Are you feeling stressed about explaining late payments? It can be a tricky conversation, but it's important to approach it with transparency and professionalism. Whether you're reaching out to a supplier or a client, clarity in your message can help maintain strong relationships. So, let's delve into some effective strategies for crafting that message and keeping the lines of communication openâread on to discover our tips!

Apologetic Tone

Apologizing for overdue invoices can significantly impact small businesses, particularly when dealing with clients or vendors. Late payments may disrupt cash flow, causing strain on purchasing inventory or settling operational expenses. For example, a late payment from a major client, like a retailer in New York, can hinder a supplier's ability to pay employees timely, buy raw materials, or fulfill other financial obligations. Furthermore, consistent late payments can damage business relationships, affecting trust and future transactions. Communicating clearly and professionally about these situations is essential to maintain credibility and foster a positive rapport with all stakeholders involved.

Explanation of Delay

Delays in payments can significantly impact small business cash flow, often leading to financial strain. Various factors contribute to such delays, including unforeseen events like natural disasters, economic downturns, or supply chain disruptions. For instance, the COVID-19 pandemic caused widespread delays across multiple sectors, affecting timelines and payment schedules globally. Specific industries, such as construction or manufacturing, may experience prolonged payment cycles due to project delays or client cash flow issues. In these scenarios, collection processes can stagnate, prompting businesses to seek alternative financing solutions (like lines of credit) to remain operational. Maintaining open communication between parties involved is essential to address the reasons for delays and implement feasible solutions for timely payments.

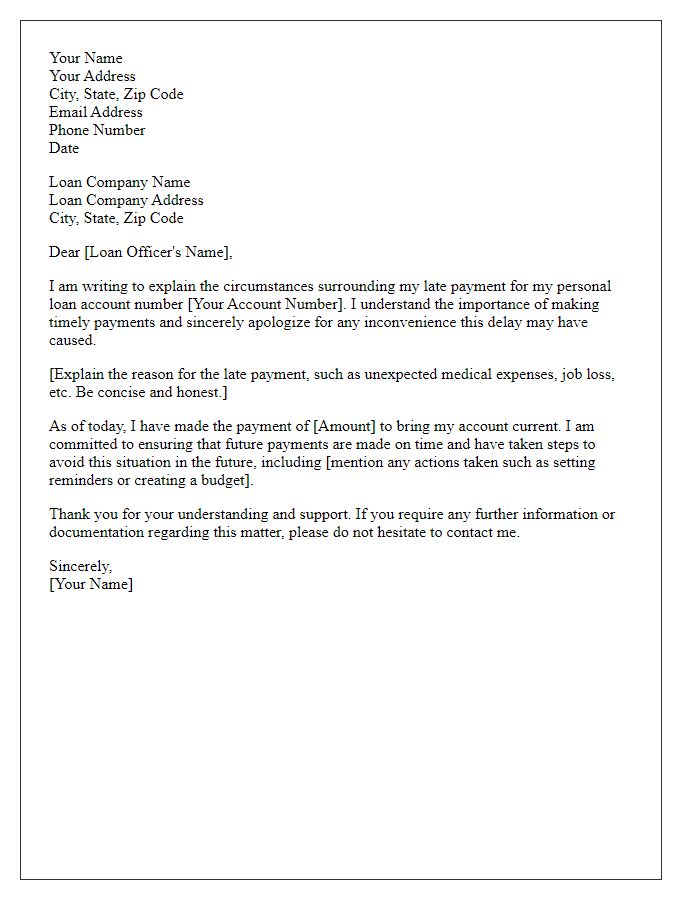

Assurance of Payment

Late payments can significantly impact financial stability for both individuals and businesses. Situations may arise due to unforeseen circumstances, such as medical emergencies or unexpected job loss. In such cases, communication with creditors can help mitigate further penalties or damage to credit scores. Standard practices suggest sending assurance of payment within seven days of missing a due date. Providing a clear timeline for resolving the outstanding balance can foster trust. Setting up a payment plan can demonstrate commitment while ensuring gradual debt settlement, preventing overwhelming financial strain. Notifying about changes in financial circumstances can also aid in finding supportive solutions from lenders or service providers.

Commitment to Avoid Recurrence

Late payments can significantly disrupt cash flow for small businesses, particularly in competitive markets like retail. Invoices, typically due within 30 days, may experience delays due to various factors, such as unforeseen operational challenges or supply chain disruptions. Businesses must assess their accounts receivable processes to ensure timely follow-ups, potentially utilizing automated systems for reminders. Furthermore, establishing clear payment terms during contract negotiations can enhance payment predictability. Implementing a robust financial management strategy, including regular reconciliations and cash flow forecasting, can effectively mitigate late payment occurrences, ensuring a healthier financial future and improved vendor relationships.

Contact Information

Late payments can negatively impact business cash flow and relationships with suppliers. Delays in payments beyond the agreed-upon terms, often exceeding the 30-day period, can result in accrued interest or late fees. Communication is crucial to resolving these issues; for example, reaching out via email or phone (using dedicated contact numbers and professional language) ensures transparency and collaboration. Providing a specific payment timeline, referencing invoices and due dates, fosters understanding. Additionally, maintaining accurate records of transactions can help in discussions about payment statuses and accountability. Addressing late payments promptly can mitigate potential disruptions in service or supply chains.

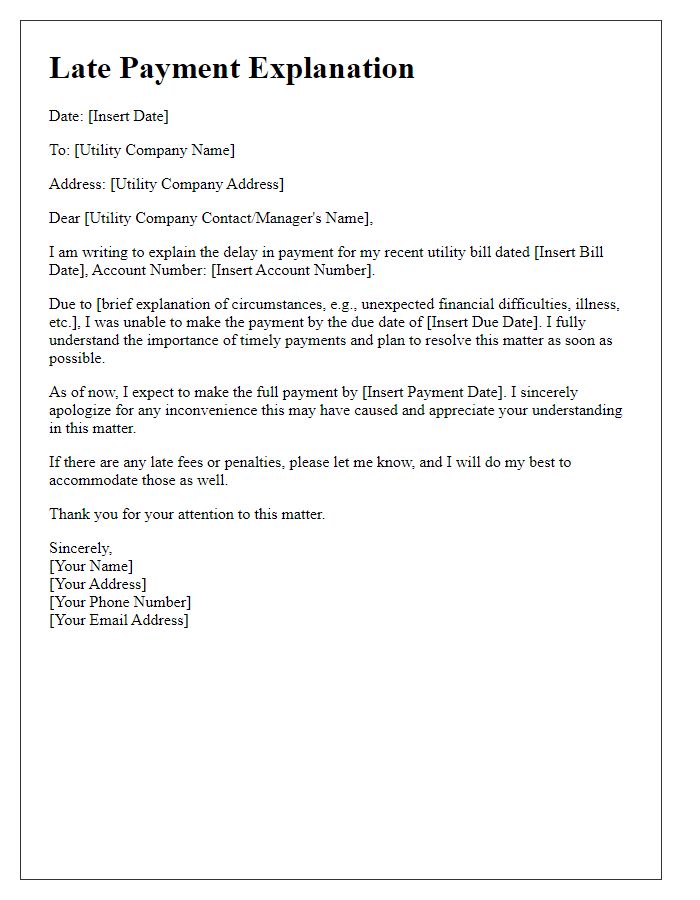

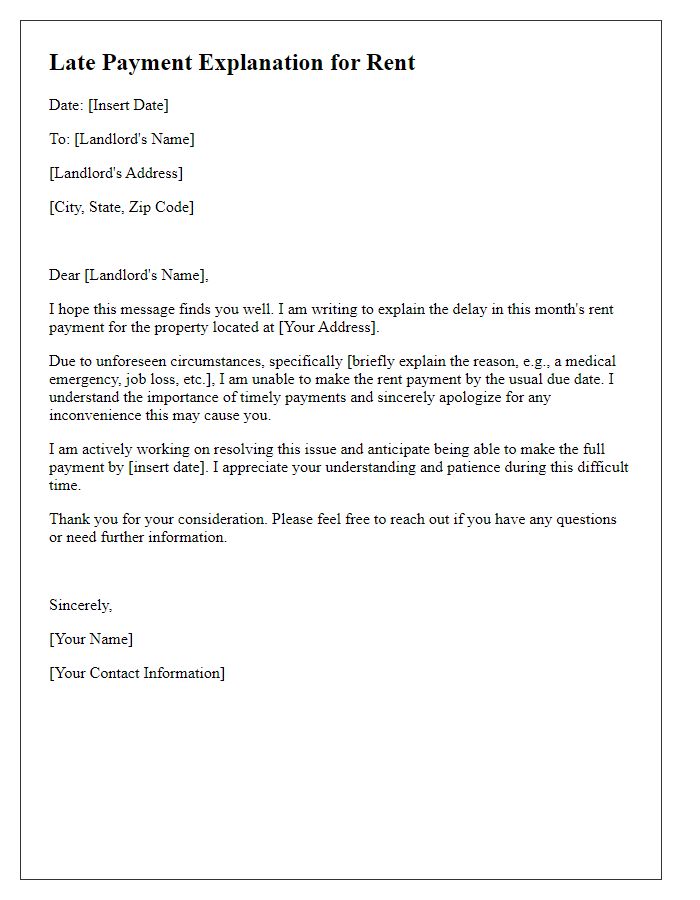

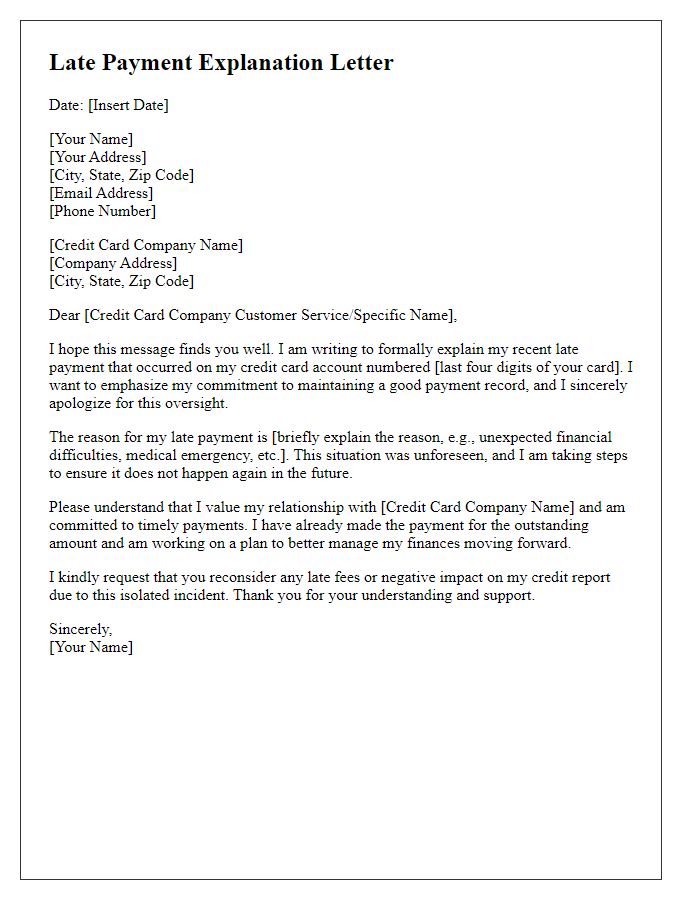

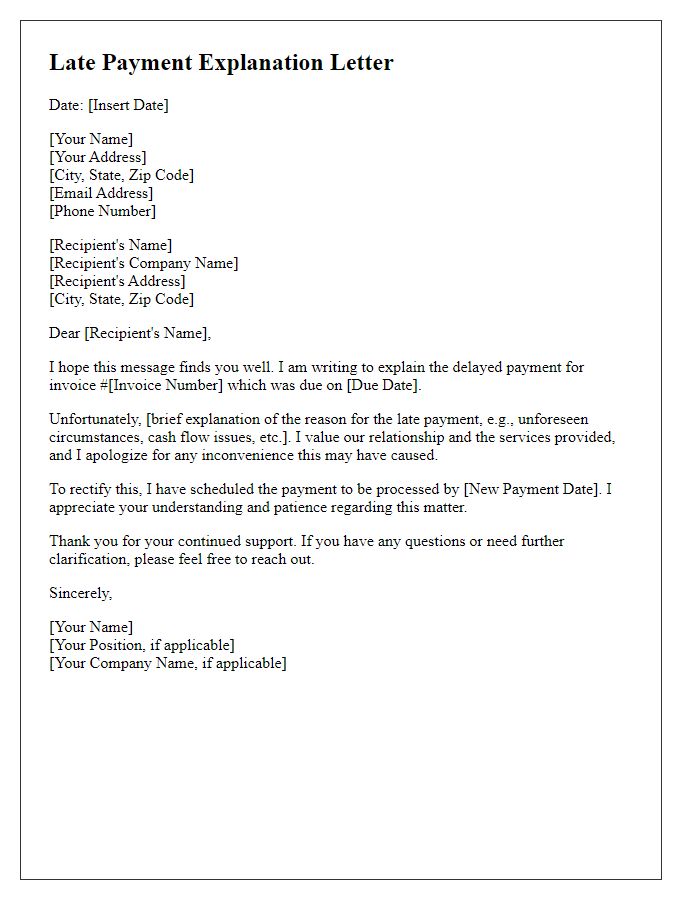

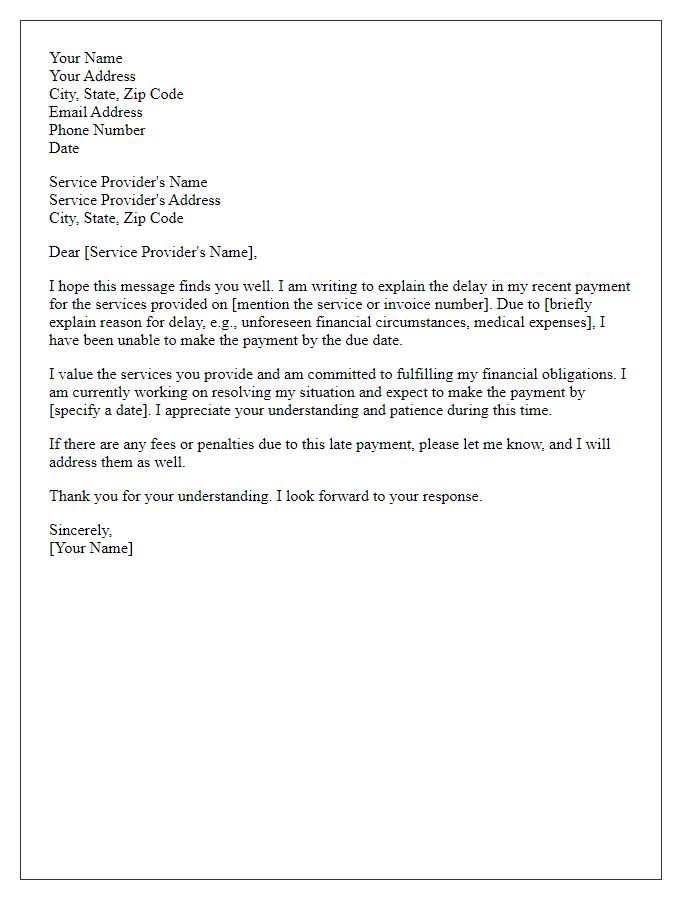

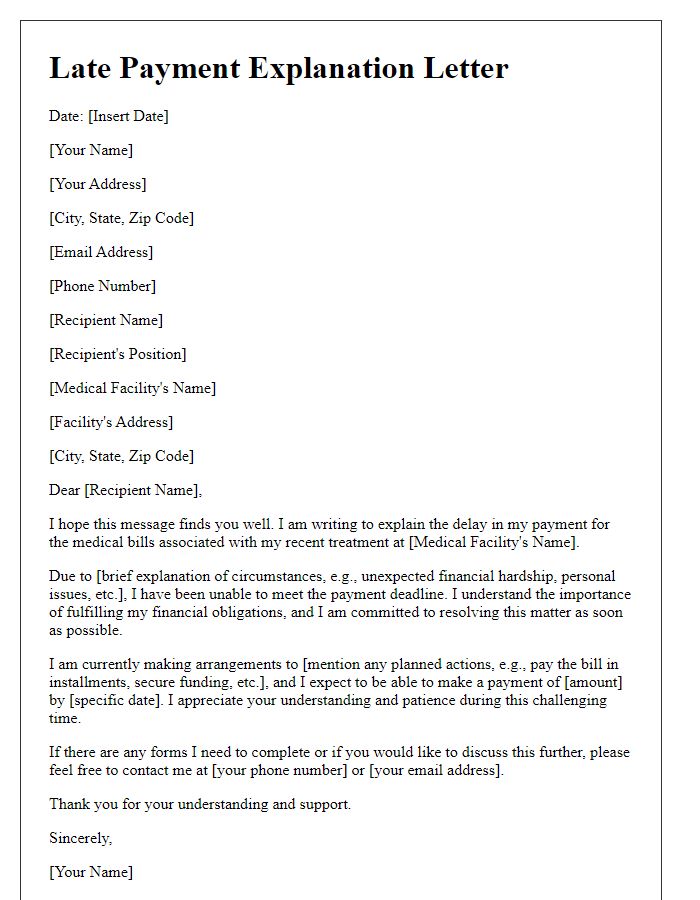

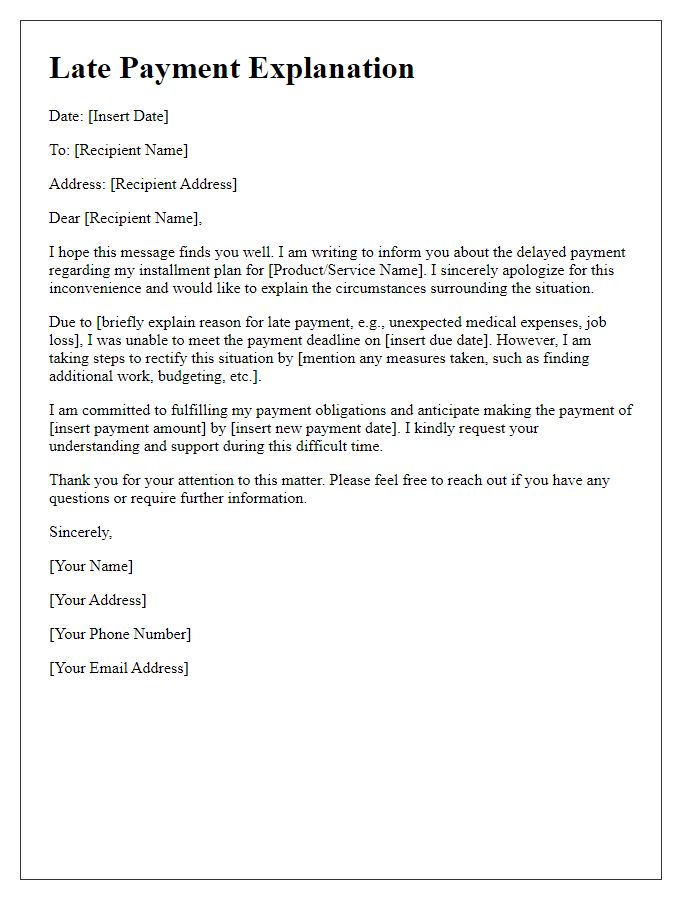

Letter Template For Explaining Late Payments Samples

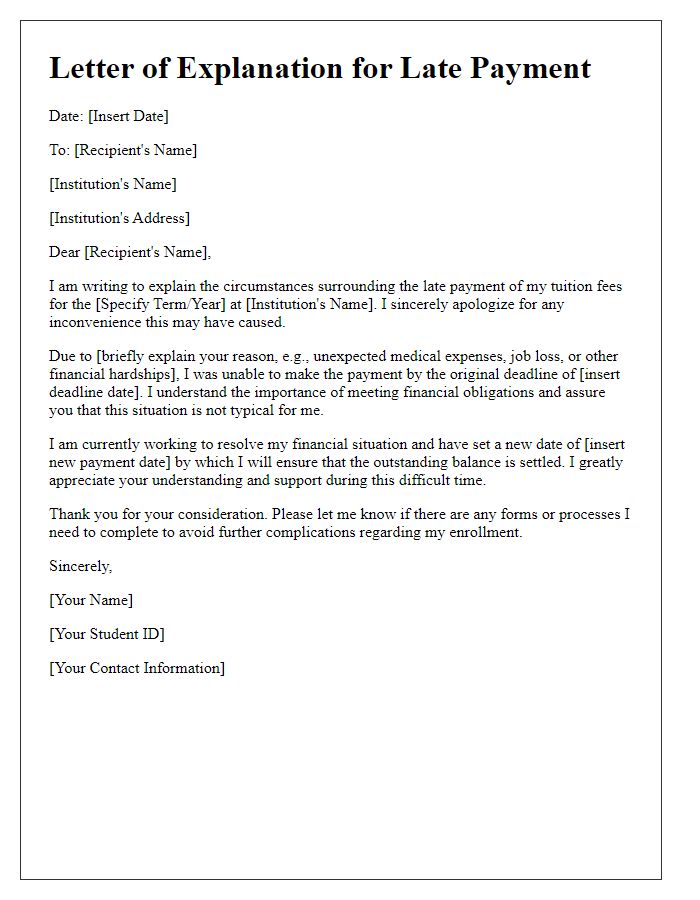

Letter template of late payment explanation for educational institutions

Comments