Are you feeling overwhelmed by the complexities of time-barred debts? You're not alone! Many people are uncertain about what time-barred debts mean and how they can impact their financial well-being. In this article, we'll break down everything you need to know, so you can navigate these waters with confidenceâread on to explore valuable insights!

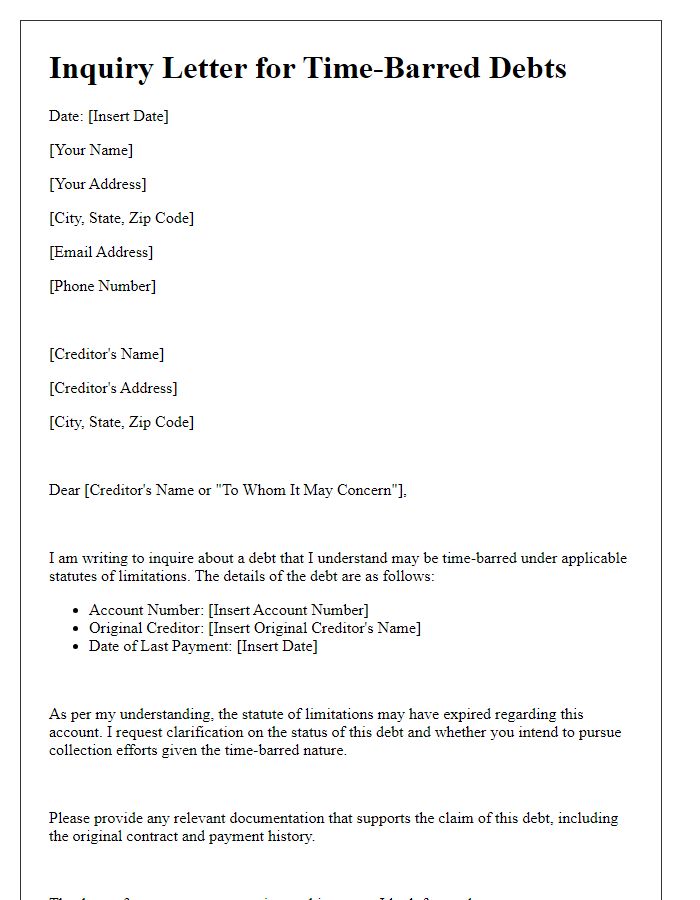

Debtor's name and address

Time-barred debt refers to debts that cannot be legally enforced due to the expiration of the statute of limitations. For example, in many jurisdictions, consumer debts such as credit card balances may fall under a statute that limits collection actions to six years. Debtors should be aware that providing personal information, such as name and address, can be advantageous for both parties. Debt collectors can better assess the situation and facilitate communication regarding potential settlements or written confirmations of debt status. However, sharing such personal details necessitates caution due to possible identity theft risks. Collectors should always follow applicable federal and state laws when handling personal information of debtors.

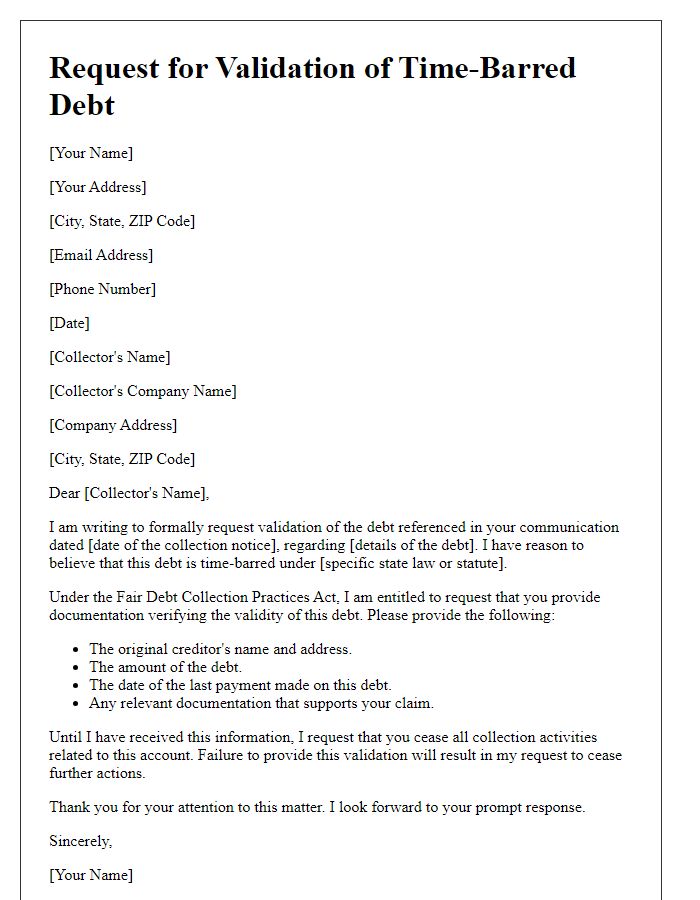

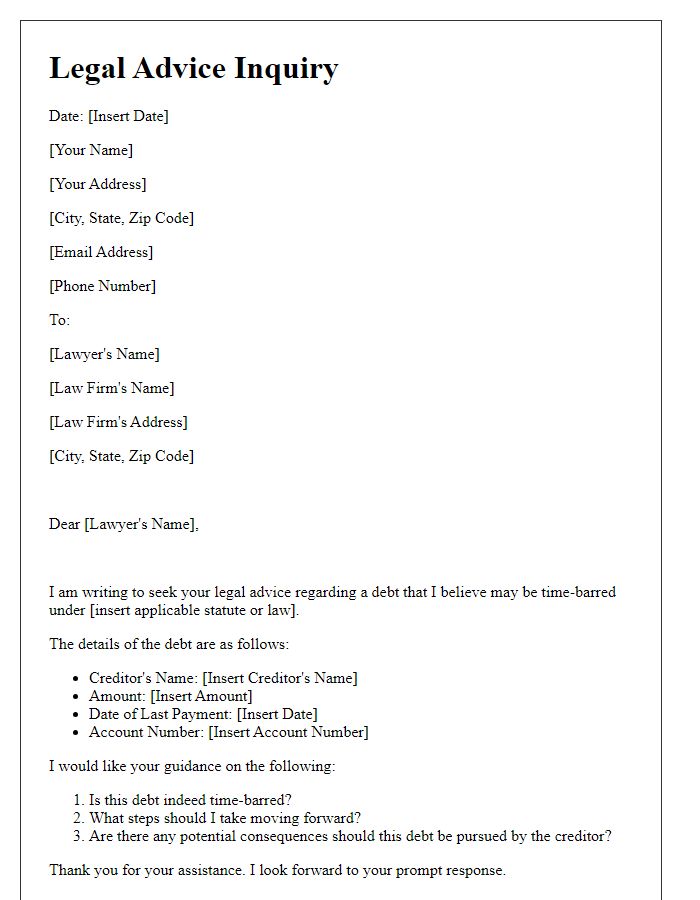

Creditor's details and reference number

Time-barred debt can create complications for both creditors and debtors. According to the Limitation Act 1980 in the United Kingdom, a creditor has six years from the date of the last payment or written acknowledgment to pursue a debt. After this period, the debt can be considered unenforceable in court. For instance, if a credit card company established in Manchester, with a reference number XYZ123456, attempts to collect a debt incurred in 2015 without any recent acknowledgment from the debtor, they may be barred from legal action. Debtors should remain aware of their rights regarding such expired debts, including the ability to dispute the validity of the claim based on the elapsed time frame.

Expiry date of debt collection statute

Time-barred debt refers to financial obligations that can no longer be legally enforced due to the expiration of the statute of limitations, typically ranging from three to ten years depending on jurisdiction and specific circumstances. For example, in jurisdictions such as California, the statute of limitations for written contracts is typically four years, while in New York, it may extend up to six years. Collectors must adhere to these timelines, ensuring they do not attempt to collect debts past their expiration dates, which can lead to potential legal issues and consumer protection violations. It is crucial to verify the exact date of the last payment or acknowledgment of debt, as this may reset the statute of limitations. Inaccurate information regarding debt collection can result in significant penalties for collectors and can harm the credit reports of consumers depending on the reporting practices of agencies like TransUnion or Experian.

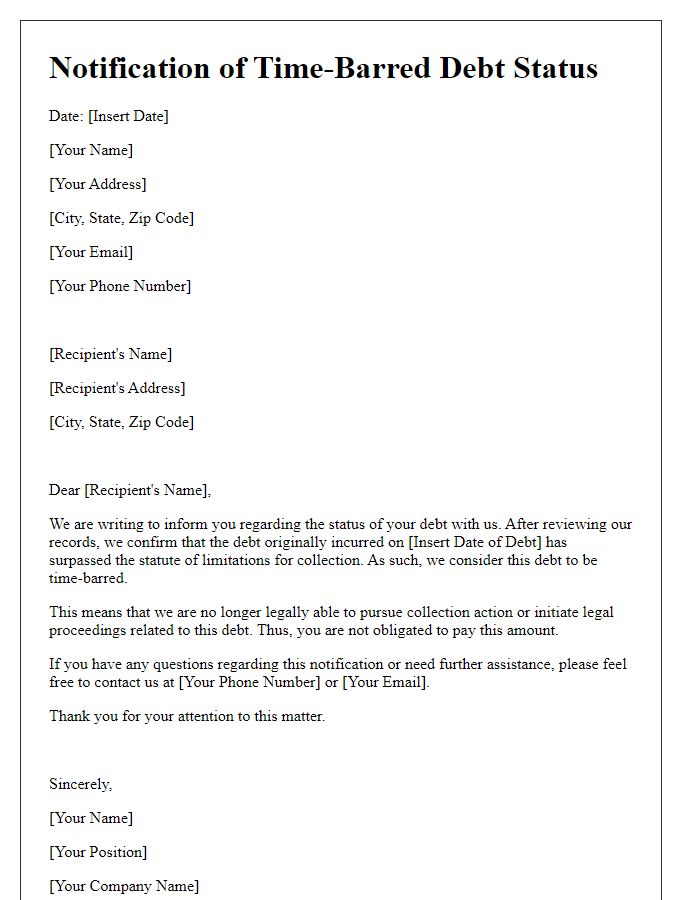

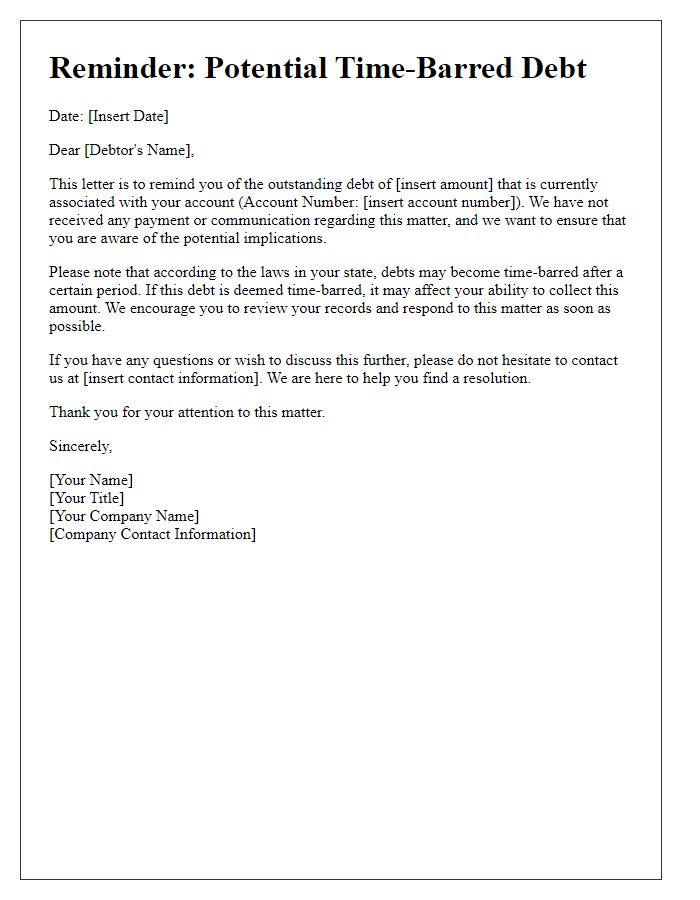

Request for written confirmation of time-barred status

Time-barred debt pertains to unpaid financial obligations that surpass a given period defined by law, commonly ranging from three to ten years, depending on jurisdiction and specific circumstances. Acknowledging this status can prevent legal action taken by creditors in places such as California, which abides by a four-year statute of limitations for written contracts. Requesting written confirmation of a debt's time-barred status not only serves to safeguard individuals from potential collection efforts but also provides clarity on the debt's enforceability. Creditors must respond promptly, typically within 30 days, as per regulations outlined by the Fair Debt Collection Practices Act, thereby protecting consumer rights and ensuring transparency.

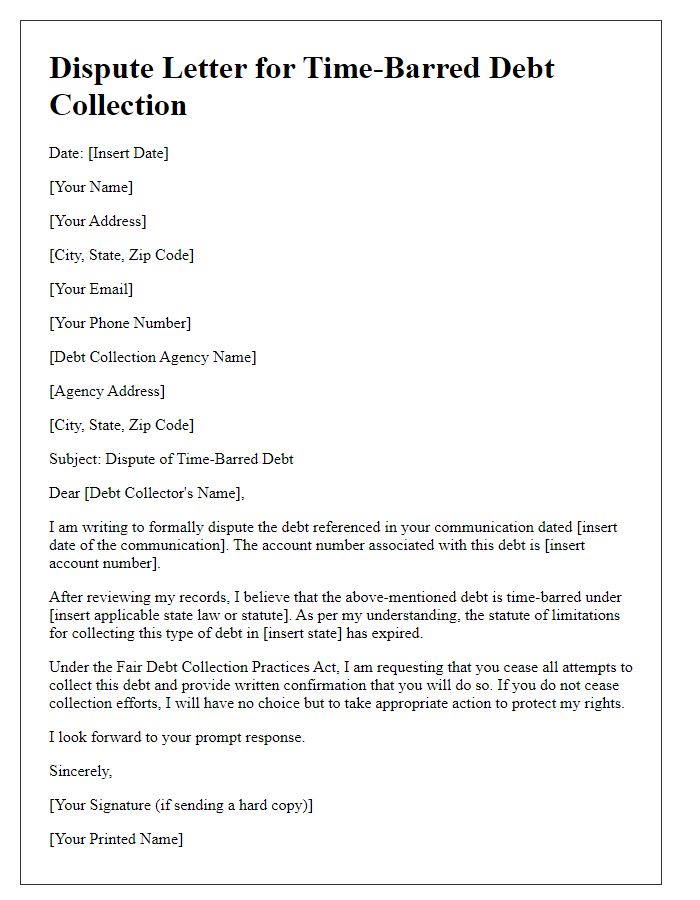

Cease-and-desist communication request for enforced collection purposes

Time-barred debt refers to outstanding financial obligations that cannot be legally enforced due to the expiration of the statute of limitations, which varies by jurisdiction and typically spans three to six years. Sending a cease-and-desist communication requests that debt collectors halt all collection efforts, particularly regarding debts that fall outside this legal timeframe. Individuals may invoke their rights under the Fair Debt Collection Practices Act (FDCPA), reinforcing their position against aggressive collection tactics. Additionally, the communication may cite relevant state laws, such as the Fair Credit Reporting Act (FCRA), which governs how long debts can appear on credit reports (usually seven years from the date of delinquency), further supporting the request for cessation of collection efforts.

Comments