Hey there! If you or a loved one is preparing for military deployment, it's crucial to consider a credit freeze to protect your financial identity while you're away. A credit freeze can help safeguard against identity theft, ensuring that unauthorized accounts aren't opened in your name during your absence. It's a simple yet effective step to give you peace of mind as you focus on your duties. Ready to learn more about how to set up a credit freeze and what to keep in mind? Let's dive in!

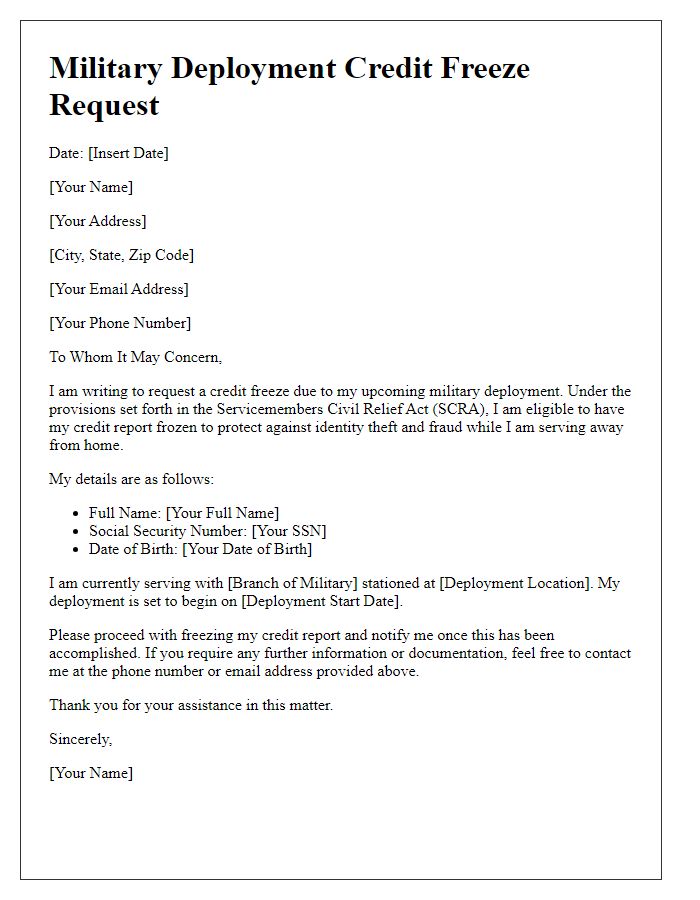

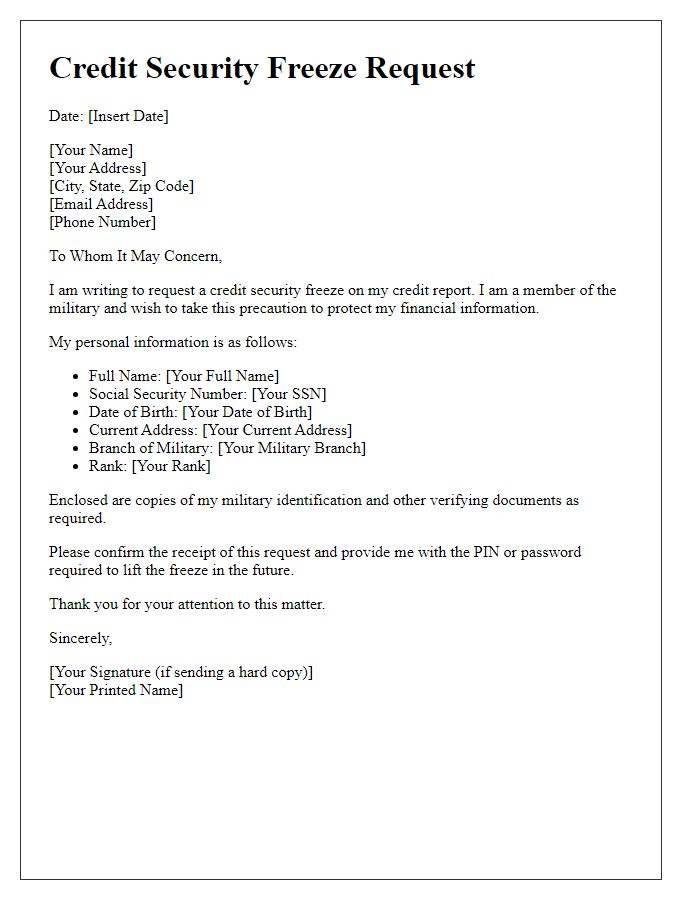

Personal Information

A military deployment credit freeze is a protective measure for active duty service members, ensuring their credit reports remain secure while they serve. Service members must provide personal information including full name, Social Security number, date of birth, and address to initiate the freeze. The freeze guards against identity theft, particularly during deployments, as fraudulent activities may increase in their absence. Agencies like Experian, TransUnion, and Equifax require this information to authenticate requests and safeguard sensitive data, helping service members maintain credit integrity during and after their deployment to locations such as Afghanistan or Iraq.

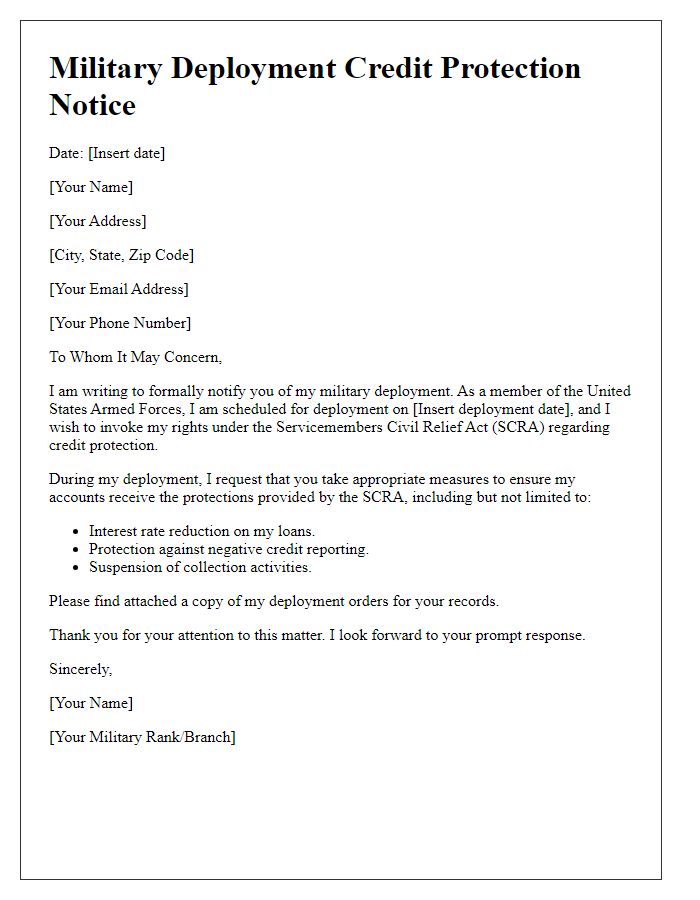

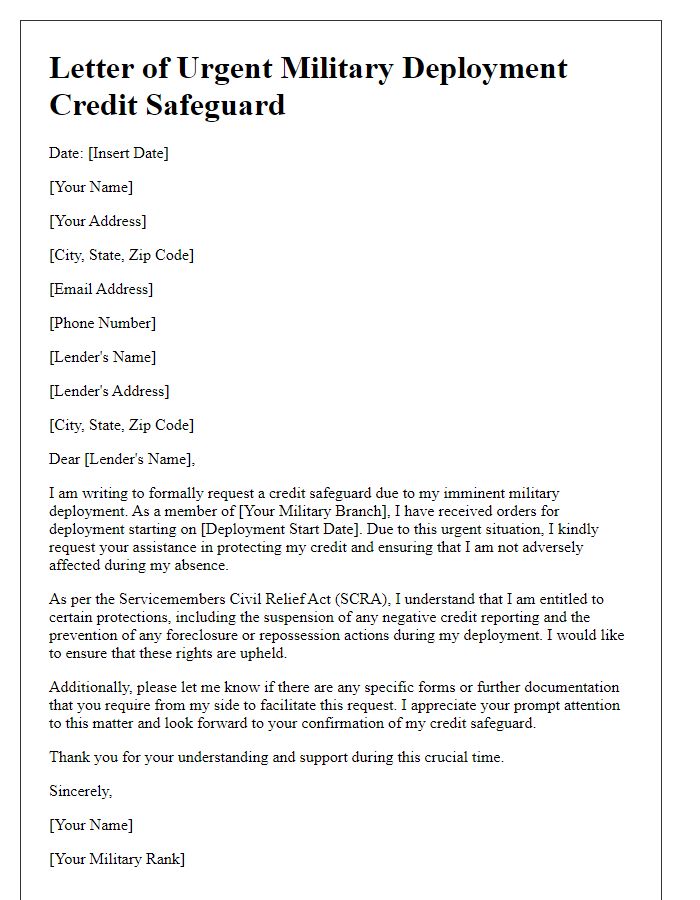

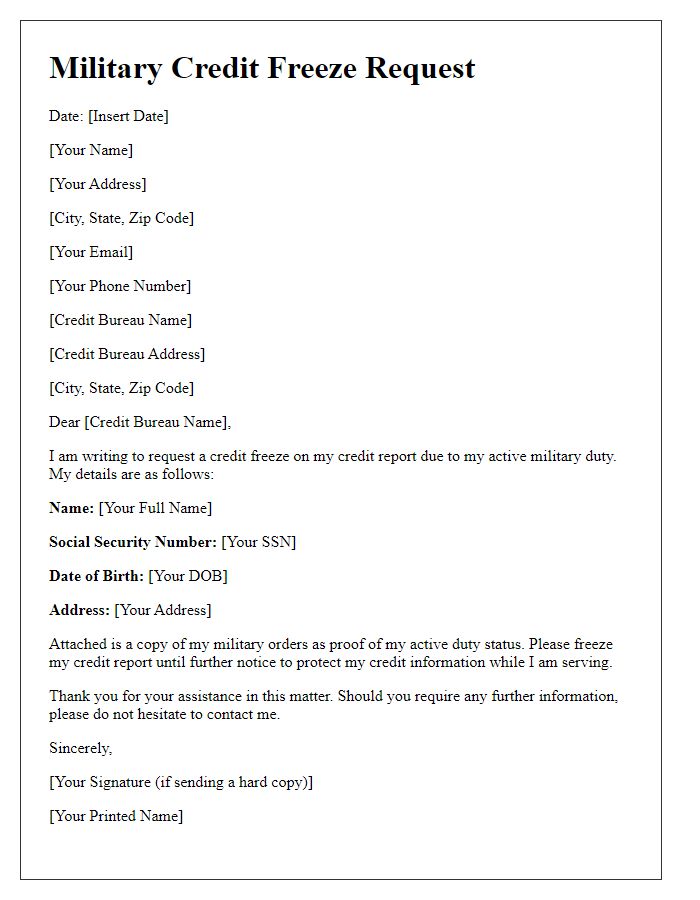

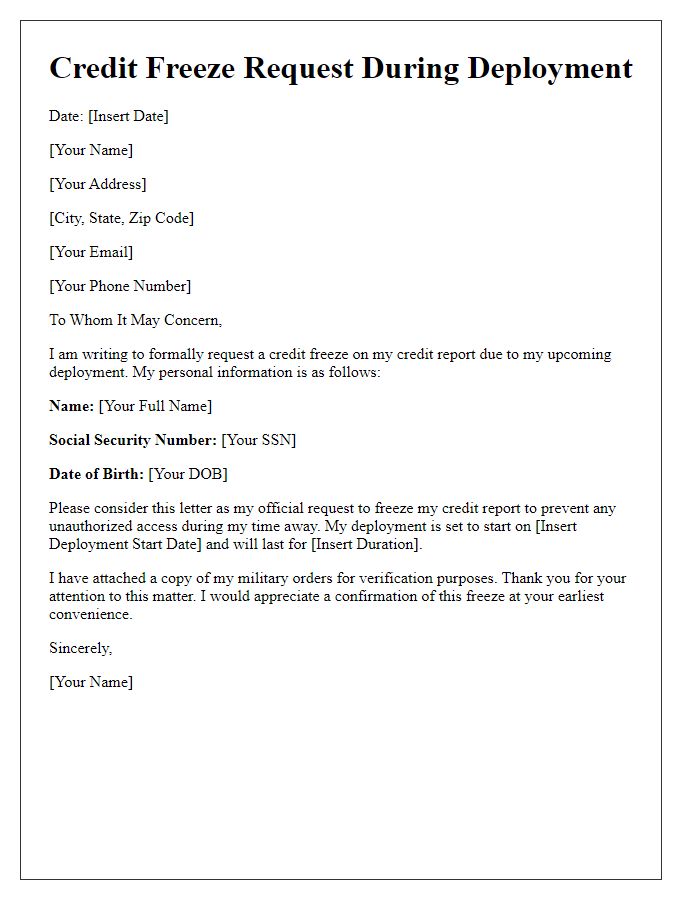

Deployment Orders

Military personnel often face the need to implement a credit freeze during deployment due to heightened identity theft risks while stationed away from home. Deployment orders, issued by commanders, typically include details such as the specific deployment location, duration, and mission objectives. This process protects sensitive information by restricting access to personal credit reports, ensuring that unauthorized parties cannot open accounts. The credit freeze can be initiated through major credit reporting agencies, including Experian, TransUnion, and Equifax. It's crucial for service members to reference their deployment orders, including their unit's name and the dates of service, when submitting requests to facilitate a seamless credit freeze process.

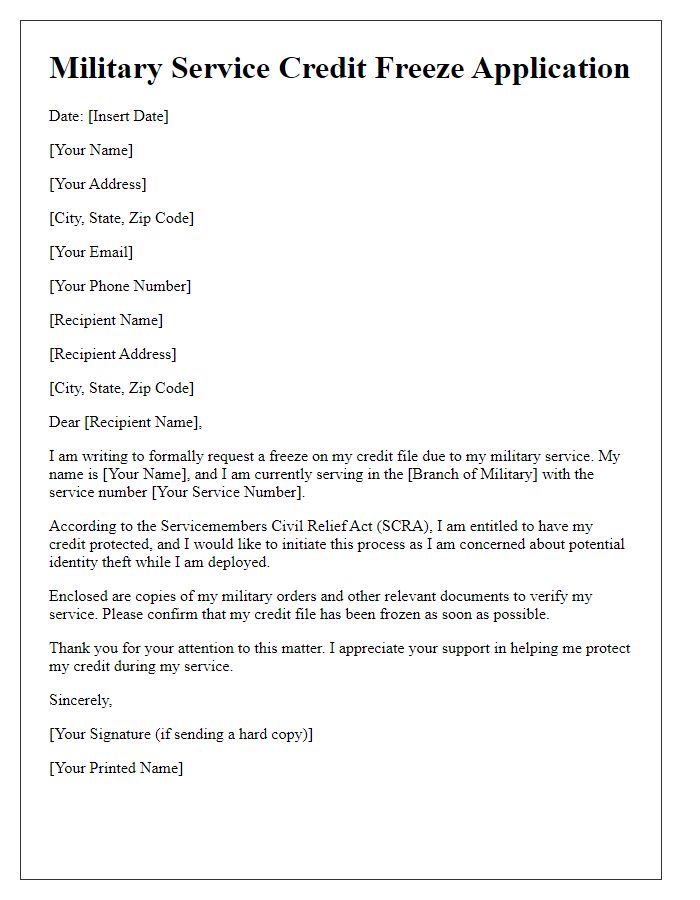

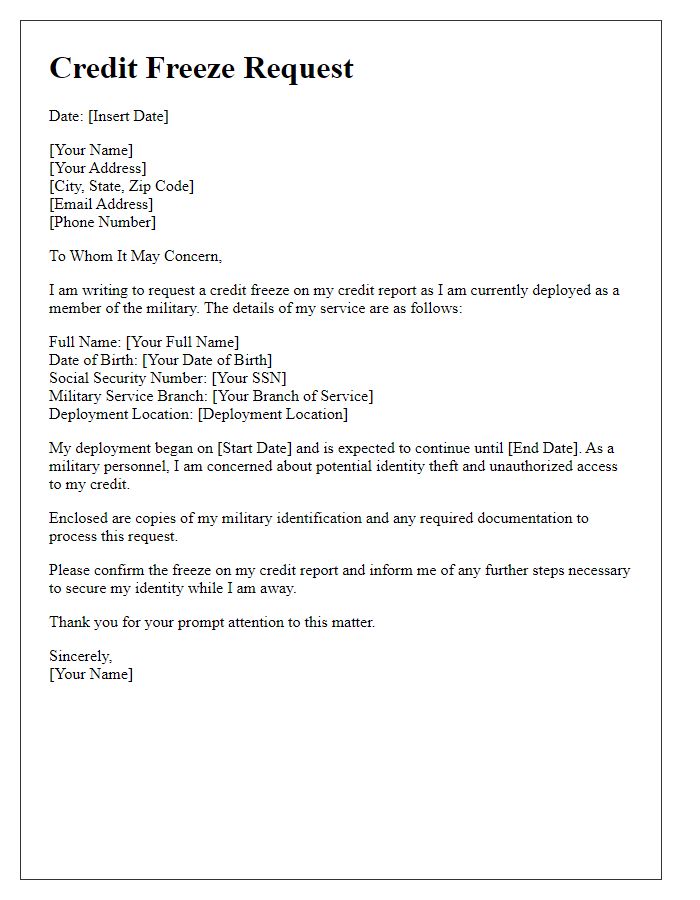

Credit Freeze Request

Military personnel often face unique challenges when deployed, particularly regarding financial security. A credit freeze is a proactive measure that prevents identity theft and unauthorized access to credit reports for service members during deployment. In the United States, the Fair Credit Reporting Act allows active duty military members to request a credit freeze at no cost to safeguard sensitive information. Key information must be included in the request, such as the service member's name, Social Security number, dates of service, and current contact information. It is crucial to provide details of the military branch, deployment location, and any relevant identification numbers to expedite the process. The three major credit bureaus--Experian, TransUnion, and Equifax--must each be contacted to ensure comprehensive coverage against potential fraud during the deployment period.

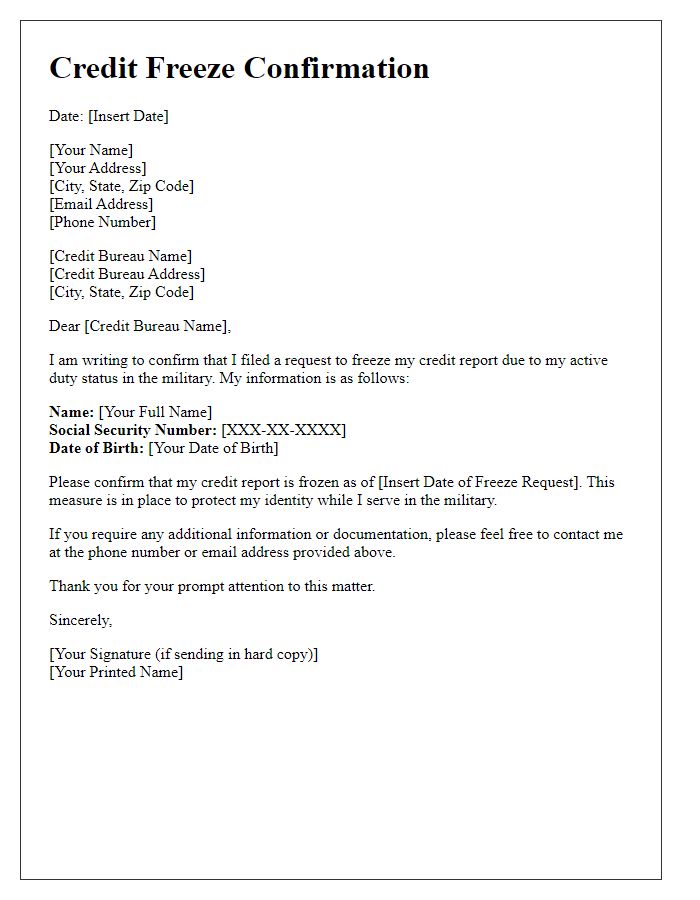

Contact Information

Military personnel undergoing deployment often need to consider a credit freeze to protect their financial identity. A credit freeze, also known as a security freeze, restricts access to credit reports, preventing identity thieves from opening accounts in their name. Military members can contact major credit bureaus - Equifax, Experian, and TransUnion - to initiate this process. Each bureau typically requires personal identification information, such as Social Security number, military identification number, and service details such as deployment dates. It's essential for military members to provide accurate contact information, including current mailing address, phone number, and email, ensuring they remain reachable for any future inquiries or updates regarding their credit status. Additionally, service members should plan to lift the freeze upon return to allow for normal credit activity and financial activities.

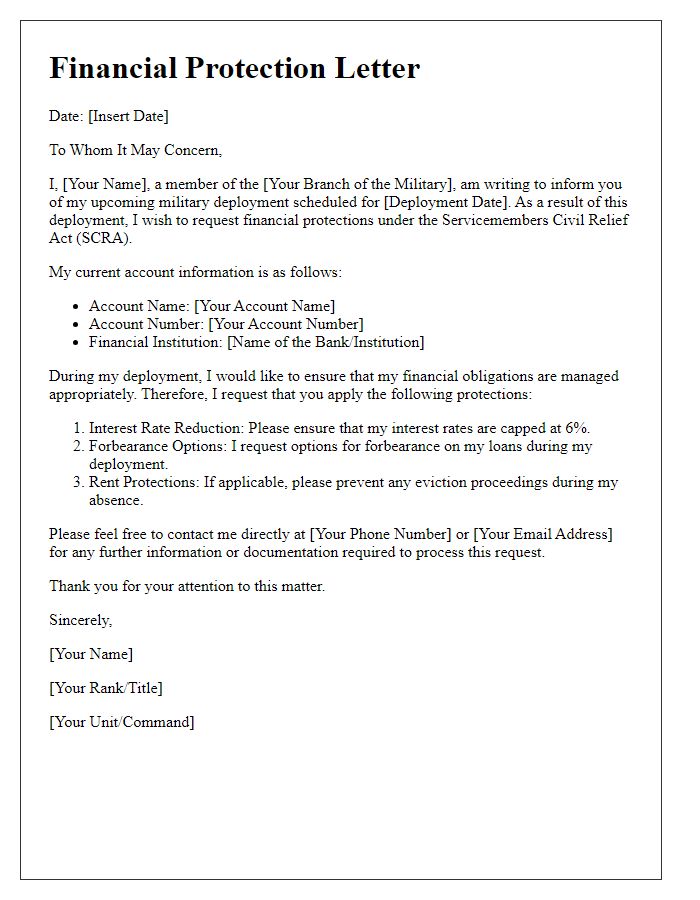

Acknowledgment and Signature

Military personnel on active duty can request a credit freeze to protect their financial identity during deployment. A credit freeze prevents creditors from accessing credit reports without explicit authorization, safeguarding against potential identity theft. Service members should provide identification details, such as their Social Security number and proof of active duty, like deployment orders from the Department of Defense. To finalize the request, signed acknowledgment of the freeze is typically required, affirming the understanding of the freeze's terms and potential impacts on obtaining new credit. A signature confirming this acknowledgment also allows for easy unfreezing post-deployment if necessary.

Comments