Are financial burdens keeping you up at night? Many people find themselves overwhelmed by debt, but there are effective ways to lighten the load. A well-crafted debt settlement proposal can be your ticket to negotiating lower payments and finally gaining control over your finances. If you're curious about how to create a compelling proposal that gets results, read on for some helpful tips!

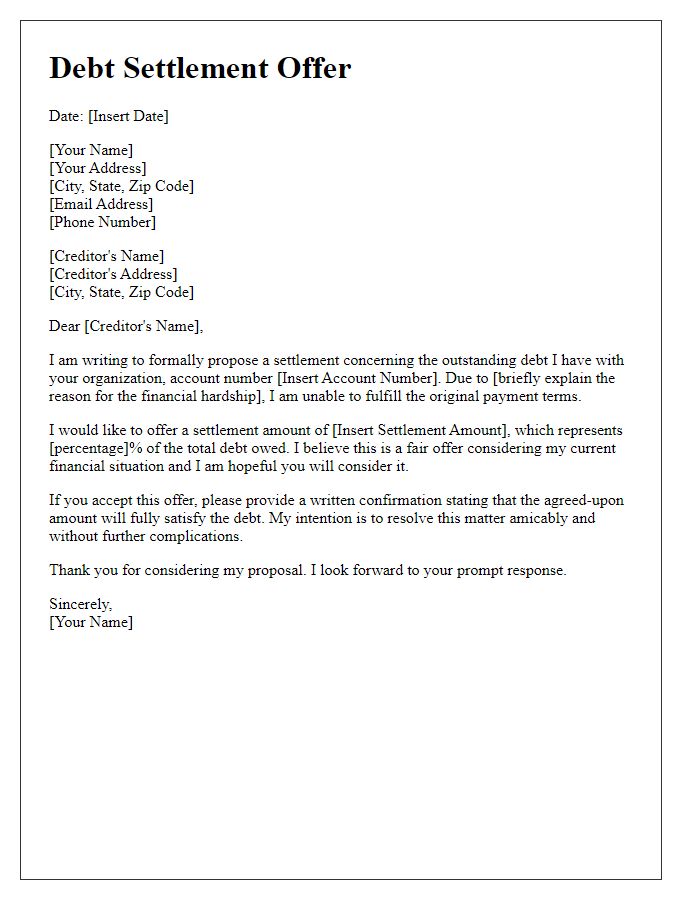

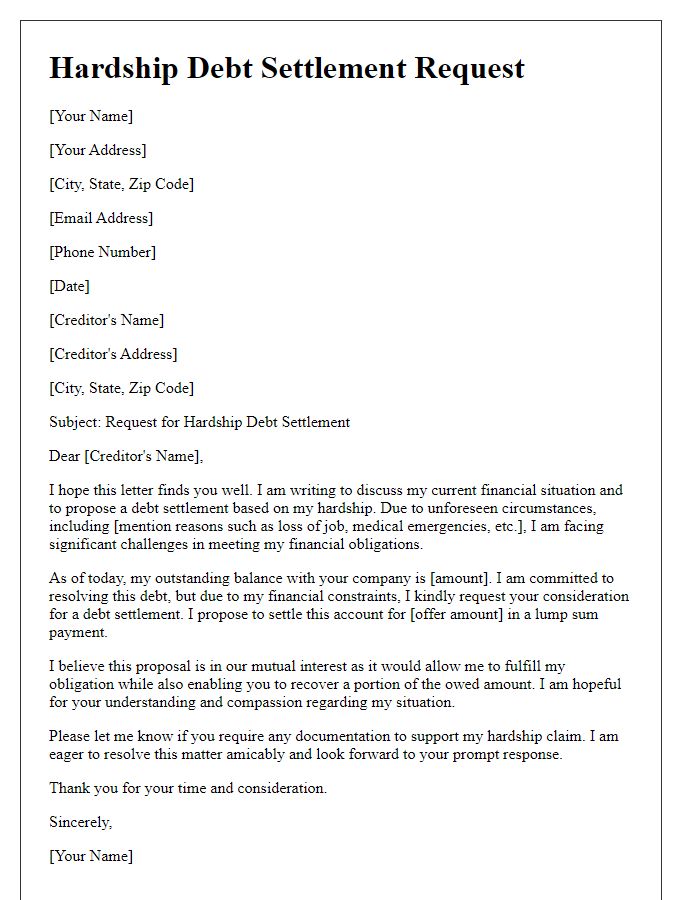

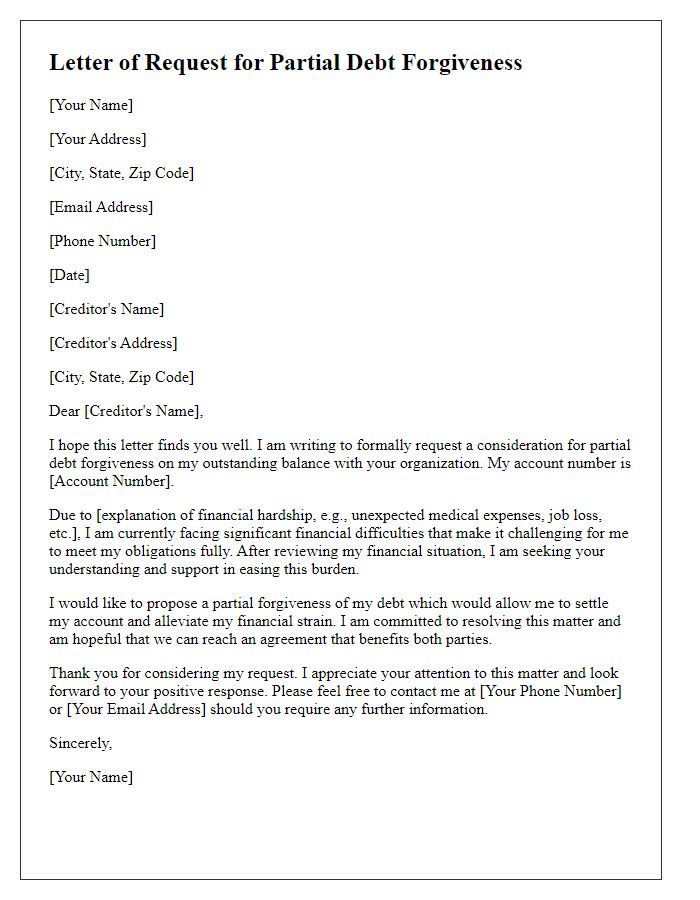

Formal Salutation and Contact Information

A debt settlement proposal requires careful consideration of financial terms and clear communication. A formal salutation addressing the creditor, such as "Dear [Creditor's Name or Company Name]," sets a respectful tone. Essential contact information includes the debtor's full name, address (including city and zip code), phone number, and email address, ensuring identification and accessibility. It is important to outline specific details like the total amount owed and proposed settlement offer, clearly stating the rationale behind the offer to facilitate productive negotiation.

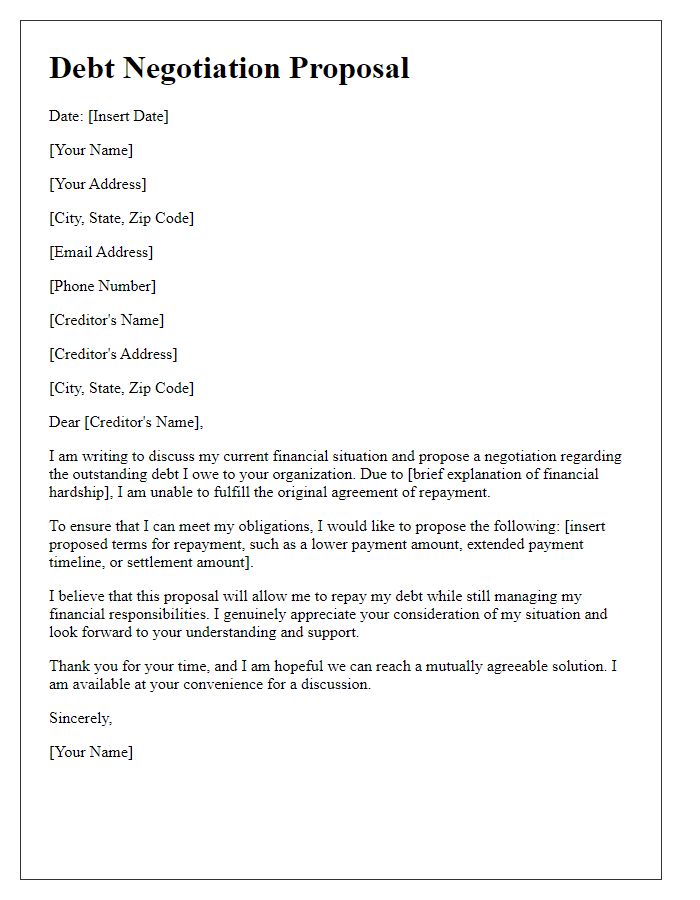

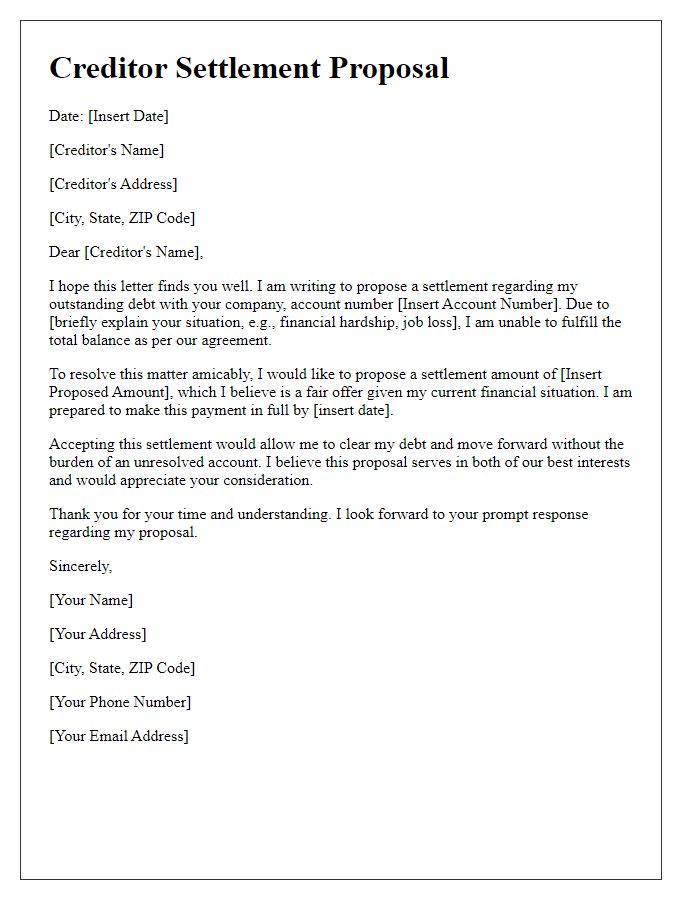

Clear Explanation of Debt and Proposal Terms

A comprehensive debt settlement proposal requires a clear explanation of the outstanding debt and the terms of the proposed settlement. Start by detailing the total amount of debt owed, such as $15,000 credit card debt to XYZ Bank, specifying the original creditor, account numbers, and any identifying information. Include a brief history of the debt, noting events like missed payments or financial difficulties, such as job loss in 2021, which led to the current situation. Then, outline the proposed settlement terms, such as offering a lump sum payment of $5,000, which represents a 66% reduction of the original balance. Specify the timeframe for the payment, ideally within 30 days of acceptance, and emphasize the benefits to the creditor, including immediate recovery of funds without further collection efforts or legal action. Additionally, request written confirmation from the creditor, ensuring that the settled amount will reflect positively on the credit report, minimizing long-term financial impact.

Demonstration of Financial Hardship

Demonstrating financial hardship is crucial when proposing a debt settlement. Direct communication with creditors about personal financial struggles can significantly influence their willingness to negotiate. Factors such as unemployment rates (e.g., recent figures showing 6.1% in certain regions), medical expenses, and unavoidable costs like housing (average rent skyrocketed to $2,500 monthly in urban areas) can illustrate an individual's inability to maintain regular payments. Providing documentation, including pay stubs, bank statements, and expense breakdowns, can support claims of financial difficulty. Additionally, sharing examples of monthly budget deficits where expenses consistently outpace income--such as a $1,000 monthly shortfall--can establish a compelling case. Lastly, emphasizing genuine intent to settle debts and maintain a positive relationship with creditors can facilitate a more favorable outcome in negotiations.

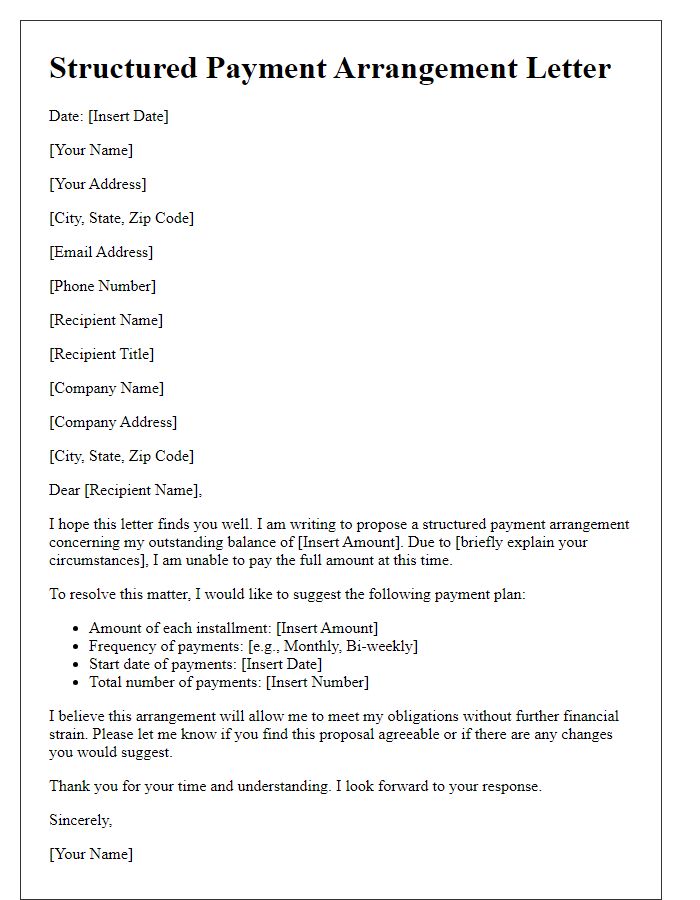

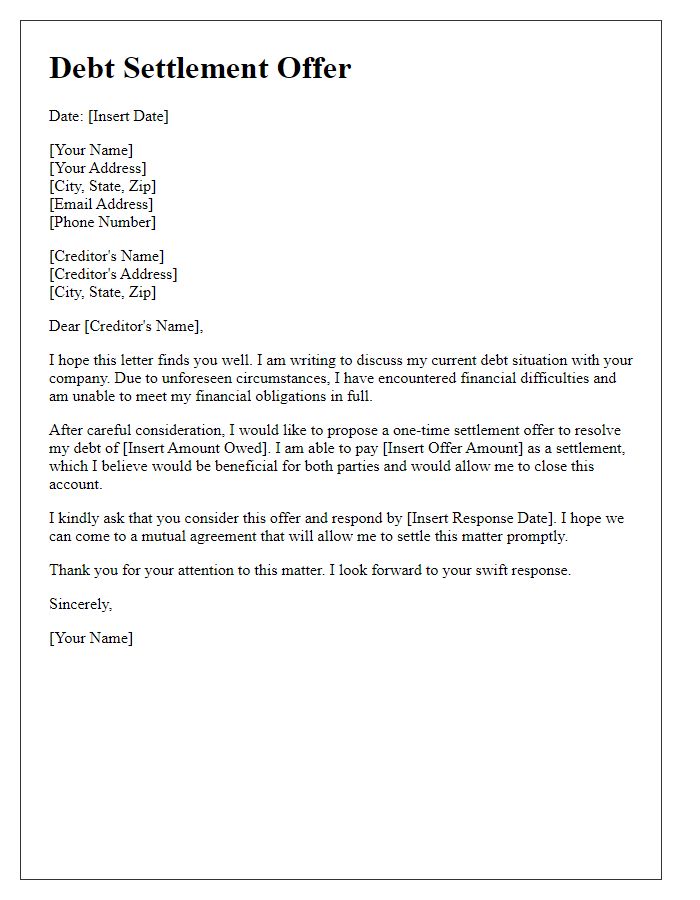

Proposed Settlement Amount and Payment Plan

A debt settlement proposal often includes specific elements such as the proposed settlement amount, which is typically less than the total outstanding debt, and a structured payment plan outlining how the agreed amount will be paid, including timelines and payment methods. For example, if an individual owes $10,000 to a creditor, they may propose a settlement of $5,000, to be paid in three monthly installments of $1,666.67 starting on a specific date. Clear communication about the reasons for the settlement request, such as financial hardship or unexpected life events, can also strengthen the proposal's effectiveness. Including additional details, such as the account number, creditor's name, and the specific debt type, enhances clarity and formality in the negotiation process.

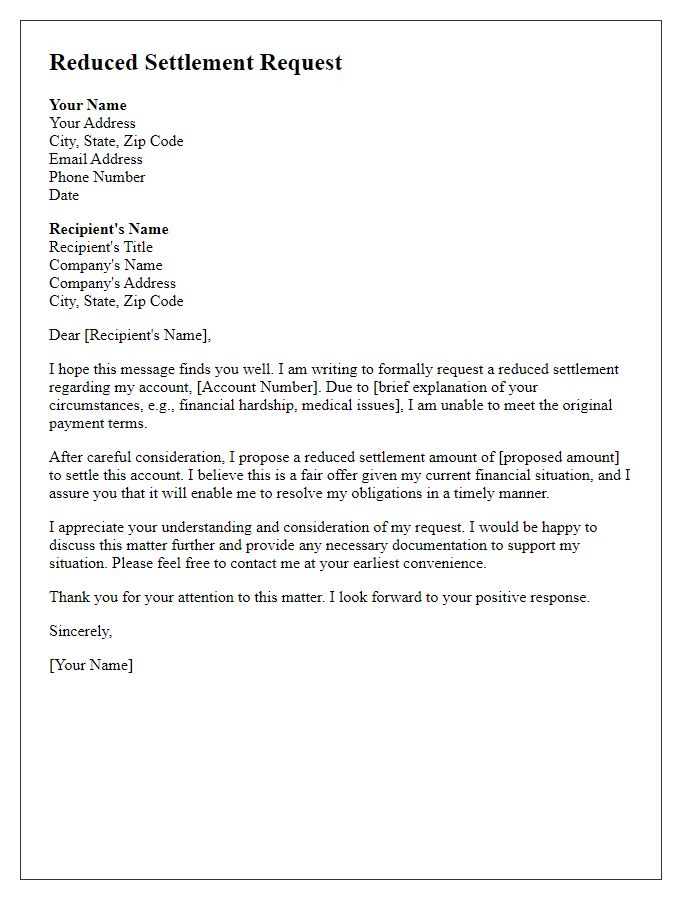

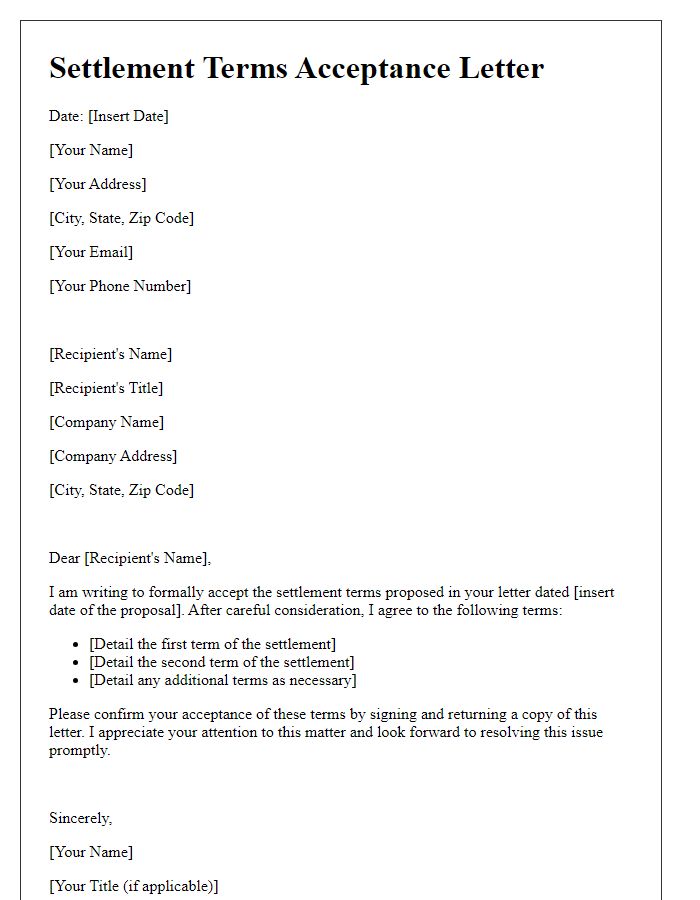

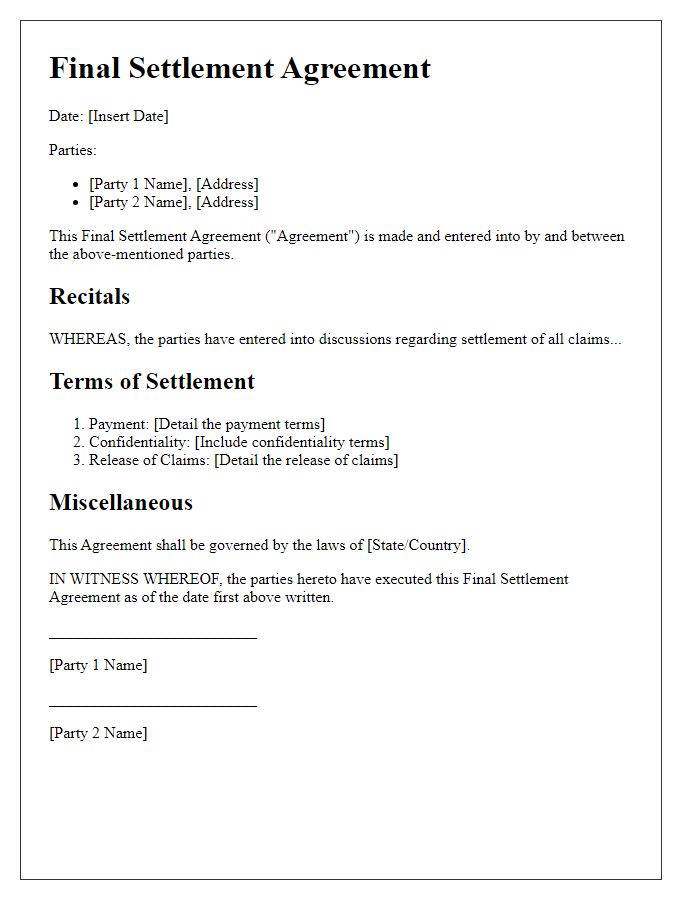

Request for Written Confirmation and Next Steps

A debt settlement proposal plays a critical role for individuals seeking financial relief from creditors. It typically outlines an offer to pay a reduced amount (often 30%-70% less than the total owed) to settle outstanding debts. The proposal should clearly specify details such as the outstanding balance, payment timeline, and the requesting party's financial circumstances. This communication should prompt creditors to provide written confirmation of agreement to terms. It's essential to continue outlining potential next steps, including how to process the payment arrangements, legal implications, and the impact on credit scores. Timely and well-structured proposals can significantly influence the likelihood of achieving successful debt resolution.

Comments