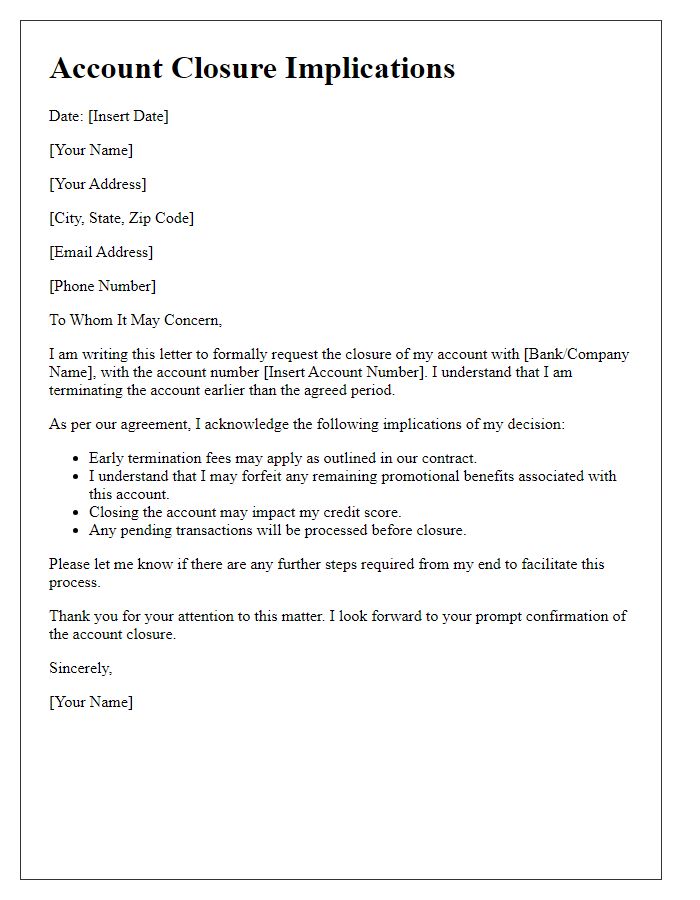

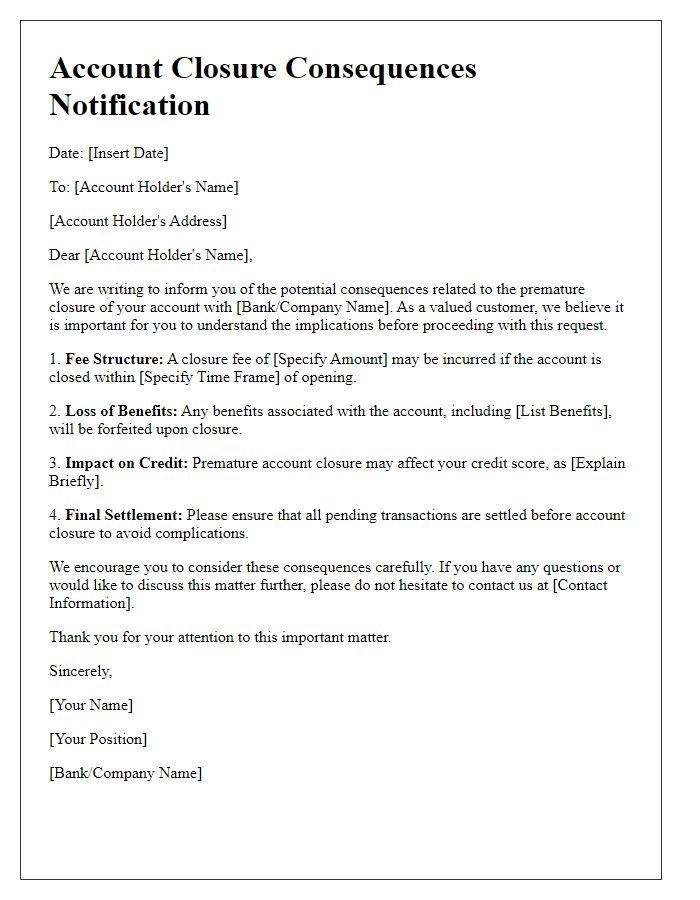

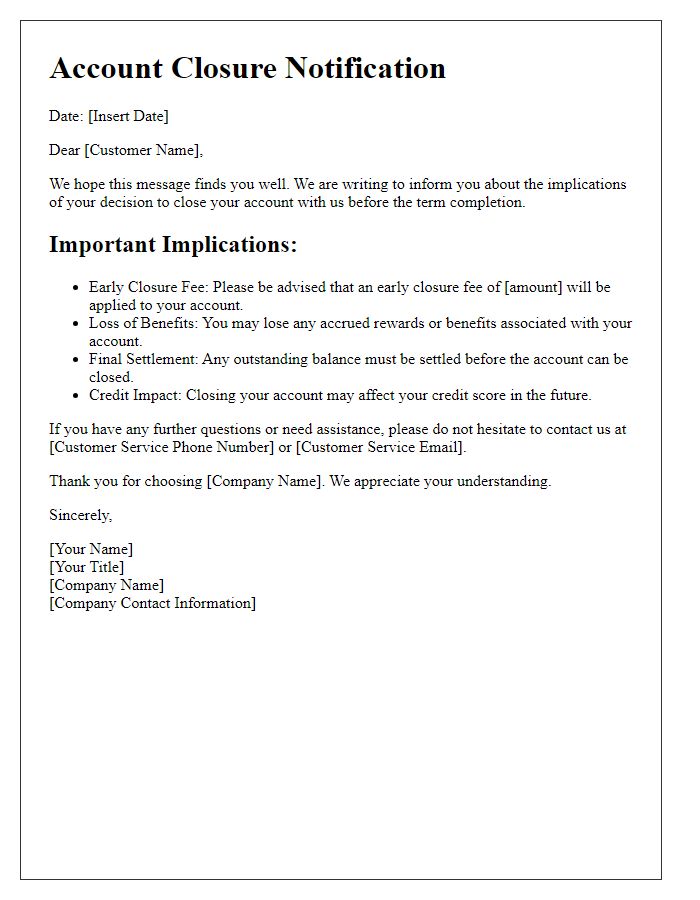

Are you considering closing your bank account prematurely? It's essential to understand the potential implications that come with this decision, as it may impact your financial health and credit score. Many people overlook the hidden fees and penalties that banks impose for early account termination, not to mention the inconvenience of needing to shift automatic payments and deposits. Before you make the leap, let's explore the intricate details surrounding premature account closure and what you should considerâread on for a deeper dive into this important topic!

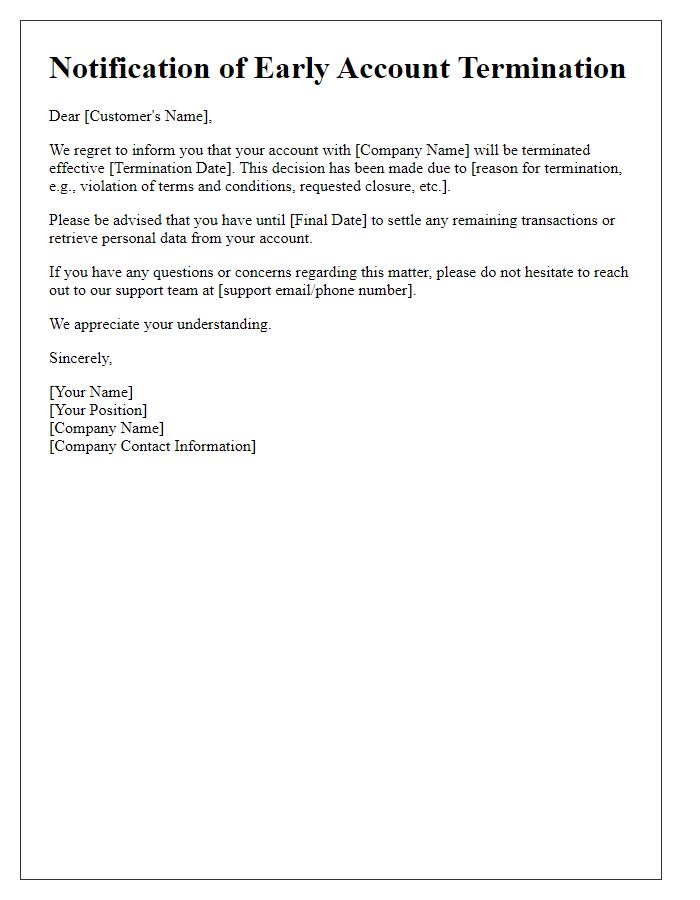

Account Closure Reason

Premature account closure may lead to various implications affecting financial stability and creditworthiness. Factors include potential penalties (often ranging from $50 to $200) imposed by financial institutions, influencing personal finances negatively. Additionally, the closure may impact the credit score, particularly if the account holds significant credit history or balances. Financial institutions typically report account closures to credit bureaus, which can also affect the credit utilization ratio. Furthermore, individuals might lose access to certain benefits associated with the account, such as loyalty rewards or accrued interest. Future banking relationships may face scrutiny as a result of previous account closures, potentially leading to higher interest rates for loans or increased fees in future accounts.

Impact on Transactions

Premature account closure can significantly impact financial transactions, specifically regarding the accessibility of remaining balances. Accounts closed before scheduled maturity dates, such as savings or fixed deposit accounts, may incur penalties, often ranging from 3% to 5% of the total balance, depending on the financial institution's policies. Future transactions, including direct deposits, automatic bill payments, and interbank transfers, may fail, potentially leading to overdraft fees or service interruptions. In addition, closed accounts can affect credit scores, particularly if linked to outstanding debts or loans, resulting in negative repercussions while applying for credit or loans in institutions like banks or credit unions. Lastly, customers may lose access to transaction histories essential for record-keeping or tax purposes, further complicating financial management.

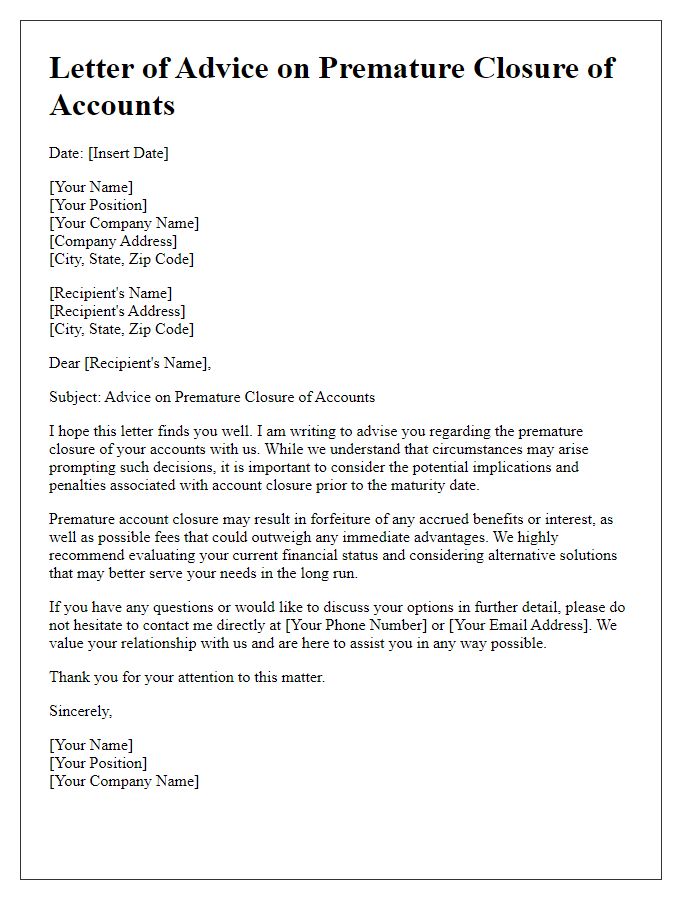

Outstanding Balance Handling

Premature account closure can significantly impact outstanding balances on financial accounts, particularly in banking institutions. When an account is closed before the scheduled termination date, any existing balance--whether a positive credit balance or a negative debit balance--requires immediate attention. Banks may impose fees for early closure, and interest calculations on remaining balances may become more complicated, affecting total deductible amounts. Additionally, not addressing outstanding balances timely can lead to consequences such as credit report impacts and potential legal actions for overdue payments. Customers must also be aware of policies specific to their financial institution regarding the treatment of remaining funds and repayment obligations after account termination.

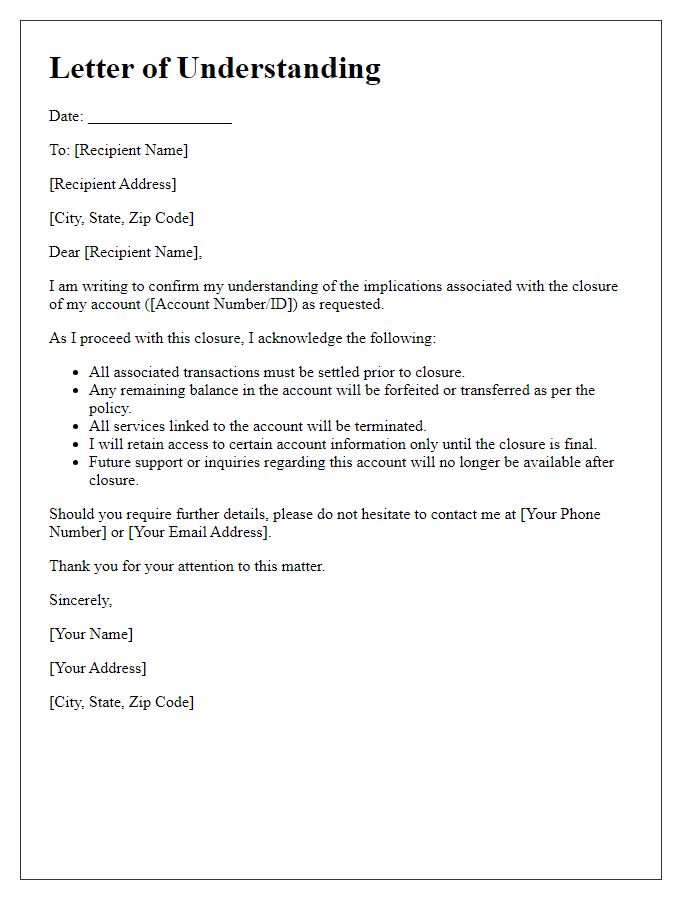

Account Settlement Procedure

Premature account closure often entails significant implications for financial accounts, including various potential penalties. In cases of bank accounts, institutions may impose early termination fees, sometimes ranging from $25 to $200, depending on the account type, such as checking or savings accounts. The balance settlement process involves verifying account activity and calculating any fees incurred. Additional implications may include negative impacts on credit scores due to reported closed accounts, which affect future loan eligibility. Furthermore, customers must ensure all outstanding transactions, like checks or direct deposits, are resolved prior to closure to avoid complications. Awareness of these factors is crucial when contemplating closure of financial accounts, ensuring informed decision-making regarding account management.

Customer Service Contact Information

Premature account closure can lead to various implications for customers, including financial penalties and loss of rewards. When closing an account, especially in financial institutions such as banks or credit unions, a customer may incur fees that vary by institution, often ranging from $25 to $100. Accumulated interest or rewards points, often amounting to hundreds of dollars, may be forfeited. Customers should also consider potential impacts on credit scores, as account closures can influence credit utilization ratios. Important contact information for customer service is typically found on official websites or statements, often comprising a dedicated phone number (e.g., 1-800-555-0199), email address (e.g., support@example.com), and live chat options, ensuring customers are aware of necessary steps and potential consequences before making a final decision.

Comments