Are you feeling overwhelmed by credit card debt and seeking a way out? Negotiating with your creditors can be an effective strategy to help reduce what you owe and regain control of your finances. In this article, we'll explore a simple yet powerful letter template that can assist you in starting those crucial conversations with your credit card companies. Join us as we delve into tips and strategies for successful debt negotiation!

Clear identification of parties involved

When negotiating credit card debt, clear identification of parties involved is crucial for effective communication. The debtor, often an individual seeking assistance with financial obligations, must present personal details such as full name, address, and account number. The creditor, typically a financial institution like Chase Bank, Citibank, or American Express, should be specified with the creditor's full corporate name, contact information, and account representative if applicable. This ensures that both parties have a transparent understanding of their identities and the context of the negotiation, facilitating a smoother discussion regarding debt resolution strategies.

Specific account details and outstanding balance

Credit card debt negotiation can significantly alleviate financial strain for individuals facing challenges with outstanding balances. Creditors, such as major financial institutions like Bank of America and Chase, may offer programs for debt settlement once the account demonstrates accounts in collections for over 120 days. Outstanding balances, which can range from a few hundred to tens of thousands of dollars, often accrue high interest rates, sometimes exceeding 25% annually, complicating repayment efforts. Negotiation strategies may include presenting personal financial hardships, such as job loss or medical expenses, to encourage flexibility on payment terms. Additionally, any documentation, such as previous statements indicating monthly payment history or missed payments, can aid in substantiating the case for negotiation, potentially resulting in a lower settlement amount or modified payment plan.

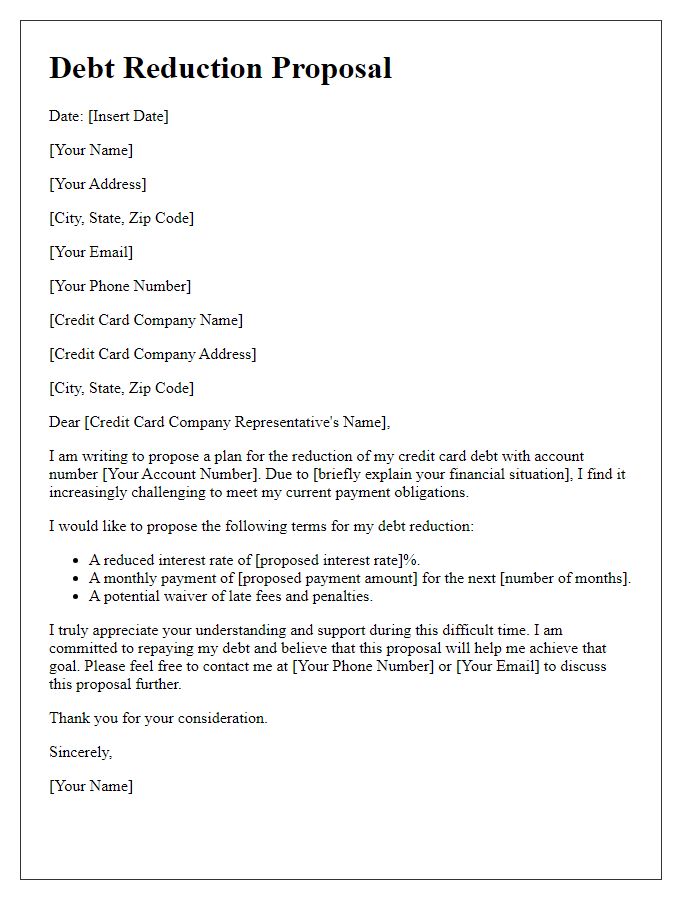

Proposed repayment plan or settlement offer

Negotiating credit card debt often involves presenting a clear repayment plan or a settlement offer. An effective approach includes specifying the current outstanding balance (for example, $5,000) and proposing a realistic monthly installment amount (such as $200) based on one's financial situation. Providing evidence of financial hardship (like unemployment since January 2023 or unexpected medical bills) enhances credibility in negotiations. Additionally, offering a settlement figure (such as 40% of the total debt) could expedite the process, appealing to the lender's interest in recovering funds efficiently. Clear communication about timelines for payments and willingness to follow through strengthens the negotiation process. Always ensure documentation of agreements for future reference.

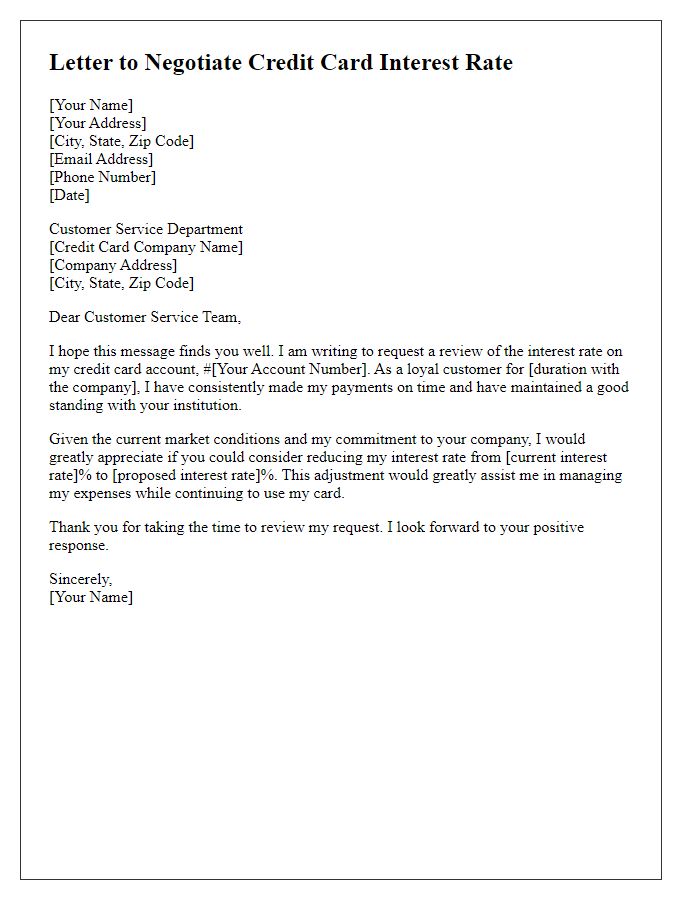

Justification for negotiation request

High credit card debt can create significant financial strain on individuals, often leading to overwhelming stress and difficulty in managing monthly payments. For instance, the average American household carries over $8,000 in credit card debt, with interest rates frequently exceeding 20% annually. Such high-interest rates can result in exorbitant monthly payments that become unsustainable, particularly during unexpected financial hardships like job loss or medical emergencies. Many consumers find themselves in a cycle of minimum payments, with little progress on reducing the overall debt. Requesting negotiation for lower interest rates or a settlements serves as a practical approach to alleviate some of this financial burden, allowing individuals to stabilize their finances and work towards a more manageable debt repayment plan.

Contact information for further communication

Effective communication is crucial during credit card debt negotiation. Establishment of clear contact information enhances the ability to resolve issues swiftly. Essential details include the phone number associated with the account, such as (555) 123-4567, and the email address for correspondence, like customer.service@bank.com. Providing a mailing address, for example, 123 Financial St, Cityville, ST 12345, ensures that physical documents can be sent if required. Specifying preferred hours for contact, like weekdays from 9 AM to 5 PM, offers convenience for both parties. Clear identification of the account holder's name, including, for instance, John Doe, assists in quick reference during discussions.

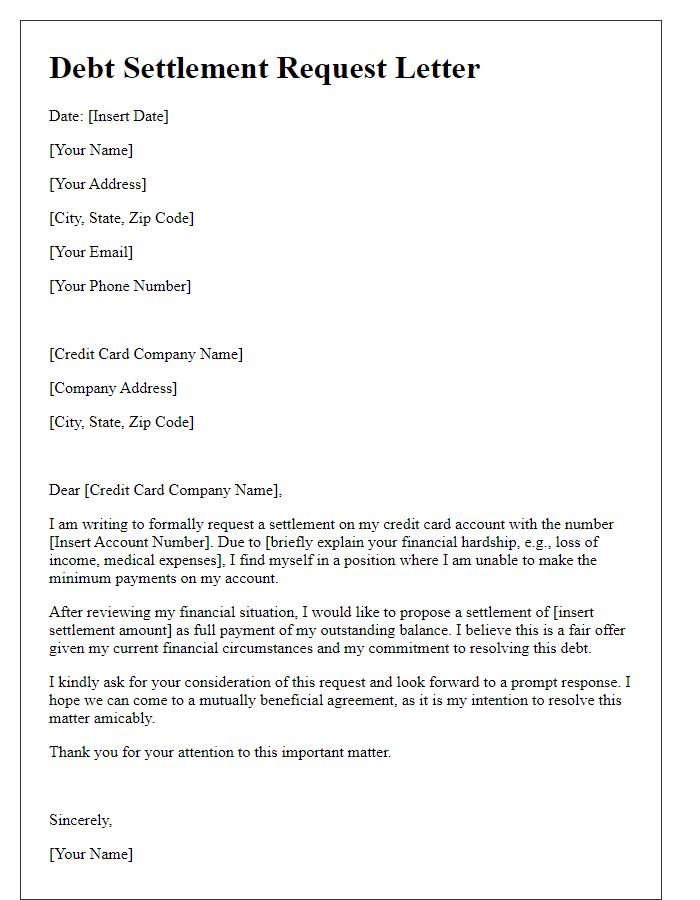

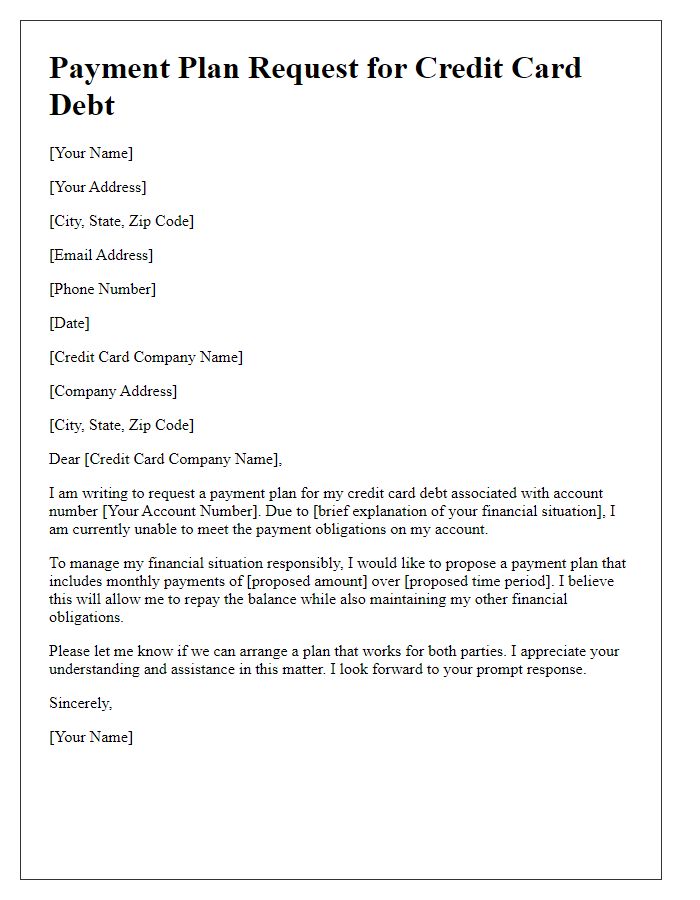

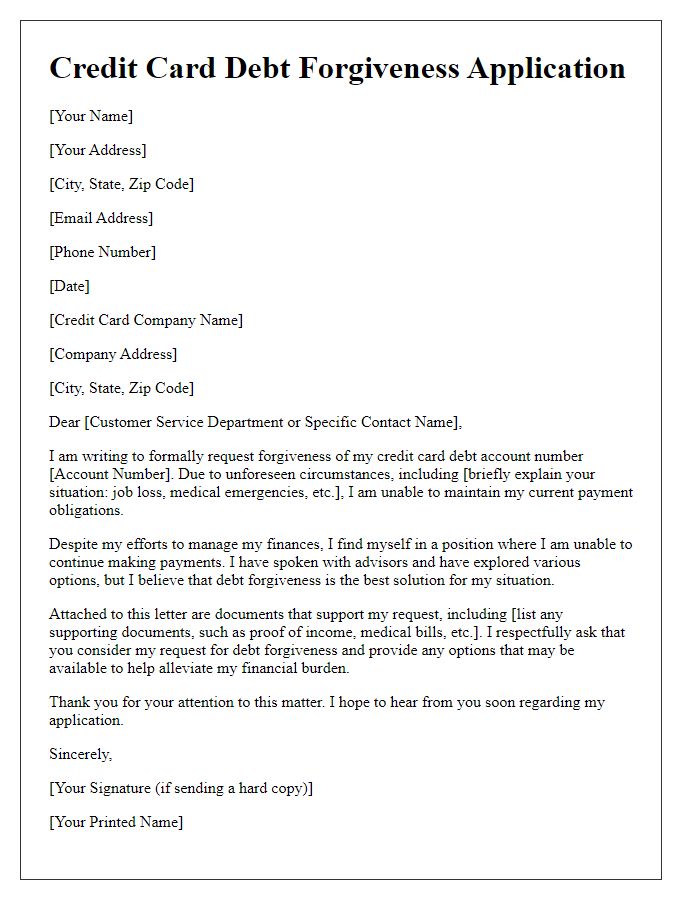

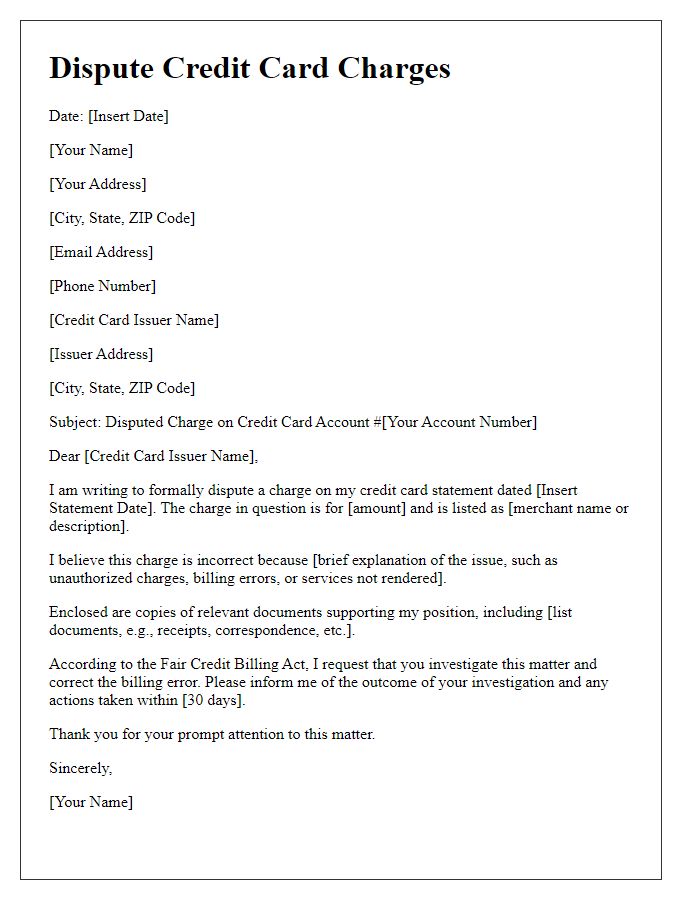

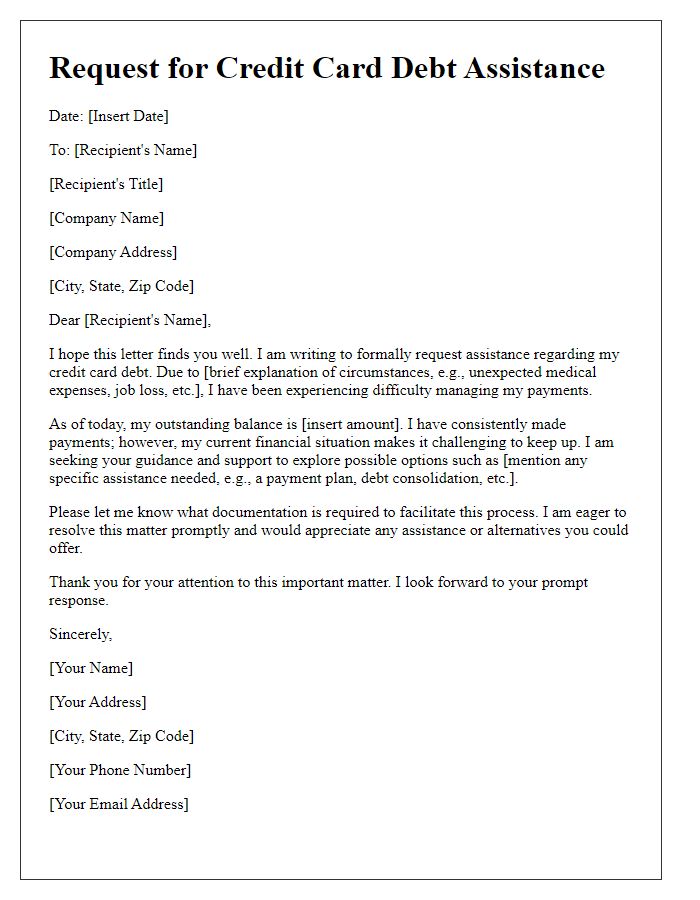

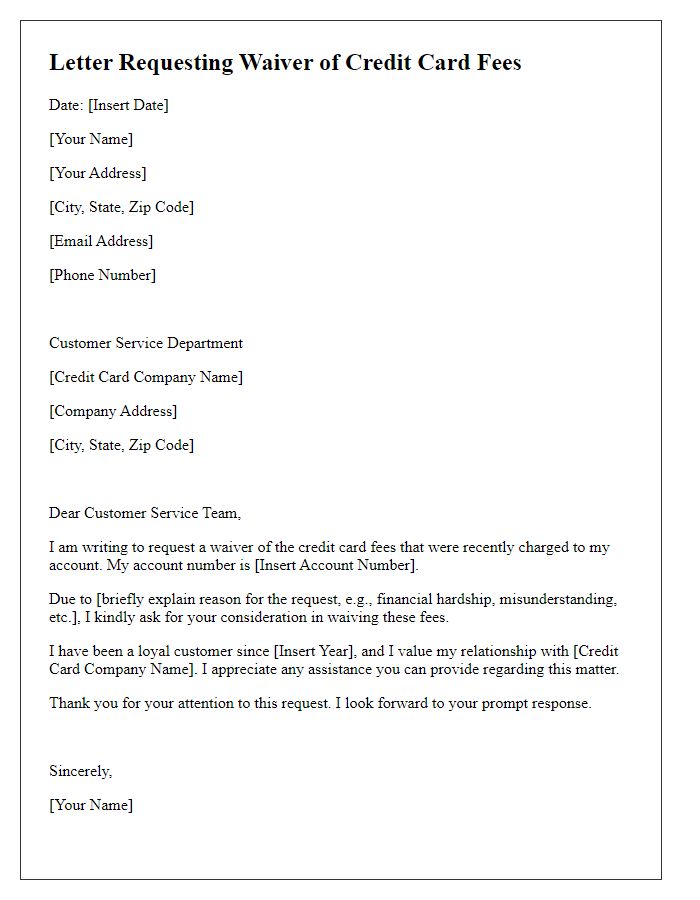

Letter Template For Credit Card Debt Negotiation Samples

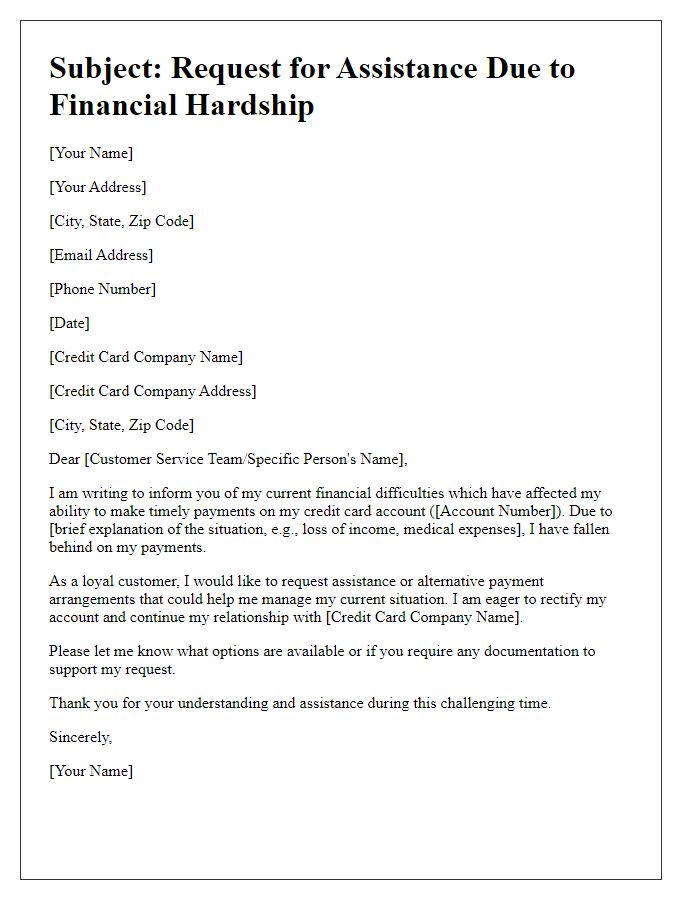

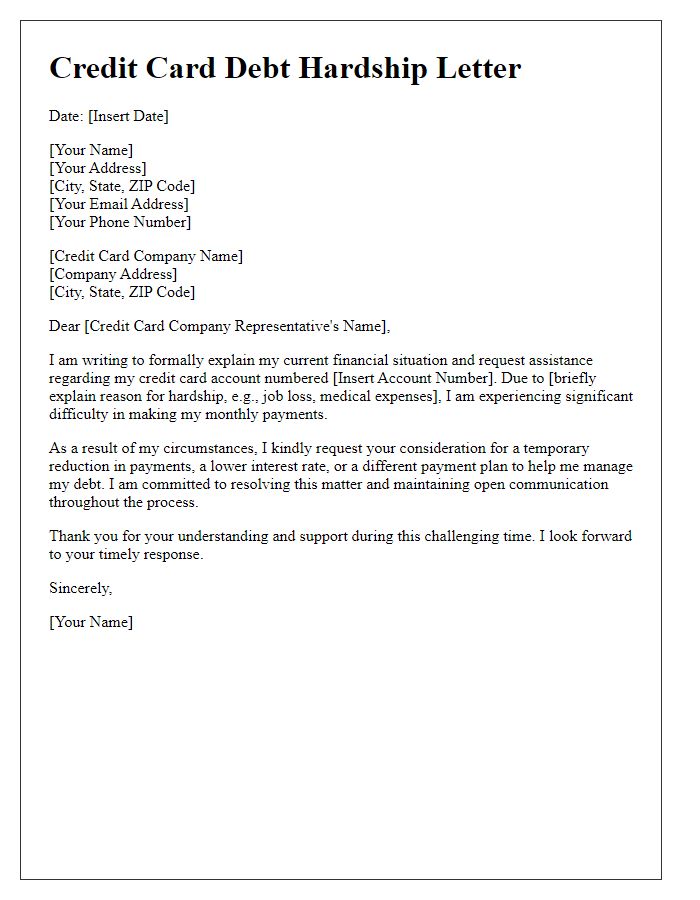

Letter template of communicating financial difficulties to credit card company

Comments