Are you feeling overwhelmed by the idea of creating a personal financial statement? You're not aloneâmany people find the process daunting, but it doesn't have to be! With the right approach and a clear template, you can easily present your financial information in an organized manner. Grab a cup of coffee and let's dive into how to craft the perfect personal financial statement that showcases your fiscal healthâkeep reading to discover more!

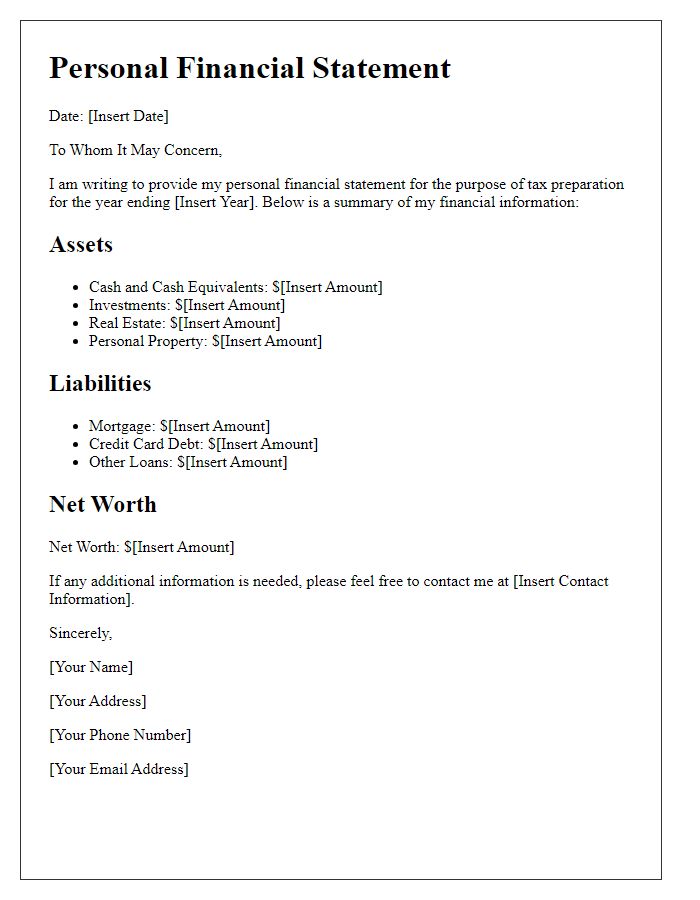

Contact Information

Contact information serves as the primary means of communication in a personal financial statement. It typically includes full name, residential address (often including street number and name, city, state, and zip code), phone number, and email address. Providing accurate contact information is essential for potential lenders or financial advisors to reach the individual easily. Clarity in this section ensures all parties involved can establish a connection, addressing inquiries related to finances, investments, or credit. Additionally, listing a reliable secondary contact method, such as a secondary email or phone number, enhances accessibility and reflects professionalism in financial documentation.

Statement of Purpose

A personal financial statement serves as a comprehensive overview of an individual's financial health, detailing assets, liabilities, income, and expenses. This document is essential for various purposes, including loan applications, investment evaluations, and budgeting analysis. Typically, it includes key financial figures such as net worth (the difference between total assets and total liabilities), monthly income from sources like employment and investments, and ongoing expenses such as mortgage payments or rent. By assessing these figures, individuals can gain valuable insights into their financial standing, identify areas for improvement, and outline goals for future financial planning. A personal financial statement is a crucial tool in achieving financial literacy and stability.

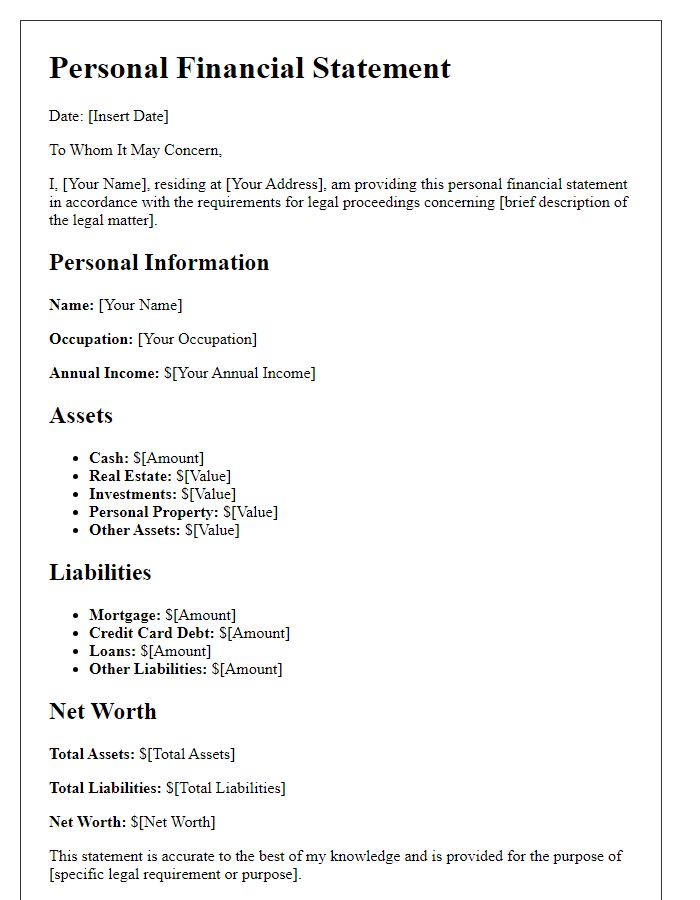

Financial Summary

A personal financial statement provides an overview of an individual's financial position at a specific point in time. This summary typically includes detailed sections such as assets, liabilities, and net worth. Assets can encompass real estate, stocks, savings accounts, and personal property, while liabilities may include mortgages, credit card debts, and loans. The net worth is calculated by subtracting total liabilities from total assets, revealing the individual's financial health. For example, an individual owning a house valued at $300,000, savings of $50,000, and investments worth $100,000 would list these in their assets. If liabilities total $150,000, the net worth stands at $300,000 - $150,000 = $150,000. This statement serves as a crucial tool for financial planning, lending applications, and personal assessments of financial growth over time.

Asset Details

Personal financial statements provide a snapshot of an individual's financial health by detailing assets, liabilities, and net worth. Assets typically include cash and cash equivalents such as savings accounts, checking accounts, and certificates of deposit, which together may total thousands of dollars. Investments may encompass stocks, bonds, mutual funds, and real estate holdings, each varying widely in market value, often articulated through up-to-date evaluations or brokerage statements. Personal property such as vehicles, valuable collectibles, or electronics should also be documented with their estimated fair market values to reflect true worth. Additionally, retirement accounts including 401(k)s or IRAs should be listed, showcasing accumulated funds often amounting to significant sums intended for future financial security. Accurate documentation of each asset not only supports financial planning but also aids in assessing overall wealth and financial stability.

Liability Overview

A liability overview is essential for understanding the total obligations of an individual or business. This section outlines various financial responsibilities, including mortgages, personal loans, credit card debts, and any other outstanding commitments. When detailing liabilities, it is important to include key information such as the total amount owed, interest rates, and payment due dates. Outstanding mortgage balances on properties, for example, can significantly influence overall financial health. Additionally, reflecting on student loan obligations, car loans, or business debts can provide a comprehensive view of one's financial standing. Proper analysis can aid in identifying areas for improvement, budgeting strategies, and potential financial planning needs.

Letter Template For Personal Financial Statement Samples

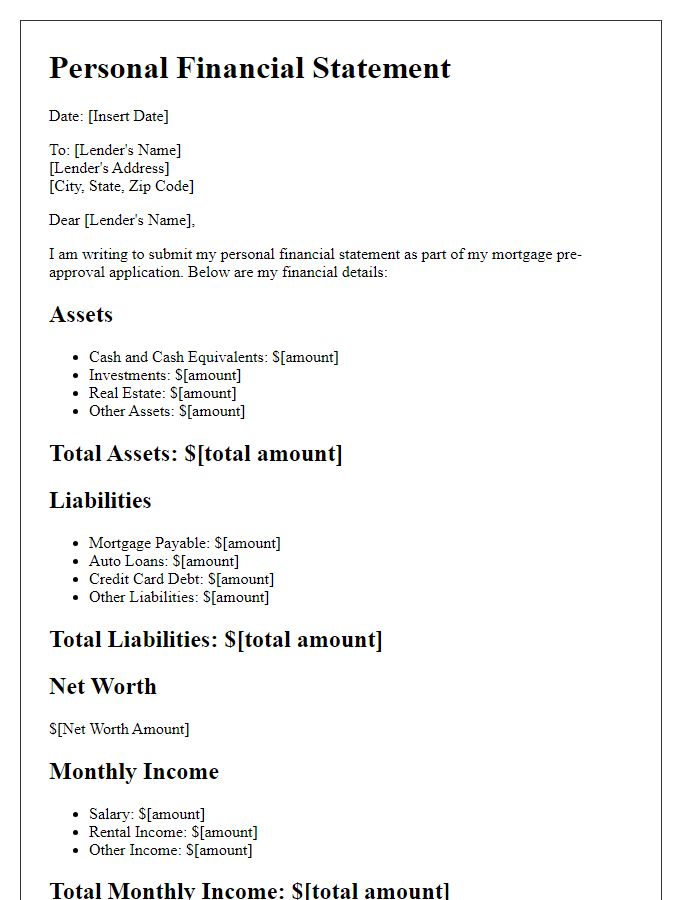

Letter template of personal financial statement for mortgage pre-approval.

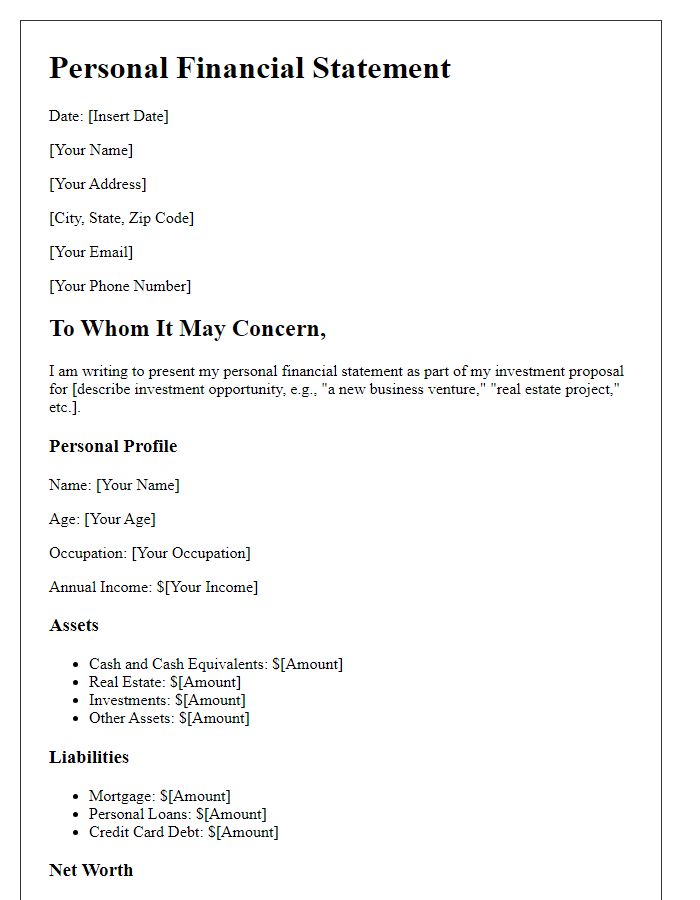

Letter template of personal financial statement for investment proposal.

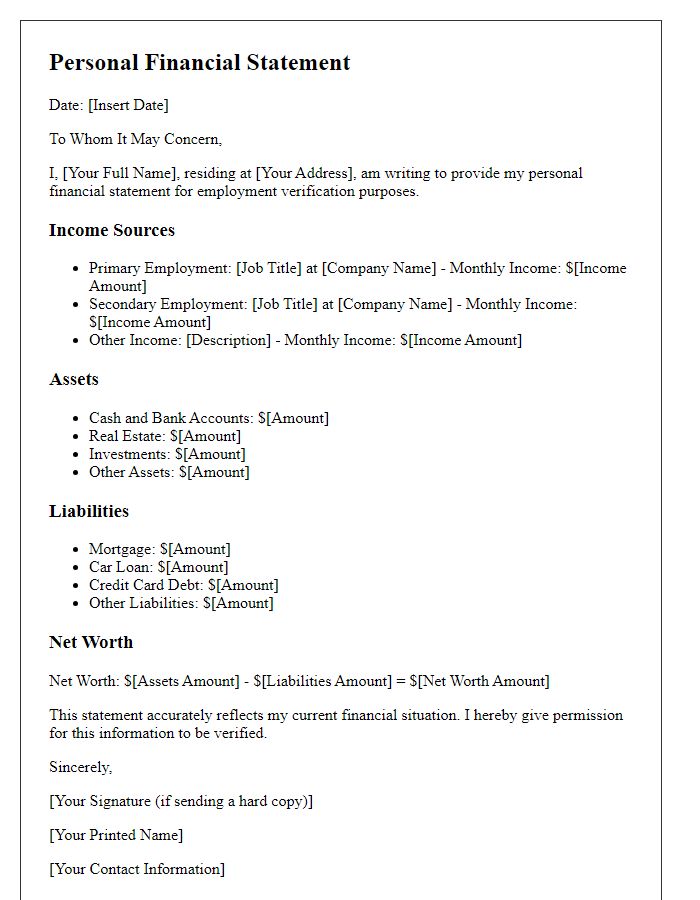

Letter template of personal financial statement for employment verification.

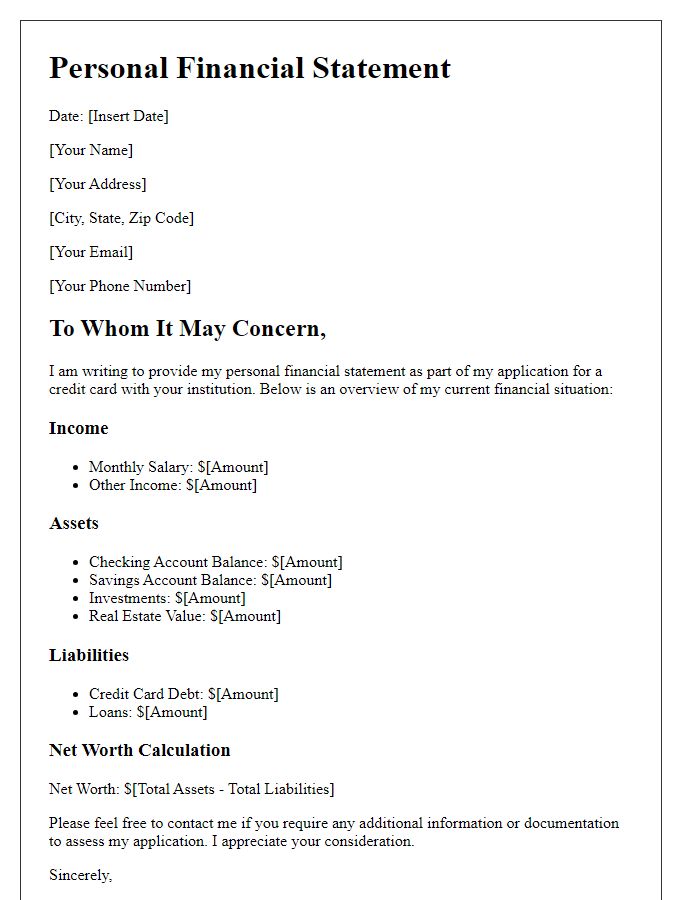

Letter template of personal financial statement for credit card application.

Letter template of personal financial statement for scholarship consideration.

Letter template of personal financial statement for business partnership.

Comments