Are you looking for a way to simplify your installment payment arrangement? Crafting a well-structured letter can make all the difference in ensuring both you and the recipient are on the same page. This template will help you communicate your terms clearly and professionally, making the process smoother for everyone involved. Keep reading to discover how to effectively outline your payment plan!

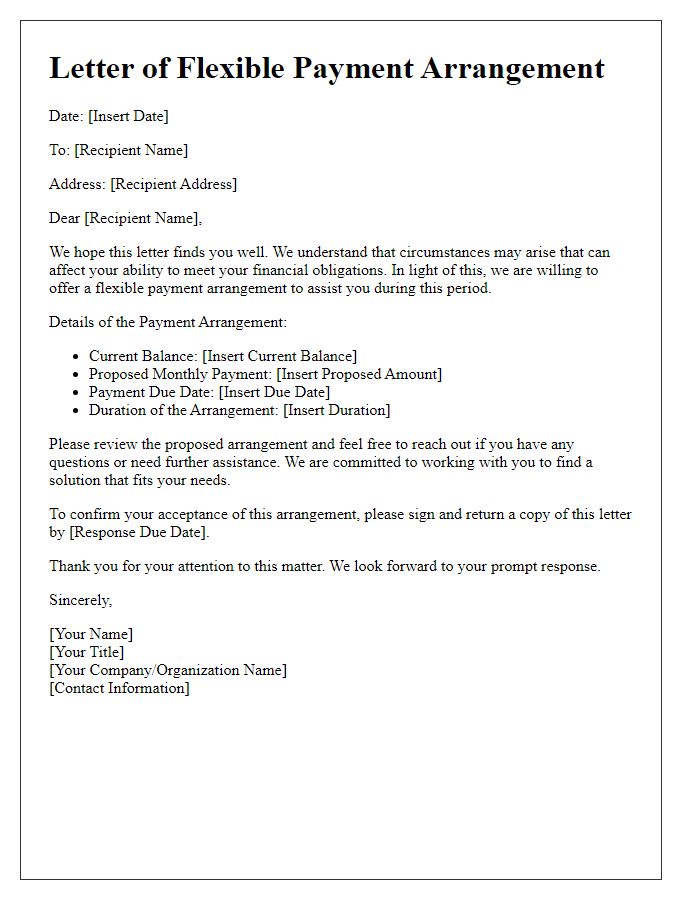

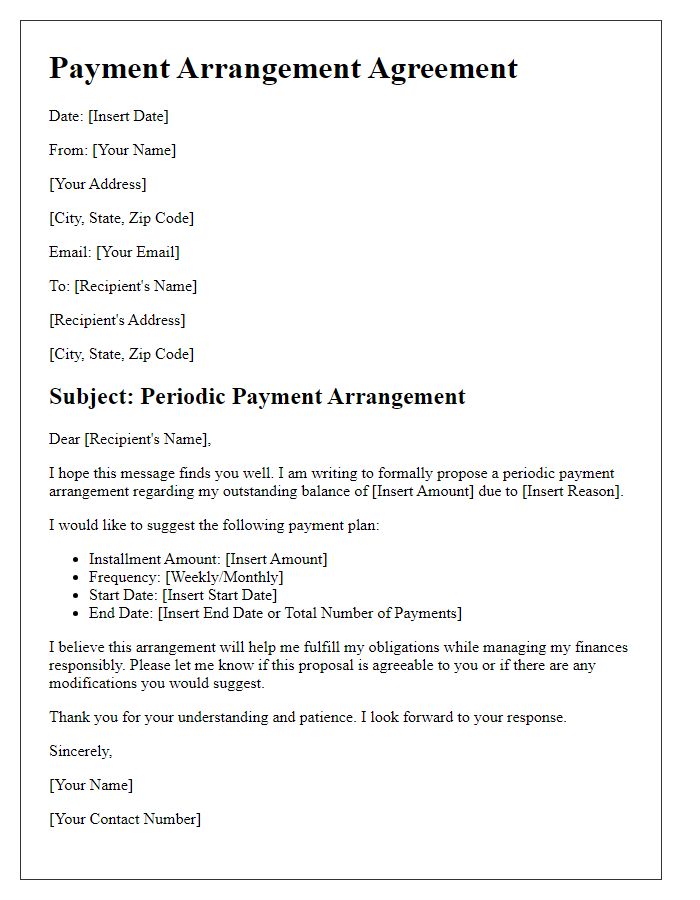

Introduction and Purpose

When establishing an installment payment arrangement, clear communication is essential. The purpose of this arrangement typically lies in easing financial burden by dividing the total debt into manageable monthly payments. This can be particularly useful in cases such as outstanding loans, medical bills, or educational fees. An installment plan may span several months or years, depending on the total amount owed and the agreed-upon monthly payment structure. The introduction of such an agreement requires outlining the total debt amount, payment intervals (monthly, bi-weekly), and specific due dates to foster mutual understanding and ensure timely payments.

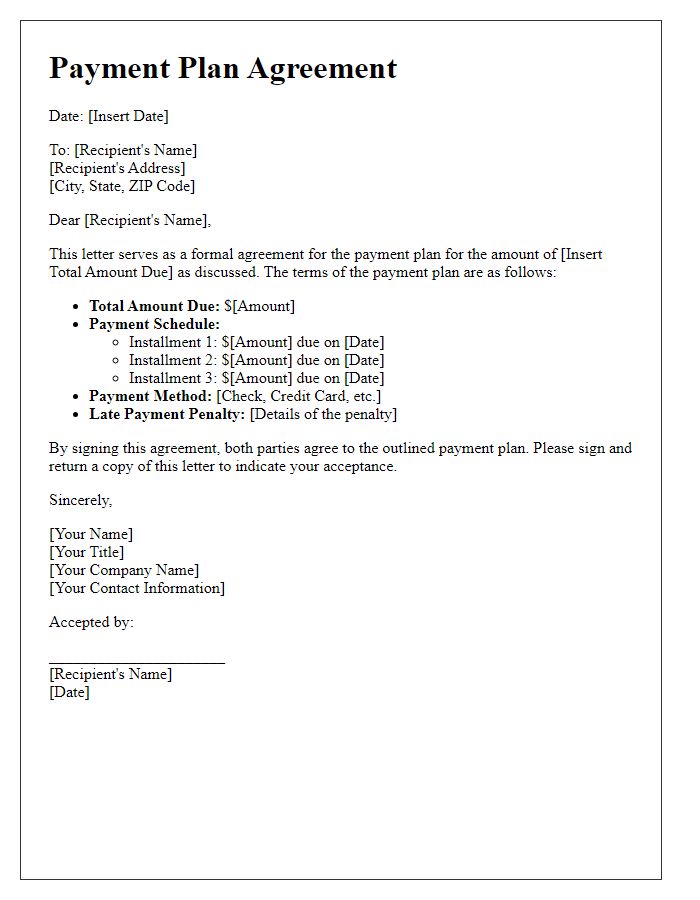

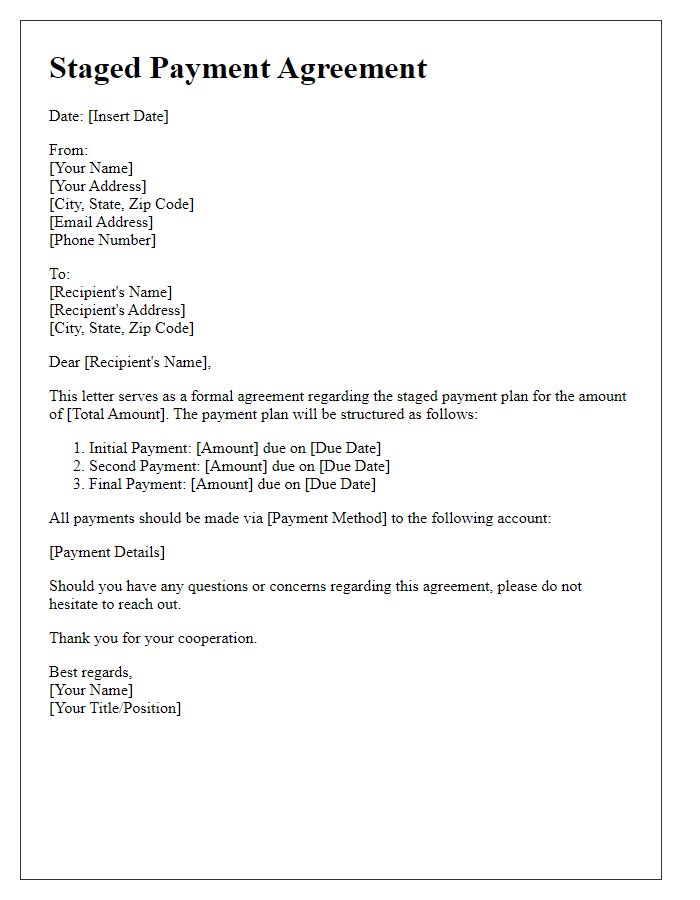

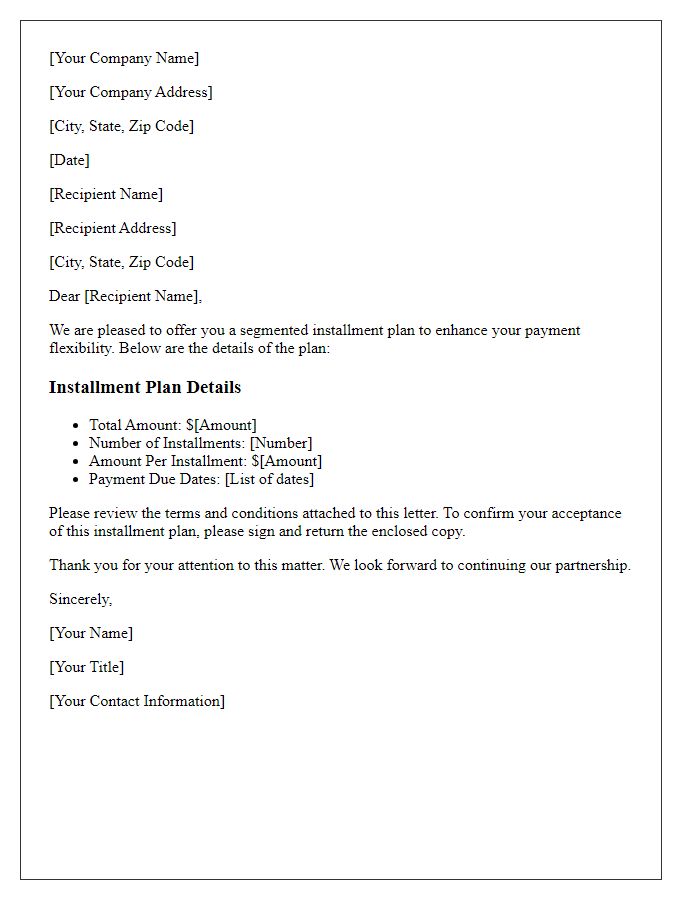

Payment Terms and Schedule

Payment arrangements for installment plans often require clear and precise terms to ensure both parties understand their obligations and expectations. An installment payment plan typically includes details such as total amount owed, the number of payments, payment due dates, and acceptable payment methods. For example, a $2,400 payment plan might involve ten monthly installments of $240 each, due on the first of every month starting from January 1st. Additionally, late fees can be imposed if payments are not received by the due date, often around 5% of the overdue amount. It is important to document all terms in writing, specifying contact information and any penalties for defaulting on payments, ensuring transparency and accountability for both parties.

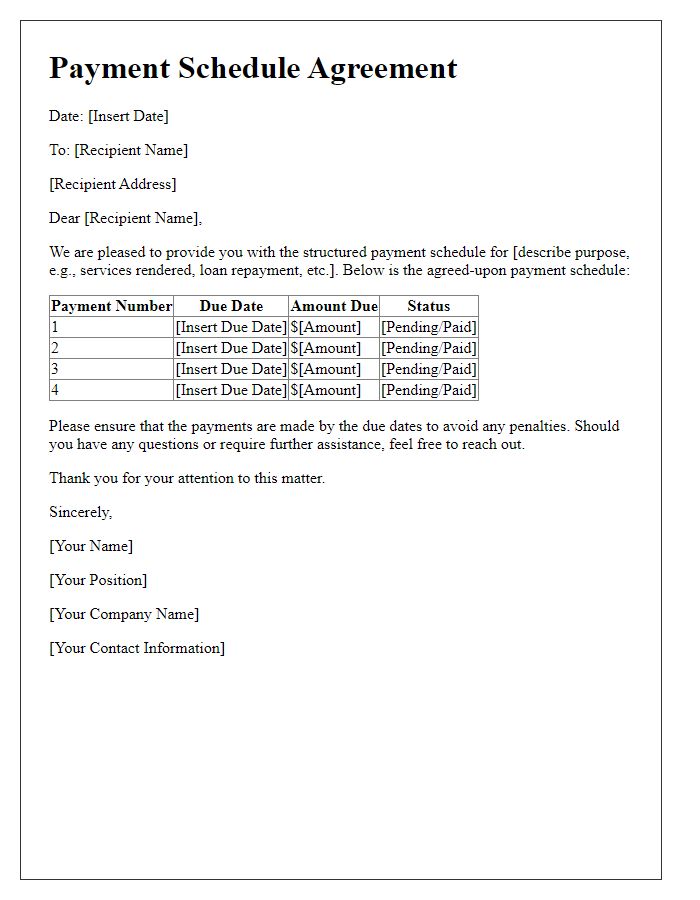

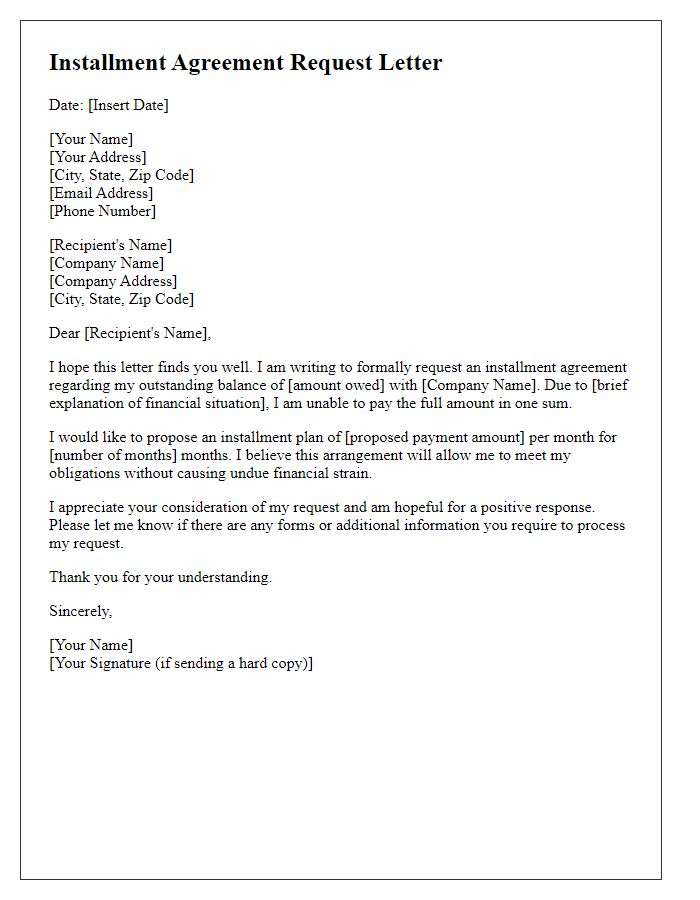

Amounts and Due Dates

A structured installment payment arrangement at a financial institution, such as XYZ Bank, may include specific amounts and due dates. For example, an initial payment of $500 due on January 15, followed by four equal payments of $250 each due on February 15, March 15, April 15, and May 15. This payment schedule allows borrowers to manage their financial responsibilities over a designated period. Each installment contributes towards the overall balance of the loan, facilitating transparency and adherence to repayment terms. Additionally, late fees may be applied if payments are not received by the due date, adding an element of urgency to the arrangement.

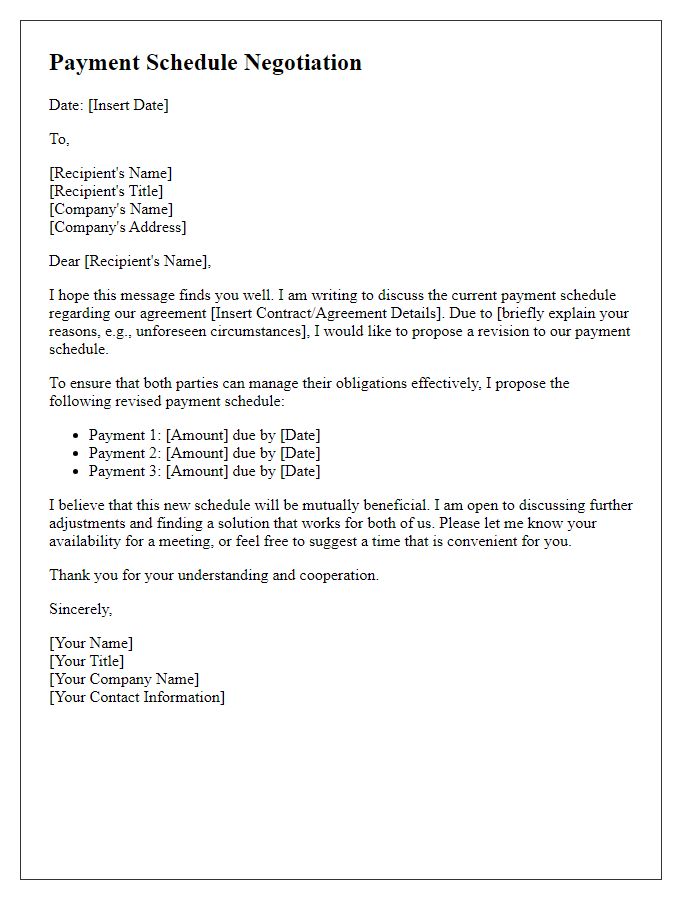

Consequences of Non-Payment

Failure to adhere to installment payment arrangements can result in significant consequences. For instance, overdue accounts may incur late fees, often ranging from 5% to 15% of the outstanding balance, depending on the agreement specifications. Additionally, continued non-payment can lead to the involvement of collection agencies, which may further complicate financial standings and credit ratings. In some circumstances, persistent delinquency might result in legal actions, such as lawsuits, leading to court judgments that could mandate wage garnishment or asset seizure. Notably, the impact on credit scores can be substantial, with potential reductions of 100 points or more, jeopardizing future borrowing opportunities and increasing interest rates on loans. Thus, it remains crucial to maintain communication with creditors to explore possible alternatives or adjustments to payment schedules.

Contact Information and Signature

The installment payment arrangement requires clear communication and structured format. Essential components include sender and recipient details: for example, the sender's name (John Doe), address (1234 Maple Street, Springfield), and contact number (555-1234). The recipient's information should follow, including the business name (XYZ Services), address (4567 Elm Street, Springfield). The date of correspondence is significant as it establishes the timeline for the agreement. Important details within the body of the letter outline payment terms: for instance, monthly payment amount ($200), number of installments (six months), and due dates (first of each month). A signature line provides space for both parties to confirm the arrangement legally. Clear and concise information ensures mutual understanding and accountability for both the sender and recipient.

Comments