Are you worried about the possibility of your tax refund being garnished? Understanding the ins and outs of tax refund garnishments can be a bit overwhelming, but it's essential to know your rights and options. This article breaks down everything you need to know, from common scenarios that lead to garnishment to tips for navigating the process. So let's dive in and empower you with the knowledge you need to protect your hard-earned money!

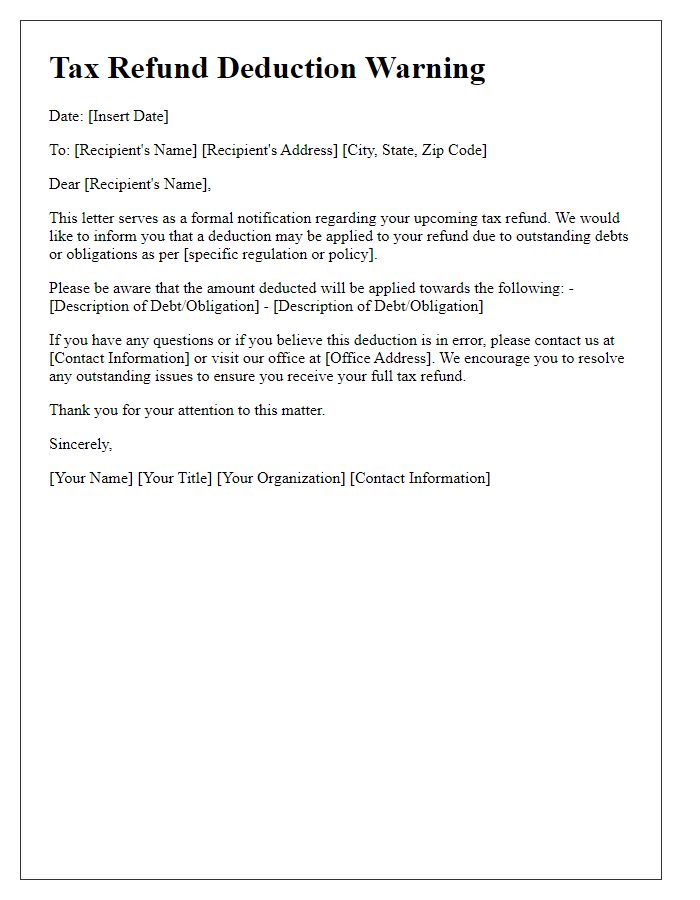

Clear subject line indicating urgency.

Tax refund garnishment warnings are crucial for individuals with outstanding tax liabilities. The IRS (Internal Revenue Service) can intercept federal tax refunds to satisfy debts, including federal tax debts, state tax obligations, and child support arrears. Timely notification is essential, as individuals may have limited time to respond before garnishment occurs. Readers should anticipate urgent communication typically sent via certified mail, detailing specific amounts that may be garnished, the legal basis for garnishment, and any options available for resolution. Understanding the implications of such garnishments is critical, as they can significantly impact financial planning and budgeting for the year ahead.

Official letterhead with agency details.

Tax refund garnishment notices serve as formal alerts issued by the tax authority, outlining the potential withholding of an individual's tax refund due to outstanding debts. The notice typically includes crucial information such as the taxpayer's identification number, an explanation of the debt amount owed to the government, and specific reference to the relevant tax years involved in the garnishment. Additionally, the document may specify deadlines for responding to the notice, the consequences of failing to address the debt, and details on how to contest the garnishment or arrange payment plans. The official letterhead features the agency's logo, contact details, and any pertinent legal disclaimers regarding the collection of taxes and the protection of taxpayer rights.

Taxpayer's identification and details.

The warning regarding tax refund garnishment highlights the critical implications for the taxpayer, specifically identified by their unique Social Security Number (SSN or Employer Identification Number - EIN), used by the Internal Revenue Service (IRS) to manage tax obligations. In this context, tax obligations arise from unpaid taxes, including income tax, property tax, or any federal or state taxes, leading to potential garnishment of future tax refunds. Events such as the taxpayer's failure to pay assessed taxes, missed deadlines for tax payments, or tax liens filed against the taxpayer can trigger garnishment procedures. Additionally, locations like the IRS offices or state revenue departments may be involved in processing garnishment requests, affecting the taxpayer's financial standing. Understanding this process is vital, as it influences not only the taxpayer's immediate financial resources but also future deductions and refunds.

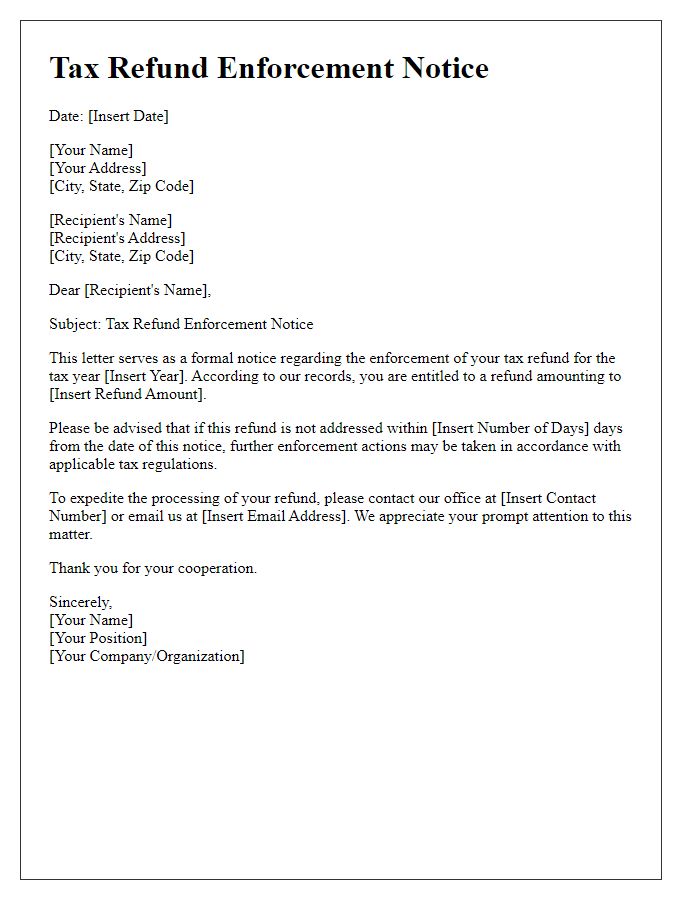

Explanation of garnishment process.

Tax refund garnishment occurs when the government seizes part of a taxpayer's refund to satisfy outstanding debts, such as unpaid taxes or student loans. The process begins when a federal or state agency identifies a taxpayer with delinquent obligations. The Internal Revenue Service (IRS) or state tax authorities prepare a notice indicating the amount owed. This notice is sent to the taxpayer, often detailing the reasons for the garnishment. The agency then submits a levy to the U.S. Department of the Treasury, directing them to withhold a specified portion of the taxpayer's refund. Affected taxpayers can challenge the garnishment through formal appeals, but they must do so promptly before the refund is disbursed. If successful, taxpayers can have a portion of their refund released, depending on their financial situation and the legitimacy of their claims.

Contact information for assistance and clarification.

Individuals receiving a tax refund garnishment warning from the Internal Revenue Service (IRS) are advised to seek assistance for clarification. The IRS provides a dedicated contact number (1-800-829-1040) for taxpayers, offering support during official business hours, typically Monday through Friday from 7 a.m. to 7 p.m. local time. Taxpayers can also access the IRS website for resources and information related to their refund status. Additionally, consulting with a tax professional or financial advisor can provide personalized assistance in navigating the complexities of tax garnishment and understanding individual circumstances, especially in cases involving outstanding debts or unresolved tax obligations.

Comments