If you've ever found yourself tangled in the web of credit reports and scores, you're not alone. Many people face the challenge of inaccuracies and the occasional financial hiccup that can affect their credit standing. A goodwill adjustment letter can be a pivotal tool in rectifying these issues, allowing you to politely request the removal of specific negative items from your report. Interested in learning how to craft the perfect letter for your situation? Let's dive in!

Accurate Personal Information

A goodwill adjustment request for a credit report emphasizes the importance of accurate personal information in maintaining a healthy credit score and overall financial reputation. Inaccurate details, including misspelled names, incorrect addresses, or outdated account information, can significantly hinder creditworthiness assessments by major bureaus such as Experian, TransUnion, and Equifax. Potential lenders, including banks and mortgage companies, often scrutinize these reports meticulously; even minor discrepancies can lead to unfavorable lending terms or outright denials. By rectifying such inaccuracies, consumers can improve their credit reports, which is crucial for securing favorable loans or reducing interest rates on existing debt. Moreover, accurate personal information fosters trust and reliability in the eyes of creditors.

Account Details and Specifics

Goodwill adjustments refer to the requests made to creditors or credit bureaus to remove negative information from a credit report. These adjustments are typically requested based on a history of on-time payments and other mitigating circumstances. A goodwill adjustment involves reaching out to the creditor or company and asking them to consider removing a late payment or other negative marks from the credit report as a show of goodwill. Many companies have specific departments for these requests, and many individuals have had success with this process when they have maintained a positive payment history. When crafting such a request, it is important to include account details, such as the account number (usually a unique identifier), the name of the creditor (e.g., Bank of America, Capital One), the specific negative mark being addressed, and the dates associated with it. Including personal circumstances that contributed to late payments helps provide a narrative for understanding the situation. Key details to include: - Account Number (unique identifier for the account) - Creditor Name (company or bank managing the account) - Dates of missed payments (specific moments in time impacting credit history) - Explanation of circumstances (personal hardships or situations leading to payment delays) Successful goodwill requests often hinge on a respectful tone, appreciation for their past services, and a demonstration of responsible financial behavior going forward.

Reason for Late Payment or Error

Goodwill adjustments are often requested to remove late payment details from a credit report, which can significantly impact an individual's credit score. Late payments, typically considered any payment over 30 days past the due date, can remain on a credit report for up to seven years. Key factors that might warrant such an adjustment include documented evidence of previous timely payments, a demonstrated history of responsible credit use, personal hardships such as medical emergencies or job loss, and other extenuating circumstances. Requesting a goodwill adjustment often involves communicating directly with lenders or creditors, emphasizing the circumstances surrounding the payment lapse, and appealing to the lender's policies regarding customer relationships and retention.

Emotional Appeal and Positive Credit History

A goodwill adjustment request for a credit report can often reflect personal circumstances, like unexpected financial challenges, that led to past delinquencies. Positive credit history, showcasing timely payments and responsible credit usage over years, reinforces the case for an adjustment. The emotional appeal emphasizes growth, accountability, and a desire for a fresh start, often referencing specific life events such as job loss (affecting income) or health issues (incurring unexpected medical expenses). Many lenders value long-term relationships with clients, considering the overall credit behavior rather than isolated late payments. A well-articulated request can evoke understanding, prompting lenders to remove or adjust negative entries, restoring a consumer's creditworthiness significantly.

Request for Specific Adjustment or Deletion

A goodwill adjustment request for a credit report aims to seek the removal or modification of negative information, such as late payments or delinquencies, from a credit report due to extenuating circumstances. This process often involves reaching out to creditors or credit bureaus, like Experian, TransUnion, or Equifax. Providing proof of timely payments following a specific incident, such as a medical emergency or temporary job loss, can strengthen the request. A personal narrative detailing the circumstances, including dates and amounts involved, helps to humanize the appeal. Successful adjustments can lead to improved credit scores, enhancing chances for better loan terms or credit card approvals in the future. Results can vary significantly depending on the creditor's policies and the nature of the request.

Letter Template For Goodwill Adjustment On Credit Report Samples

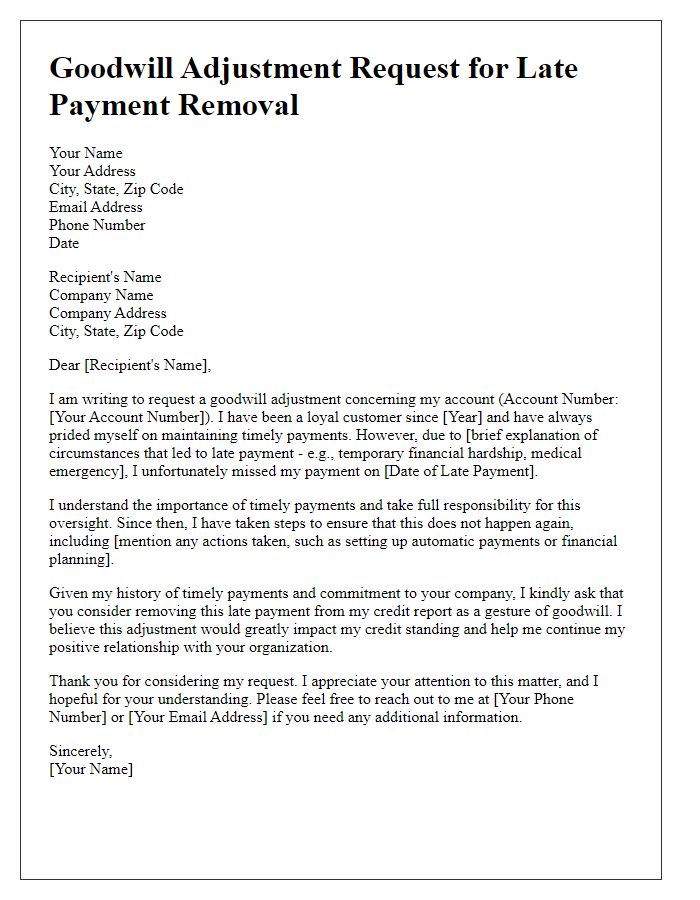

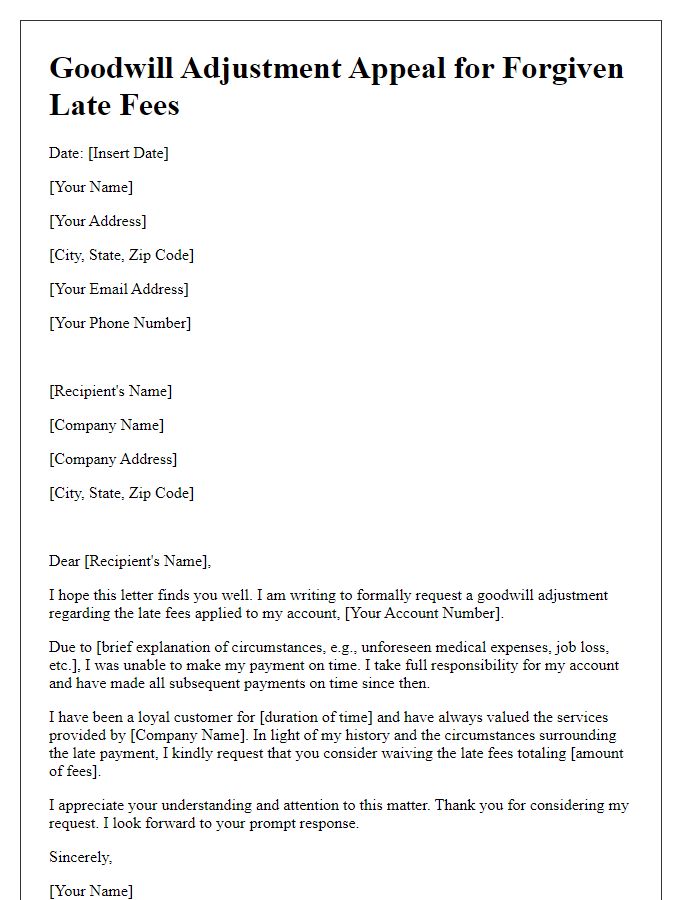

Letter template of goodwill adjustment request for late payment removal.

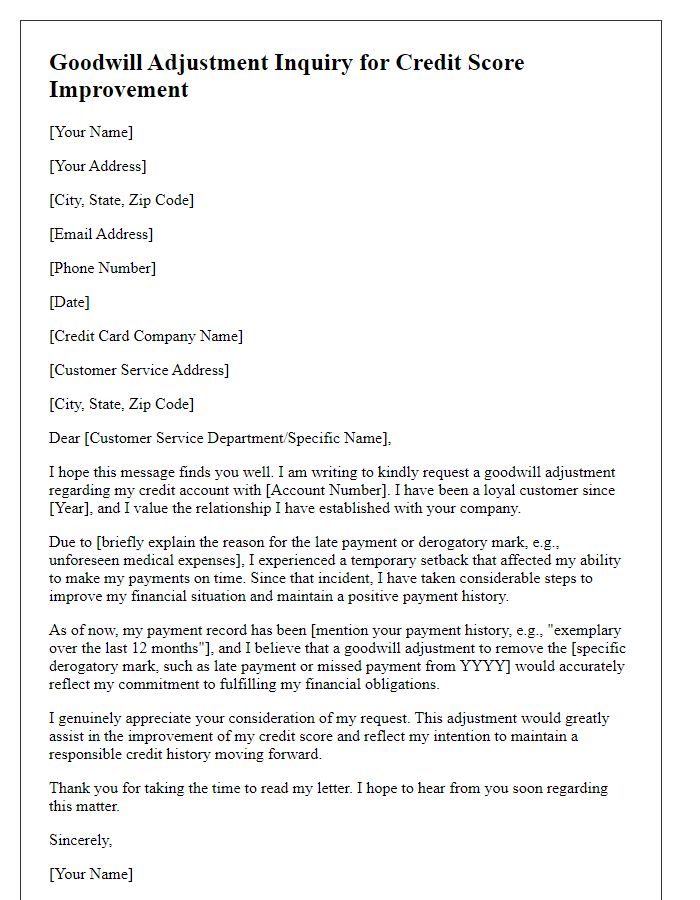

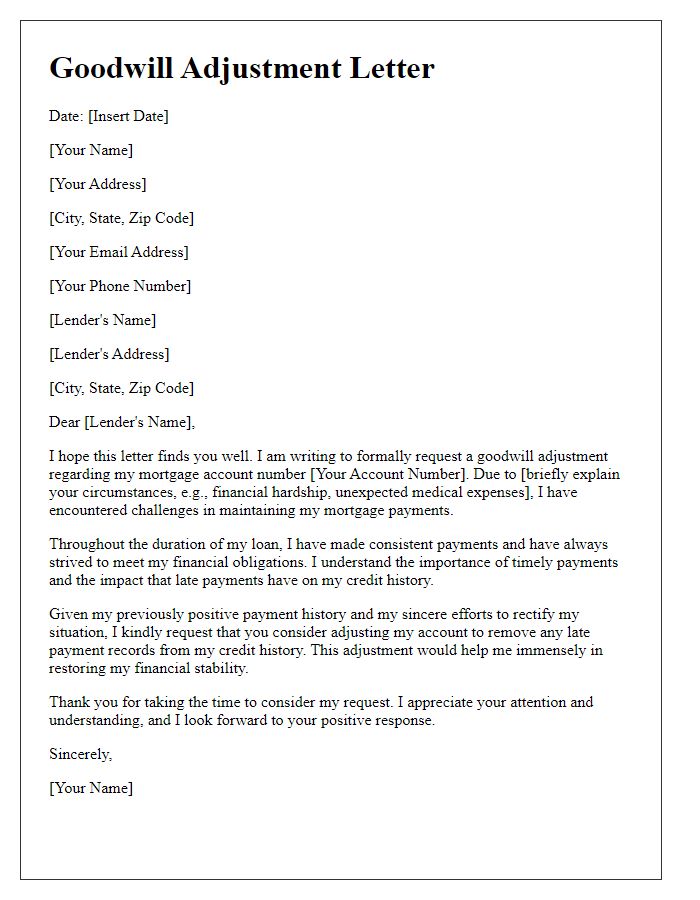

Letter template of goodwill adjustment inquiry for credit score improvement.

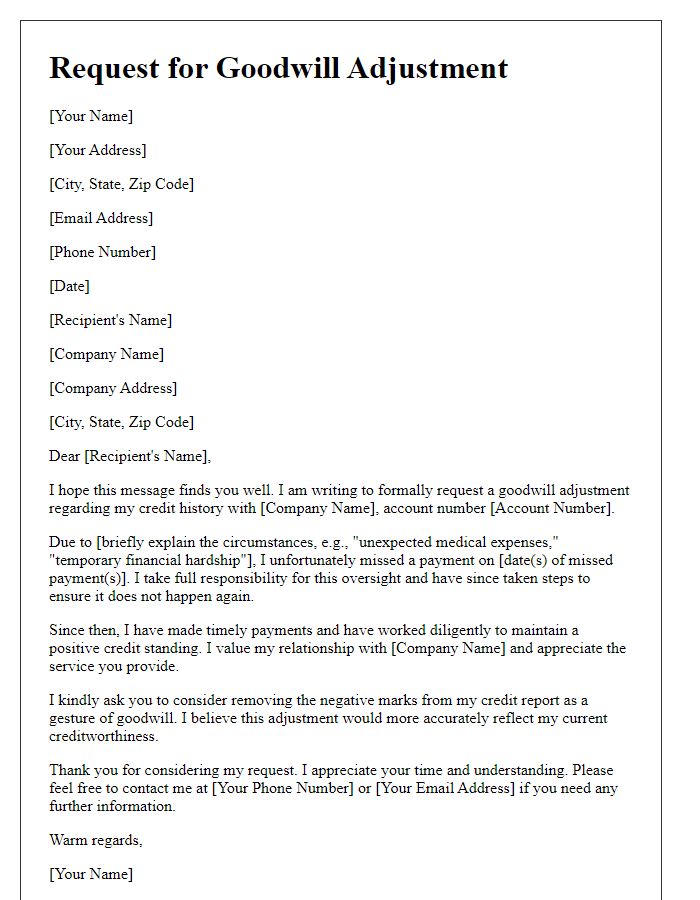

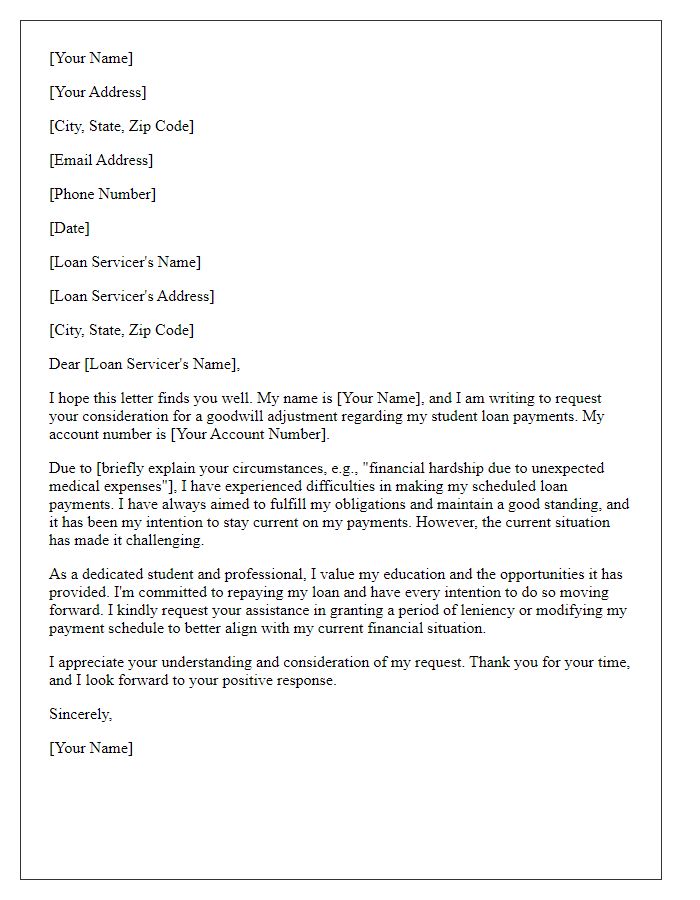

Letter template of goodwill adjustment seeking reconsideration for credit history.

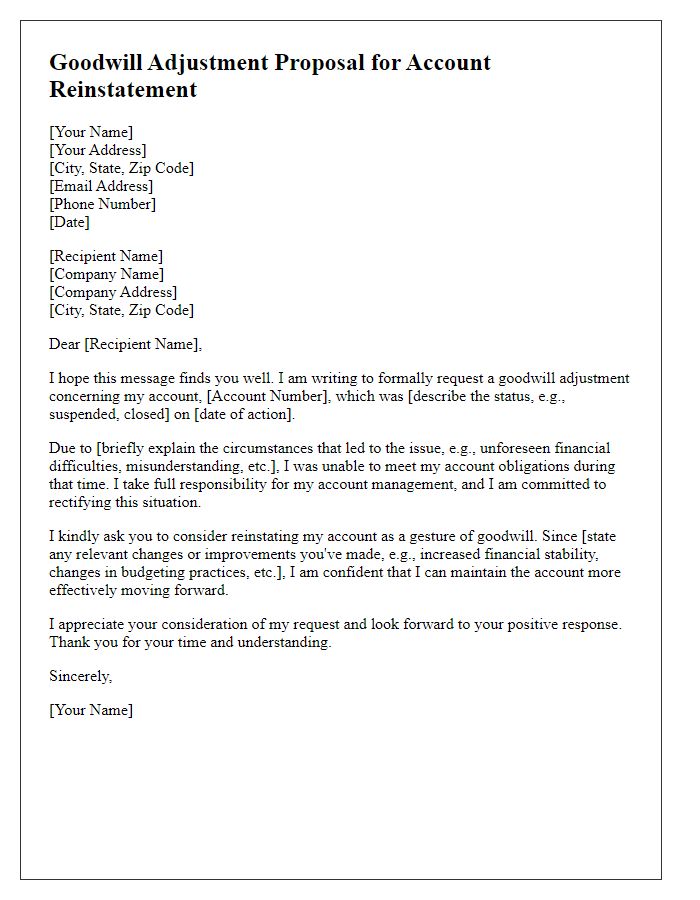

Letter template of goodwill adjustment proposal for account reinstatement.

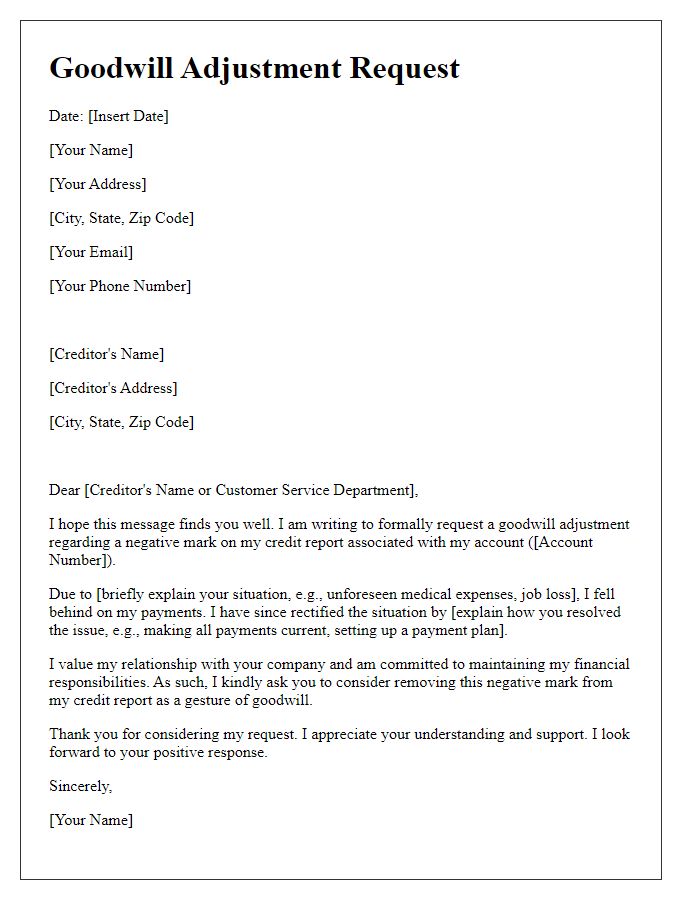

Letter template of goodwill adjustment request for negative mark deletion.

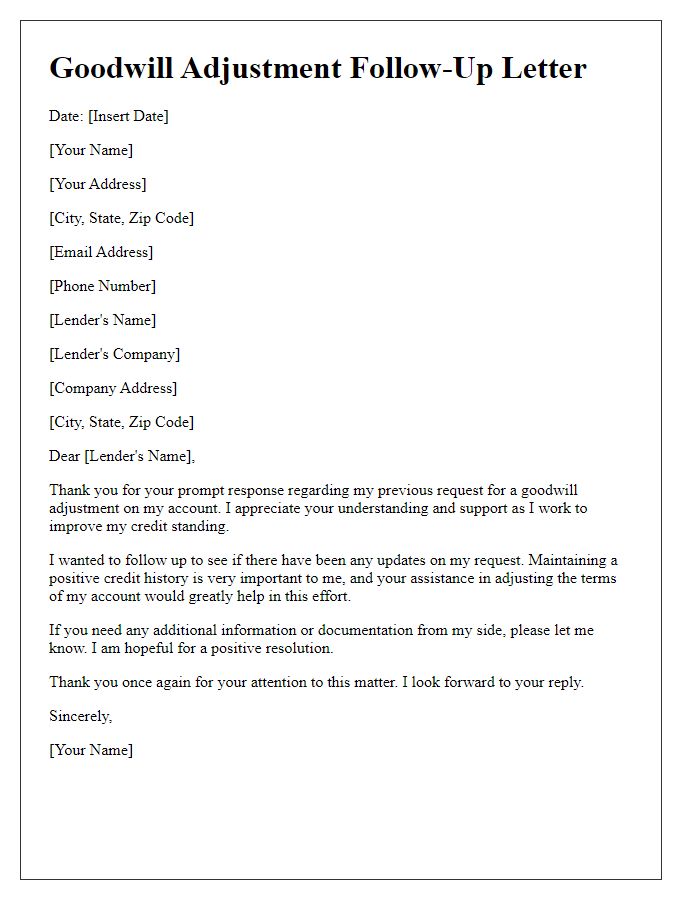

Letter template of goodwill adjustment follow-up for better credit terms.

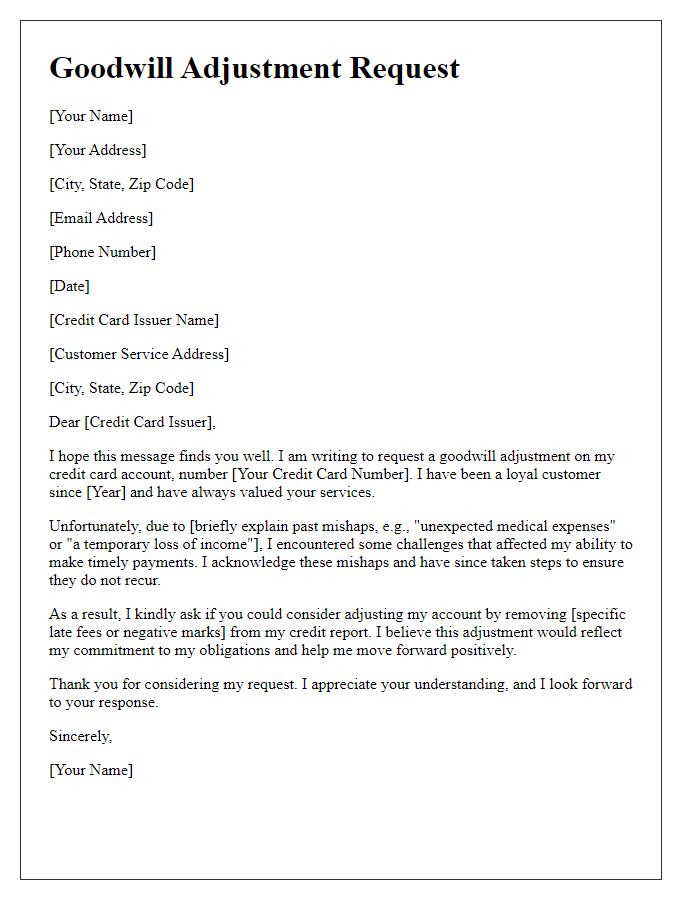

Letter template of goodwill adjustment to credit card issuer for past mishaps.

Comments