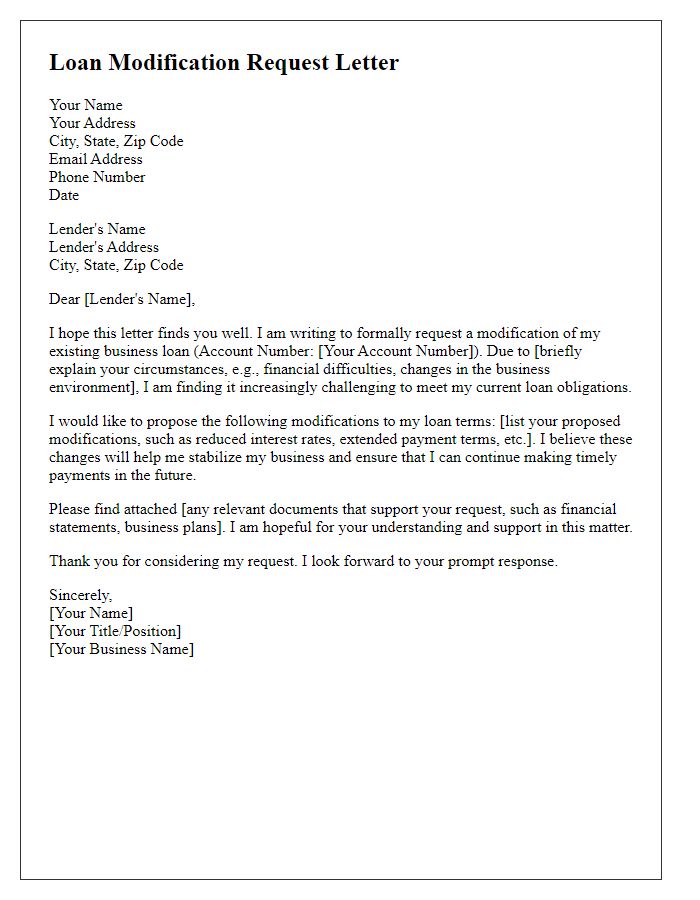

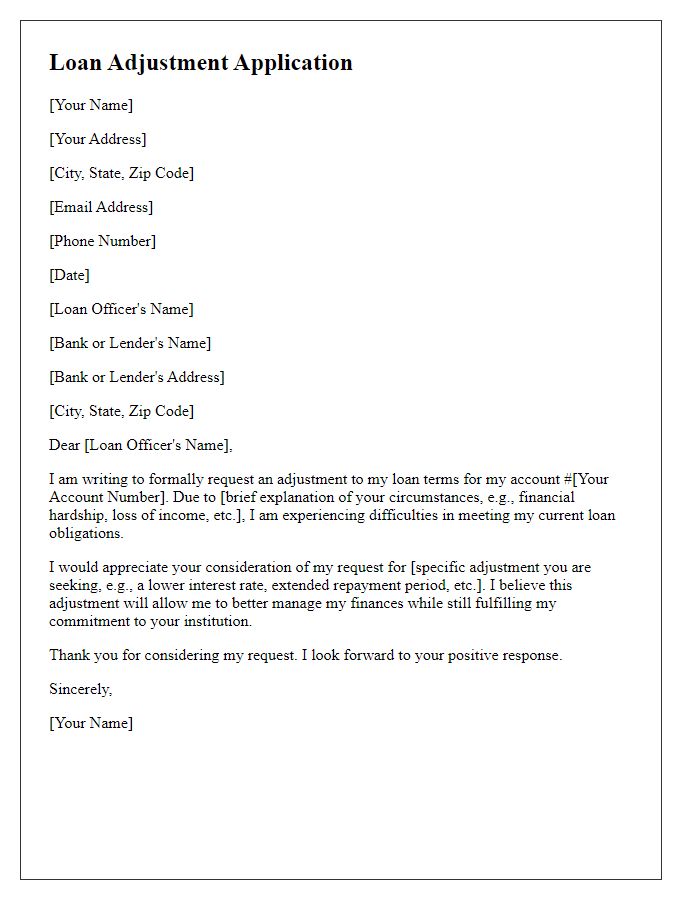

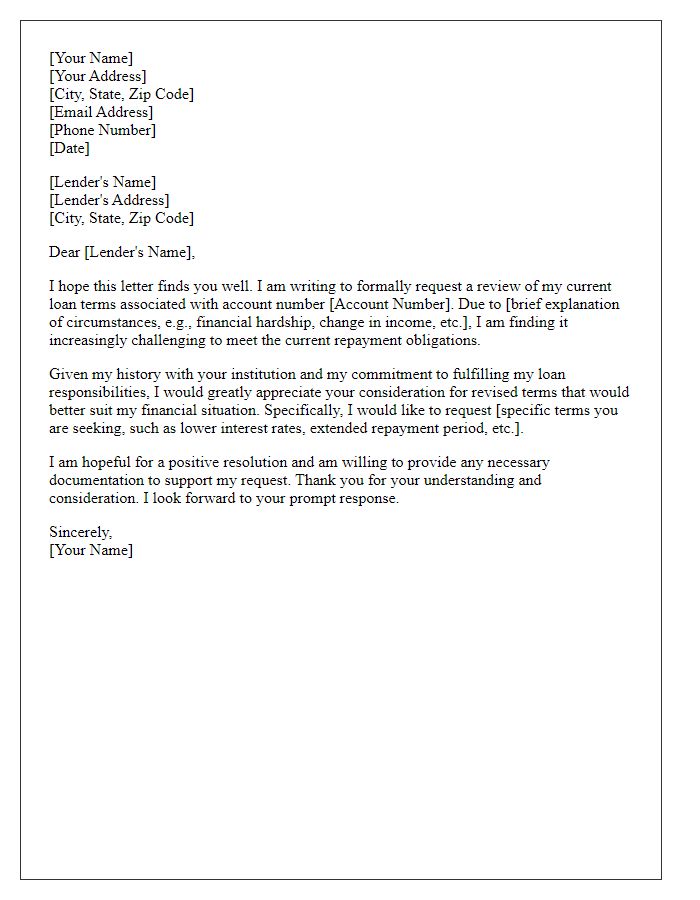

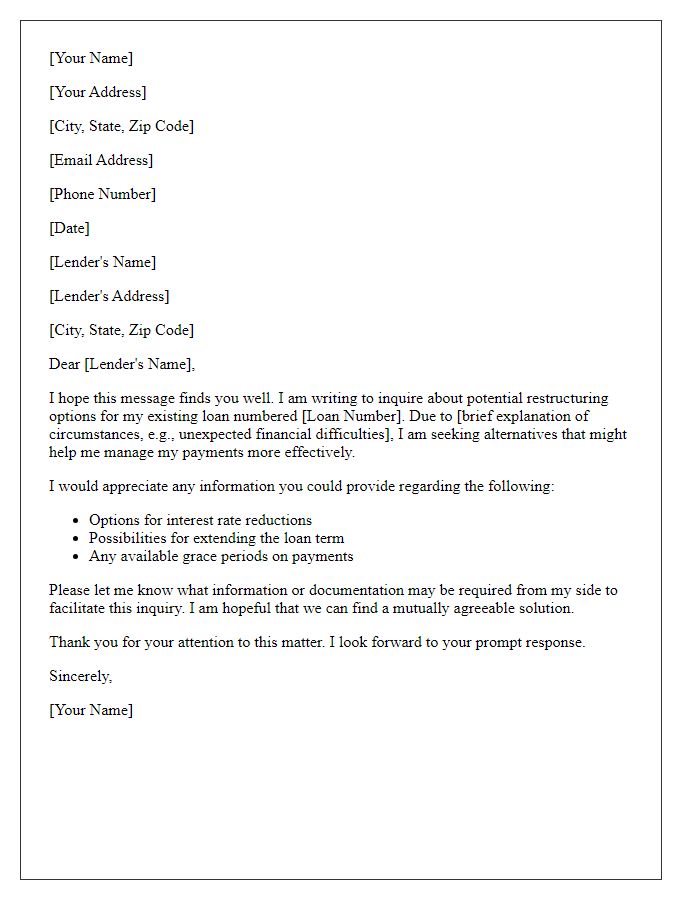

Are you considering a business loan modification but unsure where to start? Crafting a clear and compelling letter is essential to effectively communicate your needs to the lender. In this article, we'll guide you through the key components of a successful loan modification request, ensuring you present your case with confidence. Let's dive in and explore how to secure the financial adjustments your business needs to thrive.

Clearly Defined Loan Details

A clearly defined business loan modification outlines specific terms vital for understanding adjustments to existing financial agreements. Loan amount, indicated as the original principal of $250,000, establishes the baseline for any modifications. The interest rate, originally set at 5%, becomes critical when discussing potential reductions or alterations. Payment schedule, detailing monthly installments due on the first of each month, operates under this loan structure. Maturity date, set for December 31, 2025, serves as the specified endpoint for repayment obligations. Collateral, such as commercial property located at 123 Business Lane, Cityville, reinforces the loan's security. Understanding these elements clarifies the implications of any proposed modifications, ensuring transparency in financial negotiations.

Concise Explanation of Hardship

In recent months, my small business has faced significant financial challenges due to the unprecedented economic impact of the COVID-19 pandemic. Sales have declined by over 40%, primarily due to reduced customer foot traffic and restrictions on indoor gatherings mandated by local health authorities in California. As a consequence, cash flow has been severely affected, making it difficult to meet the current terms of our loan with ABC Bank. Our efforts to cut operational costs and adapt to new market conditions have not been sufficient to stabilize our finances. Additionally, unexpected expenses, such as implementing health safety measures and maintaining inventory during this downturn, have further strained our resources. A loan modification would provide the necessary relief to navigate this difficult period and ensure the sustainability of our business moving forward.

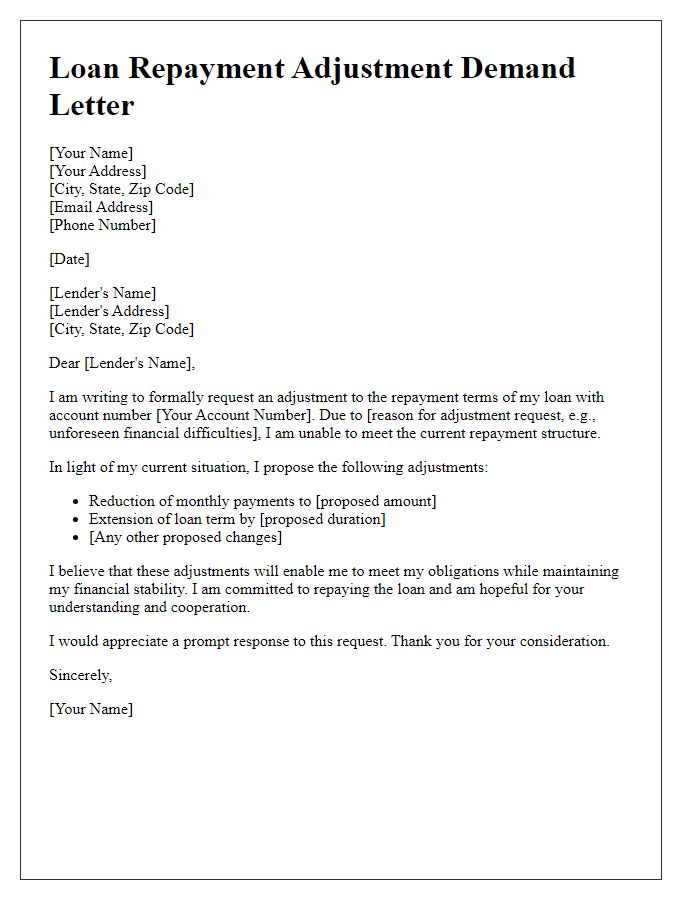

Specific Modification Request

A business loan modification request outlines essential details regarding the adjustments desired for an existing loan agreement. The document should specify the original loan amount (for example, $500,000 from Bank of America), the current interest rate (such as 5%), and the monthly payment (approximately $5,500) that is proving challenging to meet. The business owner must detail the reasons for the request, such as a sudden decline in revenue due to economic downturns, possibly citing specific events like the COVID-19 pandemic's impact on local businesses. Furthermore, the proposed modification terms should be clear, including requests for lower interest rates (for instance, a reduction to 3%) or extended repayment periods (such as a request to move from a 5-year to a 10-year term), which can ease the financial burden and allow for a more sustainable repayment plan while maintaining the business's operational stability.

Supporting Financial Documentation

Supporting financial documentation is crucial for evaluating a business loan modification request. Key financial statements, including profit and loss statements, detailed balance sheets, and cash flow projections for the past three years, should provide a clear picture of the company's financial health. Tax returns (Form 1040 with Schedule C for sole proprietors, Form 1120 for corporations, or Form 1065 for partnerships) must be submitted for a comprehensive review. Bank statements for the last six months will help verify cash reserves and regular income streams. Additionally, any supporting documents that outline current liabilities, such as lease agreements and other debts, are valuable for assessing repayment capabilities. This thorough documentation allows lenders to make informed decisions regarding the requested modification of loan terms, which may include adjustments to interest rates, repayment periods, or principal amounts.

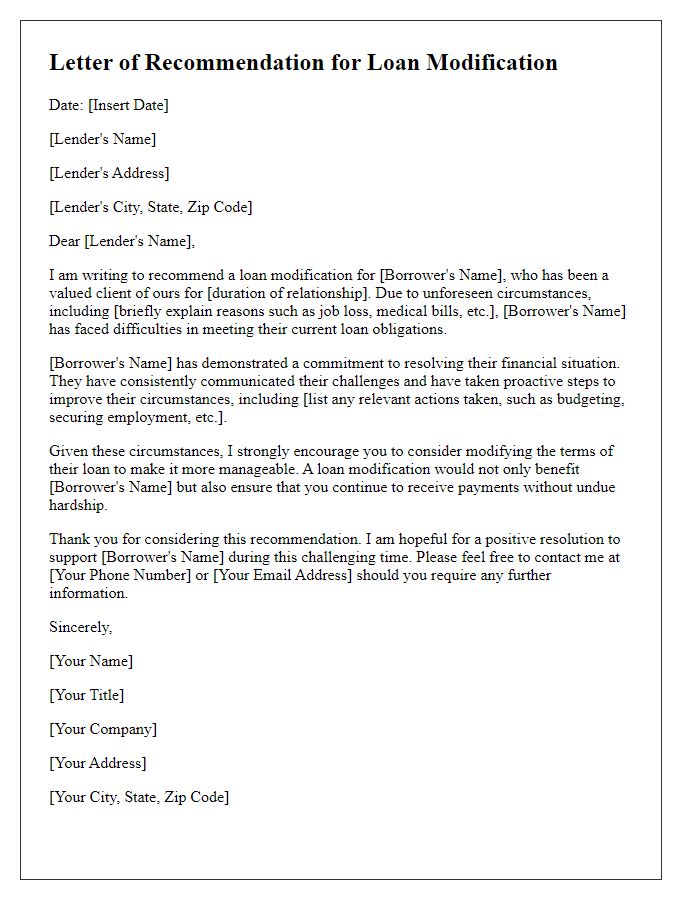

Professional and Polite Tone

Loan modification requests involve adjustments to existing loan terms to alleviate financial burdens. For businesses struggling with cash flow, a formal request to lenders may be necessary. Essential details include the current loan amount, interest rate, and payment schedule. Specific financial challenges must be documented, along with proposals for revised terms. A concise overview of the business's performance, including revenue changes and industry conditions, strengthens the case for modification. Detail Note: - Loan amount: Total outstanding debt, typically expressed in dollars. - Interest rate: Percentage charged on the principal. - Payment schedule: Monthly or quarterly payment expectations. - Financial challenges: Could include reduced sales, increased operational costs, etc. - Revised terms: New proposed interest rates, extended repayment periods, or payment reductions. - Business performance: Analysis of sales figures, profit margins, and any market fluctuations affecting income.

Comments