Are you puzzled about your outstanding loan balance? It's a common concern among borrowers seeking clarity on their financial obligations. Understanding the details of your loan can not only alleviate confusion but also empower you to manage your finances more effectively. Join us as we explore how to request a comprehensive breakdown of your outstanding loan balance and take control of your financial future!

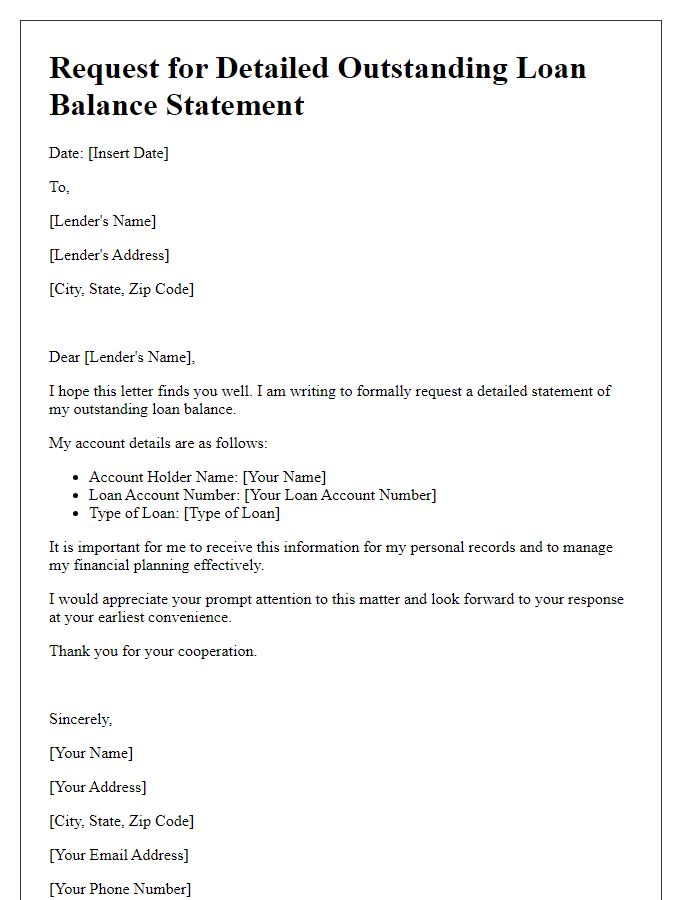

Personal identification information

To obtain a detailed breakdown of an outstanding loan balance, individuals should provide their personal identification information, such as full name, date of birth, and social security number. Including account-specific details like the loan account number and lender's name facilitates quick access to records. Dates of last payment and outstanding amounts, typically found in recent statements, should also be mentioned for clarity. Such comprehensive information aids financial institutions in efficiently retrieving accurate data regarding the loan status, interest rates, and payment history. This structured request can lead to a clearer understanding of an individual's remaining financial obligations.

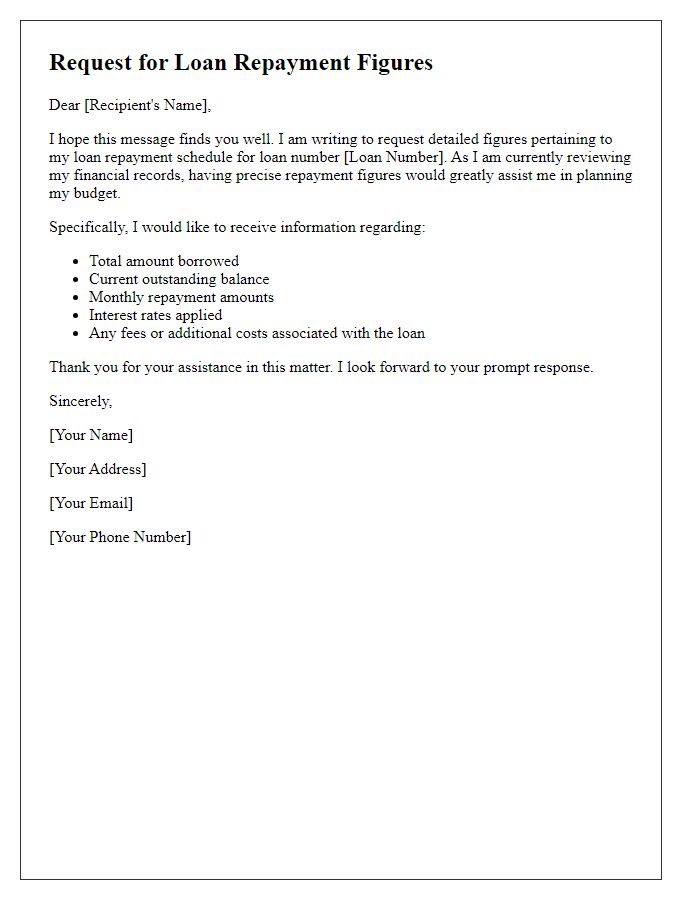

Loan account number

Outstanding loan balance breakdown requests are vital for borrowers seeking to understand their financial obligations. When contacting financial institutions, such as banks or credit unions, it is important to provide specific details regarding the loan account, including the unique loan account number (e.g., 123456789) related to the outstanding balance. Borrowers may seek clarification on principal amounts owed, accrued interest over time, any applicable fees (such as late payment penalties), and the payment history which impacts the remaining balance. This breakdown aids in transparency, allowing borrowers to track their repayment progress and plan accordingly for future payments.

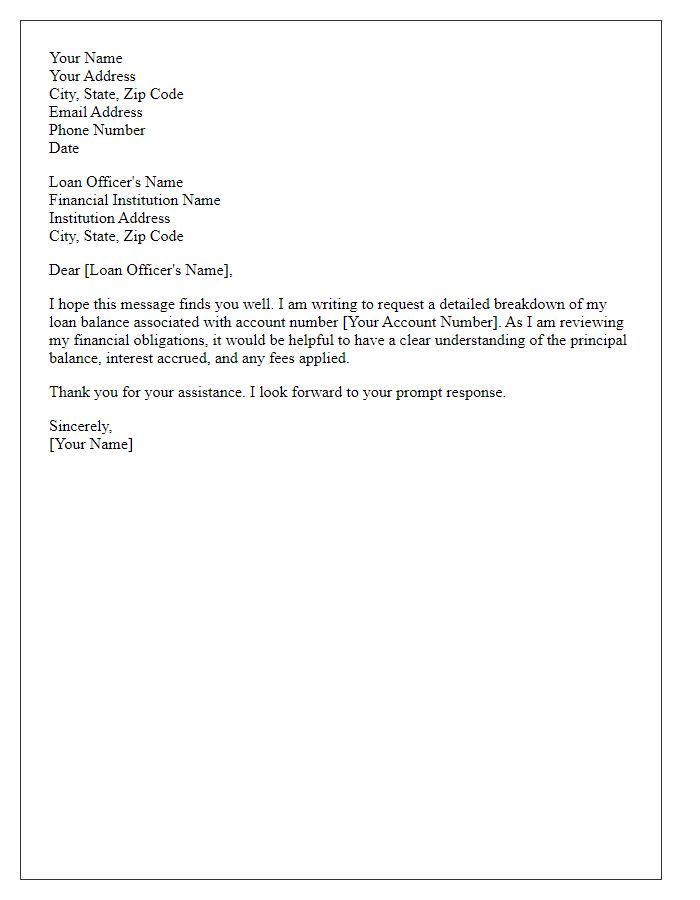

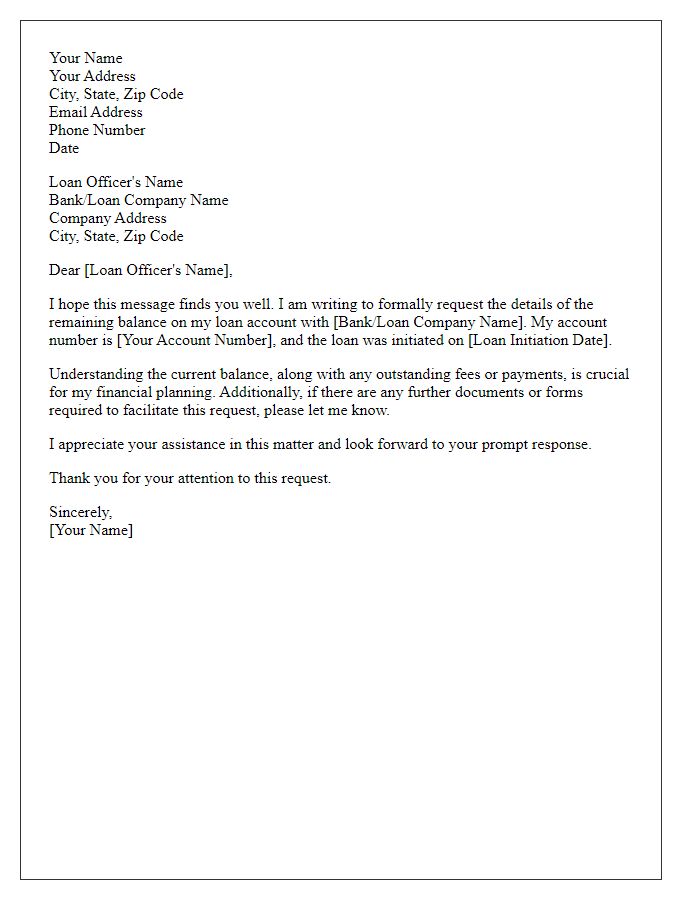

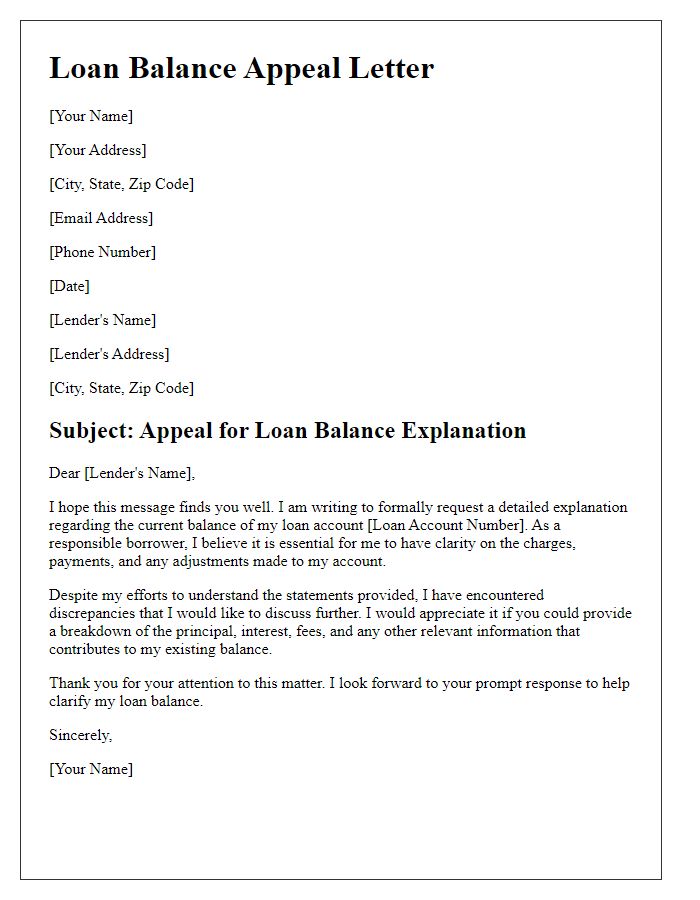

Specific request for detailed breakdown

A formal request for an outstanding loan balance breakdown is essential for understanding financial obligations. A breakdown should include principal amount, interest accrued, fees charged, and payment history associated with the loan. Information should specify loan type, such as secured or unsecured, as well as the lender's name, typically a financial institution such as a bank or credit union. Dates of loan issuance and the current outstanding balance will provide clarity. Details about any missed payments or penalties incurred can also be significant. Accurate records are crucial for effective financial management and planning.

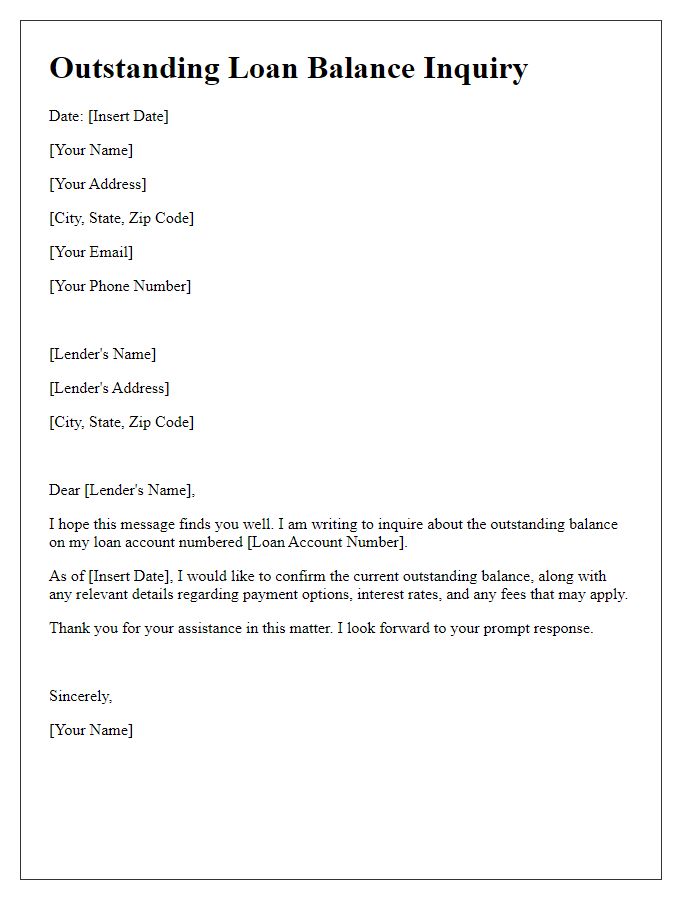

Contact information for response

Requesting an outstanding loan balance breakdown is essential for financial clarity. A loan balance breakdown should include detailed information on the principal amount, interest rates, payment history, and any additional fees. This information is crucial for understanding how much remains on loans, such as personal loans from institutions like Wells Fargo or Bank of America. Specific details regarding due dates, payment methods, and interest accrual should also be highlighted. For a prompt response, ensure to provide clear contact information, including a phone number, email address, or mailing address, to facilitate communication with the lending institution, which can be reached during standard business hours (8 AM - 5 PM).

Clear deadline for response

Requesting an outstanding loan balance breakdown represents an essential step in understanding financial obligations. Borrowers often seek clarity regarding principal amounts, interest rates, and additional fees associated with loans, such as those from federal programs like FFEL or private lenders. A breakdown typically includes detailed figures, payment history, and any overdue amounts, which helps individuals plan their financial future. Including a clear deadline for a response, such as a specified date (e.g., 14 days from the date of the request), ensures timely communication, allowing borrowers to address any discrepancies and avoid potential penalties. This process is crucial for maintaining financial health and ensuring responsible loan management.

Letter Template For Requesting Outstanding Loan Balance Breakdown Samples

Letter template of request for detailed outstanding loan balance statement

Comments