In today's fast-paced world, navigating financial commitments can sometimes feel overwhelming. Whether it's a temporary setback or an unexpected expense, many people find themselves in need of a little extra time to meet their obligations. This is where a goodwill credit extension can come in handy, offering a lifeline when times get tough. Curious about how to effectively request one? Read on to discover the best approach to crafting your letter!

Clear Subject Line

A goodwill credit extension allows consumers to receive additional time to repay debts without incurring penalties. Many financial institutions offer this option after evaluating the account holder's behavior, repayment history, and current financial circumstances. It is essential for consumers to clearly express their intentions, provide relevant account details, and specify the proposed extension duration in their request. By presenting a well-structured appeal, individuals maximize the likelihood of approval while demonstrating responsibility in managing their finances.

Formal Salutation

Requesting a goodwill credit extension from a financial institution could significantly impact customer satisfaction and trust. Many financial institutions, like banks or credit card companies, typically evaluate requests on a case-by-case basis. Customer account history, including payment regularity and outstanding balances, often plays a crucial role in the decision-making process. The request should ideally detail the specific circumstances prompting the extension, such as unforeseen financial hardships like medical emergencies or job losses. Recognition of the financial institution's policies, along with a polite expression of appreciation for their consideration, can enhance the likelihood of a favorable outcome. Documentation, such as pay stubs or medical bills, may be necessary to support the request.

Personal Account Details

Goodwill credit extensions can greatly assist individuals facing temporary financial challenges, such as unexpected medical expenses or job loss. A goodwill credit extension may provide additional time for payment or an increase in available credit limit. Personal account details, such as the account number (XXXX-XXXX-XXXX-1234) and the credit history (displaying consistent payments over the past 12 months), are usually required for consideration. Additionally, specifying the amount of extension requested (e.g., $500) and illustrating the circumstances that led to the request enhances the likelihood of approval. This process typically involves direct communication with the customer service department of the financial institution, which may have policies tailored to support loyal customers.

Reason for Request

A goodwill credit extension can be requested when customers experience unexpected financial hardship or unforeseen circumstances, such as medical emergencies, job loss, or significant repair expenses. Providing context, such as the impact of these events on monthly budget management, can strengthen the request's legitimacy. References to positive account history, such as timely payments for over two years, can enhance the appeal. Mentioning the specific amount of credit extension requested, such as an additional $1,000 on the existing limit, contextualizes the inquiry. By specifying a reasonable duration for the extension, such as three months, the request becomes more structured and feasible.

Appreciation and Closing

Goodwill credit extensions play a crucial role in maintaining customer relationships and ensuring satisfaction. Companies often assess request validity by considering account history, payment punctuality, and loyalty duration. Situations such as financial hardship (common during economic downturns) can compel customers to seek extensions, highlighting the importance of understanding individual circumstances. Customer service departments may evaluate garnishments for flexibility, ensuring compliance with corporate policies while fostering goodwill. A clear communication process, encompassing appreciation for past services, and transparent closing statements ensures a positive interaction, which may lead to favorable outcomes for both parties involved.

Letter Template For Requesting Goodwill Credit Extension Samples

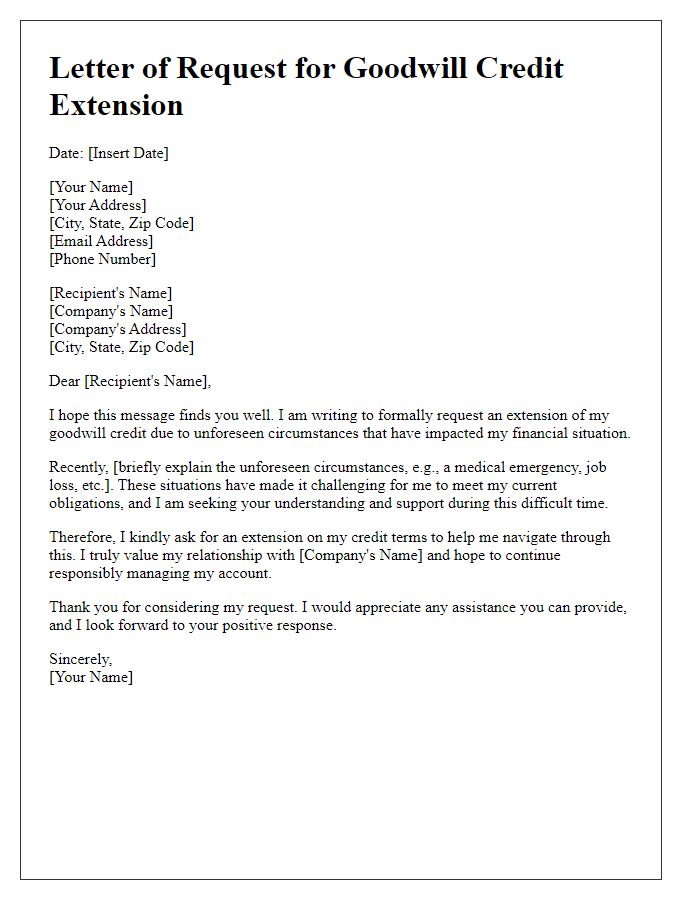

Letter template of request for goodwill credit extension due to unforeseen circumstances.

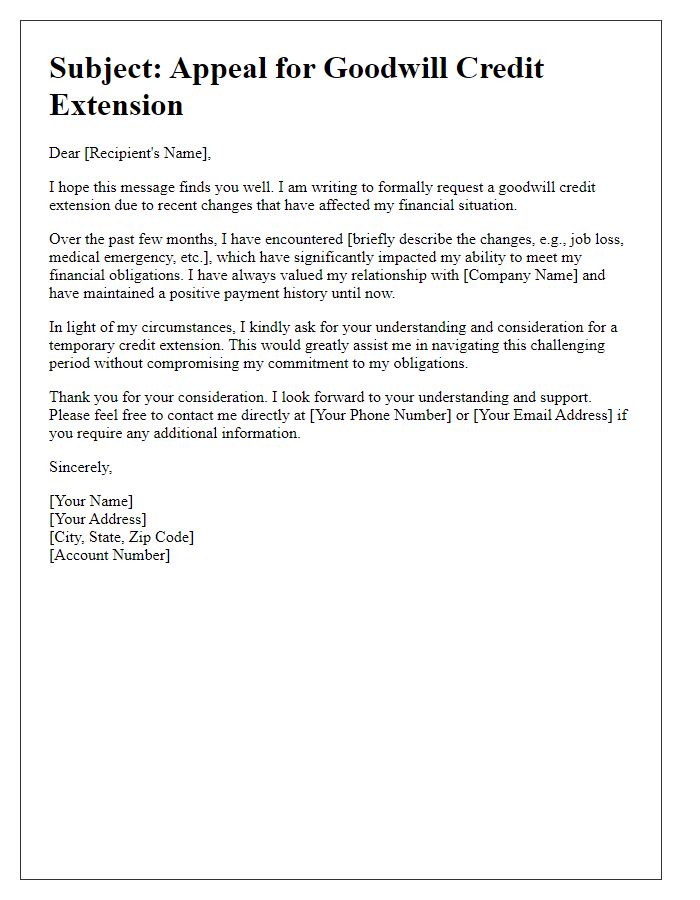

Letter template of appeal for goodwill credit extension in light of recent changes.

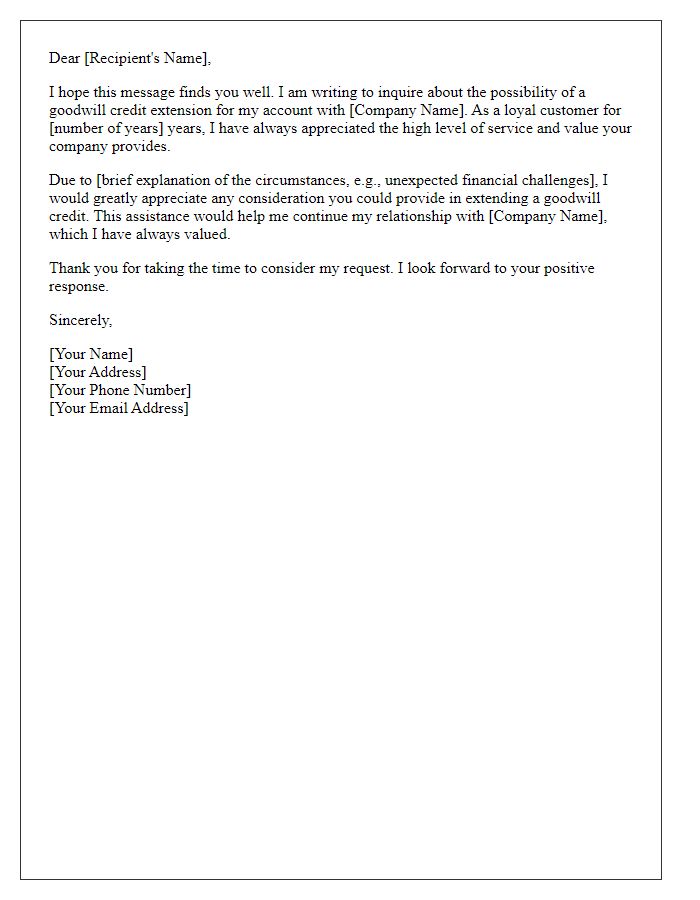

Letter template of inquiry for goodwill credit extension for loyal customers.

Letter template of solicitation for goodwill credit extension amid financial strain.

Letter template of petition for goodwill credit extension following service disruption.

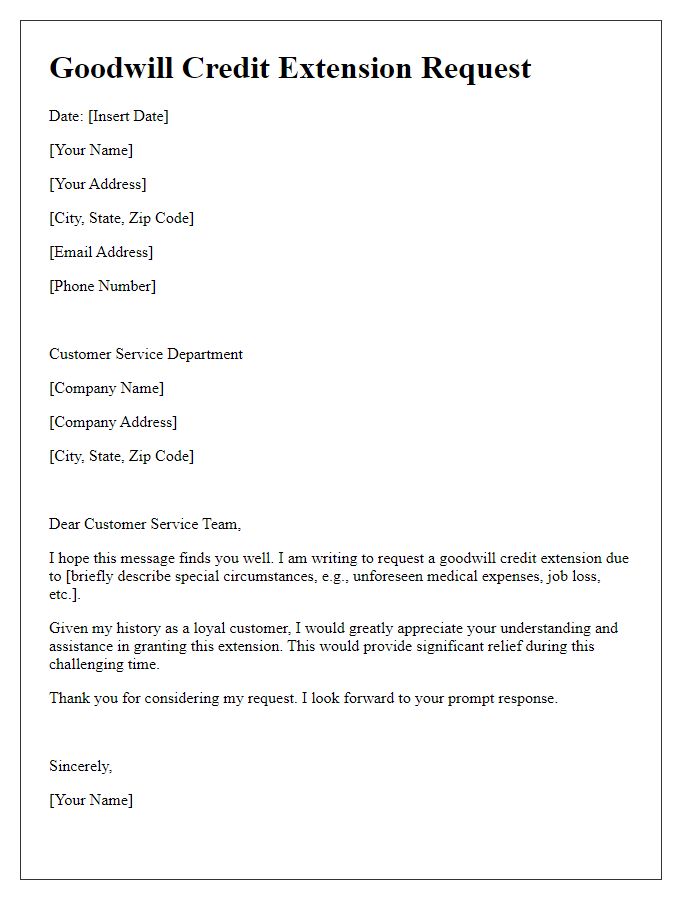

Letter template of formal request for goodwill credit extension based on customer history.

Letter template of claim for goodwill credit extension due to unexpected expenses.

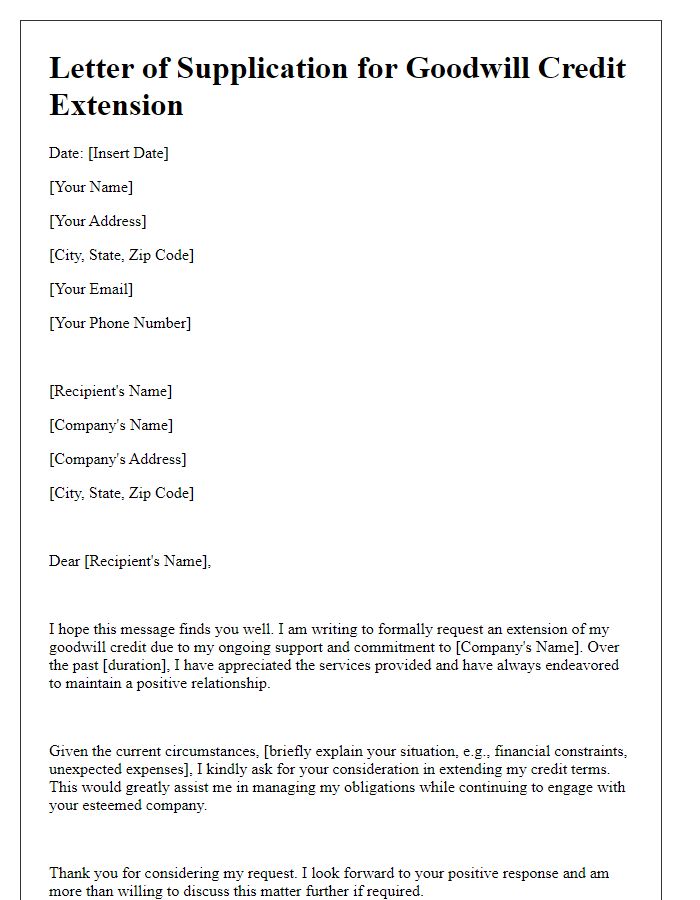

Letter template of supplication for goodwill credit extension considering ongoing support.

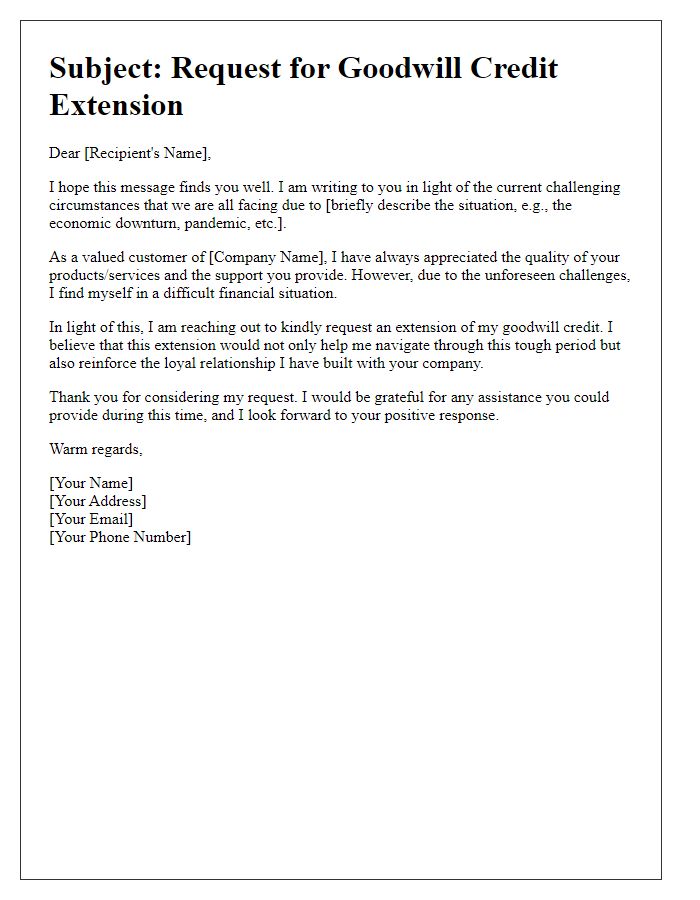

Letter template of approach for goodwill credit extension during challenging times.

Comments