Are you feeling overwhelmed by financial pressures and unsure how to communicate your situation? Crafting a letter to declare your financial hardship can be a crucial step in seeking the support you need. In this article, we'll guide you through the process of writing an effective letter that clearly outlines your circumstances and demonstrates your need for assistance. So, let's dive in and explore how you can articulate your message with confidenceâread on to discover valuable tips!

Introduction and Personal Information

Financial hardship declarations are essential documents for individuals facing economic challenges, such as job loss or medical emergencies. Personal information, including full name, current address, date of birth (typically formatted as MM/DD/YYYY), and social security number (with the last four digits highlighted for security), is crucial in verifying identity and ensuring the accuracy of the financial claim. Additionally, a brief overview of the financial situation, such as recent unemployment or unexpected medical expenses, helps set the context for the hardship being experienced. Supporting details, like monthly income figures or outstanding debt amounts, can further substantiate the claims made in the declaration.

Description of Financial Hardship Situation

Financial hardship can significantly impact individuals and families, particularly when unforeseen events arise, such as job loss or medical emergencies. A sudden unemployment situation, reflecting a 25% decrease in household income, can result from company downsizing or layoffs occurring during economic downturns. Medical costs for critical illnesses, averaging $8,000 annually, can compound financial strain, leading to insurmountable debt. Rent prices in metropolitan areas, often exceeding $2,500 monthly, can further challenge budgets, while essential expenses such as utilities and groceries can consume over 60% of available funds. These factors combined create an overwhelming financial burden, making timely payments for obligations increasingly difficult to maintain, necessitating discussions with creditors or assistance programs.

Explanation of Efforts Made to Address Situation

A financial hardship declaration typically involves a detailed account of the steps taken to alleviate one's financial difficulties. Individuals facing economic challenges often explore various methods, such as negotiating payment plans with creditors, seeking additional employment opportunities, or applying for governmental assistance programs such as food stamps or housing support. Many also consider budgeting strategies by creating detailed monthly expense reports to identify areas to cut back on discretionary spending. Utilizing community resources such as local food banks, welfare agencies, or nonprofit organizations can provide essential support during tough times. Documenting these efforts is essential for lenders or support agencies to understand the individual's commitment to resolving their financial issues and to assess their eligibility for assistance programs designed to provide relief in difficult situations.

Request for Specific Assistance or Consideration

A financial hardship declaration serves as a formal acknowledgment of one's inability to meet financial obligations due to specific adverse circumstances. Individuals facing unemployment can report significant income loss, illustrated by a reduction of 50% from a previous monthly salary of $4,000. Events such as medical emergencies, like a major surgery resulting in unexpected expenses of $15,000, can exacerbate financial difficulties. Additionally, unexpected expenses from home repairs due to natural disasters, such as a flood causing damages exceeding $20,000, can further strain an individual's finances. Places where one lives, like urban areas with high living costs, can amplify the burden of limited income. Requesting assistance from organizations, such as local non-profits or government programs, can provide vital resources in times of crisis.

Closing and Contact Information

In dire financial hardship situations, individuals may need to take proactive steps to communicate their circumstances formally to institutions. Providing thorough context about income reductions, significant expenses, or unexpected financial setbacks is crucial. Organizations or entities requiring this information often include banks, government agencies, or universities. The closing section should reinforce the importance of the written declaration, expressing desire for understanding and assistance. Contact details such as phone numbers, emails, and mailing addresses should be clearly listed, ensuring efficient communication moving forward. Transparency and clarity in these communications can help facilitate necessary adjustments or support.

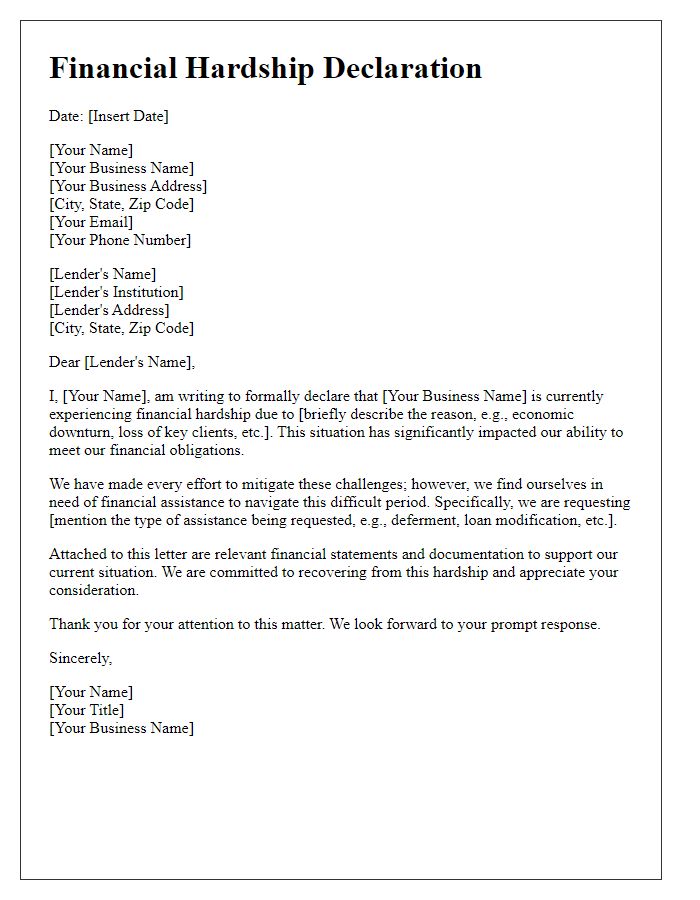

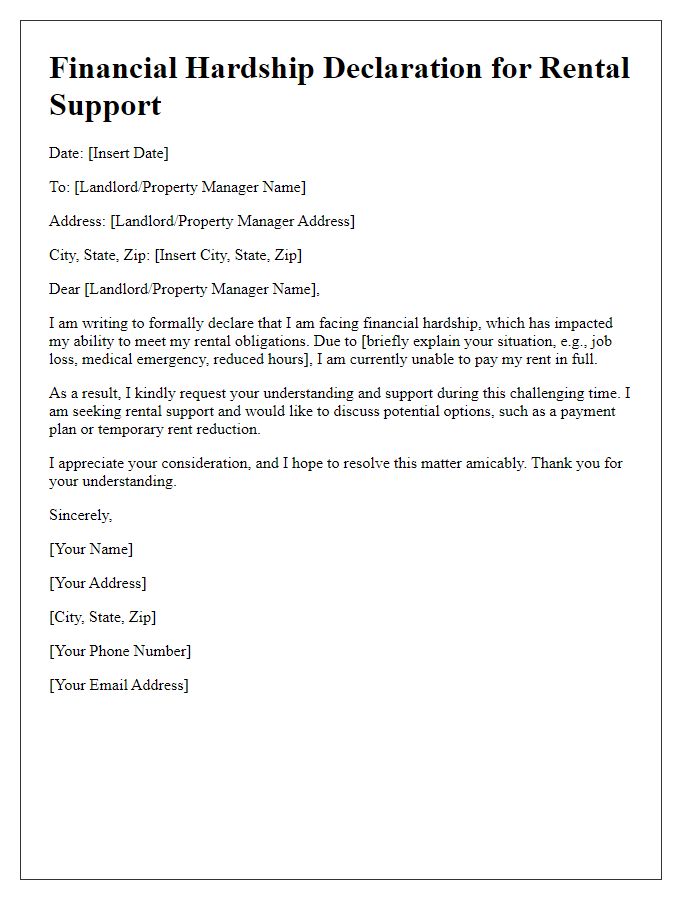

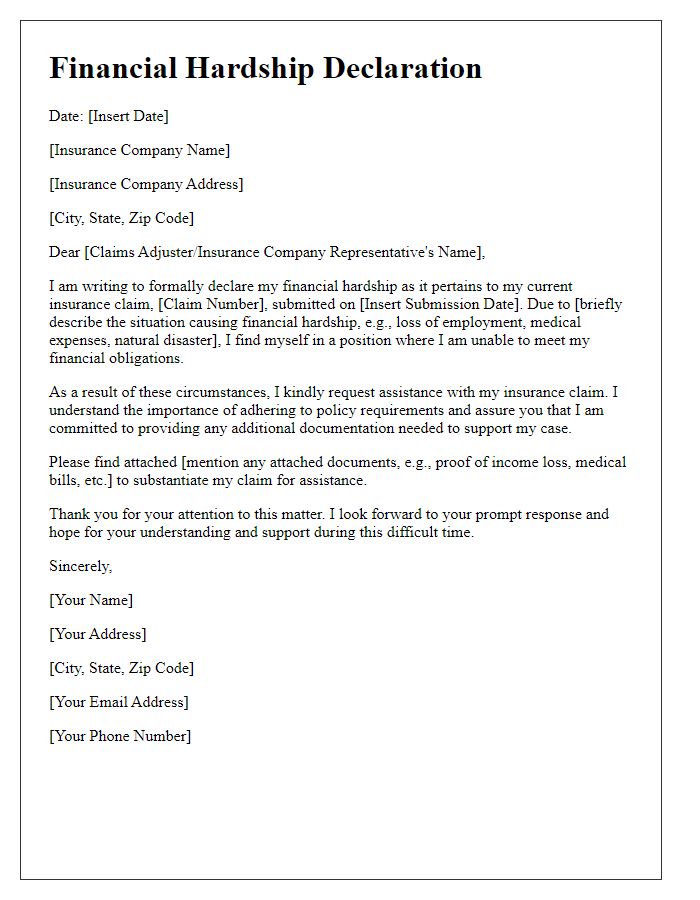

Letter Template For Financial Hardship Declaration Samples

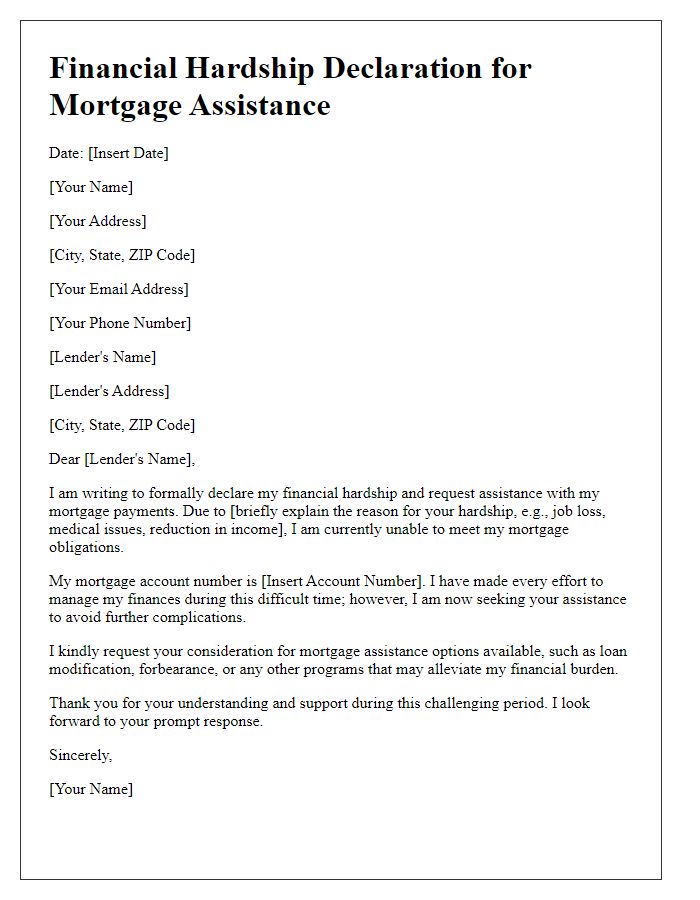

Letter template of financial hardship declaration for mortgage assistance

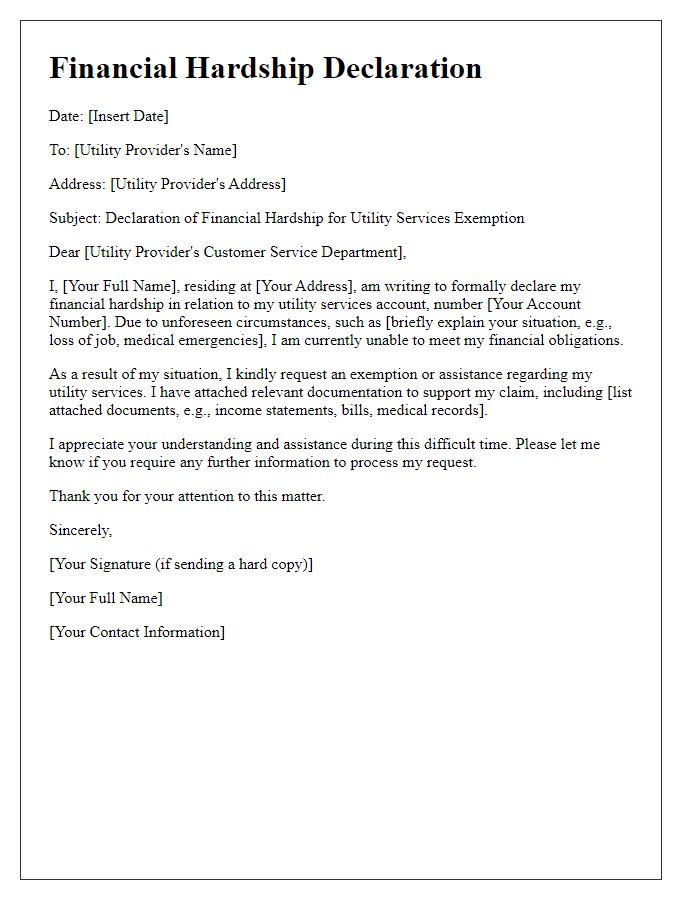

Letter template of financial hardship declaration for utility services exemption

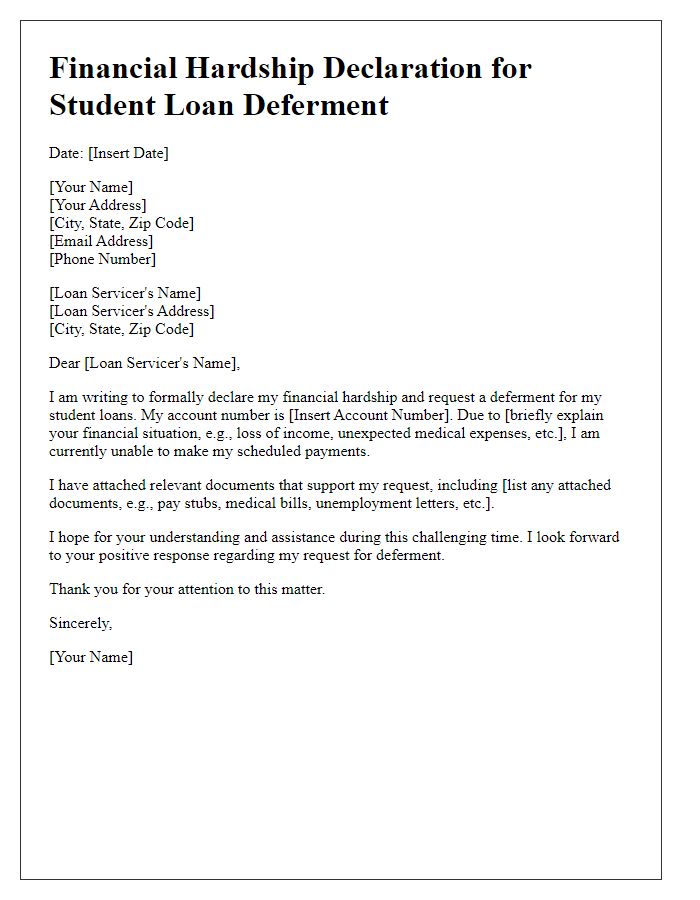

Letter template of financial hardship declaration for student loan deferment

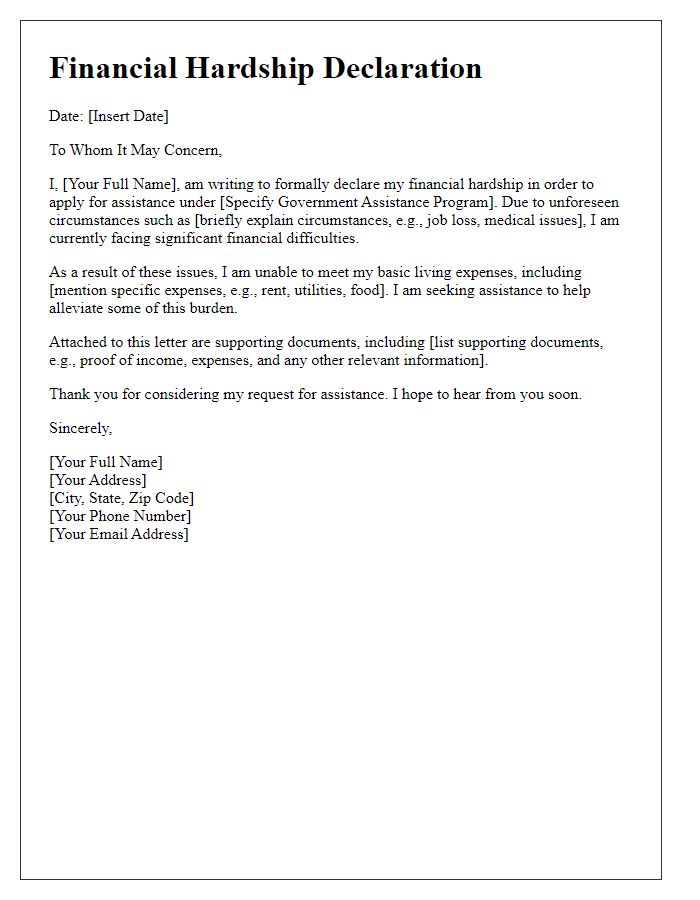

Letter template of financial hardship declaration for government assistance programs

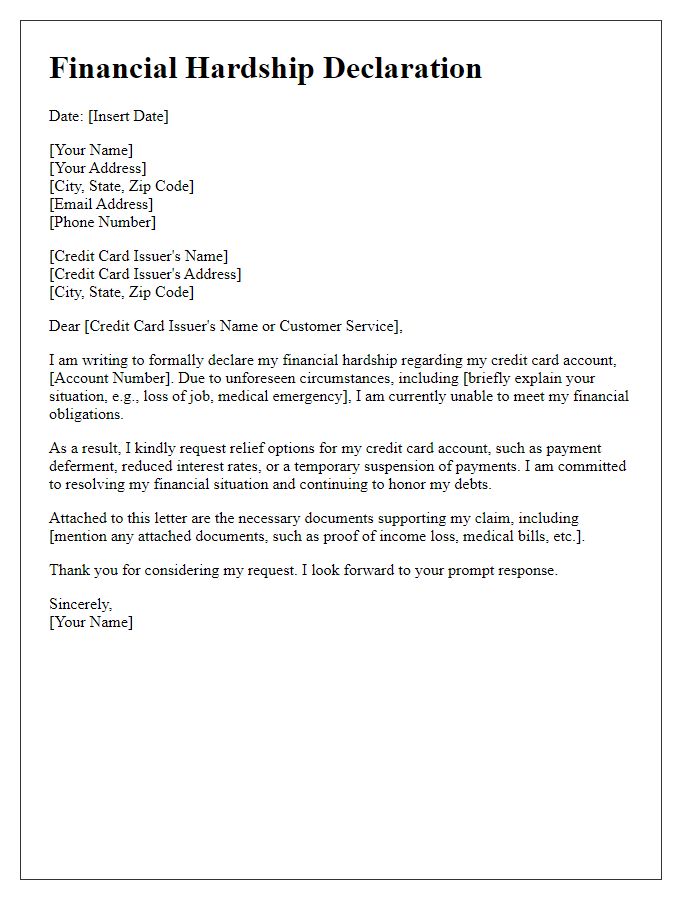

Letter template of financial hardship declaration for credit card relief

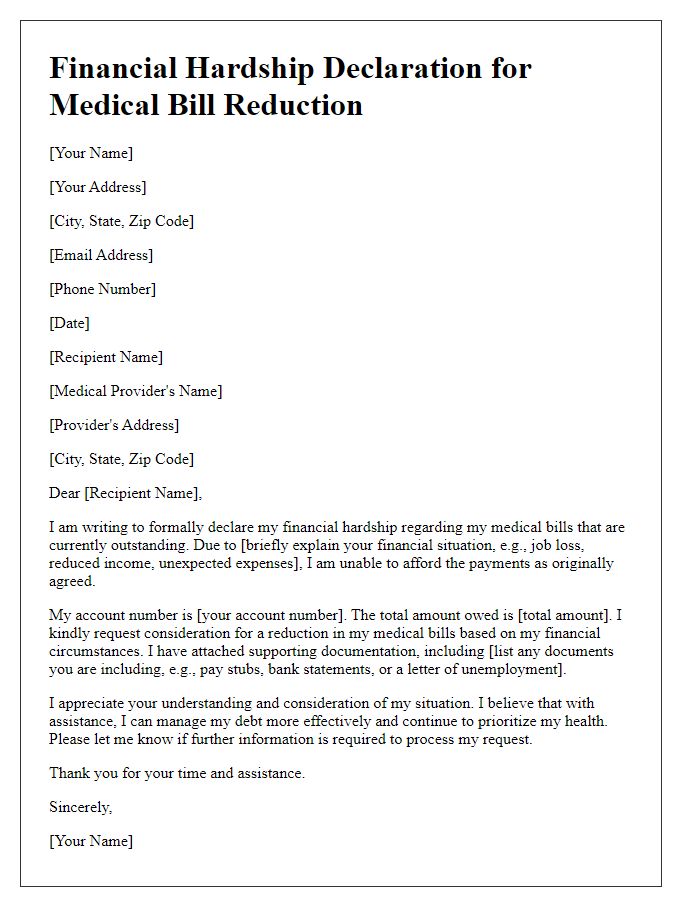

Letter template of financial hardship declaration for medical bill reduction

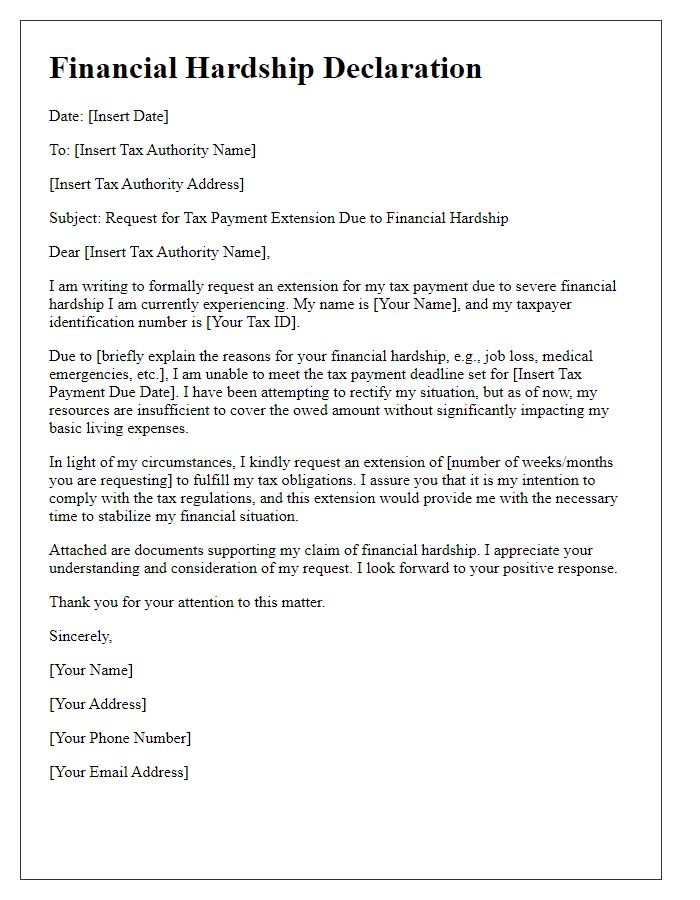

Letter template of financial hardship declaration for tax payment extension

Letter template of financial hardship declaration for small business loans

Comments