Have you ever found yourself in a situation where you needed to reinstate a closed account? It can be a bit daunting, but the good news is that with the right approach, it's entirely possible to navigate this process smoothly. Whether it's a bank account, subscription service, or online platform, understanding the steps to take can make all the difference. Keep reading to discover a handy letter template and tips for a successful account reinstatement!

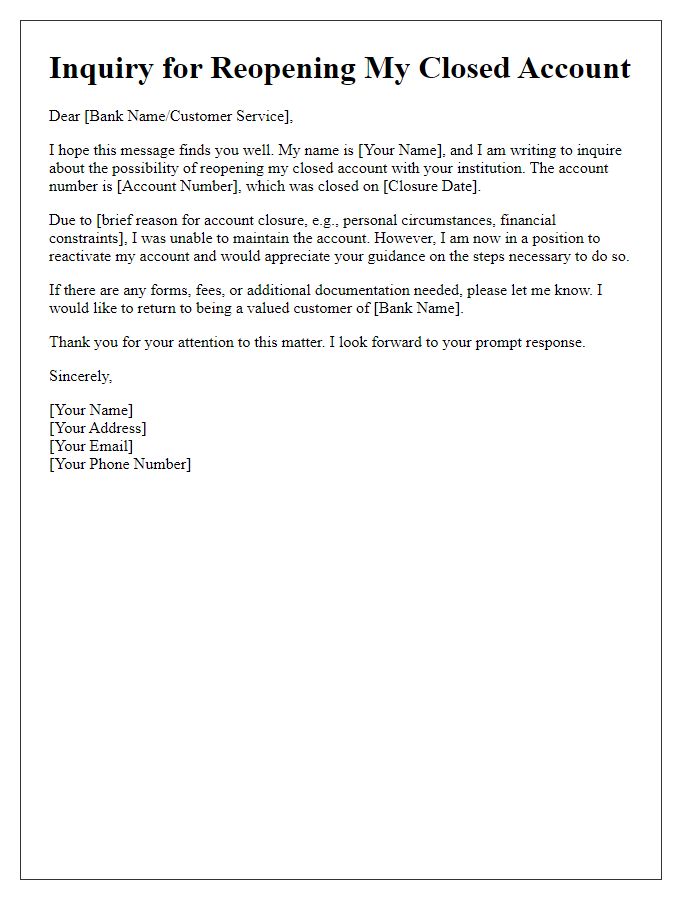

Account details and identification

Account reinstatement for closed accounts requires specific identification details to verify ownership. Customers must provide their account number, which uniquely identifies the account in the institution's database. Identification can include government-issued photo ID, such as a passport or driver's license, ensuring authenticity. Additionally, the individual may need to provide personal information, for example, full name, address, date of birth, and the last four digits of the Social Security number. In many cases, customers must explain the reason for closure and the circumstances that led to the request for reinstatement. This process may occur via bank branches, online platforms, or customer service hotlines, depending on the institution's policies.

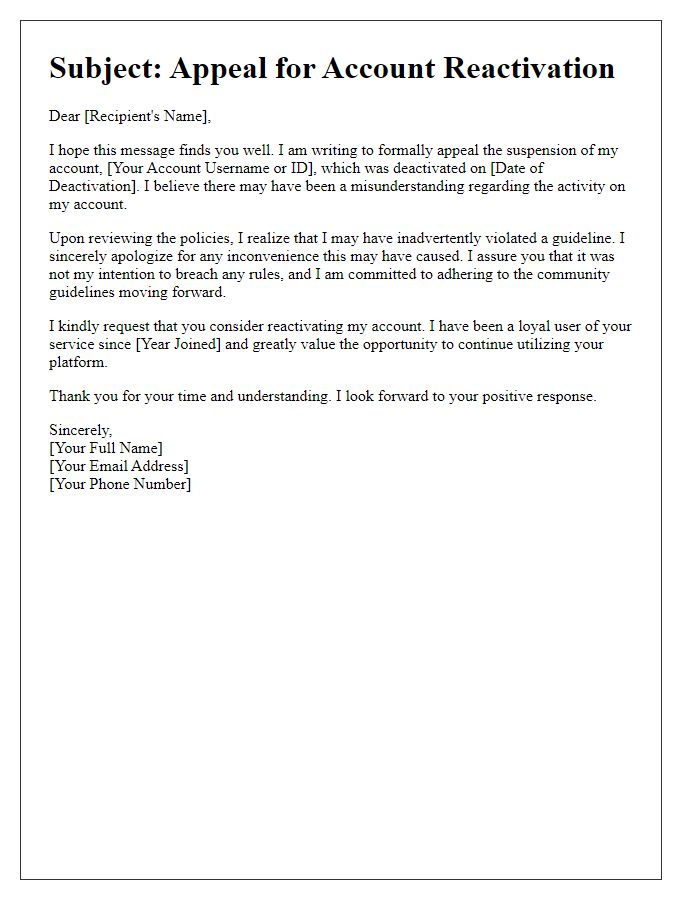

Reason for account closure

An individual may seek reinstatement of a closed bank account due to various reasons, such as personal financial difficulties, identity theft concerns, or a misunderstanding regarding account fees. Banks, including major institutions like JPMorgan Chase or Bank of America, typically close accounts for inactivity, suspicious transactions, or failure to meet minimum balance requirements. In 2022, reports indicated a 15% increase in account closures attributed to new banking regulations and heightened scrutiny of transaction patterns. Reinstatement efforts often require submitting a formal request, providing identification, and clarifying circumstances surrounding the closure. Engaging customer service representatives can also assist in navigating the reinstatement process.

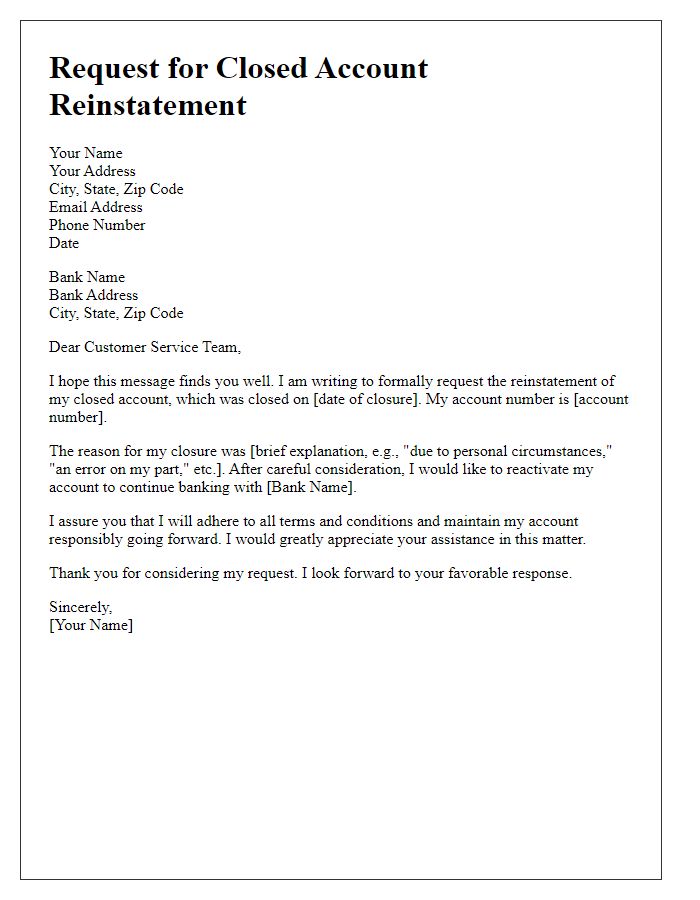

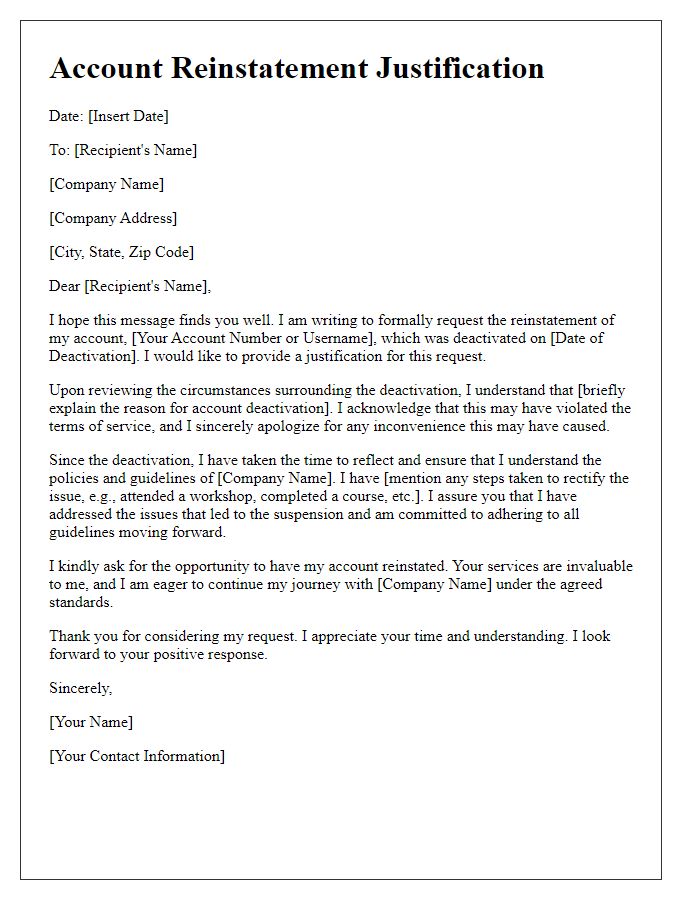

Justification for reinstatement

Reinstating a closed bank account can be a complex process requiring a thorough explanation of the circumstances surrounding the closure. Various issues may lead to account termination, such as overdrafts, inactivity, or suspicious transactions. Demonstrating a clear understanding of the bank's policies is crucial. When writing to the bank, include specific details about the account in question, such as the account number and the date of closure. Explain any changes in financial habits, resolution of previous issues, or misunderstanding that contributed to the closure. Mention a commitment to improved account management practices, and express a deep understanding of the importance of maintaining a good relationship with the bank. Finally, the request should be polite and convey appreciation for the bank's services, fostering a positive tone that increases the likelihood of reinstatement.

Contact information for follow-up

A closed account reinstatement involves providing detailed contact information that enables a seamless follow-up process. Essential components include the account number, which identifies the user's specific account within the service provider's database. The full name, as registered with the account, must be included for verification purposes, along with an email address for prompt electronic communication. A current phone number, reflecting the user's most accessible means of contact, ensures clarity in any necessary follow-up discussions. Additionally, specifying a preferred time frame for contact can facilitate an expedited resolution. This comprehensive set of contact details promotes efficient communication regarding the reinstatement process.

Request for prompt action and resolution

A closed account reinstatement request highlights the urgency and necessity for restoring access to financial services. Customers may face challenges, such as inability to process transactions due to account statuses. Prompt action becomes crucial, particularly for accounts related to significant financial platforms, like PayPal or Bank of America. Providing necessary identification details, like Social Security numbers or account numbers, ensures verifiable ownership. Clear communication about past account activity or previous support interactions can facilitate a quicker resolution. Timely reinstatement may also involve addressing potential issues, such as fraud alerts or compliance checks that led to the account closure.

Comments