Are you considering negotiating an early loan payoff with your lender? It's a smart move that can save you money on interest and help you achieve financial freedom. In this article, we will guide you through steps to effectively communicate your intentions and secure a favorable outcome. So, let's dive in and explore how you can make this financial leap!

Clear Identification of Loan Details

Early loan payoff negotiations require clear identification of loan details for effective communication. Essential elements include the loan number, uniquely assigned to the borrowed amount, the principal amount ($50,000) that was initially financed, along with the interest rate (5.5% annually), and the date of loan origination (January 15, 2020). The remaining balance ($20,000) should be specified to highlight the outstanding obligation. Payment schedule details, including the monthly payment amount ($500) and the original loan term (60 months), serve to clarify the timeline of repayment. Additionally, the lender's name, such as ABC Bank, must be identified to facilitate accurate correspondence regarding the terms of potential early payoff. This clarity, combined with an assertive request for a potential reduction in prepayment penalties (5% of remaining balance), can streamline the negotiation process and enhance the chances of reaching favorable terms.

Expression of Financial Stability

Early loan payoff negotiations can result in potential savings on interest, especially with loans like mortgages or personal loans. Financial stability, characterized by consistent income (for example, an annual income exceeding $50,000) and a robust credit score (typically over 700), plays a crucial role in these discussions. Maintaining a stable employment history (over three years in the same job), alongside substantial savings (having at least six months of expenses in a savings account), reinforces the negotiation position. Demonstrating readiness to settle the remaining balance (calculating precise payoff amounts) may also lead to favorable terms, potentially including reduced interest penalties and an expedited payoff process. Financial institutions appreciate clients showing responsibility and commitment, which can result in a more amiable negotiation atmosphere.

Proposal of Payoff Amount

Early loan payoff negotiations often involve calculating a specific payoff amount that reflects the outstanding balance and any applicable fees. Borrowers should consider details such as the original loan amount, interest rate, and remaining term. For example, if a borrower has a $50,000 loan at a 5% interest rate with 3 years left on a 5-year term, they might negotiate a payoff amount of approximately $30,000, accounting for any prepayment penalties or fees outlined in the loan agreement. Clear communication with the lending institution is essential to ensure the agreed payoff amount is documented properly. Keeping records of previous payments, correspondence, and final agreements helps borrowers leverage their negotiations effectively.

Benefits for Lender

Negotiating an early loan payoff can provide several benefits for lenders. Reduced risk of default occurs when borrowers settle their loans early, alleviating potential losses on outstanding debt. Liquidity improves as lenders receive funds sooner, allowing reinvestment into new projects or loans, generating additional income. Interest revenue savings arise from decreased interest payments over the life of the loan, enhancing overall profitability. Furthermore, reputational improvements emerge as lenders demonstrate flexibility and understanding to borrowers, potentially attracting new customers in the competitive financial market. Lastly, streamlined administrative costs are achieved by reducing the duration of loan accounts, cutting operational expenses associated with prolonged account management.

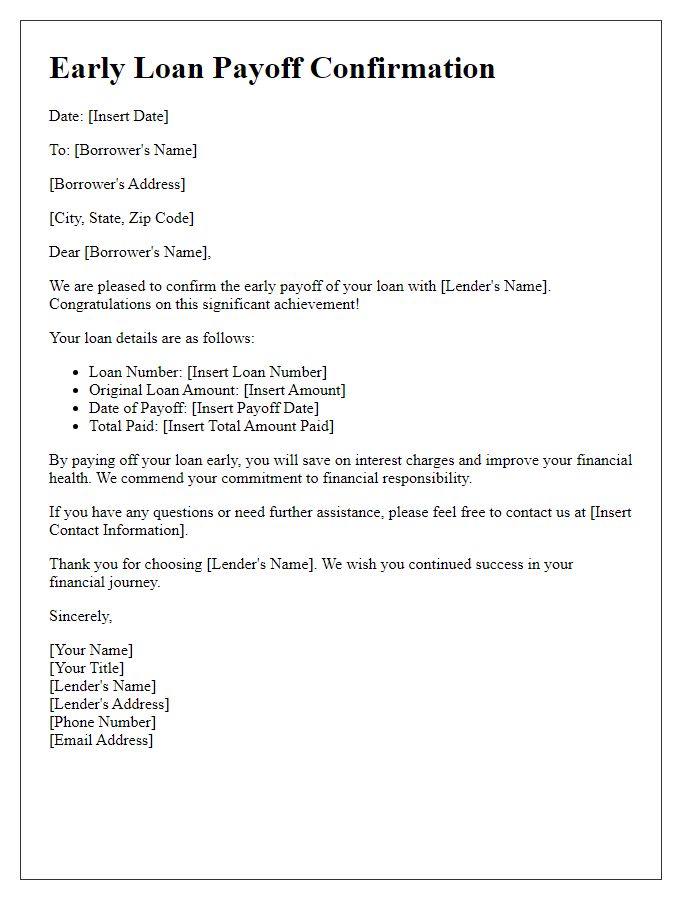

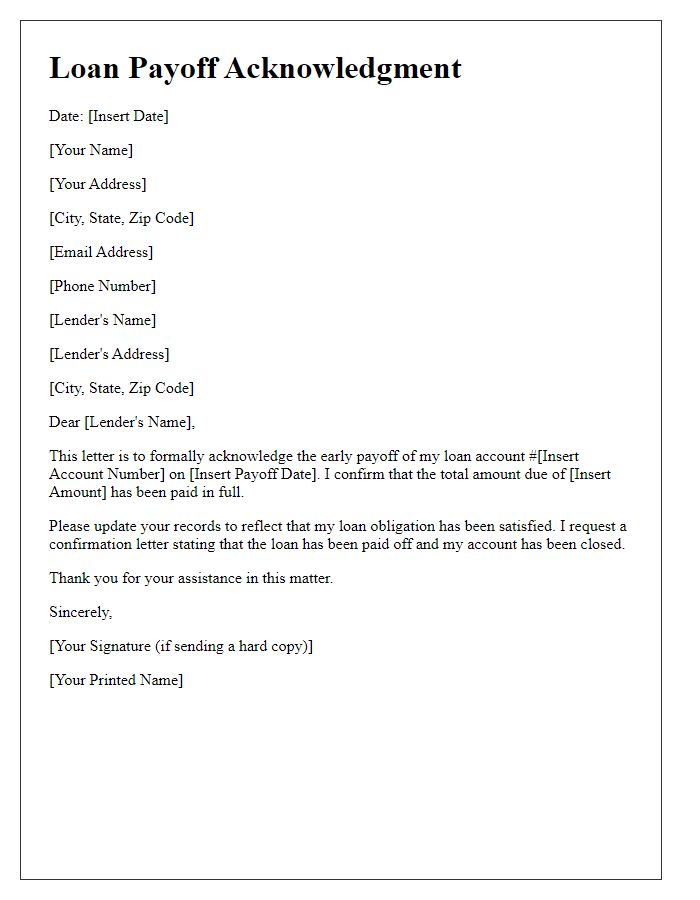

Request for Confirmation and Next Steps

Negotiating early loan payoff can be crucial for financial planning. Borrowers seeking to clear their debts ahead of schedule, especially for personal or student loans, can save on interest payments. The loan servicer, typically a bank or financial institution, needs to provide confirmation of the current balance, including any prepayment penalties that may apply. Understanding the implications on the credit score is essential, as early payoff often leads to enhanced creditworthiness. Establishing next steps involves obtaining a payoff quote, confirming payment methods, and clarifying how the early payoff affects loan terms. Clear communication can streamline the process and facilitate a smoother resolution.

Letter Template For Early Loan Payoff Negotiation Samples

Letter template of early loan payoff inquiry based on financial hardship.

Letter template of early loan payoff notification for lender consideration.

Letter template of early loan payoff resolution for improved credit report.

Letter template of early loan payoff submission for revised repayment plan.

Comments