Navigating the details of a personal loan contract can often feel overwhelming, but understanding the terms is essential for your financial peace of mind. Whether you're looking to clarify interest rates, repayment schedules, or any hidden fees, it's important to ensure you have all the information you need in writing. Clear communication with your lender can help prevent any misunderstandings down the line, ultimately making your loan experience more manageable. Dive into this article to explore how to craft the perfect letter to clarify your personal loan terms!

Clear Identification of Parties Involved

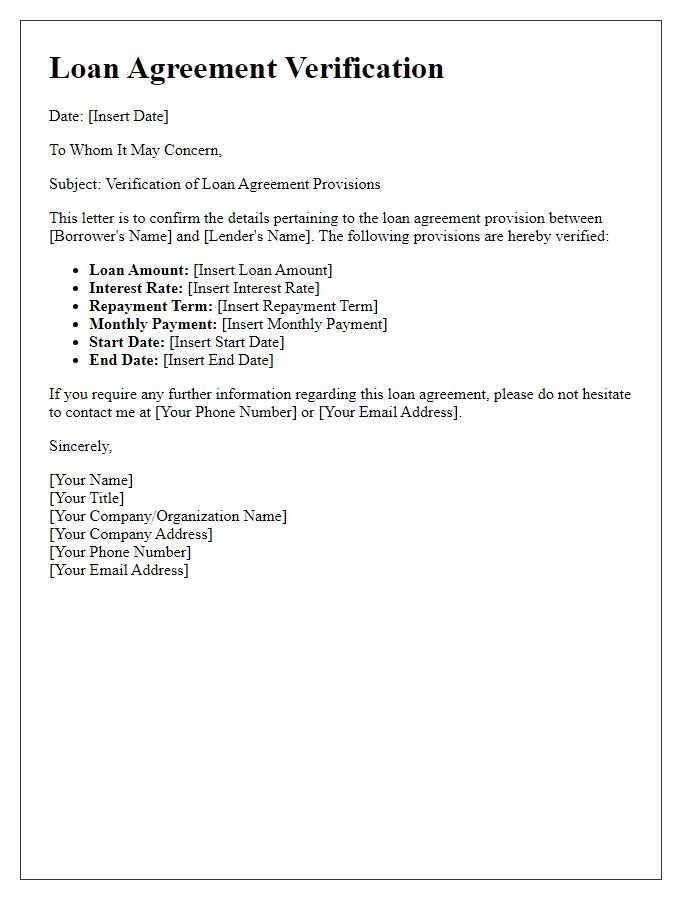

The personal loan contract involves two main parties: the borrower, typically an individual seeking funds for personal use (such as home improvements or debt consolidation), and the lender, which may be a financial institution (like a bank or credit union) or a private individual. Clear identification includes the full legal names of both parties, their addresses, and contact information. Additional pertinent details may encompass personal identification numbers or Social Security numbers for verification purposes and the loan amount, specified in numerical form, alongside the agreed interest rate and repayment terms. Essential dates, including the loan origination date and maturity date, must also be stated to outline the duration of the loan agreement unequivocally.

Detailed Breakdown of Loan Amount and Interest Rate

A personal loan contract typically outlines the loan amount, which can range significantly depending on lender policies, borrower creditworthiness, and purposes such as debt consolidation or home improvement. For example, borrowers often request amounts between $1,000 and $50,000, with varying repayment terms to suit financial situations. The interest rate, often expressed as an Annual Percentage Rate (APR), can also vary widely from approximately 5% to 36%, reflecting individual credit scores and market conditions. Important loan details include repayment schedule, which can range from 12 to 72 months, impacting monthly payment amounts and total interest paid over the loan term. Furthermore, understanding any associated fees, like origination fees or late payment penalties, is crucial as these can add substantial costs beyond the initial loan amount and interest rates specified in the contract.

Comprehensive Repayment Schedule

A comprehensive repayment schedule outlines specific obligations of borrowers in personal loan contracts, detailing the timeline for payments. Typically, this schedule includes monthly payment amounts, interest rates (often ranging from 5% to 36% APR), and total repayment periods (commonly 12 to 60 months). Important dates such as the first payment due date and final payment date must be included. Loan amounts can vary significantly, often between $1,000 and $50,000, depending on the lender and borrower's creditworthiness. Furthermore, penalties for late payments or prepayment options can significantly impact the total borrowing cost, making it essential for borrowers to fully understand the implications of each term outlined in the repayment schedule.

Explanation of Fees and Penalties

Personal loan contracts often include various fees and penalties that borrowers must understand clearly. Typical fees may include origination fees, which can range from 1% to 5% of the loan amount, and late payment fees that generally amount to $15 or more if payments are not made by the due date. Additionally, prepayment penalties may apply for borrowers who wish to pay off their loans early, typically costing 1% of the remaining balance. Understanding these terms is crucial to avoid unexpected charges and ensure a smooth borrowing experience throughout the loan term, usually spanning from one to five years, depending on the lender's policies.

Terms of Prepayment and Early Settlement

Personal loan contracts often include specific terms regarding prepayment and early settlement. Prepayment refers to paying off part or all of the loan balance before the due date, while early settlement involves closing the loan entirely ahead of schedule. Many financial institutions, such as banks or credit unions, may impose a prepayment penalty, which is a fee calculated as a percentage of the outstanding loan amount, typically ranging from 1% to 5%, designed to compensate the lender for lost interest income. In some instances, borrowers might have the option for partial prepayment, allowing them to reduce their principal balance without incurring penalties, enhancing financial flexibility. It's essential for borrowers to thoroughly review this section in the loan agreement to understand any applicable fees and the process for making early payments. Additionally, establishing the effects of prepayments on interest calculations can provide clearer insights into overall savings and loan management strategies.

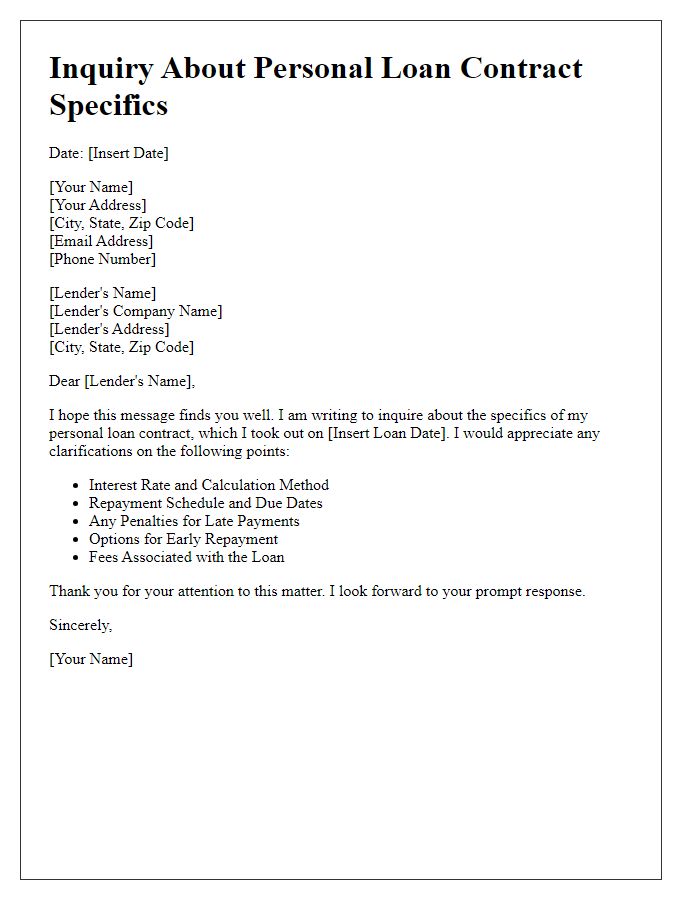

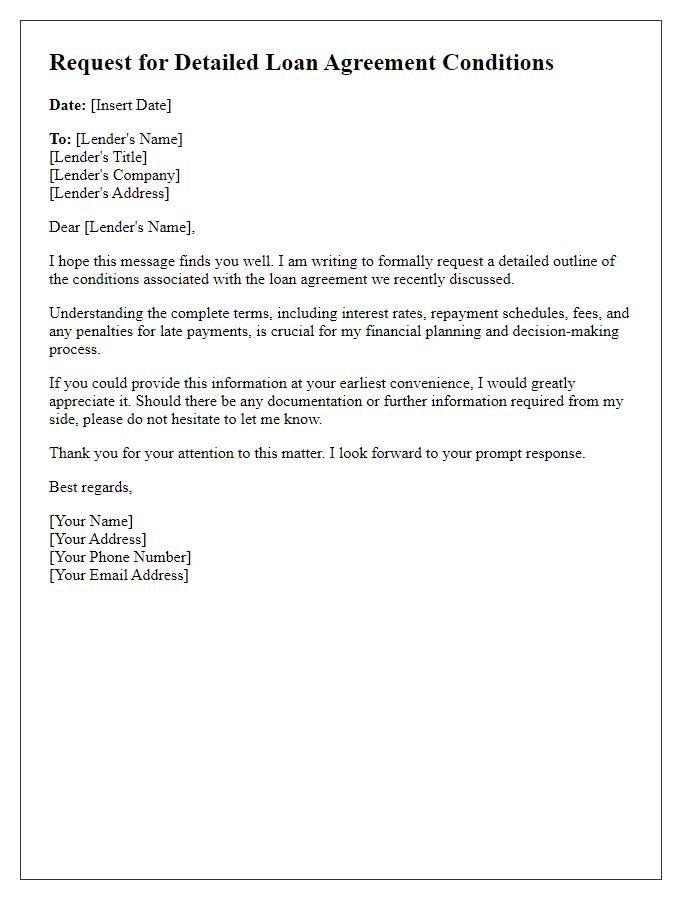

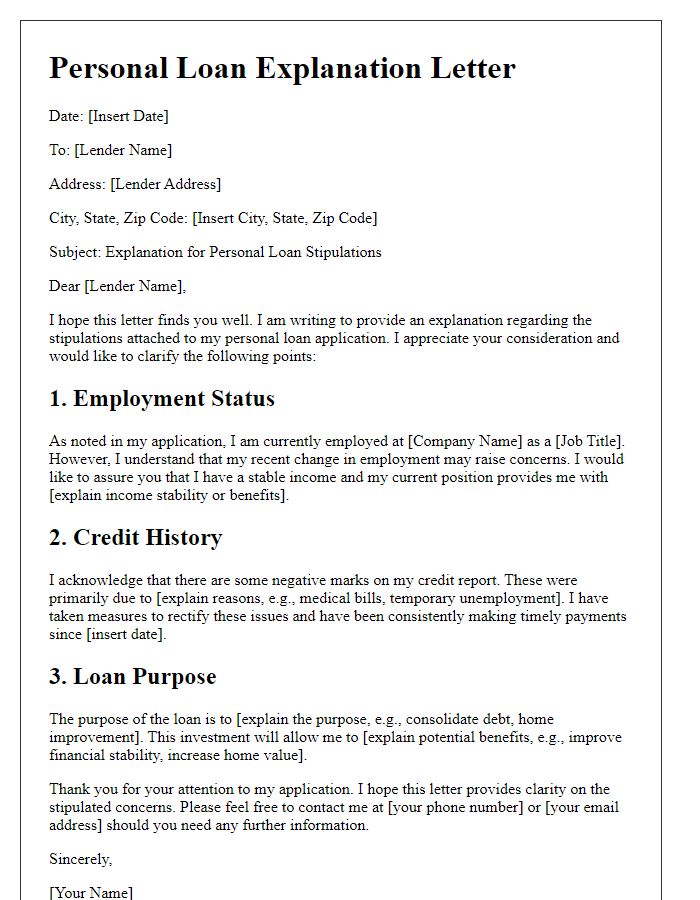

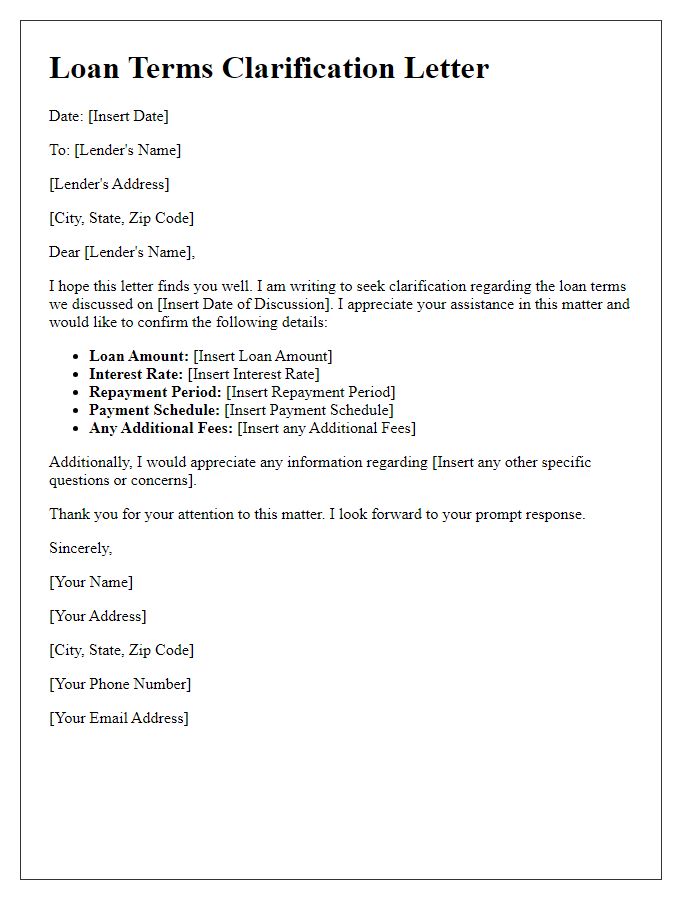

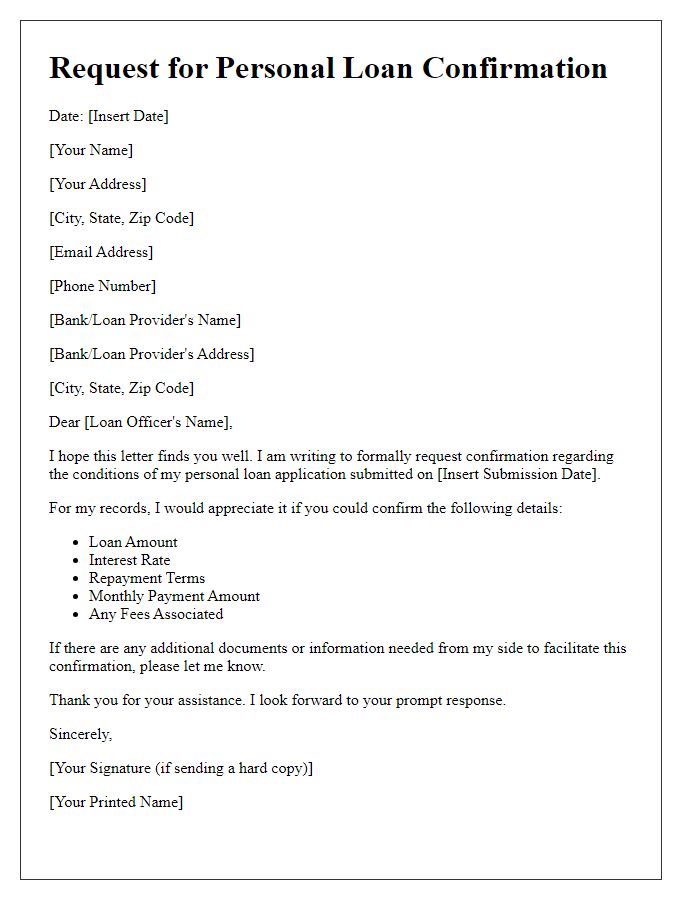

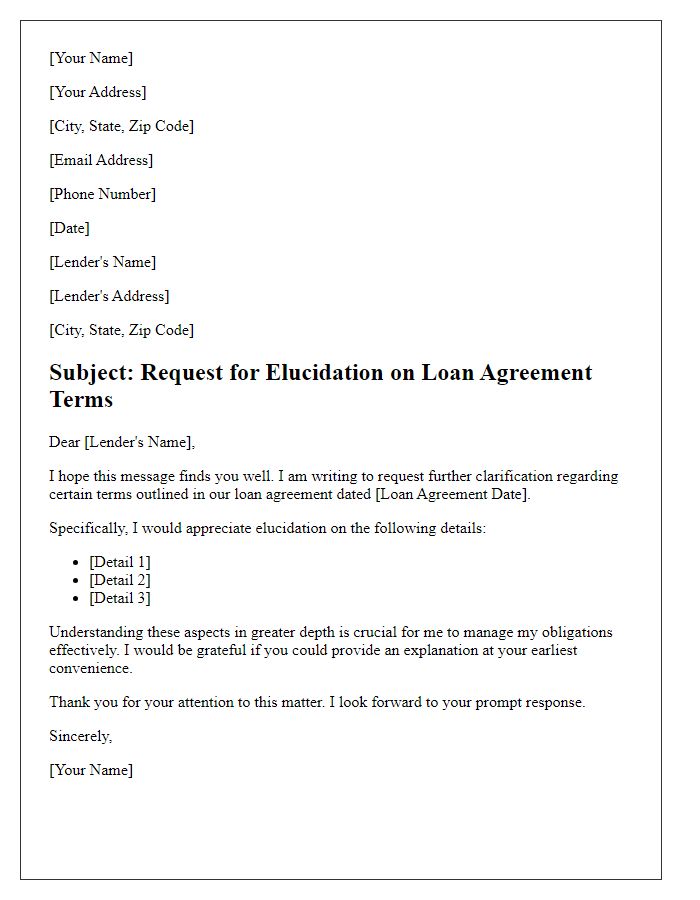

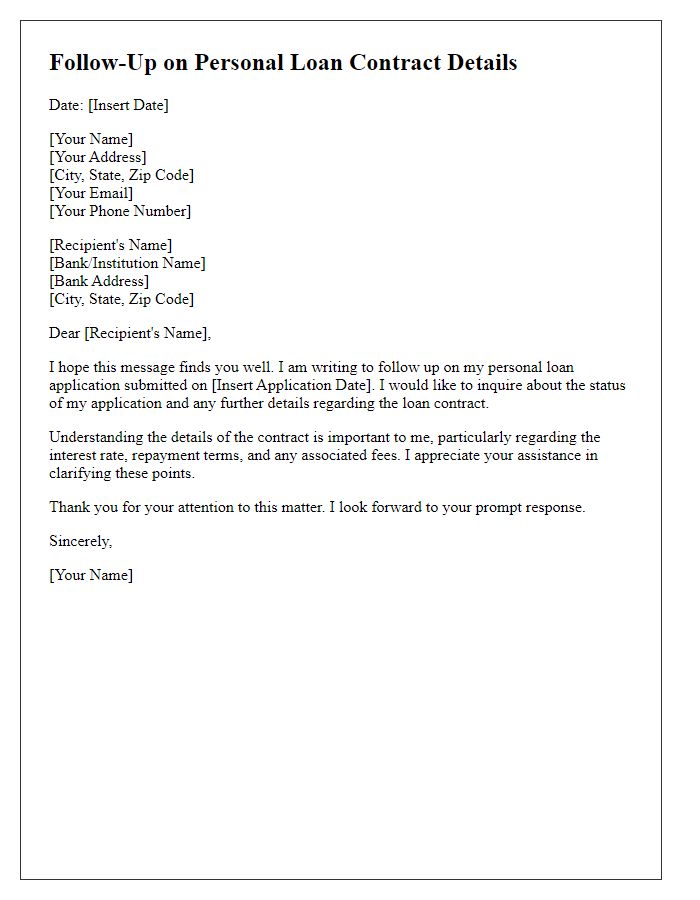

Letter Template For Clarifying Terms Of Personal Loan Contract Samples

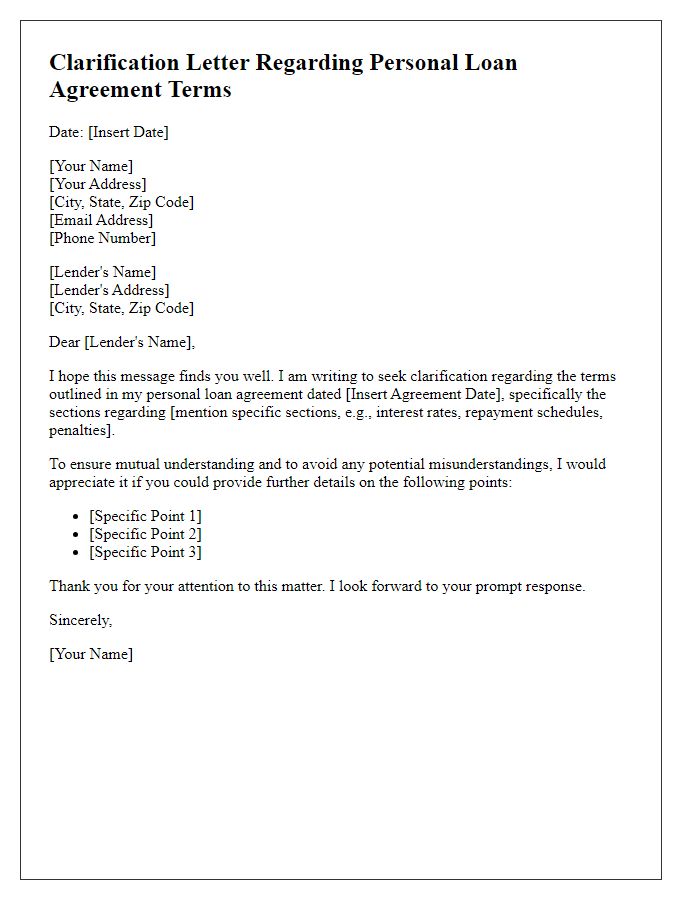

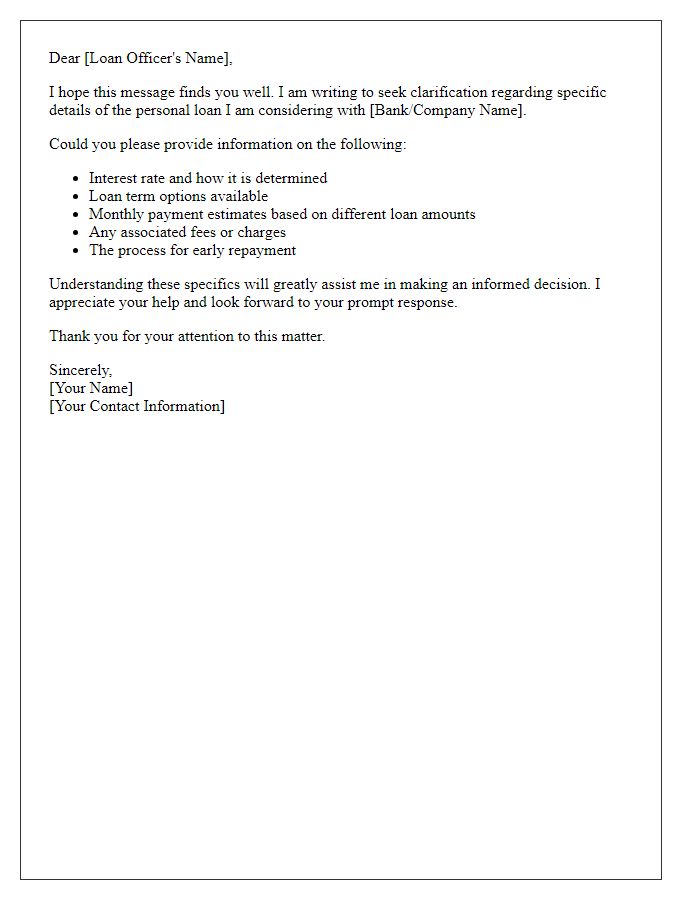

Letter template of clarification regarding personal loan agreement terms

Comments