Are you considering applying for a business credit line increase but unsure where to start? Crafting the perfect letter can make all the difference in demonstrating your business's financial health and future potential. In this article, we'll guide you through each step of the process, explaining key elements to include and tips to ensure your request stands out. Ready to take your business to the next level? Let's dive in!

Clear subject line and purpose statement.

A business credit line increase request can significantly enhance financial flexibility for companies seeking to expand operations. A detailed and concise letter outlining the purpose of the request, specifying the desired increase amount, and presenting supporting financial data is crucial. Clearly stating recent business achievements, such as increased sales figures (e.g., 20% growth in the last quarter), can strengthen the case for increased credit. Including specific plans for fund utilization, like inventory expansion or new marketing strategies, provides context. Furthermore, documenting a solid repayment history and an improved credit score (e.g., surpassing 700) adds credibility. Providing a clear rationale will facilitate a smoother decision-making process by the lending institution.

Current account and financial details.

A business credit line increase can significantly enhance a company's financial flexibility, allowing for greater operational capacity and seamless cash flow management. Current accounts, generally held at financial institutions such as Bank of America or Wells Fargo, often demonstrate transaction histories that showcase revenue patterns and financial stability. Financial details such as annual revenue (for example, $500,000), monthly expenses (approximately $40,000), and existing credit utilization ratios (preferably below 30%) play crucial roles in determining eligibility for an increase. Additional factors include a strong business credit score (ideally over 680) and positive banking relationships, which provide lenders with the assurance of repayment capability. Providing updated tax returns (for the past two years) and business financial statements helps paint a comprehensive picture for loan officers reviewing the request.

Justification for credit line increase.

A business credit line increase can significantly enhance operational flexibility for companies navigating financial demands and growth opportunities. Many businesses, especially small to medium enterprises, rely on credit lines provided by financial institutions for cash flow management, unexpected expenses, or strategic investments. A well-justified request may highlight increased revenue metrics, expansion efforts, such as opening a new location or launching a product, and a solid payment history demonstrating reliability. Recent financial data, including revenue growth percentages or profit margins, can strengthen the case. Additionally, showcasing market conditions that favor operational scaling or competitive advantages may further justify the need for an increased credit line, ensuring the business can seize available opportunities without disruption.

Business financial projections and growth plans.

A business credit line increase can significantly enhance a company's financial capabilities, facilitating better cash flow management and strategic growth initiatives. Financial projections detailing estimated revenue growth often rely on historical data, industry trends, and market analysis. For example, companies within the technology sector may project a 15% annual revenue increase based on rising demand for software solutions. Business growth plans may include expanding product lines or entering new markets, such as launching environmentally-friendly products targeting eco-conscious consumers. Effective financial management strategies, such as cash flow forecasting, can demonstrate responsible use of credit and align with goals for sustainable expansion. Key performance indicators (KPIs) such as customer acquisition costs and average transaction values also play a crucial role in illustrating the potential for increasing profitability with the support of enhanced credit facilities.

Contact information for further discussion.

A business credit line increase request requires a detailed approach to enhance approval chances. The request can include essential company details, such as the business name, registered address, and tax identification number. Financial performance metrics, including revenue figures and profit margins from the last fiscal year, demonstrate the company's stability and growth potential. Emphasizing current credit utilization rates and payment histories can significantly strengthen the argument for an increase. A clear statement of the desired credit line extension amount and its intended purpose, whether for inventory expansion, operational costs, or unexpected expenses, is crucial. Additionally, providing a brief summary of market conditions, such as industry growth rates and potential for future earnings, can justify the need for increased credit. Lastly, including contact information, such as a direct phone number and email address, facilitates further discussions and highlights the company's readiness for communication.

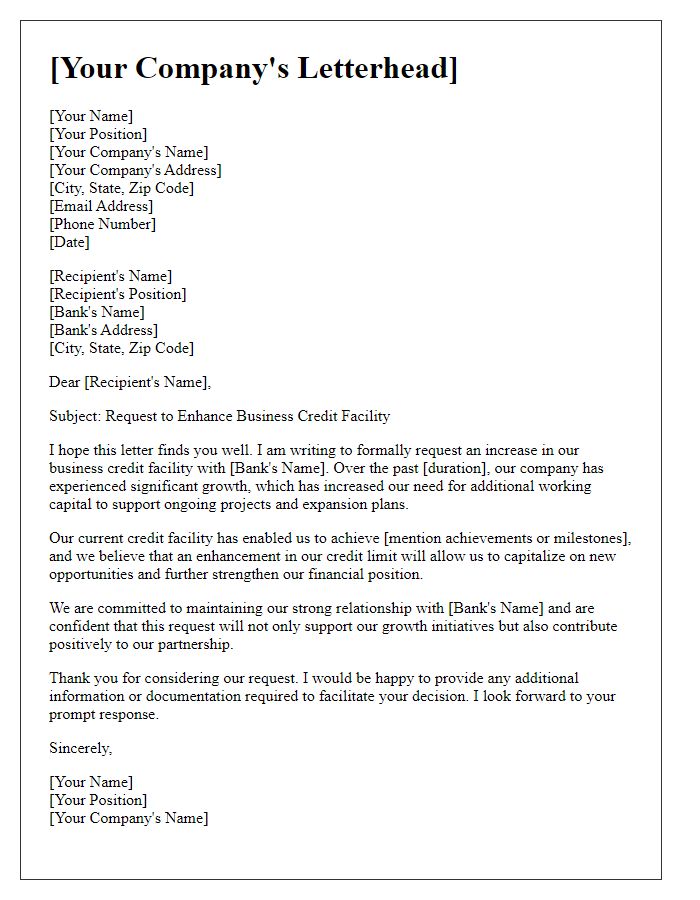

Letter Template For Business Credit Line Increase Samples

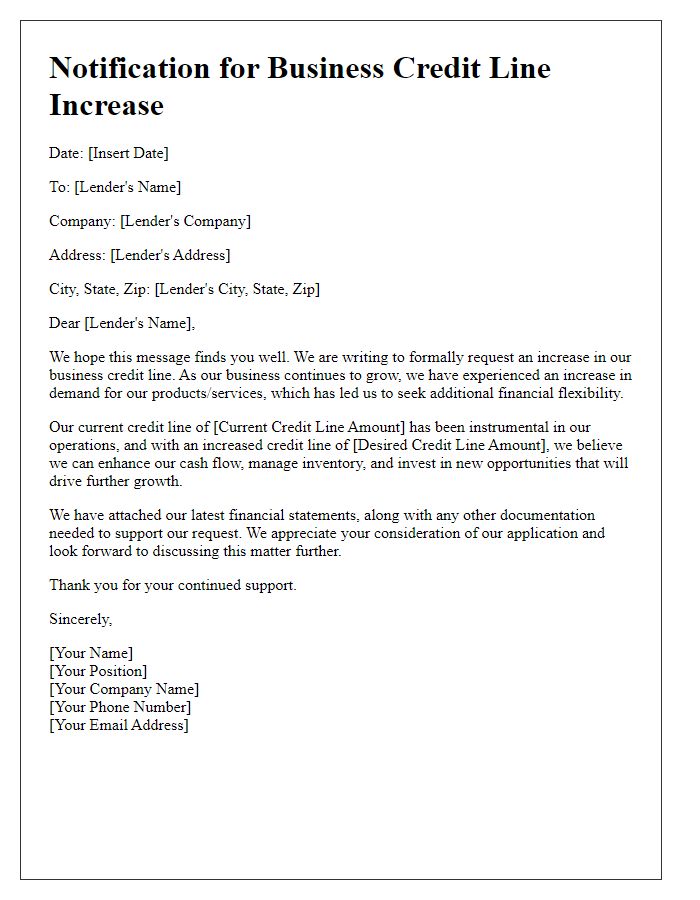

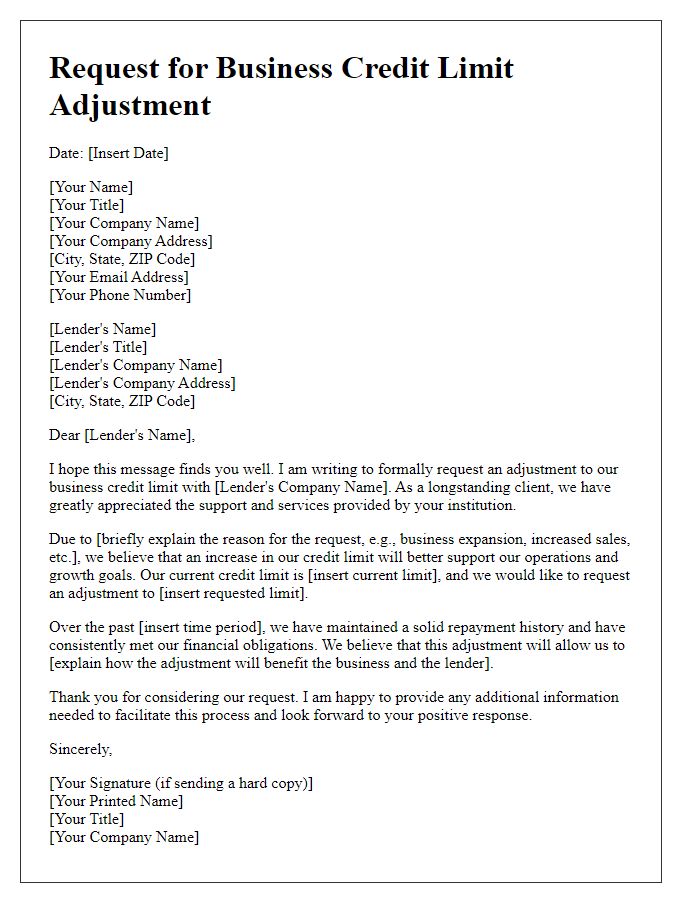

Letter template of notification for desired business credit line increase

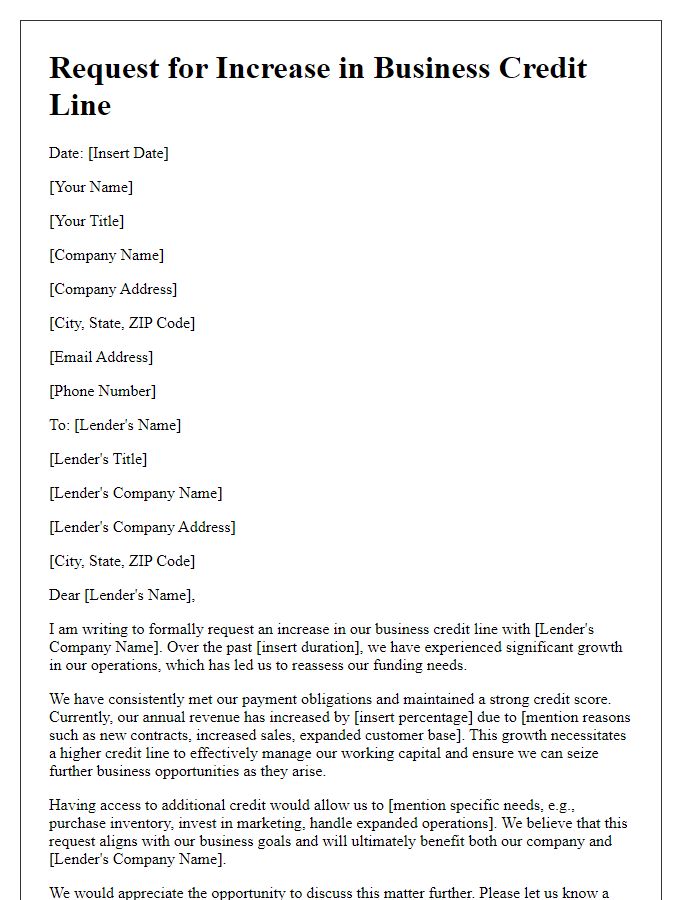

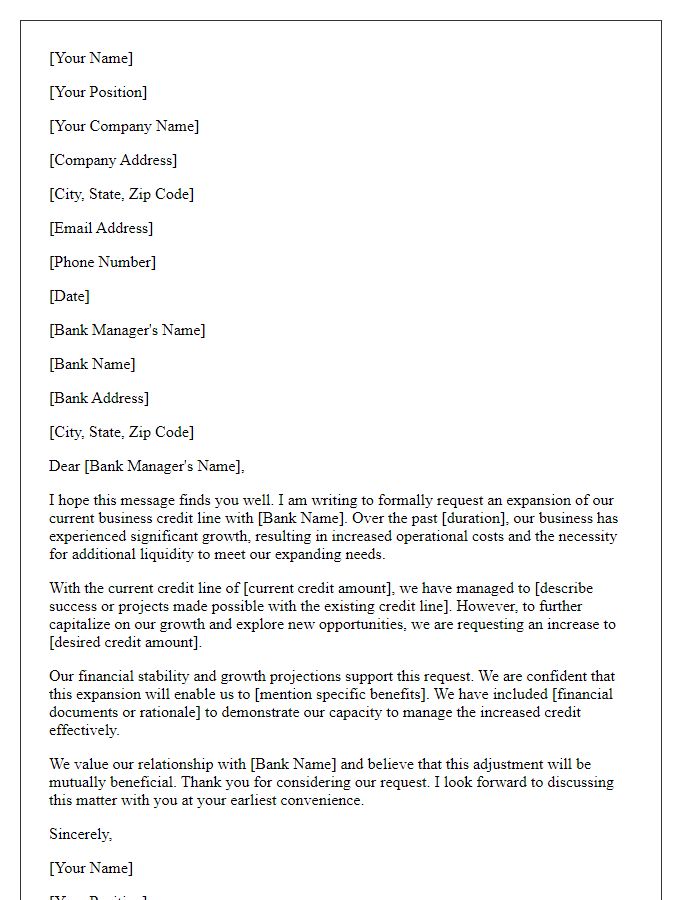

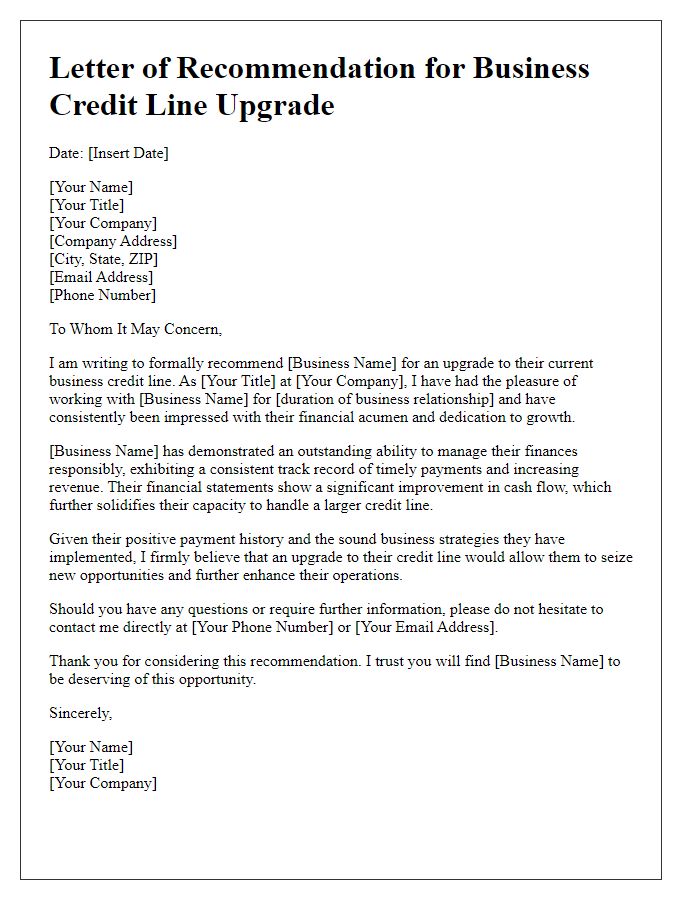

Letter template of justification for requesting a higher business credit line

Comments