Are you considering altering your mortgage loan conditions but feeling overwhelmed by the process? You're not aloneâmany homeowners find themselves in need of adjustments to better fit their financial situations. Whether you're looking to lower your interest rate, extend your loan term, or explore refinancing options, understanding how to navigate these changes is crucial. Join us as we dive into the essential steps and tips for successfully requesting a modification of your mortgage loan terms.

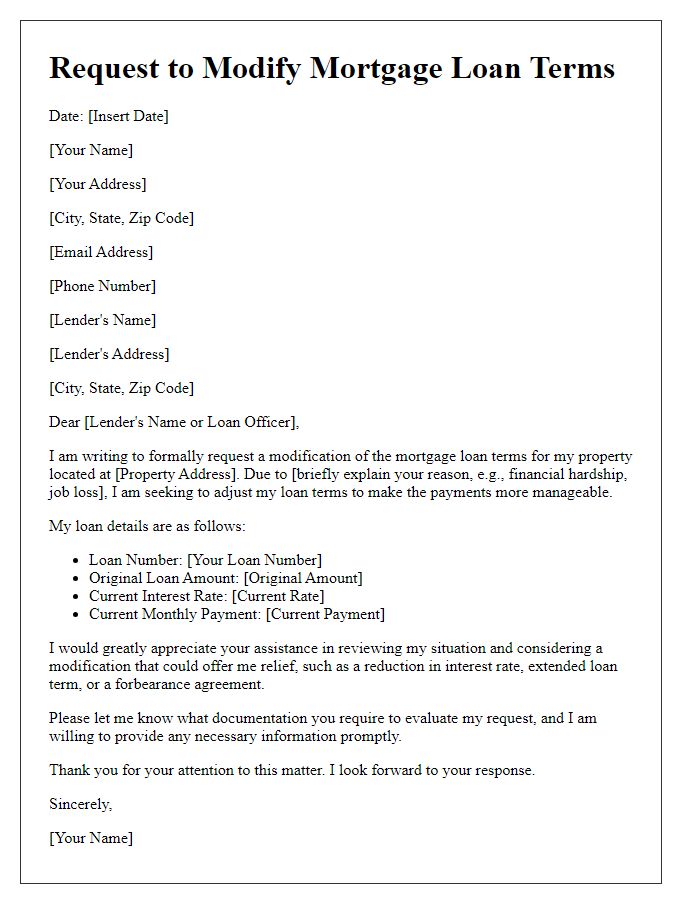

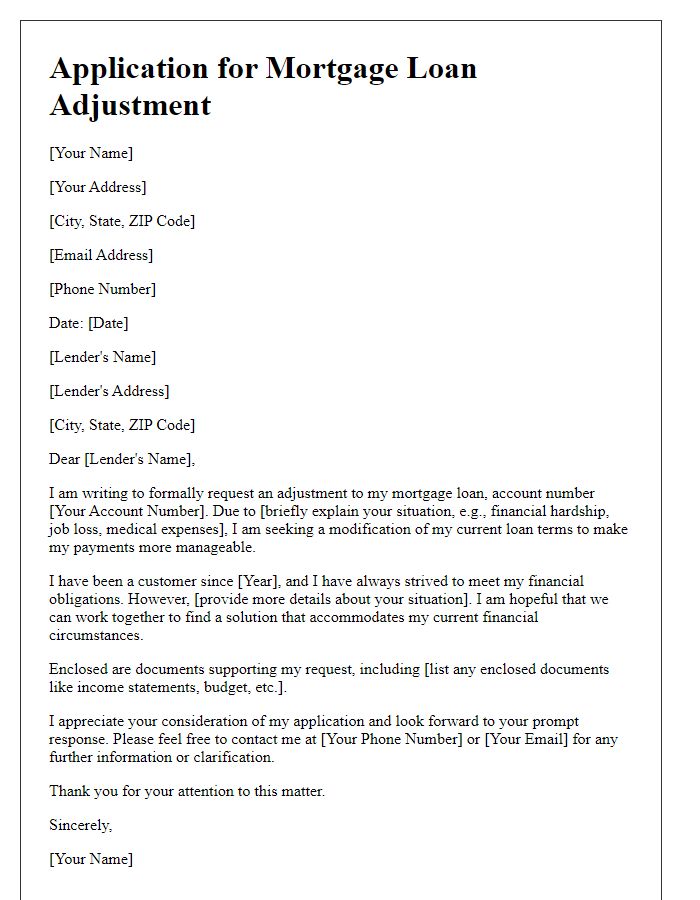

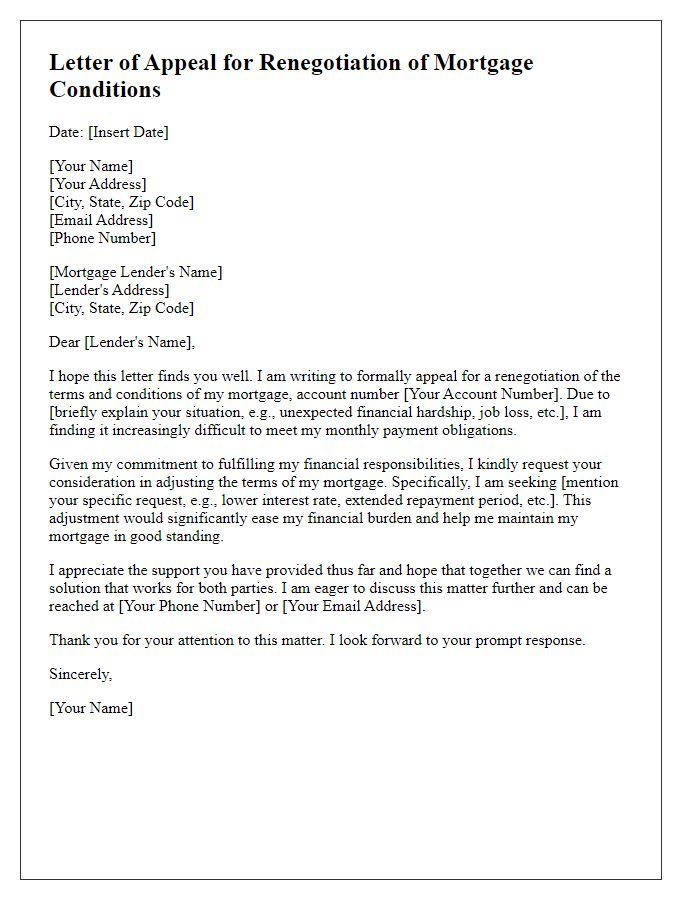

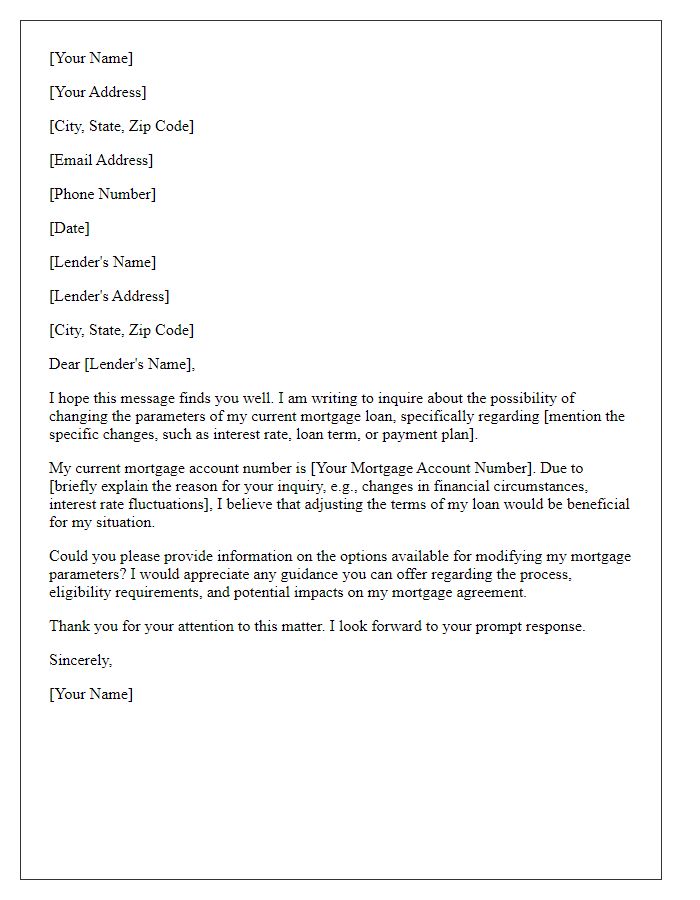

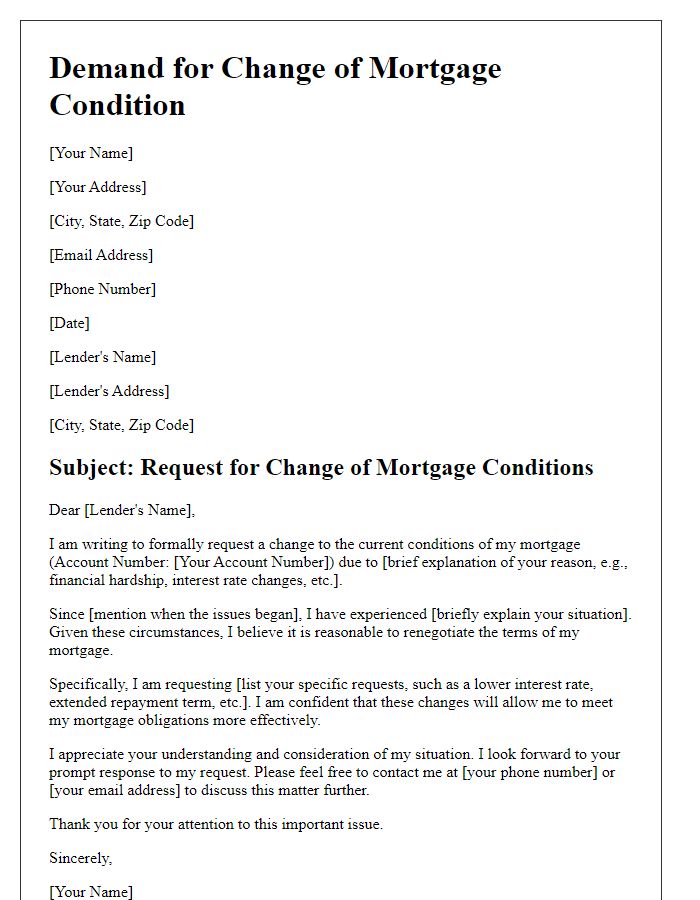

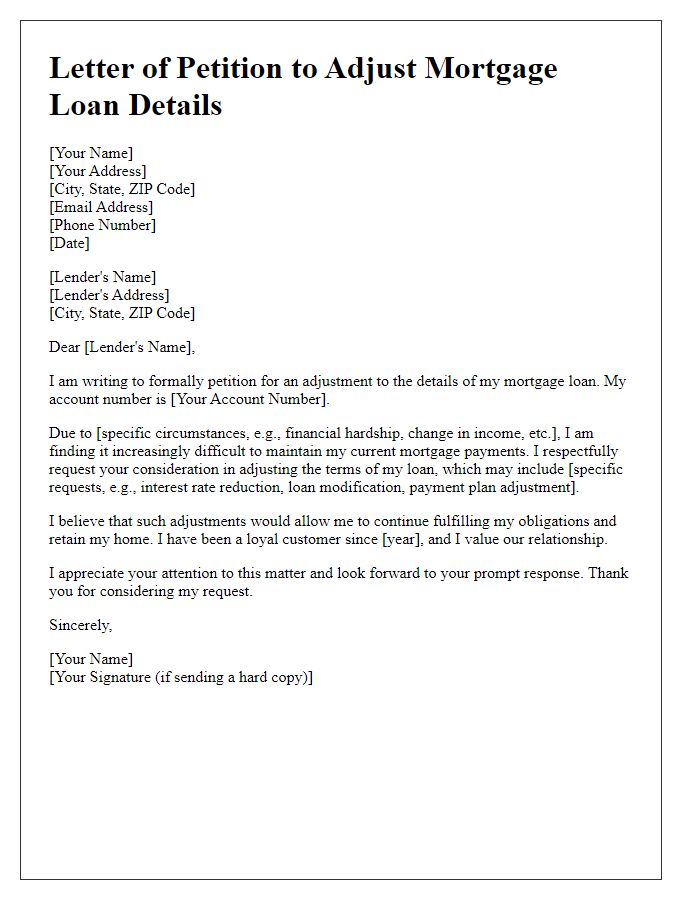

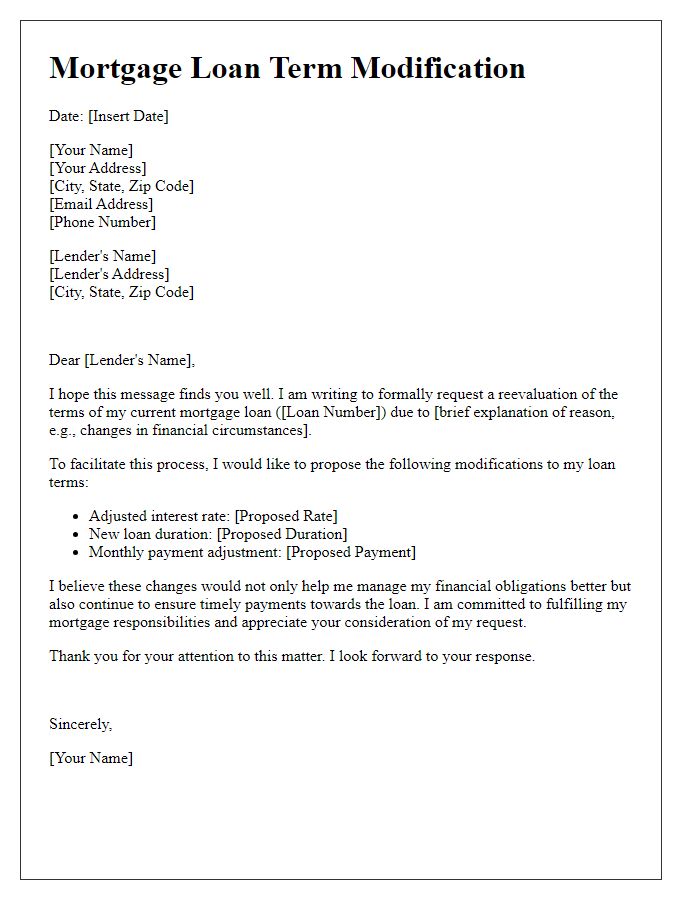

Borrower's Personal Information

In the context of altering mortgage loan conditions, the Borrower's Personal Information serves as a crucial foundation for communication with the lending institution. Including specific details like the Borrower's full name, which often includes middle initials for accurate identification, current address, encompassing street, city, state, and zip code, along with the associated mortgage account number, can streamline the process. Additionally, incorporating a contact number (preferably a mobile phone number for immediate communication) and email address enhances accessibility for any required follow-up. This information is typically designated at the outset of the correspondence to establish the identity of the Borrower and facilitate any necessary changes in terms that reflect their current financial situation or preferences. Being meticulous with this information ensures effective communication and improves the odds of successfully negotiating better loan terms.

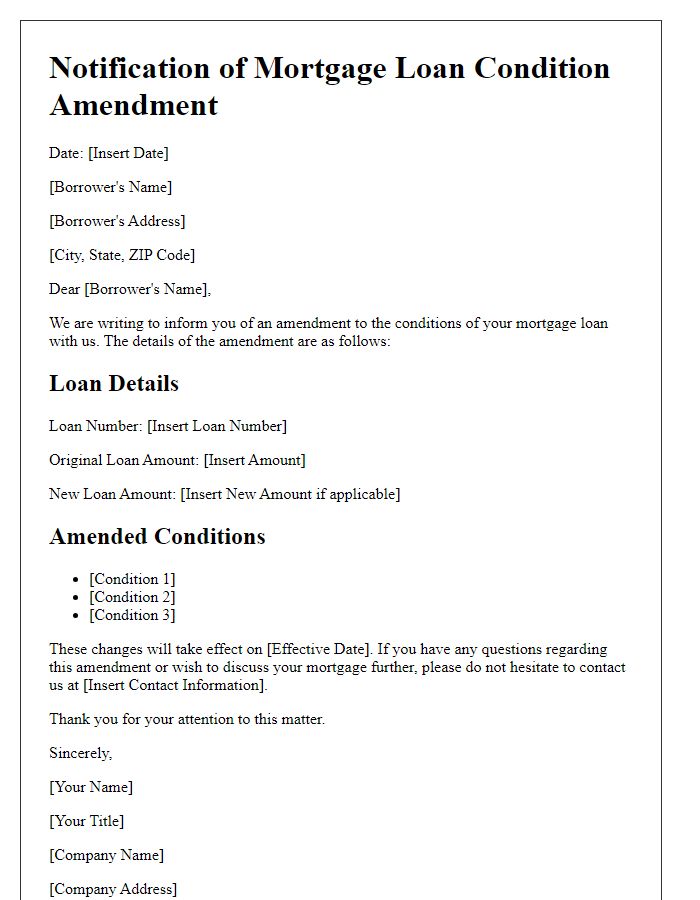

Loan Account Details

When considering alterations to mortgage loan conditions, borrowers must reference Loan Account Details, including account number, outstanding balance, and loan type (e.g., fixed-rate, adjustable-rate). Providing specific information about the terms being altered, such as interest rate adjustments or changes in repayment period, is crucial. Documentation should include copies of recent financial statements illustrating current income, debt levels, and any hardships faced, such as job loss or medical expenses. Additionally, borrowers may need to highlight their payment history, demonstrating reliability and commitment towards repayment obligations. Engaging in open communication with the lending institution, which may be local or national, can facilitate negotiations for more favorable loan terms, impacting overall monthly payments and long-term financial health.

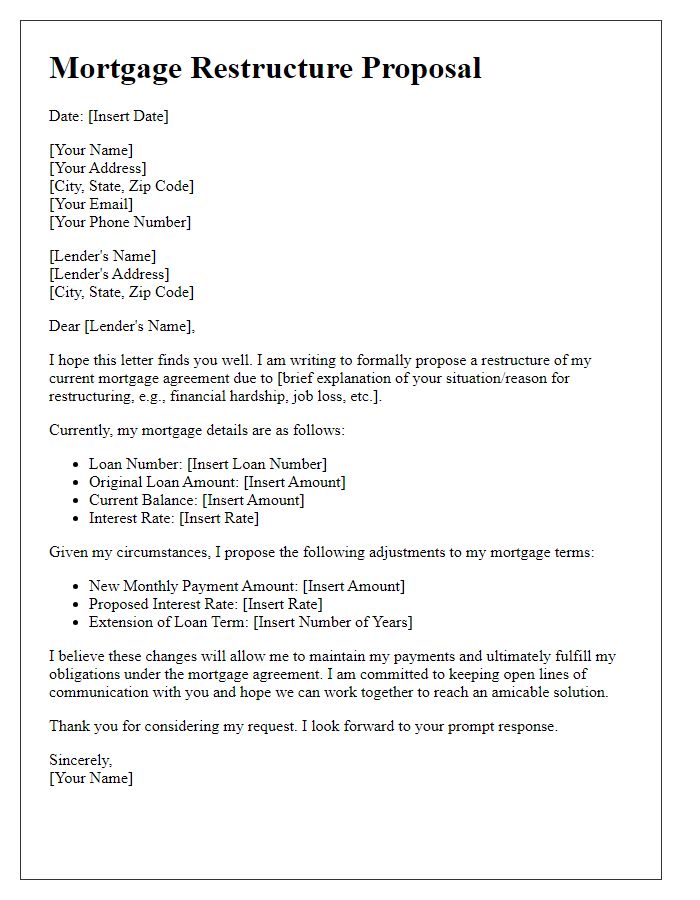

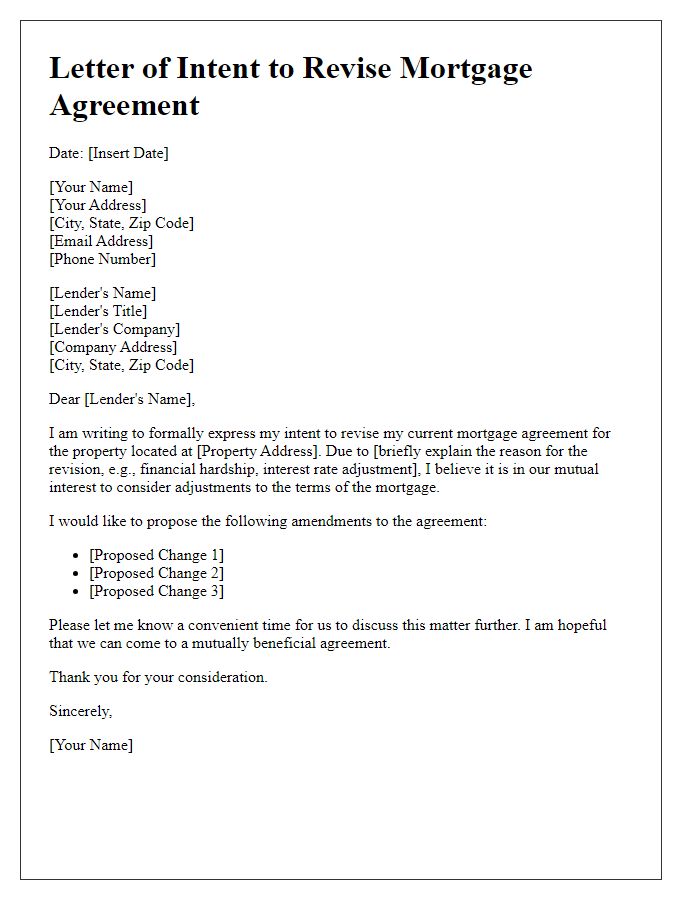

Specific Alteration Request

Homeowners often seek alterations to mortgage loan conditions due to changing financial situations or market trends. A specific alteration request may involve adjustments like lowering interest rates, extending the loan term, or switching from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage. For such requests, important documents include proof of income, current mortgage statements, and a detailed explanation of the desired changes. Lenders, such as large institutions like Wells Fargo or Bank of America, typically evaluate these requests based on the homeowner's financial history, current market conditions, and potential risks. Notably, strategic changes can lead to significant monthly savings or enhance financial flexibility during economic fluctuations.

Justification for Request

Homeowners seeking to alter mortgage loan conditions often rely on financial changes or shifts in personal circumstances. Significant events such as job loss, medical emergencies, or divorce can severely impact a household's income, leading to challenges in meeting monthly mortgage payments. For example, in economically volatile areas like Detroit, Michigan, property values can fluctuate, affecting homeowners' equity and ability to refinance. Additionally, interest rate changes influenced by the Federal Reserve can warrant a request for modification to lower monthly payments. Homeowners may provide documentation, including tax returns, pay stubs, or bank statements, to support their justification for altering the loan's terms, making it crucial to clearly outline the need for more manageable payment structures to ensure long-term housing stability.

Borrower's Contact Information

When altering mortgage loan conditions, borrowers may need to provide important personal details. Full names, such as John Smith or Jane Doe, ensure identification accuracy. Current addresses (e.g., 123 Main St, Springfield, IL 62701) offer essential location context. Also, include phone numbers (e.g., (555) 123-4567) for direct communication. Email addresses (e.g., john.smith@email.com) facilitate quick correspondence. Loan account numbers (e.g., #987654321) link the request to specific mortgage files. Providing this information allows lenders to process the alteration efficiently, tailoring terms to meet borrowers' financial needs.

Comments