Are you feeling overwhelmed by your mortgage payments and uncertain about how to make them fit into your revised budget? You're not alone; many homeowners find themselves in a similar situation and need to navigate the adjustments. By realigning your mortgage payments to match your financial goals, you can take a proactive step toward financial stability and peace of mind. Join us as we explore practical tips and strategies to make this process easier and more manageable for you!

Introduction of Current Situation

Current mortgage payments represent a significant financial responsibility for homeowners, often constituting a large portion of monthly expenses. As of October 2023, rising interest rates and inflation have impacted household budgets. Many homeowners are reassessing their financial situations to accommodate changing economic conditions. Adjusting mortgage payments to align with a revised budget can alleviate financial strain and promote long-term stability. This process involves communicating with mortgage servicers, understanding terms of loan agreements, and possibly exploring options such as loan modifications or refinancing to better fit new financial realities.

Reason for Budget Adjustment

A revised budget often necessitates adjustments to mortgage payments, especially when financial circumstances have changed considerably. Various reasons can lead to budget adjustments, such as increased living expenses, unexpected medical bills, or a job loss. These shifts in personal finance can lead to the need for a recalibrated budget that aligns with current financial realities. In many cases, homeowners may seek to reduce their monthly mortgage payment by extending the loan term or exploring loan modification options. By effectively managing the mortgage payment in accordance with a revised budget, homeowners can maintain financial stability while accommodating changes in income or expenses. Understanding the implications of these adjustments is crucial for ensuring long-term sustainability in meeting mortgage obligations.

Proposed Payment Plan

A proposed payment plan for mortgage alignment can help homeowners manage financial responsibilities effectively. A detailed breakdown includes the new monthly payment amount adjusted to match the revised budget, along with an explanation of the factors leading to this modification, such as changes in income or unforeseen expenses. The proposed structure should consider the original mortgage terms, including principal (the actual loan amount), interest rates (the cost of borrowing), and loan duration (typically 15 or 30 years). Additionally, this plan may involve a request for potential adjustments from mortgage lenders, emphasizing the importance of clear communication regarding the homeowner's current financial situation. The objective remains to maintain timely payments while ensuring financial stability during challenging economic times.

Request for Consideration or Meeting

Navigating mortgage payments can be complex, especially amidst changing financial circumstances. Homeowners may find it crucial to align their mortgage obligations with a revised budget due to factors such as job loss, unexpected medical expenses, or inflationary pressures impacting household finances. A meeting request directed to the mortgage lender can highlight the intention to discuss potential adjustments in payment terms, including proposals for reduced monthly payments or extended repayment periods. This proactive communication aims to foster understanding and cooperation between the borrower and the lender, ensuring financial stability while safeguarding the property located at the specified address.

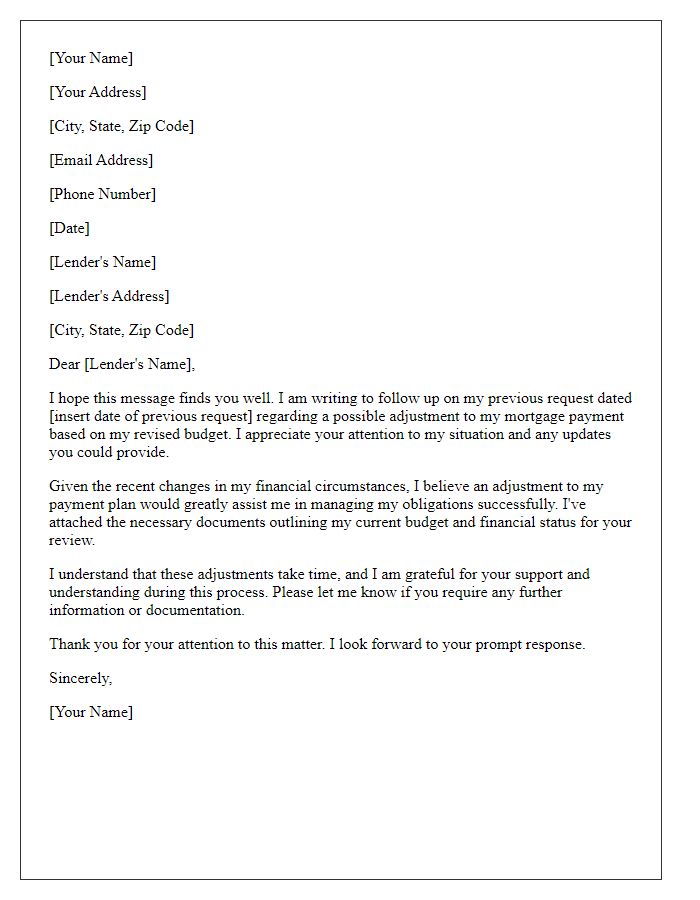

Contact Information for Follow-Up

Revised mortgage payment plans require careful alignment with updated budget forecasts. Homeowners should assess income stability, expense fluctuations, and interest rates (currently averaging around 3.5% for 30-year fixed mortgages). Document updates to monthly financial obligations, including property taxes and homeowners insurance, typically constituting 1-2% of the home value annually. Regular monitoring of mortgage servicing guidelines, communicated by local lenders, is essential for compliance with any new negotiation terms. A detailed follow-up schedule should be established to ensure timely adjustments, with priority given to communication avenues such as email and phone calls for swift resolution.

Letter Template For Aligning Mortgage Payments To Revised Budget Samples

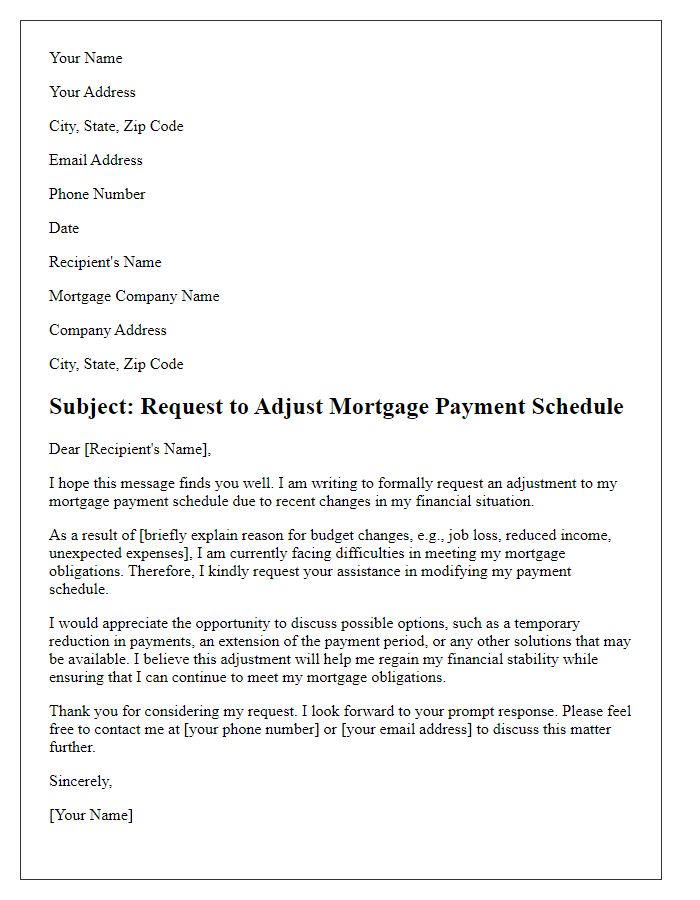

Letter template of request to adjust mortgage payment schedule due to budget changes

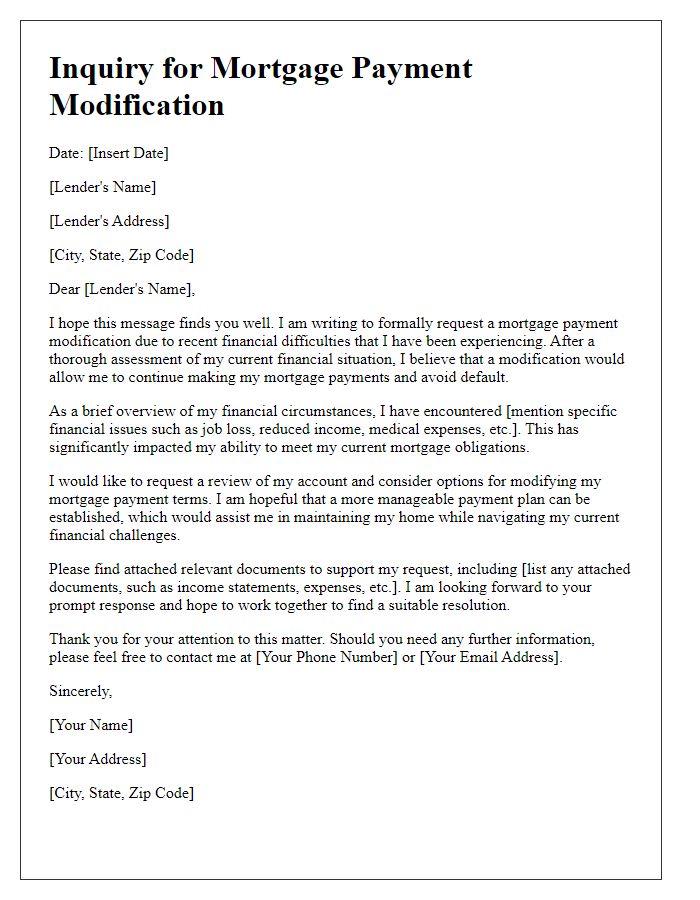

Letter template of inquiry for mortgage payment modification based on financial assessment

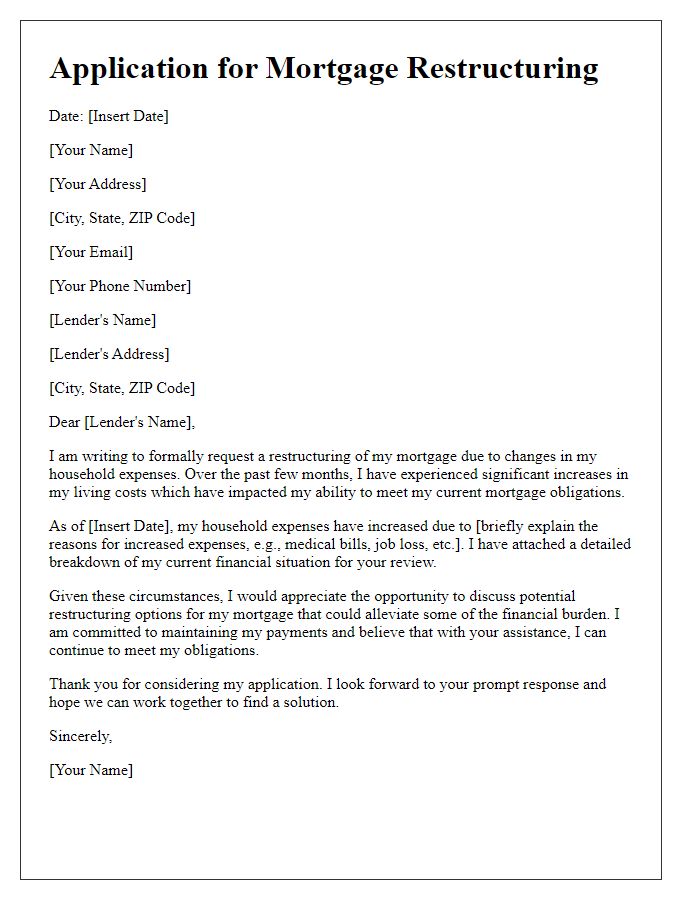

Letter template of application for mortgage restructuring related to updated household expenses

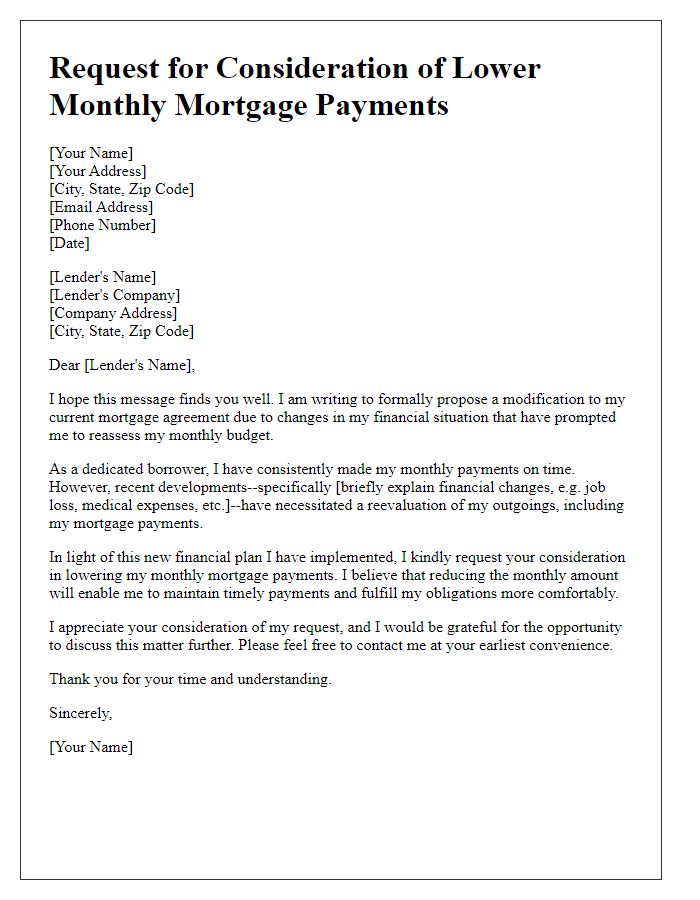

Letter template of proposal to decrease monthly mortgage payments in light of new financial plan

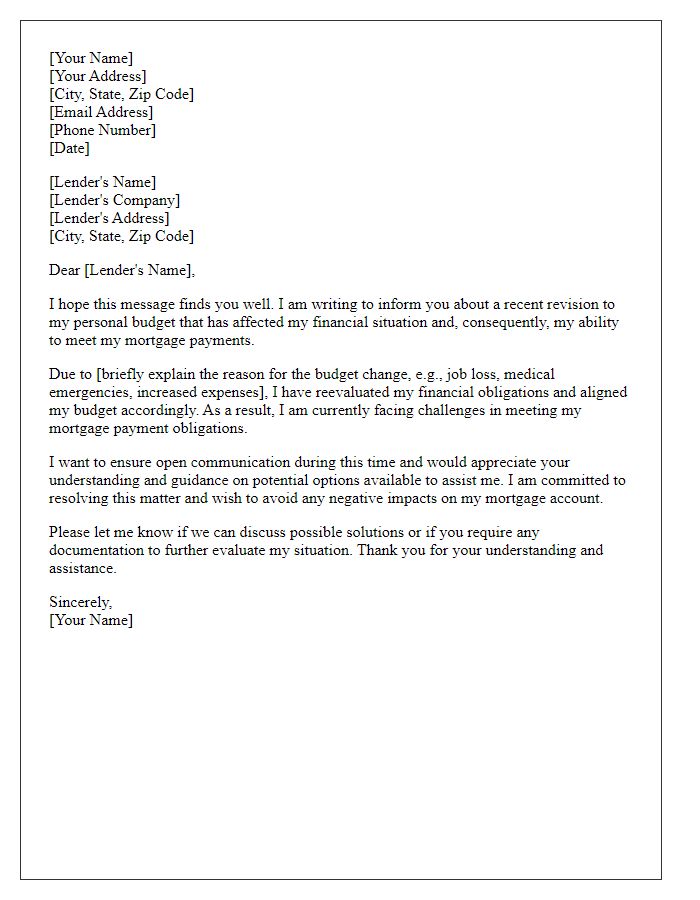

Letter template of notification for mortgage lender about revised budget affecting payment capability

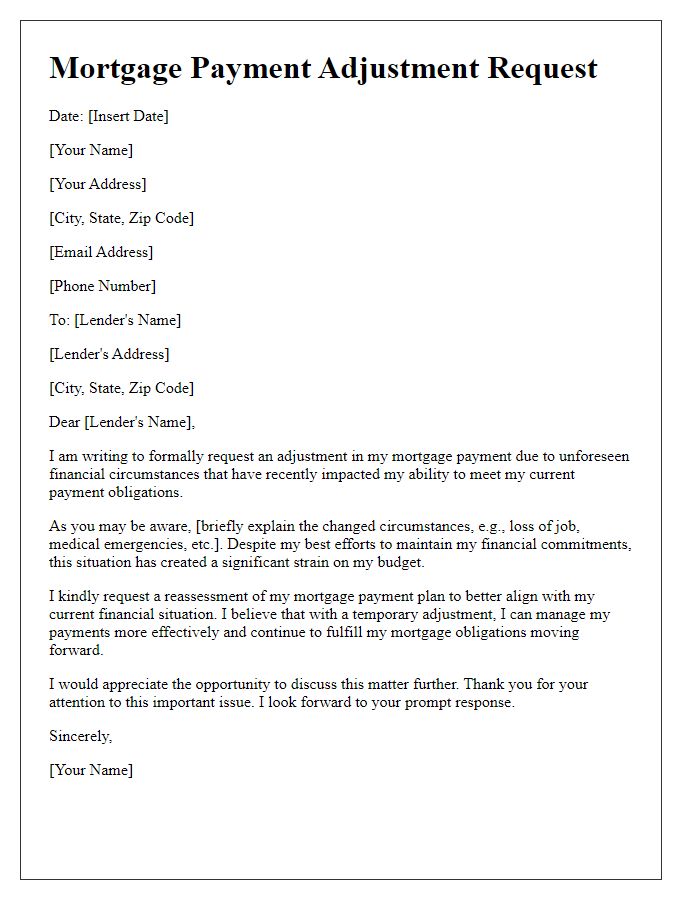

Letter template of explanation for needed mortgage payment adjustment due to changed financial circumstances

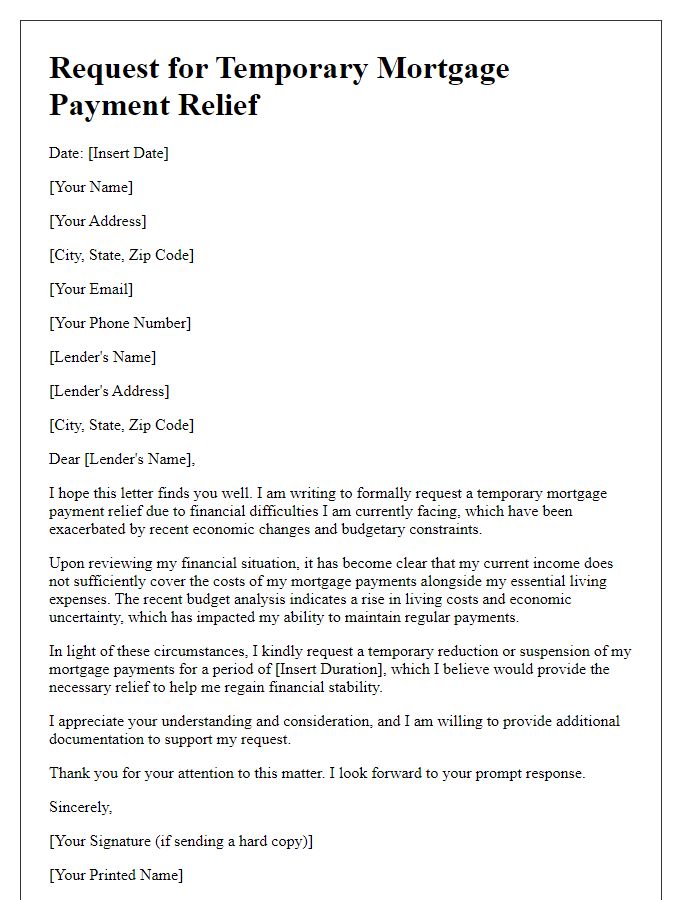

Letter template of appeal for temporary mortgage payment relief aligned with recent budget analysis

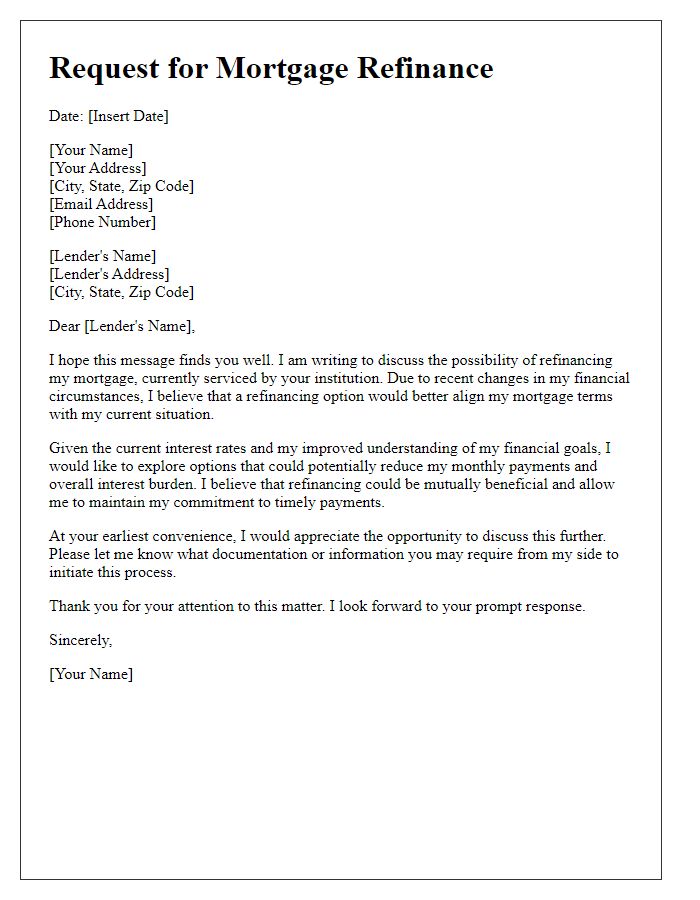

Letter template of communication for refinancing mortgage to better match revised financial situation

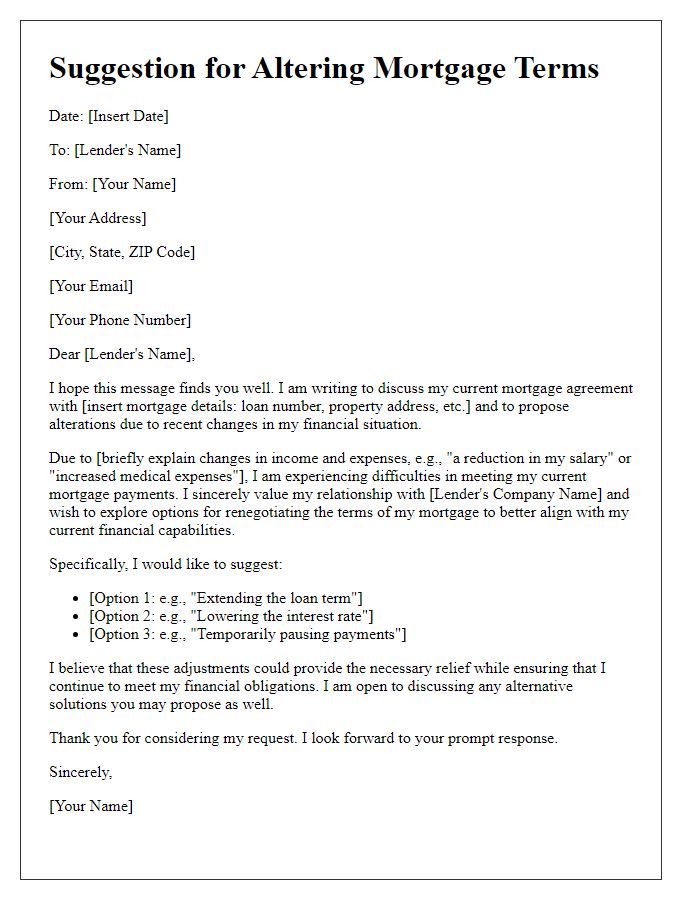

Letter template of suggestion for altering mortgage terms reflecting changes in income and expenses

Comments