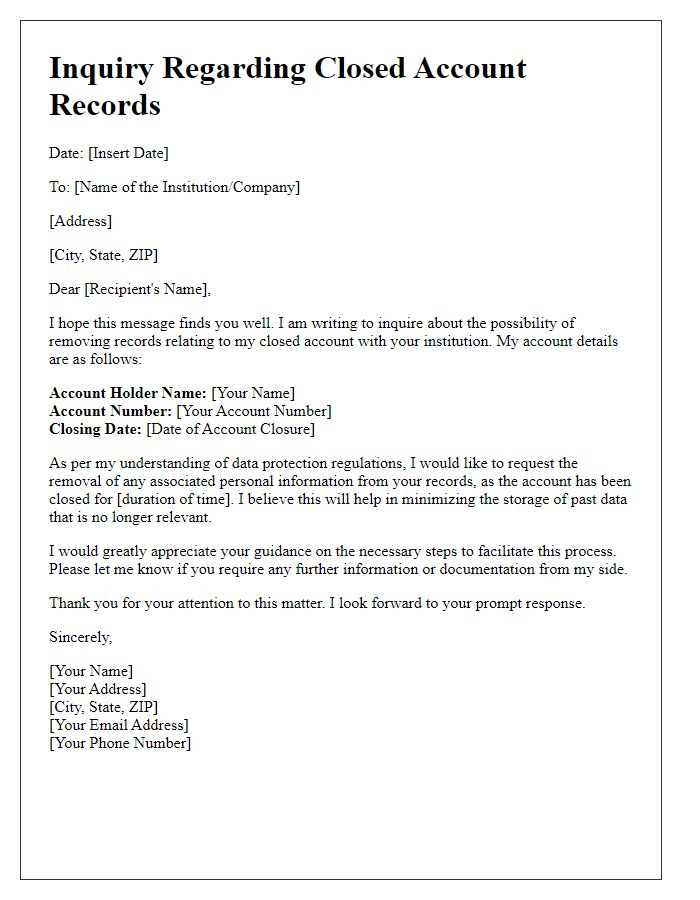

Requesting the removal of a closed account requires clear identification. Your email should include essential details such as account number (a specific numeric identifier linked to your financial institution), account holder name (the personal name associated with the account), and type of account (savings, checking, credit, etc.). Include the closure date (the specific day the account was officially closed) and a reason for removal request (such as data privacy concerns or simplification of records). Additionally, specify contact information (email address or phone number) to facilitate follow-up communication regarding account status.

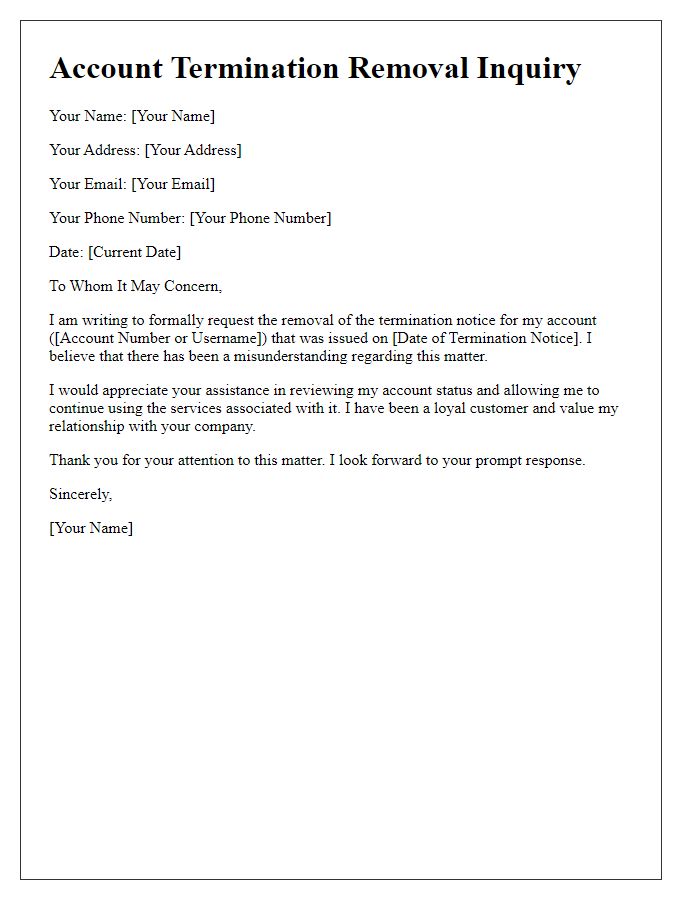

Request for written confirmation of account closure

Request for written confirmation of account closure involves a formal notification directed towards a financial institution or service provider. This process typically requires details such as account number, associated personal information, date of account closing, and specific closure request motivation. Clear communication helps ensure that customer records reflect the account removal effectively. Written confirmation serves as valuable documentation, providing proof of account closure and protection against potential future disputes. A timely response, ideally within 30 days, is standard practice to ensure compliance with financial conduct regulations across various jurisdictions.

Assurance of no outstanding balance

Financial institutions may require customers to submit a closed account removal request to eliminate personal information from their records, ensuring no lingering data remains. Customers typically seek assurance of no outstanding balance prior to this request, which can prevent future fees or potential identity theft. Completed accounts should reflect a zero balance (indicating no further transactions or financial obligations exist), providing peace of mind. Request documentation, such as account statements from the last two months, can serve as proof to bolster the validity of the closure request. In addition, confirmation emails or messages from customer service representatives can further verify the account's closed status, aiding in the removal process from the bank's database.

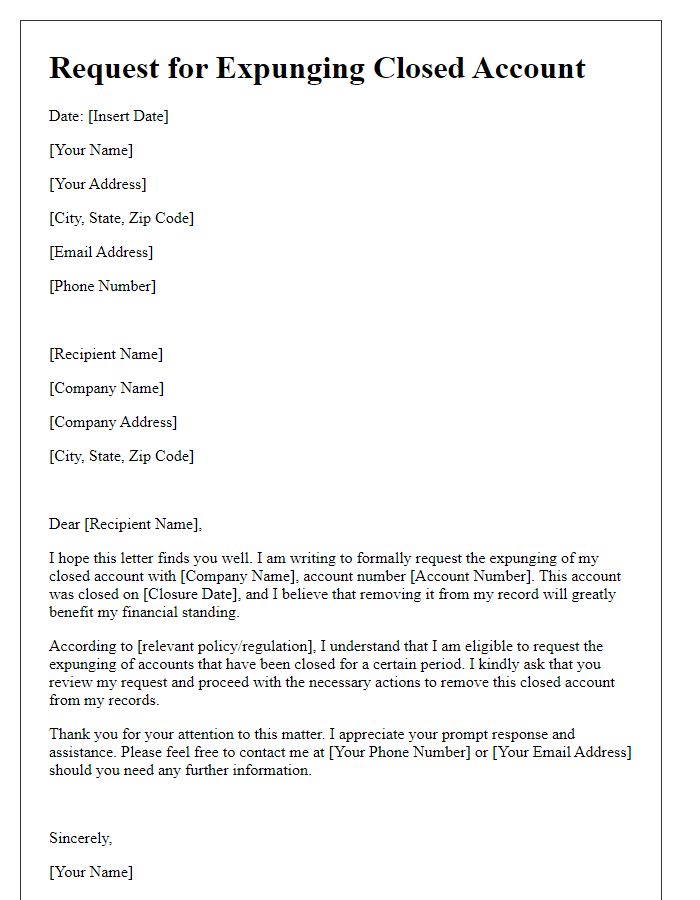

Request for removal of account from credit report

A closed account can impact credit scores, particularly if it has negative information. Credit reporting agencies such as Experian, TransUnion, and Equifax retain closed accounts for up to ten years. This can hinder loan approvals and affect interest rates. Consumers can request removal of closed accounts by submitting a formal dispute, providing documentation like account statements and closure confirmation from the lender. Timely action (within 30 days of identifying inaccuracies) is crucial for increasing credit score potential. Proper follow-up with credit bureaus post-request ensures the removal process is initiated effectively.

Contact information for follow-up communication

A closed account removal request should include essential details to facilitate a streamlined process. Providing comprehensive contact information is crucial for follow-up communication. Include full name (as registered with the account), email address (primary communication channel), and phone number (for direct inquiries or verification). Also, specify the account type (e.g., savings, credit card) and associated account number (if applicable), ensuring the removal request is linked to the correct account. For further clarity, indicate any preferred method for future correspondence, such as email or phone, and state a reasonable timeframe for a response, typically 5-10 business days. Including a concise summary of the request's purpose can also enhance clarity and expedite actions taken by the receiving institution.

Comments