Are you struggling with the impact of a tax lien on your credit report? Don't worry; you're not alone, and there are ways to navigate this challenging situation. In this article, we'll explore a simple yet effective letter template that can help you request the removal of a tax lien from your credit report and improve your financial standing. Let's dive in and discover how you can take the first step towards a cleaner credit history!

Clear Identification Information

Tax lien removal from a credit report involves several critical steps, including understanding the implications of a tax lien (a legal claim by a government entity due to unpaid taxes) and its effects on credit scores. Most individuals face challenges in their credit profiles when tax liens appear, with a potential score drop of up to 100 points. Identification information, including full legal name, Social Security number, and current address, must be clearly articulated for effective processing. If the lien is paid or released, documentation should be attached as evidence, including a statement from the tax authority (like the IRS) confirming the lien status. Additionally, timely submission of the removal request, often through credit bureaus such as Experian, Equifax, and TransUnion, ensures a higher chance of success in improving one's credit standing.

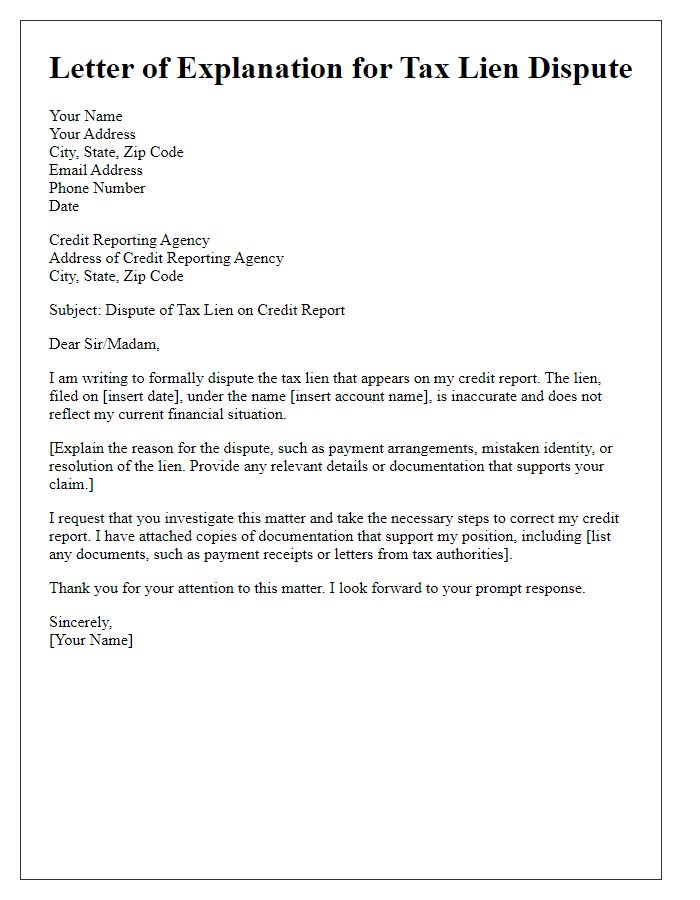

Detailed Account of Tax Lien Discrepancy

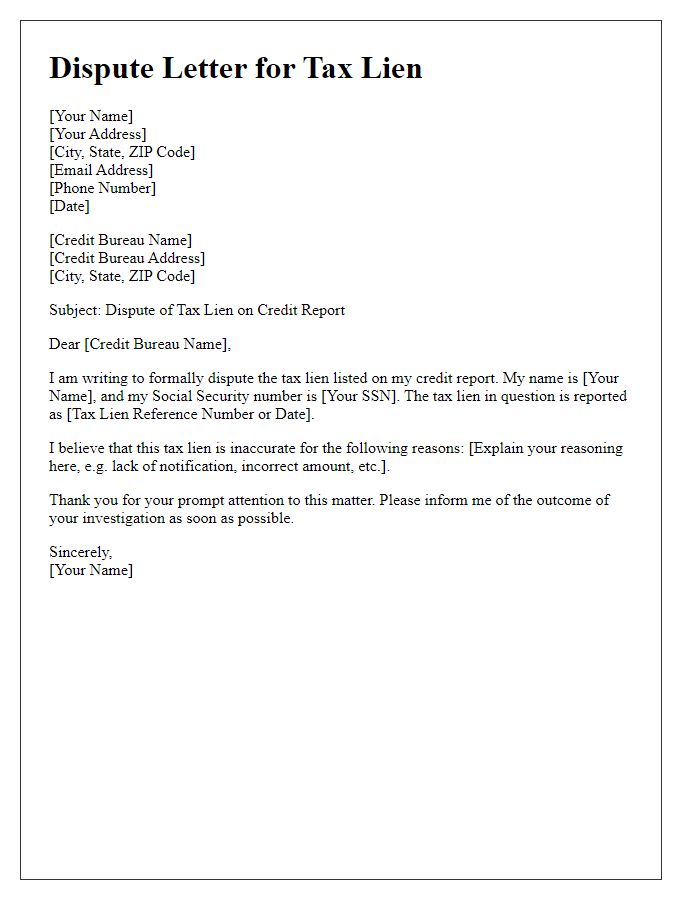

A tax lien can significantly impact an individual's credit report, often recorded by credit reporting agencies such as TransUnion or Experian. A discrepancy in the tax lien amount, often due to clerical errors by the Internal Revenue Service (IRS) or local tax authorities, can lead to a misleading financial narrative affecting eligibility for loans or mortgages. Tax liens, for instance, can linger on credit reports for up to seven years, with the potential to lower credit scores by impacting the payment history and debt-to-income ratio calculations. Accurate documentation, such as IRS account transcripts or relevant notice letters, is essential for contesting the lien and facilitating its removal. Timely communication with credit bureaus can expedite the review process and correct any inaccuracies linked to the tax liability.

Supporting Documentation Attached

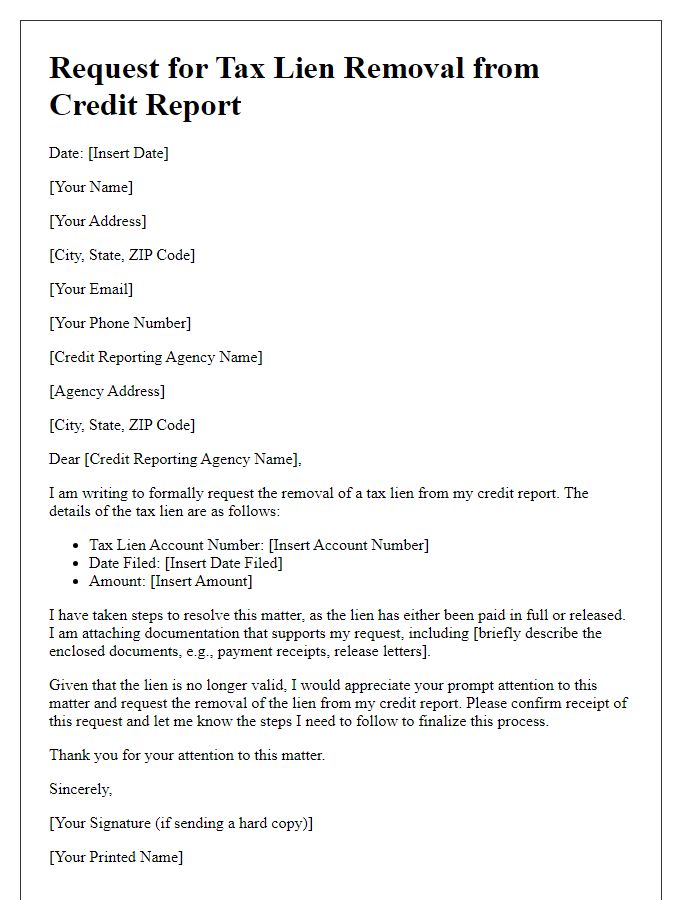

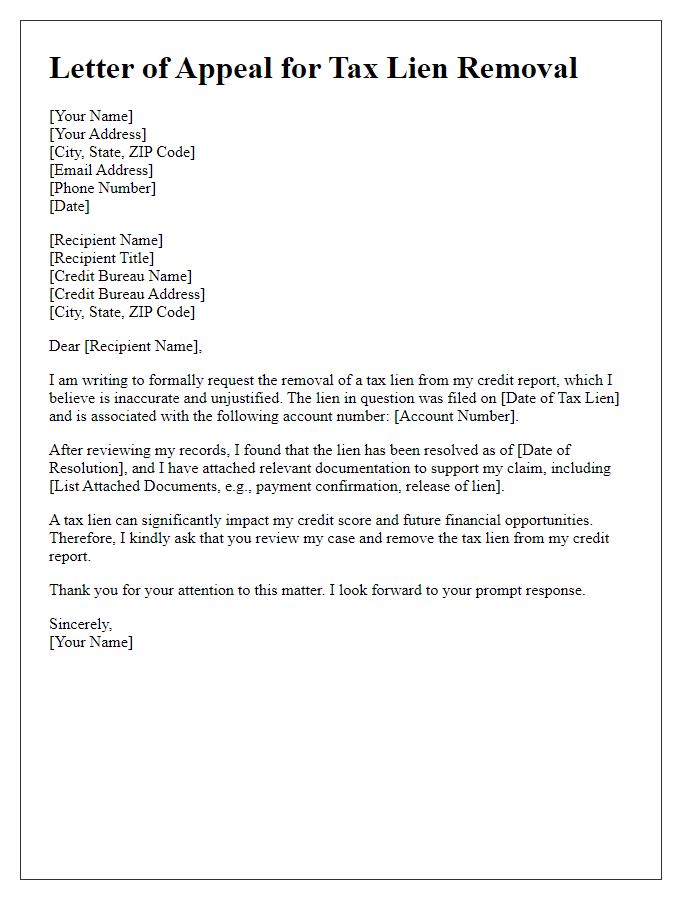

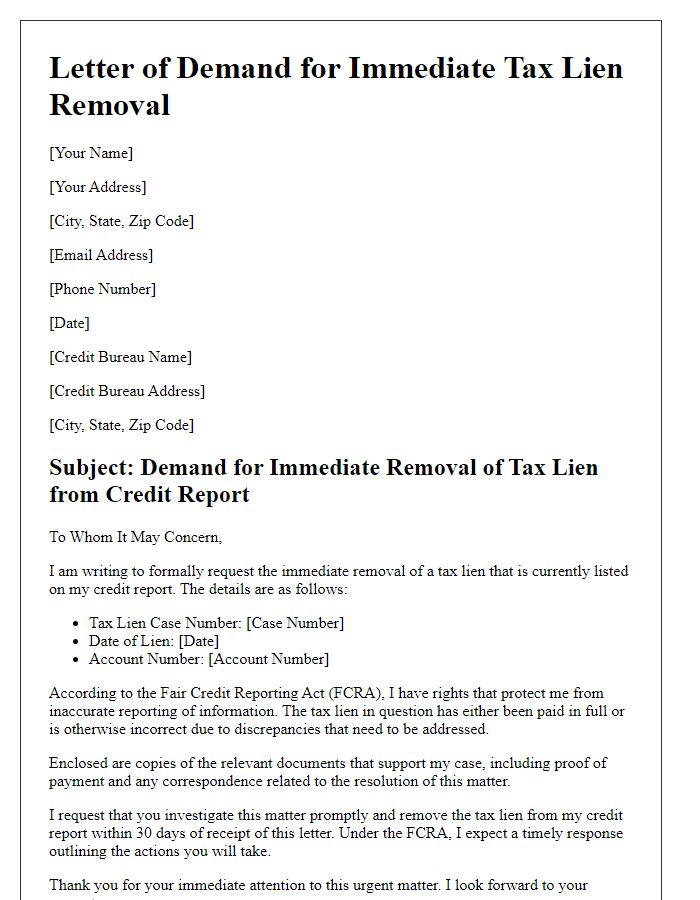

A tax lien can significantly impact an individual's credit score and financial opportunities, particularly in the United States, where unresolved tax debts are publicly recorded. Tax liens typically arise from unpaid federal or state taxes, with amounts varying based on individual circumstances. The removal process involves submitting a formal request, often accompanied by documentation such as proof of payment or a release from the tax authority, like the Internal Revenue Service (IRS). Important dates include the original lien filing date and any subsequent payment or settlement date that may strengthen the case for removal. These actions must comply with the Fair Credit Reporting Act (FCRA) guidelines, which dictate how long such negative information can remain on credit reports, typically seven years. Properly addressing tax liens can restore creditworthiness and open avenues for securing loans or mortgages, essential for future financial stability.

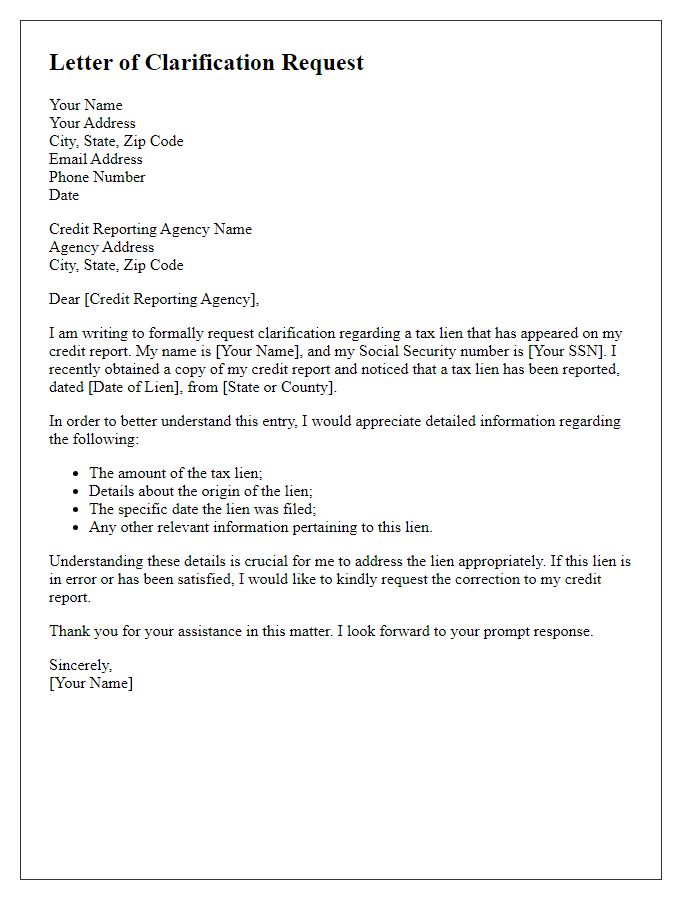

Request for Verification and Removal

Tax liens can significantly impact credit reports, especially for individuals facing financial challenges. Disputing a tax lien involves submitting a formal request for verification and potential removal from credit reports maintained by agencies such as Equifax, Experian, and TransUnion. An important note is the adherence to the Fair Credit Reporting Act, which mandates timely responses from reporting agencies. The specific tax lien, often originating from unfulfilled obligations to the Internal Revenue Service (IRS), may reflect negatively for up to seven years. Individuals should gather relevant documentation such as payment receipts or discharge notices that demonstrate lien resolution. Timely follow-ups (within 30 days) can enhance the chances of a favorable outcome.

Contact Information for Follow-up

The process of removing a tax lien from a credit report involves several important steps that have specific implications for one's financial health. A tax lien, a legal claim by the government against an individual's assets due to unpaid taxes, can significantly lower credit scores (typically ranging from 300 to 850). To initiate the removal process, obtaining a lien release form (often referred to as IRS Form 12277) is crucial, which serves as proof that the outstanding tax debt has been satisfied. Sending this documentation to credit reporting agencies like Experian or Equifax is necessary, as they then can update the credit profile accordingly, which may take up to 30 days. Additionally, maintaining thorough records of all communications with tax authorities, along with securing a confirmation receipt for mailed documents, ensures a smoother follow-up and supports the dispute process with credit bureaus if necessary. Understanding these steps and timelines can assist individuals in regaining their creditworthiness more efficiently.

Letter Template For Tax Lien Removal From Credit Report Samples

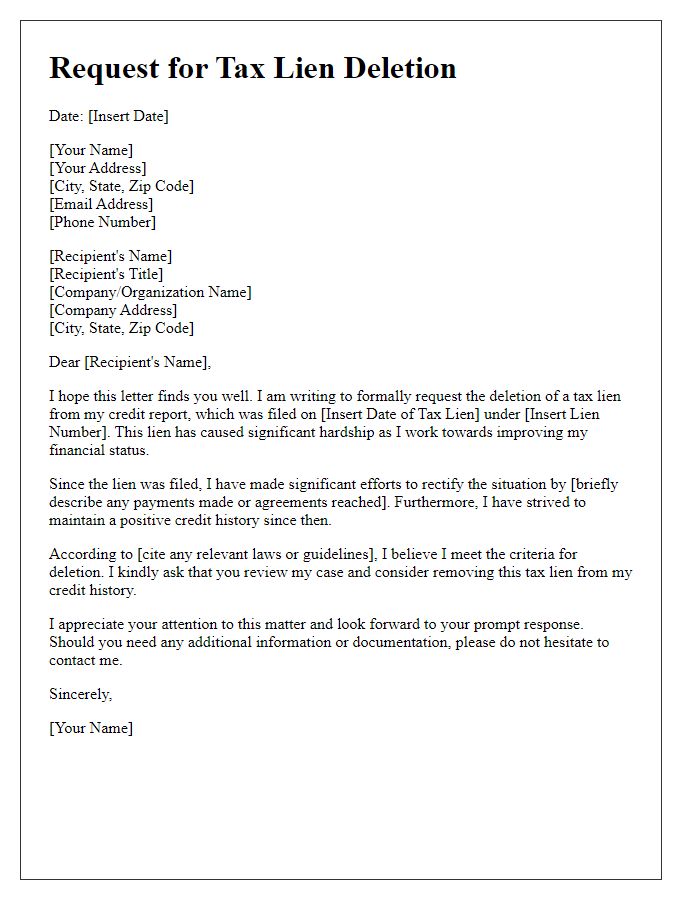

Letter template of formal request for tax lien deletion from credit report

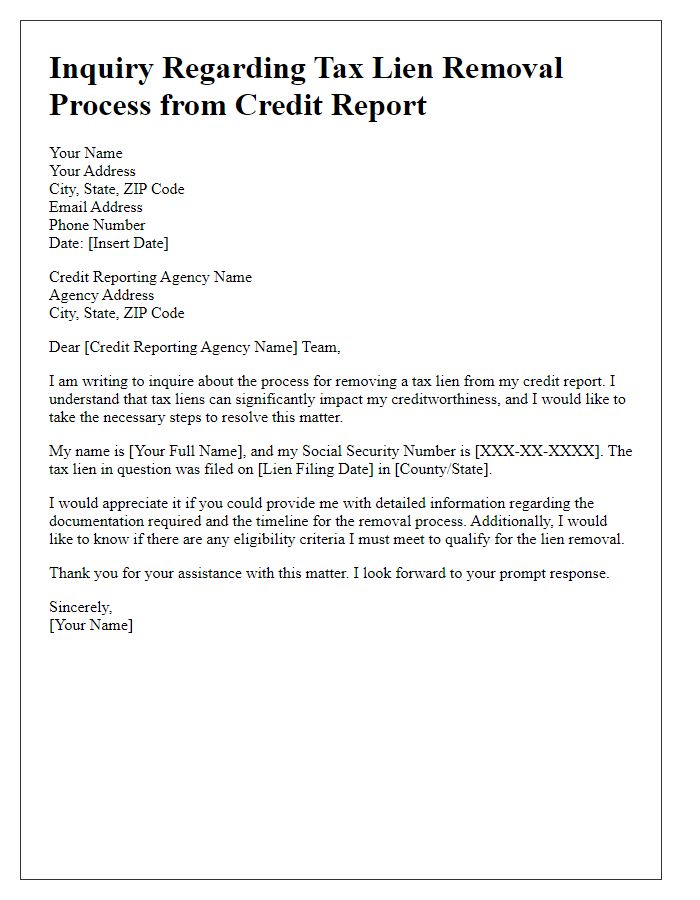

Letter template of inquiry regarding tax lien removal process from credit report

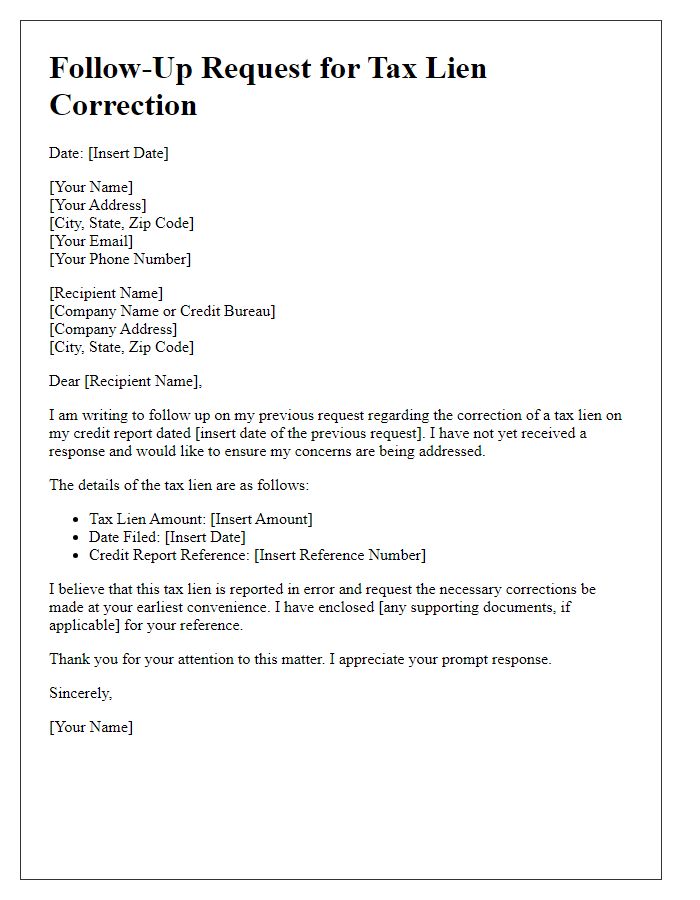

Letter template of follow-up request for tax lien correction on credit report

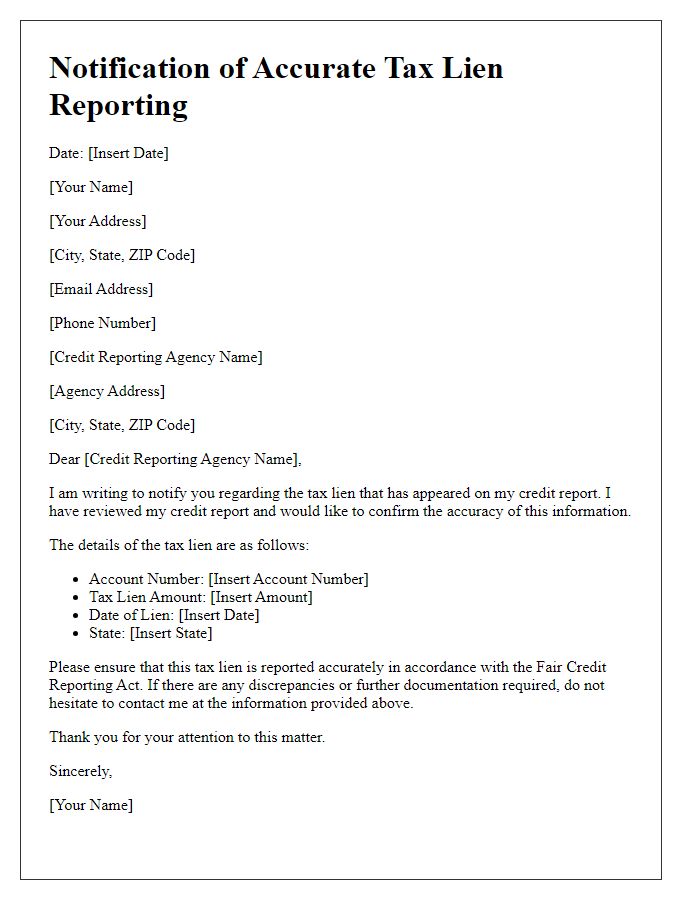

Letter template of notification for accurate tax lien reporting on credit report

Comments