Life can sometimes throw unexpected challenges our way, and missed auto loan payments can happen to the best of us. Whether it's due to unforeseen expenses or a temporary financial setback, it's important to communicate openly with your lender about the situation. A heartfelt letter can not only express your intentions but also help facilitate a solution that works for both parties. Curious about how to craft the perfect letter to explain your missed payment? Read on for tips and examples!

Clear explanation of missed payment reason

The missed auto loan payment on October 15, 2023, was due to sudden unemployment caused by company downsizing at Tech Innovations Inc., a local IT firm in Seattle, Washington, where I worked for over five years. This unexpected job loss resulted in a temporary financial strain, impacting my ability to meet monthly obligations. I am actively seeking new employment opportunities and have secured a few interviews in the coming weeks. I am committed to addressing this missed payment promptly and maintaining communication with my lender for possible arrangements or assistance during this challenging period.

Mention of corrective action and payment schedule

Missed auto loan payments can lead to financial setbacks and damage credit scores. Recent data indicate that 30-day delinquencies have become more common in January 2023, impacting borrowers across the United States. Addressing such issues promptly is crucial. Implementing corrective actions like setting up automatic payments can prevent future missed payments. Establishing a new payment schedule can help borrowers manage their finances more effectively, ensuring timely contributions that align with their budget. Notifying the lender about the missed payment and demonstrating proactive steps taken enhances trust and may result in more favorable loan terms or restructuring options.

Inclusion of account details and previous payment history

A missed auto loan payment can significantly impact creditworthiness and financial stability. Borrowers should communicate proactively with their financial institution to explain the circumstances. Account details, such as the loan number (e.g., 123456789), should be included in the correspondence to ensure accurate identification. Previous payment history should reflect a consistent record of on-time payments, with dates and amounts (e.g., $300 monthly payments since January 2021). This information reinforces the borrower's commitment and reliability, demonstrating that the missed payment (e.g., November 2023) was an anomaly rather than a pattern. Providing context, such as unexpected medical expenses or temporary loss of income, can help the lender understand the situation better and potentially negotiate a resolution.

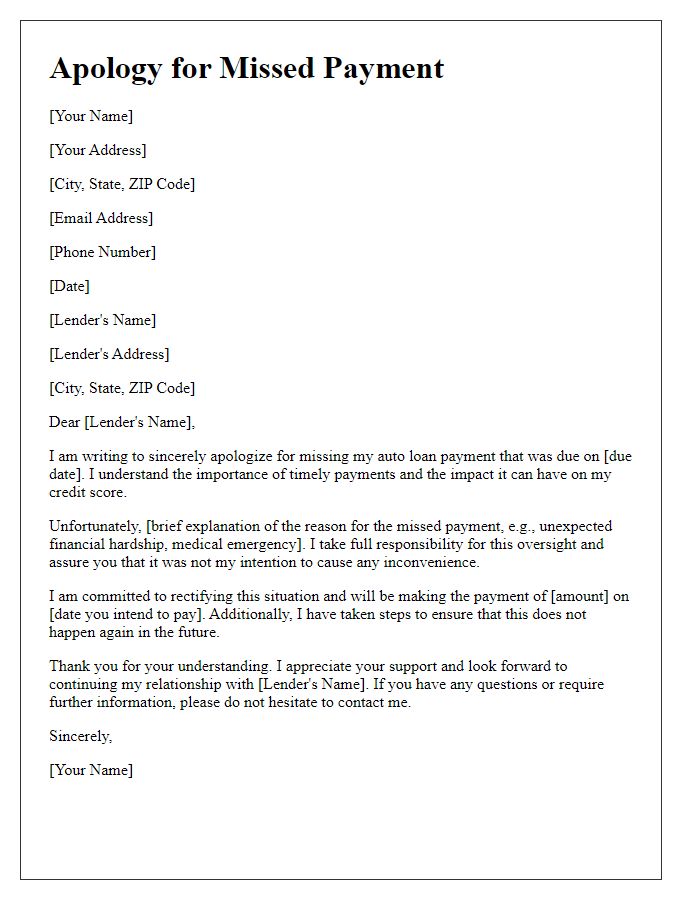

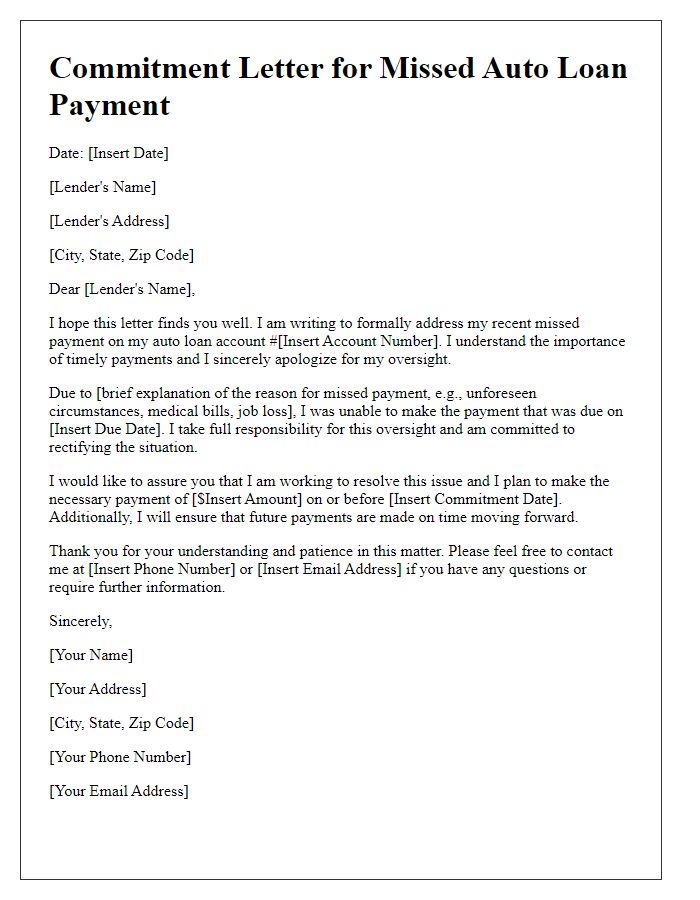

Expression of apology and commitment to future payments

Missed auto loan payments can lead to financial difficulties, impacting credit scores and long-term financial health. The borrower may face late fees, often ranging from $25 to $50, and potential damage to their credit report, which can lower scores by 100 points or more. Consistent late payments could result in the lender reporting the delinquency to credit bureaus, affecting the borrower's ability to secure future loans. Communication with the lender is crucial to discuss repayment options, such as deferment or restructuring, helping alleviate the financial burden and demonstrating commitment to fulfilling future payment obligations.

Request for understanding and potential fee waiver

A missed auto loan payment often creates significant financial stress for borrowers. Individuals may encounter unforeseen circumstances, such as job loss (affecting income stability), medical emergencies (resulting in unexpected expenses), or natural disasters (causing property damage and repair costs). During these challenging times, communication with the lending institution becomes crucial. Many car loan providers, including nationwide banks or local credit unions, may offer options like fee waivers or payment deferrals for borrowers experiencing hardship. Engaging in open dialogue about the situation can help mitigate late fees (usually ranging between $25 to $50) and maintain the borrower's credit score while seeking a resolution. Showing genuine intent to remedy the missed payment may lead to a favorable outcome, benefiting both the borrower and the lender.

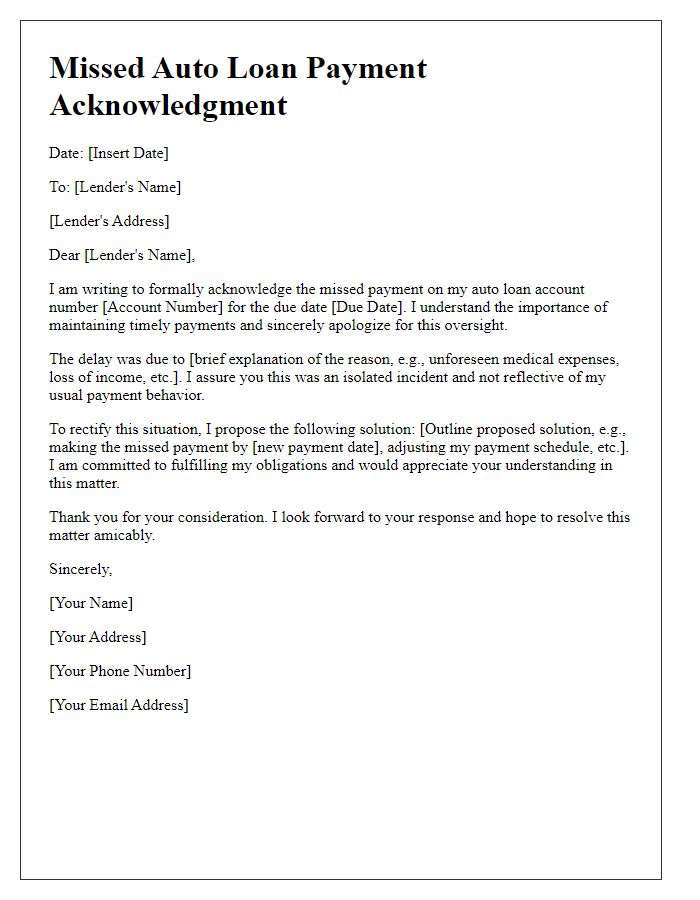

Letter Template For Explaining Missed Auto Loan Payment Samples

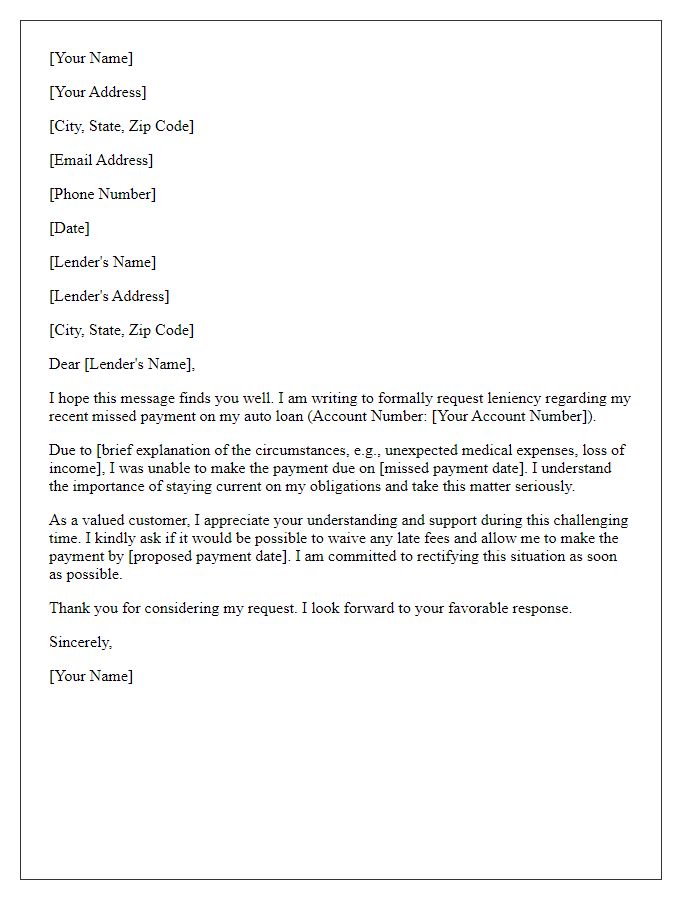

Letter template of notification of financial hardship affecting auto loan payment.

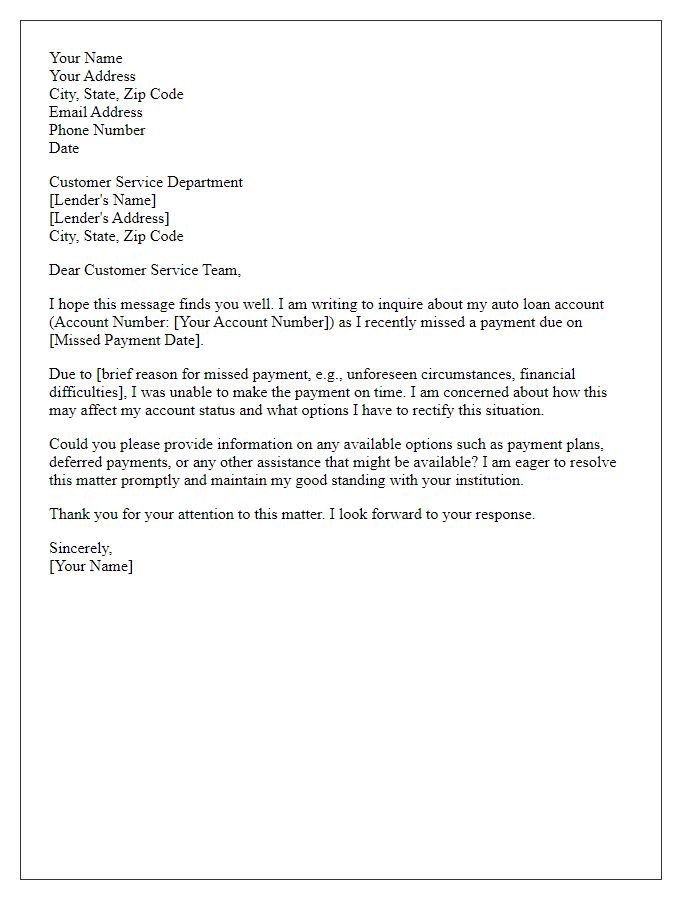

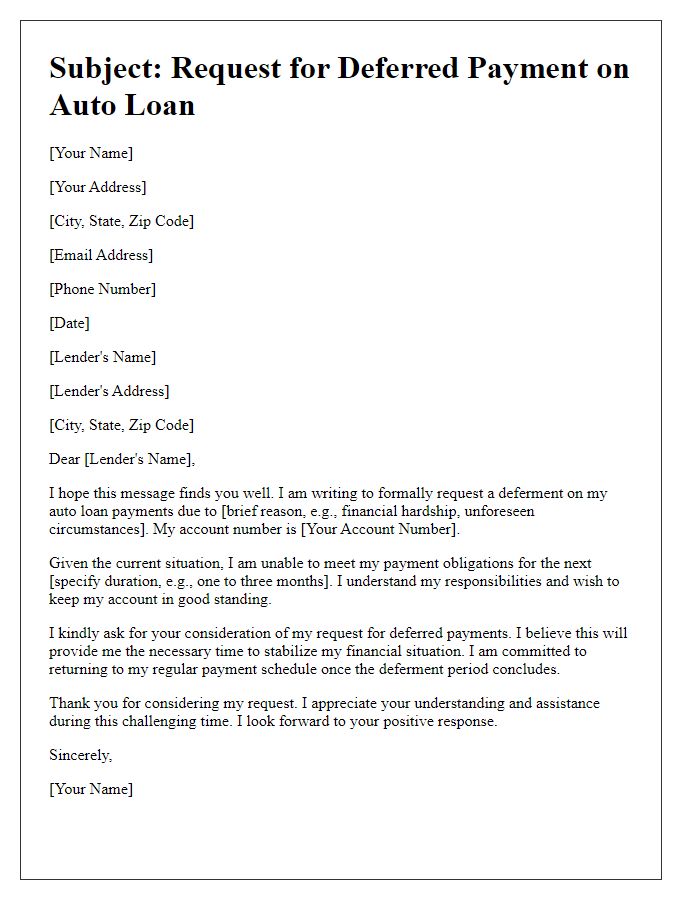

Letter template of inquiry about options after missed auto loan payment.

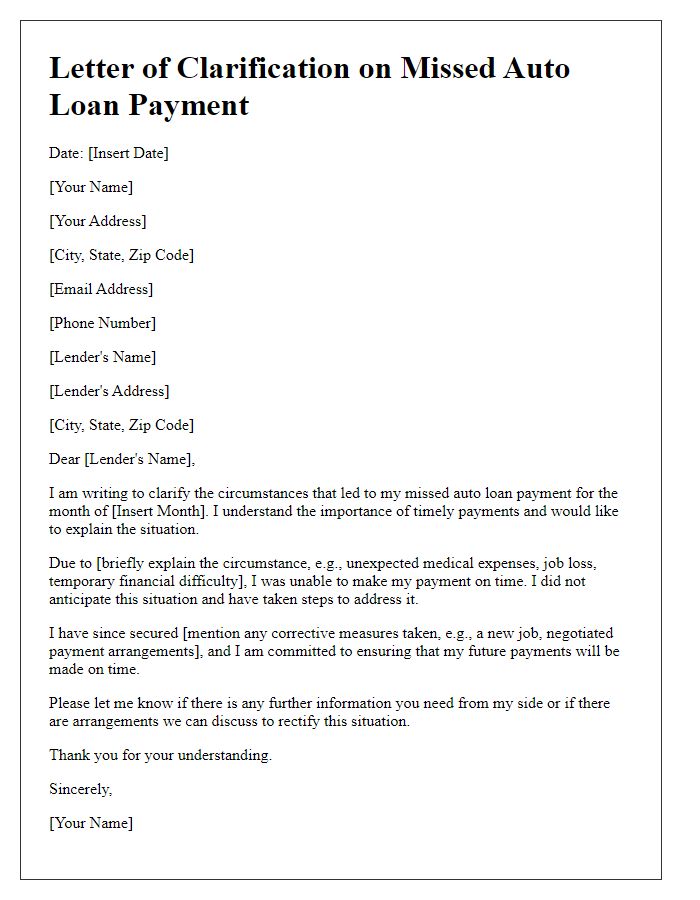

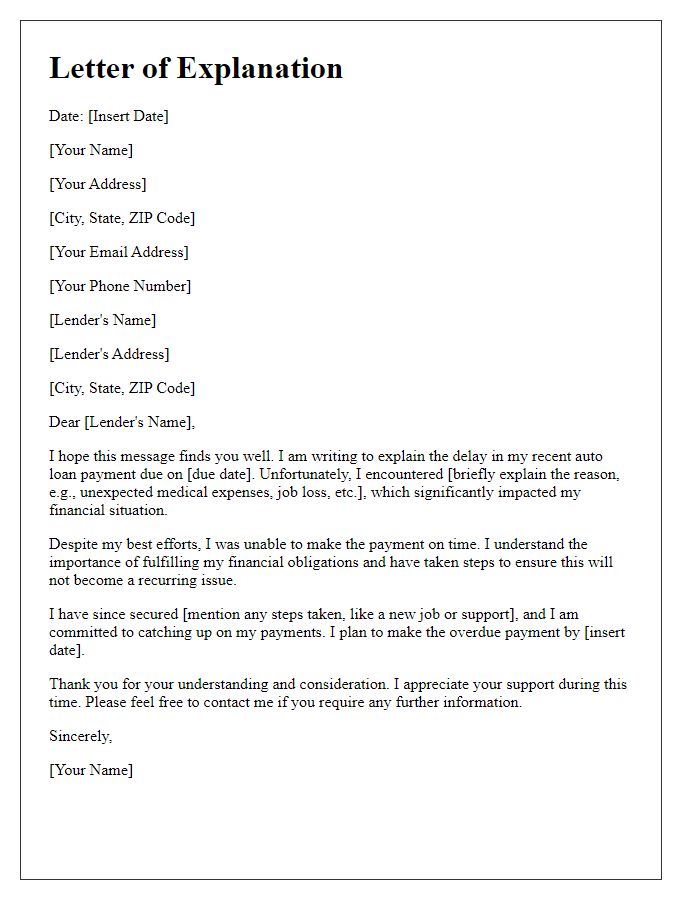

Letter template of clarification on circumstances leading to missed auto loan payment.

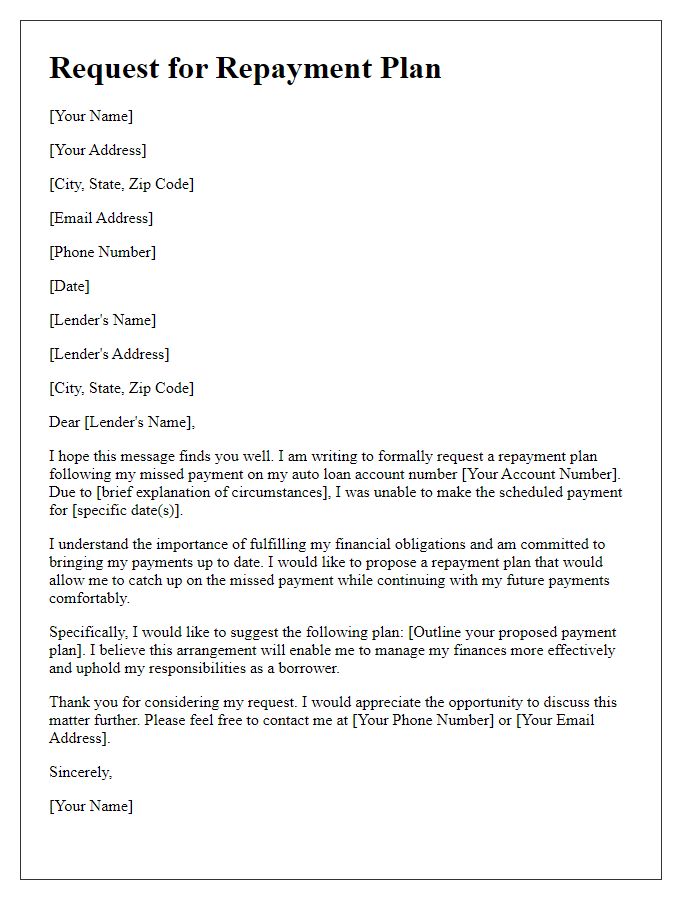

Letter template of request for repayment plan after missed auto loan payment.

Comments