Are you tired of seeing late payment fees stacking up on your bills? It's a common struggle many face, and you shouldn't have to pay for circumstances that might have been out of your control. In this article, we'll explore how to effectively draft a letter requesting the removal of those pesky fees, making it easier for you to manage your finances. So, let's dive in and discover how you can take charge of your payments and potentially save some money!

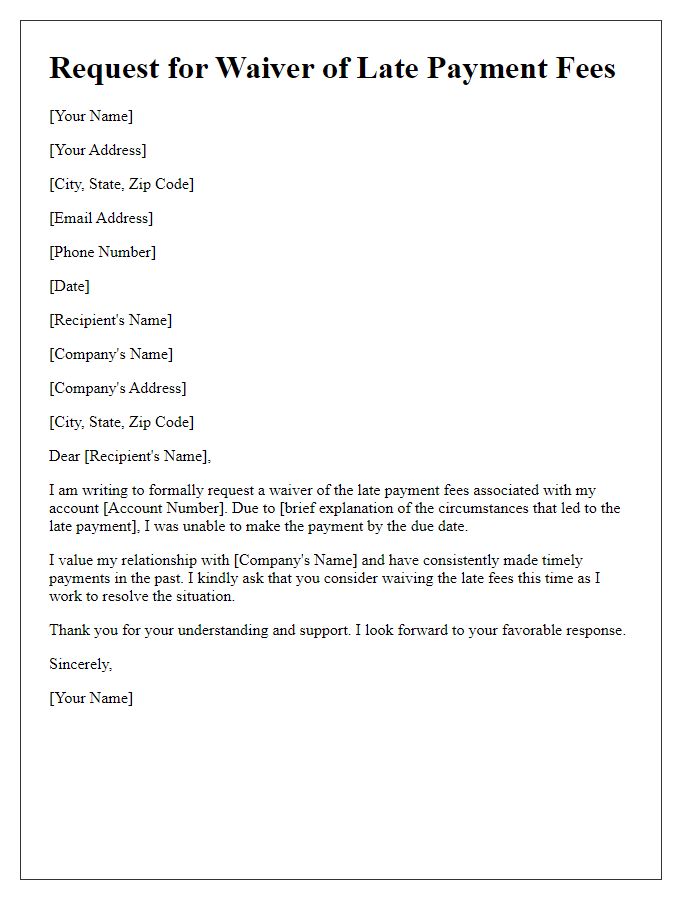

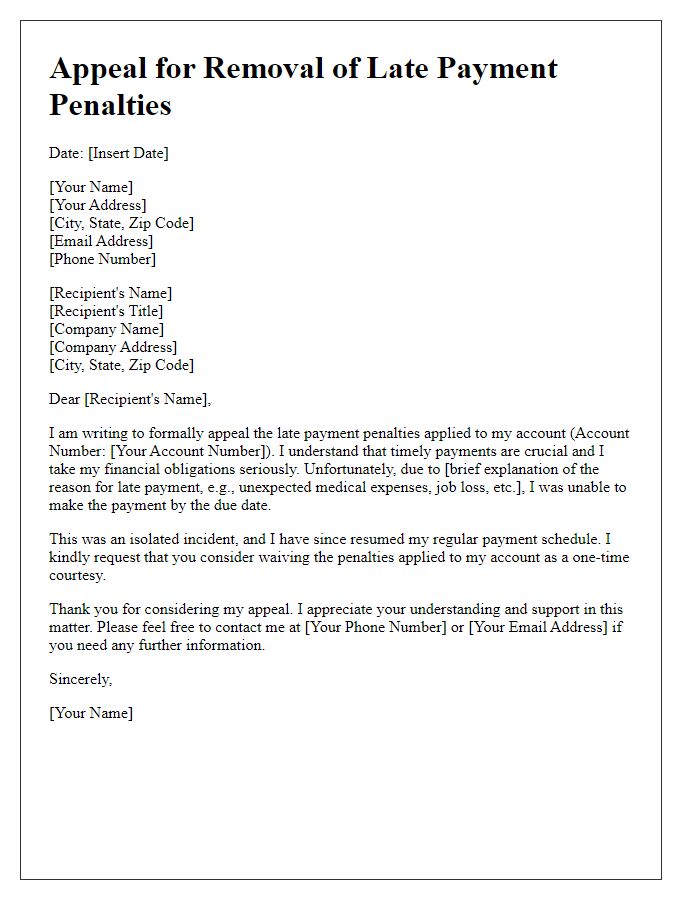

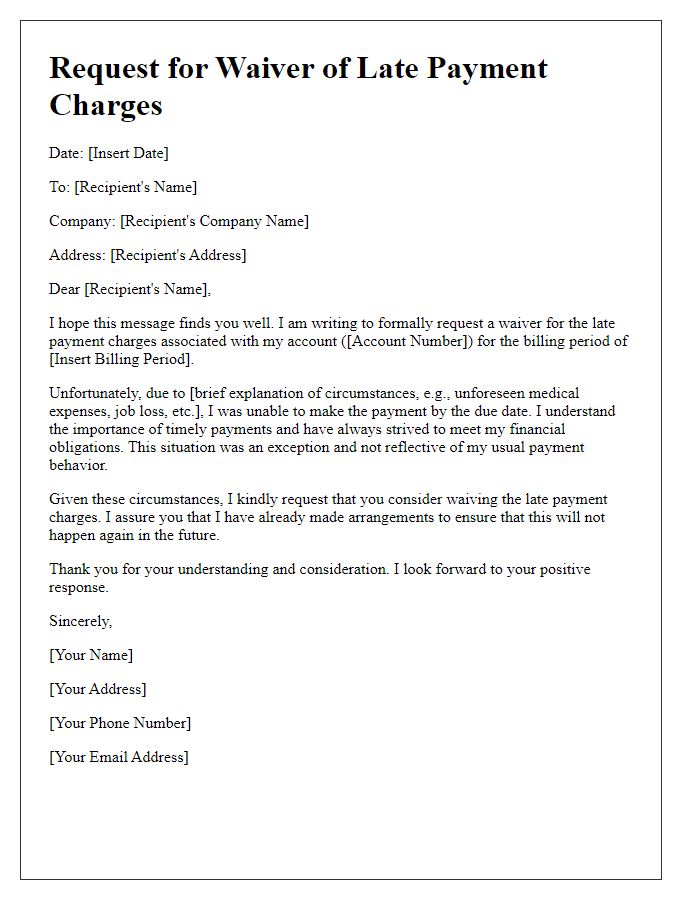

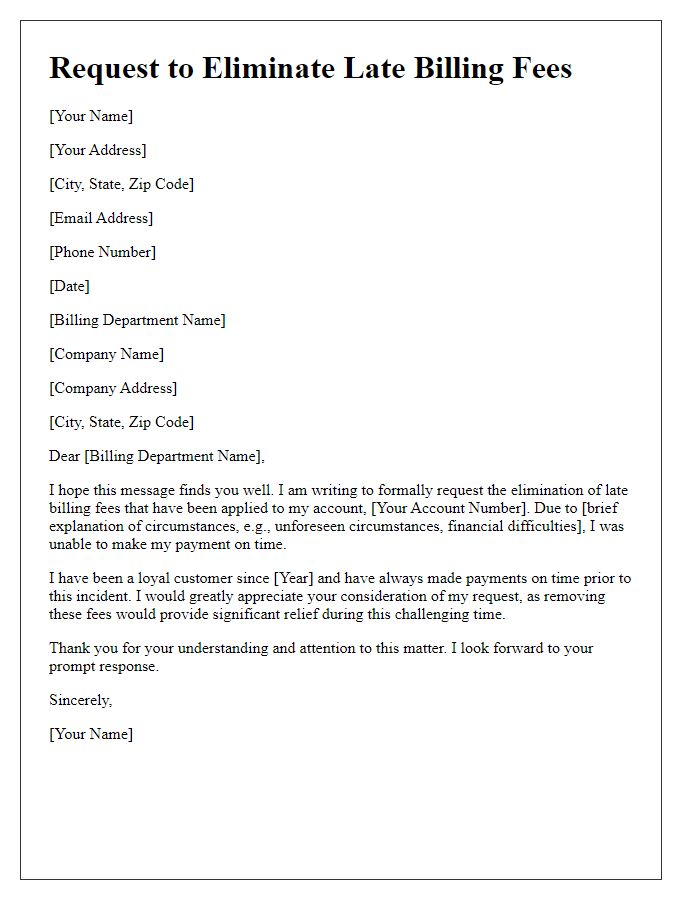

Clear Account Information

Late payment fees can significantly impact the financial health of individuals and businesses, particularly when dealing with utilities like electricity. For many, consistent, timely payments (often due on specific dates like the 15th of each month) reflect responsible budgeting and financial management. Organizations such as power companies may impose fees (ranging from $10 to $50) for payments received after the deadline, which could lead to increased overall costs and strain on monthly budgets. Removing these fees can enhance customer satisfaction and loyalty, promoting better relationships with service providers. In circumstances like unexpected hardships or emergencies (such as job loss or natural disasters), companies can show empathy by waiving these penalties, thus supporting their clients' financial stability and fostering a sense of community.

Specific Fee Details

Late payment fees, commonly imposed by credit card companies and utility providers, can vary significantly. For example, a credit card company like Chase might charge a late fee of $39 if payments are not received by the due date, typically at the end of each billing cycle. Utility providers like Pacific Gas and Electric (PG&E) may impose fees ranging from $5 to $15 for late payment, depending on the total amount due and service type. These fees often accumulate, creating financial strain, especially for individuals experiencing unexpected financial difficulties. Removal requests should specify the fee amount, such as a $39 charge from Chase, highlight the payment history, and express extenuating circumstances, like medical emergencies or job loss. Addressing these factors can help negotiate a waiver or reduction of late payment fees.

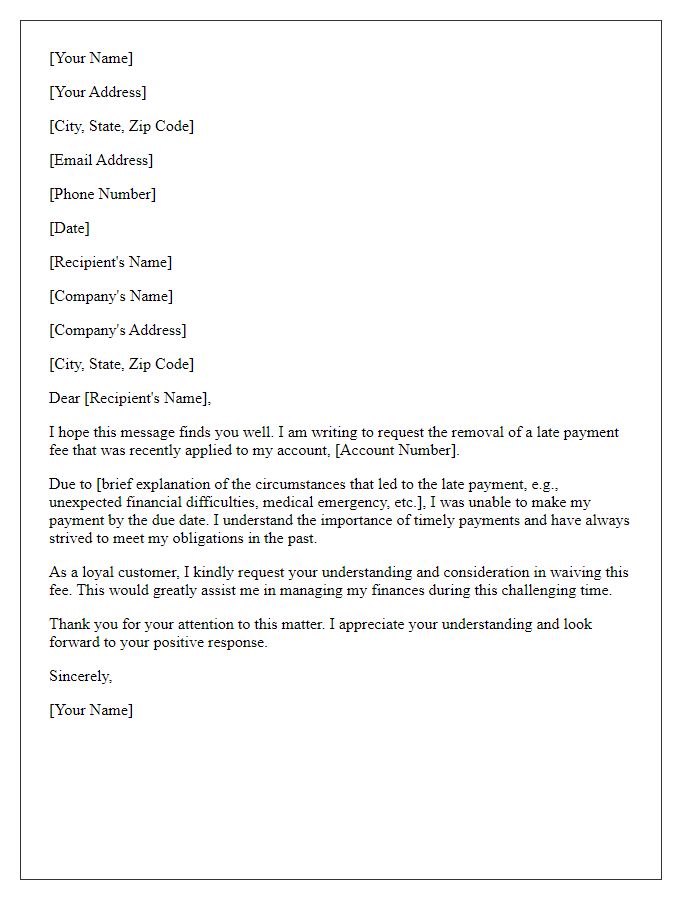

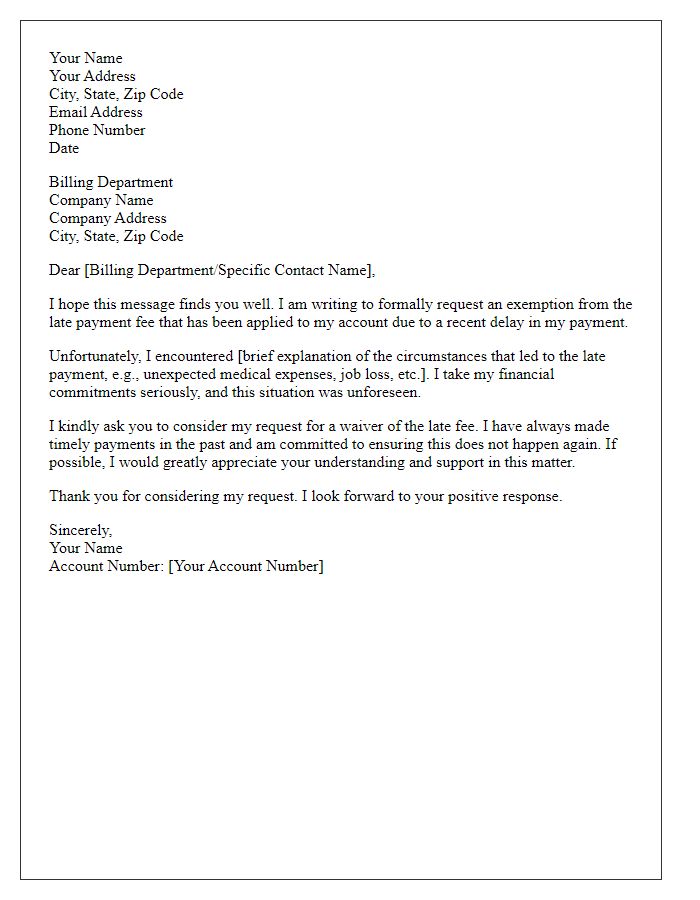

Reason for Delay Explanation

Late payment fees can significantly impact financial stability, particularly for individuals facing unforeseen circumstances. Unexpected events such as medical emergencies (hospital bills exceeding $5,000), job loss (unemployment rates rising to 5.9% in the U.S.), or natural disasters (like hurricanes affecting coastal regions, causing widespread damage) can contribute to payment delays. It is essential to communicate these factors clearly when requesting a waiver for late fees. Providing documentation, such as a letter from a healthcare provider or termination notice from an employer, can strengthen the request. Financial institutions often review customer accounts and payment history (such as on-time payments over 12 months) to assess requests, making it crucial to highlight past responsible behavior while outlining the specific reasons for the current situation.

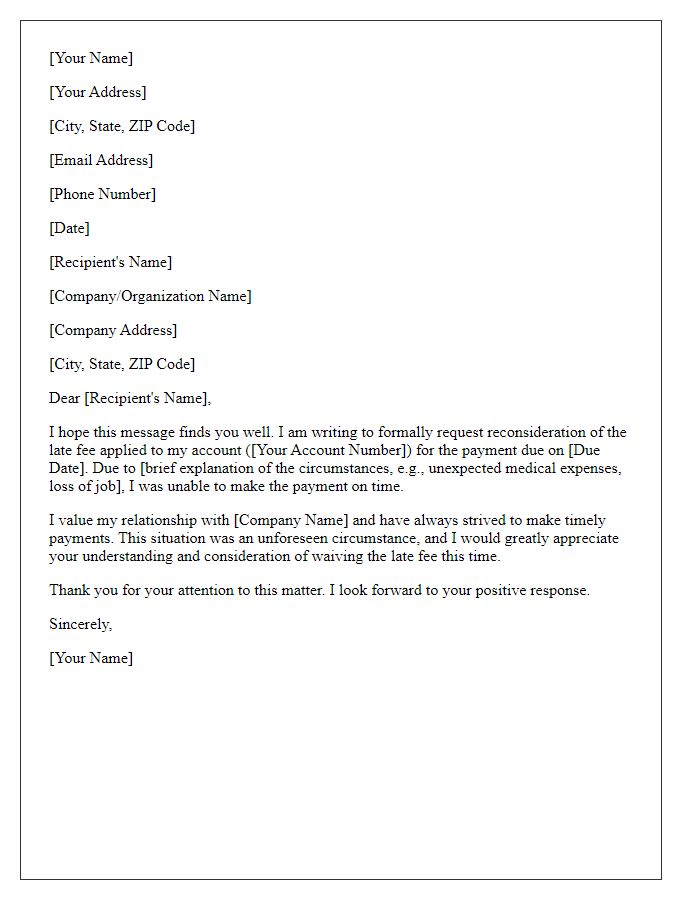

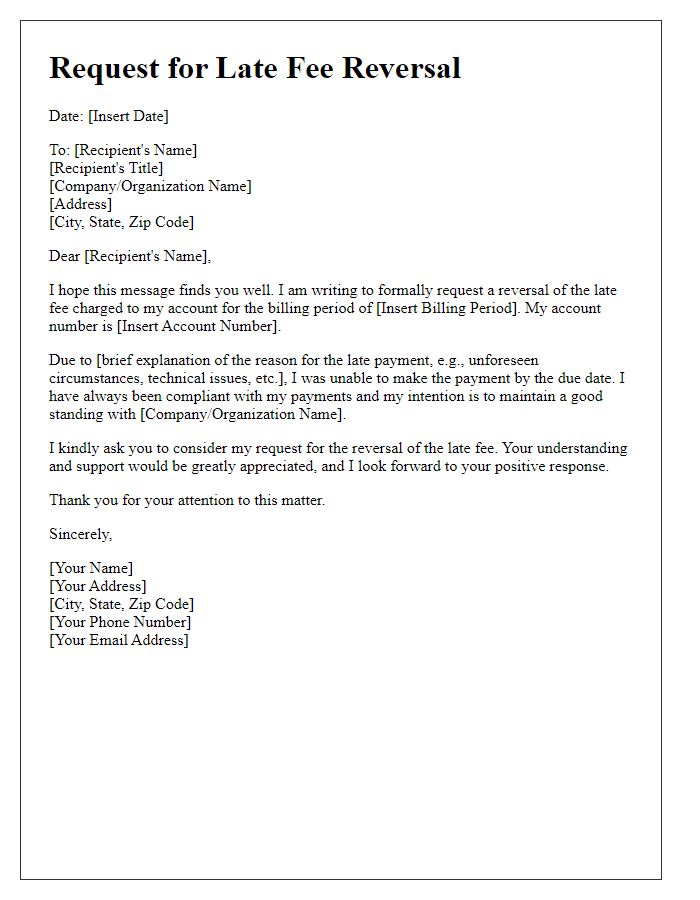

Request for Waiver

Late payment fees can significantly impact personal finances. Financial institutions, such as banks and credit card companies, typically charge these fees when payments are not received by the due date. For example, a late fee can range from $25 to $39, depending on the type of account and the institution's policy. Clients facing unexpected events, such as medical emergencies or job loss, may experience difficulty meeting payment deadlines. Many financial institutions offer customer service options to request a waiver of these fees, especially for first-time occurrences or proven extenuating circumstances. Understanding the specific policies of institutions can greatly assist individuals in effectively communicating their requests and potentially alleviating financial burdens caused by these fees.

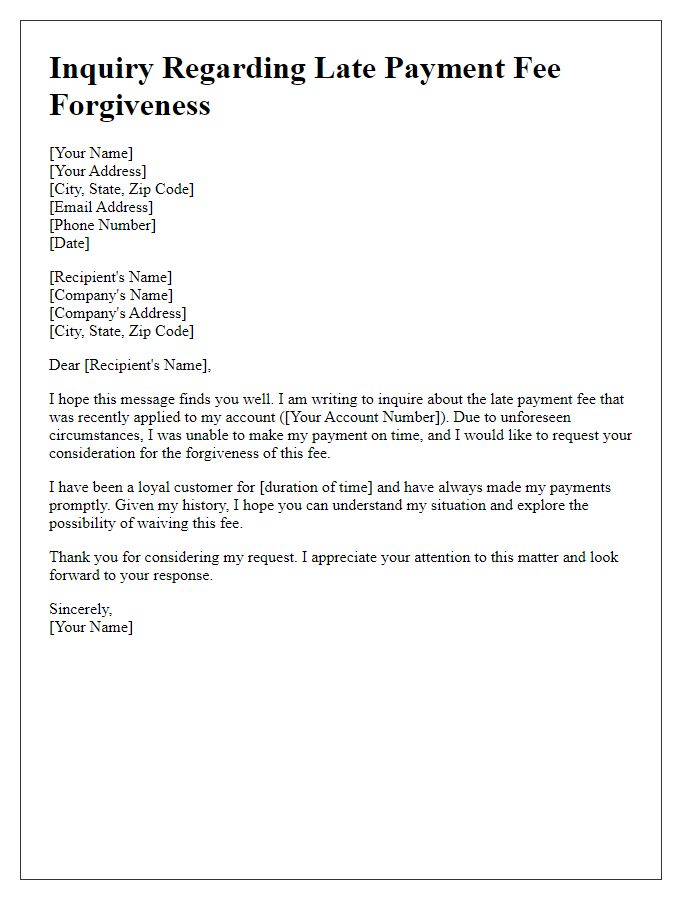

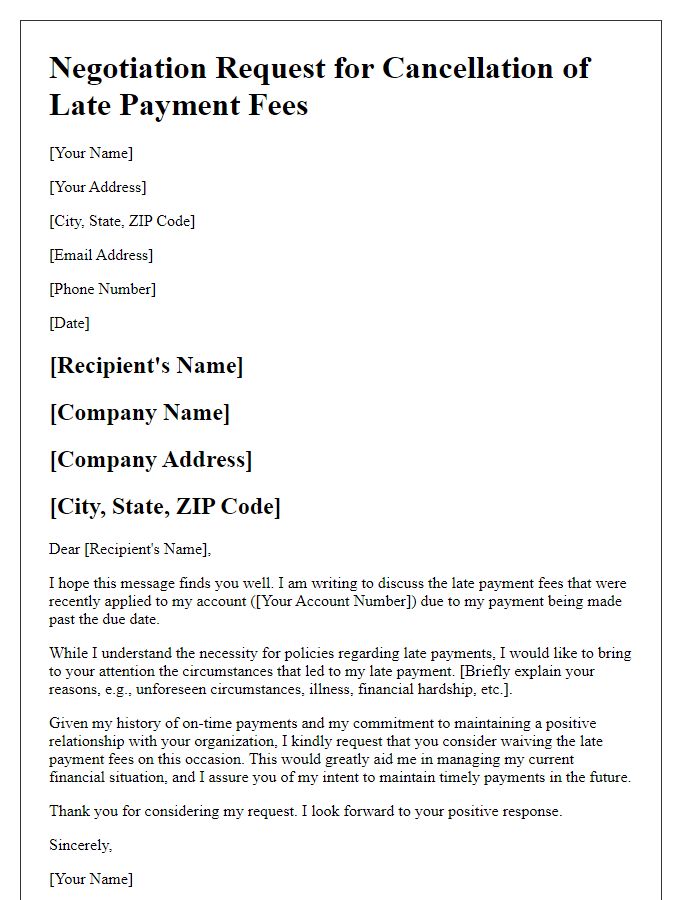

Polite and Professional Tone

Late payment fees can be frustrating for consumers. Such charges, often incurred due to unforeseen circumstances (like job loss or medical emergencies), can burden individuals financially. Many companies, such as banks and service providers, have policies on late fees that typically range from $25 to $50. Requesting a waiver can be beneficial, especially for loyal customers with a history of timely payments. Crafting a polite, professional letter addressing the issue directly can increase the chance of a favorable outcome. Emphasizing open communication and willingness to maintain a positive relationship may persuade the entity to reconsider the imposed fees.

Comments