Are you feeling the weight of financial stress and need a little extra time to manage your loan payments? You're not alone! Many people find themselves in similar situations, and the good news is that there are options available. In this article, we'll guide you through crafting a compelling letter to request a grace period on your loan, giving you the tools to take control of your financial journey. Read on to learn how to make your request as effective as possible!

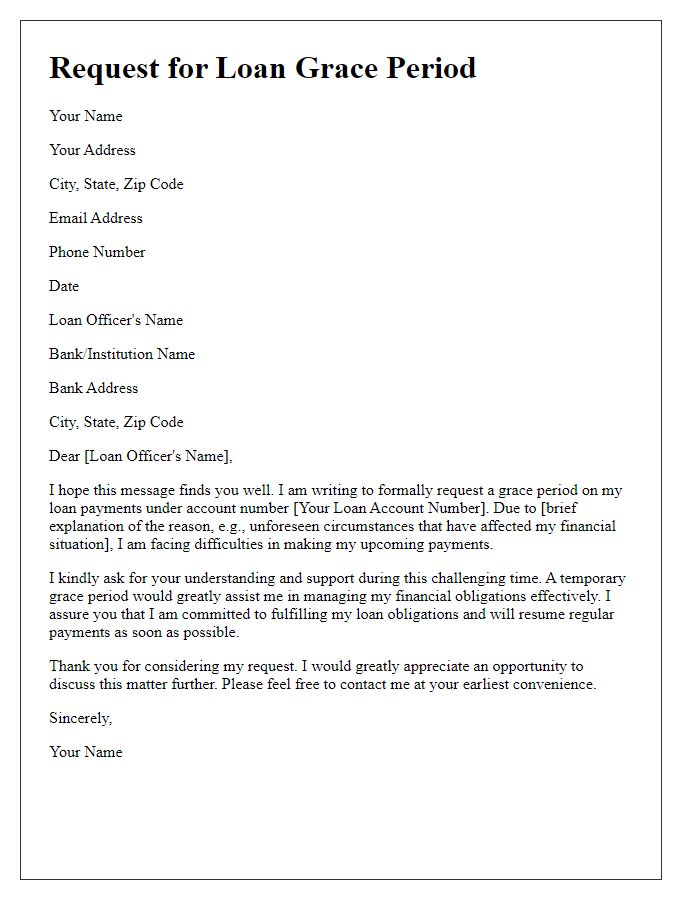

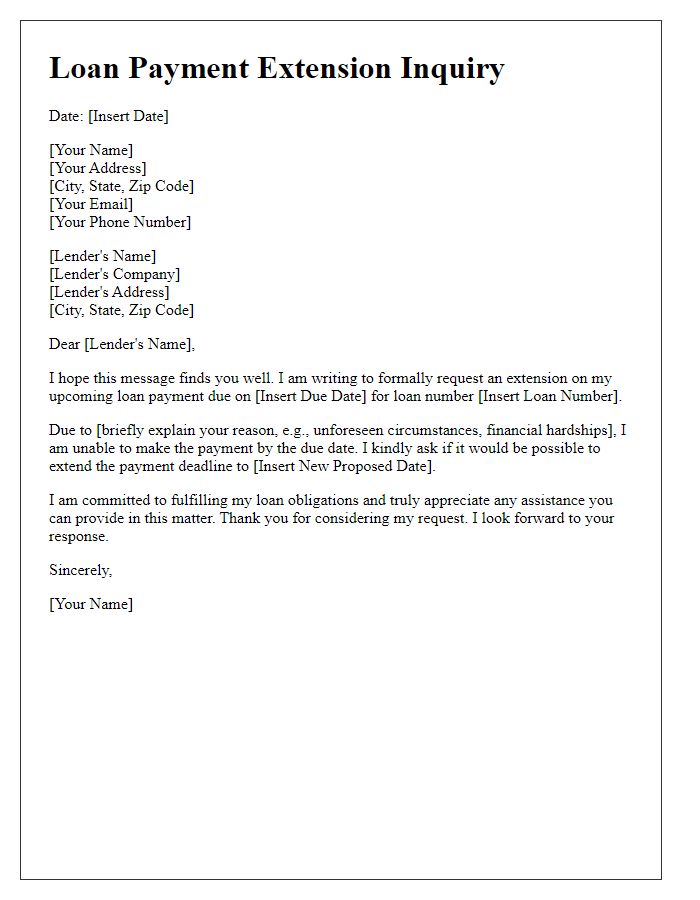

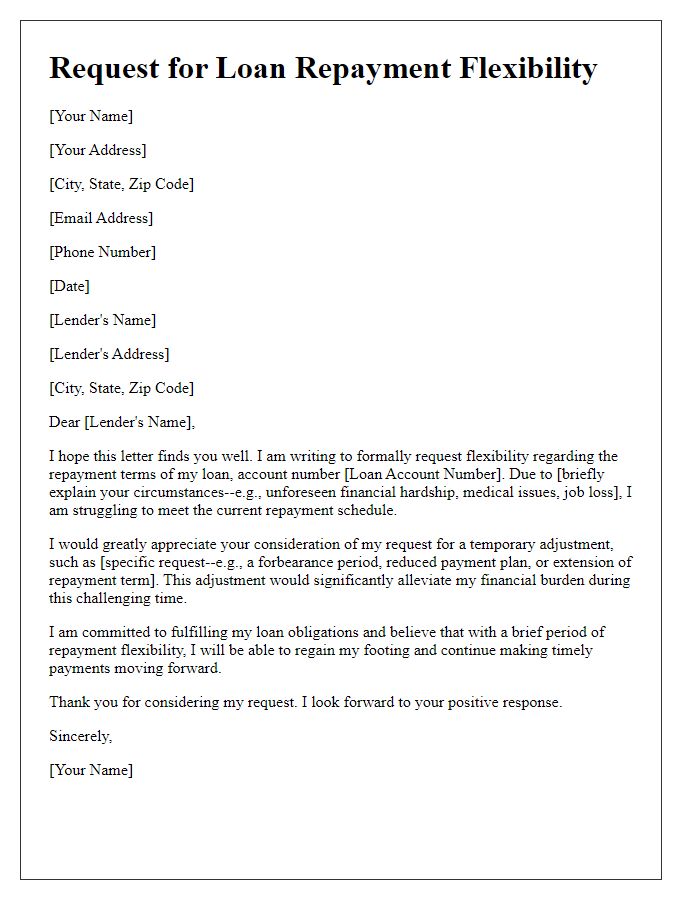

Personal Information

A grace period request for a loan may arise due to unforeseen financial hardships, such as job loss or medical expenses. Individuals must provide essential personal information, including full name, address, contact number, and email address, to facilitate communication with the lender. It's critical to detail the type of loan, including the lender's name and loan account number, allowing the lender to easily identify the loan in question. Additionally, a clear explanation of the financial circumstances necessitating the request for the grace period should be included, providing supporting evidence, such as a job termination letter or medical bills, to substantiate the claim.

Loan Account Details

A grace period on loan obligations can significantly ease financial stress during challenging times. Borrowers may request an extension to the repayment timeline, allowing for missed payments without penalty. One notable example is a mortgage loan, where an additional month can prevent default. Without a formal grace period, interest rates may increase, affecting the total cost of the loan. Specific details such as account number, loan type, and current outstanding balance must be included in the request. Financial institutions typically consider the borrower's payment history and current economic conditions, making timely and well-documented requests crucial for approval.

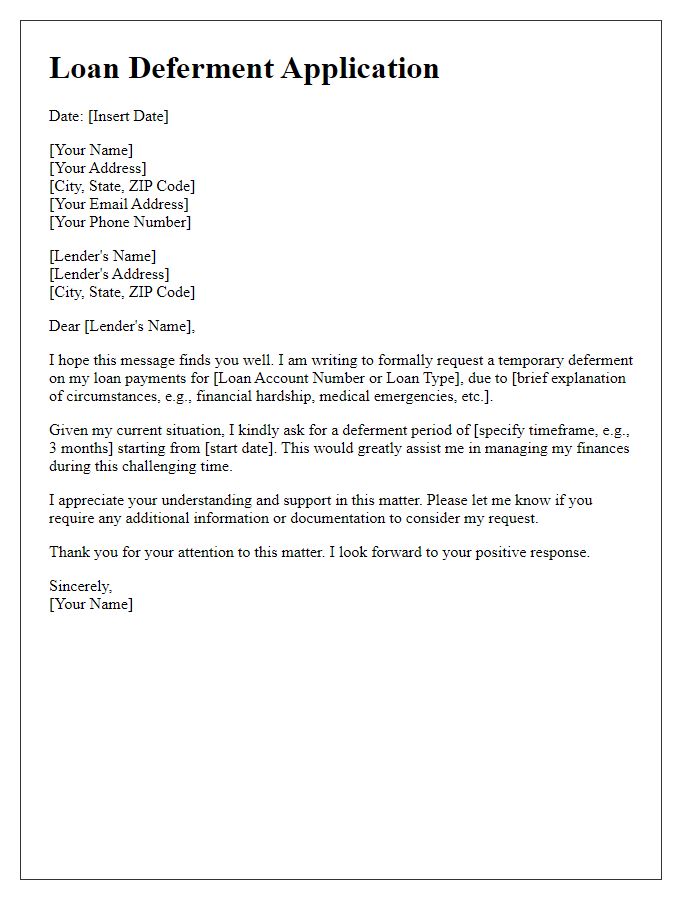

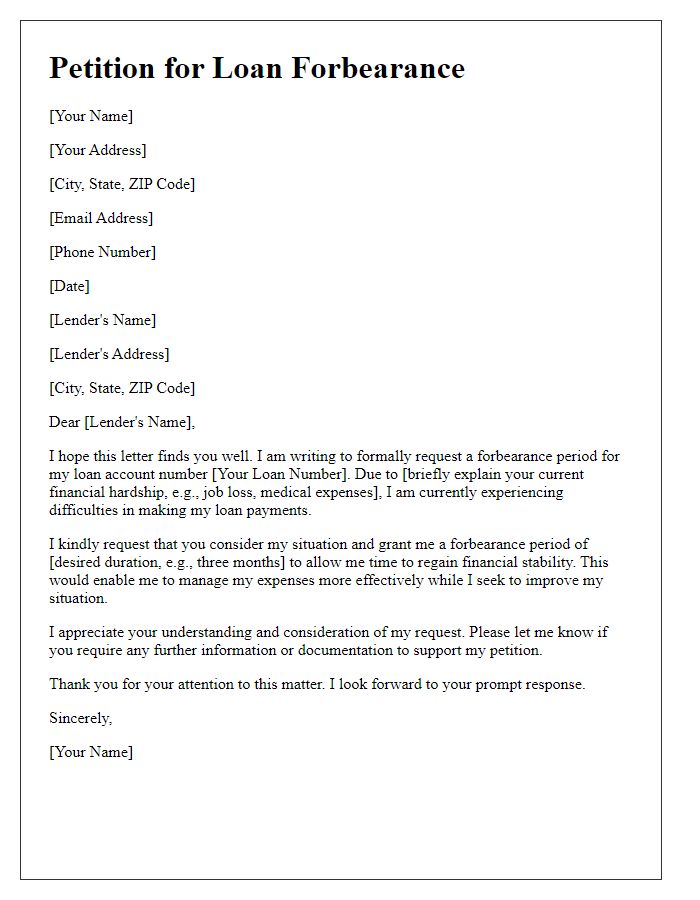

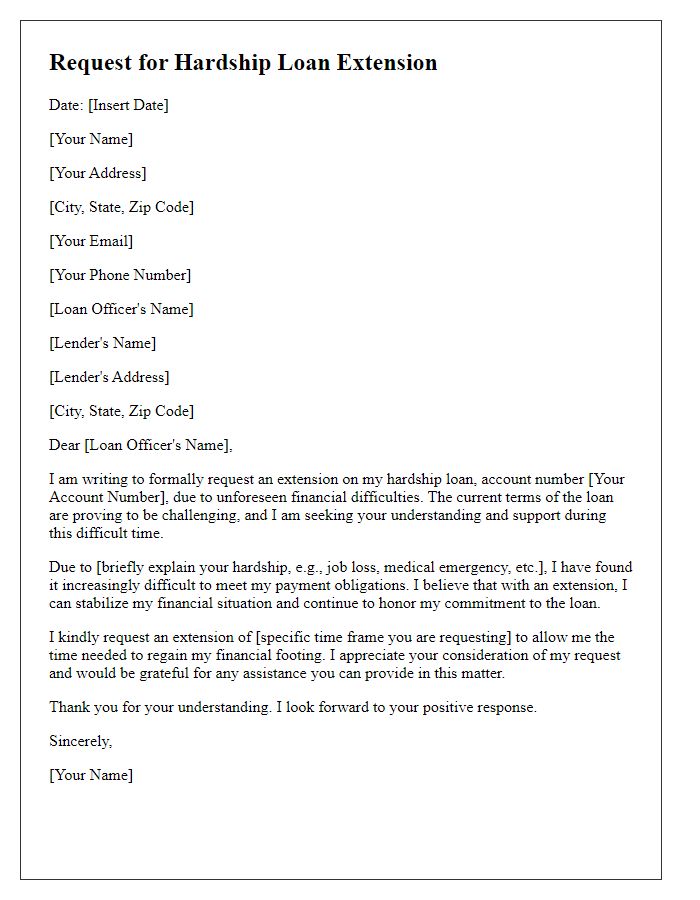

Reason for Request

Many individuals face financial difficulties due to unforeseen circumstances, such as unexpected medical expenses or job loss, which can hinder timely loan repayments. Inability to meet the repayment schedule on secured loans, such as mortgages or personal loans, often leads to additional fees and potential damage to credit score (which can decrease rating by over 100 points). A grace period allows borrowers a reprieve, providing extra time (typically 30 days) to gather funds without penalties, ultimately supporting financial recovery. Financial institutions like banks or credit unions often offer these periods as part of their borrower assistance programs, ensuring both parties maintain a positive relationship.

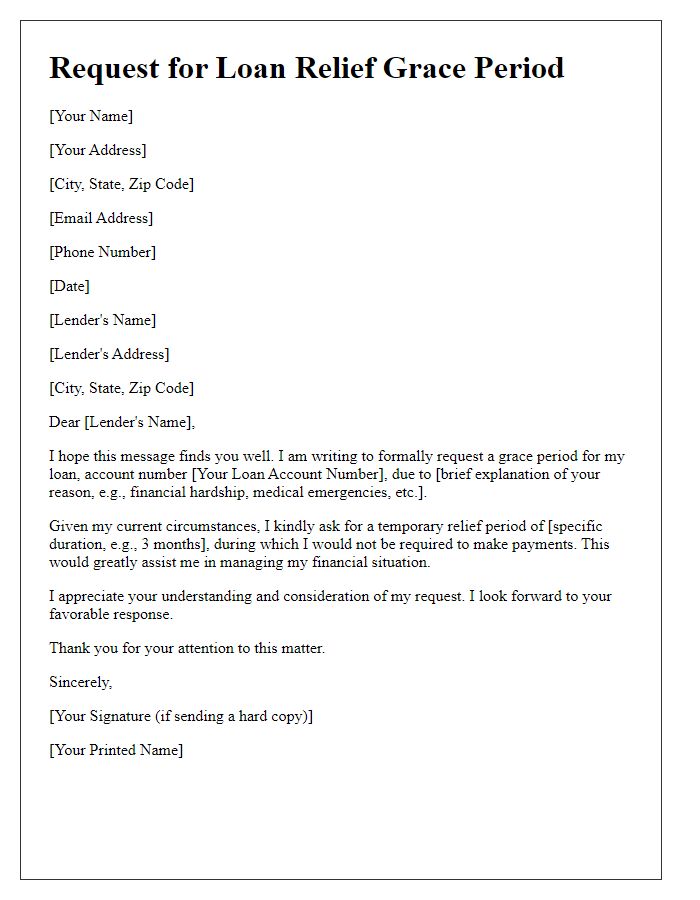

Grace Period Duration

Borrowers may seek a grace period on loans to temporarily alleviate financial pressure. A grace period, commonly ranging from one month to six months, allows individuals to pause or reduce payments without facing penalties or damage to their credit score. These periods are particularly useful during unexpected events, such as job loss, medical emergencies, or natural disasters, which disrupt regular income streams. Institutions typically evaluate requests based on financial hardship documentation and past payment history, ensuring responsible lending practices. Understanding the specific terms and conditions of the grace period, such as whether interest accrues during this time, is crucial for borrowers to make informed financial decisions.

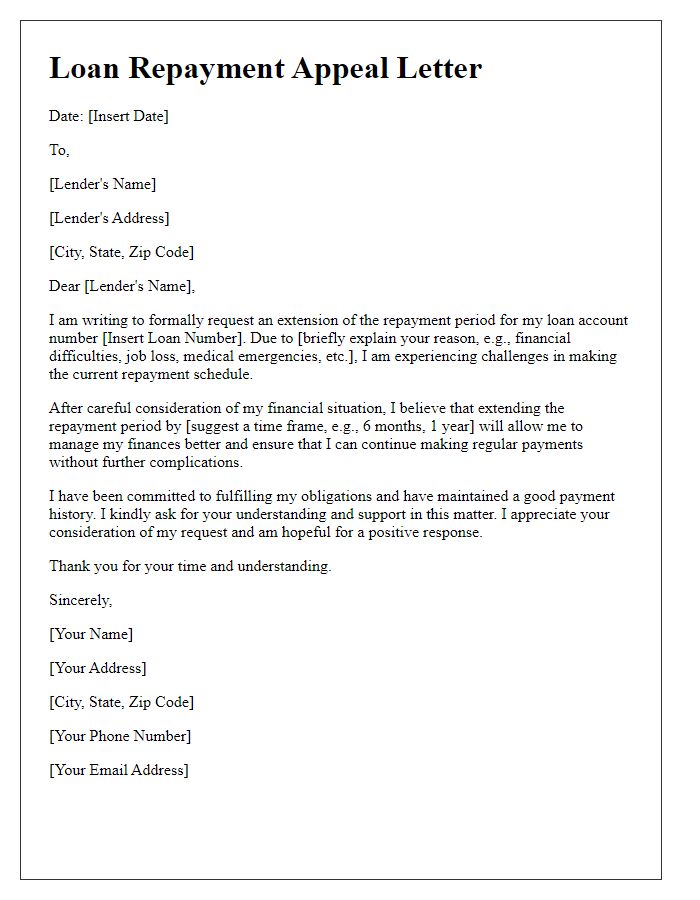

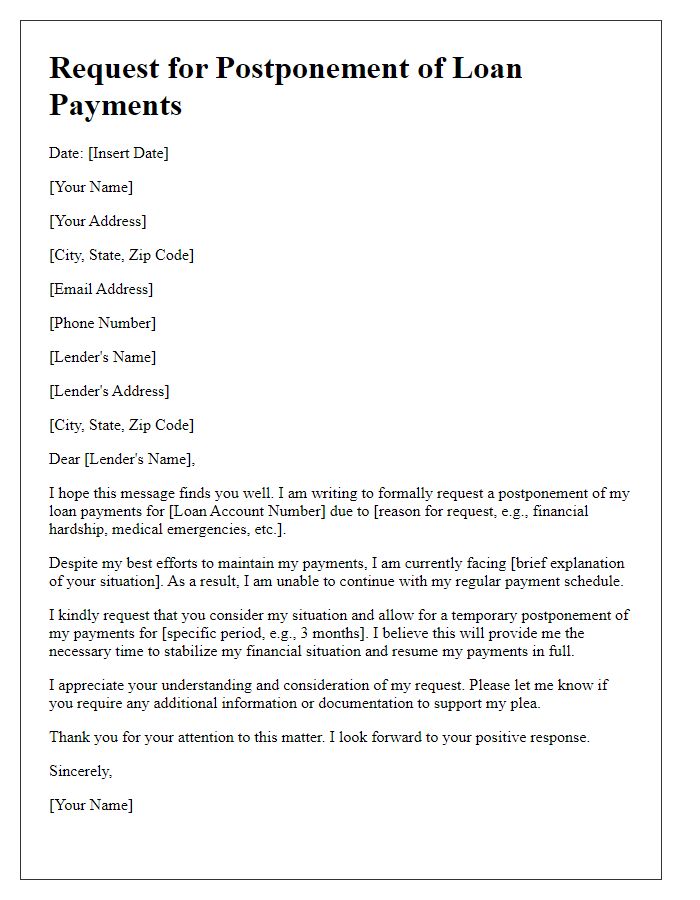

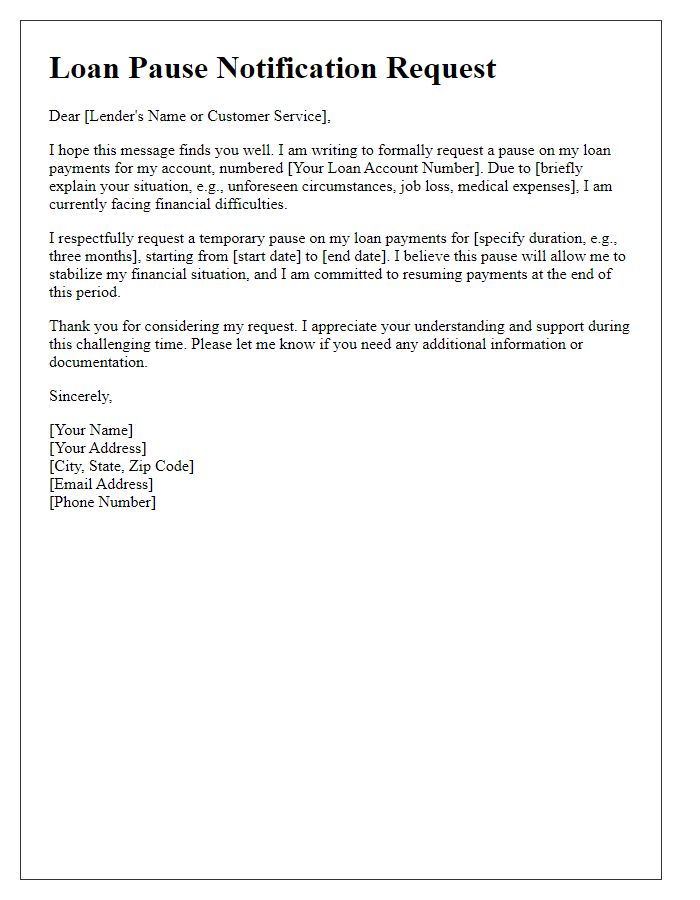

Future Payment Plan

A grace period for loans can significantly ease financial burdens on borrowers experiencing unexpected hardships. Many lending institutions, such as banks and credit unions, offer grace periods ranging from 30 to 90 days, allowing clients to delay payments without penalty. During this time, interest may continue to accrue, potentially altering the total repayment amount. Borrowers must provide documentation proving their financial difficulties, such as job loss statements or medical bills, to support their request. Notably, formal communication with the lender should include essential details like account numbers, payment history, and a clear explanation of the current financial situation to enhance the likelihood of approval.

Comments