Are financial burdens causing you stress and uncertainty? If you've been struggling to keep up with your debt payments, you might be considering a debt re-age request to ease the pressure. This approach can potentially refresh your account status and improve your chances of financial recovery. Stick around to learn more about how to navigate this process effectively!

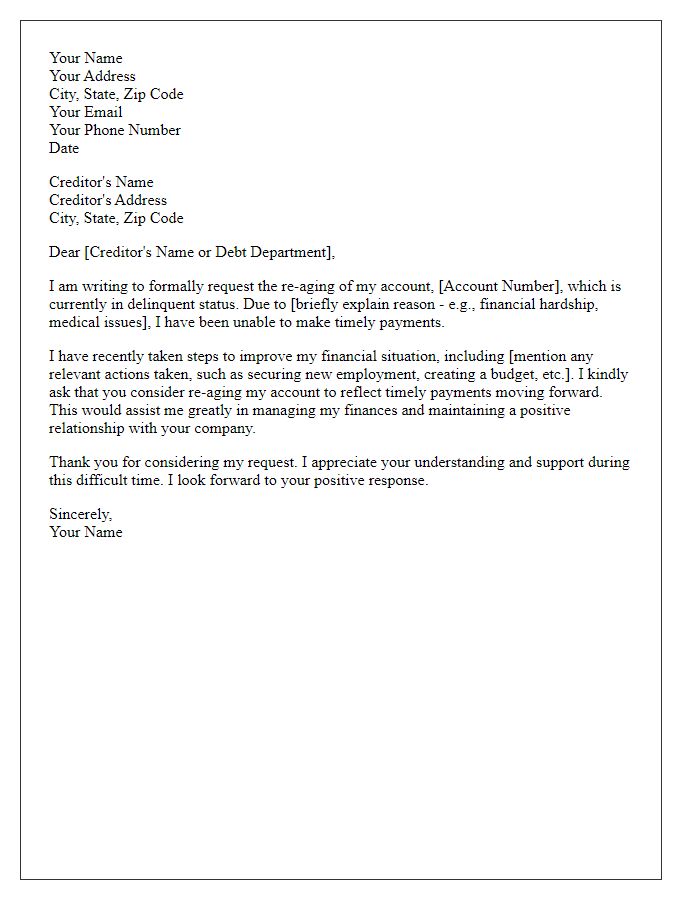

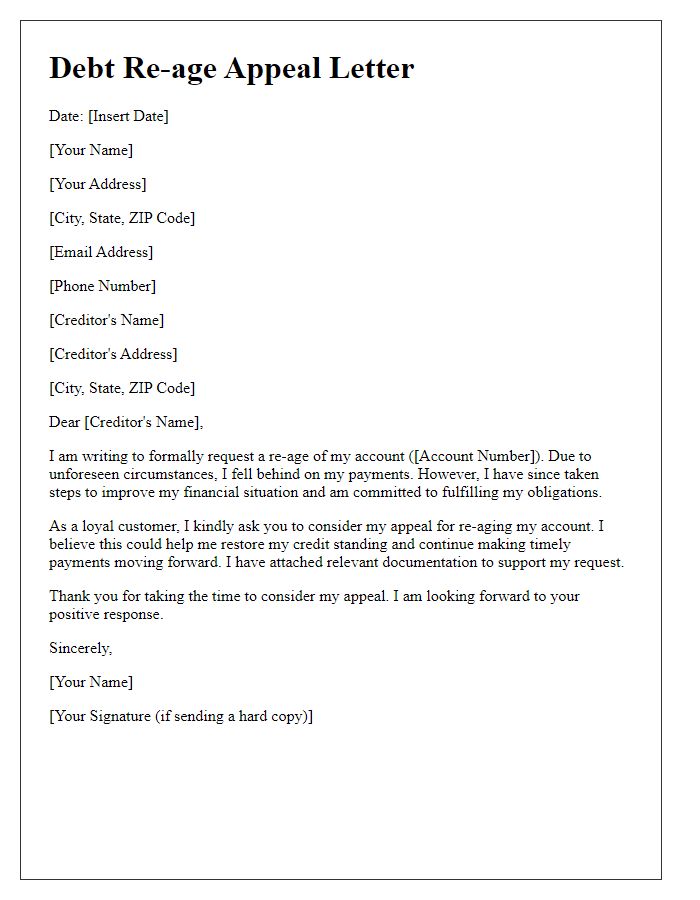

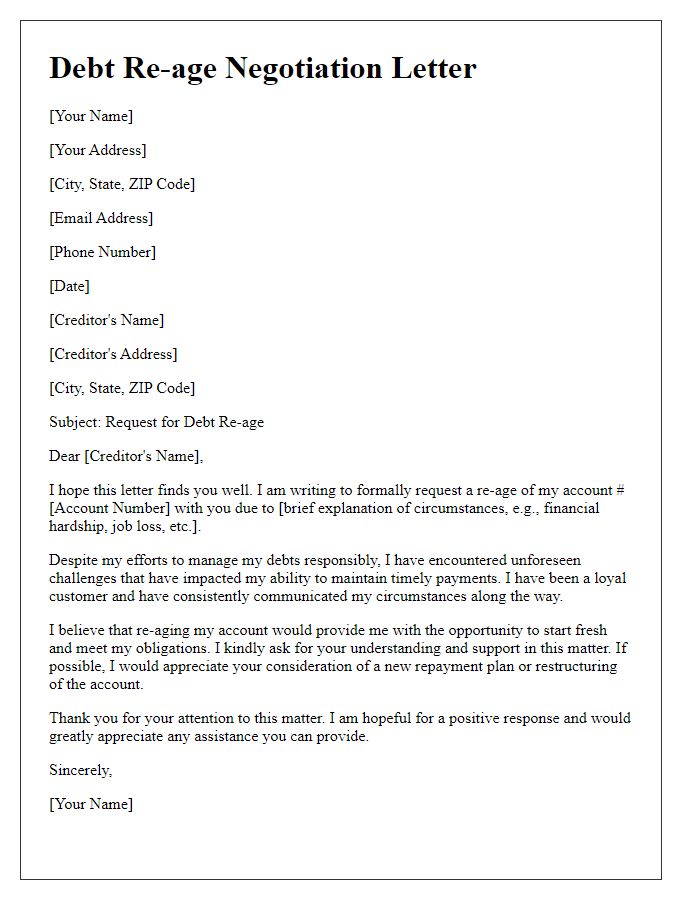

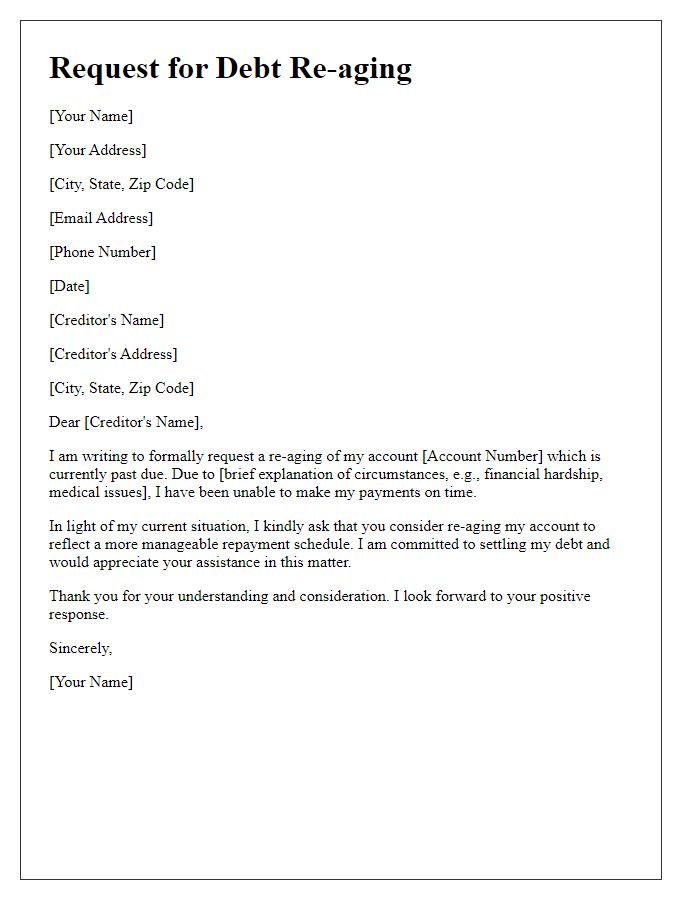

Debtor's personal information

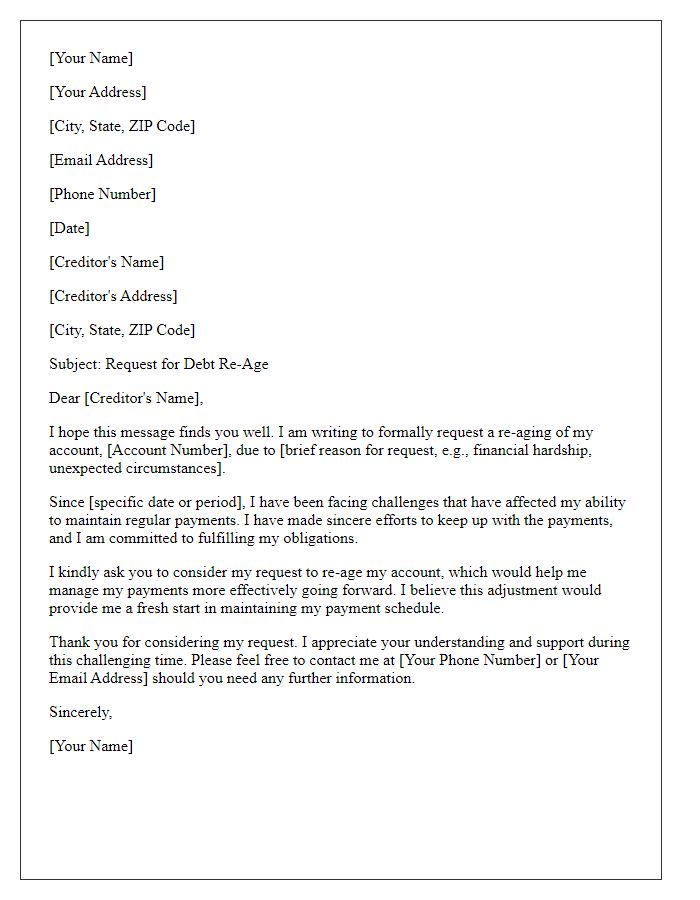

To request debt re-aging, individuals must provide key details including their full name, address, and account number associated with the debt. Personal information should be current to ensure accurate processing. It is essential to include a contact number (typically a mobile or home phone) and an email address for further communication about the request. Additionally, individuals should describe the circumstances leading to the re-aging request, including any financial hardships or changes in employment status that impact repayment ability. Supporting documents such as income statements (pay stubs, tax returns) or hardship letters may also be included to strengthen the request.

Account details and current status

A debt re-age request involves communicating with financial institutions regarding adjustments to the repayment terms of a particular account. Key elements include the account number, which uniquely identifies the borrower's financial obligation, and the current status, which reflects the repayment condition, including outstanding balances and payment history. For instance, an account with a history of late payments may face difficulties in obtaining favorable terms. Additionally, detailing the borrower's current financial circumstances, such as income reduction or unexpected medical expenses, would provide context for the request. The request's objective is to engage with lenders to potentially reset payment timelines, improving cash flow and mitigating the risk of default.

Explanation for financial hardship

Financial hardship can be a significant challenge for many individuals and families, especially in times of unexpected crisis like job loss or medical emergencies. For example, unemployment rates reached 14.7% in the United States during the COVID-19 pandemic in April 2020, leading many to struggle with meeting their financial obligations. Sudden medical expenses, such as a hospital stay averaging $1,500 in out-of-pocket costs, can also strain budgets. Individuals may experience difficulties in maintaining timely payments on debts, including mortgages or credit cards, causing further stress. Seeking a debt re-age arrangement can provide a temporary relief, allowing individuals to stabilize their finances. A debt re-age allows for previously missed payments to be reclassified as current, improving credit scores and enabling better financial management moving forward.

Request for re-aging and proposed repayment plan

Re-aging of debts allows borrowers to restructure payment terms to improve financial management. A re-aging request involves formally asking the lender to adjust the payment schedule of an account, typically to reflect new payment capabilities or financial circumstances. This process can assist individuals facing temporary financial hardship, like job loss or unexpected expenses. Proposed repayment plans often outline specific amounts and timelines, enabling both the borrower and lender to align on achievable goals. Important to include detailed information such as account numbers, outstanding balances, and proposed amounts, ensuring clarity in communication with the lender. Note: Ensure that the request includes any relevant supporting documentation, demonstrating the need for re-aging, such as pay stubs or financial statements.

Contact information for follow-up

A debt re-age request involves communicating with financial institutions or credit agencies regarding the alteration of the status of a delinquent account. This process often relates to consumer loans, credit cards, or mortgage payments that have fallen behind. Providing clear contact information for follow-ups is essential in this matter. It is crucial to include a dedicated phone number (ideally with area code), email address, and perhaps a mailing address for recorded correspondence. Ensure to specify preferred contact times and any relevant account numbers to facilitate efficient communication. This practice helps organizations quickly identify the account in question, streamlining the re-age request process.

Comments