Are you grappling with the challenge of settling an outstanding loan dispute? Navigating the complexities of financial disagreements can be daunting, but a well-crafted letter can pave the way for resolution. In this article, we'll explore effective strategies and templates for drafting your letter, ensuring clarity and professionalism. Ready to take the first step towards resolving your loan disputes? Let's dive in!

Clarity and Conciseness

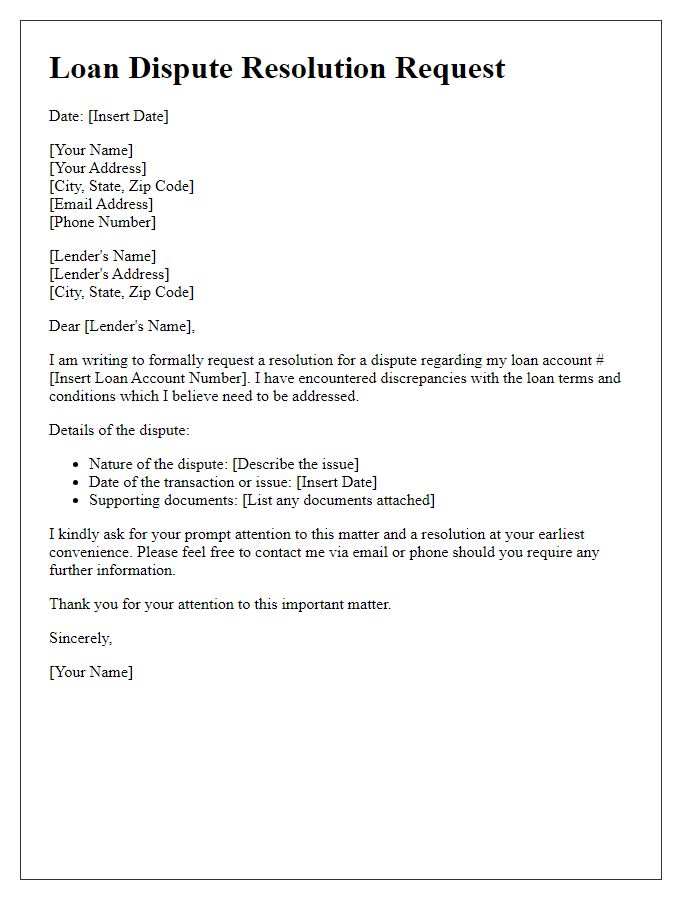

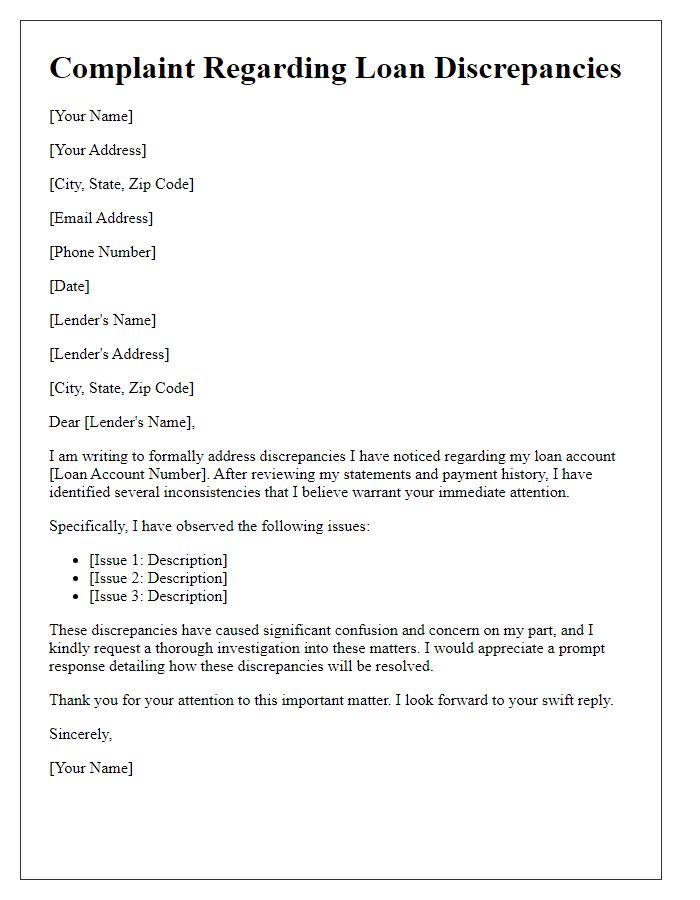

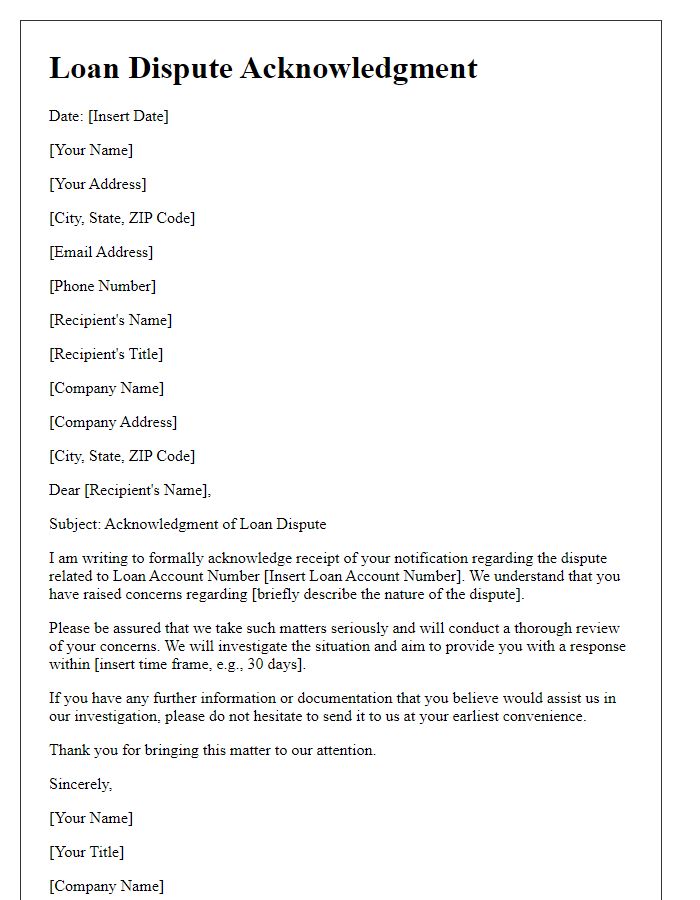

When dealing with outstanding loan disputes, clarity and conciseness in communication are crucial. Providing well-organized information can significantly aid in resolving issues effectively. Begin by stating the loan details, including the loan amount, account number, and the parties involved. Clearly outline the nature of the dispute, whether it pertains to repayment terms, interest rates, or missed payments. Include any specific dates relevant to the issue, such as loan origination date or missed payment date. Consider attaching copies of pertinent documents, like loan agreements or payment notices, to substantiate your claims. Clearly state the desired resolution, whether it is adjusting repayment terms, waiving fees, or any other agreeable outcome. Finally, provide your contact information for further communication to ensure swift resolution.

Professional Tone

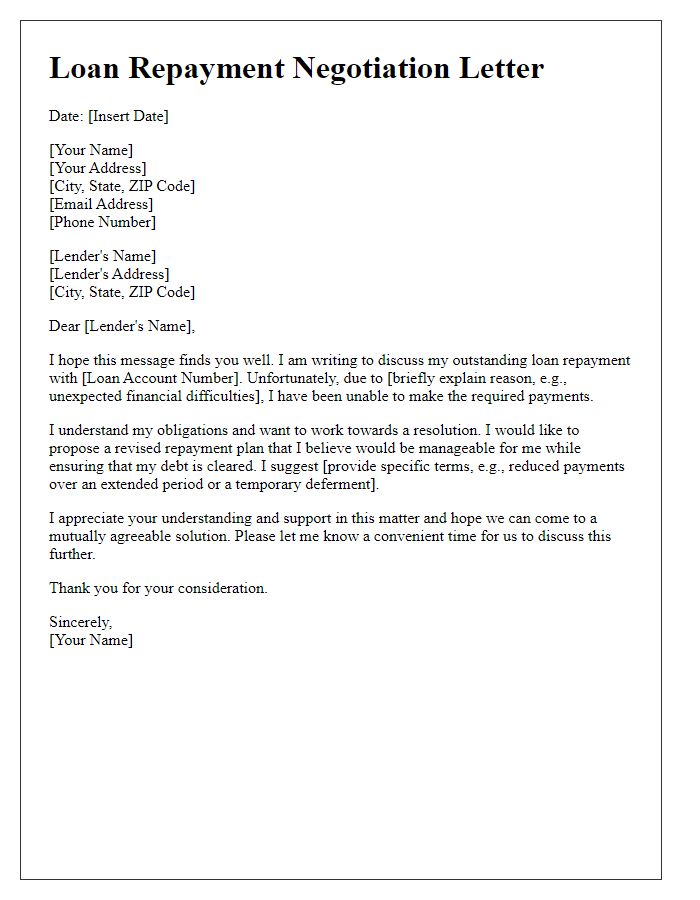

Outstanding loan disputes can have significant financial implications for parties involved, particularly in cases such as the unresolved loan from ABC Bank amounting to $10,000. Delays in repayment not only accrue interest but also risk damage to credit scores, as reported to agencies like Experian. Financial institutions frequently employ negotiation strategies for settlement, aiming for amicable resolutions that can include reduced principal amounts or modified payment plans. Engaging in discussions with a mediator experienced in loan settlements can also provide guidance in navigating complex legalities. Regular communication regarding outstanding balances combined with documentation of all transactions can aid in establishing a clear record, essential for dispute resolution.

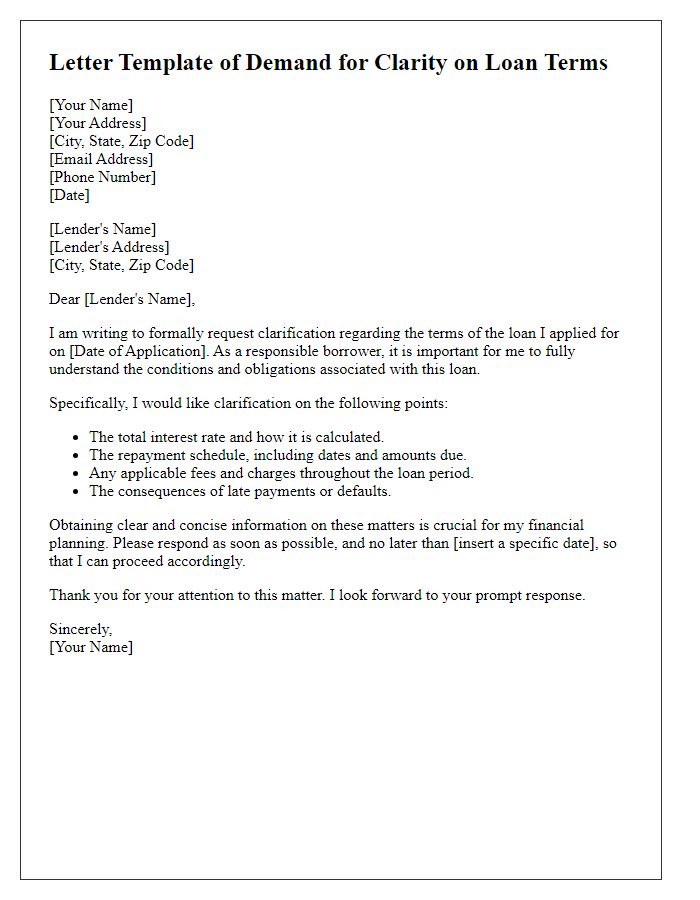

Specific Loan Details

A careful examination of outstanding loan disputes requires detailed documentation, such as Loan ID (123456789), which references an unsecured personal loan issued by ABC Financial in January 2021. The total principal amount borrowed was $15,000, with an annual interest rate of 7.5%. Monthly payments were set at $500 over a 36-month term, starting February 2021. As of October 2023, several late payment notices were issued due to missed payments in July, August, and September, leading to an increase in the total amount due. Documentation of these payment discrepancies, including the date and amount owed, helps establish a clearer understanding of the current outstanding balance, which now stands at $4,500. The resolution of disputes surrounding miscommunication regarding payment schedules is crucial for both the lender and borrower to ensure accurate financial records and repayment terms.

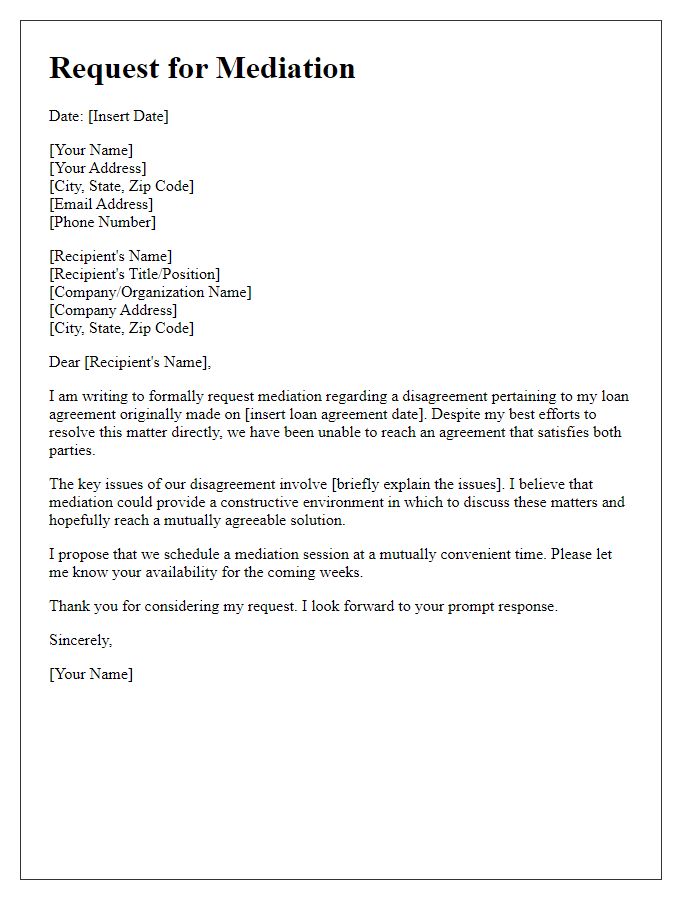

Proposed Resolution

Outstanding loan disputes often arise from unresolved payment issues or miscommunication between parties. Proposed resolutions should include detailed repayment plans that specify amounts, due dates, and potential interest rates involved. For instance, if a borrower owes USD 5,000, a proposed resolution might suggest monthly installments of USD 500 for ten months, ensuring clarity on terms. Additionally, parties should document any adjustments to repayment schedules to prevent future misunderstandings. Including contact information for both parties facilitates direct communication, expediting dispute resolution. Legal terms, such as confidentiality clauses, can also enhance trust during negotiations.

Contact Information

Outstanding loan disputes can significantly impact financial stability and credit scores. Proper communication through a formal letter, addressing the lender or financial institution directly, is essential. Ensure to include your full name, contact number, and email address at the top. Provide details of the loan, such as the loan number, original loan amount of $10,000, and outstanding balance of $2,500. State the nature of the dispute clearly, referencing specific occurrences like missed payments or incorrect billing dates. Assert any proposed resolutions, including potential repayment plans or negotiation of terms. Follow up with your contact information to facilitate further communication and resolution.

Comments