Navigating the complexities of child support can be challenging, especially when it comes to its impact on your credit score. Many parents may not realize that missed payments can lead to negative credit reporting, making it vital to stay informed and proactive. Understanding your rights and responsibilities is the first step in ensuring your financial health remains intact. If you're curious about how child support influences your credit and what you can do to mitigate any potential damage, keep reading for valuable insights!

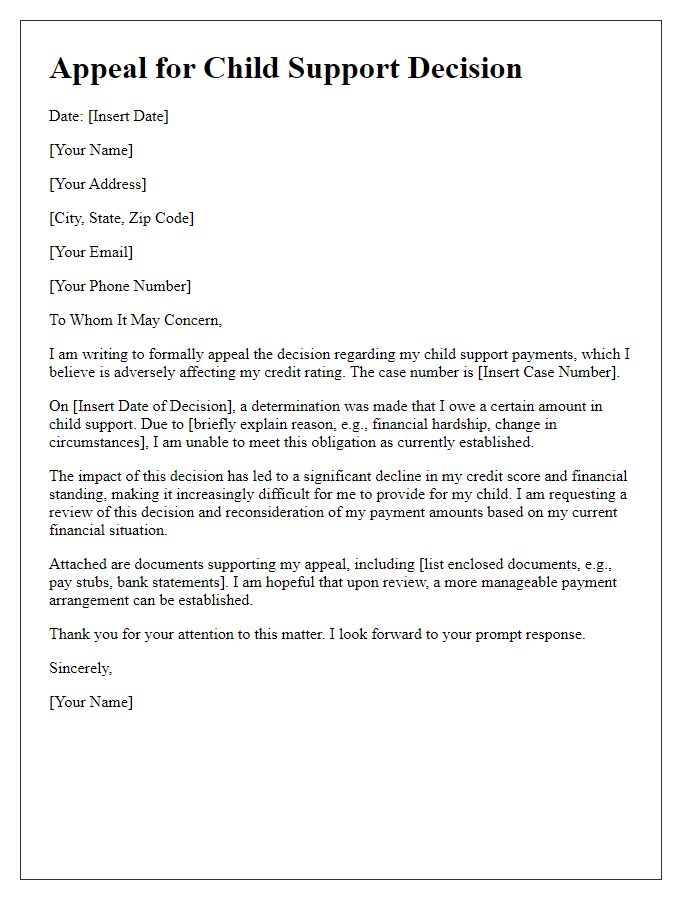

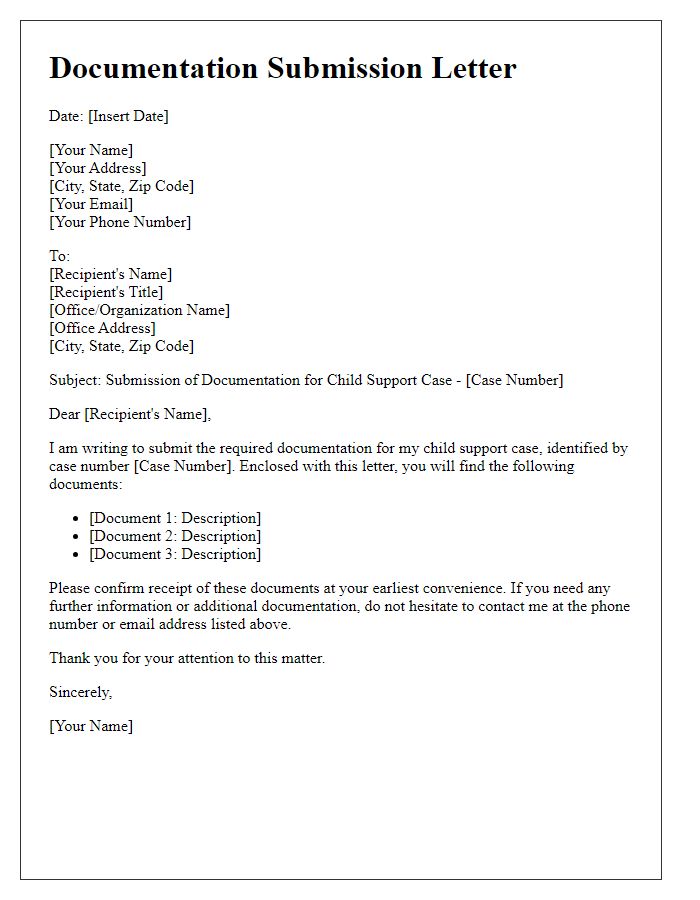

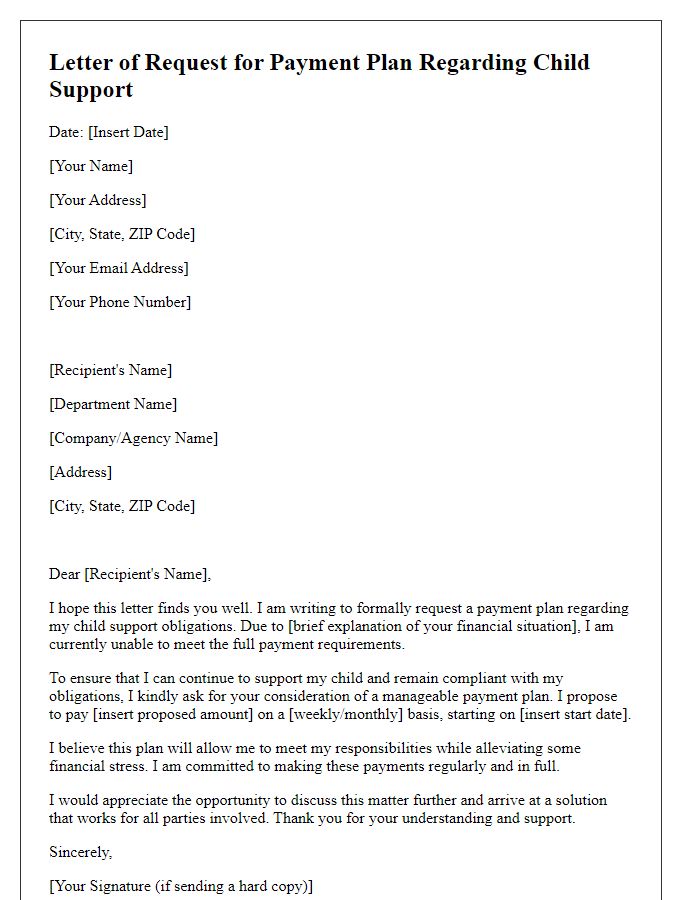

Clear subject line

Child support payments can significantly impact an individual's credit score. Payments that are consistently made late or remain unpaid can be reported to credit bureaus, potentially leading to a decrease in credit ratings, which range from 300 to 850. Under laws in various states, such as the Child Support Enforcement Act, non-payment can result in legal consequences, including wage garnishment. Additionally, child support arrears may appear on credit reports as a collection account, further complicating the parent's financial situation. Proper management of these obligations is essential for maintaining a positive credit history, particularly when considering major financial decisions, such as mortgages or loans.

Contact information

Child support obligations, particularly those not met on time, can significantly impact an individual's credit score and financial stability. In the United States, failure to pay child support could result in negative reporting to credit bureaus, potentially dropping credit scores by 100 points or more. This situation can lead to difficulties in securing loans or mortgages (such as a home loan for a property in New York City) and may also incur interest and penalties related to state child support laws. Additionally, collection agencies may become involved, exacerbating the negative impact on the credit report, which remains visible for up to seven years. Legal actions, such as wage garnishment or property liens, may occur due to ongoing non-compliance, further complicating financial health and long-term goals.

Statement of purpose

Child support obligations significantly impact credit ratings and financial stability. Failing to meet child support payments (averaging $400 monthly) can result in negative marks on credit reports, leading to lower scores. The Fair Credit Reporting Act stipulates that missed payments can be reported after 30 days delinquency. States like California and Florida enforce rigorous enforcement measures, including income withholding and potential liens on properties, further complicating financial circumstances. The repercussions extend to the ability to secure loans or mortgages, affecting future financial planning. Understanding these implications is essential for navigating obligations and maintaining a healthy credit profile.

Details of child support agreement

Child support agreements, often established during divorce proceedings in family court, play a critical role in ensuring the financial well-being of children. Typically, these agreements specify the monthly payment amount, due date, and duration of support, reflecting legal requirements under state laws such as the Child Support Enforcement Act. Non-compliance with these agreements can lead to significant consequences, including negative impacts on credit scores, especially if payments fall 30 days delinquent or more. Credit reporting agencies can receive notifications of unpaid child support, resulting in potential credit score drops of 100 points or more, affecting one's ability to secure loans or mortgages. Courts may also enforce wage garnishment as a remedy, further complicating financial stability. Understanding the specific terms of the agreement, like the annual adjustment guidelines or modification processes based on changes in income, is vital for maintaining both compliance and credit health.

Action request and closing statement

Child support arrangements, established by family courts to ensure the welfare of minors, can have significant implications for credit ratings. Late or missed payments may be reported to credit bureaus, impacting scores and potentially hindering future borrowing opportunities. In some cases, amounts owed can lead to serious consequences such as legal action, wage garnishment, or even property liens. Developing a payment plan with the custodial parent or seeking assistance through mediators can help rectify the situation. Taking proactive steps to address any discrepancies in payment history is crucial for maintaining a positive credit profile.

Letter Template For Child Support Affecting Credit Samples

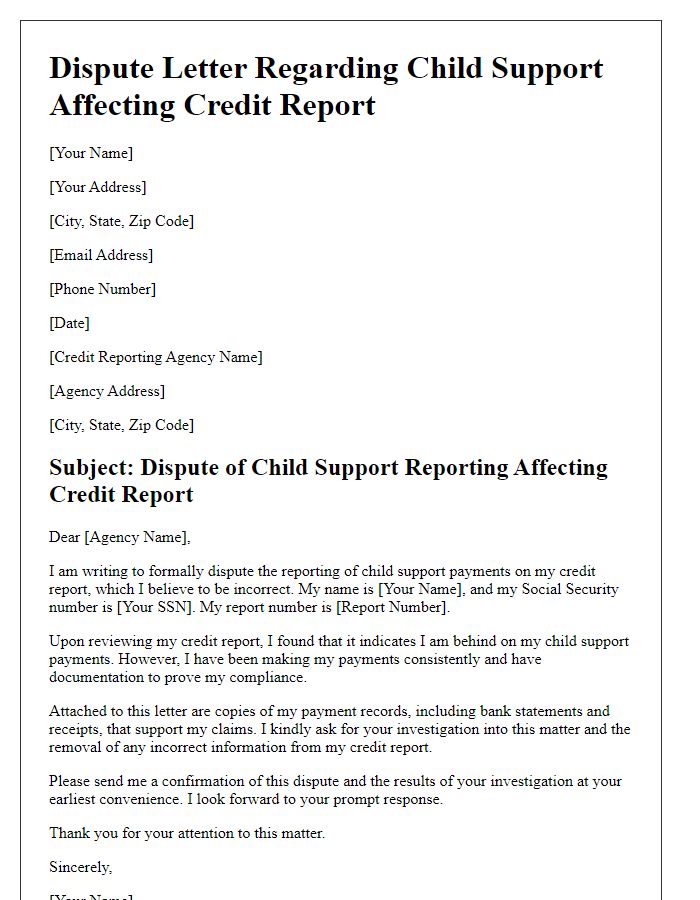

Letter template of dispute regarding child support affecting credit report

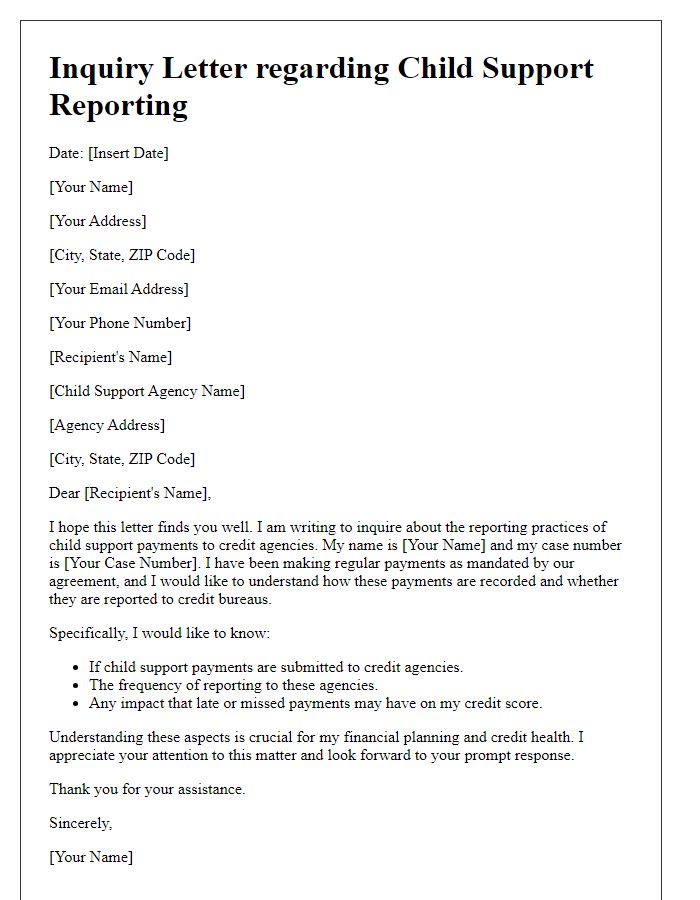

Letter template of inquiry on child support reporting to credit agencies

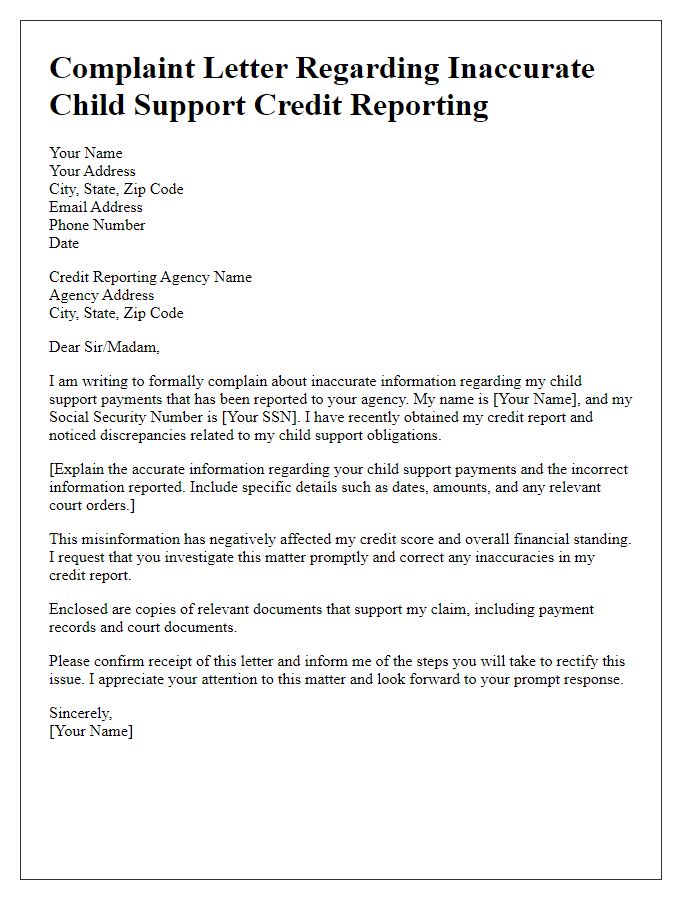

Letter template of complaint about inaccurate child support credit reporting

Letter template of clarification on child support obligations and credit

Comments