Are you considering entering into a commercial brokerage agreement but unsure where to start? Crafting the perfect letter can set the stage for a successful partnership. In this article, we'll walk you through a well-structured template to help you clearly outline the terms and expectations of your agreement. Ready to dive in and get your business moving? Let's explore the details!

Parties Involved

A commercial brokerage agreement typically involves multiple parties, including a client (the property owner or seller) and a broker (the licensed professional facilitating the transaction). The client can be an individual, corporation, or real estate investment trust, while the broker represents a real estate brokerage firm that must be licensed in the specific state or region, such as California or New York, to conduct real estate transactions. The agreement outlines the roles and responsibilities of each party, including commission fees typically expressed as a percentage of the sale price, such as 3% to 6%, and the duration of the agreement, which often lasts between six months to one year. Additionally, any third parties involved, such as investors or co-brokers, can also be specified to clarify their rights and obligations within the transaction process.

Scope of Services

A commercial brokerage agreement outlines the specific scope of services provided by brokerage firms in facilitating real estate transactions. This agreement typically includes property listing (a detailed presentation of the commercial property such as office buildings, retail spaces, or warehouses) and marketing strategies (efforts like digital advertising, open houses, or networking within the real estate community). The brokerage may also conduct property showings (scheduled tours for potential buyers or tenants), negotiate offers (discussions concerning pricing and terms), and offer administrative support (documentation and compliance tasks necessary during the transaction process). Additionally, market analysis (research on local market trends, pricing, and comparable properties) is critical for informed decision-making, while compliance with state real estate laws (various regulations governing property transactions, varying by location) ensures all actions remain within legal boundaries.

Compensation and Payment Terms

The compensation structure for commercial brokerage agreements typically outlines the payment obligations between the broker and the client. Commissions often range between 5% to 10% of the total transaction value, depending on the market and property type. Payment terms should specify the timeline for commission disbursement, often occurring upon successful closing of the sale or lease, generally within 30 to 60 days post-transaction. Additional fees may also arise for specialized services such as market analysis or investment consultations. Clarity regarding reimbursement for marketing expenses, often between $500 to $5,000, should be included, ensuring both parties understand financial commitments.

Duration and Termination

The duration of the commercial brokerage agreement typically spans a fixed term, beginning on the effective date, and can last from 6 to 12 months, depending on the specific agreement between the broker and the client. Termination clauses specify conditions under which either party may end the agreement, often requiring a written notice period ranging from 30 to 90 days. Events that may trigger termination include failure to meet performance benchmarks, breach of contract, or mutual consent. Additionally, provisions may allow for termination under specific circumstances such as insolvency or significant changes in market conditions. Clear definitions of the duration, termination process, and conditions should be outlined to ensure both parties fully understand their rights and obligations during the course of the brokerage relationship.

Confidentiality and Non-disclosure

Confidentiality and non-disclosure agreements (NDAs) are essential in the realm of commercial brokerage to protect sensitive information shared between parties involved in transactions. These agreements ensure that confidential information, such as client lists, proprietary financial data, trade secrets, and strategies, remains secure and undisclosed to third parties. Penalties for breach of confidentiality can include legal action, financial restitution, and damage to professional relationships. Effective NDAs typically delineate the scope of confidentiality, duration (often ranging from one to five years), and specific exclusions, such as information already in the public domain or independently obtained data. It is crucial for both brokers and clients to fully understand and comply with these stipulations to foster trust and facilitate smooth commercial dealings.

Letter Template For Commercial Brokerage Agreement Samples

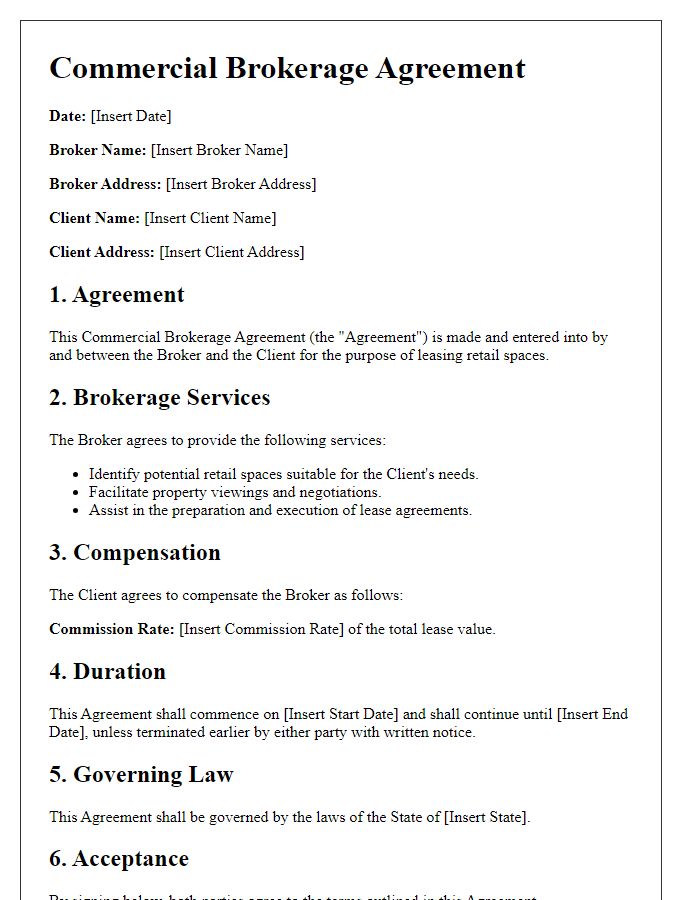

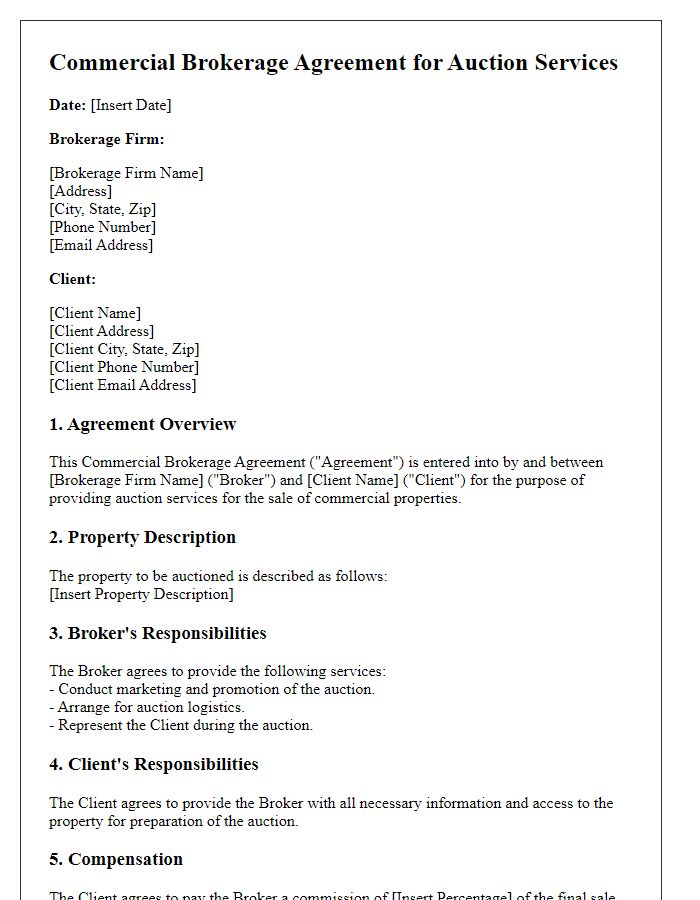

Letter template of Commercial Brokerage Agreement for Real Estate Transactions

Letter template of Commercial Brokerage Agreement for Lease Negotiations

Letter template of Commercial Brokerage Agreement for Property Management Services

Letter template of Commercial Brokerage Agreement for Investment Properties

Letter template of Commercial Brokerage Agreement for Franchise Development

Letter template of Commercial Brokerage Agreement for Mergers and Acquisitions

Letter template of Commercial Brokerage Agreement for Industrial Properties

Comments