Keeping your business credit profile up to date is crucial for maintaining a healthy financial standing and unlocking new opportunities. Whether you're applying for a loan, seeking partnerships, or ensuring your business's credibility, a clear and accurate credit profile speaks volumes. It's essential to regularly review and update your information to reflect any changes in your business, from new addresses to recent financial achievements. Ready to learn how to effectively update your business credit profile? Read on!

Accurate Business Information

Accurate business information is crucial for maintaining a reliable business credit profile, especially for small to medium enterprises (SMEs) seeking financing. Essential details include the registered business name, physical location (such as 123 Main St, Anytown, USA), contact numbers (like (555) 123-4567), and the business's official registration number. This accurate representation enhances credibility with lenders and suppliers. Regular updates, particularly during mergers or relocations, should be documented with appropriate state authorities. The use of consistent information across credit reporting agencies, including Experian and Dun & Bradstreet, significantly improves creditworthiness. Misleading or outdated information can lead to funding complications, affecting growth opportunities.

Updated Financial Records

Updating financial records for business credit profiles is crucial for maintaining accuracy and credibility with lending institutions. Recent figures, such as revenue changes, net income adjustments, or shifts in liabilities, can significantly influence creditworthiness assessments. Accurate documentation, including tax returns and balance sheets for the fiscal year ending in 2023, should reflect current financial health. Establishing transparent communication with credit bureaus, such as Dun & Bradstreet or Experian Business, ensures that any revised information, such as updated addresses or business ownership changes, is promptly incorporated into the profile. Regular updates contribute to improved credit scores, enhancing the ability to secure favorable loan terms for future expansion initiatives.

Contact Details of Authorized Personnel

A business credit profile update ensures accurate representation of a company's financial status. Authorized personnel, typically including titles such as Chief Financial Officer (CFO) or Accounts Manager, should provide their full names, phone numbers, and email addresses for contact purposes. For instance, the CFO, Jane Doe, may be reached at (555) 123-4567 or janedoe@business.com. This information facilitates proper communication with credit bureaus like Dun & Bradstreet or Experian, ensuring timely updates on credit scores and financial reports. Accurate records maintain the integrity of the business's financial reputation, aiding in loan approvals and credit negotiations.

Recent Credit Transactions

Recent credit transactions, particularly those listed on business credit profiles, play a crucial role in determining creditworthiness for companies like XYZ Corporation. Over the past quarter, XYZ Corporation has engaged in several significant transactions, including a $50,000 increase in a revolving credit line with ABC Bank, which offers favorable interest rates around 5.2%. Additionally, a recent procurement loan of $100,000 from DEF Financial Services was secured for equipment expansion in their New York facility, addressing increased production demand. These adjustments in credit usage and acquisition not only enhance liquidity but also positively impact the organization's credit score, reflecting responsible management and strategic growth initiatives within the competitive landscape of the manufacturing sector.

Compliance with Regulatory Requirements

Business credit profiles must remain current and compliant with regulatory requirements set forth by organizations such as the Federal Trade Commission (FTC) and the Consumer Financial Protection Bureau (CFPB). Accurate representation of financial data, including payment histories, credit utilization ratios, and credit inquiries, is essential for maintaining a favorable credit score. Regular updates to business credit reports can prevent inaccuracies that may arise due to changes in business structure, ownership, or financial status. Timely submission of necessary documentation, such as tax returns or financial statements, to agencies like Dun & Bradstreet or Experian can enhance credibility and ensure transparency in financial dealings. Understanding and adhering to guidelines helps mitigate the risk of penalties and promotes trustworthiness in business operations.

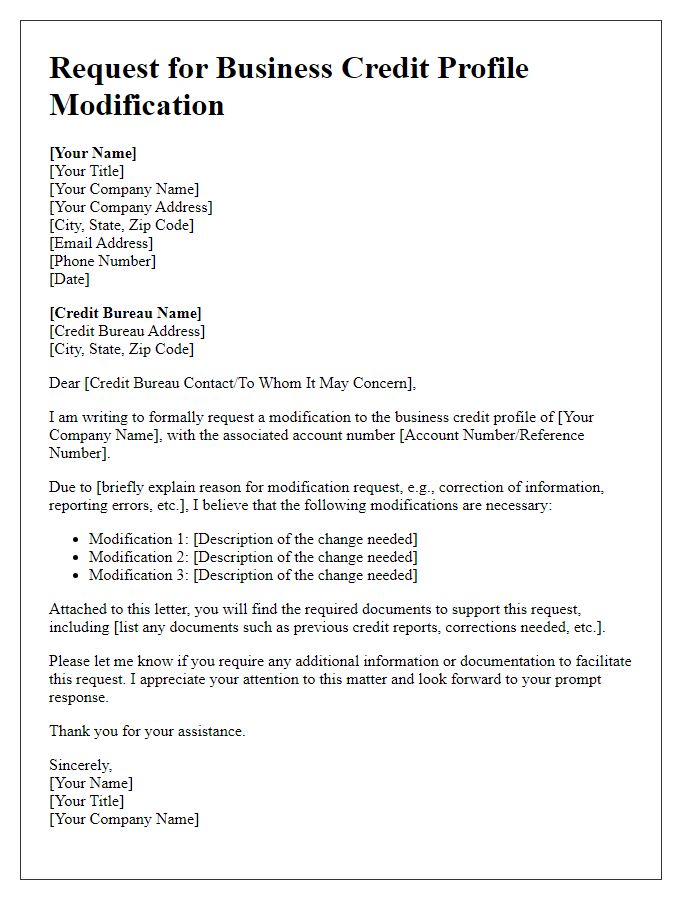

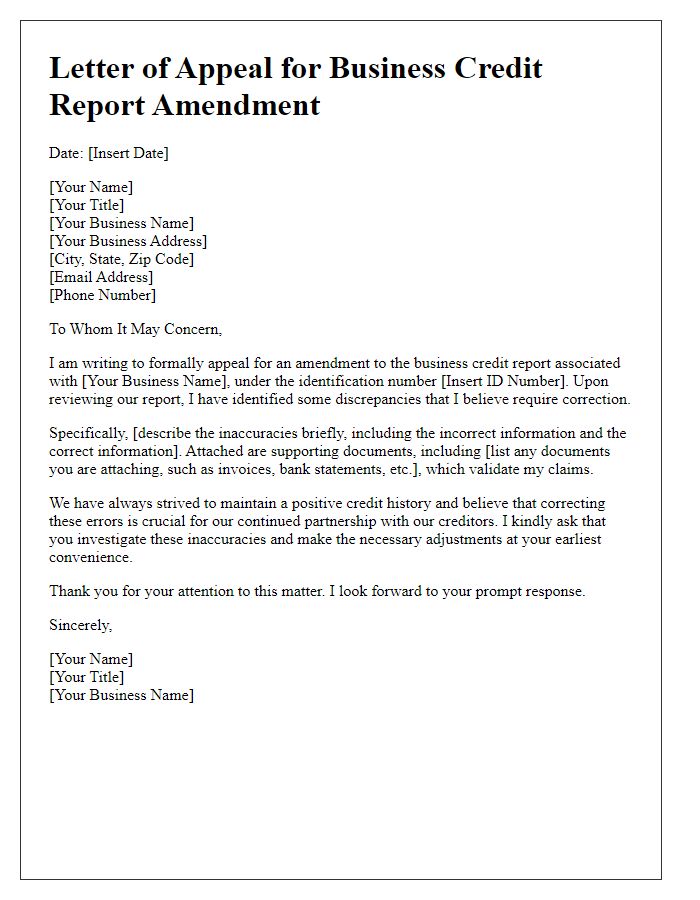

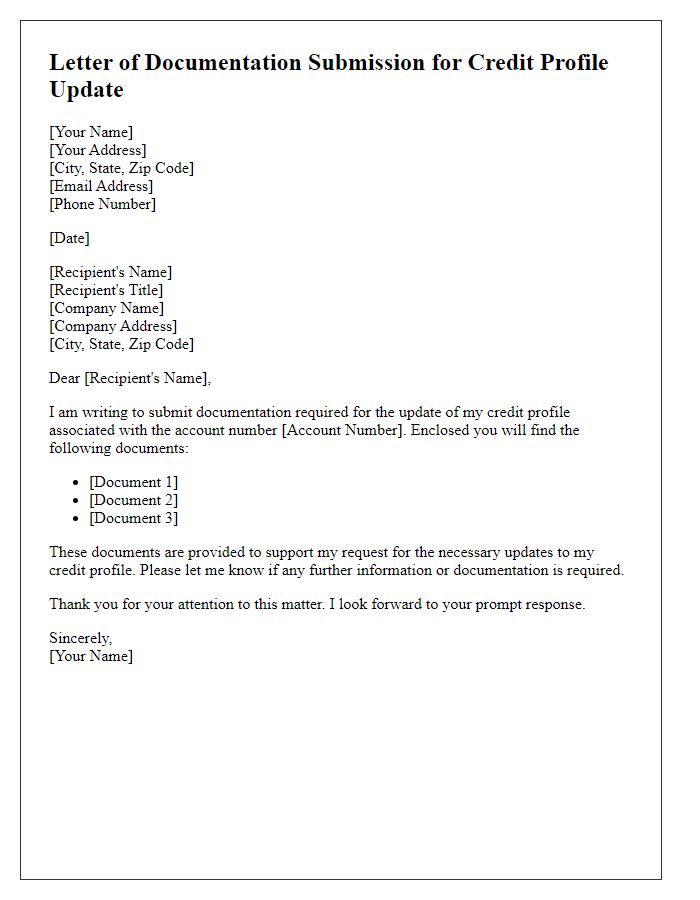

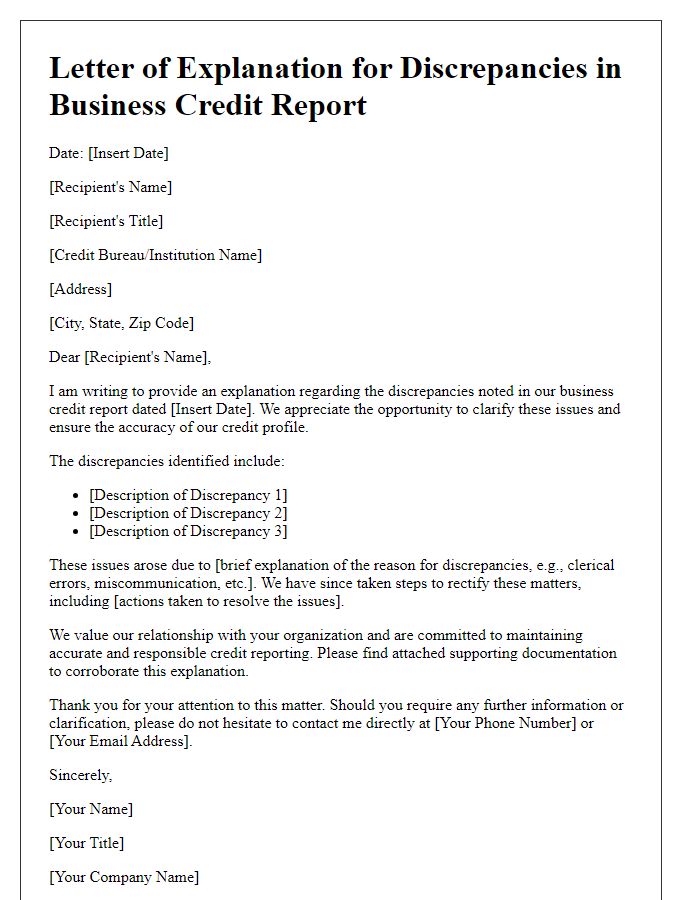

Letter Template For Business Credit Profile Update Samples

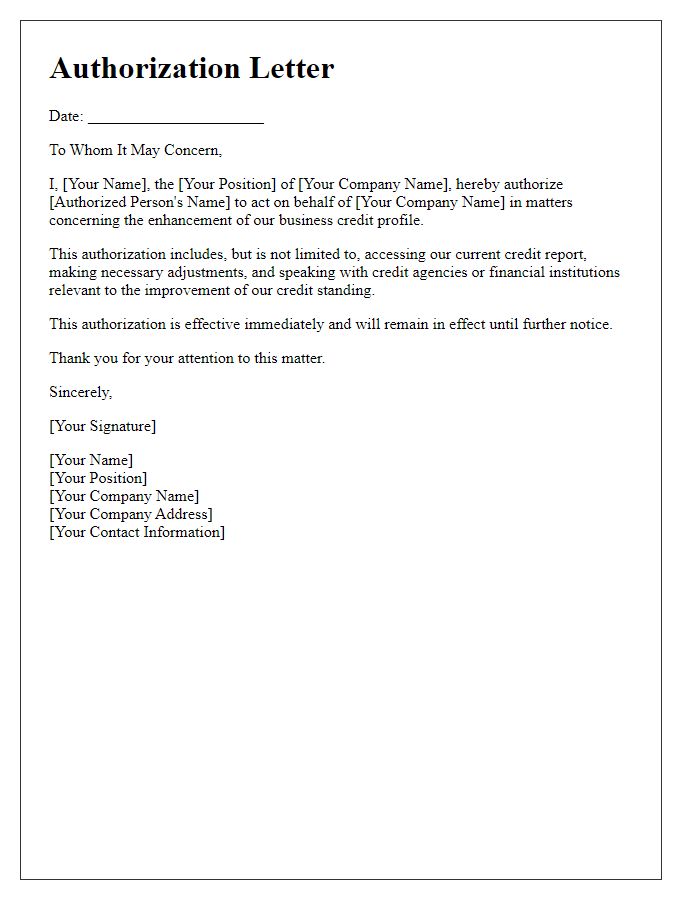

Letter template of authorization for business credit profile enhancement

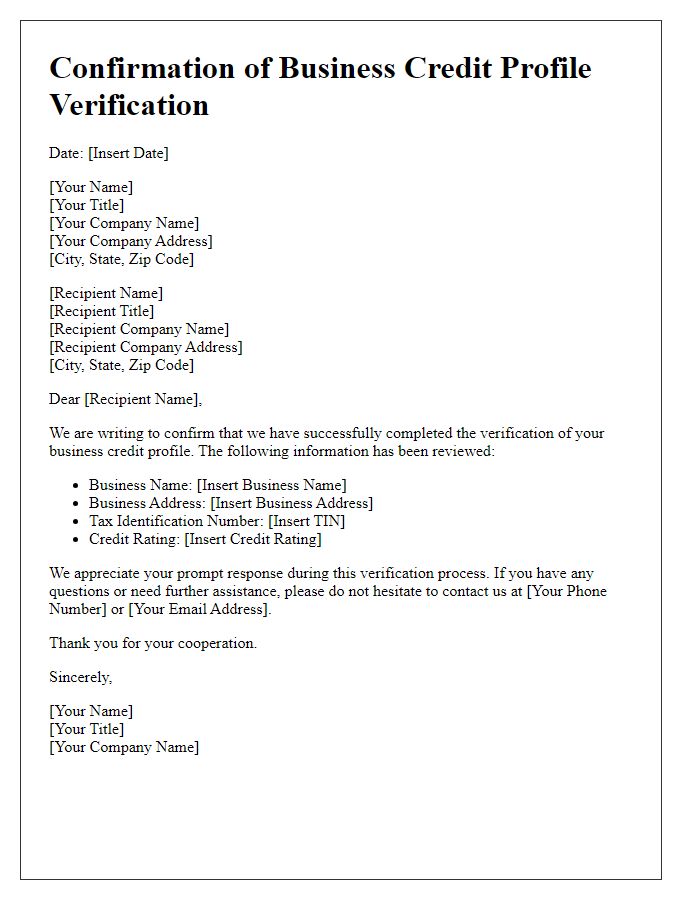

Letter template of confirmation for business credit profile verification

Comments