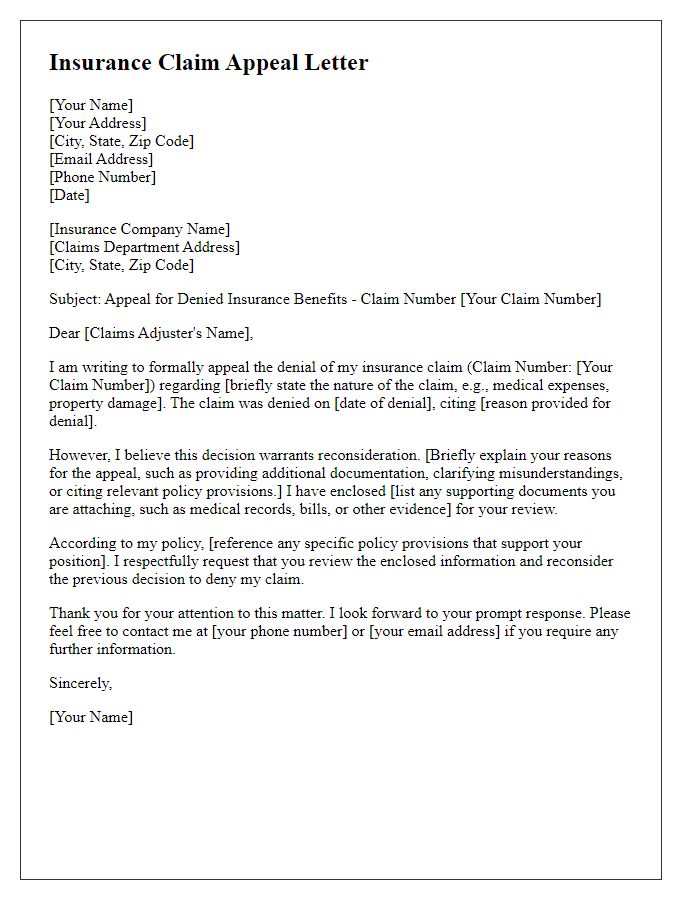

When it comes to filing an insurance claim, the process can often feel overwhelming and frustrating. Knowing the right steps to take can make all the difference, and having a well-crafted letter is crucial in ensuring your claim gets the attention it deserves. By understanding the key components of a successful claims letter, you're one step closer to recovering what you're entitled to. So, if you're ready to dive in and learn how to write an effective insurance claim recovery letter, keep reading!

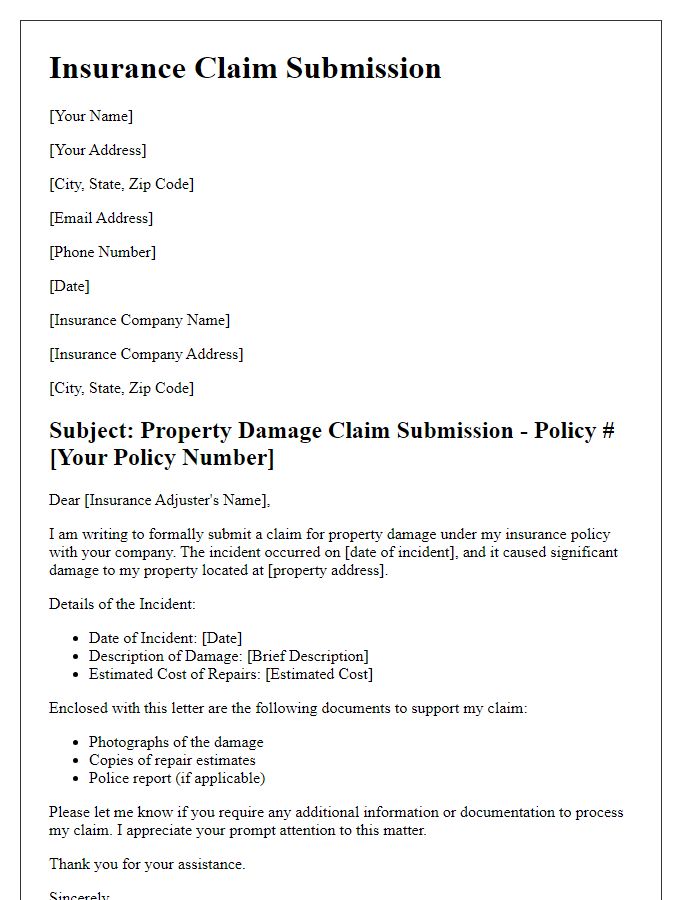

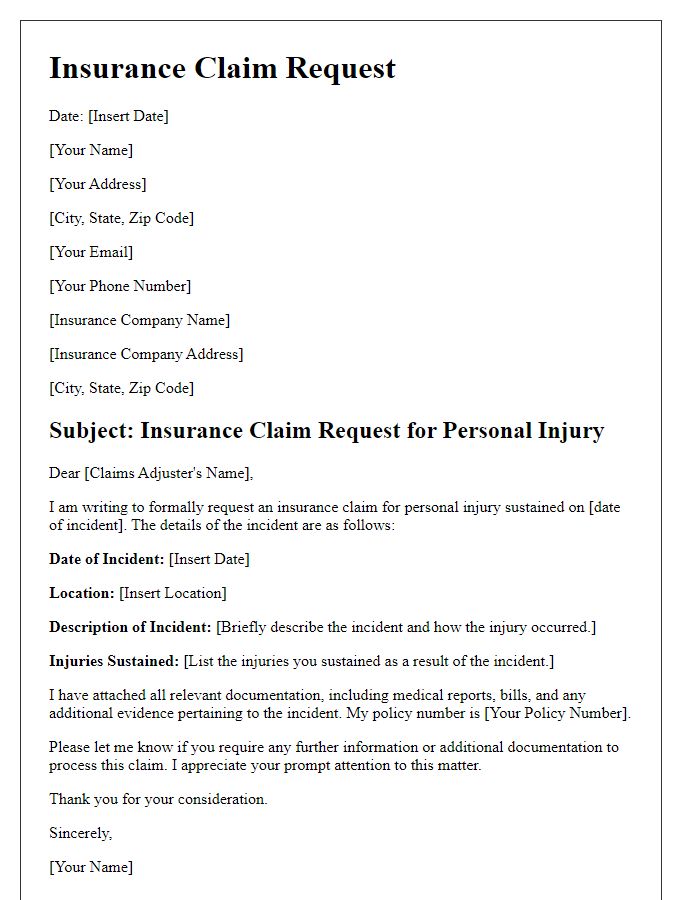

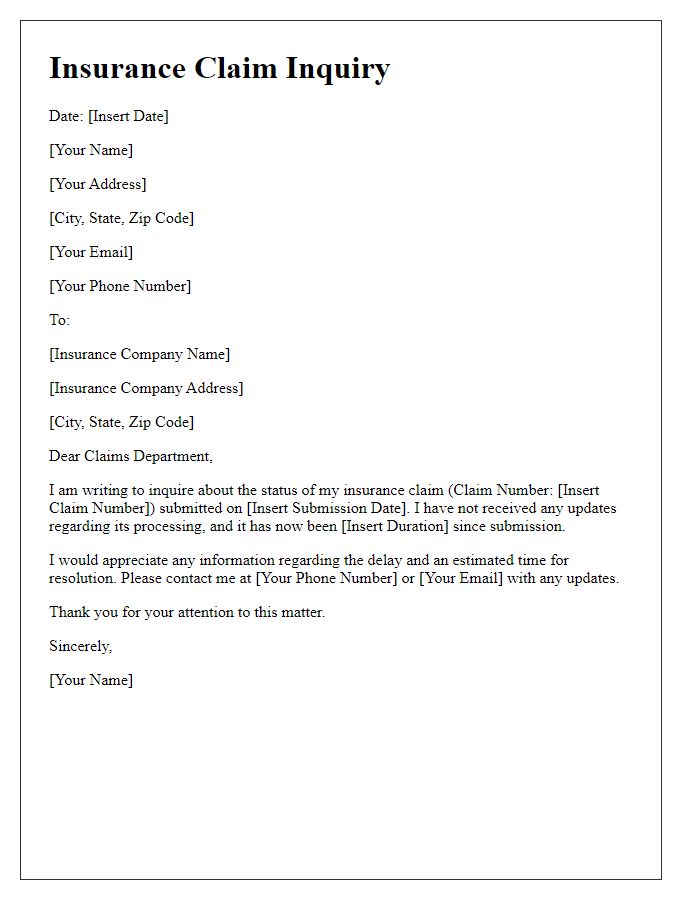

Claimant Information

Claimant information is crucial for processing insurance claims efficiently. Accurate details such as name (Johnathan Smith), address (123 Maple Street, Springfield, IL 62704), contact number (555-123-4567), policy number (ABC123456), and date of loss (October 15, 2023) should be clearly outlined. Additionally, specifying the type of claim (property damage, health insurance) and including relevant identification documents (driver's license, police report) enhances the clarity of the submission. This comprehensive information assists insurance adjusters in verifying claims and expediting recovery processes. Accurate claimant information minimizes delays in processing and maximizes the likelihood of successful reimbursement.

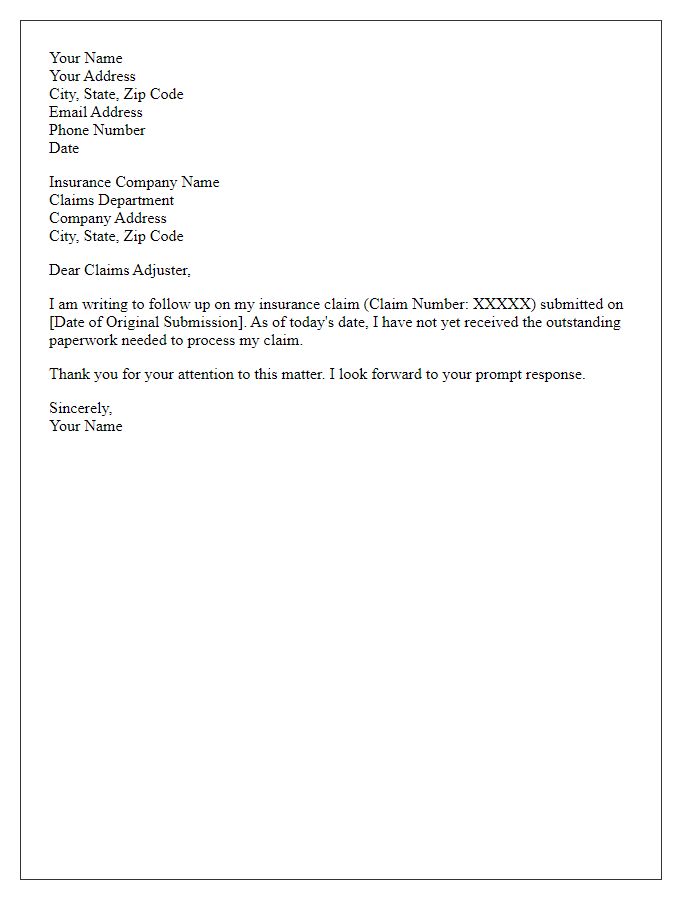

Incident Details

A comprehensive insurance claim recovery process requires detailed incident documentation. For example, on June 15, 2023, an automobile collision occurred at the intersection of Fifth Avenue and Main Street in New York City, involving a blue 2019 Honda Accord and a red 2020 Ford F-150. The accident resulted in property damage exceeding $15,000, with injuries sustained by two individuals, necessitating immediate medical attention at Lenox Hill Hospital. The responding NYPD officers filed an accident report (Report No: 123456) outlining witness statements and photographic evidence. Additionally, traffic conditions were noted as congested due to ongoing construction work, creating hazardous circumstances contributing to the incident. Accurate documentation of these details assists in facilitating timely recovery of claims from the insurance provider.

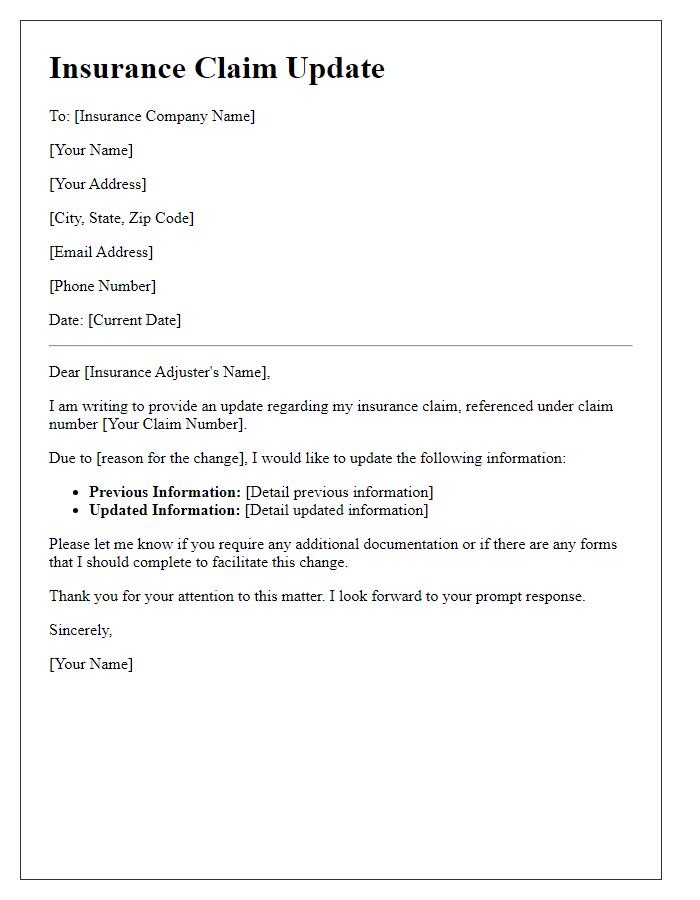

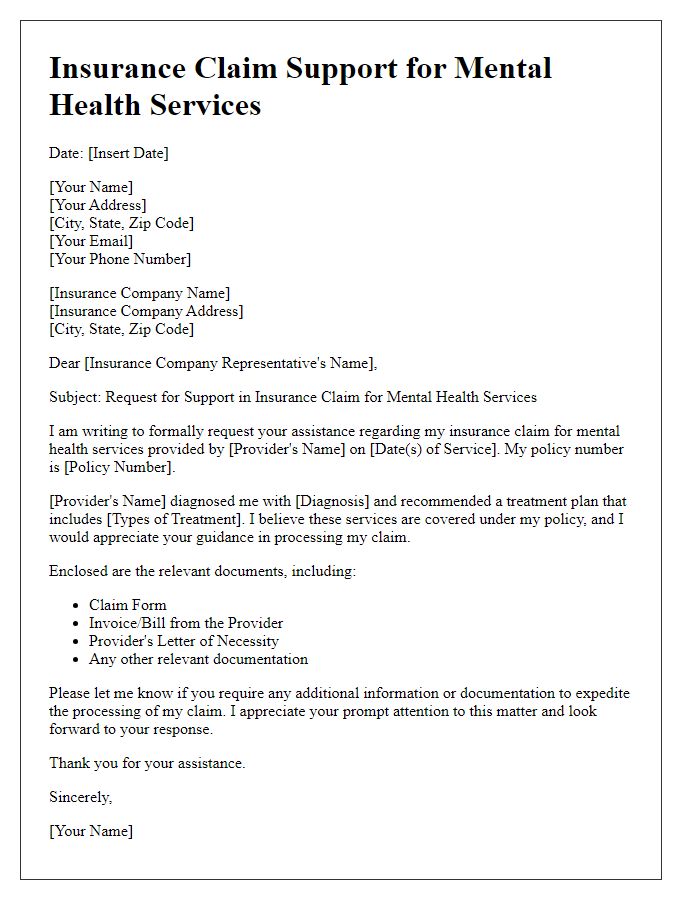

Policy Information

Insurance claims can involve intricate details specific to the policyholder's situation. In the realm of insurance recoveries, policy information encapsulates crucial elements. Policy numbers (typically a combination of letters and numbers), policyholders' names, and dates of issuance define the coverage scope. Types of coverage, such as comprehensive, collision, or liability, delineate the extent of protection. Important dates like the incident date and claim submission date affect claims processing timelines. Each insurance provider, like State Farm or Allstate, has distinct protocols for evaluating claims. Documenting thorough policy information aids efficient communication with insurers, enhancing claim recovery success rates.

Supporting Documents

Insurance claims require supporting documents to validate losses and expedite recovery processes. Essential documents include detailed incident reports, such as police reports (for accidents or thefts), which provide official accounts and witness statements. Photographic evidence captures damage to property or injury, serving as visual proof of claims. Receipts or invoices of losses, such as repair bills or medical expenses, substantiate the financial impact experienced due to the incident. Policy documentation, including copies of the insurance policy (highlighting coverage limits), and prior correspondence with the insurance company ensure clarity regarding policyholder rights and responsibilities, streamlining the claims review process.

Contact Information

To successfully recover an insurance claim, providing clear and comprehensive contact information is crucial. Ensure your policy number, often a series of digits identifying your specific policy, is included prominently. Full name should encompass first name, middle initial, and last name for clarity. Include a physical address, such as a street address followed by city, state, and zip code, aiding in location verification. Phone numbers must be current, preferably a mobile number for immediate communication, plus any alternate numbers for backup. An email address offers an additional communication method, allowing for electronic correspondence and documentation exchange. Including these details ensures prompt and efficient processing of your insurance claim.

Comments