Are you feeling overwhelmed by your loan obligations because of a sudden illness? You're not alone; many individuals face similar situations, and it's crucial to understand that there are options available to relieve some of that financial stress. In this article, we'll explore a step-by-step guide on how to effectively communicate with your lender about modifying your loan terms, ensuring you can focus on your recovery without the added burden of financial worry. So, let's dive in and discover how to navigate this process together!

Borrower's Personal Information

Serious health conditions can significantly impact an individual's financial obligations, particularly in the context of loan agreements. For instance, a borrower diagnosed with a severe illness, such as cancer or a debilitating chronic disease, may face mounting medical expenses exceeding thousands of dollars. This unexpected financial strain can hinder the ability to meet monthly loan repayments on personal loans, mortgages, or auto loans. Institutions like banks and credit unions often have specific procedures for borrowers seeking to modify loan terms, which may include interest rate reductions or extended payment periods. Communication with lenders, typically involving documentation such as medical certificates and a detailed account of financial changes, is essential to navigate these challenging circumstances effectively.

Loan Account Details

Loan account modification can be necessary for individuals facing health challenges. Medical conditions can impact income stability and financial responsibilities. Borrowers should gather essential documents, such as medical reports and proof of income changes, to provide context for the request. Specific loan details, including the outstanding balance and current interest rate, are vital for context. Institutions may consider adjusting terms like extension of repayment period or reduced monthly payments. Affected individuals should target assistance from their loan servicer or financial institution, providing clear explanations for their circumstances to facilitate understanding and cooperation.

Reason for Modification Request

Financial modifications due to personal health issues, such as chronic illnesses or significant medical conditions, can yield substantial impacts on one's financial obligations. Illness often results in increased healthcare costs, decreased income due to inability to work, and additional expenses related to treatment and medication. These factors may compromise the ability to meet regular loan payments. Institutions like banks or credit unions may offer options such as deferments or interest rate adjustments to alleviate financial strain during recovery. Formal requests often include detailed documentation, such as medical records or letters from healthcare providers, to substantiate the impact of health on financial stability.

Medical Documentation or Reference

Illness can significantly impact individuals' financial situations, particularly regarding loan repayments. Medical documentation, such as hospital bills or doctors' notes, serves as critical evidence in supporting requests for modified loan terms. Financial institutions may assess the severity of conditions like chronic illnesses or temporary disabilities, impacting clients' ability to meet current repayment schedules. Reference to pertinent regulations, such as the Fair Debt Collection Practices Act, could strengthen arguments for favorable modifications. Clear articulation of changes requested, like reduced monthly payments or extended loan terms, provides clarity to lenders. Such adjustments can alleviate financial strain while clients recover, ultimately fostering better loan management and ensuring loan compliance.

Proposed Modified Loan Terms

Proposed modified loan terms can often address accessibility for borrowers facing health challenges, such as chronic illnesses or significant medical events. Financial institutions may offer flexible repayment options, such as extending the loan term, which can decrease monthly payment amounts. Interest rates might be adjusted to lower levels to accommodate the borrower's financial hardship. Moreover, provisions for temporary forbearance, allowing borrowers to pause repayments during recovery periods, can provide crucial relief. Specific conditions, such as submitting medical documentation or verifying income changes, may apply to these modified terms. Ensuring open communication with lenders is essential to navigate the modification process effectively.

Letter Template For Modifying Loan Terms Due To Illness Samples

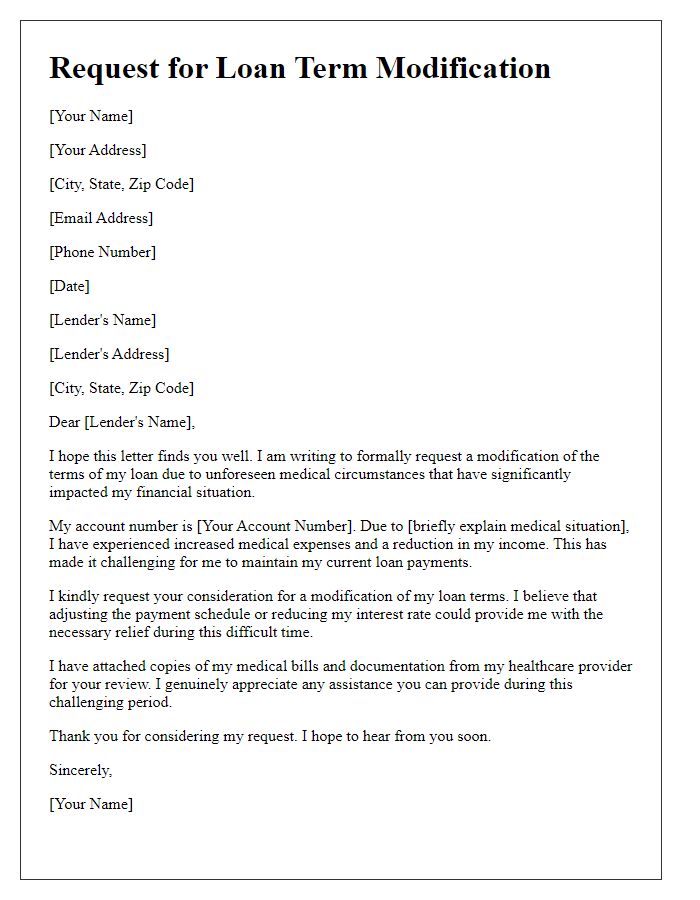

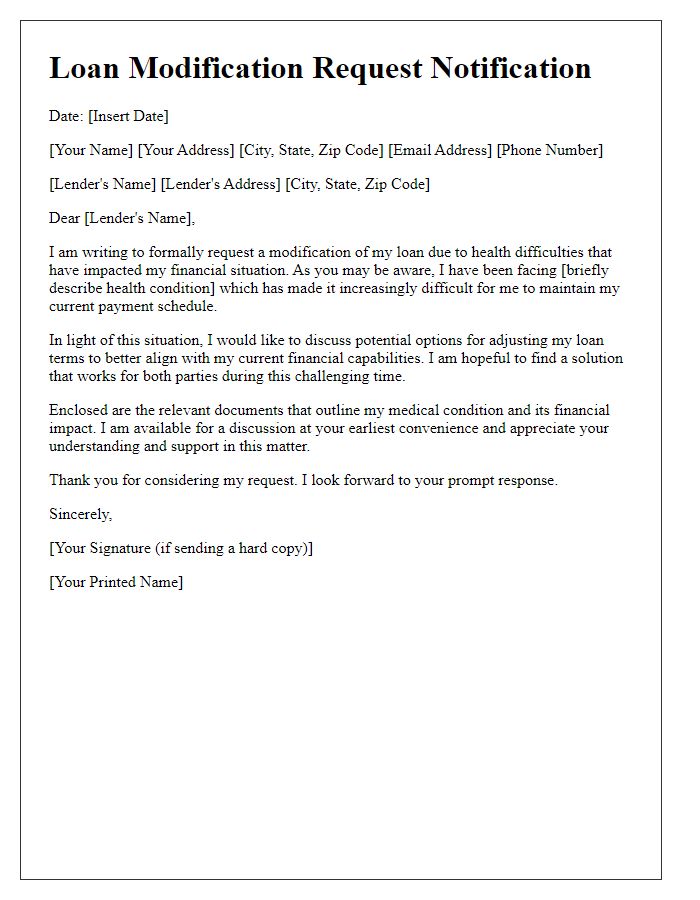

Letter template of request for loan term modification due to medical hardship.

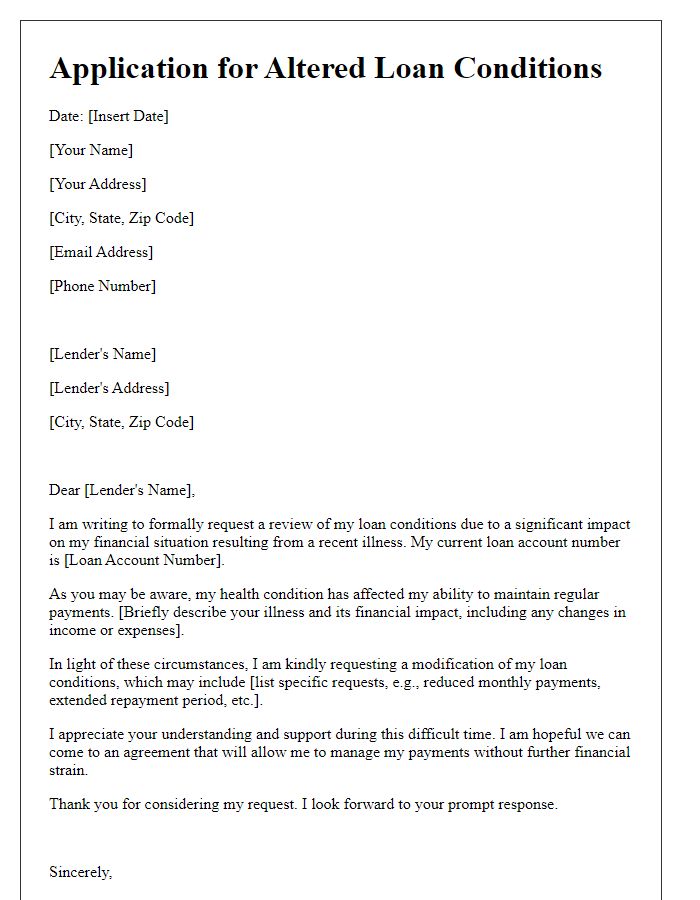

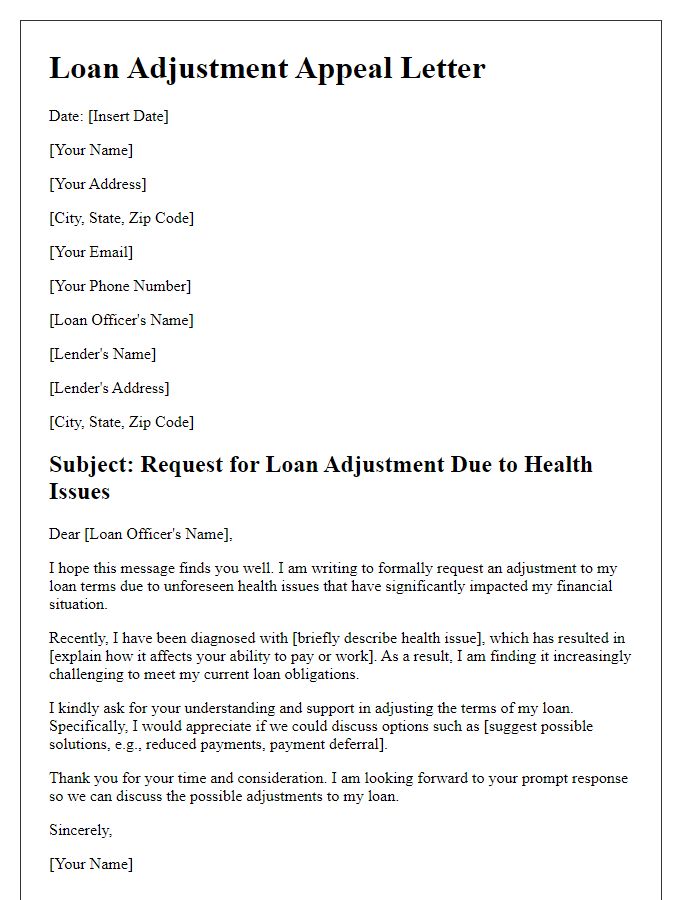

Letter template of application for altered loan conditions based on illness impact.

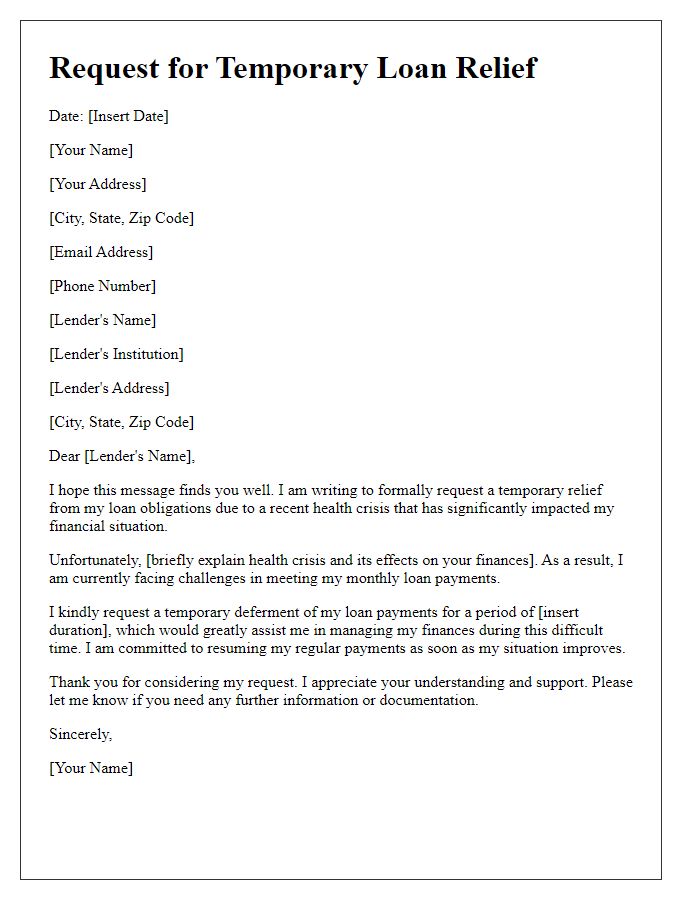

Letter template of notice for requesting temporary loan relief due to health crisis.

Letter template of statement for adjusting loan repayments because of medical circumstances.

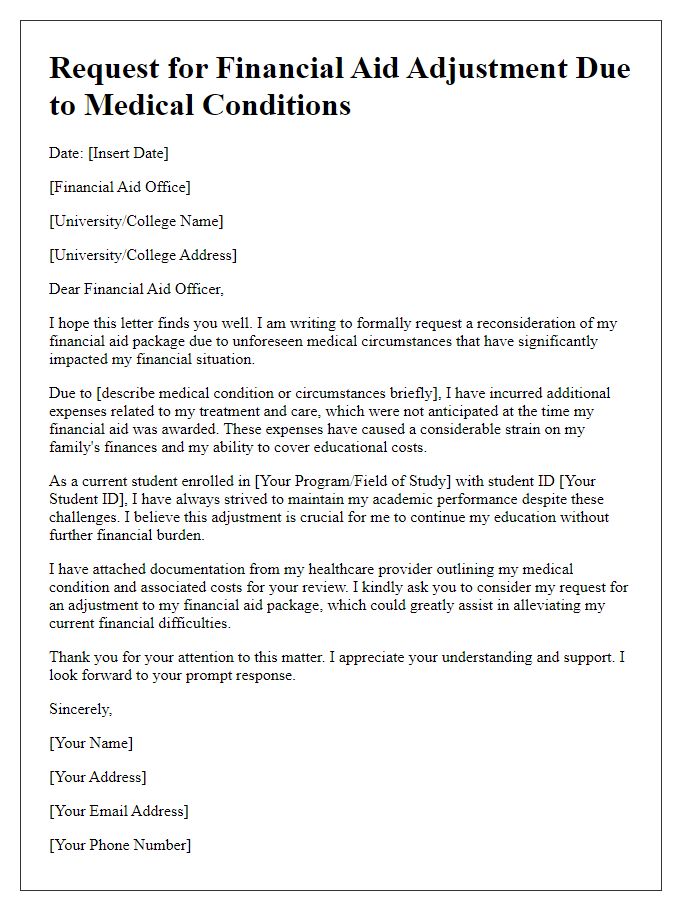

Letter template of inquiry for modified loan structure owing to chronic illness.

Letter template of proposal for reduced loan payments during health recovery.

Letter template of petition for easing loan terms due to unexpected health challenges.

Letter template of notification for loan modification consideration linked to health difficulties.

Comments