If you've ever found yourself in a bind with your credit account, you're not alone. Many people discover that having a closed credit account can impact their financial journey in ways they never expected. In this article, we'll explore how to effectively write a letter for the reconsideration of a closed credit account, offering tips and insights to ensure your voice is heard. So, let's dive in and learn how to advocate for your financial future!

Account Details and Personal Information

A reconsideration request for a closed credit account can be crucial for consumers seeking reinstatement or clarification regarding their credit status. Essential elements include account details such as the account number (typically a 16-digit identification code), account type (credit card, personal loan), and the date of closure (important for credit reporting timelines). Personal information should encompass full name, current address (including city, state, and zip code), and contact information (phone number and email for communication purposes). Providing context for the request involves details like payment history (number of late payments) and the underlying reason for account closure (e.g., inactivity, delinquency). Additionally, a mention of any changes in financial circumstances or improved credit behavior since closure may strengthen the argument for reconsideration. Lastly, emphasizing adherence to lender guidelines and expressing willingness to discuss the matter further can aid in achieving a favorable response.

Explanation for Account Closure

A reconsideration request for a closed credit account typically requires a clear explanation regarding the account's closure. For instance, a credit account may be closed due to missed payments (defined as 30 days or more overdue), which can negatively impact credit scores (potentially dropping by 50 to 100 points). Occasionally, a creditor might take action after identifying potential fraud, especially in cases involving identity theft. If the credit limit was reduced significantly (for example, more than 50%) without prior notice, it may cause unforeseen financial strains. Customers may also express confusion about changes in terms or fees that were not adequately communicated, which could have led to mismanaged balances or defaults. Engaging directly with customer service and providing documented explanations of financial hardships or resolution efforts can strengthen a reconsideration appeal for reinstatement of the account.

Reason for Reconsideration

A closed credit account can significantly impact an individual's credit score and financial health, often causing frustration. The closure may result from missed payments or inactivity over a specified period, usually six months, which varies based on credit issuer policies. In some cases, consumers may encounter unforeseen circumstances, such as job loss or medical emergencies, leading to financial difficulties. Reconsideration requests can seek to reopen the account, providing the opportunity to demonstrate improved financial responsibility. Supporting documentation, such as proof of stable income and timely bill payments post-closure, can strengthen the case for reconsideration. Financial institutions may review these requests on a case-by-case basis, particularly for long-standing customers with a previously good payment history, assessing the potential for a renewed positive relationship.

Demonstration of Financial Stability

Reopening closed credit accounts can offer significant advantages for individuals aiming to improve their financial standing and credit score. A credit account, such as a revolving credit line or a secured credit card, is pivotal for establishing a positive credit history. Demonstrating financial stability involves maintaining a consistent income, evidenced by pay stubs or tax returns, and managing monthly expenses effectively, ideally reflected in a budget plan. Responsible credit usage, characterized by on-time payments and low credit utilization rates (ideally under 30% of the total available credit), can enhance a credit score, which typically ranges from 300 to 850. Furthermore, addressing any past credit issues with clear documentation, such as debt repayment plans or agreements with creditors, can showcase a commitment to improving financial habits. Engaging with credit counseling services, recognized by institutions like the National Foundation for Credit Counseling (NFCC), can also provide valuable resources for maintaining financial discipline.

Contact Information for Follow-up

Reconsideration of a closed credit account can often hinge on several factors, including payment history and account utilization. Consumers may consider reaching out to financial institutions, such as major banks or credit unions, to provide evidence of responsible credit behavior. Relevant details like account number, closure date (which could be significant, such as a closure within the past year), and specific reasons for the account closure should be clearly documented. The Fair Credit Reporting Act mandates that accounts must be accurately reported to credit bureaus, impacting credit scores for years. Providing new information, such as improved income or changes in financial circumstance, could strengthen the request. Follow-up contact can be effective, with methods including calls to customer service or online chat features. It is crucial to retain records of all communication, including dates, names of representatives, and outcomes to support the appeal.

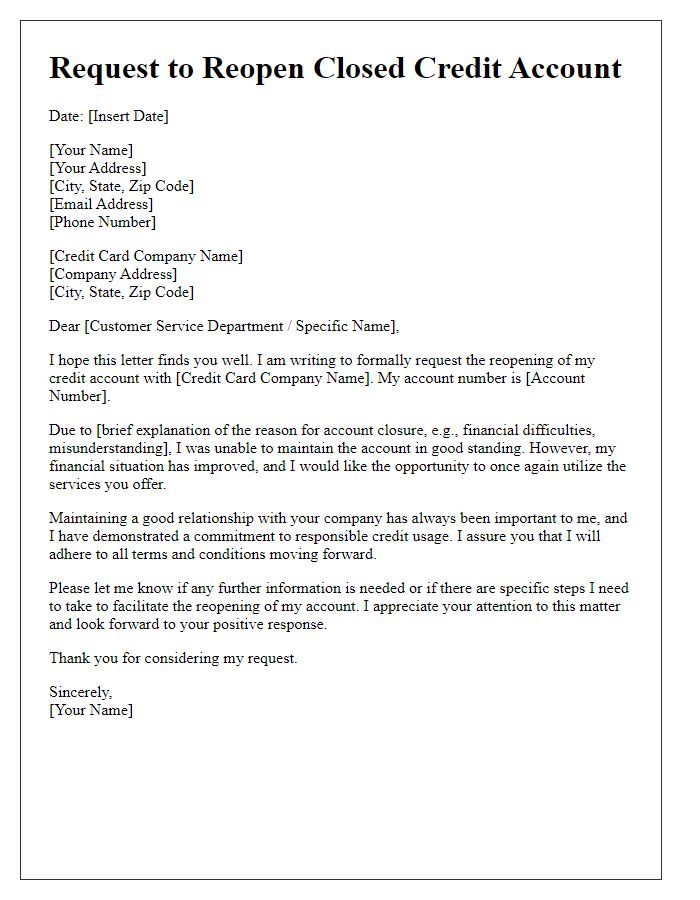

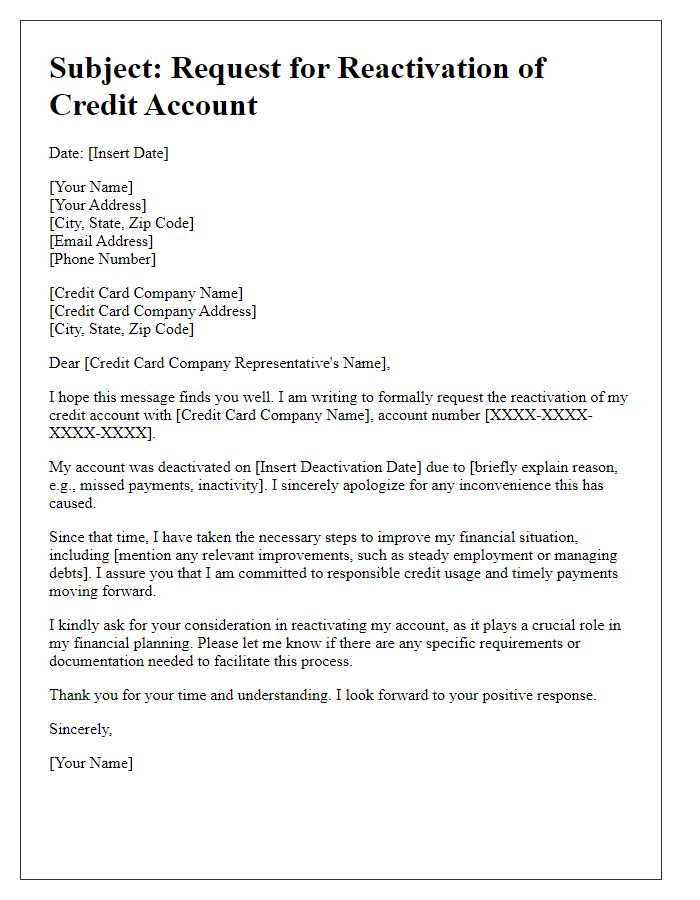

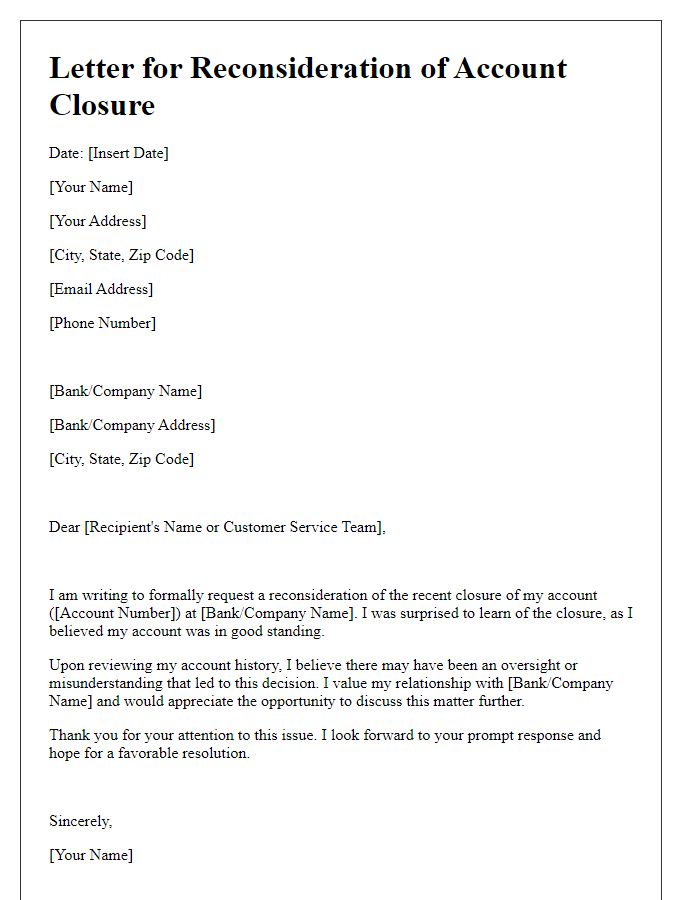

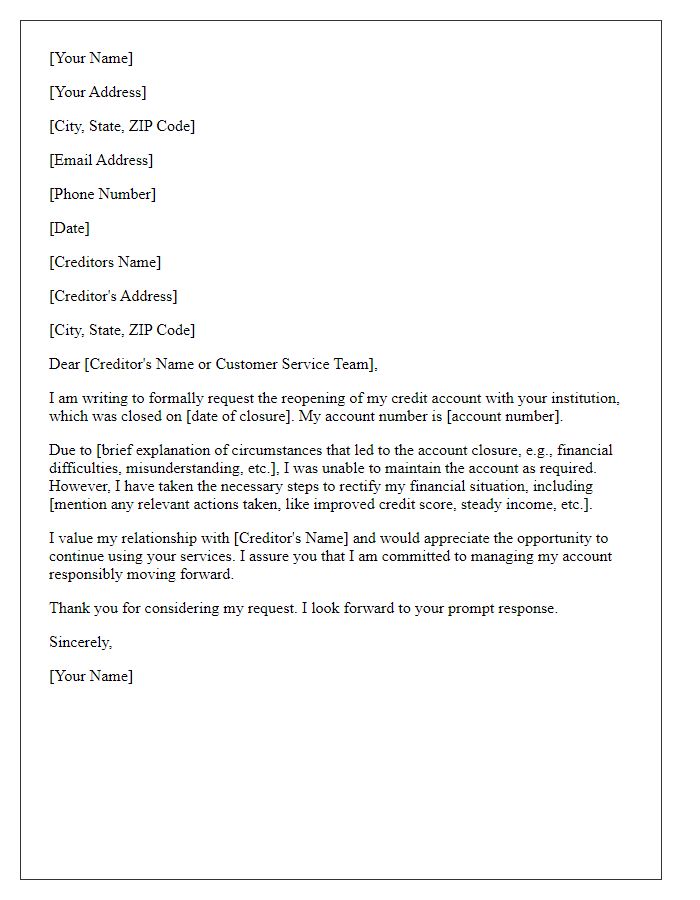

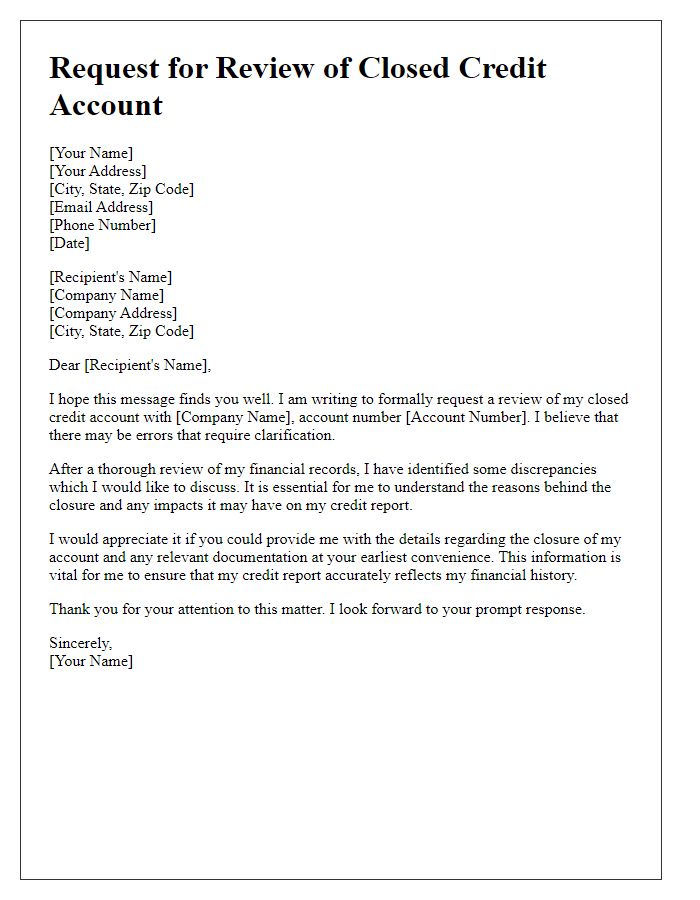

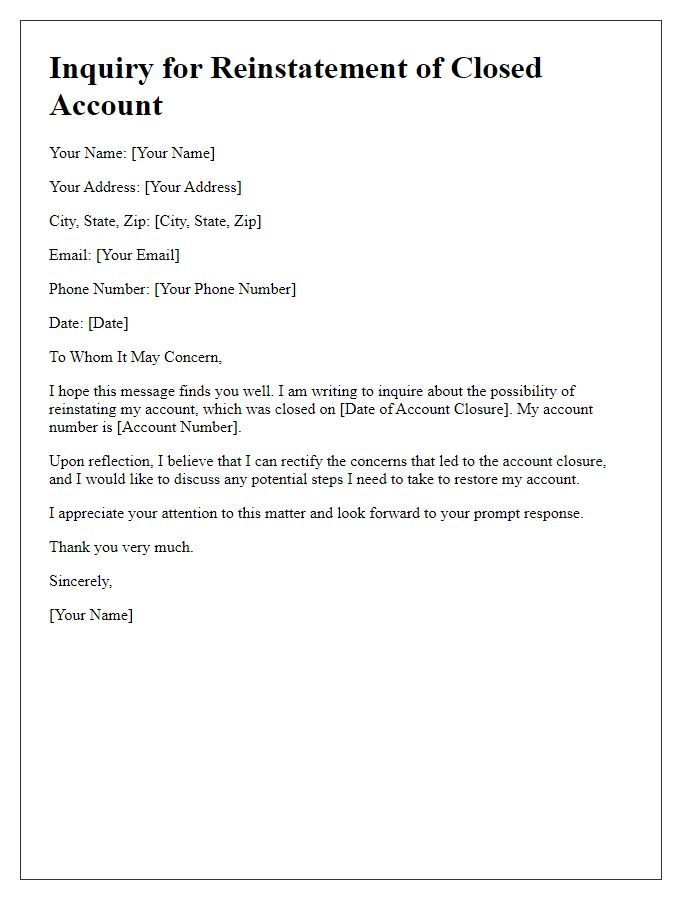

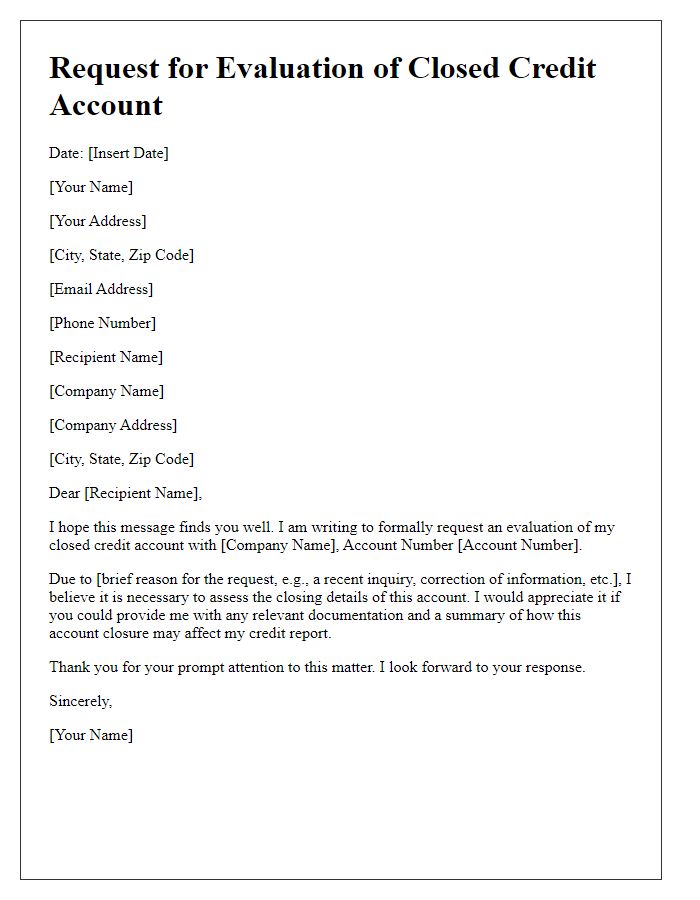

Letter Template For Reconsideration Of Closed Credit Account Samples

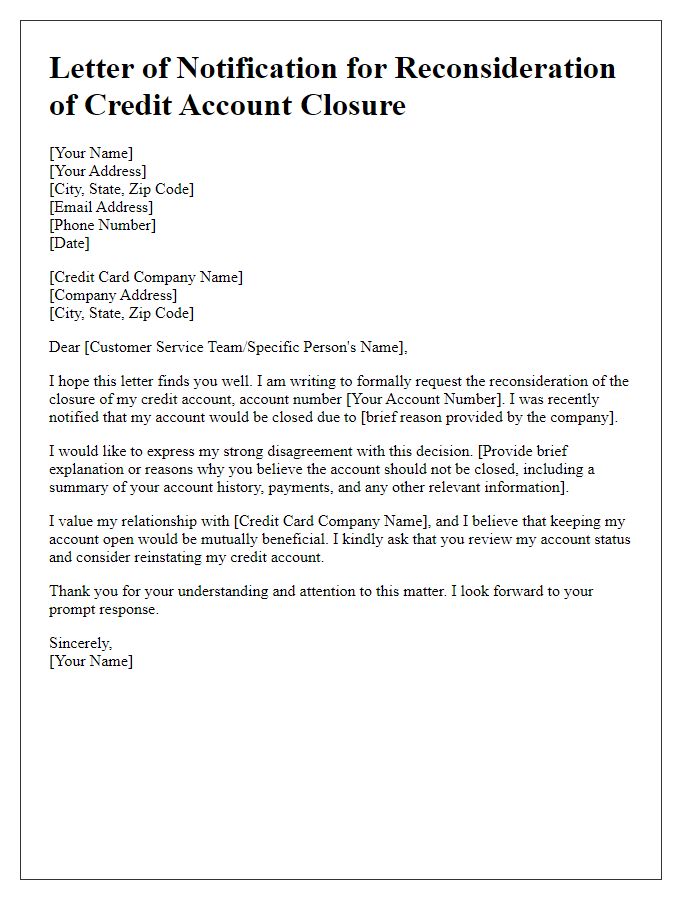

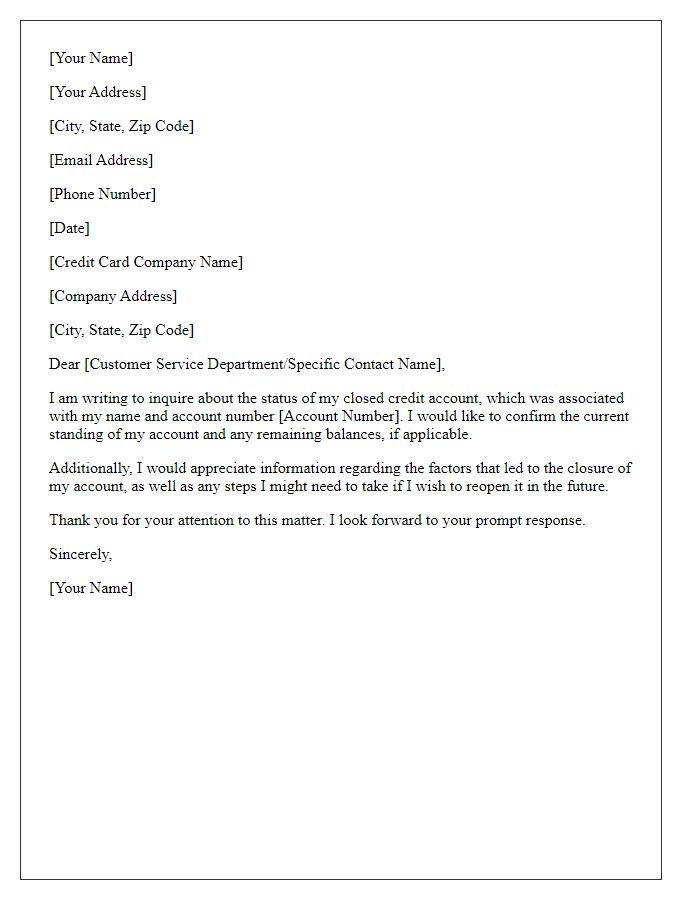

Letter template of notification for reconsideration of credit account closure

Comments