Are you feeling overwhelmed by your student loan payments? You're not aloneâmany borrowers are exploring income-driven repayment plans to ease the financial burden. These plans can adjust your monthly payments based on what you earn, potentially saving you significant amounts over time. Curious about how to get started with an income-driven repayment plan? Let's dive into the essentials!

Personal identification details

Personal identification details are essential for the income-driven repayment plan application process. Full name should reflect legal identification documents, such as driver's license or passport. Permanent address must include street number, city, state, and zip code to ensure proper correspondence regarding financial plans. Social Security number is crucial for identity verification and matching with federal student loan records. Date of birth, formatted as MM/DD/YYYY, is necessary to establish eligibility and age requirements for different repayment plans. Additionally, contact information, including a current phone number and email address, ensures timely updates about loan statuses and applicable changes in repayment terms. These details facilitate an efficient evaluation of financial circumstances and the creation of a tailored repayment strategy.

Loan account information

An income-driven repayment plan allows borrowers to manage federal student loans based on income levels. The loan account information includes vital details such as the loan servicer's name, account number, and type of federal loans (e.g., Direct Subsidized, Direct Unsubsidized). Additionally, income documentation, such as recent pay stubs or tax returns, may be required to calculate the new monthly payment amount, potentially no more than 10% to 20% of discretionary income. Changes in this plan can significantly improve financial stability by adjusting payments during periods of lower income, thereby avoiding default. Prompt communication with the loan servicer is crucial for timely adjustments and continued eligibility.

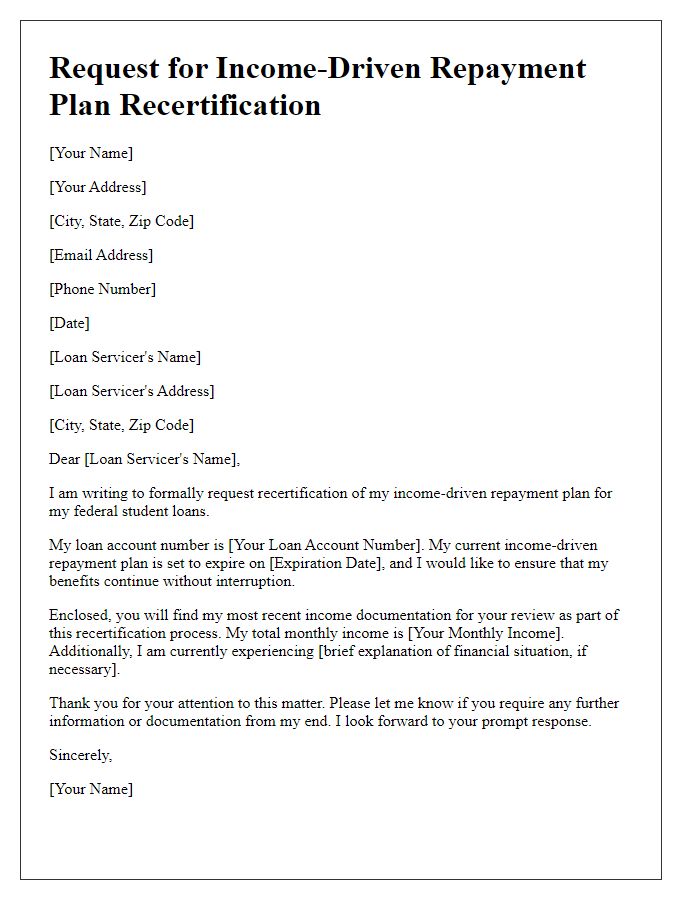

Income documentation

Income-driven repayment plans, such as those available for federal student loans, require specific income documentation to determine eligibility. Tax returns (e.g., IRS Form 1040) from the previous year serve as primary proof of income, supporting the assessment of monthly payment amounts based on adjusted gross income (AGI). Pay stubs (typically from the last two or three months) can provide additional verification of current earnings for self-employed borrowers, offering insights into fluctuating income. Important documents like W-2 forms from employers may also be necessary, reflecting total wages for the year. Additionally, if applicable, documentation for unemployment benefits or Social Security income could further clarify the financial situation required for accurate repayment calculations. Ensuring submission of these documents to the loan servicer promptly is crucial for maintaining the repayment plan and avoiding default.

Requested repayment plan

The Income-Driven Repayment (IDR) Plan serves as a crucial financial tool for borrowers managing federal student loans in the United States. This plan calculates monthly payments based on the borrower's income and family size, aiming to make payments more manageable. For example, under the Revised Pay As You Earn (REPAYE) Plan, payments are capped at 10% of discretionary income. Additionally, borrowers may qualify for loan forgiveness after 20 or 25 years of consistent payments, depending on the loan type. It is essential to submit updated income documentation annually to ensure accurate payment calculations. The IDR Plan can significantly alleviate the financial burden, especially for those with lower income jobs or widespread student debt, enhancing overall financial stability.

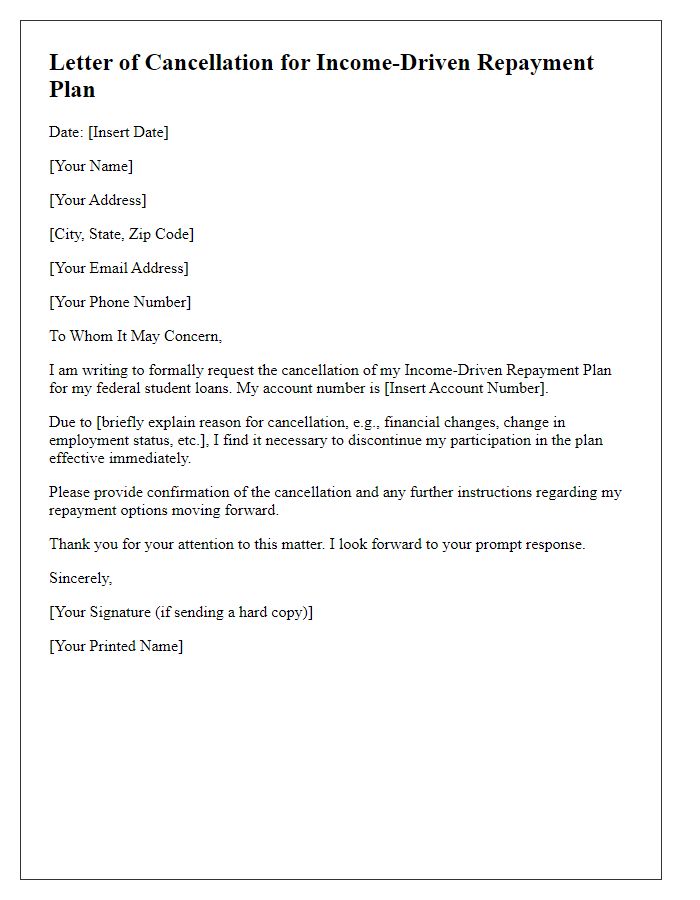

Contact information and signature

The Income-Driven Repayment (IDR) plan application requires comprehensive information to assess eligibility and future payments. Submission should include personal identification details such as borrower's full name, address including city and zip code, and contact phone number. In addition, social security number is necessary for record tracking. Clear documentation for adjusted gross income (AGI) from tax returns will enhance the application's credibility, especially if submitted for the previous tax year. The application should conclude with a signature, typically the borrower's, to confirm authorization and agreement with the information provided. Proper completion of this process ensures alignment with federal guidelines for student loan repayments, particularly for programs such as Public Service Loan Forgiveness (PSLF).

Letter Template For Income-Driven Repayment Plan Samples

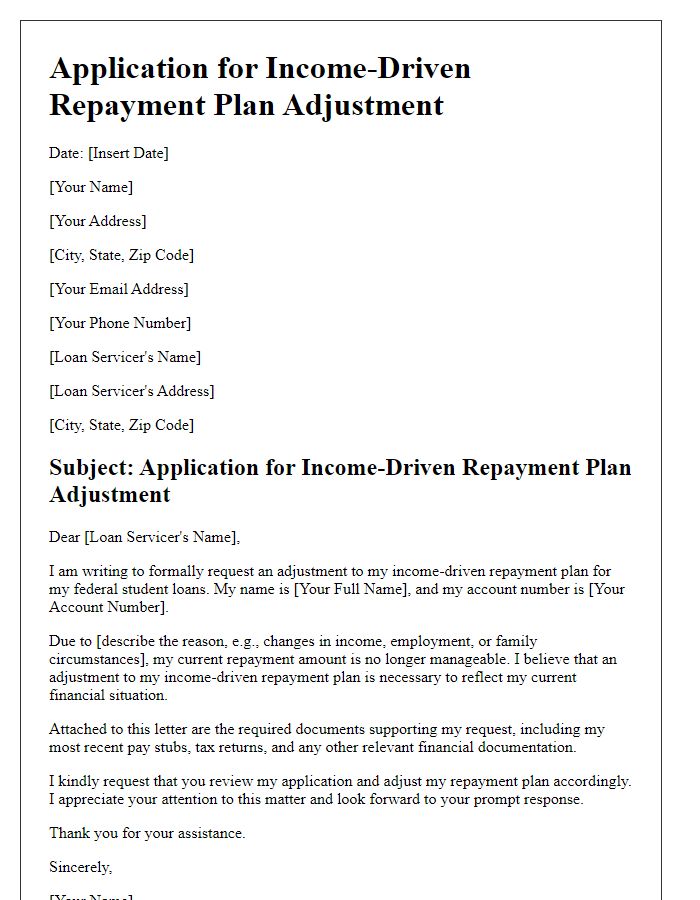

Letter template of application for income-driven repayment plan adjustment

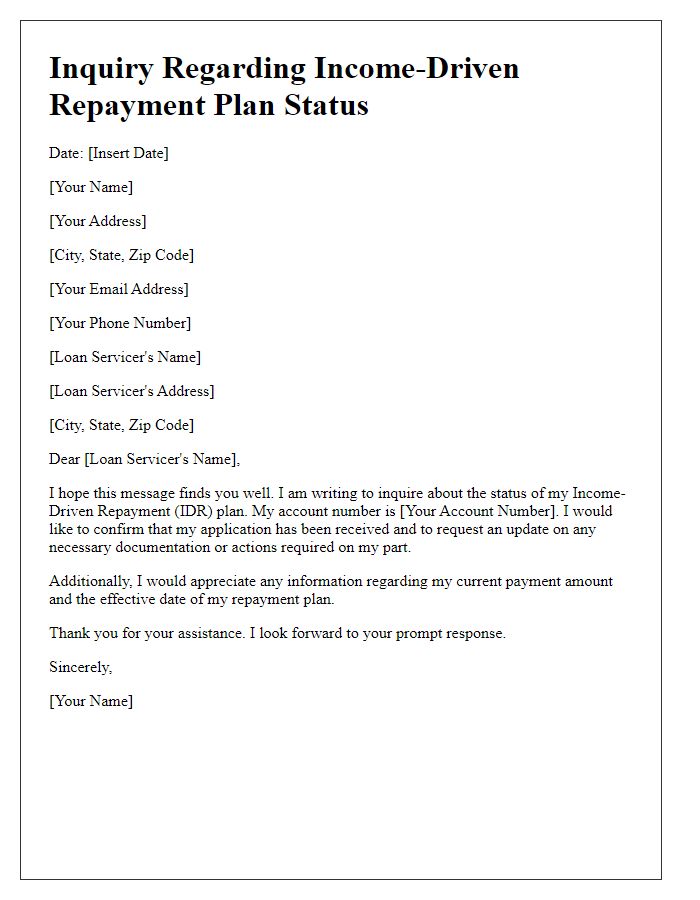

Letter template of inquiry regarding income-driven repayment plan status

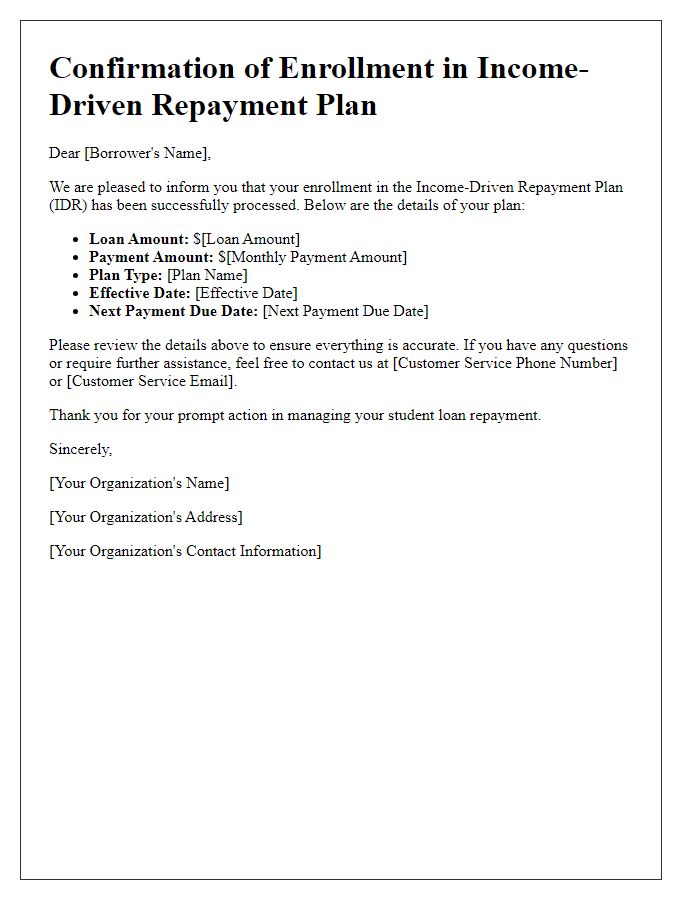

Letter template of confirmation for income-driven repayment plan enrollment

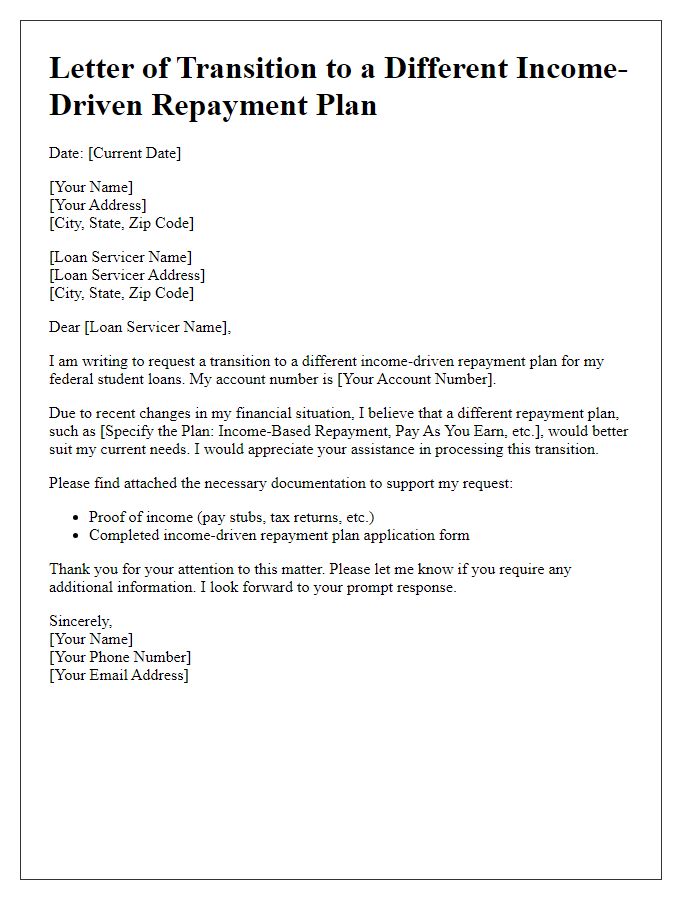

Letter template of transition to a different income-driven repayment plan

Letter template of verification request for income-driven repayment plan documentation

Comments