Are you navigating the world of debt verification and compliance? If so, you're not alone! Many individuals and businesses face the complexities of ensuring their debts are accurately documented and legally validated. In this article, we'll explore a simple yet effective letter template designed to help you assert your rights and seek the necessary verificationâso keep reading to find out how you can take your first step toward financial clarity!

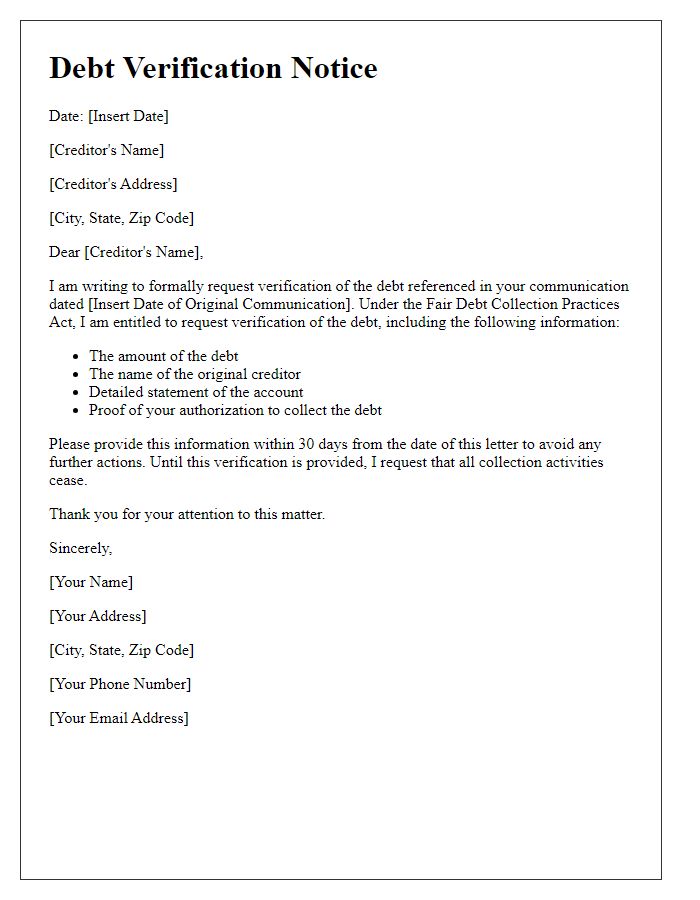

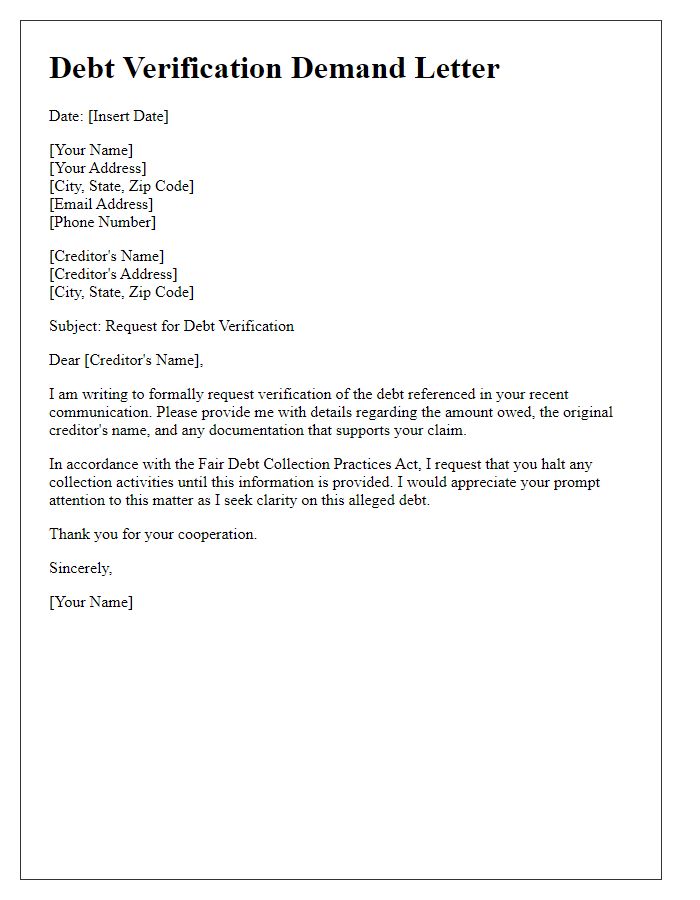

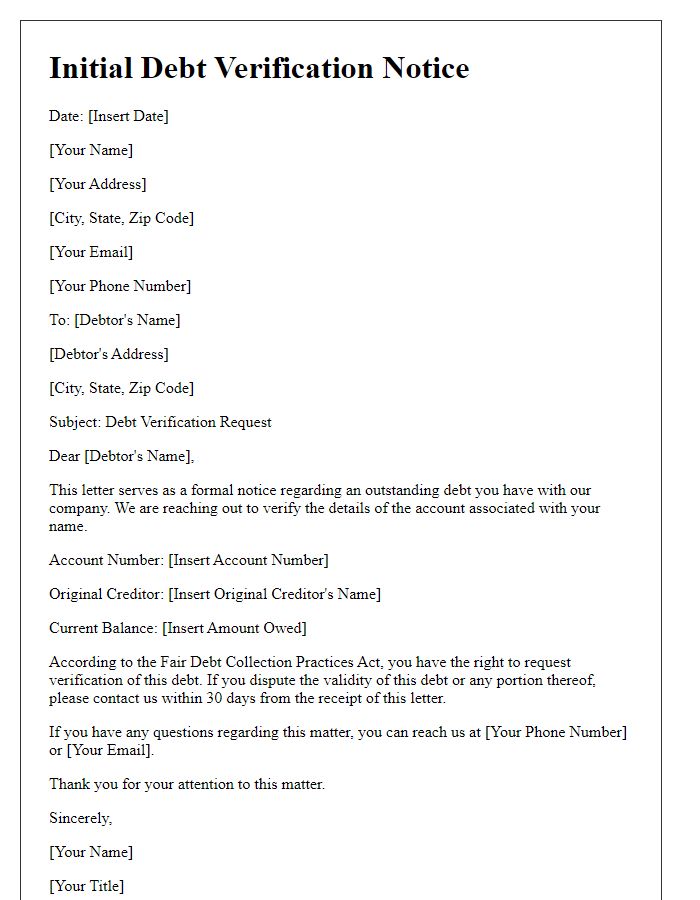

Creditor and Debtor Information

Debt verification plays a critical role in ensuring accurate communication between creditors and debtors throughout the collection process. The creditor (the entity or individual to whom money is owed) typically includes their name, address, and contact details (often a telephone number) in the documentation. The debtor (the individual or organization responsible for the debt) will provide similar information, including their full name, address, and any relevant account numbers associated with the outstanding amount. Detailed notes on the loan amount (total owed), original creditor's name, date of default (when the account became overdue), and relevant account history may be crucial for compliance with the Fair Debt Collection Practices Act (FDCPA). Accurate details can facilitate the verification of claims, ensuring that both parties have a clear understanding of the obligations, rights, and responsibilities involved. Compliance with legal regulations is paramount to maintaining transparency and trust in financial transactions.

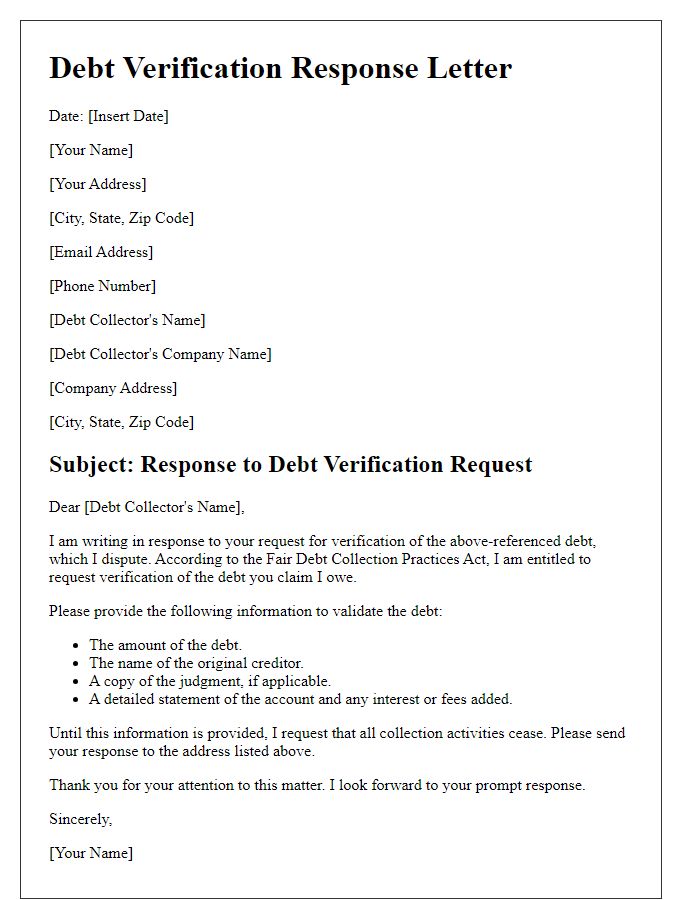

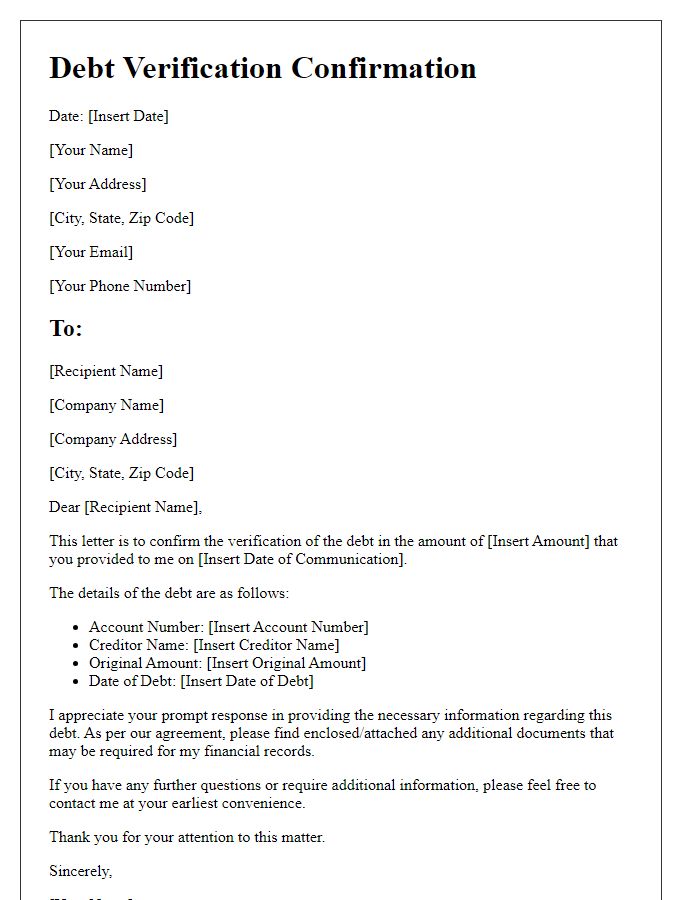

Amount Owed and Account Details

Debt verification compliance requires a clear representation of the outstanding balance and account specifics. The total amount owed, whether it is $1,500 or a higher sum, including principal, interest, and any fees, needs precise documentation. Each account detail, such as the original creditor's name (for instance, Chase Bank), account number (e.g., 123456789), and date of delinquency (e.g., October 15, 2022), should be explicitly stated. Providing accurate information about any specific agreements or payment plans (like a 6-month installment plan) enhances transparency. Compliance with regulations such as the Fair Debt Collection Practices Act is essential, ensuring consumers' rights are protected throughout the verification process.

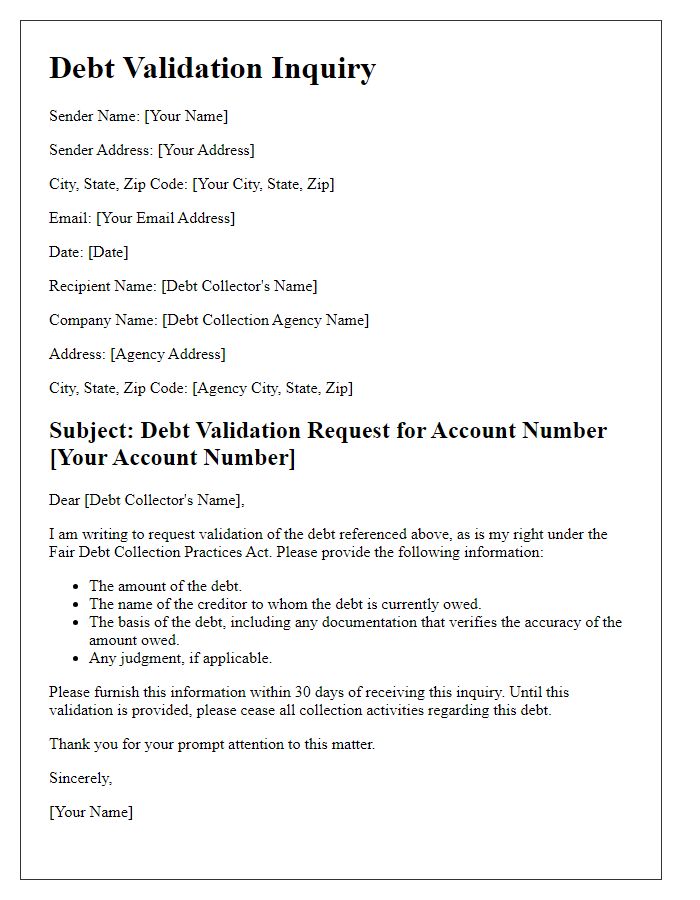

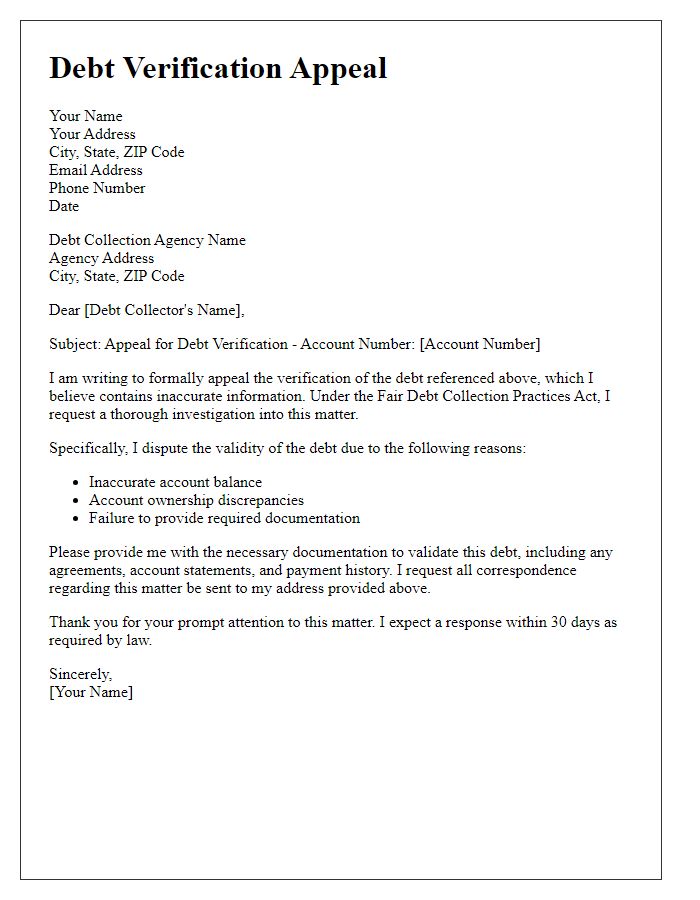

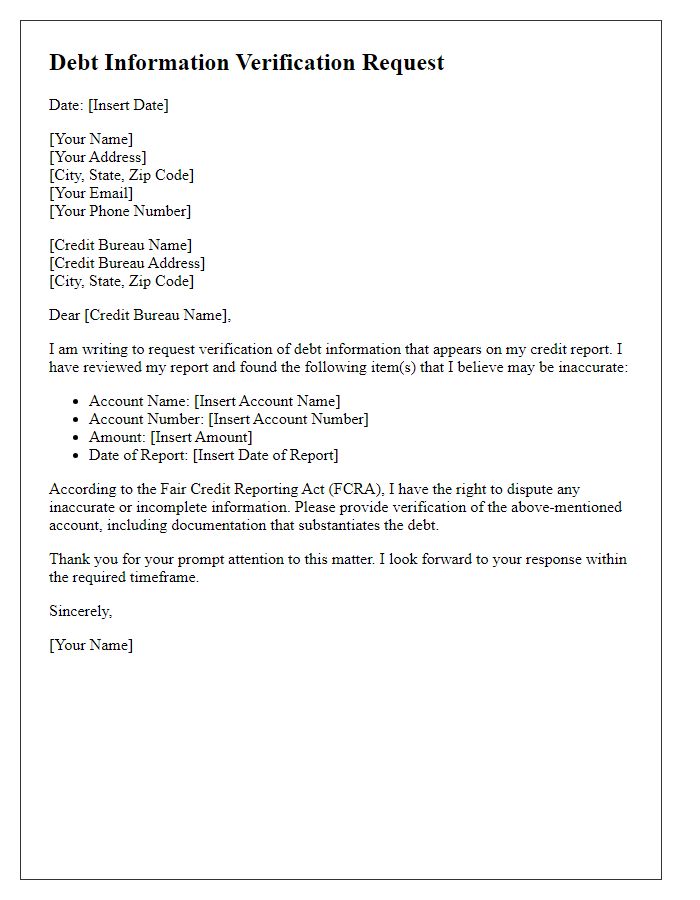

Debt Validation Statement

Debt validation statements serve as formal communication from creditors to consumers, ensuring compliance with the Fair Debt Collection Practices Act (FDCPA) guidelines. These documents must include essential details such as the total amount owed, specific creditor name, and account number, aiding in clear identification of the debt in question. The statement should also provide information about the consumer's rights, including the right to dispute the debt and request further validation, typically within 30 days of receipt. Additionally, a physical address for the creditor or collection agency, such as a prominent financial institution or agency, is necessary for transparency and accountability. By including these crucial components, debt validation statements uphold legal standards while fostering a fair process for individuals facing financial challenges.

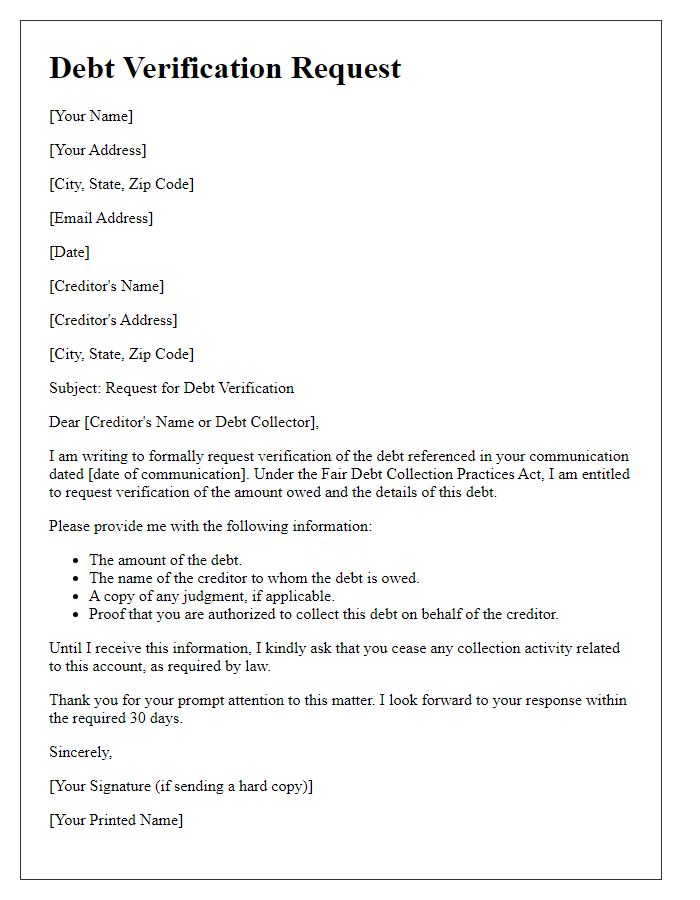

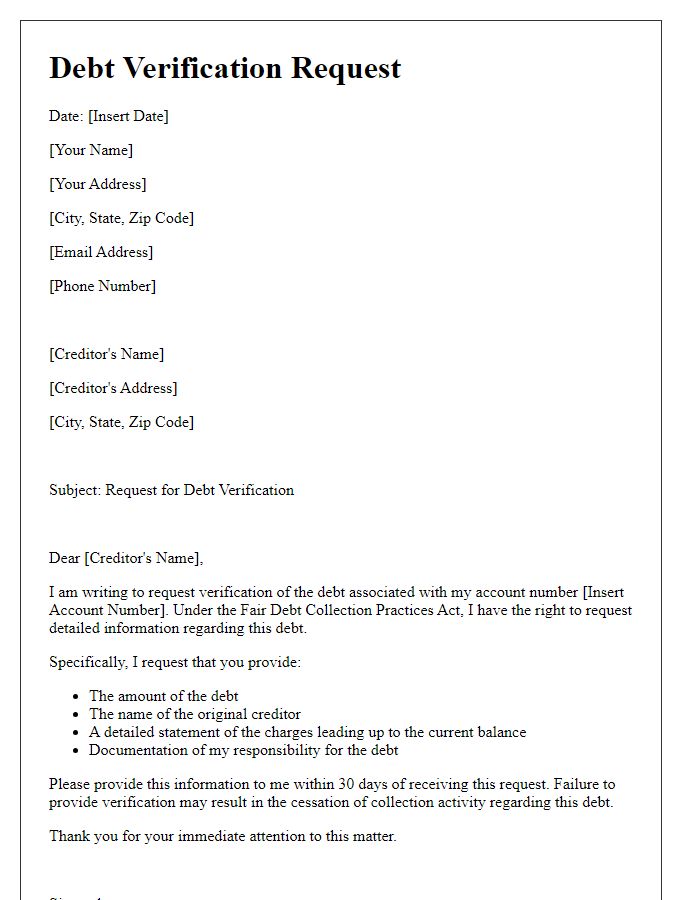

Verification Documents Request

Debt verification processes are essential for maintaining consumer protection and ensuring accuracy in financial transactions. Debt collectors must comply with the Fair Debt Collection Practices Act (FDCPA) guidelines, which provide consumers with the right to request documentation verifying the legitimacy of debts. Relevant verification documents often include detailed account statements, original creditor information, and payment history. These documents serve to substantiate the claim and clarify any discrepancies that might exist. Consumers can formally request verification through a written communication, asserting their rights to confirm the authenticity of debts and ensuring that collectors adhere to legal obligations.

Contact Information for Communication

Debt verification compliance requires clear and effective communication. Providing precise contact information is essential for facilitating this process. Include the debtor's full name associated with the debt account, mailing address for formal correspondence, and a valid phone number for quick inquiries. Additionally, an email address can expedite communication regarding dispute resolutions or verification requests. For correspondence regarding the debt amount (for example, $2,500 from ABC Collections Agency), ensure to reference the specific account number to prevent confusion. Clearly stated office hours of availability (typically 9 AM to 5 PM, Monday through Friday) help set expectations for response times. Proper alignment of this information with compliance regulations ensures all parties maintain transparency and adhere to legal obligations.

Comments