Are you considering a second mortgage adjustment and feeling overwhelmed by the process? You're not aloneâmany homeowners find themselves in a similar situation, looking for guidance on how to navigate this important financial decision. In this article, we'll break down the steps you need to take to prepare your adjustment request, ensuring you have the best chance for approval. So, stick around, and let's explore how you can make this easier!

Loan details and account information

Homeowners seeking a second mortgage adjustment often find themselves navigating financial complexities. A second mortgage, typically secured against the property value (often ranging from 80% to 125% of the home's appraised value), offers additional funding. Borrowers must reference specific loan details, such as the original loan amount (often in the range of $25,000 to $300,000), current interest rates (which can fluctuate between 3% to 10% based on market conditions), and account information like the loan's account number, which usually consists of 10 to 15 digits. Specific events, such as a change in financial circumstances (e.g., job loss, medical emergencies) or fluctuations in property value (potentially dropping by 10% to 30% during economic downturns), may prompt requests for adjustments in terms or payment plans. Including this detailed information enhances the request's clarity, facilitating communication with lenders.

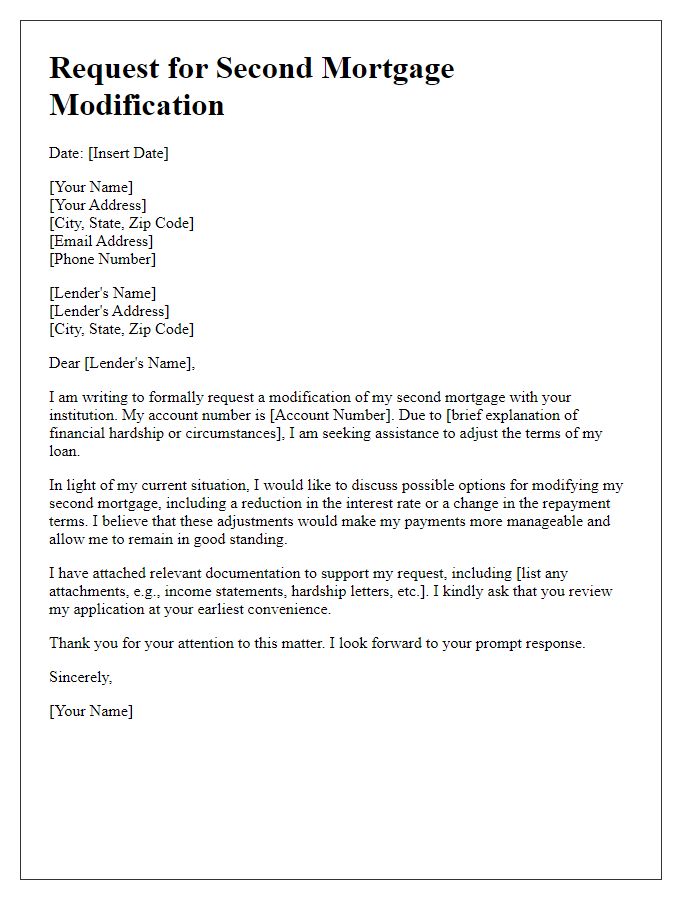

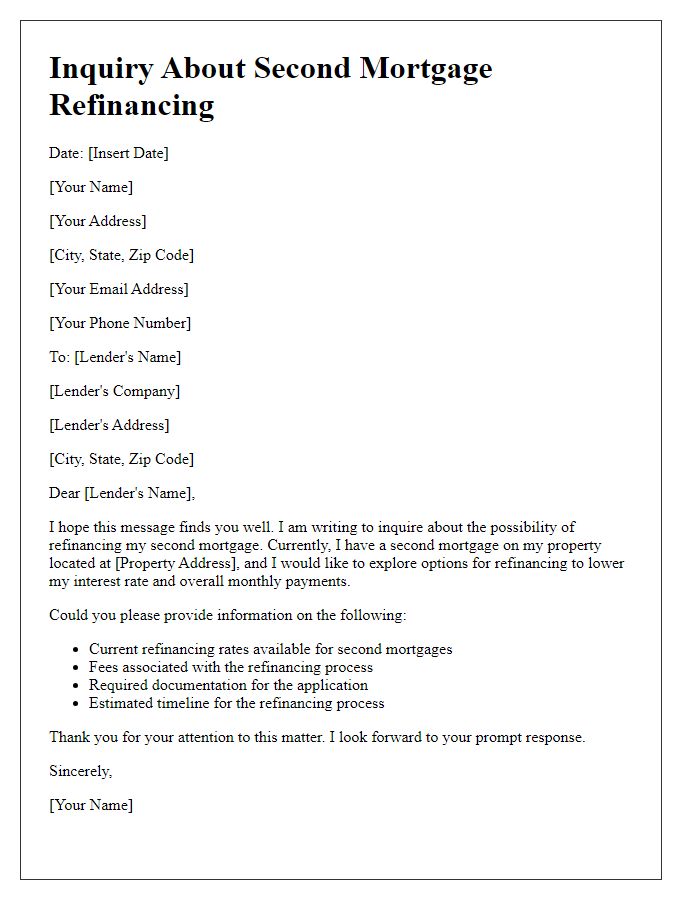

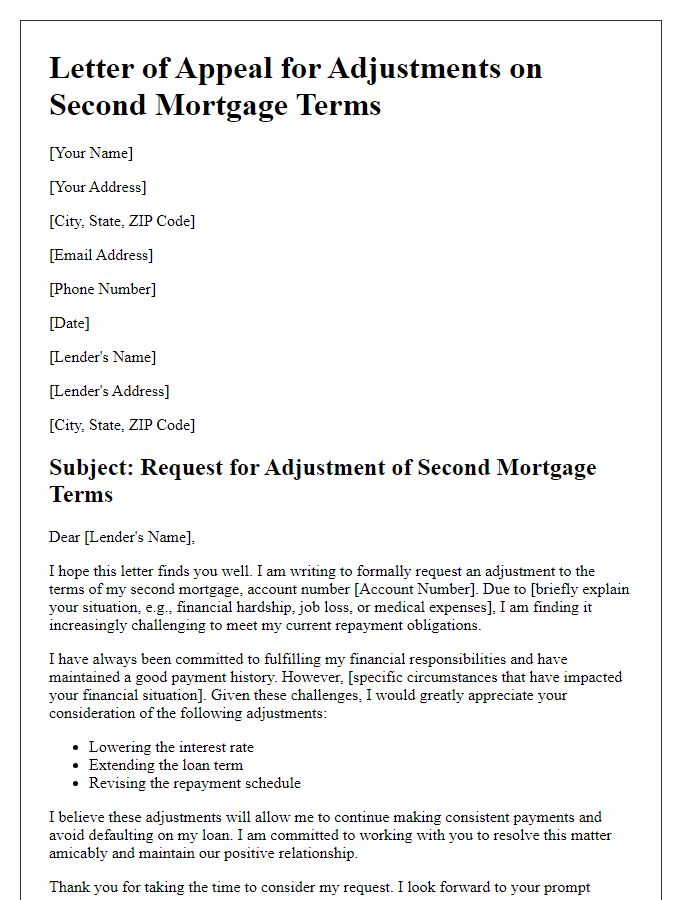

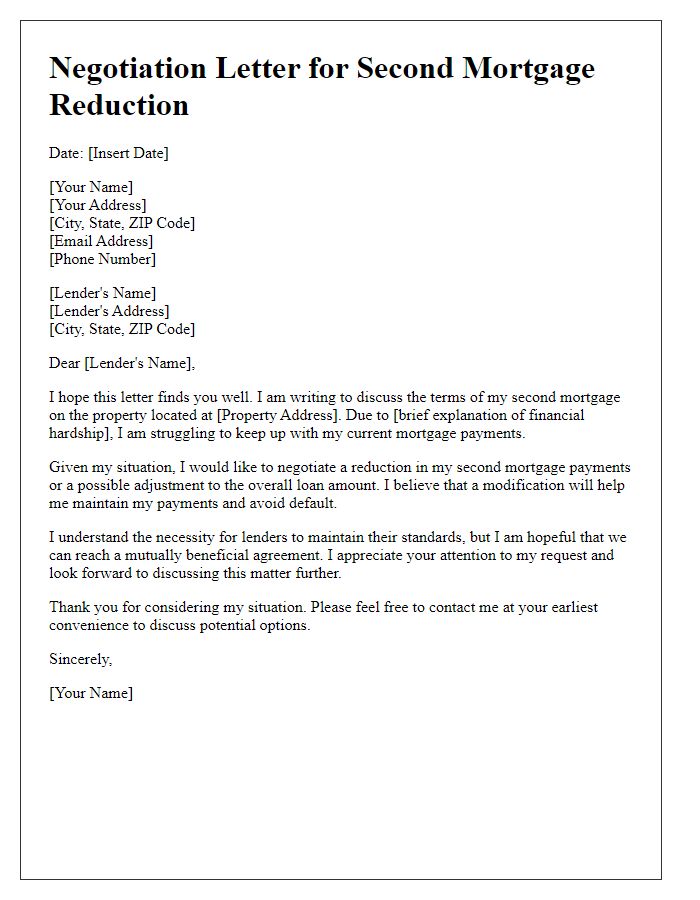

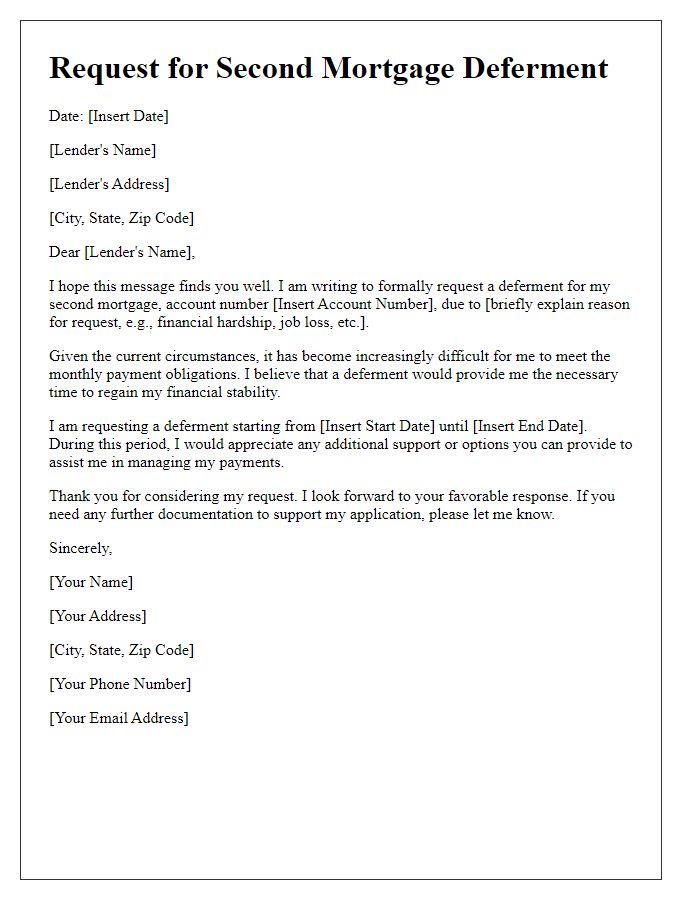

Clear purpose of the request

A second mortgage adjustment request aims to modify the terms of an existing second mortgage loan, often for more favorable conditions. Homeowners seek adjustments to improve financial flexibility, reduce monthly payments, or lower interest rates. Specifics include current mortgage balance, interest rate, and payment terms, along with proposed changes. Documentation may include income statements, current financial burdens, and home value analysis, critical for lenders to assess eligibility. The outcome could yield significant monthly savings, enhance cash flow, and provide opportunities for further financial investment or home improvement.

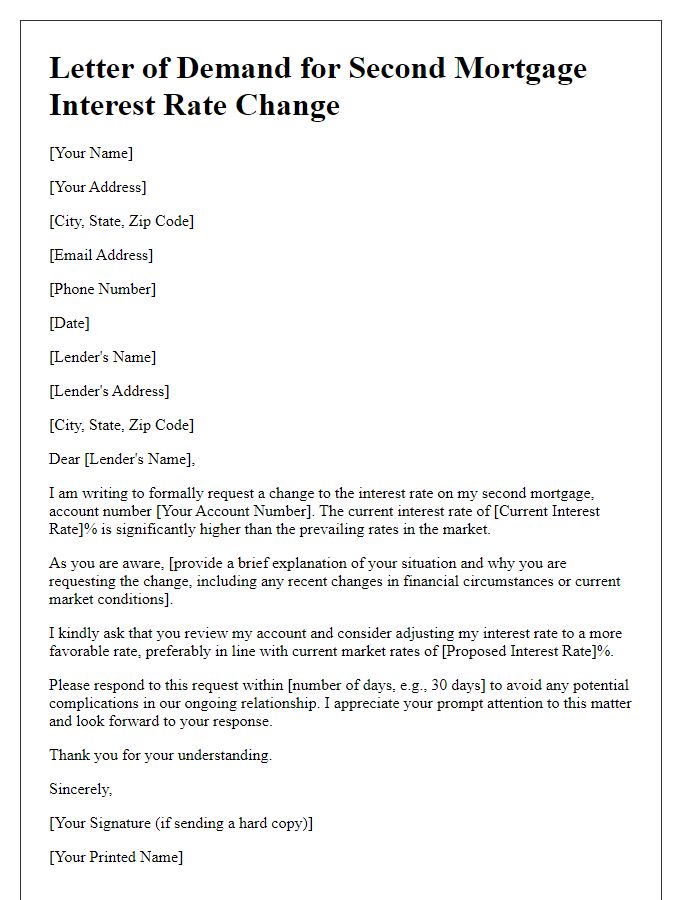

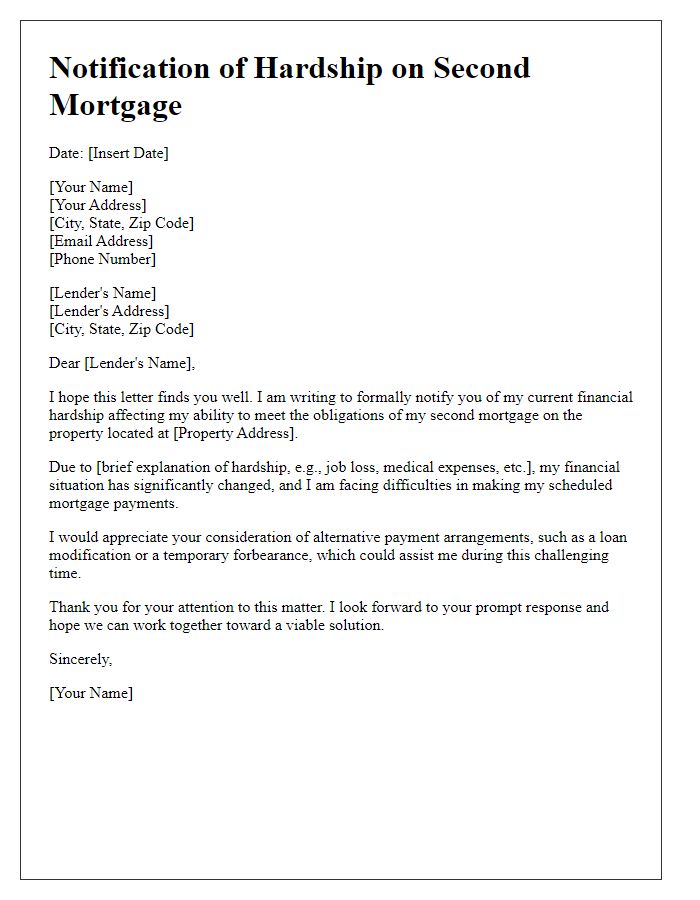

Justification for adjustment request

Homeowners often seek a second mortgage adjustment due to rising financial pressures. Adjustments can include changes in interest rates or payment terms, directly impacting overall monthly expenses. A significant life event, such as job loss affecting income levels, contributes to these requests. The mortgage market can fluctuate, with current rates dipping below existing loan terms, making refinancing advantageous. Additionally, property values may increase, providing equity that can be utilized to negotiate better terms. Filing a formal request with documentation, such as recent pay stubs or property appraisals, strengthens the case for a favorable adjustment.

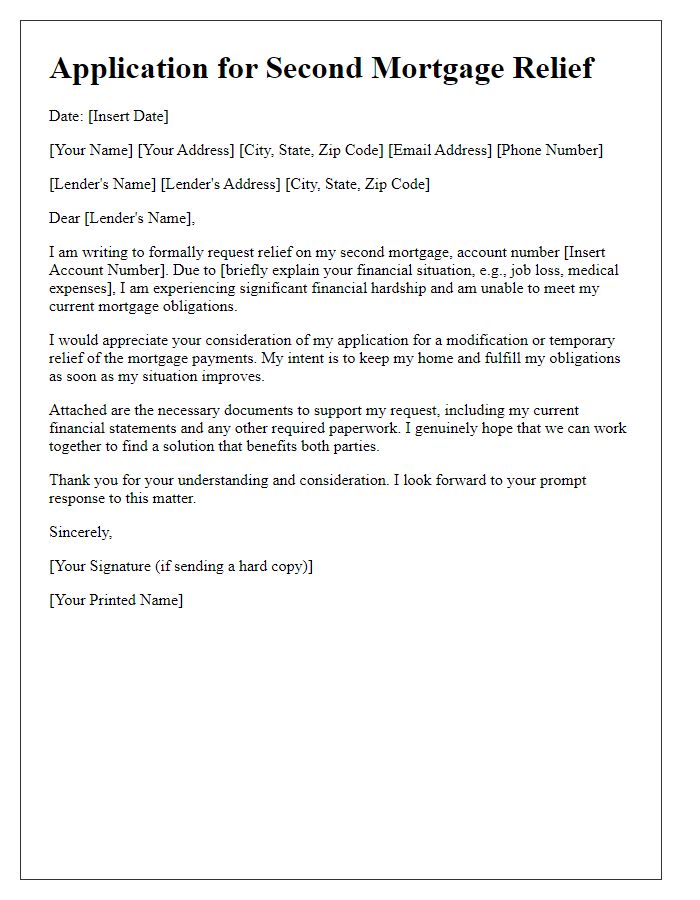

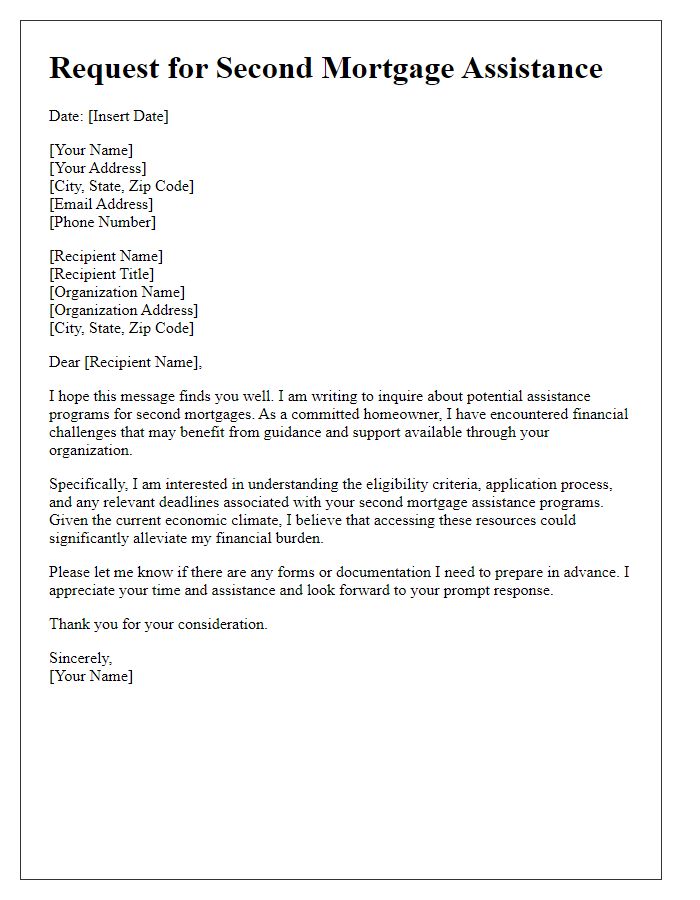

Financial documentation support

A second mortgage adjustment request requires comprehensive financial documentation to support the application. Essential papers include income verification documents, such as recent pay stubs or tax returns from the last two fiscal years, alongside a detailed monthly budget outlining all expenses. Additionally, providing a current credit report enables lenders to assess creditworthiness, while a property appraisal report, completed by a certified appraiser, establishes the home's market value. Corresponding bank statements for at least the last three months showcase financial stability and liquidity. Gathering these documents can streamline the adjustment process, increasing the chances of approval for favorable mortgage terms.

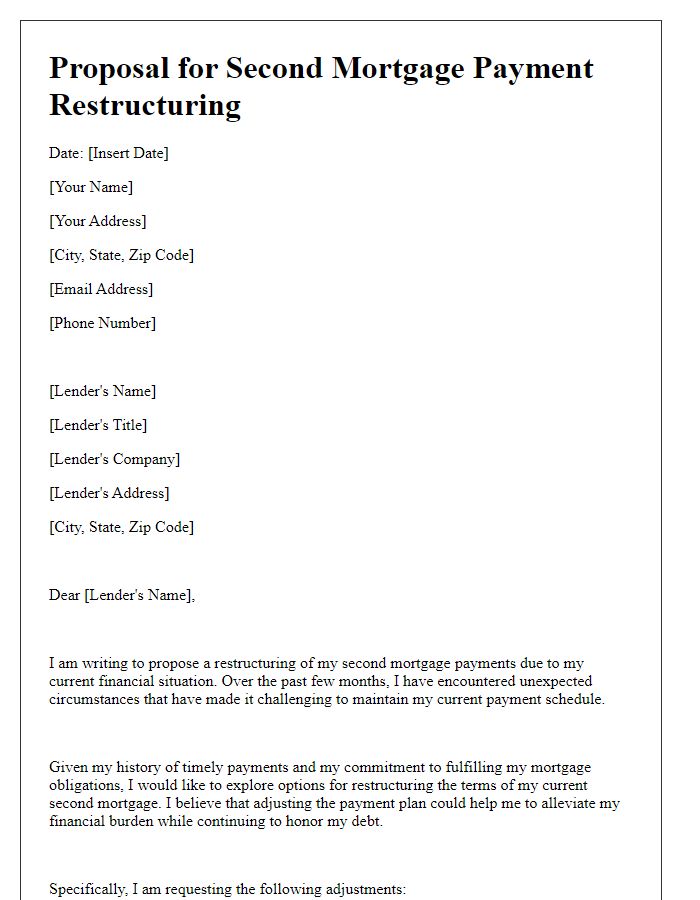

Contact information and follow-up instructions

A second mortgage adjustment request requires precise communication to ensure clarity and prompt attention. Homeowners should include accurate contact information such as full name, address of the property securing the mortgage (including state and ZIP code), and a primary phone number for follow-up. It is vital to indicate the best times for contact, ensuring availability for discussions during business hours, typically 9 AM to 5 PM on weekdays. Moreover, homeowners may benefit from providing an email address for additional correspondence and document sharing. A clear subject line, such as "Request for Second Mortgage Adjustment," will help mortgage service representatives prioritize the request efficiently. Additionally, homeowners should mention any relevant identification numbers associated with the mortgage, such as the loan number, to aid in quick identification of the account.

Comments