Are you tired of inaccuracies in your annual credit report? It can be frustrating to find errors that could affect your financial health and credit score. Don't worry, you're not alone; many people face similar issues. In this article, we'll guide you through a simple letter template to help you correct any misinformation on your credit report, ensuring your financial records are accurate and up to date. Ready to take control of your credit? Let's dive in!

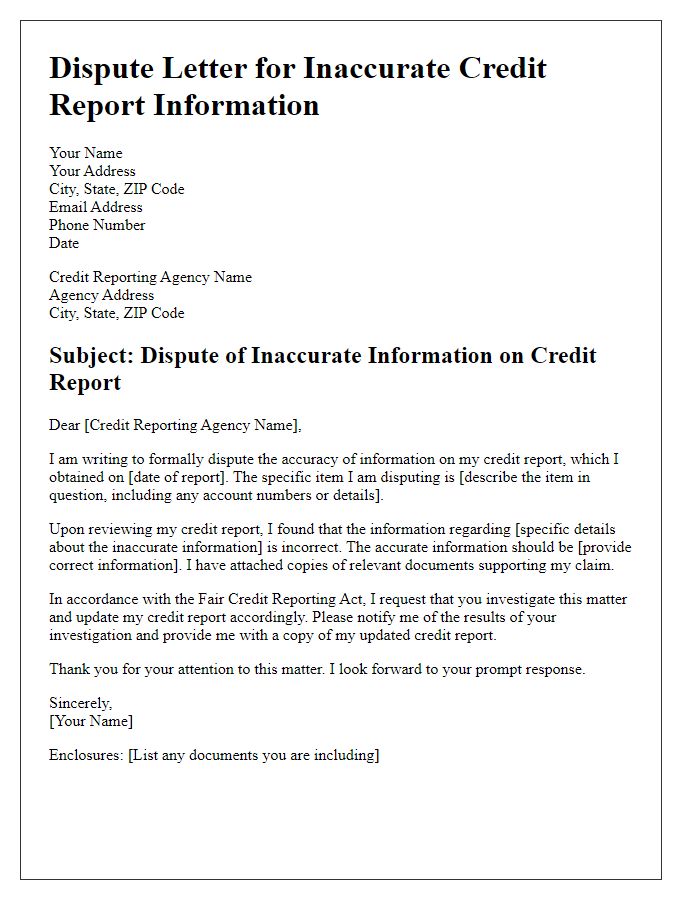

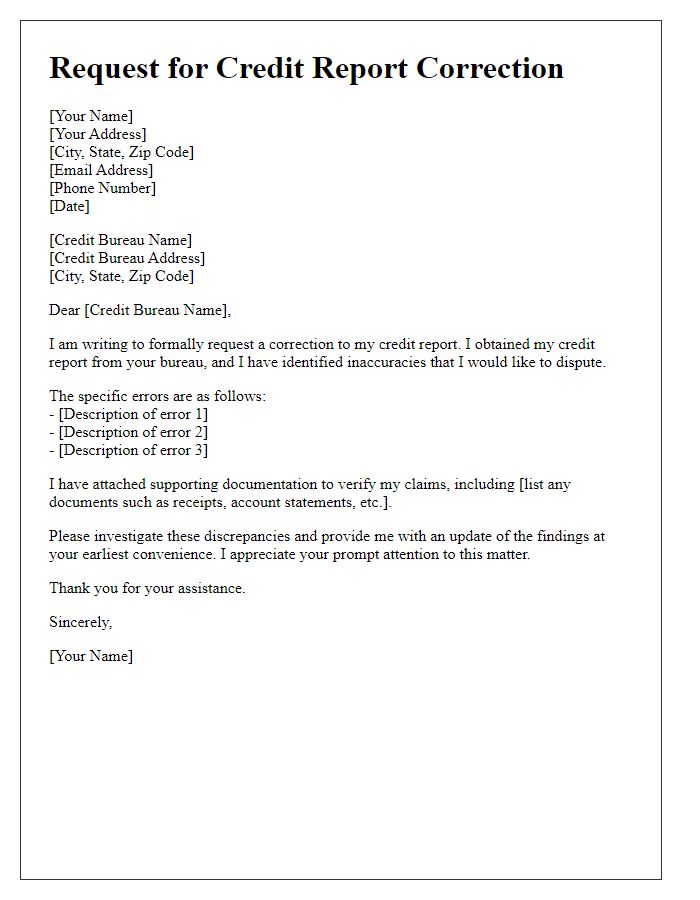

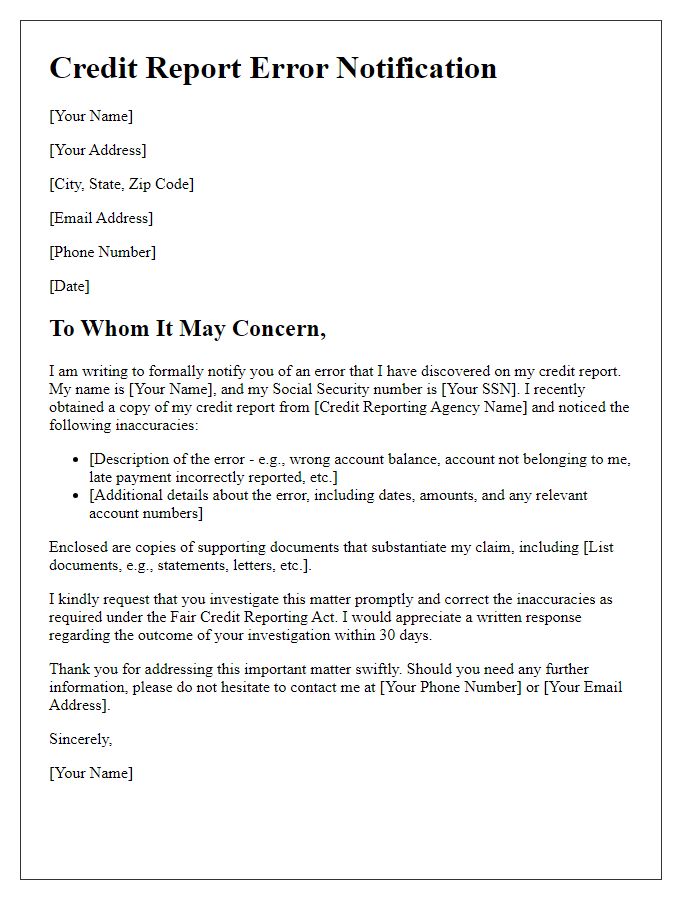

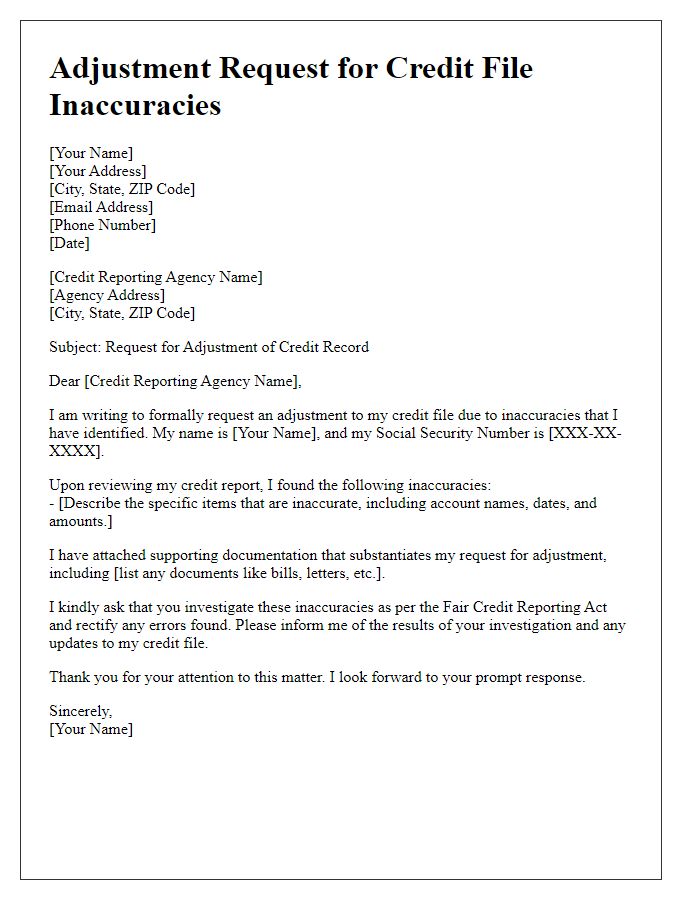

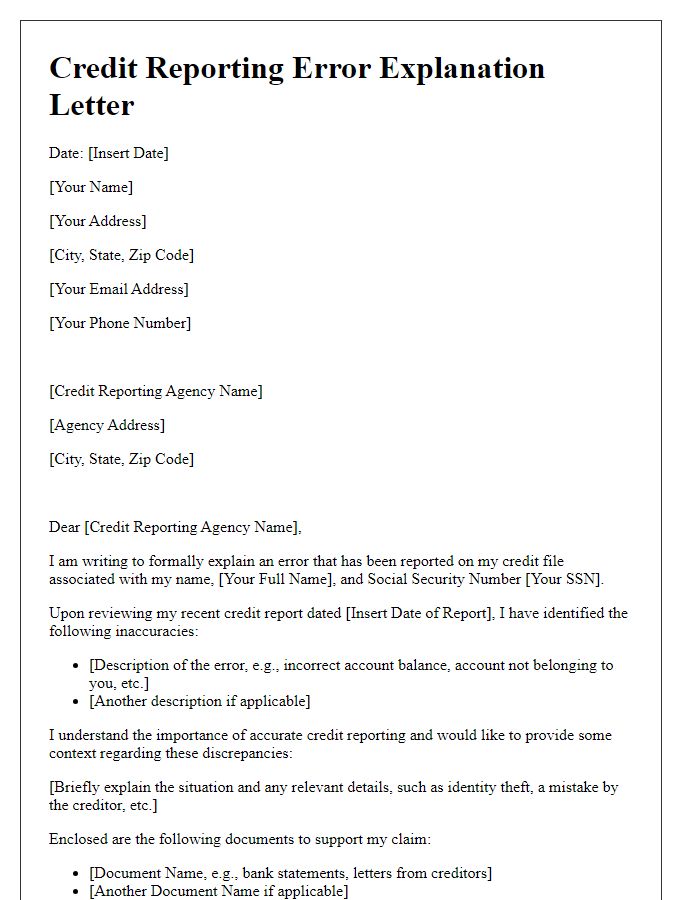

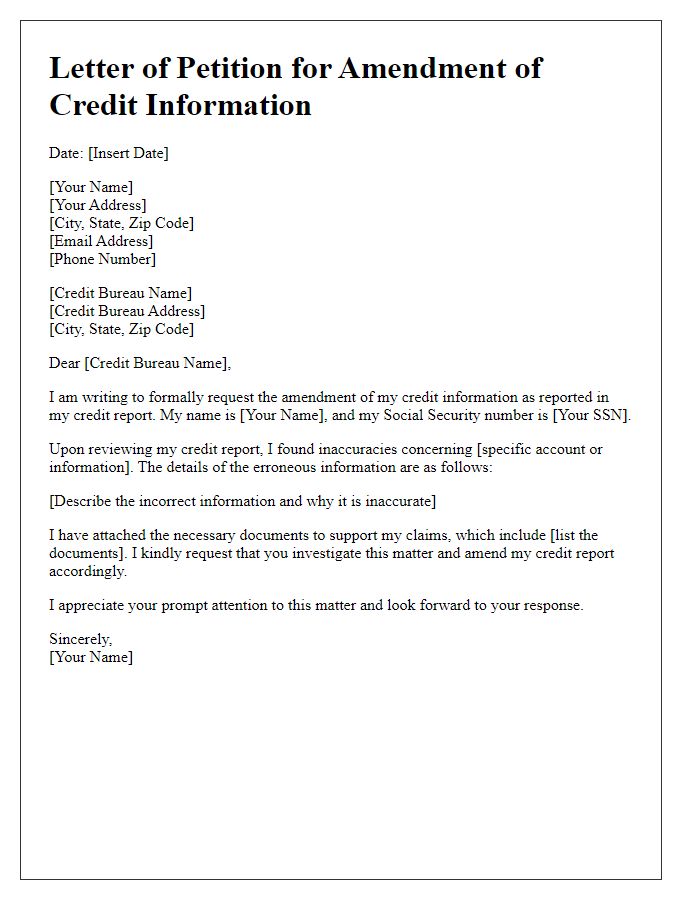

Personal Information

Inaccurate personal information on annual credit reports can adversely affect credit scores, influencing loan approvals and interest rates. Common inaccuracies include misspellings of names, incorrect addresses, and wrong Social Security numbers, which can lead to identity confusion. Correcting these discrepancies requires submitting a dispute to credit reporting agencies such as Experian, TransUnion, and Equifax. According to the Fair Credit Reporting Act (FCRA), consumers are entitled to receive a free credit report annually from each of these agencies. Timely correction of personal data ensures accurate credit histories, which are crucial for financial decisions, including home purchases and car loans.

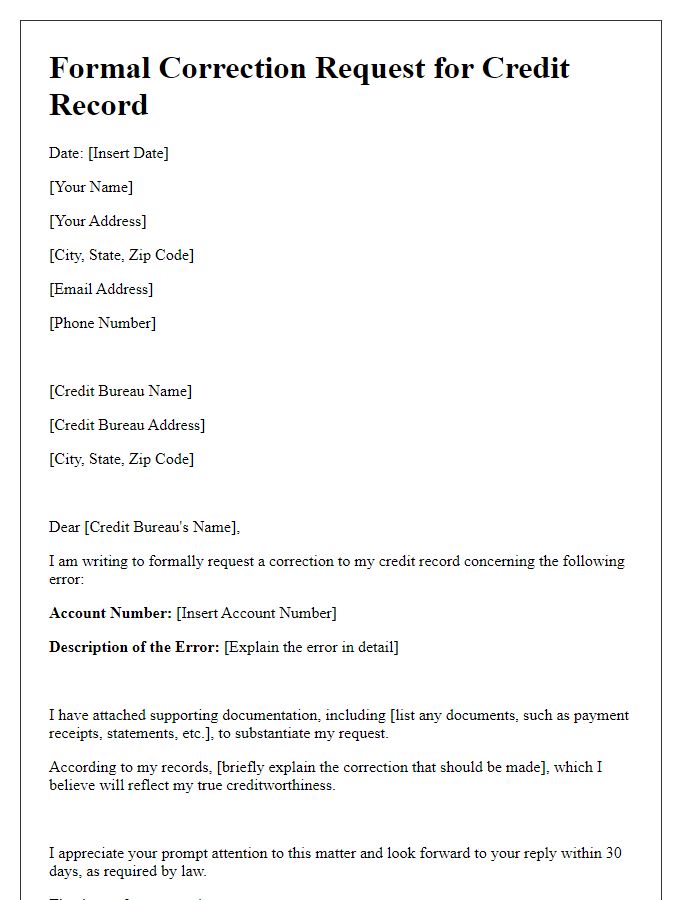

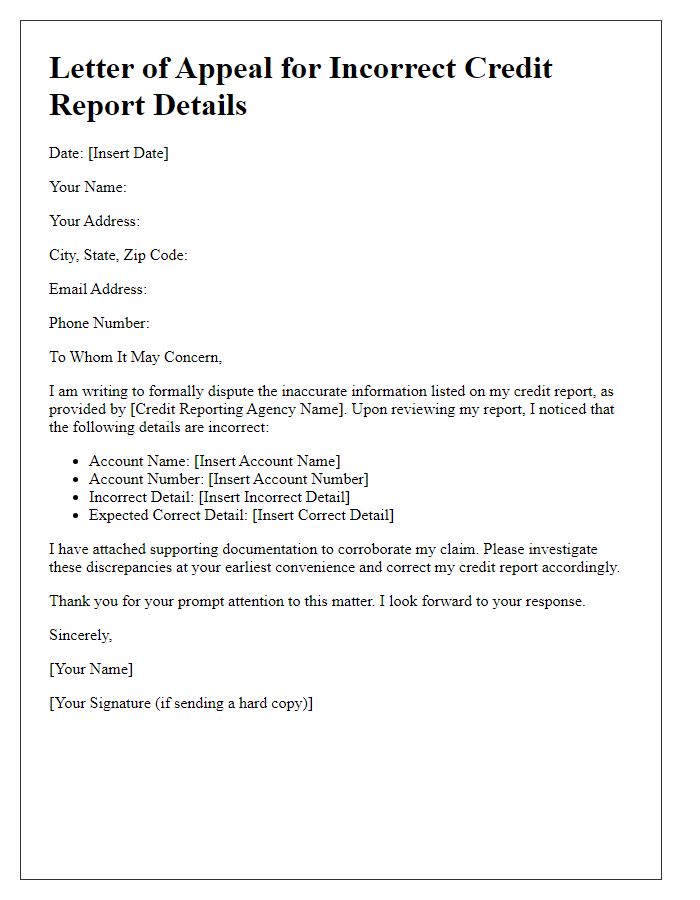

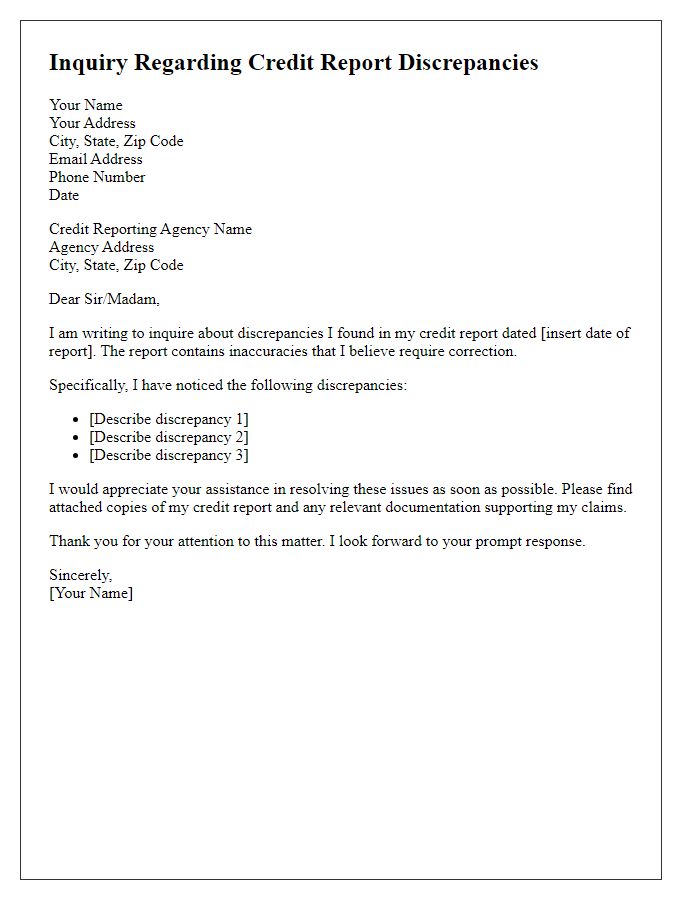

Dispute Details

Incorrect information on annual credit reports can significantly impact financial health and borrowing capabilities. Disputed details, such as inaccurate payment history or erroneous account balances, need immediate attention. For instance, inaccuracies in reported late payments can diminish credit scores, affecting loan eligibility. Consumers should gather supporting documents, including bank statements or payment receipts, to substantiate claims. The Fair Credit Reporting Act (FCRA) mandates credit reporting agencies to investigate disputes within 30 days, requiring a thorough review of submitted evidence. Individuals residing in the United States must send their dispute letters to agencies like Experian, Equifax, or TransUnion for resolution.

Supporting Documentation

Accurate financial records are crucial for maintaining a healthy credit score and overall financial stability. When disputing errors on an annual credit report, supporting documentation such as credit card statements, loan agreements, and payment receipts must be gathered. Key institutions like Experian, TransUnion, and Equifax, which manage and report credit histories, require clear evidence to substantiate claims of inaccuracies. Specific details, including account numbers, outstanding balances, and dates of transactions, enhance the credibility of the dispute. Effective documentation can expedite the resolution process, ensuring a timely update to the credit profile and reflecting the true financial standing of the individual involved.

Corrective Action Requested

Inaccurate credit report information can significantly impact credit scores and financial opportunities. For instance, individuals may discover erroneous entries regarding payment history (which can include late payments marked in error) or account balances (incorrect debts reported) on their annual credit report from agencies such as Experian, Equifax, or TransUnion. The Fair Credit Reporting Act mandates consumers to dispute any inaccuracies within a 30-day timeframe, enabling corrective action to rectify these issues. Documentation accompanying the dispute may involve copies of pertinent statements, payment confirmations, or any other relevant correspondence. Corrected information will ensure fair representation of an individual's credit history and improve overall financial health.

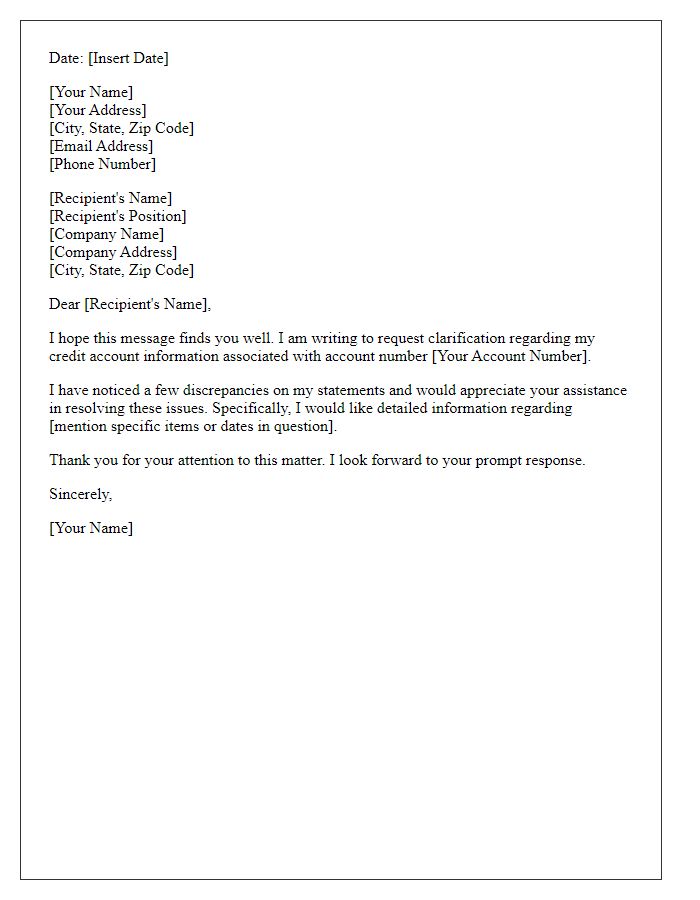

Contact Information

Incorrect information on an annual credit report can significantly impact credit scores. Contact information includes details such as addresses, phone numbers, and associated accounts. For example, a report from Experian may list an outdated address, which can create confusion regarding creditworthiness. Ensuring that your contact information accurately reflects your current residence (such as 123 Main Street, Springfield, Illinois) and phone number is crucial for maintaining communication with lenders. Key steps involve gathering documentation, such as utility bills or bank statements, that corroborate the correct details. Submitting a formal request through the official dispute process is essential to rectify discrepancies.

Comments