Are you curious about how credit utilization impacts your financial health? Understanding this key concept can make a significant difference in managing your credit score and overall financial well-being. In this article, we'll dive into the ins and outs of credit utilization, shedding light on what it is, why it matters, and how you can optimize it for better credit management. So, stick around and let's explore how to harness the power of credit utilization together!

Clear Account Overview

Credit utilization refers to the percentage of available credit being used, which significantly impacts credit scores. A healthy credit utilization ratio is typically below 30%, meaning if a person has a credit limit of $10,000, they should ideally maintain a balance below $3,000. High credit utilization can signal financial distress to lenders, potentially resulting in unfavorable terms for loans and mortgages. Monitoring accounts regularly, particularly following significant events like increased spending during holidays or unexpected expenses, is crucial. Tools like credit monitoring services help track utilization in real-time, providing insights on how spending habits affect overall credit health. Financial institutions often recommend paying off high-balance accounts or redistributing charges to maintain a balanced utilization ratio, positively influencing creditworthiness.

Timeline of Events

In January 2023, an unexpected medical emergency led to significant unplanned expenses, forcing a temporary increase in credit card usage, resulting in a credit utilization rate of 85%. By March 2023, resolution of the medical situation and receipt of reimbursement from the insurance company allowed for a gradual reduction in balances. By June 2023, consistent payments from a new job significantly decreased credit utilization to 40%. In September 2023, a budgetary plan was implemented, which included higher payments toward the credit card balance, reducing utilization further to 25%. This timeline illustrates the dynamic nature of credit utilization and the impact of unexpected events on financial health.

Justification for Usage

Credit utilization impacts credit scores significantly, typically reflecting the ratio of outstanding credit card balances to total credit limits. For instance, maintaining a credit utilization ratio below 30% is often advisable for individuals aiming for strong credit scores. High utilization rates, above 50%, can indicate potential financial distress, leading to lower credit ratings. Financial institutions, such as banks or credit unions, analyze this ratio during credit checks, particularly when assessing loan applications, mortgages, or credit card approvals. A positive justification for increased usage often includes unexpected expenses, such as medical bills, home repairs, or temporary job loss. Communicating the contextual factors behind credit utilization can demonstrate responsible financial management and help mitigate the adverse effects of high usage on creditworthiness.

Repayment Plan

Credit utilization, defined as the ratio of outstanding credit card balances to total credit limits, plays a pivotal role in determining credit scores. For optimal financial health, maintaining this ratio below 30% is advisable. A high utilization rate, surpassing 50%, can negatively impact credit ratings and is often caused by factors such as high spending, unexpected expenses, or minimal available credit. A structured repayment plan can alleviate these issues, allowing individuals to gradually reduce their balances over time. For instance, employing strategies like the avalanche method targets high-interest debts first, while the snowball method focuses on paying off smaller balances. Establishing a monthly budget and regularly checking credit reports can enhance awareness of spending habits, ultimately fostering better credit management and improved credit scores.

Supporting Evidence

Credit utilization refers to the ratio of an individual's current credit card balances to their total available credit limits, a crucial factor influencing credit scores. Keeping this ratio below 30% is advisable; exceeding this threshold can negatively impact credit scores. For example, if one's total credit limit is $10,000, maintaining balances under $3,000 helps achieve optimal credit health. Credit card issuers, such as Capital One and American Express, often provide tools to monitor this utilization, helping consumers manage their finances effectively. Reports from credit bureaus, like Experian and TransUnion, detail utilization statistics, highlighting the importance of maintaining a low balance to protect one's creditworthiness. Regular payments and responsible spending habits contribute significantly to maintaining a favorable credit utilization ratio, thus enhancing overall financial stability.

Letter Template For Credit Utilization Explanation Samples

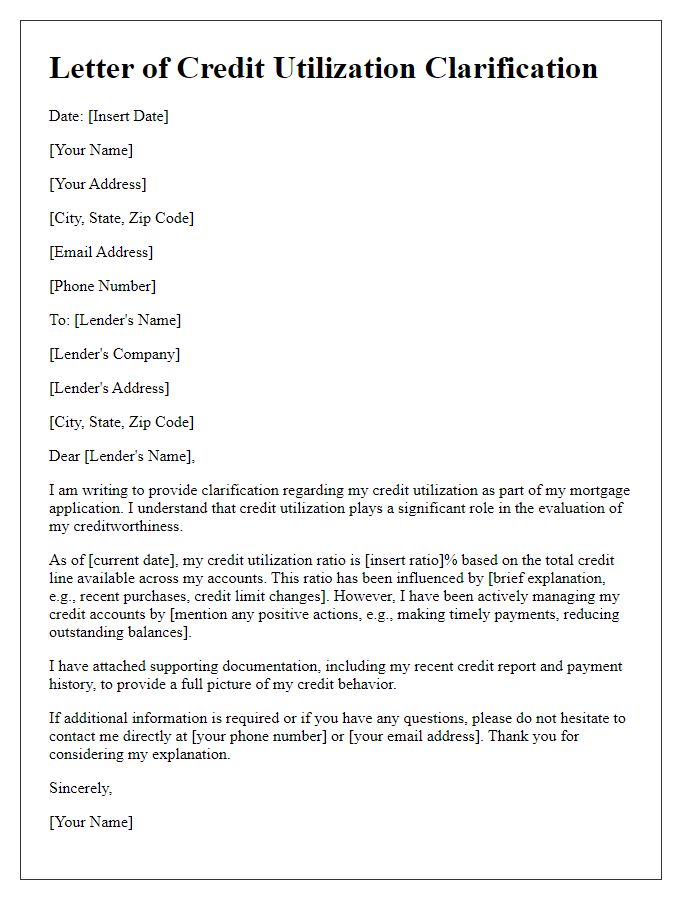

Letter template of credit utilization clarification for mortgage application.

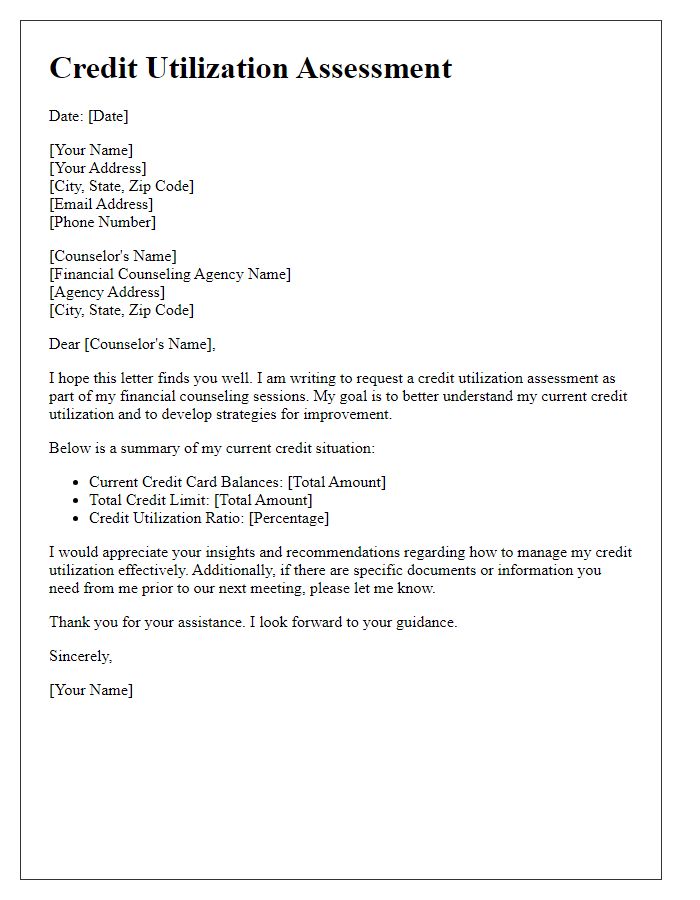

Letter template of credit utilization assessment for financial counseling.

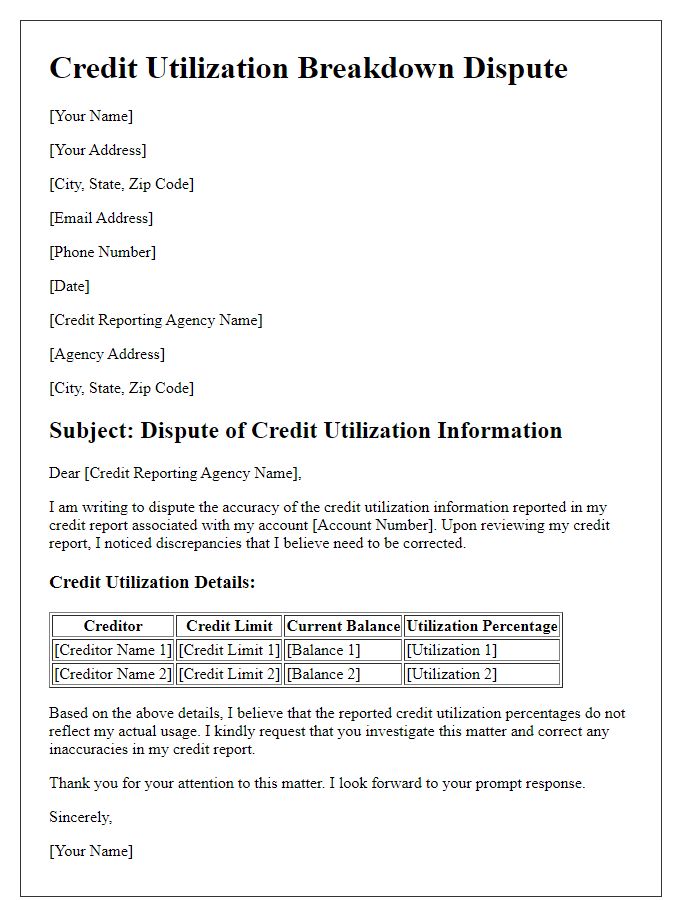

Letter template of credit utilization breakdown for credit report dispute.

Comments