Are you feeling overwhelmed by your financial situation and uncertain about how to communicate with your creditors? Writing a letter to request better communication can be a powerful step towards regaining control. By clearly outlining your needs and concerns, you not only establish a connection with your creditors but also pave the way for more manageable repayment options. If you're interested in learning how to craft the perfect request letter, read on for some helpful tips and templates!

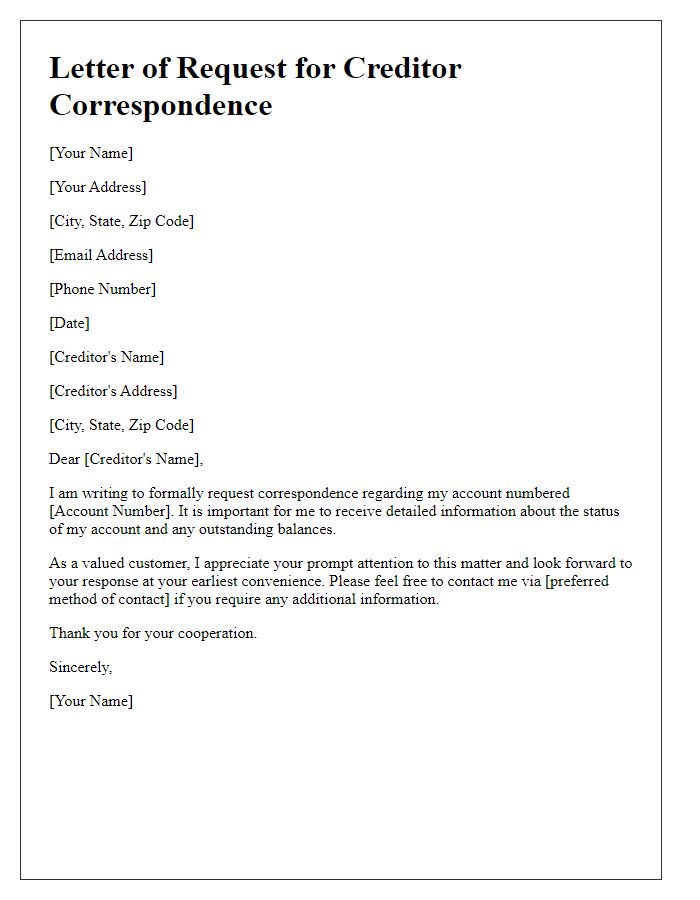

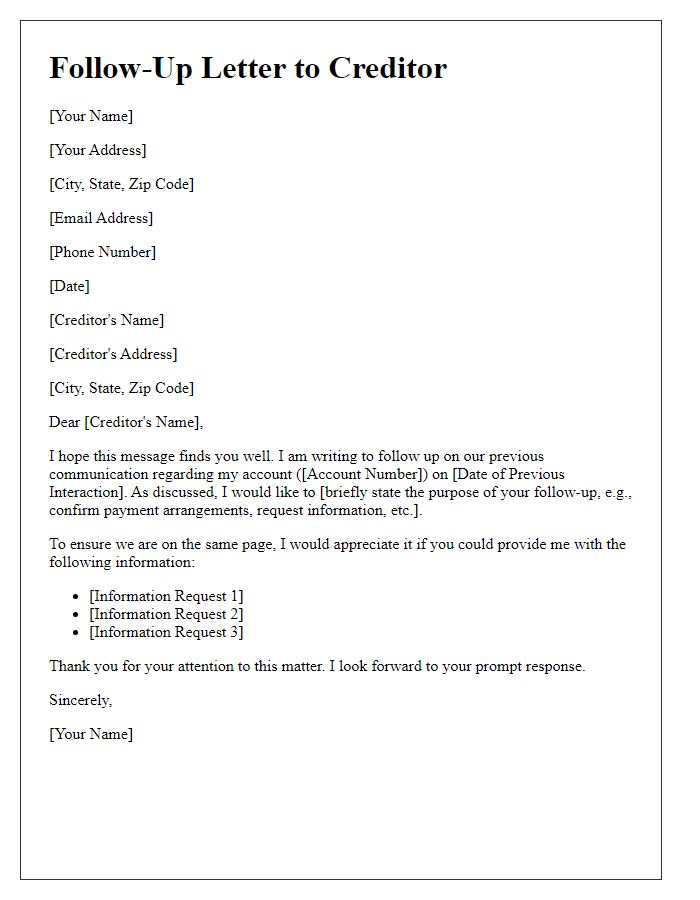

Clear identification details (name, account number).

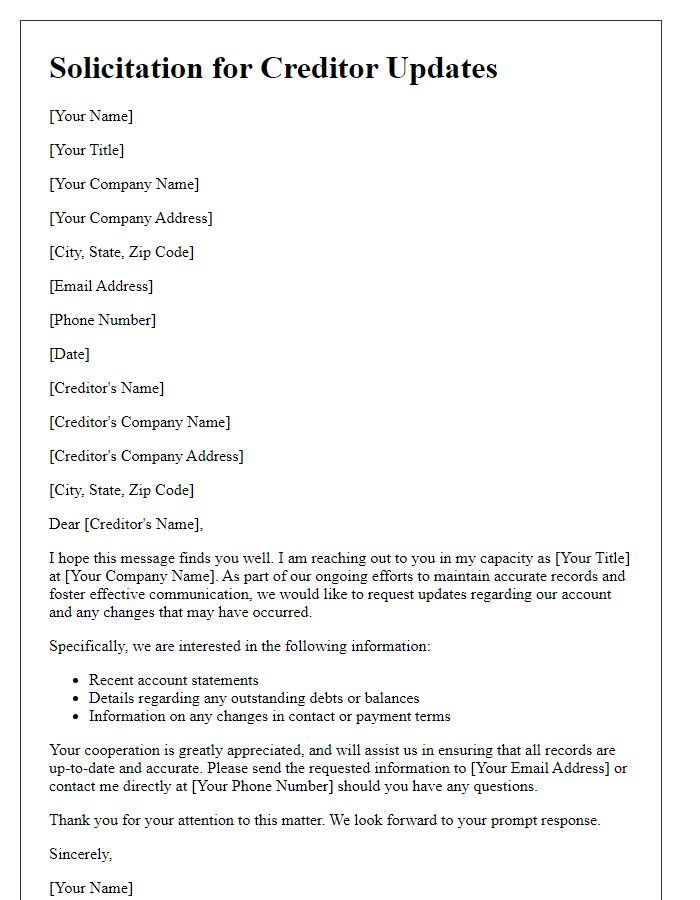

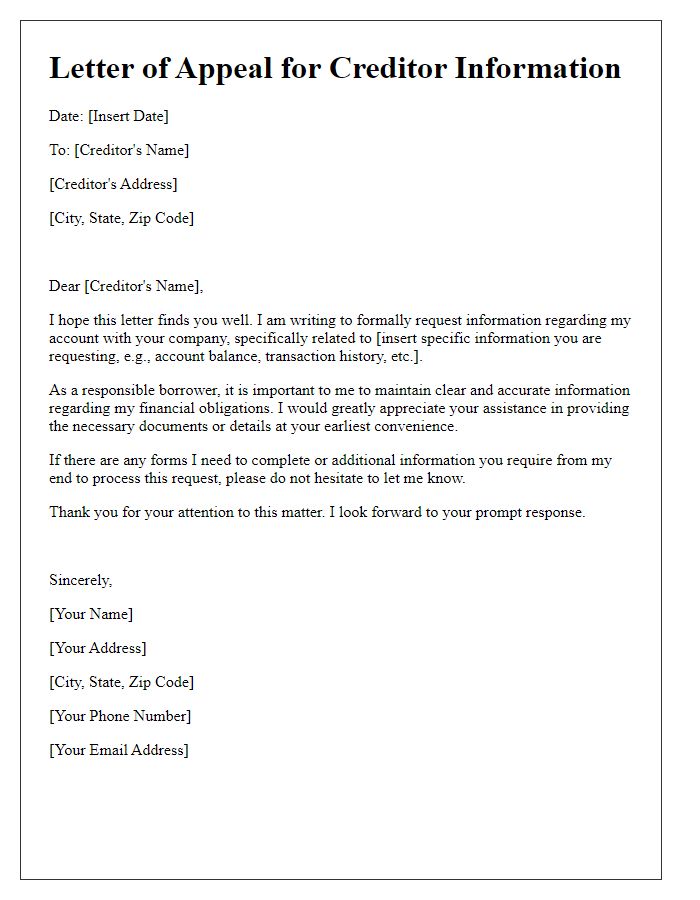

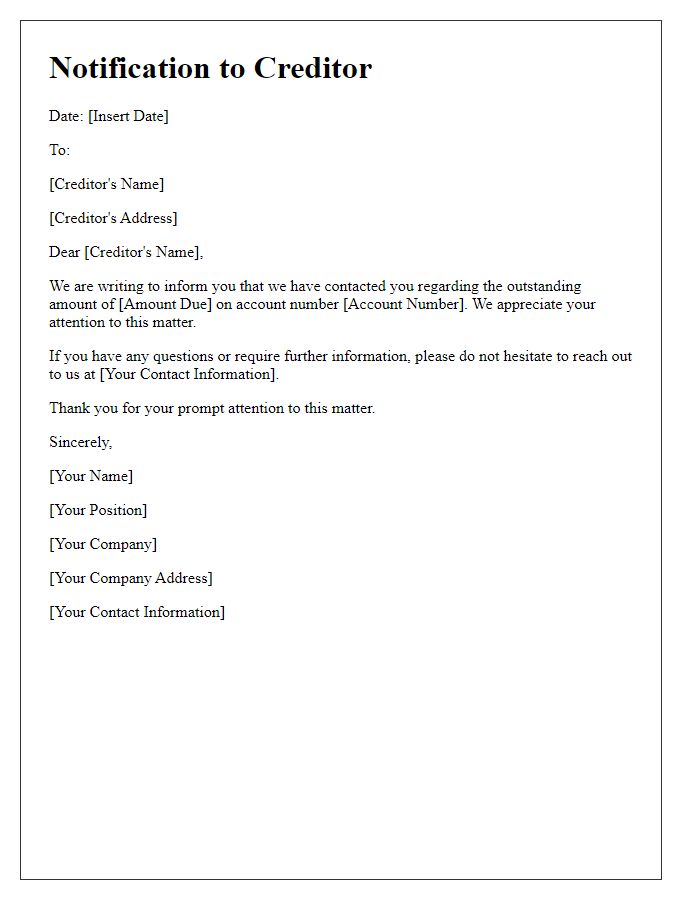

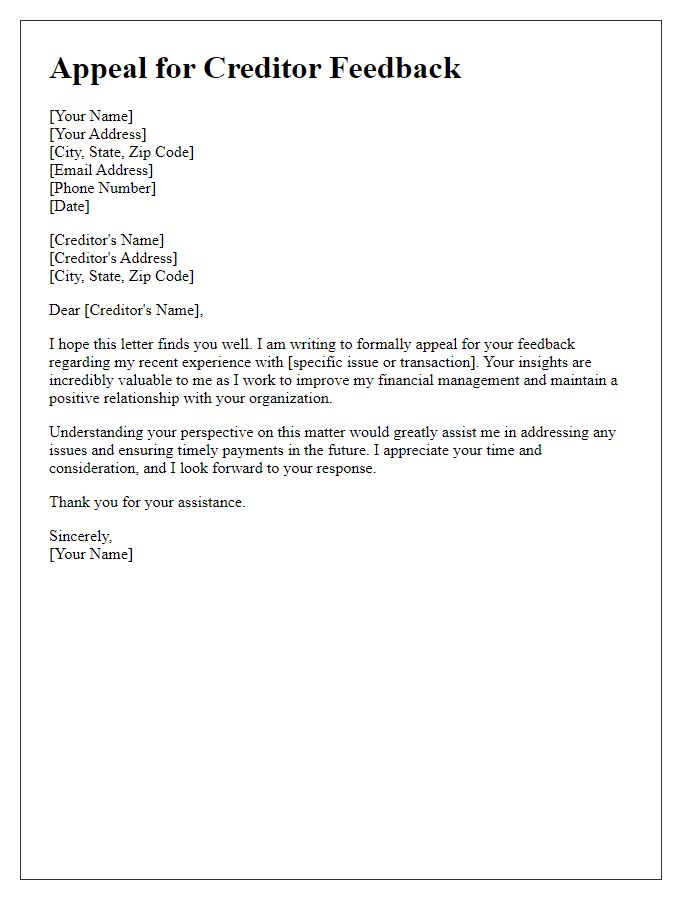

Creditors must maintain clear communication with clients regarding outstanding balances and payment terms. Individuals should include specific identification details such as full name, which helps establish their identity. Account number is critical, providing a unique reference tied directly to personal financial transactions. Including contact information ensures prompt responses. A respectful and professional tone enhances the likelihood of receiving constructive feedback. This correspondence fosters transparency, crucial for managing debts effectively. Keeping accurate records of such communications can assist in tracking resolutions or ongoing payment plans.

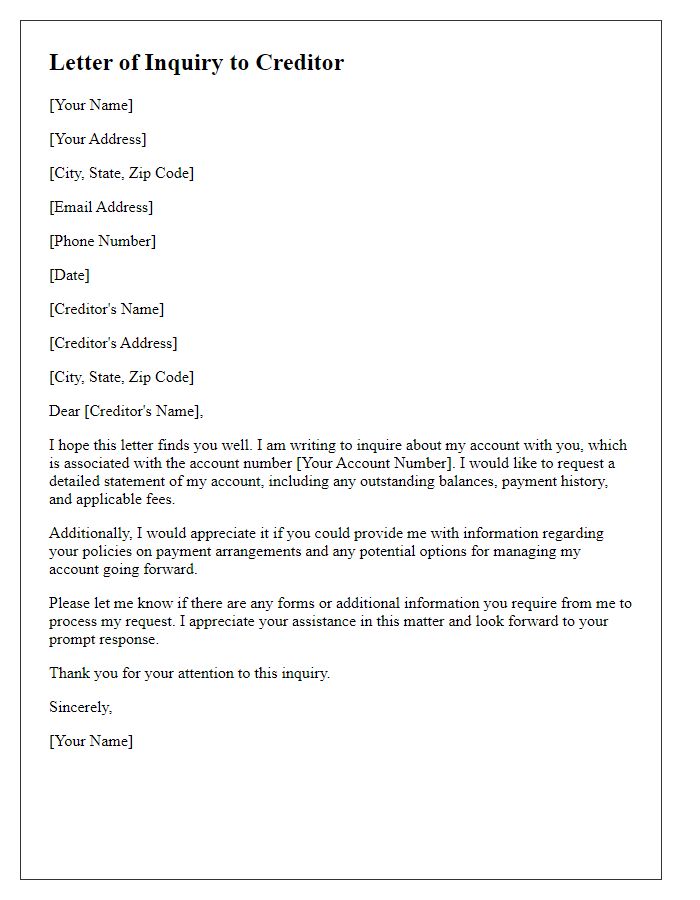

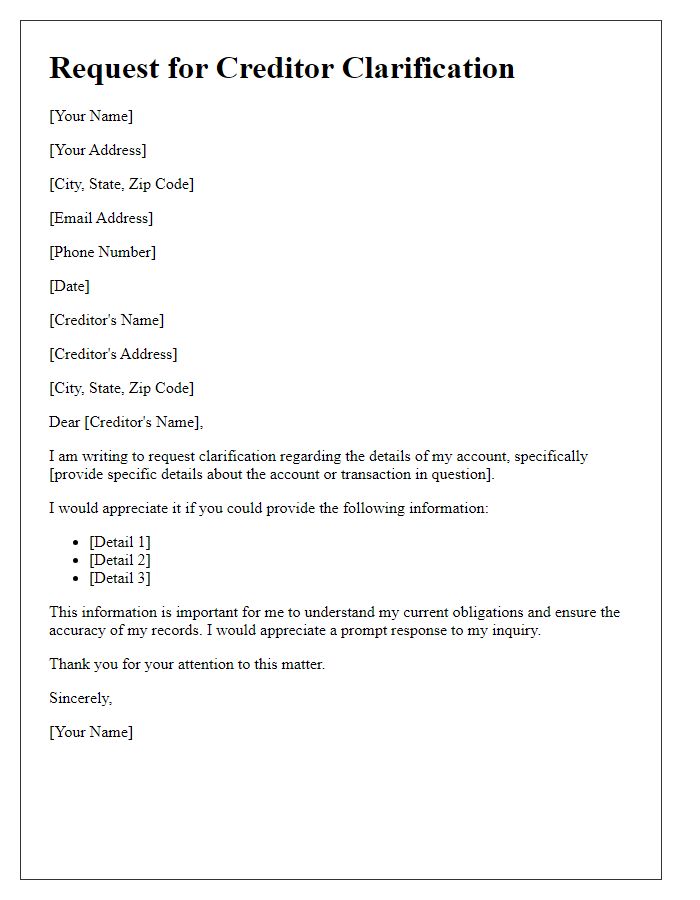

Purpose of communication (specific request or issue).

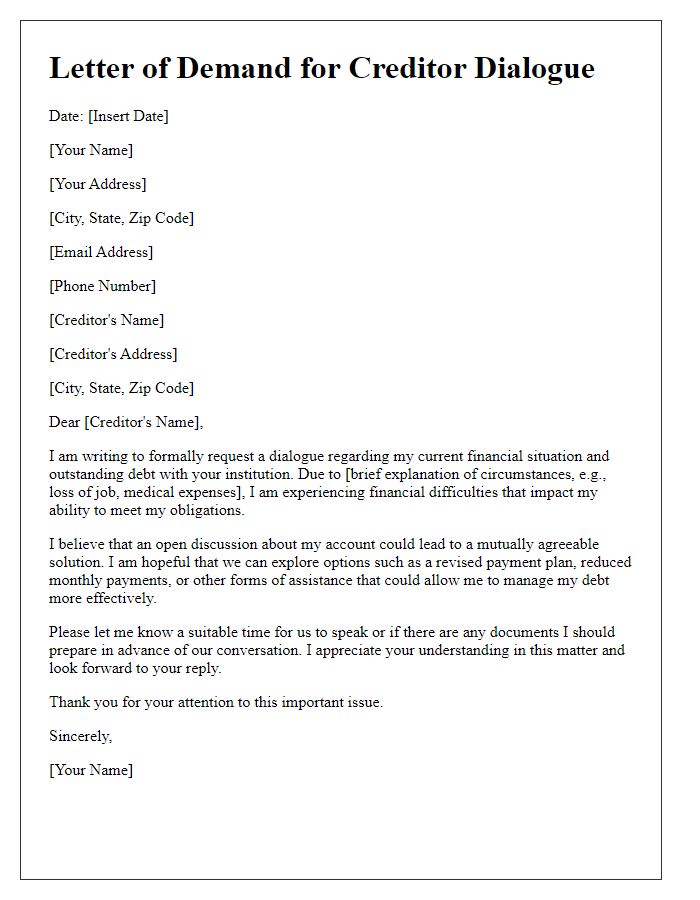

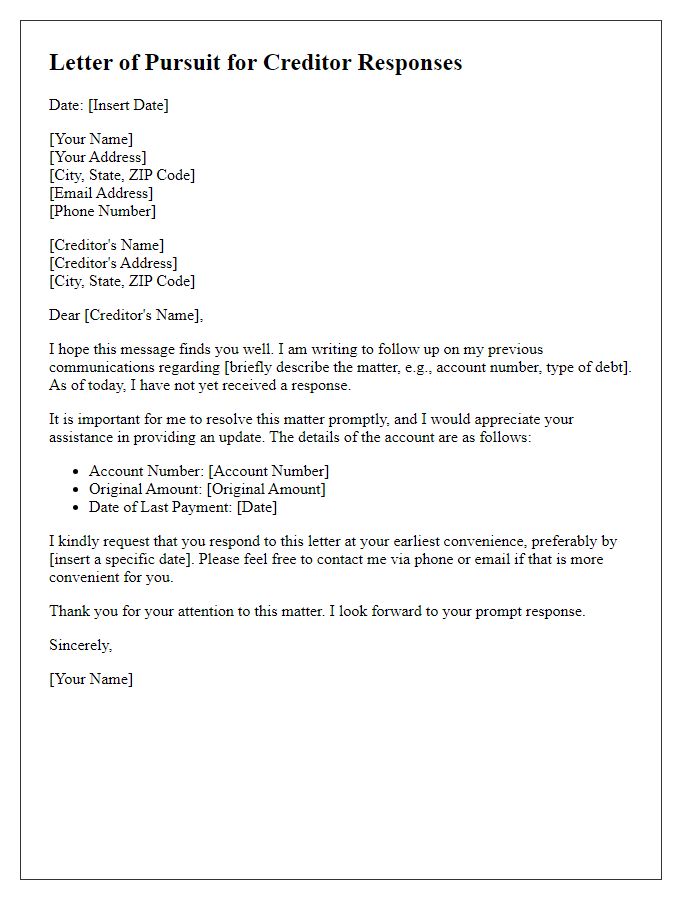

A formal request to creditors regarding outstanding balances can facilitate better understanding of financial obligations. Such communication usually involves clarifying payment schedules, inquiring about interest rates, or disputing charges. The creditor's name, account number, and specific amounts owed, often detailed in previous statements, are key pieces of information to include. In some instances, it may be beneficial to provide context, such as recent financial hardships or employment changes that affect repayment capability, making the request for leniency or alternative payment arrangements more compelling. Clear documentation of previous correspondence may further strengthen the legitimacy of the request.

Professional and polite language.

Creditors often require formal communication regarding outstanding debts or payment plans. A structured request may begin by addressing the creditor directly, mentioning the specific account number associated with the debt. Clarity in outlining the purpose of the request, whether seeking a payment plan, disputing charges, or requesting detailed statements, ensures the creditor understands the intent. Including relevant details such as payment history, current financial situation, and proposed terms can facilitate constructive dialogue. It is essential to emphasize a willingness to cooperate and find a mutually agreeable solution while maintaining a respectful tone throughout the correspondence. Closing with gratitude for their attention to the matter can leave a positive impression.

Preferred method of contact and contact information.

When a debtor seeks to facilitate communication with a creditor, it is essential to specify the preferred method of contact (such as phone, email, or written correspondence) and provide up-to-date contact information to ensure effective dialogue. Clear, concise communication can prevent misunderstandings and streamline the process of resolving outstanding debts. Using email, for instance, allows for documented interactions, while phone calls offer immediate dialogue. Providing alternative options, such as a secondary phone number or an alternative email address, can enhance accessibility. Additionally, indicating the best times for communication can further optimize response efficiency and ensure both parties can engage without inconvenience.

Request for confirmation or response timeline.

Creditors often require clear communication to ensure the timely resolution of financial matters. A request for confirmation or timeline regarding outstanding debts, such as invoices or loan repayments, should clearly outline the specifics of the debt, including the original amounts, due dates, and any previous correspondence. Providing a deadline for the creditor's response, typically within 14 days, helps establish urgency. It is essential to maintain a professional tone, referencing relevant account numbers and agreements to facilitate efficient processing. Clear expectations can prevent misunderstandings and foster a collaborative approach to resolving any outstanding issues.

Comments