Hey there! If you're navigating the sometimes tricky waters of loan repayment terms, you're not alone. It's crucial to have clear communication when changes arise, ensuring you and your lender are on the same page. In this article, we'll explore how to effectively confirm those changes in a letter, making the process smoother for everyone involved. So, let's dive in and discover the best practices for crafting your confirmation letter!

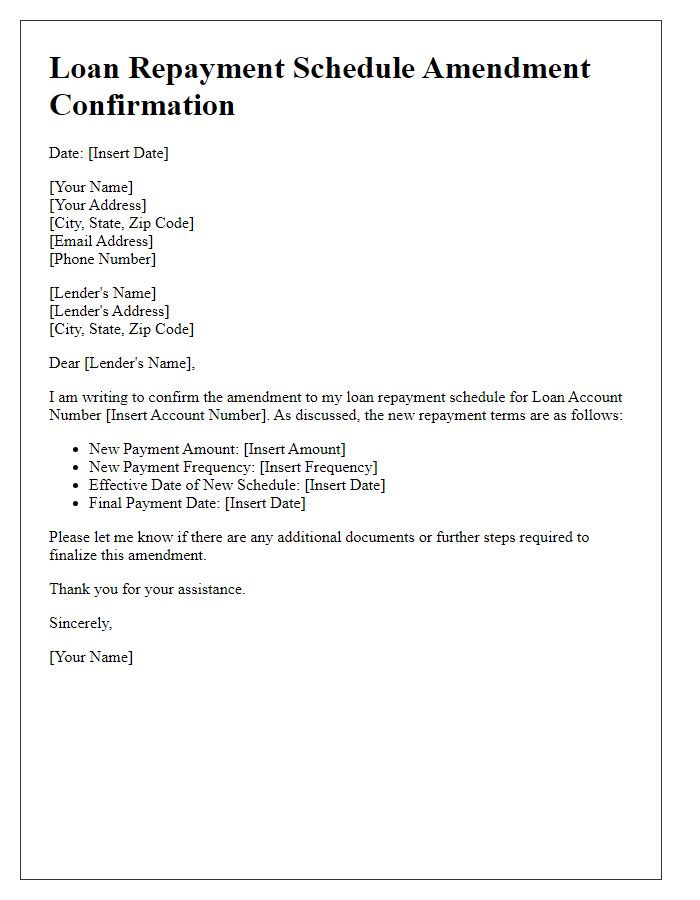

Clear identification of loan details

Loan repayment terms can be altered for various reasons, such as financial hardship or changes in interest rates. Clear identification of loan details includes the principal amount, which could be $50,000 in a 15-year home loan, and the original interest rate, often around 3.5% APR. The loan servicer's name and contact information, including a phone number, particularly for customer support, are crucial for communication. Borrowers should also specify the new repayment terms, such as a revised monthly payment of $400, which reflects adjustments in interest, term length, or repayment schedule. Additionally, a timeline for the changes, such as starting in the first month of the next quarter, should be included for clarity. Documenting these revisions helps both parties understand their commitments and facilitates smoother transactions moving forward.

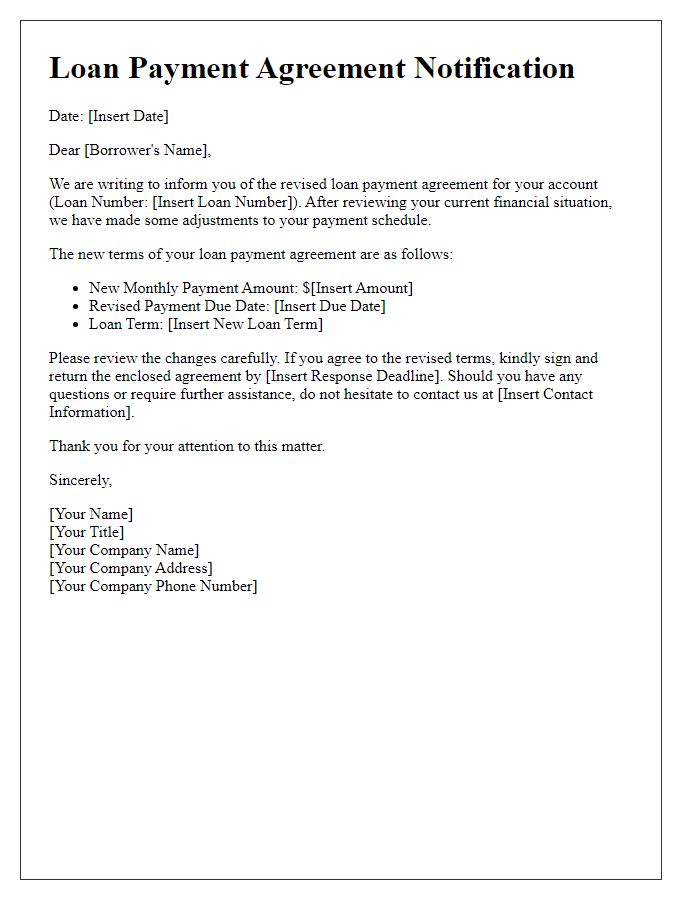

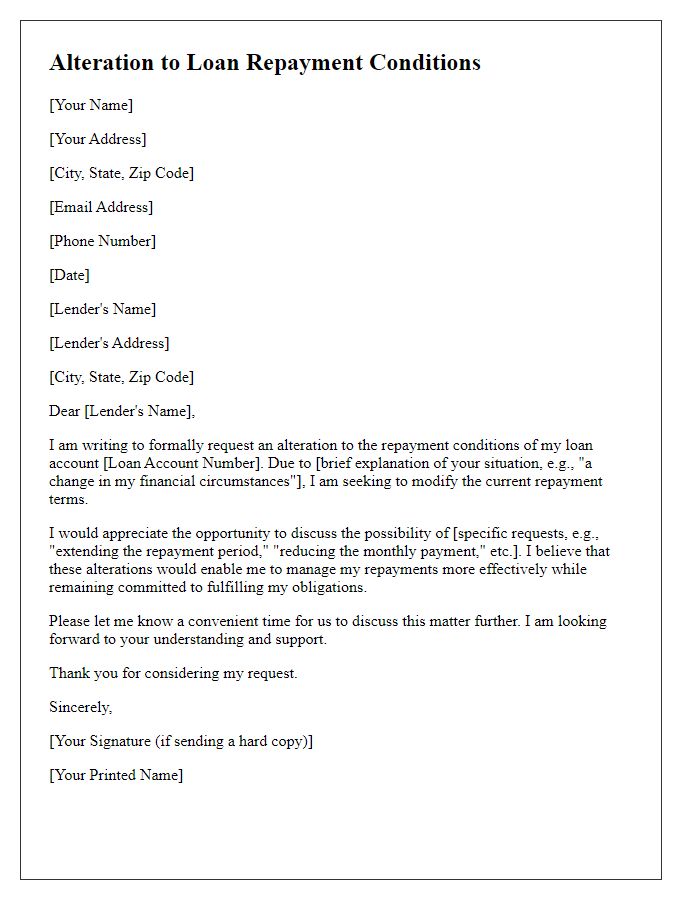

Specific changes to repayment terms

Confirming changes to loan repayment terms involves a detailed understanding of the specific modifications being made. For example, a borrower may have their monthly payment decreased from $500 to $400 due to an extended loan term of five additional years, resulting in a lower interest rate of 3.5% from the previous 5%. Adjustments in payment schedules, frequency (monthly to bi-weekly changes), or additional grace periods (extending from 15 to 30 days) can also be included. Such alterations not only alleviate current financial burdens but also reflect a formal agreement between the lender and borrower, ensuring clarity in the new repayment strategy. Details such as effective dates (e.g., changes effective from January 1, 2024) and the revised total repayment amount (adjusting to $30,000 over the new term) must also be clearly documented.

Effective date of changes

Confirmation of changes to loan repayment terms indicates a formal agreement between the lender and borrower, crucial for transparency in the financial relationship. Effective dates for adjustments must be clearly stated, often resulting in shifts in monthly payment amounts, interest rates, or loan durations. For instance, a borrower may have their repayment schedule altered starting January 1, 2024, reflecting an interest rate adjustment from 4% to 3.5%. Such modifications can significantly impact overall financial obligations and total interest paid over the loan's lifespan. Documenting these changes helps protect both parties and ensures compliance with applicable loan agreements.

Borrower's acknowledgment and consent

Loan repayment terms alterations require clear acknowledgment from borrowers to ensure mutual understanding. Documentation should include critical elements like the specific loan amount, original repayment schedule, and proposed changes, such as modified installment amounts or adjusted due dates, with reasons for the changes. Consent must be explicitly stated in the document, emphasizing the borrower's agreement to new terms, including any potential impacts on interest rates or fees. The borrower's signature and date should confirm the acknowledgment of changes, ensuring both parties are aligned with the adjusted repayment plan. Additional notes about applicable state laws or regulations may be included for comprehensive clarity.

Contact information for queries

Loan repayment term modifications can significantly impact borrowers' financial commitments and monthly budgeting strategies. For example, adjustments to a 30-year fixed-rate mortgage due on August 1st, 2023, can result in altered monthly payments, which may range from a few dollars to hundreds depending on interest rates, total loan amount (such as $250,000), and new terms negotiated. Borrowers should maintain precise contact details, such as phone number and email address, to facilitate prompt communication with lenders regarding questions or concerns about these modifications. Effective communication ensures clarity on new terms, payment schedules, potential fees, and provides support for seamless transitions to ensure personal finances remain stable during the repayment period.

Comments