Hey there! Keeping track of your finances can sometimes feel overwhelming, but staying up-to-date with your account balance is key to managing your budget effectively. In this article, we'll provide you with a comprehensive letter template that makes it easy to communicate any account balance changes. So, if you're ready to simplify your financial correspondence, let's dive in and explore the details!

Personalization

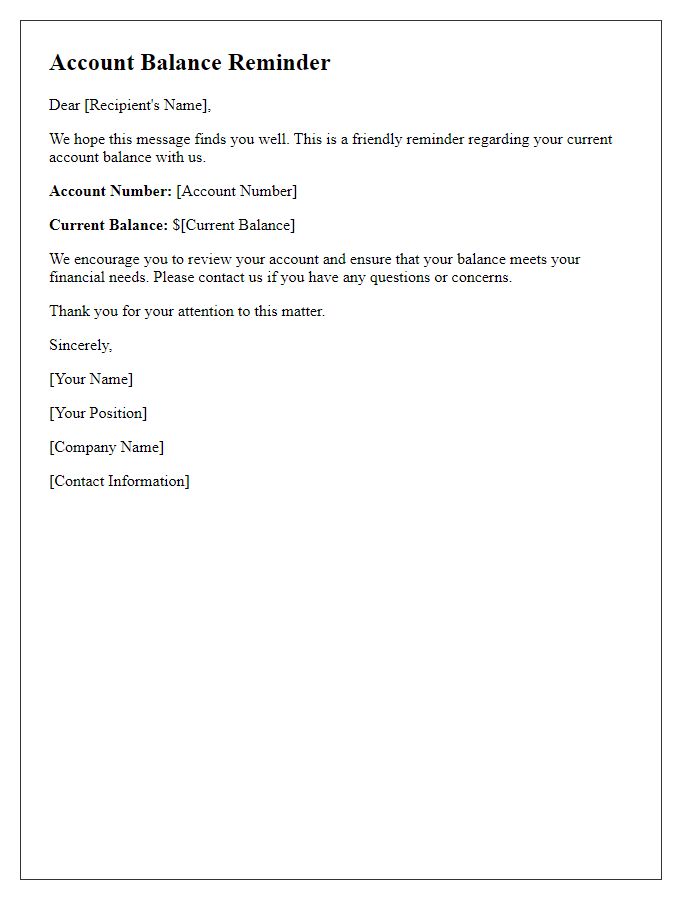

An account balance update can significantly enhance customer engagement when personalized effectively. This type of communication typically includes relevant account information, such as current balance figures, recent transactions, and spending insights. It can also feature tailored recommendations for financial products or services, encouraging users to explore options that align with their financial activities. Additionally, highlighting key dates, such as payment due dates or upcoming fees (for example, annual fees that may be incurred in November) can aid in better financial planning. Using the customer's name and referencing their preferred communication method can further increase receptiveness to the message, ultimately fostering a stronger relationship between the customer and the financial institution.

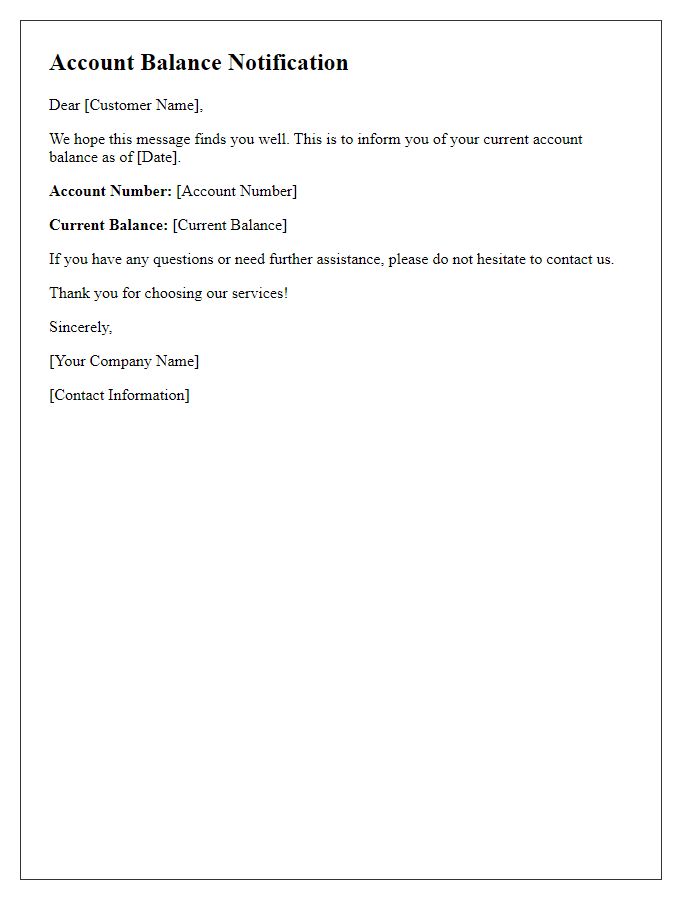

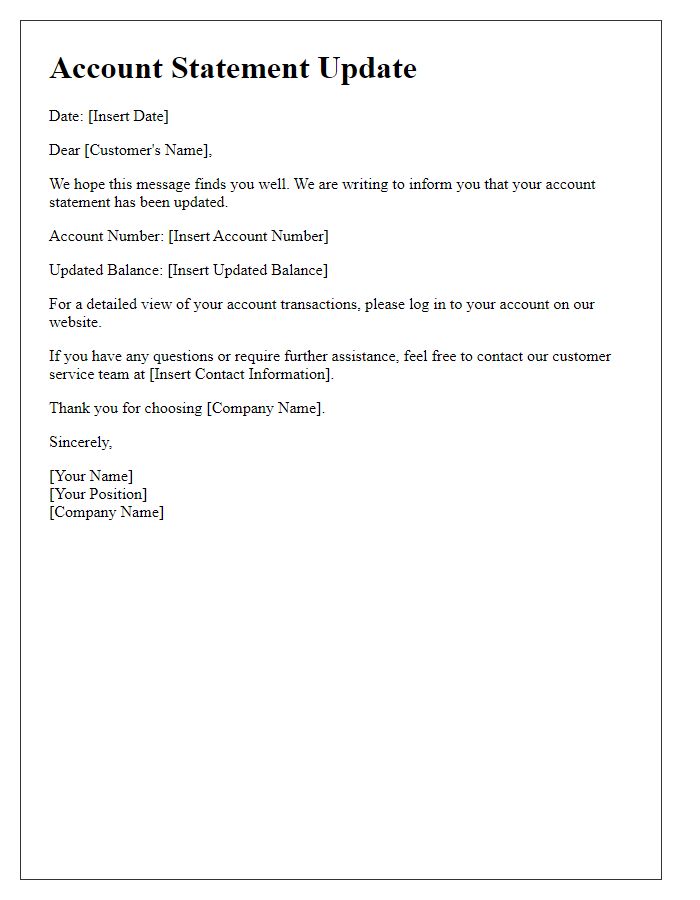

Clear subject line

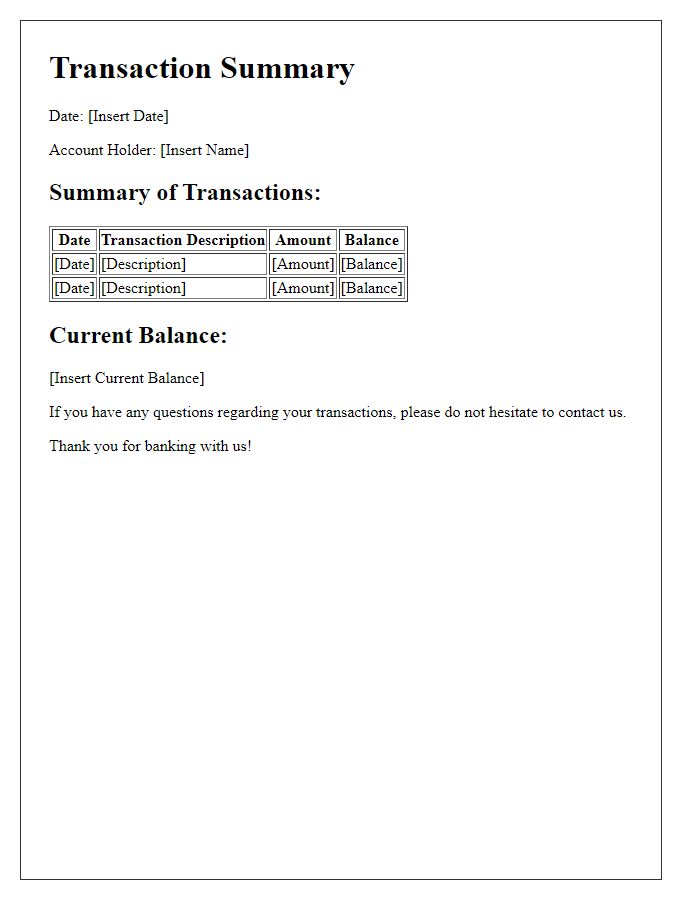

Account balance updates provide crucial information regarding financial status. Regular notifications include current balance figures, transaction summaries, and any pending charges that may affect available funds. Users can track their financial history, identify unusual activities, and make informed decisions to manage their finances effectively. Financial institutions often utilize email formats with clear subject lines, such as "Your Current Account Balance Update" or "Monthly Balance Statement," to ensure immediate recognition and prompt attention. Automated systems send these updates frequently, helping users maintain awareness of their monetary situation.

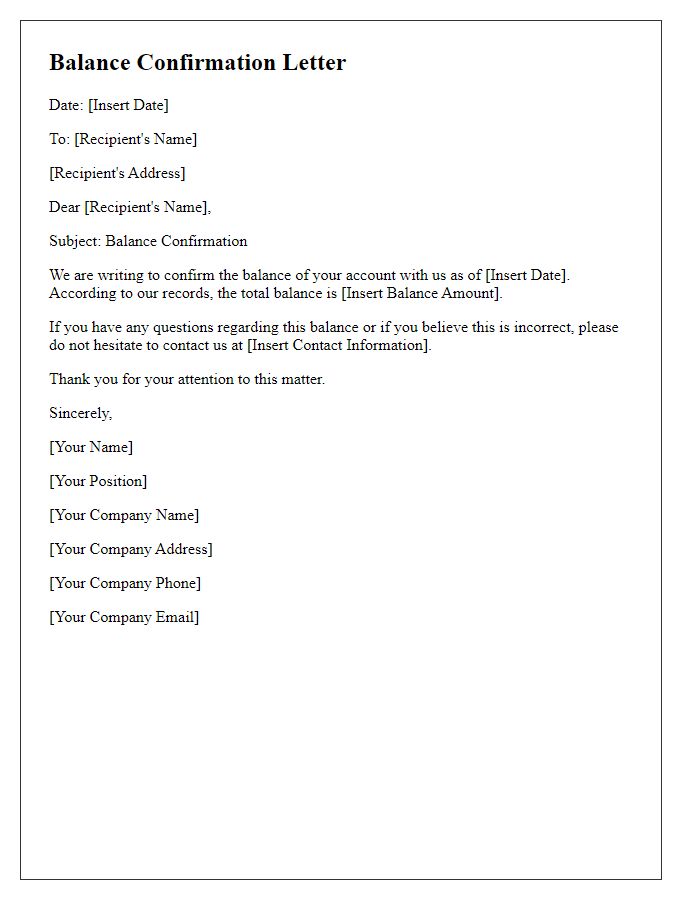

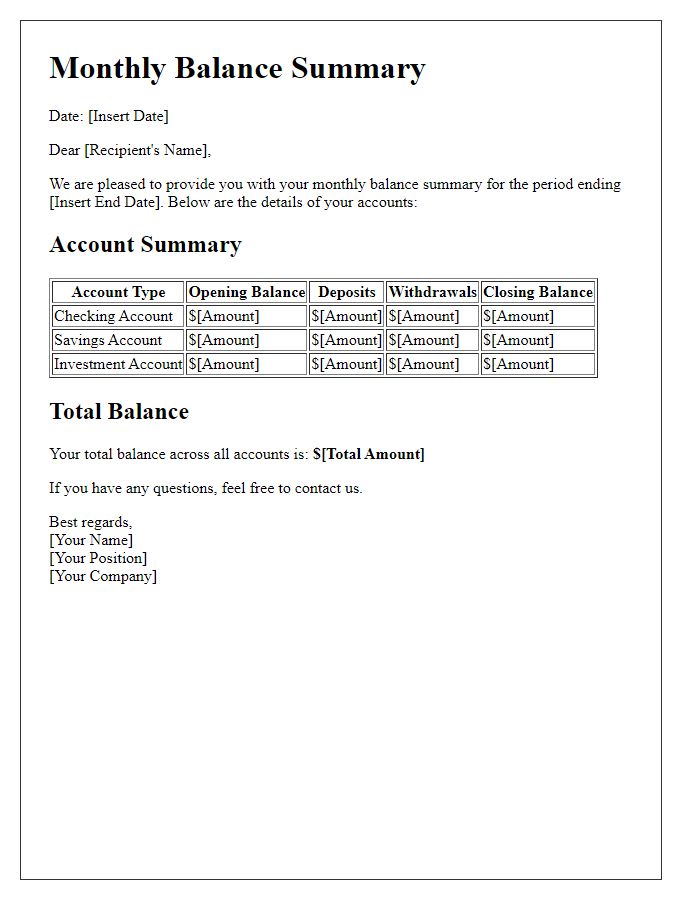

Accurate balance details

An accurate account balance update is crucial for financial transparency and management. Account balance refers to the amount of money available in a financial account, such as a bank account or investment portfolio. Regular updates, often provided on a monthly basis, allow users to track expenditures and deposits, ensuring fiscal responsibility. Statements typically include key figures - total assets, liabilities, and recent transactions - providing a comprehensive overview of financial health. Institutions like Bank of America or Chase use secure systems to maintain this information, emphasizing data accuracy and cybersecurity to protect client details. Understanding current balance figures (as of the latest statement date) plays a critical role in planning for expenses and investments.

Contact information

Account balance updates provide essential financial information to individuals and businesses. These updates typically include current figures reflecting funds available in checking accounts, savings accounts, or investment portfolios. Account holders may receive notifications periodically through various channels such as email, SMS alerts, or physical mail. For personal accounts, details like account numbers or customer identification can enhance security and clarity, while businesses may require tailored reports that summarize cash flow, outstanding invoices, and expenditures. Regular account balance updates ensure informed decision-making regarding spending, savings, and financial planning.

Call to action

A recent account balance update can significantly influence customer financial awareness, promoting proactive management of personal finances. Individuals receiving monthly statements from financial institutions, such as banks or credit unions, should prioritize reviewing their current balance and recent transactions. Regularly monitoring account activity mitigates the risk of overdrafts or unauthorized charges, fostering better budgeting habits. It is essential to encourage recipients to log into their online banking portal or mobile app to access real-time information regarding their account balance. Additionally, setting up alerts for low balances or unusual transactions can enhance security and facilitate timely financial decision-making.

Comments