Are you concerned about your credit score? It can be frustrating to find discrepancies that might affect your financial opportunities. In this article, we'll guide you through drafting a letter requesting a recalculation of your credit score due to an error. Stick around to learn how to effectively communicate your request and take control of your credit health!

Personal Information Verification

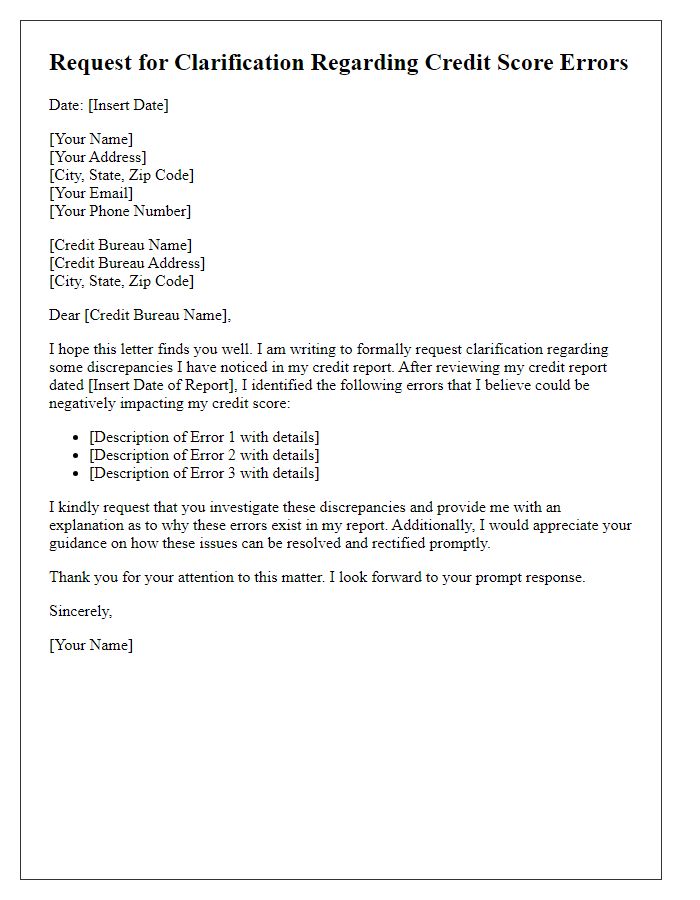

A credit score recalculation can significantly impact financial opportunities, especially when involving discrepancies in personal information. Errors such as incorrect names, addresses, or Social Security Numbers can lead to a lower credit rating, affecting loan approvals and interest rates. The Fair Credit Reporting Act (FCRA) allows consumers to dispute inaccuracies with credit bureaus like Experian, Equifax, and TransUnion. Each bureau must investigate inaccuracies within 30 days, which may lead to improved scores if corrections are validated. Providing documentation, such as government-issued IDs or utility bills, enhances the dispute process. Ensuring accurate personal information can facilitate better access to financial products and services in the future.

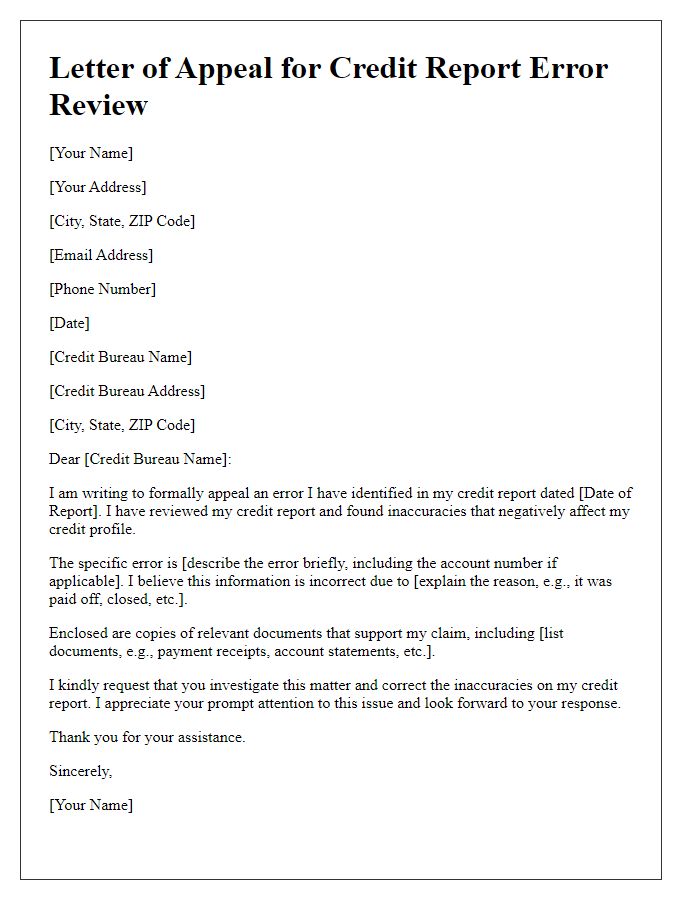

Specific Error Identification

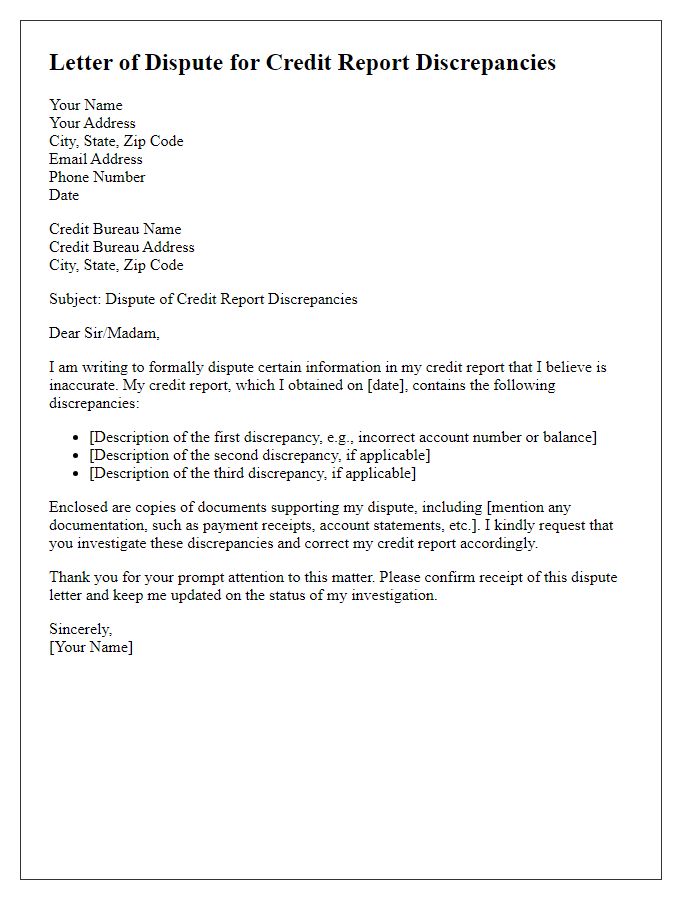

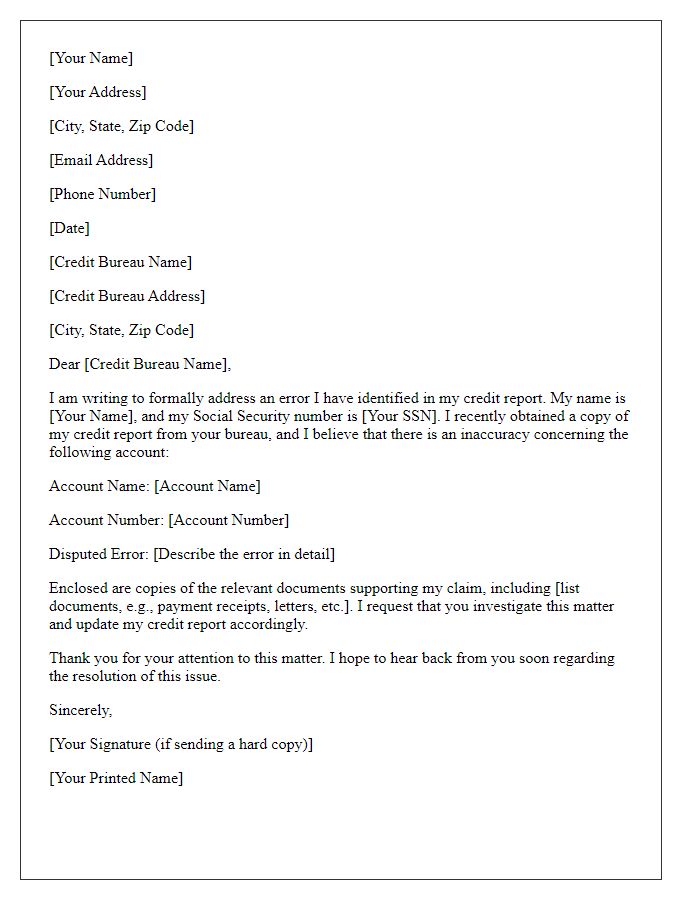

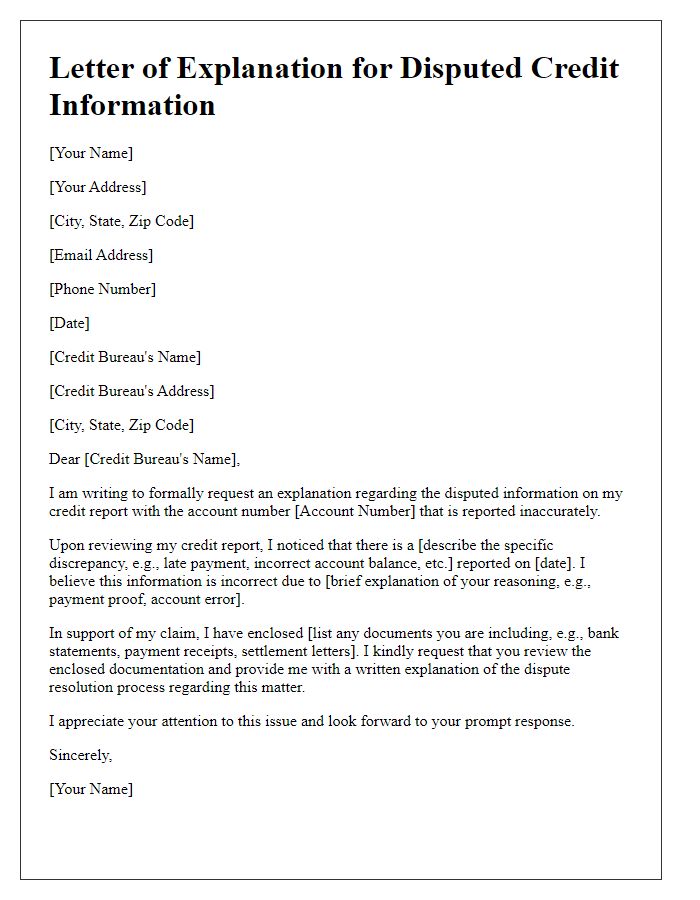

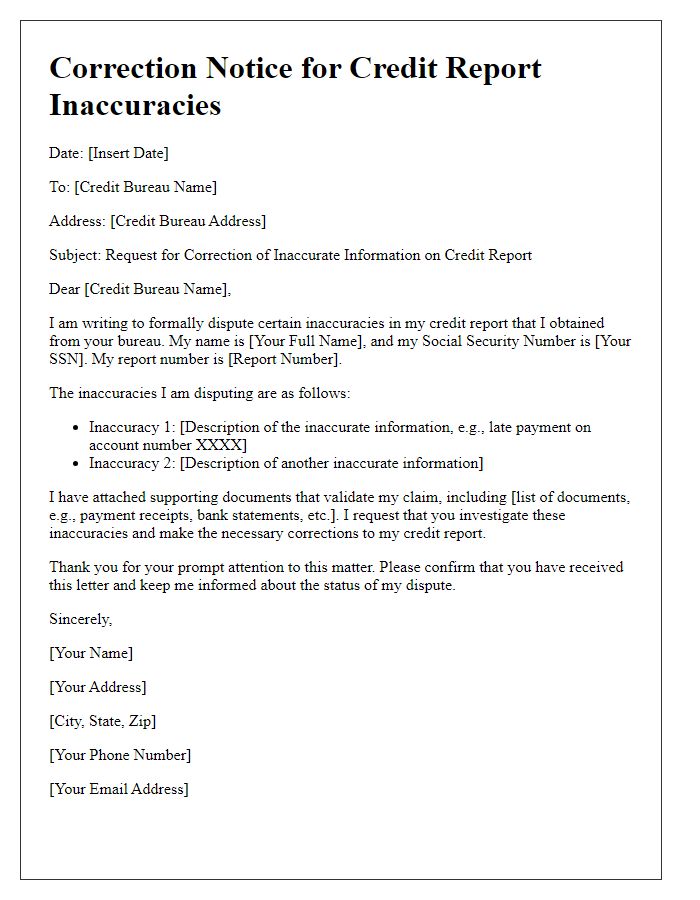

Errors in credit reports can significantly impact financial decisions, including loan approvals and interest rates. A specific error may consist of incorrect account balances or inaccurately reported late payments, potentially stemming from data entry mistakes or identity theft. The Fair Credit Reporting Act (FCRA) mandates that credit reporting agencies maintain accurate records, requiring consumers to challenge discrepancies. A thorough review of the credit report from major agencies, such as Equifax, Experian, and TransUnion, can help identify these errors. Gathering documentation, such as payment receipts or bank statements, is essential to substantiate claims. Once a specific error is confirmed, submitting a formal dispute including necessary details and supporting evidence can lead to correction in the credit report and eventual recalculation of the credit score.

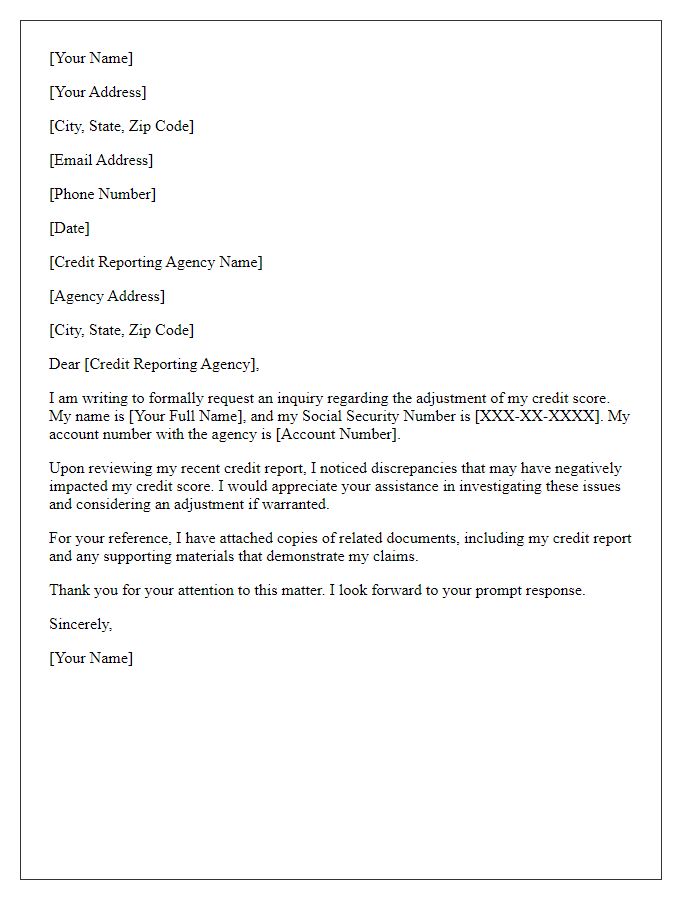

Supporting Documentation

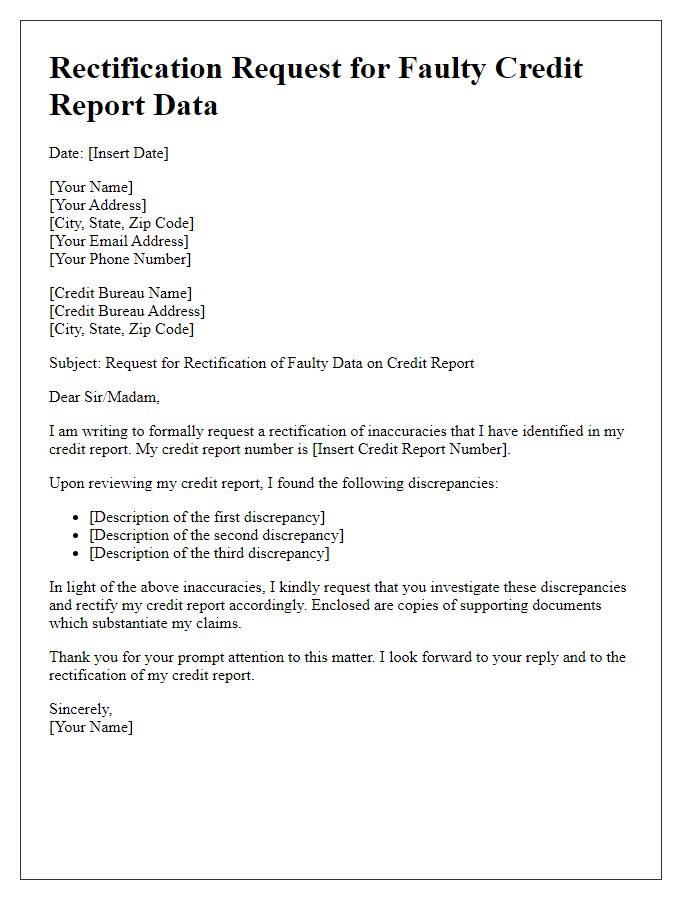

Credit score recalculation can be initiated when discrepancies arise in reported data, leading to inaccurate scoring. Supporting documentation is crucial when disputing an error, which may include bank statements, payment histories, and credit card statements reflecting timely payments. Financial institutions, such as Experian or Equifax, play vital roles in maintaining accurate records. Detailed evidence (e.g., receipts dated within the last two years) provides legitimacy to the claim, while an explanation of the specific error helps in addressing the issue effectively. Timely submission of this documentation is essential for ensuring a prompt investigation and potential correction of the credit score.

Request for Reassessment

Accurate credit scores are essential for financial transactions, affecting borrowing capacity. Errors in credit reporting can significantly alter these scores. The Fair Credit Reporting Act (FCRA) allows consumers to dispute inaccuracies, ensuring that agencies like Equifax, Experian, and TransUnion correct discrepancies. A credit score, often ranging from 300 to 850, determines interest rates on loans. Common errors may include incorrect account balances, missed payments misreported, or accounts not belonging to the consumer. Each state has different laws regarding dispute resolution timelines, often ranging from 30 to 45 days for credit bureaus to investigate. Regularly reviewing credit reports can help identify such errors, leading to potential score reassessment.

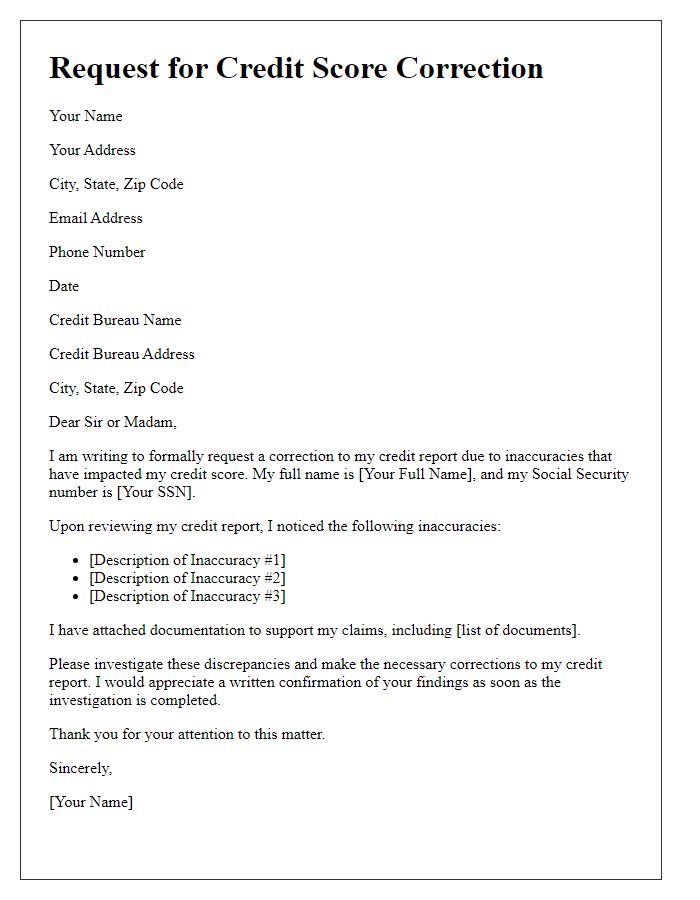

Contact Information for Follow-Up

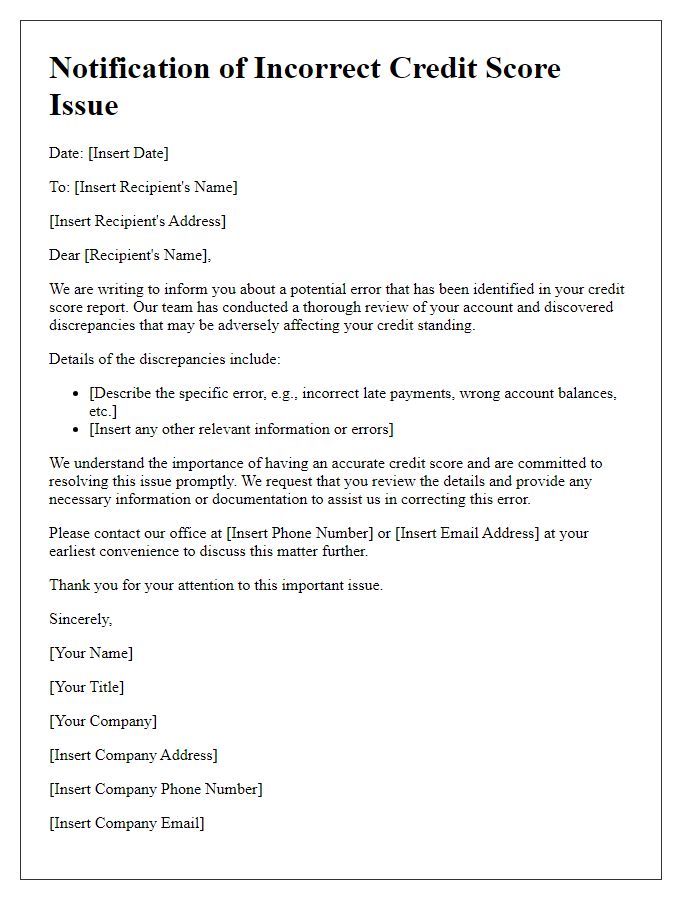

A credit score recalculation due to an error can significantly impact an individual's financial standing. The process begins when a consumer identifies inaccuracies in their credit report, often provided by agencies such as Experian, Equifax, or TransUnion. Timely communication is essential; consumers should include their full name, residency (specific address including city and zip code), contact number, and email address to ensure efficient follow-up. Documentation such as identification and records detailing the error must accompany the request. Consumers should verify the accuracy of their report against the Fair Credit Reporting Act (FCRA) guidelines, which protect against erroneous information. Following up within 30 days (the typical response window) is crucial for maintaining oversight on the recalculation process and ensuring errors are rectified promptly.

Letter Template For Credit Score Recalculation Due To Error Samples

Letter template of request for credit score correction due to inaccuracies

Comments