Are you feeling the pressure of managing your mortgage during a challenging time? You're not alone, as many homeowners are navigating similar waters, especially during recovery periods. It's essential to know that there are options available, like a mortgage loan extension, that can provide much-needed relief. Join us as we delve deeper into the steps you can take to secure an extension and regain financial stability.

Lender's contact information

A mortgage loan extension during a recovery period can provide borrowers with much-needed relief. A lender's contact information should include essential details such as the official name of the lending institution, typically a bank or credit union, followed by their physical address located in the city and state where the institution operates. Additionally, include critical phone numbers, such as customer service and loan modification departments, preferably with specified hours of operation for accessibility. Email addresses specific to loan inquiries can facilitate quick communication. This information is crucial for borrowers seeking to negotiate terms, particularly during challenging financial times, ensuring they can reach the right department promptly.

Borrower's personal details

Specific borrower details are essential for processing a mortgage loan extension, especially during a recovery period marked by financial hardships. Borrower's full name (for identification purposes), loan account number (for tracking), current address (to verify residential status), and contact information (for communication) are required. Employment status (to assess income stability), monthly income (to determine repayment capacity), and any changes in financial circumstances (including medical expenses or loss of employment) will be relevant. Documented proof of hardship (such as medical bills, layoff notices, or significant decreases in income) is necessary to support the request for an extension. Additionally, the requested extension period duration, along with acknowledgment of existing loan terms and conditions, should be included in the communication.

Clear explanation of extension request

During the economic recovery period, many borrowers find themselves needing additional time to meet their mortgage payment obligations. A mortgage loan extension allows homeowners to prolong the loan term beyond the original maturity date, providing financial relief and flexibility during challenging circumstances. Individuals may face unexpected events, such as loss of income or increased living expenses, leading to difficulty in maintaining monthly payments. A request for an extension typically details the borrower's current financial situation, including any income changes and efforts made to regain stability. Loan servicers might assess these factors, along with the borrower's payment history and overall loan performance, to make informed decisions tailored to the needs of each individual case.

Current financial status and recovery plan

Currently facing financial challenges, many individuals and families are seeking mortgage loan extensions. Specific circumstances, such as job loss or reduced income during economic downturns, necessitate adjustments to mortgage agreements. Implementing a detailed recovery plan, outlining monthly income, expenses, and potential sources of additional revenue, can significantly enhance the likelihood of obtaining an extension. Providing documentation reflecting the current financial status, including bank statements from the past three months and recent pay stubs, is also crucial. Engaging with lenders and showcasing a commitment to maintaining payments as circumstances improve can foster favorable negotiations regarding extended loan terms.

Proposed new loan terms and conditions

Mortgage loan extensions can provide relief for borrowers during financial recovery periods. Revised loan terms may include an extended repayment period, such as an additional 5 to 10 years, which can significantly lower monthly payments. Interest rates might be adjusted, possibly reduced to market rates, to ease financial burdens, often ranging from 3% to 5%, depending on current economic conditions. A temporary forbearance period could allow the borrower to pause payments for 3 to 6 months without penalties, ensuring they can focus on stabilizing their finances. Additionally, the inclusion of options like a graduated payment plan, increasing payments gradually each year, can help borrowers manage cash flow effectively while planning for future financial recovery. Clear communication about these proposed new terms and conditions is crucial for both parties to ensure a smoother transition and better understanding of obligations.

Letter Template For Mortgage Loan Extension During Recovery Period Samples

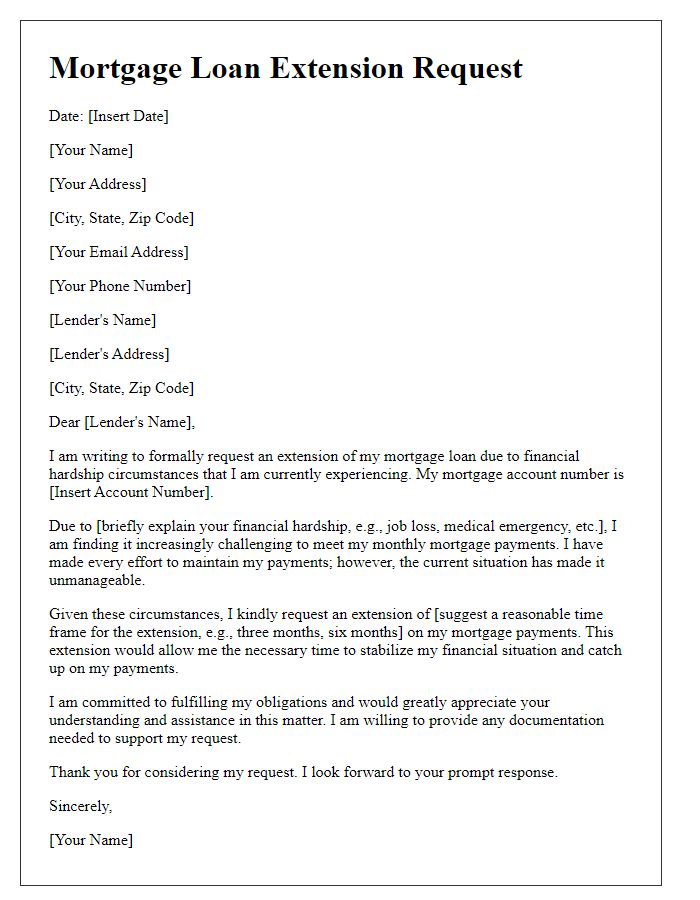

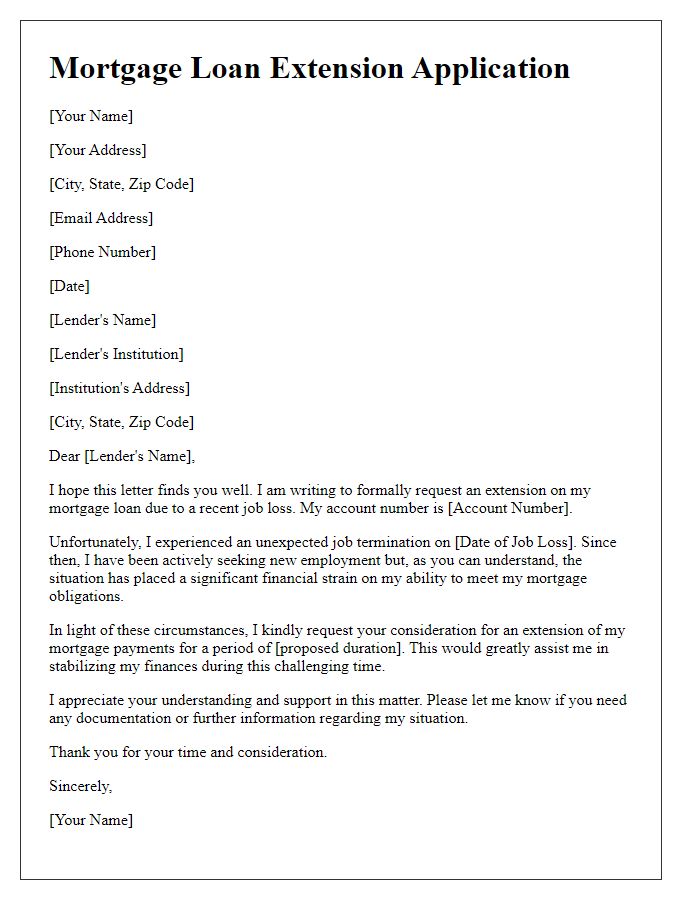

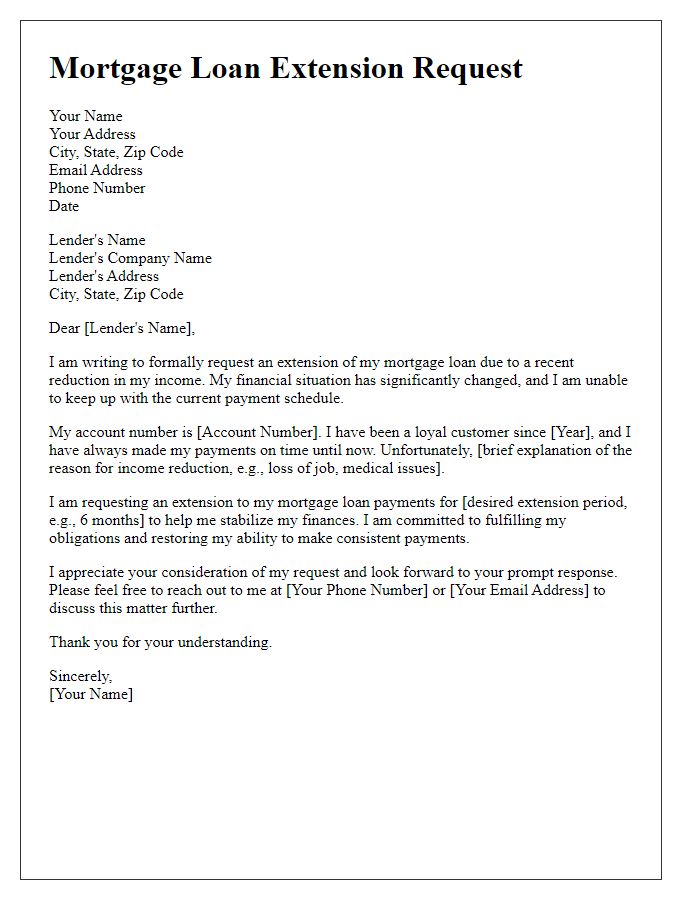

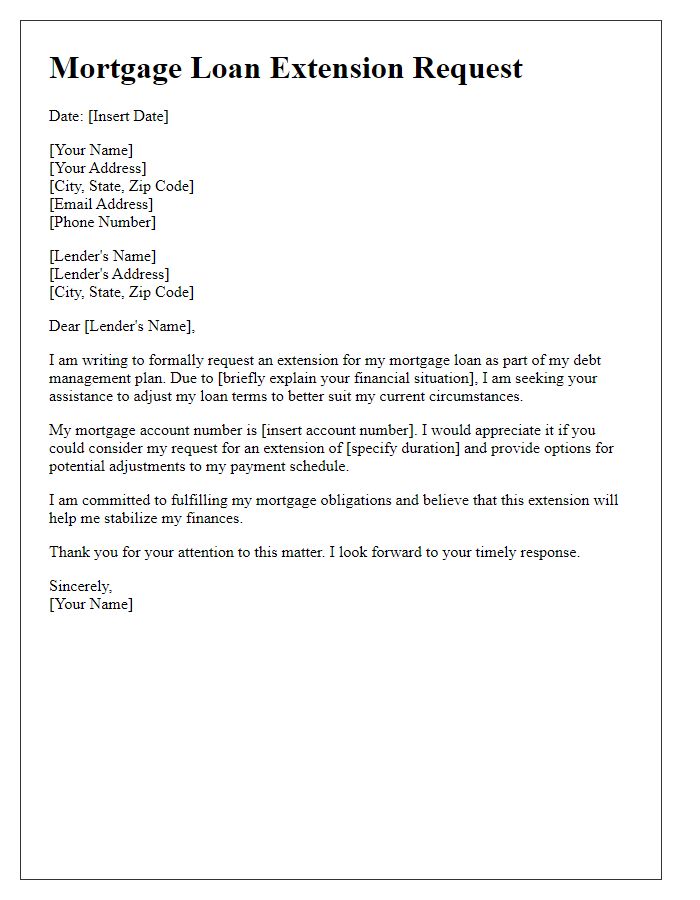

Letter template of mortgage loan extension request for financial hardship.

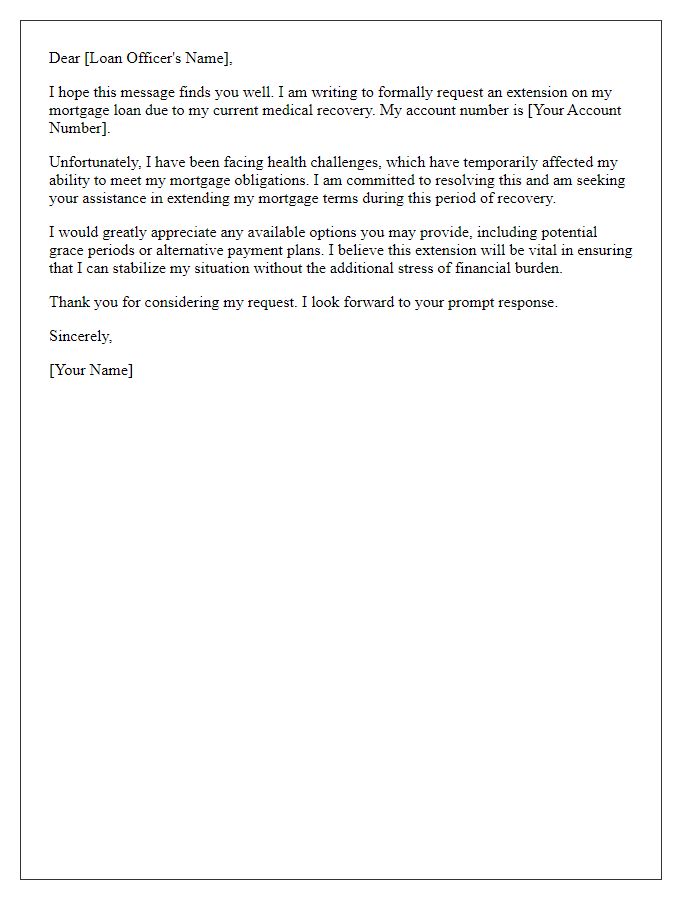

Letter template of mortgage loan extension inquiry during medical recovery.

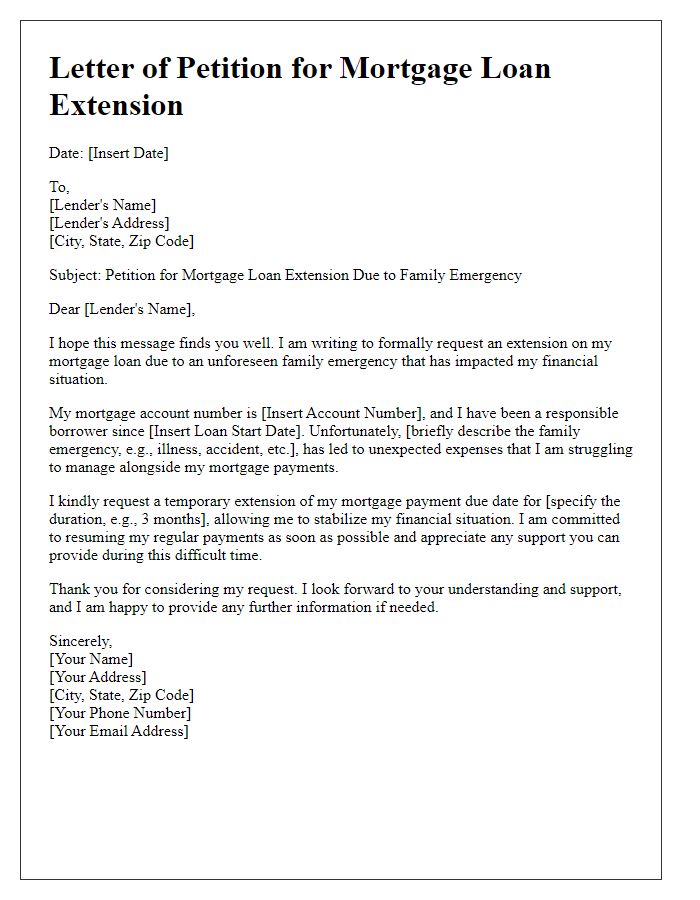

Letter template of mortgage loan extension petition for family emergency.

Letter template of mortgage loan extension proposal during pandemic-related difficulties.

Letter template of mortgage loan extension justification for temporary unemployment.

Letter template of mortgage loan extension need due to unexpected expenses.

Letter template of mortgage loan extension request for assistance during housing instability.

Comments