Have you ever found yourself staring at your bank statement, bewildered by unfamiliar transactions? It's a frustrating experience that can leave you feeling vulnerable and anxious about your financial security. Fortunately, there are steps you can take to dispute fraudulent charges and reclaim your hard-earned money. In this article, we'll guide you through a simple letter template to help tackle the situation effectively, so keep reading to empower yourself with the tools you need!

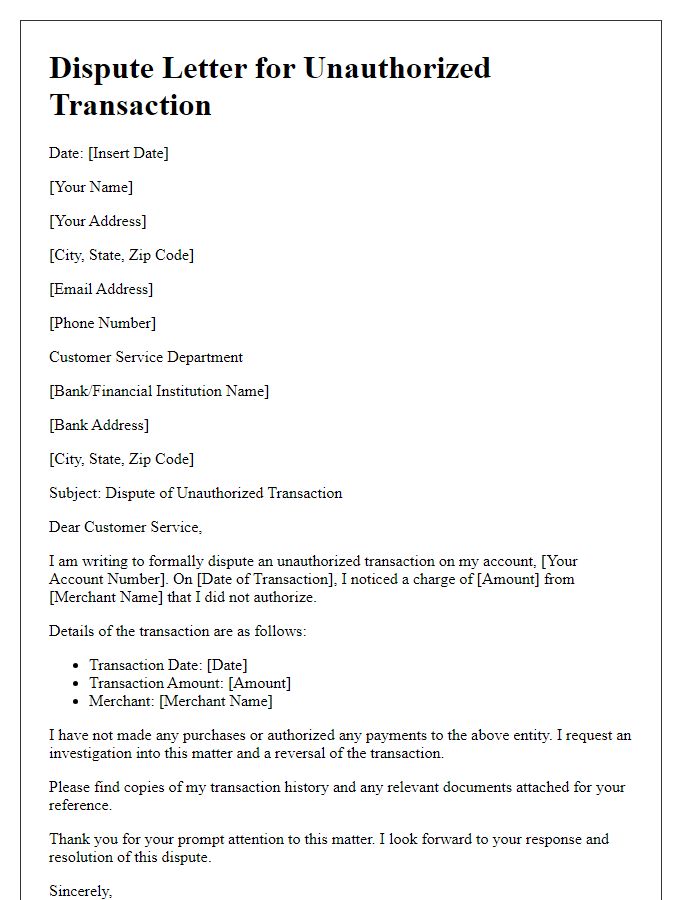

Account Information

Fraudulent charges on credit card statements can significantly impact financial stability, leading to potential monetary loss for consumers. In 2022, the Federal Trade Commission reported approximately 2.1 million cases of fraud related to credit and debit accounts in the United States, emphasizing the urgency of prompt dispute actions. Individuals must gather relevant account information, including account numbers, transaction dates, and amounts, to prepare a compelling case. Notifying the financial institution, often through certified letters or online dispute forms, ensures that actions are documented and can initiate investigations into unauthorized transactions. Effective documentation is crucial for consumers to protect their rights and seek reimbursement for any fraudulent charges incurred.

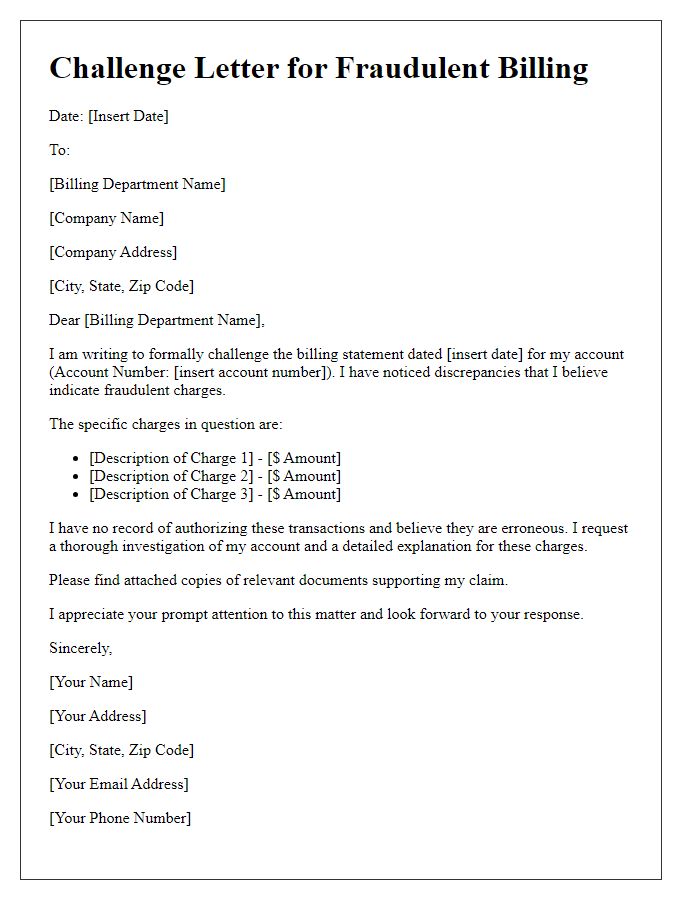

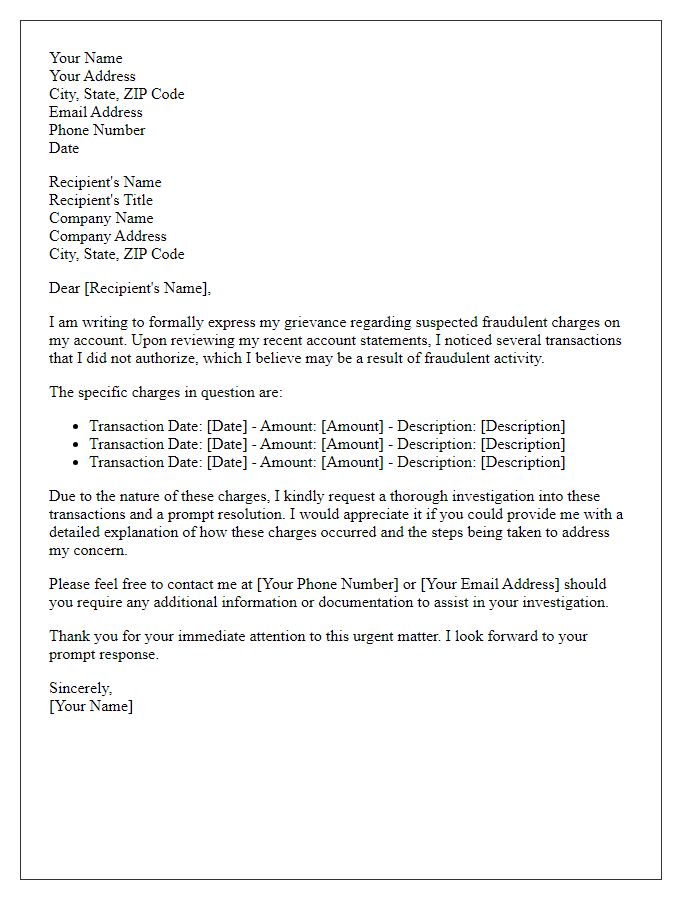

Charge Details

Fraudulent charges on Credit Card accounts can cause significant distress for consumers. A disputed transaction may involve amounts exceeding $100, often stemming from unauthorized purchases made without the cardholder's consent. Events such as data breaches at major retailers, like Target or Home Depot, can lead to compromised card information, resulting in unfamiliar charges appearing on billing statements. The Federal Trade Commission (FTC) recommends that consumers report these incidents promptly, often enabling a dispute process within 60 days of the transaction date. Cardholders are encouraged to review their statements regularly for inaccuracies and communicate with their financial institutions to protect their accounts against identity theft.

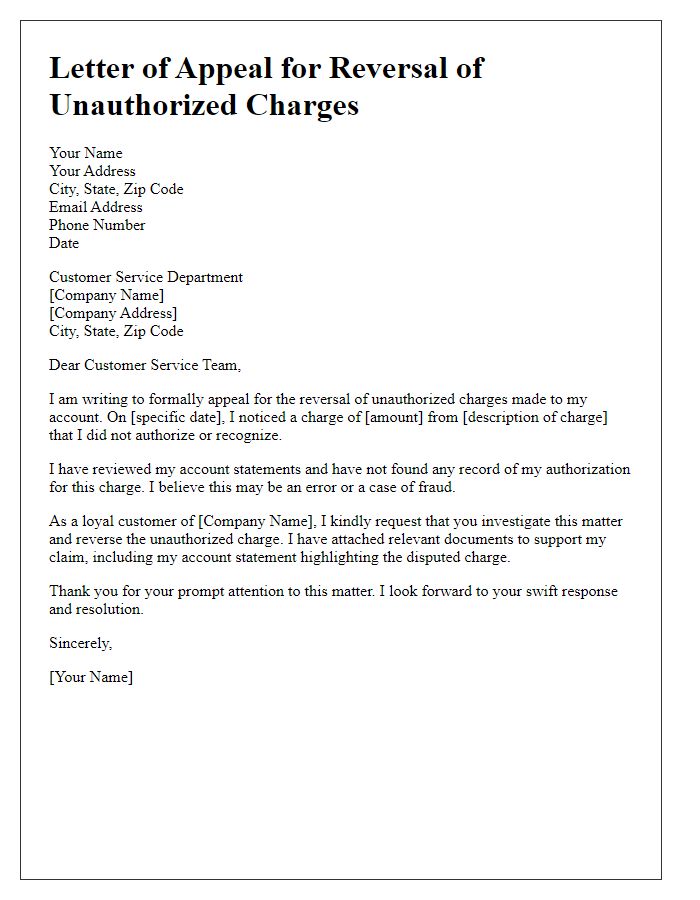

Description of Dispute

Fraudulent charges on credit card statements can severely impact financial stability, often leading to significant stress and confusion. Unauthorized transactions, often amounting to hundreds or even thousands of dollars, appear on statements without the cardholder's consent. For example, a $750 charge to a luxury goods retailer, such as Neiman Marcus, may not have been made by the account holder. Affected individuals often report these discrepancies to their financial institution, necessitating a formal dispute process. Proper documentation, including transaction history and communication records, is crucial in supporting the dispute, ensuring that credit card companies, like Visa or MasterCard, take immediate action to investigate and possibly reverse the erroneous charges.

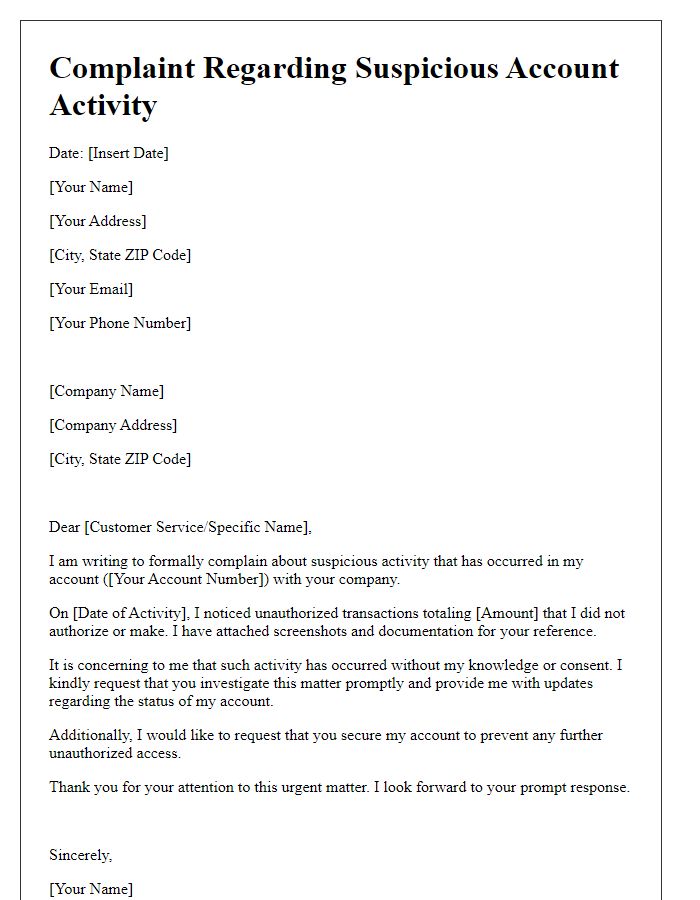

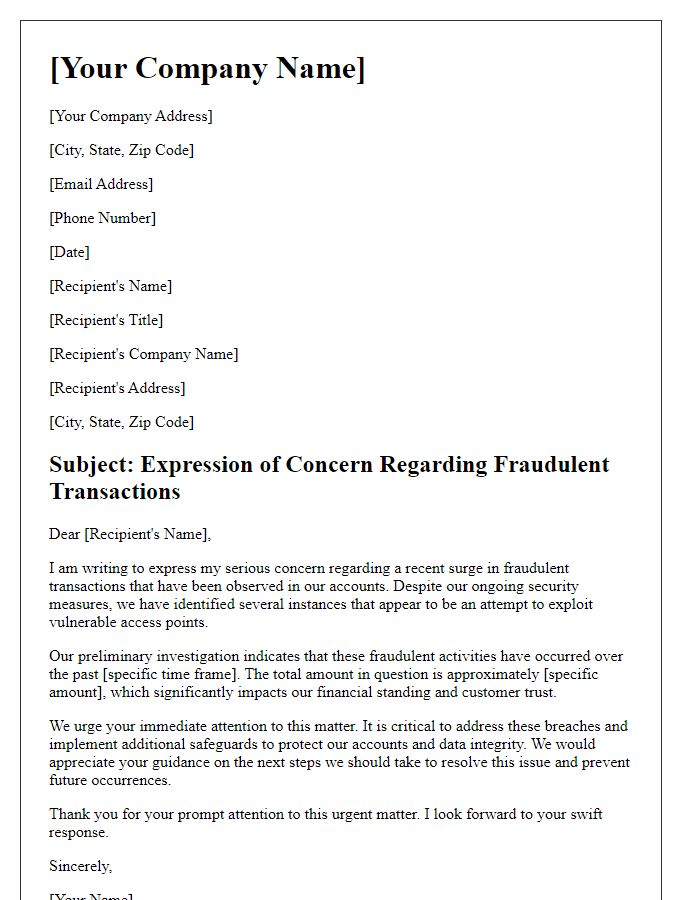

Request for Resolution

Fraudulent charges on credit cards can often raise significant concerns for consumers, affecting financial stability and peace of mind. A fraudulent transaction may involve unauthorized purchases on accounts held at major financial institutions like Visa or Mastercard, potentially amounting to hundreds or even thousands of dollars. It is crucial to report these discrepancies promptly, ideally within 60 days of the statement date, to comply with federal regulations such as the Fair Credit Billing Act. Ensuring proper documentation, including transaction details and related correspondence, is essential to facilitate resolution. Filing disputes with both the bank and credit reporting agencies can help restore account integrity, prevent identity theft, and reclaim lost funds, enhancing overall consumer protection in a complex digital marketplace.

Contact Information

Fraudulent charges can lead to significant financial distress for consumers. These unauthorized transactions often appear on credit or debit card statements, sometimes amounting to hundreds or thousands of dollars. Immediate action is crucial. Contacting the financial institution, such as a bank or credit card provider, typically should occur within 60 days of the statement date reflecting the fraudulent charge. Documentation, including account numbers (often unique to the card holder), transaction details, and potentially police reports, aids in resolving disputes effectively. Institutions like the Federal Trade Commission (FTC) provide resources to guide consumers through the dispute process, ensuring that victims of fraud can recover lost funds and regain financial security.

Comments