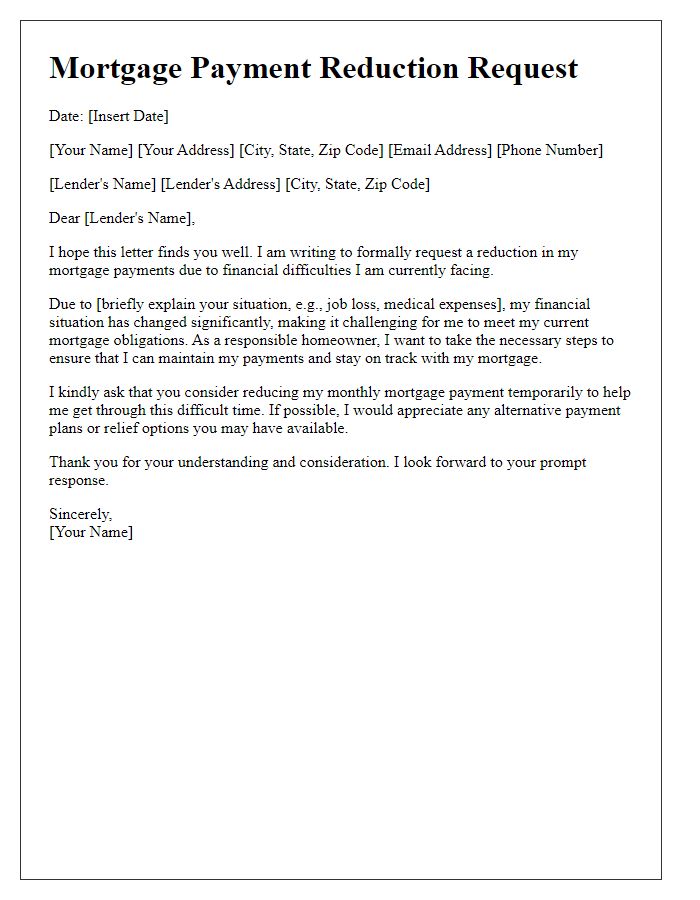

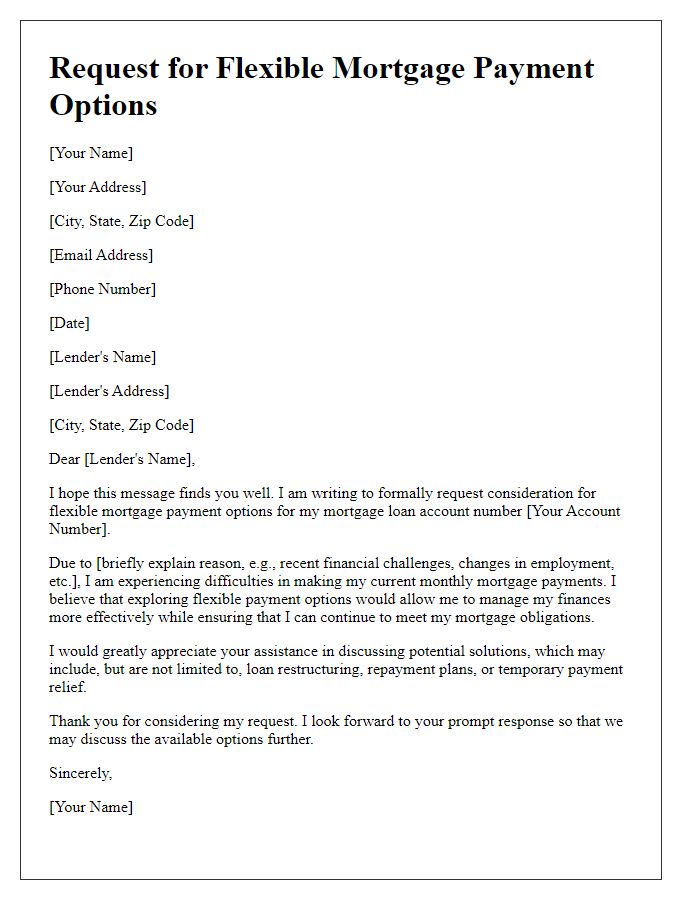

Are you feeling the pinch of rising mortgage payments? You're not alone, and there are options available to help ease the burden. One effective approach is to submit a mortgage payment adjustment request, which can potentially lead to more manageable terms based on your current financial situation. If you're curious about how to craft this request effectively, read on to discover our step-by-step guide!

Account Information

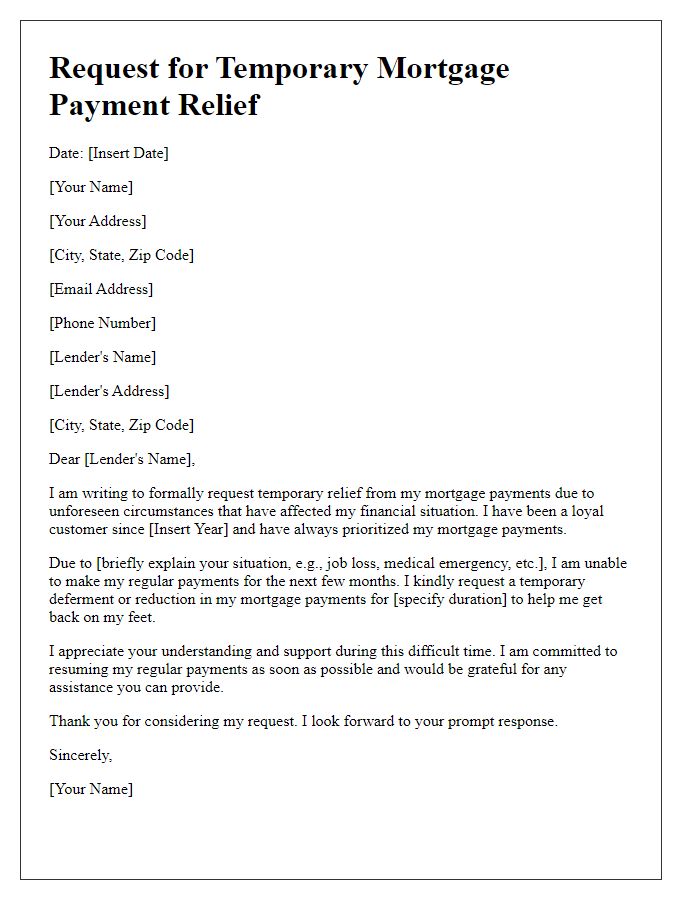

Homeowners seeking a mortgage payment adjustment must provide essential account information to initiate the process. This includes mortgage account number, which uniquely identifies the loan on the lender's system, and property address, specifying the exact location of the mortgaged property, such as the street name, city, and ZIP code. Borrower's contact details, including phone number and email address, enable communication with the lender, ensuring timely updates on the request status. Alongside financial hardship documentation, such as recent pay stubs or unemployment letters, borrowers may include specific adjustment requests, mentioning desired changes in monthly payment amounts or loan terms, to facilitate the lender's review. Clear presentation of this information is crucial for an efficient adjustment process.

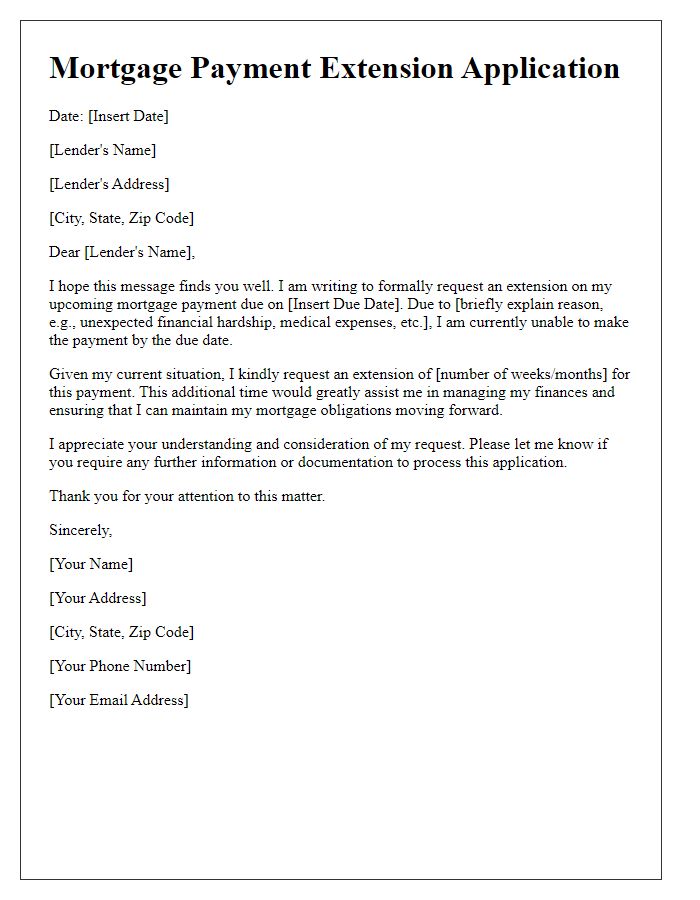

Reason for Adjustment

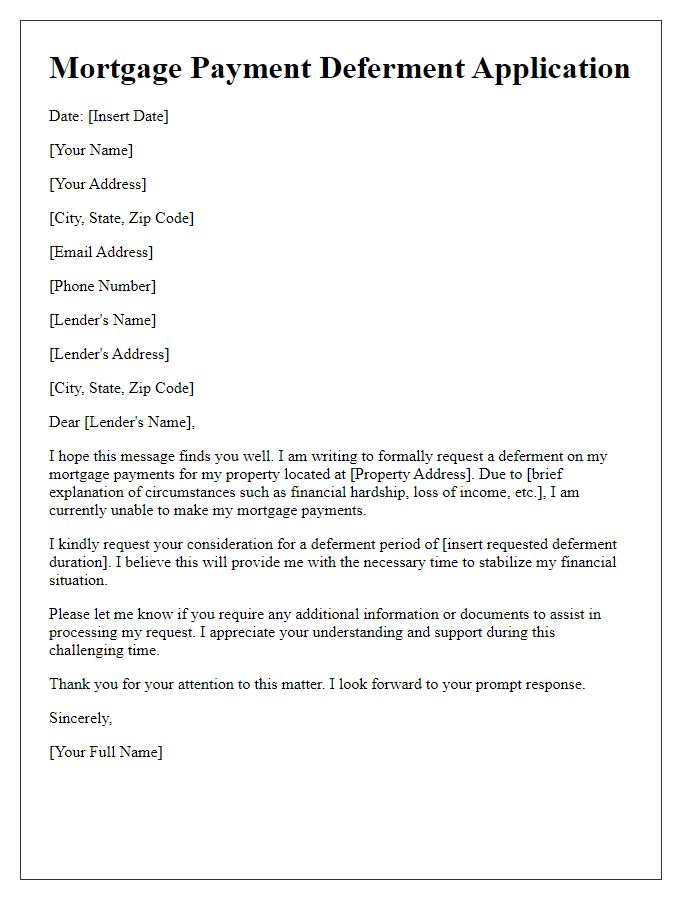

Mortgage payment adjustments can provide relief for homeowners facing financial difficulties. Situations such as job loss (unemployment rates at 5.8% in certain regions), medical emergencies (with average hospital stays costing $30,000), or unexpected home repairs (like roof damage averaging $8,500) often lead to the necessity of reducing monthly payments. Financial institutions may offer tailored solutions if borrowers present well-documented evidence of their challenges, which can include bank statements, doctor's notes, or layoff letters. The process typically involves submitting a formal request to lenders, who may evaluate the homeowner's financial situation and propose alternative payment plans or forbearance options to ease their burden.

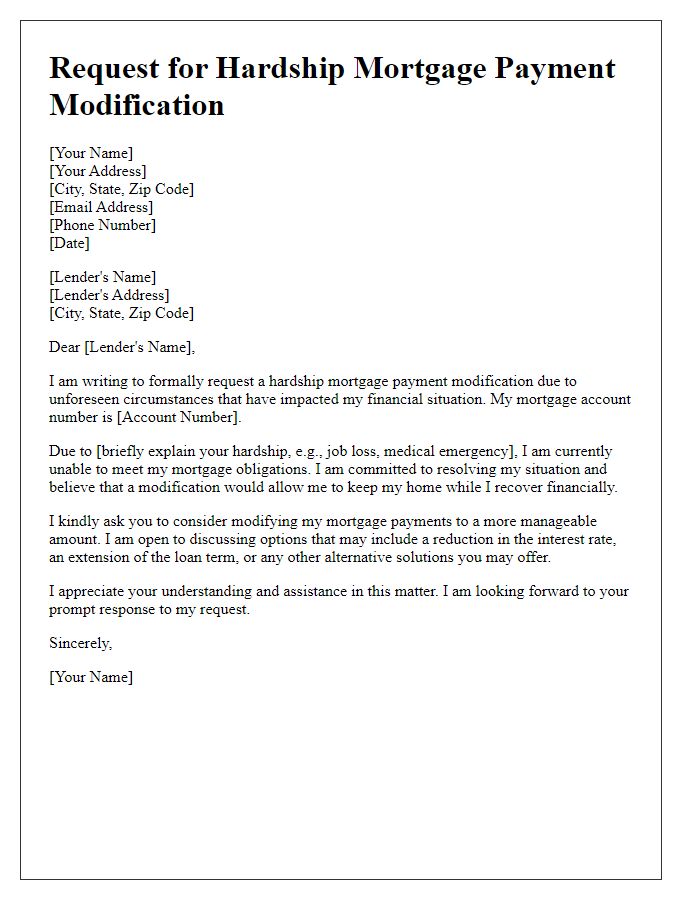

Supporting Documentation

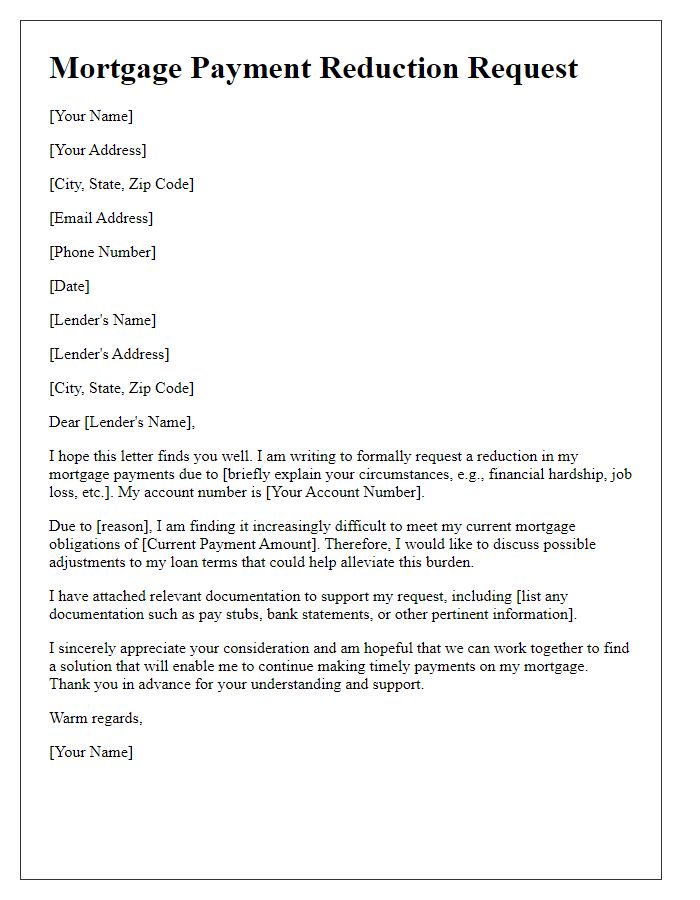

Submitting a mortgage payment adjustment request often requires supporting documentation, such as proof of income, bank statements, and a hardship letter. Accurate income verification can include recent pay stubs from employers and tax returns for the past two years, particularly for self-employed individuals. Bank statements must typically span the last three months to show current financial standings. Hardship letters should detail specific circumstances causing the request, whether unemployment, medical expenses, or other significant life changes, dated and signed for authenticity. Additionally, including documentation of any loss of employment or unexpected expenses can strengthen the case for adjustments.

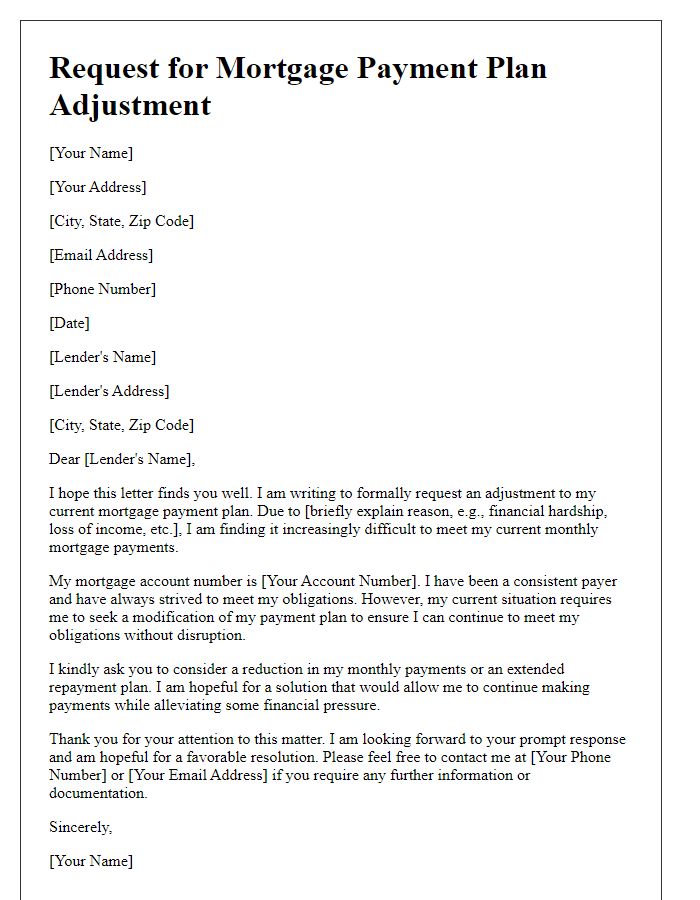

Proposed Adjustment Terms

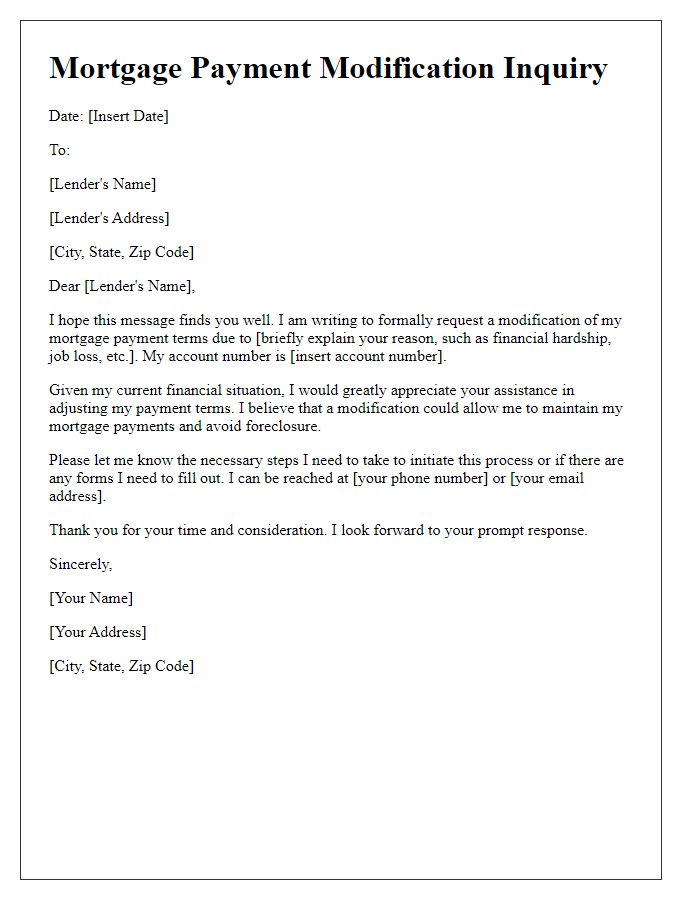

Homeowners experiencing financial strain often seek mortgage payment adjustments to maintain their properties. Proposed adjustment terms typically involve modifications such as reduced monthly payments, extended loan terms, or temporary forbearance options. Institutions like Fannie Mae or Freddie Mac facilitate such adjustments under specific conditions, ensuring homeowners can sustain mortgage obligations without sacrificing property ownership. By proposing a revised payment schedule encompassing both principal and interest recalibrations, borrowers aim to align payments with current income levels. Effective communication with lenders like Wells Fargo or Bank of America is crucial in negotiating these terms, ensuring the ongoing relationship remains constructive while aiding financial recovery.

Contact Information

Mortgage payment adjustments can significantly impact financial planning for homeowners. The process often requires clear communication with key entities such as mortgage servicers, financial institutions, or credit unions. Homeowners typically include personal details like address, account number, and phone number when submitting requests. Dates of previous payment adjustments, current mortgage terms such as principal balance and interest rate, as well as financial hardship evidence (like job loss or medical expenses) provide context for the adjustment request. Accurate documentation ensures that lenders can assess the situation effectively, fostering a productive dialogue to potentially lower monthly payments or extend terms.

Comments