Are you feeling overwhelmed by the stress of defaulted loans? You're not alone; many people face similar challenges, and understanding your options can lead to a brighter financial future. In this article, we will explore effective strategies to negotiate your loan terms, helping you regain control of your finances. So, let's dive in and discover how you can turn your situation aroundâread on!

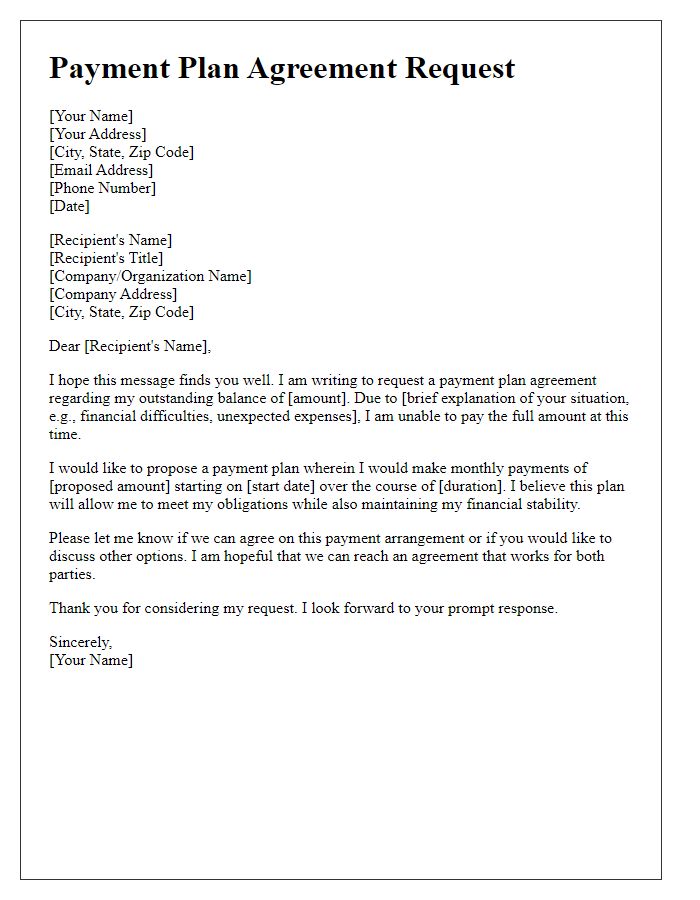

Borrower's contact details

In defaulted loan negotiations, the borrower's contact details play a crucial role in facilitating communication between the borrower and the lender. Accurate information such as the borrower's full name, current residential address (including city and zip code), email address, and primary phone number are essential for ensuring timely updates and responses during the negotiation process. Providing alternative contact methods, like a secondary email or mobile number, can enhance the lender's ability to reach the borrower quickly. This contact information is vital to address issues like loan modification, repayment plans, or possible settlements, impacting the borrower's financial future and credit score.

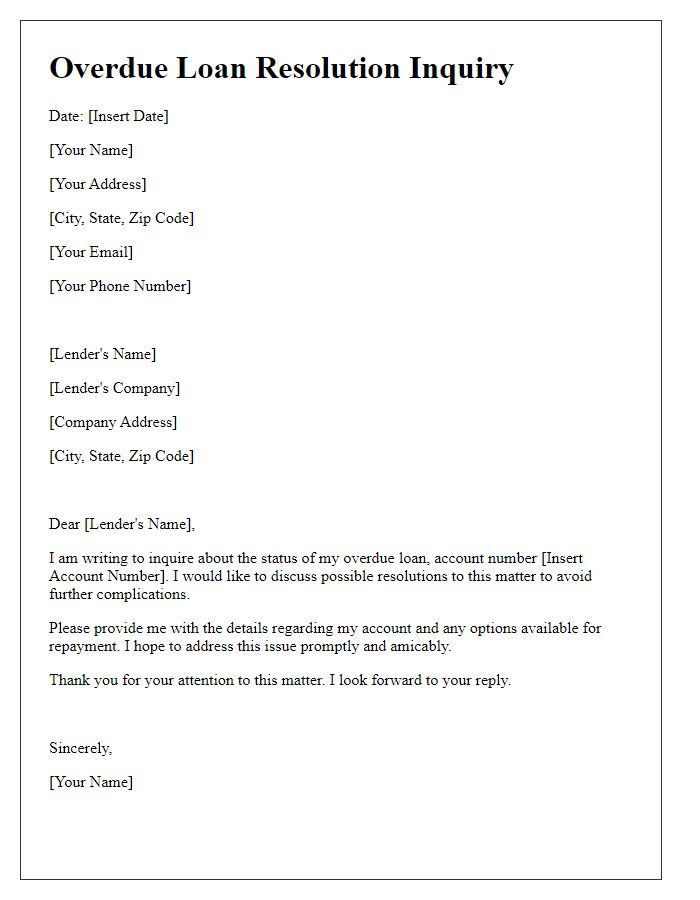

Loan account information

In a defaulted loan negotiation, carefully considering the loan account details is crucial for an effective resolution strategy. Loan account number (123456789) reflects both the borrower's financial history and outstanding balance (totaling $50,000). The interest rate (7% APR) applied significantly impacts the total repayment amount, heightening the urgency for negotiation. Identifying the original loan date (January 15, 2020) and the payment schedule (monthly installments due on the 1st of each month) underscores the timeline of defaults (four consecutive missed payments). Understanding the lender's collections practices and associated fees, such as late payment penalties ($150 per month), provides leverage in discussions for modifying the repayment terms or possible settlement amounts. Engaging in this negotiation process with complete awareness of account specifics could ultimately lead to a more manageable financial resolution that benefits both borrower and lender.

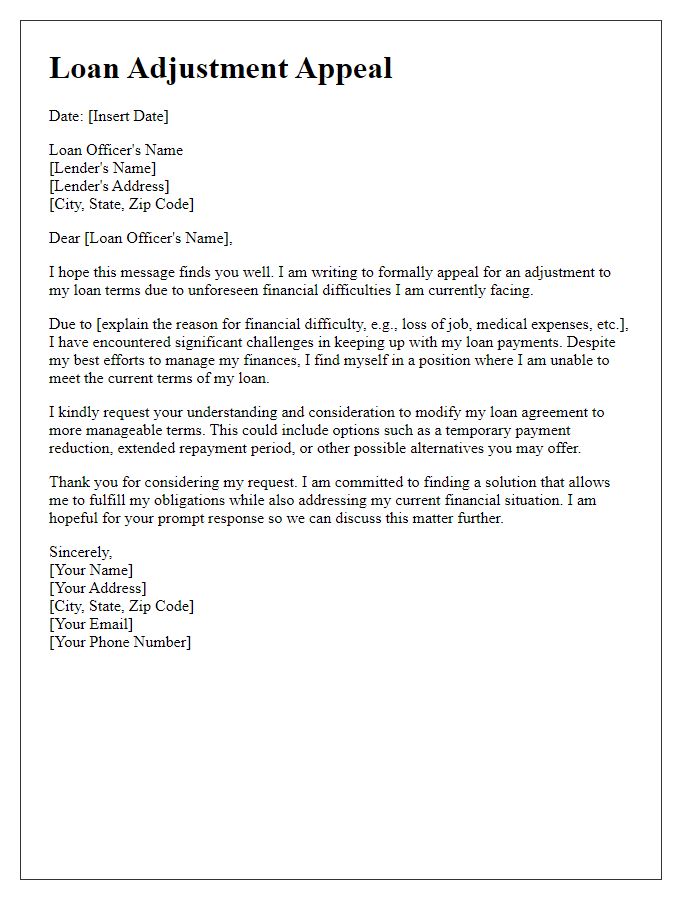

Current financial situation explanation

Experiencing a significant financial downturn, many individuals face challenges with outstanding loan obligations. Unforeseen events, such as temporary job loss or medical emergencies, often lead to decreased income levels, impacting monthly budget management. In this context, the average consumer debt has reached alarming heights, averaging around $93,000 in the United States, including personal loans, credit cards, and mortgages. Consequently, maintaining timely payments on loans proves increasingly difficult. Negotiating with financial institutions can provide a pathway to amend original terms, such as requesting lower interest rates or extended repayment periods. Open communication with lenders regarding one's circumstances may facilitate finding mutually beneficial solutions to avoid default consequences like bad credit ratings, collection efforts, or potential legal action.

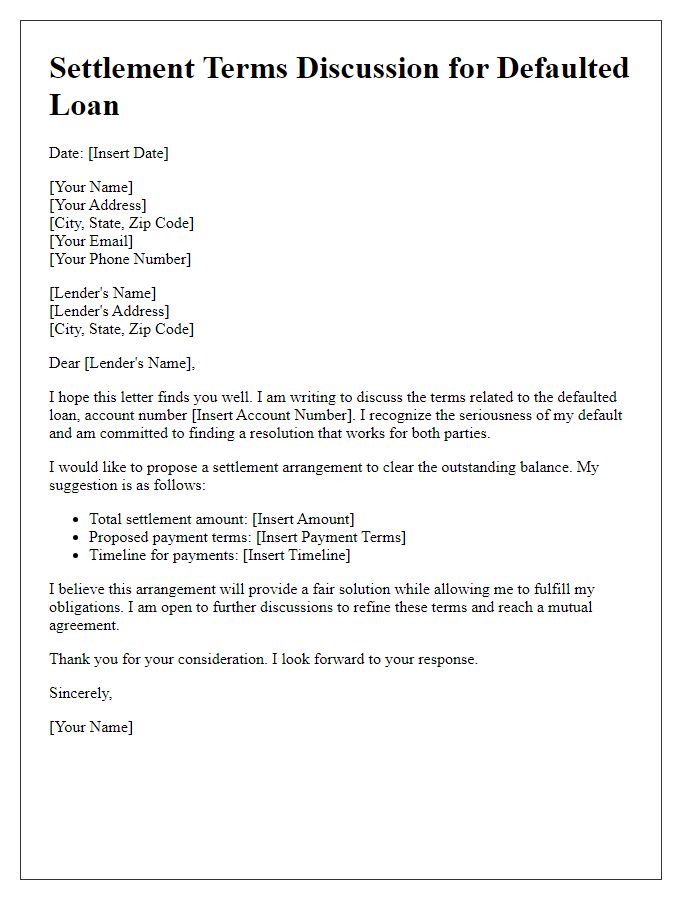

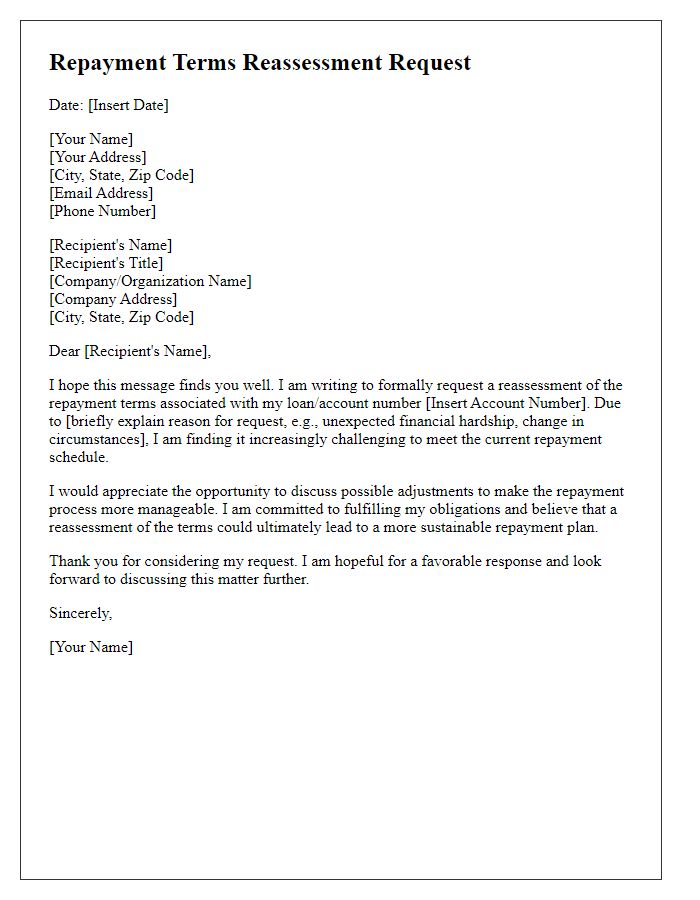

Proposed repayment plan

Negotiating a defaulted loan can lead to a more manageable repayment plan. When discussing repayment, key details emerge, such as the total loan amount, interest rate, and original loan term, which may span five to thirty years depending on the type of loan. A proposed repayment plan might suggest lowering monthly payments by extending the loan term, possibly increasing it to 60 months. Interest may also be adjusted to ensure affordability, potentially lowering it from 7% to 5%. Moreover, setting up a scheduled payment date, like the 15th of each month, can help in budgeting and maintaining consistent payments. Including options for deferment or forbearance during financial hardship may further ease financial strain and facilitate successful repayment negotiations.

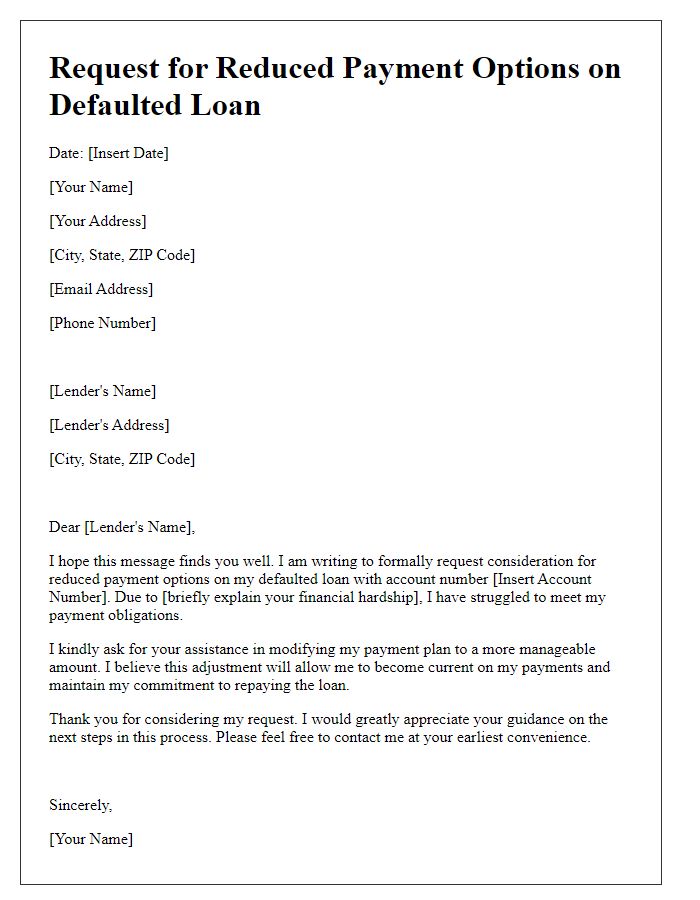

Request for loan modification or forgiveness

A defaulted loan can cause significant financial stress for borrowers, leading to difficult negotiations with lenders. Requesting a loan modification involves presenting a detailed proposal to the financial institution, often a bank or credit union, which can adjust the terms of the loan. For example, borrowers may seek a reduction in the interest rate--typically from 5% to 3%--or an extension of the repayment period, such as a shift from a 10-year to a 20-year term. Depending on the situation, some borrowers might qualify for partial loan forgiveness, potentially relieving a portion of the debt, often around 25% to 50%, if they can demonstrate financial hardship. Documentation, including income statements and proof of expenses, is crucial to support the application during this negotiation process, typically headquartered at the lender's corporate office in a state like New York or California.

Comments