Navigating the world of finance can be complex, especially with frequent law changes that can impact your financial obligations. It's crucial to stay informed about any new regulations that might affect your creditor relationships, as understanding these updates can help you manage your payments and avoid potential pitfalls. This letter serves as a helpful guide to notify you of recent changes in the law that may influence your agreements. So, grab a cup of coffee and dive into the details to ensure you're always in the loop!

Legal Compliance Requirements

Legal compliance requirements have undergone significant changes, affecting financial institutions' notification obligations. Under the revised regulations set forth in the 2019 Consumer Financial Protection Bureau guidelines, lenders are mandated to inform borrowers within 30 days of any modifications to the terms of their loans. This includes crucial details about interest rates, payment schedules, and penalties for late payments. Failure to adhere to these rules can result in penalties, including fines up to $100,000 per violation. Furthermore, institutions must maintain accurate records of compliance efforts to ensure transparency and accountability, particularly in states like California, where consumer protection laws are stringent. Maintaining proactive communication with creditors not only fosters better relationships but also mitigates legal risks.

Updated Contact Information

Creditors must be notified of updated contact information to ensure compliance with legal requirements and facilitate communication. Effective dates for such updates vary by jurisdiction, often outlined in specific laws or regulations covering creditor notifications. For instance, under the Fair Debt Collection Practices Act, creditors are required to maintain accurate contact records. Relevant contact details include phone numbers, email addresses, and physical mailing addresses, which should be accurate to prevent miscommunication or legal issues. Additionally, lenders may specify the method of notification, whether through direct mail or electronic means, to ensure that the updates reach the appropriate departments efficiently.

Changes in Reporting Procedures

Changes in reporting procedures can significantly impact the compliance requirements for creditors, particularly under the Fair Credit Reporting Act (FCRA) guidelines. Effective January 1, 2024, certain adjustments will be implemented, including stricter timelines for reporting late payments and a new standard form for dispute resolution. Creditors must adapt to these regulations to avoid penalties, which can reach up to $1,000 per violation. Additionally, state-specific regulations in jurisdictions like California may impose additional obligations, emphasizing the importance of timely and accurate reporting to credit bureaus. Regular training sessions and updates on these procedural changes will be essential for maintaining compliance and ensuring transparency with consumers.

Impact on Financial Agreements

In recent months, significant legal reforms have reshaped the landscape of financial agreements, particularly in the context of creditor-debtor relationships. The new regulations, effective from January 2024, emphasize increased transparency and protection for consumers, impacting existing contracts drastically. Creditors must now adhere to stringent guidelines outlined by the Consumer Financial Protection Bureau, including clearer disclosure requirements and limits on late fees (capped at $25). Furthermore, courts in jurisdictions like California and New York are now interpreting non-compliance with these regulations as grounds for nullifying certain provisions in financial agreements. Stakeholders must closely monitor their financial practices to ensure compliance, as failure to do so may result in fines and reputational damage. It is crucial for creditors to reassess their contractual obligations and engage in proactive communication with affected clients to navigate these changes effectively.

Key Deadlines and Timelines

In response to recent legislative changes, creditors must be aware of upcoming key deadlines and timelines affecting compliance and operations. The Fair Debt Collection Practices Act (FDCPA) amendments, effective January 1, 2024, impose stricter regulations on communication methods, specifically mandating that all electronic correspondence be stored for a minimum of two years. Additionally, the Consumer Financial Protection Bureau (CFPB) has established a timeline for submitting annual compliance audits by March 31, 2024, ensuring that all debt collection practices meet the new standards. Institutions must also prepare for the revised reporting requirements under the Fair Credit Reporting Act (FCRA), with initial compliance documentation due by May 15, 2024. Failure to adhere to these deadlines could result in significant penalties and enforcement actions from regulatory agencies.

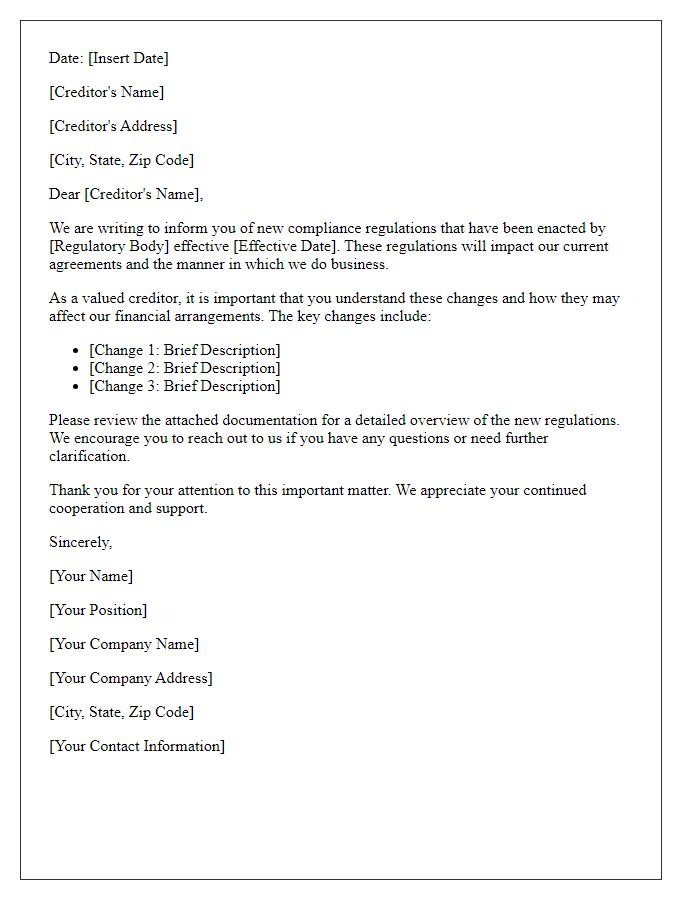

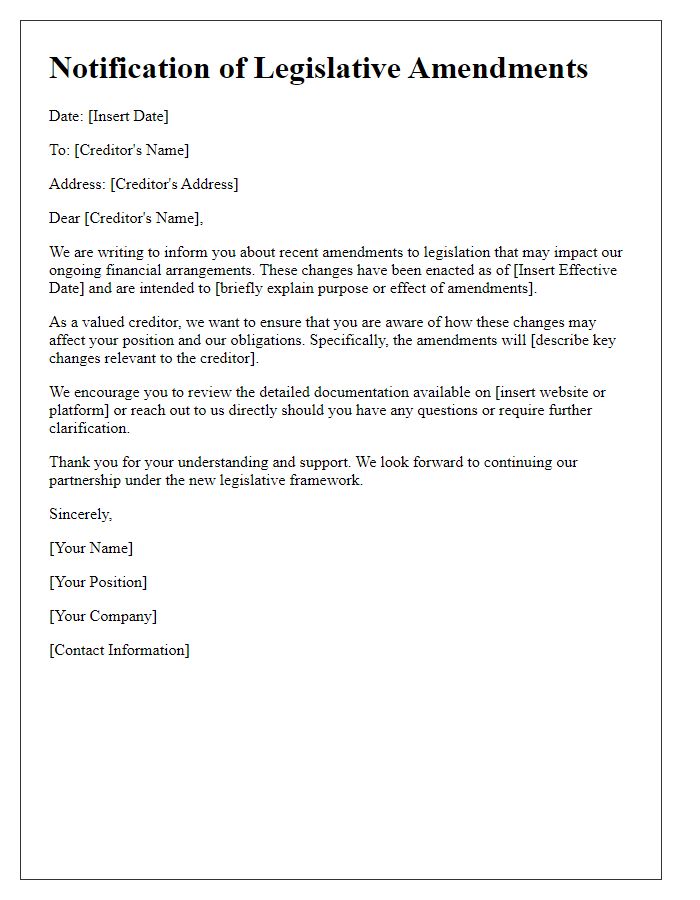

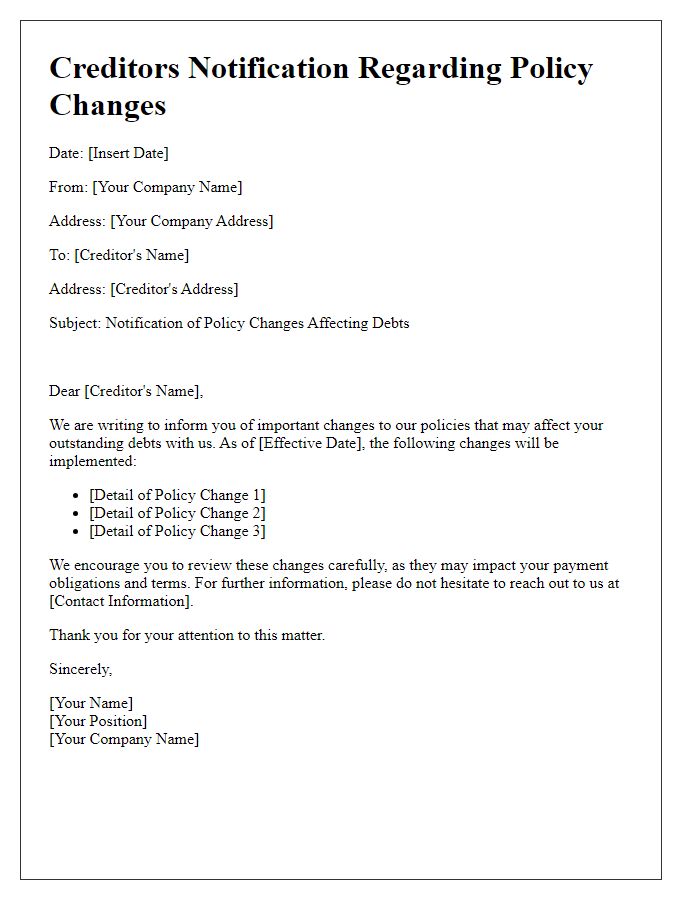

Letter Template For Creditor Notification On Law Changes Samples

Letter template of creditor notification regarding new compliance regulations.

Letter template of creditor notification about recent legislative amendments.

Letter template of creditor notification concerning policy changes affecting debts.

Letter template of creditor notification for adjustments in credit terms due to law changes.

Letter template of creditor notification on modifications to borrower rights.

Letter template of creditor notification regarding shifts in bankruptcy laws.

Letter template of creditor notification about enforcement of new consumer protection statutes.

Letter template of creditor notification for changes in interest rate regulations.

Comments