Are you feeling overwhelmed by the thought of having a co-signer on your loan? You're not alone, and many individuals find themselves in a similar situation, seeking financial independence. Luckily, the process for requesting a co-signer release can be straightforward if you know the right steps to take. Ready to learn how to navigate this crucial financial move? Read on for a detailed guide!

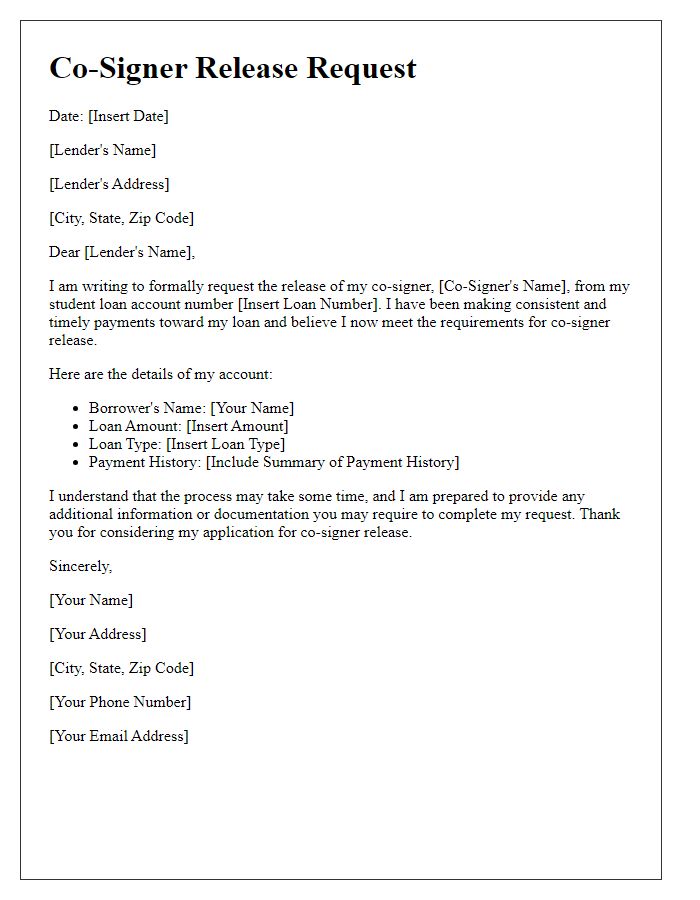

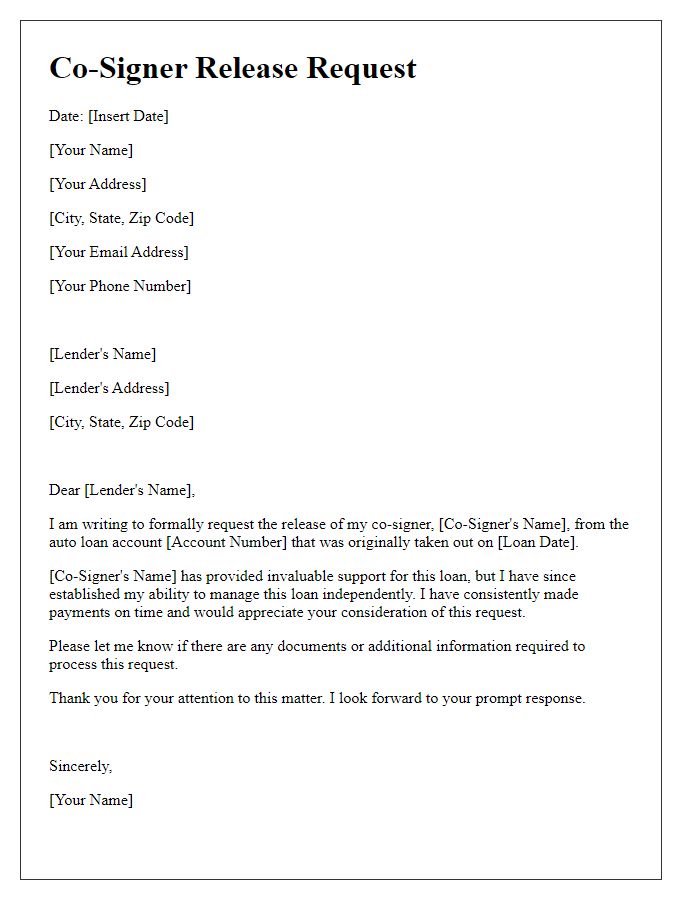

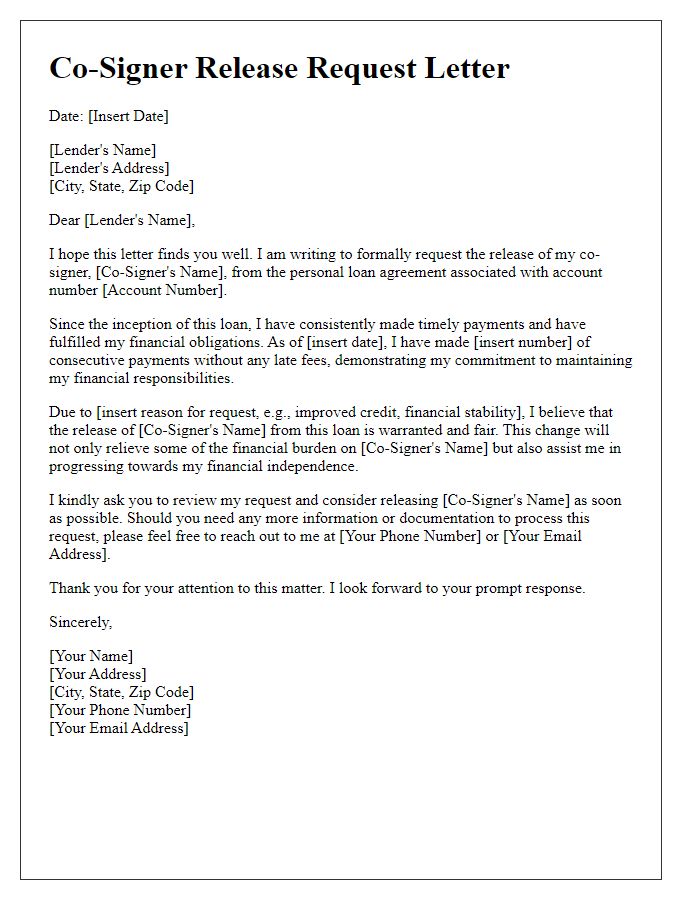

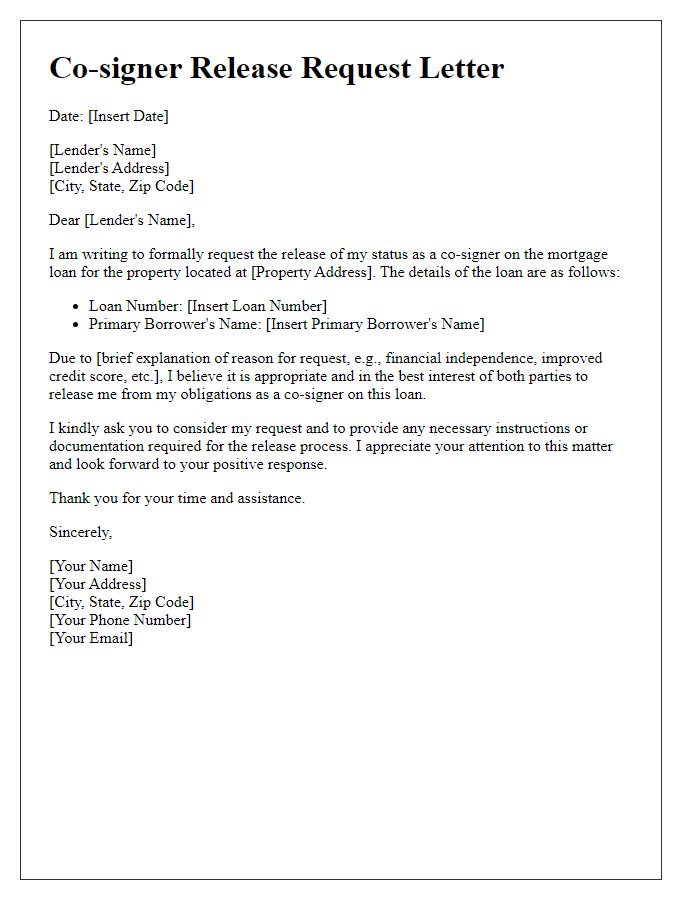

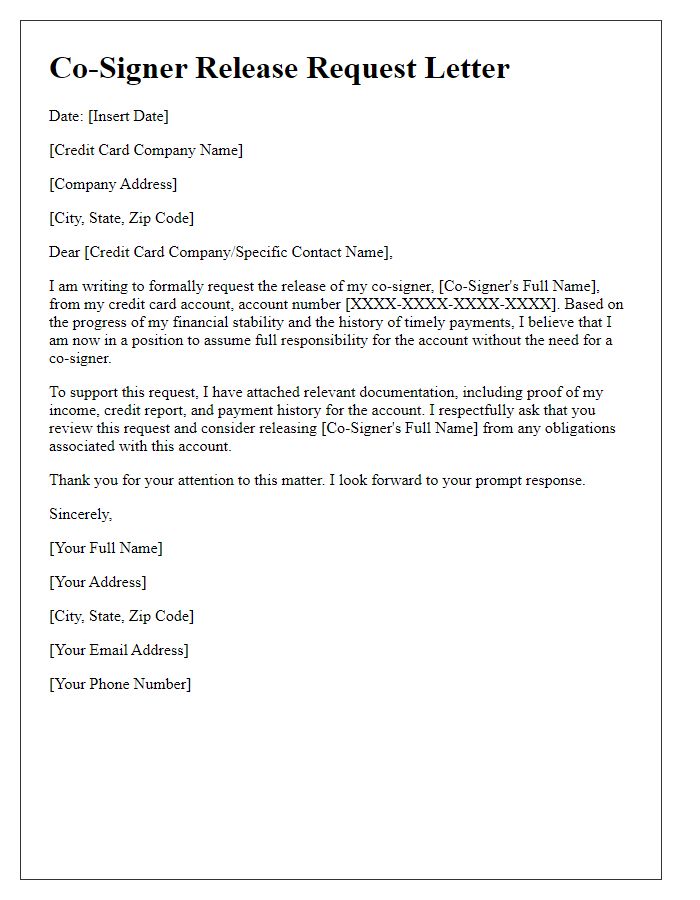

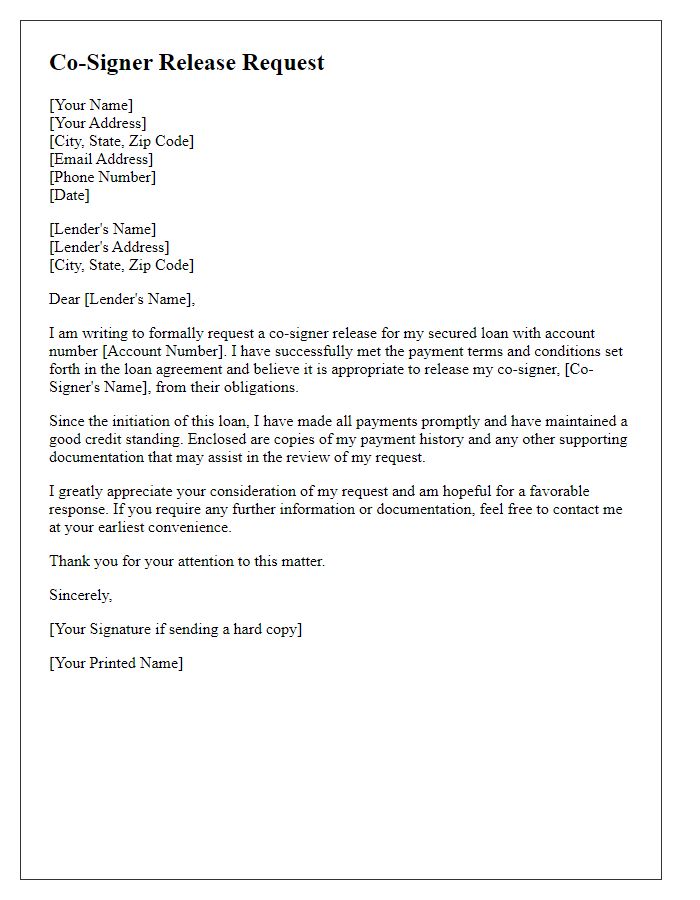

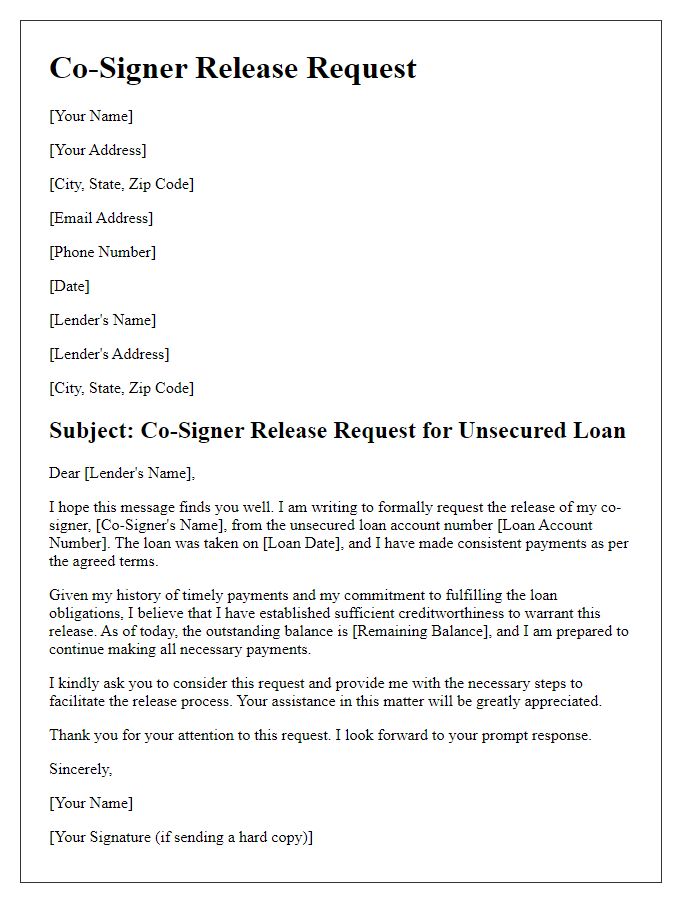

Personal and Contact Information

When requesting a co-signer release, it is important to include relevant personal and contact information for clear communication. Start with your full name, which ensures that the recipient can easily identify you in their records. Include your current address, which provides a location for correspondence. Next, add your email address; this will facilitate quick responses and allow for efficient communication. Finally, include your phone number, ensuring that the recipient has multiple ways to reach you regarding your request. This comprehensive approach will enhance clarity and expedite the processing of your co-signer release request.

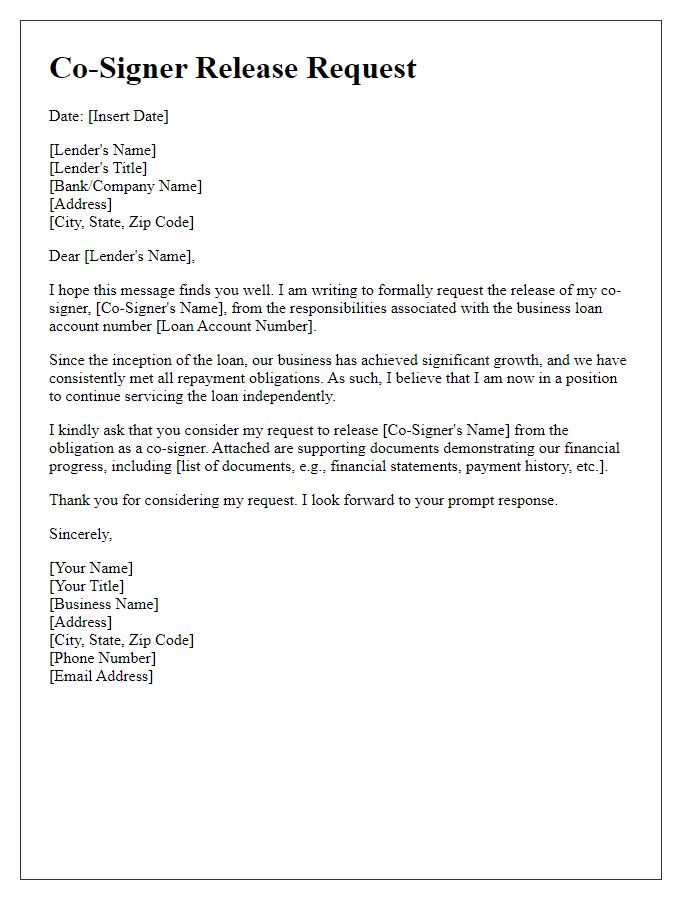

Loan Account Details

A co-signer release request involves a formal communication regarding specific loan account details that relate to the removal of a co-signer's obligation on a particular loan. The loan account number, established with a major lending institution, must be specified clearly to ensure accuracy. The original loan amount, typically ranging from $5,000 to $500,000, is crucial for identifying the exact loan in question. Relevant dates, such as the loan origination date or payment history, help establish the borrower's reliability and capacity to repay, which is often evaluated in the co-signer release process. Additionally, providing personal details about the co-signer, including their full name and social security number, can facilitate the process while keeping in compliance with privacy regulations. Detailed communication ensures that the request is processed smoothly and efficiently.

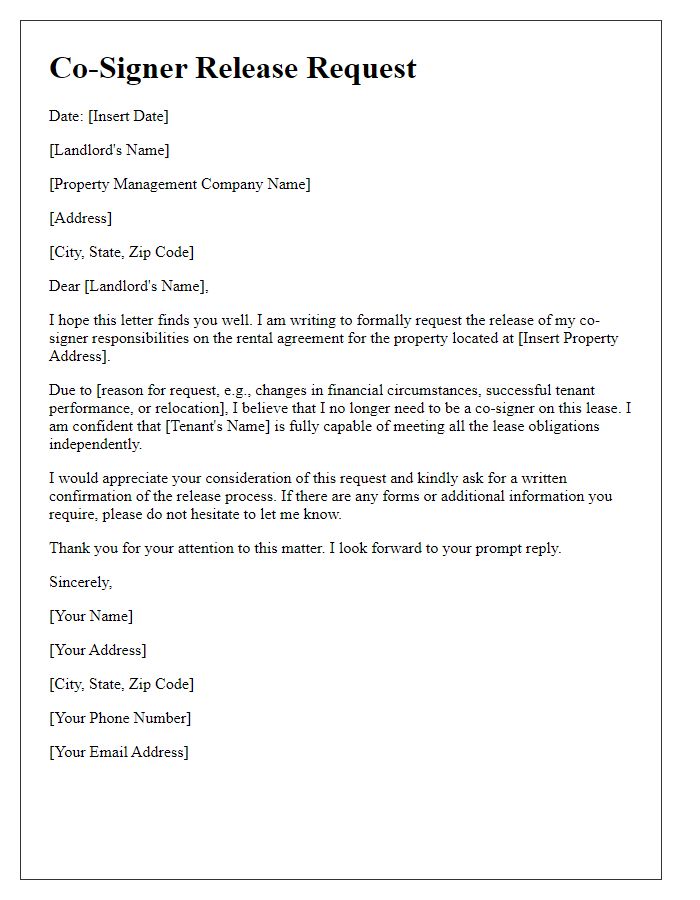

Reason for Co-signer Release Request

A co-signer release request typically arises when the primary borrower demonstrates a consistent payment history and improved financial standing, warranting their ability to manage the loan independently. For instance, in the context of a student loan, a borrower who has made on-time payments for 12 consecutive months might qualify for a release, affirming financial responsibility. Institutions such as Sallie Mae or Navient often have specific criteria for co-signer release, outlining factors including credit score improvements or increased income levels. A successful release alleviates the co-signer's financial liability, thus removing their obligation associated with the debt. Additionally, the impact on the co-signer's credit profile can be significant, as their credit utilization ratio and debt-to-income ratio may improve post-release.

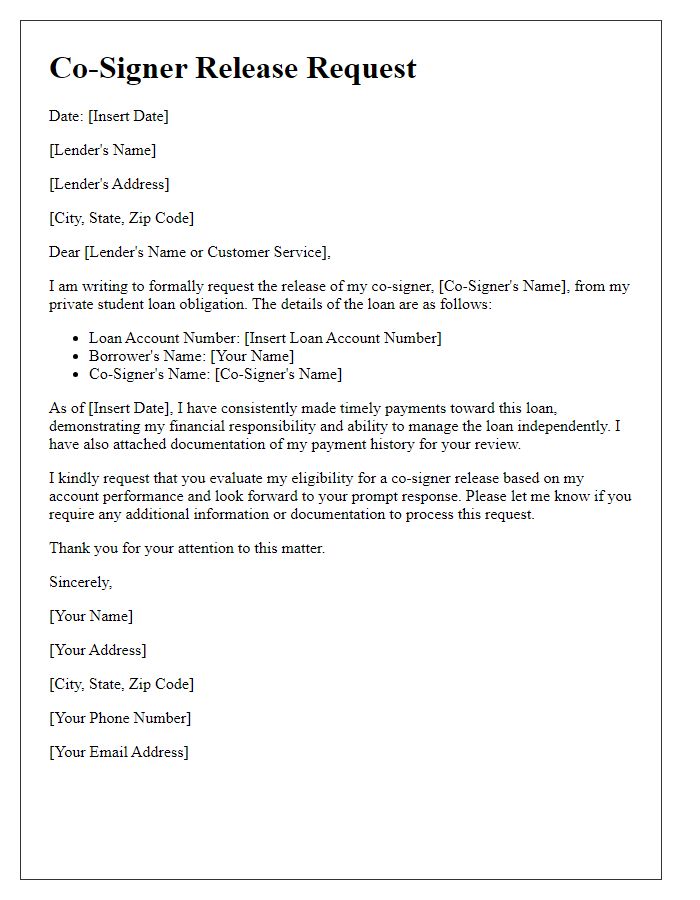

Supporting Documents

A co-signer release request requires various supporting documents to verify eligibility and facilitate the process. Essential documents include the original loan agreement, which outlines the terms of the loan (including the amount and payment schedule), proof of timely payments typically spanning the last 12 months, and a credit report that illustrates the primary borrower's creditworthiness. Additionally, recent financial statements such as bank account summaries or employment verification letters might be required to assess the primary borrower's ongoing ability to manage the loan independently. Documentation demonstrating the co-signer's current financial stability, like income tax returns or pay stubs, may also enhance the request's effectiveness. Finally, a completed release form provided by the lending institution is crucial for formal submission.

Closing Remarks and Formal Request

Co-signer release requests are formal processes often involving financial agreements, such as loans or mortgages. The request typically cites the original loan amount, which could be $300,000 for a home mortgage, and the date of the initial agreement, often seen in contracts dated at least three years prior. Furthermore, the financial stability of the primary borrower, including evidence of timely payments (for example, monthly payments consistently made for 36 consecutive months), must be highlighted. The request should be formally addressed to the lending institution, such as Wells Fargo or Bank of America, emphasizing a clear understanding of the release terms and conditions outlined in the initial contract. An appropriate conclusion would express gratitude, noting the importance of the co-signer's support throughout the loan period while requesting expedited processing for the co-signer release.

Comments